- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

567 Courses in Nottingham

Excavator Training

By Excavator training

Excavator training for all levels from experienced operators to complete novice excavator training

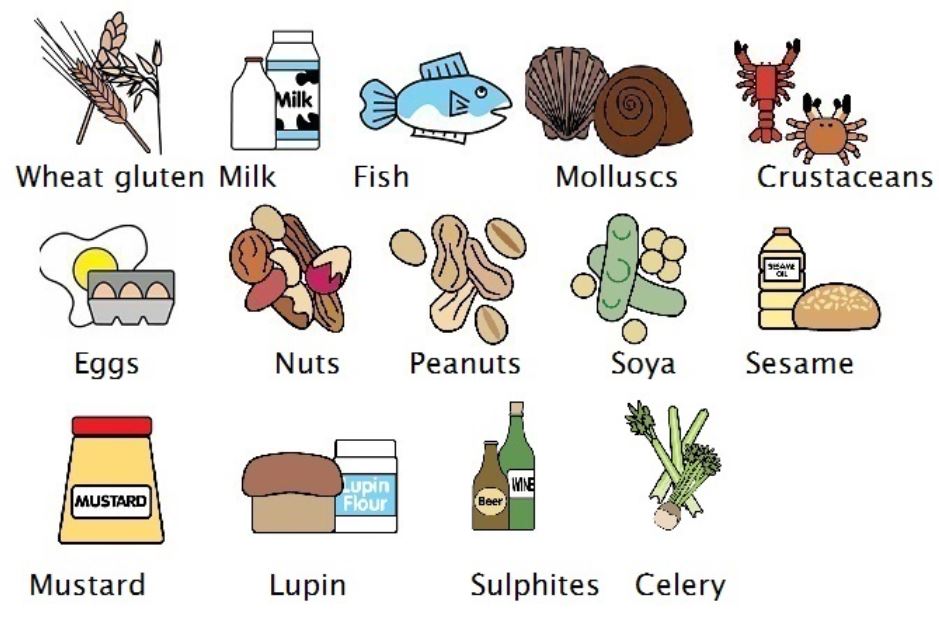

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course

By Kitchen Tonic Training Company and Food Safety Consultants

RSPH level 2 Identifying and Controlling Food Allergy Risks Training Course Do you need an allergy trainer to come to your food business and teach your staff face to face about food and drink allergens, their dangers and how to control them? Our allergy trainer can come to your business and deliver this course at your business premises. Although we are based in London, we are happy to travel and deliver this course at your business location. (Trainer travel fees may be applicable depending on your location). Staff will receive interactive training and coaching on allergens and intolerances with an experienced trainer. We can also tweak the training to include issues you would like to cover. See our website for more details. Special offer for on-site allergy training. £250 plus £20pp includes RSPH exam fees (usually £350 plus £30pp) This course is suitable for any catering business such as restaurants, pubs, hotels, cafes, catering companies, cooks, self employed, artisans, event caterers and more. This course is also important for staff who are Front of House, who take customer orders and relay the orders to cooks and chefs and other people who are preparing food for customers who have allergies and or intolerances. This is a short one day training course, typically 9am-3pm. Topics covered include- Allergens, Allergen Identification, Cross contact, Cross Contamination, Allergic Reactions, Food Intolerances, Coeliac, Anaphylaxis, Natasha's Law, UK Food Safety Regulations, Allergy Controls, Substituting ingredients, Customer Communication and what to do in an Emergency. Contact us to book training.

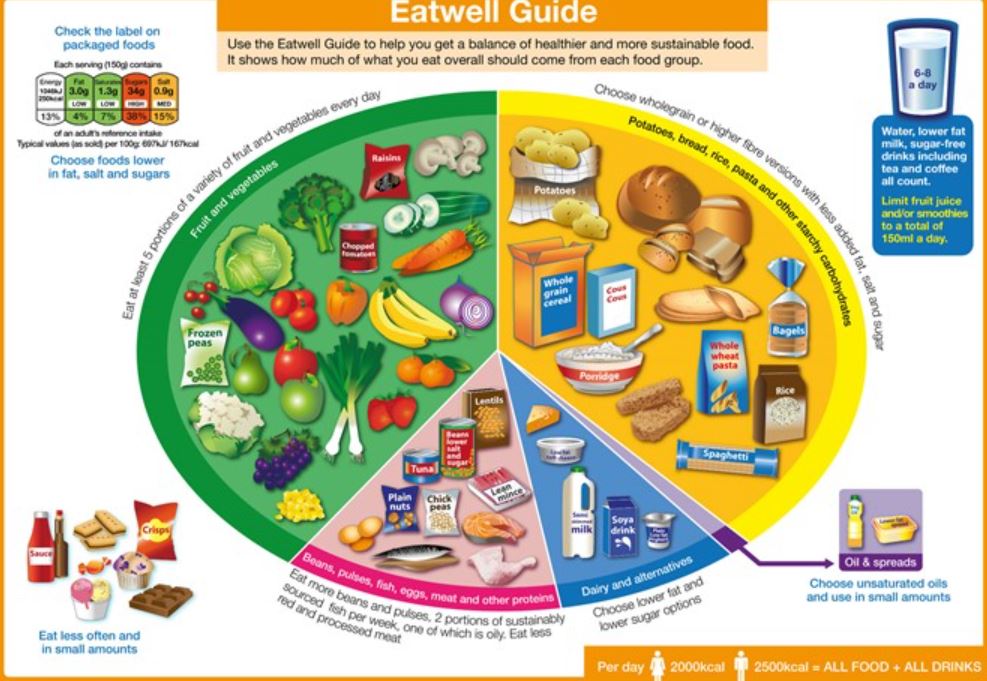

Nutrition Trainer - On-site Training - Nationwide - Level 2 Nutrition and Health Course

By Kitchen Tonic Training Company and Food Safety Consultants

Nutrition and Health Training Courses

Creating Psychological Safety for Stronger Teams

By Elite Forums UK

Course Duration: Half-day, 1-day, or modular delivery over 2–3 sessions Target Audience: Managers, team leaders, HR professionals, and employees who want to foster trust, openness, and inclusivity within their teams or organisations. Course Objectives By the end of this course, participants will be able to: Understand the concept and importance of psychological safety. Recognise how psychological safety impacts team performance and wellbeing. Identify behaviours and practices that support or undermine psychological safety. Develop strategies to create inclusive, respectful, and open team cultures. Apply tools to encourage constructive feedback, innovation, and open dialogue. Course Outline Module 1: What is Psychological Safety? Definition and origin (Dr Amy Edmondson’s research) Why psychological safety matters: the business and human case Link between psychological safety, innovation, collaboration, and retention Misconceptions: It’s not about comfort or avoiding challenge Module 2: Assessing the Current Environment Signs of a psychologically safe vs unsafe environment Common team behaviours and leadership pitfalls Self-assessment: how psychologically safe is my team? Module 3: Building the Foundations The four stages of psychological safety: Inclusion safety Learner safety Contributor safety Challenger safety Role of trust, empathy, and emotional intelligence The leader’s role in creating safe environments Module 4: Practical Strategies to Foster Safety Encouraging open communication and constructive disagreement Creating space for risk-taking and vulnerability Responding to feedback and mistakes without blame Speaking up behaviours – how to model and support them Module 5: Embedding Psychological Safety into Team Culture Meeting practices that promote psychological safety How to give and receive feedback safely Inclusive decision-making and respectful challenge Recognising and rewarding candour and contribution Module 6: Leading with Psychological Safety Coaching conversations and active listening Managing difficult conversations and underperformance safely Supporting neurodiverse or marginalised voices Sustaining safety under pressure and during change Delivery Style Facilitated discussions and group work Role plays, reflection activities, and real-life scenarios Peer learning and action planning Optional pre-work or post-session surveys Course Materials Provided Participant workbook Psychological safety assessment toolkit Conversation starter guide Leadership checklist for building safety Personal and team action plan Optional Add-ons Team psychological safety assessments (anonymous survey) Post-course coaching or leadership debrief Co-delivery with DEI (Diversity, Equity & Inclusion) workshops Integration with feedback or team development programs

Effective Interpersonal & Communication Skills

By Elite Forums UK

Course Duration: 1–2 days (or modular format across 3–4 sessions) Target Audience: Professionals at all levels seeking to improve workplace communication, strengthen relationships, and increase collaboration and influence. Course Objectives By the end of this course, participants will be able to: Communicate clearly and confidently in a range of professional situations. Adapt communication styles to suit different audiences and contexts. Build strong interpersonal relationships using emotional intelligence. Navigate difficult conversations and resolve conflict effectively. Enhance active listening, feedback, and assertiveness skills. Course Outline Module 1: Foundations of Communication The communication process: sender, receiver, and barriers Verbal, non-verbal, and written communication The impact of tone, body language, and intent Common communication pitfalls in the workplace Module 2: Developing Interpersonal Awareness Self-awareness and emotional intelligence (EQ) Understanding personal communication styles (DISC, MBTI or similar tools) Building rapport and trust The importance of empathy in professional relationships Module 3: Active Listening and Feedback Skills Listening to understand vs listening to respond Techniques for active listening Giving feedback constructively Receiving and acting on feedback Module 4: Assertive Communication Passive, aggressive, passive-aggressive vs assertive styles Setting boundaries and expressing needs clearly Using “I” statements and confident body language Role-playing assertiveness scenarios Module 5: Adapting Communication to Context Communicating with different personality types Navigating workplace hierarchy and power dynamics Cultural sensitivity and inclusive language Tailoring communication for emails, meetings, and presentations Module 6: Managing Difficult Conversations and Conflict Identifying sources of conflict Conflict resolution strategies (e.g. Interest-Based Relational Approach) Staying calm under pressure Structuring difficult conversations using frameworks (e.g. SBI – Situation, Behaviour, Impact) Module 7: Collaborative Communication in Teams The role of communication in high-performing teams Group dynamics and psychological safety Facilitating discussions and encouraging contribution Virtual communication best practices Delivery Style Engaging facilitation with practical exercises Role-plays, group discussions, and real-life scenarios Self-reflection activities and personal action planning Assessment and Outcomes Participation in interactive activities Completion of a communication skills self-assessment Development of a personalised communication improvement plan Course Materials Provided Participant workbook and slides Communication style diagnostic tool (optional) Templates for feedback and conversation planning Follow-up resources and reading list

Creating Psychological Safety for Stronger Teams

By Elite Forums Events

Course Duration: Half-day, 1-day, or modular delivery over 2–3 sessions Target Audience: Managers, team leaders, HR professionals, and employees who want to foster trust, openness, and inclusivity within their teams or organisations. Course Objectives By the end of this course, participants will be able to: Understand the concept and importance of psychological safety. Recognise how psychological safety impacts team performance and wellbeing. Identify behaviours and practices that support or undermine psychological safety. Develop strategies to create inclusive, respectful, and open team cultures. Apply tools to encourage constructive feedback, innovation, and open dialogue. Course Outline Module 1: What is Psychological Safety? Definition and origin (Dr Amy Edmondson’s research) Why psychological safety matters: the business and human case Link between psychological safety, innovation, collaboration, and retention Misconceptions: It’s not about comfort or avoiding challenge Module 2: Assessing the Current Environment Signs of a psychologically safe vs unsafe environment Common team behaviours and leadership pitfalls Self-assessment: how psychologically safe is my team? Module 3: Building the Foundations The four stages of psychological safety: Inclusion safety Learner safety Contributor safety Challenger safety Role of trust, empathy, and emotional intelligence The leader’s role in creating safe environments Module 4: Practical Strategies to Foster Safety Encouraging open communication and constructive disagreement Creating space for risk-taking and vulnerability Responding to feedback and mistakes without blame Speaking up behaviours – how to model and support them Module 5: Embedding Psychological Safety into Team Culture Meeting practices that promote psychological safety How to give and receive feedback safely Inclusive decision-making and respectful challenge Recognising and rewarding candour and contribution Module 6: Leading with Psychological Safety Coaching conversations and active listening Managing difficult conversations and underperformance safely Supporting neurodiverse or marginalised voices Sustaining safety under pressure and during change Delivery Style Facilitated discussions and group work Role plays, reflection activities, and real-life scenarios Peer learning and action planning Optional pre-work or post-session surveys Course Materials Provided Participant workbook Psychological safety assessment toolkit Conversation starter guide Leadership checklist for building safety Personal and team action plan Optional Add-ons Team psychological safety assessments (anonymous survey) Post-course coaching or leadership debrief Co-delivery with DEI (Diversity, Equity & Inclusion) workshops Integration with feedback or team development programs

Effective Interpersonal & Communication Skills

By Elite Forums Events

Course Duration: 1–2 days (or modular format across 3–4 sessions) Target Audience: Professionals at all levels seeking to improve workplace communication, strengthen relationships, and increase collaboration and influence. Course Objectives By the end of this course, participants will be able to: Communicate clearly and confidently in a range of professional situations. Adapt communication styles to suit different audiences and contexts. Build strong interpersonal relationships using emotional intelligence. Navigate difficult conversations and resolve conflict effectively. Enhance active listening, feedback, and assertiveness skills. Course Outline Module 1: Foundations of Communication The communication process: sender, receiver, and barriers Verbal, non-verbal, and written communication The impact of tone, body language, and intent Common communication pitfalls in the workplace Module 2: Developing Interpersonal Awareness Self-awareness and emotional intelligence (EQ) Understanding personal communication styles (DISC, MBTI or similar tools) Building rapport and trust The importance of empathy in professional relationships Module 3: Active Listening and Feedback Skills Listening to understand vs listening to respond Techniques for active listening Giving feedback constructively Receiving and acting on feedback Module 4: Assertive Communication Passive, aggressive, passive-aggressive vs assertive styles Setting boundaries and expressing needs clearly Using “I” statements and confident body language Role-playing assertiveness scenarios Module 5: Adapting Communication to Context Communicating with different personality types Navigating workplace hierarchy and power dynamics Cultural sensitivity and inclusive language Tailoring communication for emails, meetings, and presentations Module 6: Managing Difficult Conversations and Conflict Identifying sources of conflict Conflict resolution strategies (e.g. Interest-Based Relational Approach) Staying calm under pressure Structuring difficult conversations using frameworks (e.g. SBI – Situation, Behaviour, Impact) Module 7: Collaborative Communication in Teams The role of communication in high-performing teams Group dynamics and psychological safety Facilitating discussions and encouraging contribution Virtual communication best practices Delivery Style Engaging facilitation with practical exercises Role-plays, group discussions, and real-life scenarios Self-reflection activities and personal action planning Assessment and Outcomes Participation in interactive activities Completion of a communication skills self-assessment Development of a personalised communication improvement plan Course Materials Provided Participant workbook and slides Communication style diagnostic tool (optional) Templates for feedback and conversation planning Follow-up resources and reading list

Building and Leading High-Performing Teams

By Elite Forums UK

Course Duration: 1–2 days (or modular format across 3–4 sessions) Target Audience: Managers, team leaders, HR professionals, and anyone responsible for leading or being part of a high-performance team. Course Objectives By the end of this course, participants will be able to: Understand the key characteristics of high-performing teams. Apply strategies to build trust, collaboration, and accountability. Leverage diversity and strengths within the team. Align team goals with organisational objectives. Overcome challenges and navigate through conflict. Measure and sustain high performance over time. Course Outline Module 1: The Foundations of High-Performing Teams What defines a high-performing team? The stages of team development (Tuckman Model: Forming, Storming, Norming, Performing, Adjourning) Key traits of successful teams (trust, collaboration, accountability) The importance of team culture and values Module 2: Team Roles and Dynamics Understanding team roles (e.g., Belbin’s Team Roles, Gallup’s StrengthsFinder) Building diverse teams with complementary skills Encouraging collaboration over competition Strategies for integrating different personalities and work styles Module 3: Leadership for High Performance The role of a leader in high-performing teams Transformational leadership vs transactional leadership Delegation and empowering team members Creating a vision and setting clear expectations Module 4: Building Trust and Effective Communication The role of trust in team performance Building rapport and psychological safety Developing active listening and feedback skills Encouraging open, honest, and transparent communication Module 5: Goal Setting and Alignment The SMART goal framework for teams Aligning team goals with organisational strategy Prioritising and tracking team performance Creating individual and team accountability Module 6: Conflict Management and Problem Solving Understanding and addressing team conflict Strategies for resolving disagreements and promoting collaboration Facilitating difficult conversations Problem-solving techniques and decision-making processes Module 7: Motivation, Recognition, and Sustaining Performance Motivating team members and recognising achievements Building a culture of continuous improvement Measuring team performance (KPIs, feedback loops, 360-degree reviews) Keeping momentum in long-term projects Module 8: Measuring Success and Continuously Improving Tools for measuring team effectiveness (e.g., surveys, team assessments) Adjusting processes and practices to ensure continuous high performance Developing a personal and team action plan for ongoing growth Creating a feedback loop for long-term success Delivery Style Interactive discussions and team exercises Group activities, role-playing, and case studies Practical tools and frameworks for immediate application Peer feedback and group coaching Course Materials Provided Participant workbook with key concepts, templates, and worksheets Team development toolkits (e.g., team assessment forms, feedback templates) Leadership and team-building resources for further learning Personal action plan template for team growth Optional Add-ons Personalised team assessment and tailored development plan Ongoing coaching sessions for team leaders Facilitated team-building activities for real-world application Post-course team performance follow-up and support

Building and Leading High-Performing Teams

By Elite Forums Events

Course Duration: 1–2 days (or modular format across 3–4 sessions) Target Audience: Managers, team leaders, HR professionals, and anyone responsible for leading or being part of a high-performance team. Course Objectives By the end of this course, participants will be able to: Understand the key characteristics of high-performing teams. Apply strategies to build trust, collaboration, and accountability. Leverage diversity and strengths within the team. Align team goals with organisational objectives. Overcome challenges and navigate through conflict. Measure and sustain high performance over time. Course Outline Module 1: The Foundations of High-Performing Teams What defines a high-performing team? The stages of team development (Tuckman Model: Forming, Storming, Norming, Performing, Adjourning) Key traits of successful teams (trust, collaboration, accountability) The importance of team culture and values Module 2: Team Roles and Dynamics Understanding team roles (e.g., Belbin’s Team Roles, Gallup’s StrengthsFinder) Building diverse teams with complementary skills Encouraging collaboration over competition Strategies for integrating different personalities and work styles Module 3: Leadership for High Performance The role of a leader in high-performing teams Transformational leadership vs transactional leadership Delegation and empowering team members Creating a vision and setting clear expectations Module 4: Building Trust and Effective Communication The role of trust in team performance Building rapport and psychological safety Developing active listening and feedback skills Encouraging open, honest, and transparent communication Module 5: Goal Setting and Alignment The SMART goal framework for teams Aligning team goals with organisational strategy Prioritising and tracking team performance Creating individual and team accountability Module 6: Conflict Management and Problem Solving Understanding and addressing team conflict Strategies for resolving disagreements and promoting collaboration Facilitating difficult conversations Problem-solving techniques and decision-making processes Module 7: Motivation, Recognition, and Sustaining Performance Motivating team members and recognising achievements Building a culture of continuous improvement Measuring team performance (KPIs, feedback loops, 360-degree reviews) Keeping momentum in long-term projects Module 8: Measuring Success and Continuously Improving Tools for measuring team effectiveness (e.g., surveys, team assessments) Adjusting processes and practices to ensure continuous high performance Developing a personal and team action plan for ongoing growth Creating a feedback loop for long-term success Delivery Style Interactive discussions and team exercises Group activities, role-playing, and case studies Practical tools and frameworks for immediate application Peer feedback and group coaching Course Materials Provided Participant workbook with key concepts, templates, and worksheets Team development toolkits (e.g., team assessment forms, feedback templates) Leadership and team-building resources for further learning Personal action plan template for team growth Optional Add-ons Personalised team assessment and tailored development plan Ongoing coaching sessions for team leaders Facilitated team-building activities for real-world application Post-course team performance follow-up and support

Work-Life Integration in the Age of Remote Everything

By Elite Forums UK

Course Duration: Half-day or full-day program (with virtual and in-person options) Target Audience: Professionals working remotely, hybrid teams, managers, HR leaders, and individuals looking to improve their work-life integration in today’s fast-paced, digital-first work environment. Course Objectives By the end of this course, participants will be able to: Understand the concept of work-life integration versus work-life balance. Recognise the challenges and benefits of working remotely or in hybrid settings. Learn practical strategies for managing boundaries, time, and energy. Cultivate habits that support both productivity and personal well-being. Apply tools to foster sustainable work-life integration in their teams and organisations. Course Outline Module 1: Rethinking Work-Life Integration The difference between work-life balance and work-life integration The challenges of work-life boundaries in a remote-first world The impact of technology on personal and professional lives Why flexibility matters: remote work as a tool for integration, not separation Module 2: Understanding Your Energy and Time Identifying personal energy patterns throughout the day Time audit: understanding how you currently allocate time and energy The role of breaks, boundaries, and rituals in energy management Tools for task prioritisation: Pomodoro, time blocking, and task batching Module 3: Managing Boundaries in a Digital World Setting and communicating clear boundaries for work and personal time Managing "always-on" culture in a remote environment Tools for setting expectations with colleagues and managers Creating a dedicated workspace and establishing personal rituals Saying no effectively: how to manage overcommitment and avoid burnout Module 4: Navigating Flexibility and Productivity The benefits and challenges of flexible working hours Time management strategies for remote and hybrid work settings Overcoming distractions: creating a productive work environment at home Staying focused and motivated without the physical office Managing work interruptions and creating space for personal time Module 5: Well-Being in Remote and Hybrid Work Importance of self-care and mental health in work-life integration Strategies for staying physically active, social, and mentally engaged remotely Building habits for sleep, mindfulness, and recovery Setting clear personal and professional goals to stay aligned with values Techniques for managing stress and avoiding burnout in a remote environment Module 6: Building a Remote-First Culture Leading with empathy: supporting remote teams’ well-being Fostering communication, trust, and accountability in hybrid teams Encouraging regular check-ins, feedback loops, and work-life check-ups Building a culture of flexibility and autonomy while maintaining performance Best practices for team collaboration and social connection in remote environments Module 7: Action Planning for Sustainable Integration Developing a personalised work-life integration plan Identifying areas of improvement: time, energy, boundaries, and well-being Setting achievable goals for short-term and long-term work-life integration Peer sharing: tips and strategies that have worked for you Building accountability structures: partners, progress tracking, and revisiting goals Delivery Style Highly interactive, with a mix of discussions, reflection exercises, and case studies Practical tools, tips, and templates that participants can apply immediately Group activities to share experiences and learn from peers Guided self-reflection and action planning for immediate impact Course Materials Provided Work-Life Integration Guide Time Audit Worksheet and Energy Mapping Tools Setting Boundaries Framework and Template Remote Work Well-Being Checklist Personal Action Plan for Sustainable Integration Resource list: Apps, podcasts, and books on work-life integration Optional Add-ons Post-course coaching or check-in sessions Customised team workshop focused on hybrid work challenges Leadership session on managing remote-first teams effectively Follow-up webinars on remote collaboration and staying connected

Search By Location

- import Courses in London

- import Courses in Birmingham

- import Courses in Glasgow

- import Courses in Liverpool

- import Courses in Bristol

- import Courses in Manchester

- import Courses in Sheffield

- import Courses in Leeds

- import Courses in Edinburgh

- import Courses in Leicester

- import Courses in Coventry

- import Courses in Bradford

- import Courses in Cardiff

- import Courses in Belfast

- import Courses in Nottingham