- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

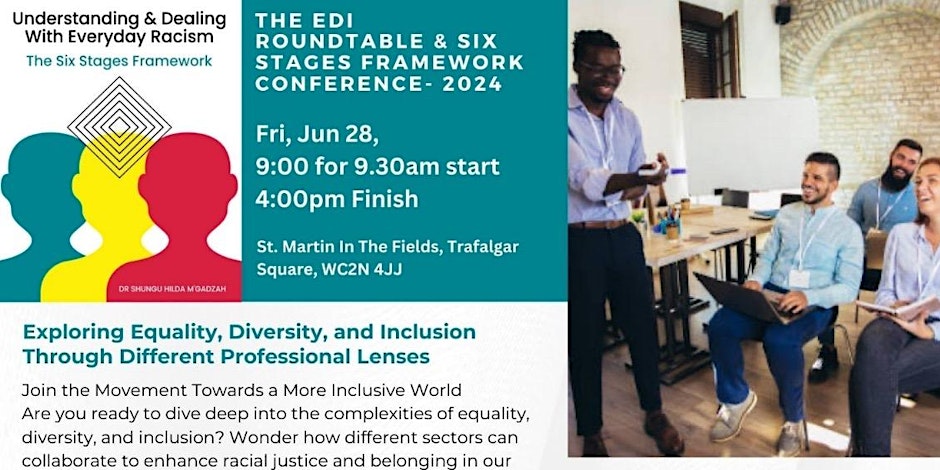

EDI Roundtable Event/ The Six Stages Framework Conference

By Dr Shungu M'gadzah

Join us for a day of discussions and insights on EDI and the Six Stages Framework at our in-person event on June 28, 2024! THE EDI ROUNDTABLE & SIX STAGES FRAMEWORK CONFERENCE 2024 Navigating & Challenging Everyday Racism and Discriminations. Embedding EDI into your Workplace & Schools Frameworks for Measuring Impact & Progress Don't miss out on our Annual trailblazing event! Our pioneering event is back by popular demand. Empower your own self development and improve diversity and inclusion in your organisation or workplace. Check out testimonials from last year. Tickets are now on sale. Only £30 including lunch! Book now https://www.eventbrite.co.uk/e/edi-round-table-event-and-the-six-stages-framework-conference-2024-tickets-884939155837?utm-campaign=social&utm-content=attendeeshare&utm-medium=discovery&utm-term=listing&utm-source=cp&aff=ebdsshcopyurl Join Us In Creating a More Inclusive World. Are you ready to dive deep into the complexities of equality, diversity, and inclusion? Have you ever wondered how different sectors can collaborate to enhance racial justice and belonging in our ever-evolving society? Online agenda and details of speakers and panelists https://www.sixstagesframework.com/edi-agenda/ Check out our Speaker/Panelists and Hosts. https://www.sixstagesframework.com/edi-round-table-2024/ https://youtu.be/DDfQtNJsNKE https://www.eventbrite.co.uk/e/edi-round-table-event-and-the-six-stages-framework-conference-2024-tickets-884939155837?utm-campaign=social&utm-content=attendeeshare&utm-medium=discovery&utm-term=listing&utm-source=cp&aff=ebdsshcopyurl Information for Schools https://www.sixstagesframework.com/schools/ What's Involved? This one-day event is not to be missed. We understand the challenges many face in embedding EDI (Equality, Diversity, and Inclusion) into the fabrics of their organisation. The Six Stages Inclusive Framework helps organisation (and schools) go beyond performative measures: cultural celebrations, conversations about unconscious bias and white privilege to real action and implementation. It supports evidence-based practice and data gathering, obtaining base line measures through the Six Stages Framework Diversity Assessments which enable you to chart your progress. Who’s the Conference For? Corporate Organisations Schools & Local Authorities Health Services Higher Education Police and Criminal Justice Anyone passionate about EDI An amazing venue! The Conference will take place at St Martin-in-the Fields, Trafalgar Square, WC2N 4JJ on June 28th, 2024, set in the heart of London. Take a 3D tour of our venue here: https://my.matterport.com/show/?m=74N3JkZtuq4 Engage with Visionaries Check out our Speaker/Panelists and Hosts. https://www.sixstagesframework.com/edi-round-table-2024/ Start your day with groundbreaking insights from leading experts. Our opening address and keynotes will set the stage for a series of powerful discussions, including: Diverse Cross-Functional Roundtable: Engage with top professionals in a dynamic panel discussion, followed by an audience Q&A. Exclusive stimulating and thought-provoking conversation between the dynamic sister duo, Afua Hirsch: Award-winning writer, journalist, former barrister and filmmaker; and Dr. Ama Collison: Millennial Psychology Limited. Networking Lunch: Connect with like-minded individuals and grow your professional network over lunch. Afternoon Sessions: Dr. Shungu H. M'gadzah: will present a compelling keynote on "The Six Stages Framework: Understanding and Dealing with Everyday Racism.” Exploring practical applications in various sectors and drawing from the SSF transformational toolkit. Workshops: To consolidate and explore the days learning and make recommendations to be published in our annual report. Who's Speaking? Dr. Shungu H. M'gadzah: Six Stages Framework & Inclusion Psychologists Ltd Dr. Ama Collison: Millennial Psychology Afua Hirsch: Award-winning writer, journalist, former barrister and filmmaker Visit the wide range of market stalls and bookstore on display. Explore the books from This is Book Love an award-winning collective and bookstore curating and showcasing and bringing together the best multicultural content the world of arts has to offer Schools, Nurseries, Public and corporate spaces www.thisisbooklove.com Get Your Tickets Tickets are now on sale. Join us for our Annual trailblazing event! Only £30 including lunch! Book now https://www.eventbrite.co.uk/e/edi-frameworks-for-inclusive-organisations-measuring-impact-tickets-909290140287?aff=oddtdtcreator https://www.eventbrite.co.uk/e/edi-round-table-event-and-the-six-stages-framework-conference-2024-tickets-884939155837?utm-campaign=social&utm-content=attendeeshare&utm-medium=discovery&utm-term=listing&utm-source=cp&aff=ebdsshcopyurl Link for more Information & Testimonials about last year’s event: https://www.inclusionpsychologists.com/post/exploring-equality-diversity-and-inclusion-through-different-professional-lenses-the-six-stages-fr-2 For sponsorship opportunities or Market stalls contact Dr. Shungu at: drshungu@inclusionpsychologists.comor Dr Ama Dr. Ama Collison Market stalls: We also have space for market stalls at a cost of £100 so if you know organisations who may be interested. Sponsorship: In terms of sponsorship, we are looking for any contribution to costs. We currently have one sponsor- Inclusivitti. https://www.inclusivitii.com/ Support with the event and donations Any help in publicising the event would be appreciated as well as any donations or sponsors. Organisers: https://www.inclusionpsychologists.com/ Dr Shungu H. M'gadzah, Six Stages Framework https://www.millennialpsychology.co.uk/ Dr Ama Collison: Millennial Psychology https://www.diversifyworld.com/ Mr Romain Muhammad: Diversify World Sponsors: Inclusivitti https://www.inclusivitii.com/ Venue: St Martin- in- the- Fields Here is the link to our online 3D tour. Take a 3D tour of our venue here: https://my.matterport.com/show/?m=74N3JkZtuq4 Best wishes, Shungu Dr Shungu Hilda M'gadzah Director & Lead Consultant Psychologist Inclusion Psychologists Ltd Tel: 07956 965 266 AUTHOR: Understanding & Dealing with Everyday Racism- The Six Stages Framework The Six Stages Framework Book https://www.sixstagesframework.com www.inclusionpsychologists.com https://www.inclusionpsychologists.com/book-online Psychology today directory https://www.psychologytoday.com/profile/774567 Follow me on twitter. https://twitter.com/DrShunguM LinkedIn profile https://www.linkedin.com/in/shunguhildamgadzah/

Art Craft Yoga - A Combined Life Drawing & Yoga Workshop

By Art Craft Studios

Enjoy the art of life drawing and yoga during this artistic relaxation class in London for beginners. If like us, you find yourself having to choose between being healthy or creative, then this workshop is the perfect option for you. You'll enjoy a combination of relaxation, stretching, and the opportunity to artistically express yourself all at the same time. Not only that, but it's also something fun and different to enjoy with friends and like-minded people. Life drawing and yoga go hand in hand as they are both therapeutic and tranquil. As you focus on the movements and techniques, that both life drawing and yoga provide, you leave your troubles behind. In this combined workshop you will: - Relax and stretch in a calm creative environment, whilst fellow guests observe the interesting shapes yoga can provide. - Draw from observation of a live yoga model (your fellow guests) using yoga shapes to help you. It's all about shorter drawings and overcoming the 'fear of the blank page'! - Feel refreshed, creative, and be able to take home a series of beautiful drawings. No yoga or creative skills are needed, our friendly hosts will guide you step-by-step through the experience with demonstrations and examples and adapt to suit your personal needs. We will supply everything you need including a matt. But if you want to bring your own you can. Please wear comfortable clothes. How will it work? For half the class you will be a yogi and for the other half of the class you will be an artist Everyone in the class will be modelling and drawing each other. On arrival you can decide whether you want to be the yogi or the artist first but either way you are going to experience both. Yoga: We've designed simple yoga poses most people can achieve and are perfect for drawing. Yogi Annie will take you through a series of stretching exercises for 35mins. She will demonstrate each pose, give you plenty of rest between movements and adapt the pose to suit your needs. Life drawing: You’ll be taken on a journey of drawing exercises with artist Klara. Whilst drawing the yogi models, for 35mins we will explore different tools such as pencil or charcoal and drawing techniques such as continuous line and blind drawing. These contemporary drawing exercises are perfect for beginners and accomplished artists we are here to support you with examples and demonstrations but you'll have creative freedom so you can be as abstract or as detailed as you like. At the end of the class, we will do some constructive rest and exhibit our drawings and you’ll leave relaxed and stretched and feel creative & healthy and display your drawing at home. Supporting you on your journey: Artist Klara revived her love of interpreting the human form 5 years ago, through the respected Dulwich Art Group. Over the last year she has taken on her first couple of commissions, and enjoys being part of the lively Instagram artist community as @the.pomegranate.art Yogi Annie has been practicing yoga for 10yrs. She gained her training for Vinyasa Flow in 2018 and has since furthered her teaching skills with Yin Yoga and Yoga Nidra. Her own practice is with other teachers including Restorative & Iyengar which help with her teaching skills.

IT'S THAT TIME AGAIN! THE NEON NIGHTMARE HALLOWEEN SCARE SPECIAL DEATH DRAWING CLASS! Join us in Dalston for an evening of spooky artistic fun. Come to a life drawing class like no other using neon reactive arts materials to draw inspiringly colorful life models. Trick or Treat! What will they be dressed as this year...crazy clowns, zealous zombies... or something much worse!

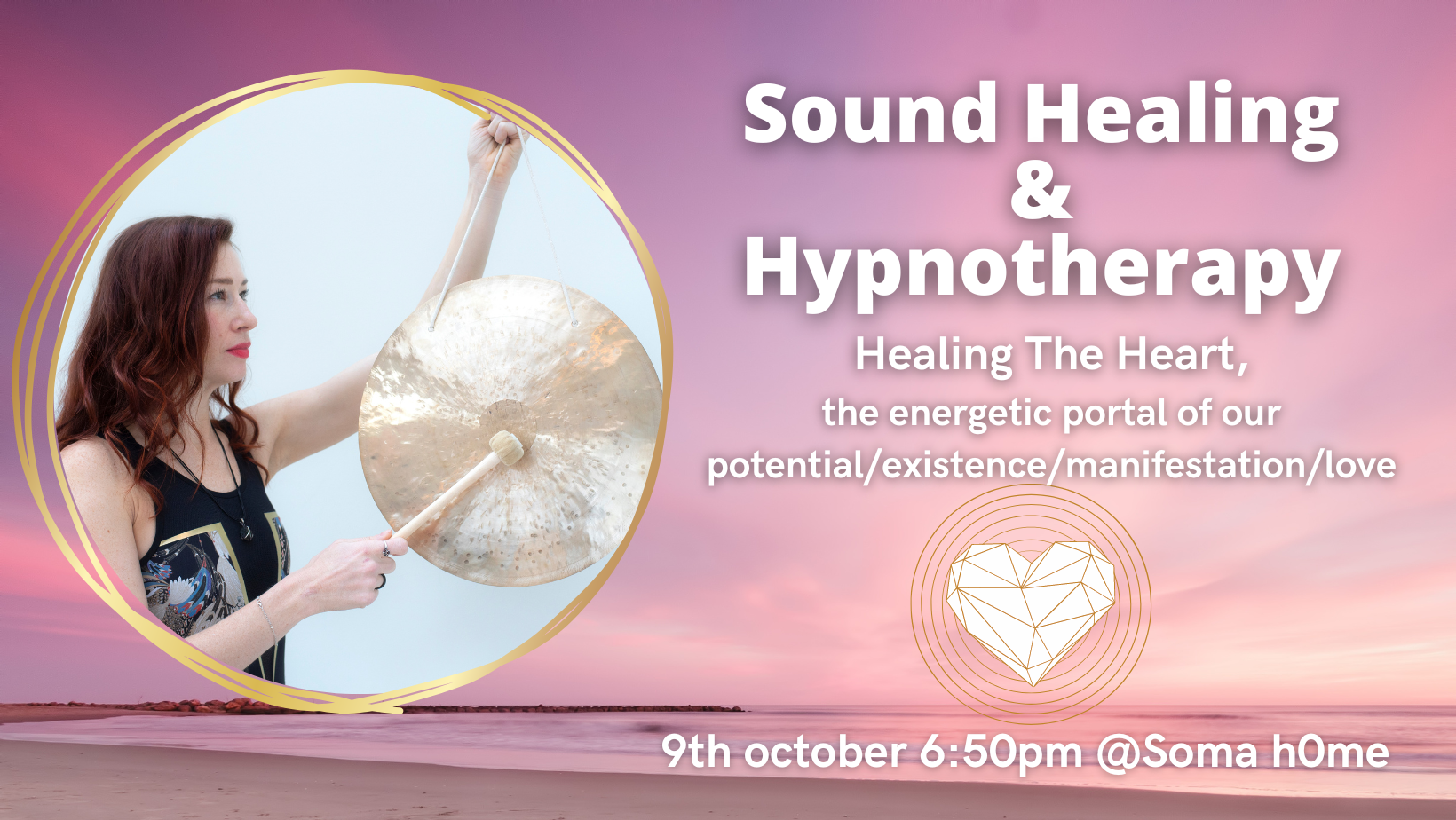

Sound Healing & Hypnotherapy Healing the Heart Centre

By Alphawavetherapy

A powerful healing experience fusing modern day therapeutic approaches and ancient healing methods. Focusing on the heart centre .

Painting Pottery & Glazing Workshop

By Art Craft Studios

Painting & 'glazing' means to add colour & patterns to your pottery. Kicking off with a practical demonstration, we will take you on a step-by-step journey of the fundamental ceramic techniques of glazing (surprisingly there are a few). Each step requires practice but you'll be hands-on in no time learning each step of the journey as we go. We have pre-made pots to choose from, inlcuding cups, bowls and planters. With your newly learned skills, you'll have what it takes to paint pottery and you can collect your finished works a few weeks later. We'll discuss when you can collect at the end of the workshop. All you need to do now is start thinking about your favourite colours and designs!

Shégitu Dance X She Runs It! Nature Walk 8km - Happy Valley

5.0(22)By Shégitu - Sensual Dance For Ladies

Come join us for a fun day of dancing and nature walking in Happy Valley with Shégitu Dance X She Runs It! - 8km adventure awaits! Shégitu Dance X She Runs It! Nature Walk 8km - Happy Valley Come join us for a fun-filled day of dancing and nature walking at Coulsdon South! This event is perfect for those who love to move their bodies and enjoy the great outdoors. Get ready to groove to the beats of Shégitu Dance and then hit the trails for an 8km nature walk with the She Runs It! community. It's a great way to stay active, connect with nature, and meet new friends. Don't miss out on this exciting event - sign up now! Get your 10,000+ steps with us as we take in Sunset and the breath-taking, versatile surroundings of Farthing Downs and Happy Valley. We will be teaching some engaging and aligning dance methods as well as fun training games from the 'She Runs It!' team This short, circular walk is the perfect opportunity to connect, explore, strengthen, and enhance your well-being. Here's what you can expect: Beginner-Friendly: Ideal for beginners who may be unsure of their mileage capabilities or new to bodyweight exercises. We'll provide a supportive environment where you can comfortably complete the distance and learn the fundamentals of bodyweight training. Whether you're a beginner, getting back into training, or advanced, our walks cater to all fitness levels. Playfulness: Expect laughter, conversation, music, and a chance to embrace the joy of being active in nature while challenging yourself with fun exercise. Come along to improve your fitness, explore nature, and meet incredible individuals while incorporating new forms of training into your routine. Suitable for 18y+ (If you are under 18 and would like to attend, you must be accompanied by a responsible adult) SUNDAY 17TH MARCH 2024 This is a circular route starting and ending at Coulsdon South Station Meeting Point: Coulsdon South Railway Station, Brighton Rd, Coulsdon CR5 3EA (There is a car park on site) Meeting Time: 14:45pm (We do appreciate your punctuality as we are aiming to align our walk with the sunset) There are regular direct trains to Coulsdon South from London Victoria and London Bridge We will be starting the walk by 15:00pm Distance: 8KM // 4.9 Miles Duration: 3.5 hours (approx. 2 1/2 hours walking time) What to bring: - Water - Wear light layers of clothing - A light rucksack if you are carrying anything - Scarf (satin or similar, to put around your hips) - Please wear waterproof shoes/hiking boots (Remember to bring a spare pair of trainers to change into at the end of the session, in case it's muddy) Please note; - If you can no longer attend after you book, please cancel your space so somebody else can fill in. - If you have any injuries or suffer from any conditions that may affect you while training, please drop us an email and we will do our best to accommodate you. Website: www.shegitu-dance.com Email us : info@shegitu-dance.com Like us on FB: https://www.facebook.com/shegituDance Follow us Instagram: @shegitudance @sherunsitldn @tashakeating @lidiaanamusic If you have any questions or would like to reschedule, get in touch. Looking forward to see you!

Saturdays Diamond Blade Fencing Club

By Diamond Blade Fencing Club

This course allows our students to raise their game to the next level. With world class coaching, we provide the best training session for your child giving them the chance to compete at a national level.

Handstitch a mini quilt at Big Penny Social

By cheekyhandmades

Join me at the Big Penny Social for a special evening of hand stitching. Make a mini quilt with me, using my fabric, threads, tools and techniques. Everyone will come away with a cool hand made piece of quilting that may just be the start of your quilting journey! Modern quilting is absolutely nothing like the beige and fussy textile we often associate with the word. Using monochrome or brightly coloured fabric, interesting patterns, oversized shapes, negative space, modern quilting is fun and funky and joyous. The class is two hours long and everything you need is included.

Search By Location

- TA Courses in London

- TA Courses in Birmingham

- TA Courses in Glasgow

- TA Courses in Liverpool

- TA Courses in Bristol

- TA Courses in Manchester

- TA Courses in Sheffield

- TA Courses in Leeds

- TA Courses in Edinburgh

- TA Courses in Leicester

- TA Courses in Coventry

- TA Courses in Bradford

- TA Courses in Cardiff

- TA Courses in Belfast

- TA Courses in Nottingham