- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Boost your team's performance through better communication!

By Culture Fit Consulting Ltd

This interactive 3-hour webinar is designed for teams who want to understand one another’s behavioural style and improve how the team interacts. Using the DISC framework, we'll uncover how people think, behave, and work differently. Participants will understand their own behavioural style and its impact on others. We'll explore how different styles prefer to communicate and collaborate, and how to adapt our messages to team members with diverse working styles and communication preferences.

From Boss to Coach (Leadership training)

By 4and20Million.

Managing others effectively by creating an environment of psychological safety and nurturing development & growth.

Mental Health First Aid

By Bright White Life - Coaching and Training

Become a Mental Health First Aider (MHFAider®) and receive 3 years of certification and ongoing benefits. This 2-day course will teach you how to identify signs of poor mental health and confidently provide support. Delivered via Zoom or in person. Includes workbook/manual, e-certificate, and 3yr access to MHFAider® Support App and learning opportunities. Enquire for more details

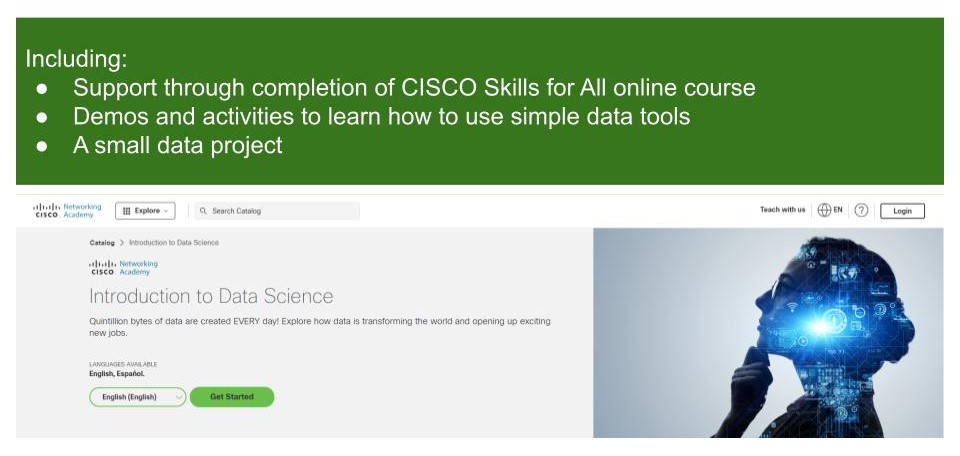

Introduction to Data Science

By futureCoders SE

Learn the basics of Data Science, combining a supported #CISCO Skills for All online course with practical learning and a project to help consolidate the learning.

Visual Basic for Applications (VBA) in Excel (from cool to geek in less than 1 day)

By Alumno Consulting

Excel but different. Harness this most powerful tool but on a course tailored to your business and needs. Using case studies relevant to your business and often actual files your firm uses on a daily basis we embark on a voyage of discovery. This isn't a boring "watch what I do and copy" course. This is exciting, engaging, funny and enjoyable. Delegates will learn relevant skills but also, because of the delivery methods they will gain an increased enjoyment of using Excel and will retain and implement all of the material covered. They also have access to the trainer for an unlimited amount of time after the course to continue to grow their knowledge

Introduction to Agile and Scrum: In-House Training

By IIL Europe Ltd

Introduction to Agile and Scrum: In-House Training This half-day course provides an overview of Agile principles and mindset, and the Scrum framework as a key Agile approach. It will provide you with the key benefits of an Agile approach, and its differences with the traditional Waterfall method. Lastly, as Agile is looked upon more frequently as an alternative delivery method, you will review situations where Agile can be adapted outside of software development, where it is most commonly used. What you will Learn At the end of this program, you will be able to: Explain the basics and benefits of using an Agile approach Describe the Scrum framework, its events, artifacts and roles and responsibilities Illustrate Agile approaches outside of Software Development Getting Started Introduction Course structure Course goals and objectives Agile Introduction What is Agile? Agile Benefits Agile Methods Overview of Scrum Scrum Overview Scrum Events Scrum Artifacts Scrum Roles Definition of Done Agile Approaches Outside of Software Development Agile in other environments Product Development Course Development Marketing Agile Project Candidates Summary What Agile is not... Concerns and Pitfalls

Customer Service: Get All Basics Right to Elevate Your Customer Experience

By Beyond Satisfaction - Customer service Training

If you want your employees to improve their customer service skills and deliver an amazing experience to your customers, feel free to check out my Training course focusing on the core values of customer service.

Advanced sales negotiation skills (In-House)

By The In House Training Company

The 'golden rule' of negotiation is simple - don't! But life's rarely that simple and very often we do have to negotiate, particularly if we want to win the business and especially if we want to win it on our terms. Such negotiations are crucial. We need to prepare for them. We need a strategy, and the skills to execute it. Does your team have a structured approach? Is it flawlessly executed, every time? Or is there room for improvement? This programme will help them master the six fundamentals of closing better business: Manage all these elements well and you will win more business, more profitably. This course will help participants: Negotiate from a position of partnership, not competition Deal more effectively and profitably with price objections Identify and practise successful sales negotiating skills Identify strengths and weaknesses as a sales negotiator Understand different types of buyer behaviour Learn to recognise negotiating tactics and stances Apply a new and proven structure to their business negotiations Identify and adapt for different behavioural styles Be alert to unconscious (non-verbal) communication Prepare and present a proposal at a final business negotiation stage Project confidence and exercise assertiveness in all sales negotiations 1 Planning for successful business negotiations This session introduces the concept of business negotiation and looks at its importance in the context of the participants' roles and activities. It briefly examines why we negotiate and the dynamics involved. Session highlights: What kind of a negotiator are you? Negotiation skills self-assessment and best practice How to establish roles and responsibilities for both parties How to identify and set objectives for both buyer and seller How to research and establish the other person's position (business negotiation stance) 2 How to structure your negotiations This module presents an eight-step framework or structure for use in negotiations and considers how best to prepare and plan your negotiations within the context of a supplier/customer relationship or business cycle. It also includes a brief review of legal responsibilities and what constitutes a 'deal'. Session highlights: Learn and apply a formal structure to use when negotiating How to establish short- and longer-term objectives and opportunities How best to plan, prepare and co-ordinate a major business negotiation meeting, or on-going negotiations Understanding of basic legal and organisational requirements 3 Verbal negotiation skills This session examines the human and communication dynamics inherent in any negotiation situation. It emphasises the importance of professional skills in preparing for a negotiation by identifying needs, wants and requirements accurately and by qualifying the competitive and organisational influences present. Session highlights: How to fully 'qualify' the other party's needs, requirements and constraints during the negotiation process by using advanced questioning and listening skills How to pre-empt negotiation objections by promoting and gaining commitment to options, benefits, value and solutions How best to propose and suggest ideas, using drawing-out skills 4 Non-verbal negotiation skills This module highlights how different personal styles, corporate cultures and organisation positions can influence events, and demonstrates practical methods for dealing with and controlling these factors. It also examines key principles of body language and non-verbal communication in a practical way. Session highlights: Gaining rapport and influencing unconsciously Understanding the importance of non-verbal communication; reading other people's meaning and communicating effectively as a result Ensure that non-verbal behaviour is fully utilised and observed to create maximum impact and monitor progress (eg, buying signals) Recognising that business negotiations are precisely structured and agreements gained incrementally 5 Proposing and 'packaging' This session highlights how best to present and package your proposal. It looks at how to pre-empt the need for negotiating by creating minor-options and 'bargaining' points, as well as how to manage the expectations and perceptions of the customer or buyer. Session highlights: How to identify the key variables that can be negotiated The power and use of 'authority' within your negotiations How to structure and present your proposal, ideas or quotation to best effect The importance of when and how to identify and influence buyer's objections 6 Dealing with price This module highlights how to best present and package price within your proposal or negotiation. In most cases, price has more to do with psychology than affordability and preparation and careful handling are essential. Session highlights: The three reasons that people will pay your asking price How to set price in a competitive market The key differences between selling and negotiating Ten ways to present price more effectively and persuasively 7 Getting to 'Yes': tactics and strategies There are many different tactics and strategies common to successful negotiators. This session looks at those that are most appropriate to the participants' own personal styles and situations. The importance of 'follow-through' is also explained and how to deal with protracted or 'stale-mate' business negotiations. Session highlights: How to negotiate price and reduce discounting early in the process How to recognise negotiating tactics and strategies in your customer or supplier Key strategies, techniques and tactics to use in negotiation The importance of follow-through and watching the details How to deal with stalled business negotiations or competitor 'lock-out' 8 Case studies and review This session examines a number of different situations and participants discuss ways to approach each. This will allow learning to be consolidated and applied in a very practical way. There will also be a chance to have individual points raised in a question and answer session. Session highlights: Case studies Question and answer Planning worksheet Negotiation 'toolkit' and check-list 9 Personal action plans Session highlights: Identify the most important personal learning points from the programme Highlight specific actions and goals Flag topics for future personal development and improvement

Negotiation skills (In-House)

By The In House Training Company

Any successful business manager will tell you that you never get the deal you deserve - you always get the deal you negotiate! This two-day workshop includes recent research and practical techniques from the Harvard Business School Negotiation Project and provides a unique opportunity to learn and practice these skills in a safe environment using up to date materials and life-like practice negotiation case studies. This course will help participants to: Understand the basics of negotiation Develop negotiating skills Increase their business acumen Develop their communication skills Learn the models, techniques and tools for an effective negotiation Identify the barriers to agreements Close the deal 1 What is negotiation? Key skills for negotiation Types of negotiation Win-lose negotiations versus Win-win negotiations Wise agreements and Principled Negotiation 2 Four key negotiating concepts BATNA - Best alternative to negotiated agreement Setting your reservation price ZOPA - Zone of possible agreement Creating and trading value 3 Business acumen Understanding pricing, gross margins and profit Knowing the key points on which to negotiate 4 A Four Phase Model for negotiation Nine steps to successful planning Discussing a deal - creating and claiming value Making and framing proposals Bargaining for the winning deal 5 Effective communication Effective questioning Active listening skills Understanding and interpreting body language Barriers to effective communication 6 Understanding influence and persuasion Influencing strategies Ten proven ways to influence people Six universal methods of persuasion Understanding why people do business with other people 7 Negotiating tactics Tactics for win-lose negotiations Tactics for win-win negotiations Effective team negotiating Understanding and using powerv What do you do when the other side has more power? 8 Barriers to agreement Common barriers to agreement The Negotiators Dilemma Dealing with die-hard negotiators Dealing with lack of trust 9 Potential barriers to cross-border agreements Understanding business methods and practice in other cultures Figuring out who has the power and who makes decisions Recognising and dealing with cultural differences What's OK here might not be OK there 10 Closing the deal Four steps to closing the winning deal

Sales Presenting

By Dickson Training Ltd

The main aim of this workshop is to encourage and enable delegates to present their sales messages stylishly and persuasively to expert buying audiences and improve their conversion rates. The focus is placed firmly on performance and creativity in top level presenting. It is aimed at experienced sales professionals who are expert at selling but need to be able to present and pitch for business at high skill levels in order to land major accounts. Delegate numbers will be restricted to 4 people. Delegates should be willing and be prepared to give video-recorded presentations as part of the course. Course Syllabus The syllabus of the Sales Presenting course is comprised of two modules, covering the following: Module One Components of Top Presenting Preparation and performance in presenting Being stylish and compelling Differentiation, risk-taking and presenting Connecting with your audience Achieving impact and drama Creating a buying emotion Getting out of a comfort zone First delegate presentations Module Two Pitching in Teams Getting your act together - the plan Looking and sounding like a team The buyer's perspective Getting your moves right - choreography Dealing successfully with questions Rehearsing to succeed Second delegate presentations Dragon's Den Exercise The delegation is split into two groups, each with a specific product or service to win the Dragons' investment. They have to also present to the Dragon's Den their business case for feedback and negotiate with the Dragons to gain either an "I'm in" or an "I'm out" reply. A full debrief is then conducted covering: Planning Commercial consequences Putting forward a business case Critical thinking Negotiating Selling skills Presentation skills Profile building Scheduled Courses This course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information please contact us.

Search By Location

- Business Courses in London

- Business Courses in Birmingham

- Business Courses in Glasgow

- Business Courses in Liverpool

- Business Courses in Bristol

- Business Courses in Manchester

- Business Courses in Sheffield

- Business Courses in Leeds

- Business Courses in Edinburgh

- Business Courses in Leicester

- Business Courses in Coventry

- Business Courses in Bradford

- Business Courses in Cardiff

- Business Courses in Belfast

- Business Courses in Nottingham