- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Application of Structural Geology in Seismic Interpretation

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course Seismic interpretation requires an understanding of structural development and its interrelation with the stratigraphic system. Bias and misunderstanding have unfortunately resulted in countless dry holes. So go beyond tracing horizons and understand their context within the structural system by extracting key information from seismic surveys and other datasets. In this 5 full-day training course, participants will learn a variety of modern structural concepts and techniques and their role in the interpretation of seismic data. Using an applied 'hands-on' approach, participants will be exposed to a diversity of worldwide case examples with complementary exercises - both of an individual and group nature. The course is designed from an applied standpoint, with numerous examples and hands-on exercises from the petroleum industry. This course can also be offered through Virtual Instructor Led Training (VILT) format. Training Objectives By the end of this course, the participants will be able to: Go beyond tracing horizons and marking faults and truly understand the structural and stratigraphic system. Understand the role of tectonics and deformation in the formation of various types and orientations of geologic structures. Understand the interaction of the structural system with the stratigraphic and sedimentologic environment for better prediction of reservoir formation. Integrate data from the large seismic scale to subseismic scale, including seismic anisotropy, to understand better the overall petroleum system. Learn about the common pitfalls of interpretation. Target Audience This course is intended for geologists, geophysicists, reservoir engineers, and exploration/production managers. Course Level Intermediate Trainer Your expert course leader received his B.S. and M.S. degrees in Geology from the now University of Louisiana-Lafayette in 1989 and 1990 respectively, and his Ph.D. as a National Science Foundation fellow at Baylor University, Waco, Texas, in 1993. From 1994 - 1996, he studied planetary tectonics as a NASA-funded postdoctoral fellow at Southern Methodist University. In 1996, he returned to UL-Lafayette, where he was awarded in 1997 the Hensarling-Chapman Endowed Professorship in Geology. He began independent consulting activities in 1991, and in 2001, he left academia for full-time consulting for clients ranging from one-man shops to supermajors. He rejoined UL-Lafayette as an adjunct professor from 2011 - 2018. He is an active researcher, receiving several million dollars in grants from federal, state, and industry sources, presenting numerous talks, including a 2019 AAPG Levorsen award, and publishing on a diversity of geoscience topics, including a Grover E. Murray Best Published Paper award in 2017. He is co-author of the inaugural GCAGS/GCSSEPM Transactions Best Student Paper award in 2018. He served as the GCAGS Publisher since 2006 and in various GCAGS/GCSSEPM Transactions editing capacities since 2006, including the 2014 and 2017 - 2022 Editor (named Permanent Transactions Editor in 2017), and Managing Editor since 2011, receiving a GCAGS Distinguished Service Award in 2018. He served as the General Chair for GeoGulf 2020 (70th GCAGS/GCSSEPM Convention), the 1st hybrid geoscience conference in the world. He is a Past President of the Lafayette Geological Society and served as its Editor and Publisher from 2002 - 2018. In 2018, he founded the Willis School of Applied Geoscience, reformulating decades of industry-training experience to provide alternative opportunities for graduate-level education. In 2020, he received an Honorary Membership from GCSSEPM. He also joined the LSU faculty as an adjunct professor in 2020. In 2021, he co-founded the Society of Applied Geoscientists and Engineers, serving as its President, General Chair for the SAGE 2022 Convention & Exposition, and Vice-Chair for the Benghazi International Geoscience & Engineering Conference 2022 (BIGEC 2022). POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Best Practice in Portfolio Management in Upstream Oil and Gas

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) This 4 half-day Virtual Instructor Led Training (VILT) course presents the principles and best practices of portfolio management in the upstream (E&P) oil and gas industry. The VILT course is equally valuable for small independents, large integrated international companies and national oil companies. The VILT course consists of presentations, case studies, illustrative practical exercises and syndicate discussions. Particular emphasis is given to pragmatic portfolio management approaches and solutions which can be implemented swiftly without recourse to major investments in planning and portfolio management software. The VILT course will draw on examples from your expert course leader's 35+ years' experience in the oil and gas industry as an explorationist, upstream vice-president and management consultant. The VILT course handout will comprise softcopy slides used in the presentation and a softcopy workbook for the exercises. Participants will gain proficiency in portfolio management techniques, understand how and why to undertake this activity and be able to apply key concepts directly in the business of their teams / divisions. The VILT course will be presented over 4 half-days, using Microsoft Teams or Zoom and a proprietary set of VILT tools. Participants will be asked to complete a pre course questionnaire (PCQ) addressing their objectives and experience, and attend a session to familiarise themselves with VILT tools before course commencement. Training Objectives To present the tools, concepts and principles of portfolio management To define the quantitative metrics which are used to describe projects in a portfolio To understand the benefits of portfolio management at different stages of the upstream business: in strategy development, opportunity screening, business development, drilling prospects, conducting appraisal of discoveries and developing fields To put portfolio management in the organisational context by describing the role of the portfolio management team and examining how value assurance (quality control) is best conducted on portfolio data for projects and assets To demonstrate how portfolio management contributes to improved business performance By the end of the VILT course, participants will understand: Key concepts and principles of portfolio management How to design a simple portfolio database and describe complex projects in a small number of objective metrics How to segment the portfolio into meaningful units How to use portfolio data in making business choices and decisions at the strategic and tactical levels The extent to which it is meaningful and reasonable to make comparisons across different portfolio segments How the portfolio management team can support the wider business in decision-making Target Audience This VILT course is specially designed for exploration and development geoscientists, E&P economists and finance staff, and E&P managers. Both technical and non-technical staff will benefit from the concepts presented. Companies are encouraged to send participants from different functions and seniority levels to gain great benefits especially those which would like to implement the concepts presented in this VILT course. Course Level Basic or Foundation Training Methods The VILT course will be delivered online in 4 half-day sessions comprising 4 hours per day, with 2 breaks of 10 minutes per day. The VILT course will be presented in an interactive workshop format that allows for discussion. Course Duration: 4 half-day sessions, 4 hours per session (16 hours in total). Trainer Your expert course leader draws on more than 35 years of experience managing, reviewing and directing projects in all aspects of the exploration business: from exploration business development (new ventures), through prospect maturation and drilling, to the appraisal of discoveries. He has more than 30 years' experience with Shell International, followed by 10 years consulting to NOCs in Asia Pacific, Africa and South America and independent oil companies in the United Kingdom, continental Europe and North America. Other than delivering industry training, he has worked on projects for oil & gas companies of all sizes, including independents, national oil companies and (super)-majors, private equity firms, hedge funds and investment banks, and leading management consulting firms. He is an alumnus of Cambridge University. He has M.A and Ph.D. degrees in geology and is a Fellow of the Geological Society of London as well as a respected speaker on management panels at international conferences. Professional Experience Management consultancy & executive education: Advice to investment banks, businesses and major consulting firms. Specialist expertise in upstream oil & gas, with in depth experience in exploration strategy, portfolio valuation and risk assessment. Leadership: Managed and led teams and departments ranging from 3 - 60 in size. Provided technical leadership to a cadre of 800 explorationists in Shell worldwide. Member of the 12-person VP team leading global exploration in Shell, a $3 bln p.a. business and recognised as the most effective and successful among its industry peers. Accountability & decision-making: Accountable for bottom-line results: in a range of successful exploration ventures with budgets ranging from $10's million to $100's million. Made, or contributed to, complex business decisions / investments, taking into account strategic, technical, commercial, organisational and political considerations. Corporate governance: Served as non-executive director on the Boards of the South Rub al Khali Company (oversight of gas exploration studies and drilling in Saudi Arabia) and SEAPOS B.V. (exploration deep-water drilling and facilities management). Technical & operations: Skilled in exploration opportunity evaluation, the technical de risking of prospects, portfolio analysis and managing the interface between exploration and well engineering activities. Unparalleled knowledge of the oil and gas basins of the world, and of different operating regimes and contractual structures, ranging from Alaska, Gulf of Mexico and Brazil, through to the Middle East, former Soviet Union, Far East and Australia. Safety: Following an unsatisfactory audit, became accountable for safety performance in Shell's exploration new ventures. Through personal advocacy and leadership of a small team, delivered pragmatic and effective HSE systems, tools and staff training / engagement and a dramatically improved safety record. R&D: Experience in the 3 key roles in R&D: scientific researcher, research manager, and 'customer' for R&D products. After re-defining Shell's exploration R&D strategy, led the re-structuring of the R&D organization, its interface with 'the business' and approaches to deployment and commercialization. Strategy: Accomplished at formulating competitive strategies in business, R&D and technology deployment, translating them into actionable tactics and results. Defined the exploration strategy of PDO (a Shell subsidiary in Oman) and latterly of Shell's global exploration programme. Professional education, behavioural/motivational coaching: Experienced in organisational re-design, change management, leadership education and talent development. Commercial skills: Personally negotiated drilling compensation claims, educational contracts and E&P contracts, with values of $5 million to $100+ million. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Directional, Horizontal and Multilateral Drilling – Simulator Assisted

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your drilling skills with our Directional, Horizontal, and Multilateral Drilling Simulator Assisted course. Join EnergyEdge for comprehensive training.

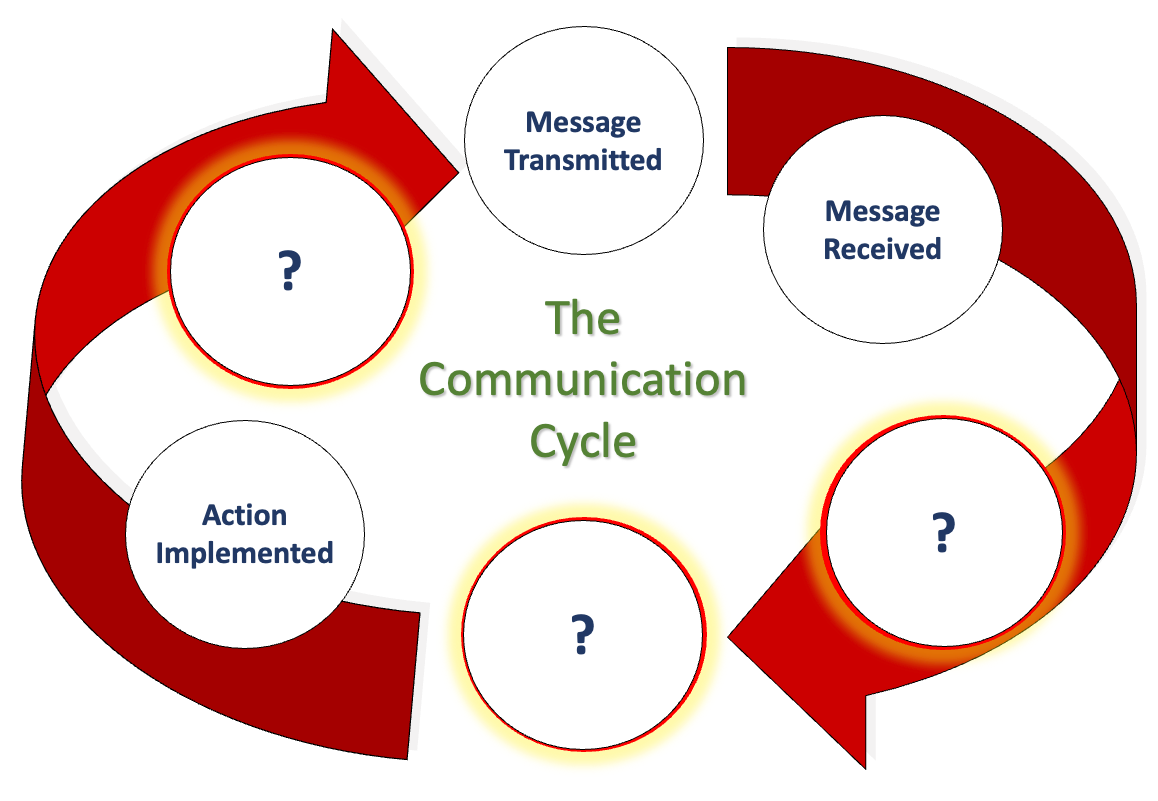

We communicate daily in many ways, including email, phone, text, Zoom, Teams, Google Meets, Slack, and even that old-fashioned thing, what was it now... oh yes, talking face-to-face. But, when we look at communication closely and really drill down into what we are doing in conjunction with how our brain works (neuroscience), how internal, organisational, and social politics control what we believe we can say, how hierarchical positioning impacts our honesty and how the lack of psychological safety means we say what we know others want to hear rather than what they need to hear…. It is oh so complicated! This workshop not only explores the concept of excellent communication, but we also want to hear what you believe it is too. We also delve into how organisational culture influences our perception of speaking up. Factors that hinder open and honest communication, and we work collaboratively towards removing these barriers to achieve a communication style that fosters trust and transparency, creating psychological safety. This workshop is particularly relevant to our Emotional Intelligence workshop (EI and Me). We firmly believe that developing emotional intelligence is the key to unlocking Clean Communication, a skill that is crucial for all of us, regardless of our roles and responsibilities, so that we thrive in our professional environment. If you want to see if we are correct, why not have us facilitate a workshop for you and see what you get by the end of it? LENGTH - Normally, one day. But please contact us to discuss your specific needs, or we can offer advice. NEXT WORKSHOP START - Please ask for more information as we deliver bespoke closed events for your people at your location or a mutually suitable location. WORKSHOP DELIVERY - The best environment for this workshop is face-to-face, but we can facilitate this workshop online. Suitability - Who should attend? Who Should Attend and Why? Who? - Perhaps think of this another way… who shouldn’t attend to ensure we can attain Clean Communication? There’s your answer. Why? - Every person needs to understand what we are saying above about how we get trapped in this organisational formatting which changes how we communicate and how it prevents us from communicating cleanly. EVERY organisation has this, despite what our values profess. And 'Values', that’s a whole other story. Workshop Content Using the 'Moccasin Approach'® to clean our personal and organisational communication LaPD’s Communication Cycle and what we must consider. (Can you work out what the ? represent above? Accountability and Responsibility raises its head in Communication. It has to. Bias, unconscious bias and its impacts on our communication. The conundrum of communicating with others and their styles (The TRAP). How would my perfect Manager/Leader communicate with me? Nonverbal communication (body language), rapport, Clean Communication. Negative communication can go viral (Self-Fulfilling Prophecy). Reflections, findings and goals (individual and team). Meeting our workshop objectives by listing five areas for development. Workshop delivery and venue This workshop is usually one day in duration, and it focuses solely on how we communicate with each other. It can also be a two-day event incorporating aspects of Emotional Intelligence (EI) with group, and individual activities to allow discussions about the various communication we need in your organisation. When you consider the content we deliver, we are sure you will understand why we always prefer to deliver our workshops, courses and programmes face-to-face. Face-to-face workshops and courses can be held at a location of your choice or, if you wish, a central UK location, such as the Macdonald Burlington Hotel in Birmingham, located directly across from the Birmingham New Street train station. We can deliver our workshops, courses and programmes online, although this will mean splitting elements into manageable learning events to suit the online environment.

Smart Metering & Power Quality Analytics

By EnergyEdge - Training for a Sustainable Energy Future

About this training course The smart meter or smart grid represents the next-generation electrical power system. This system uses information, data & communication technology within generation, delivery and consumption of electric energy. This 4-day course will equip you with the innovations that are shaping the power generation and distribution systems and will cover topics ranging from Smart Metering Architecture, Cybersecurity, Smart Grid Systems and Power Line Communications. Training Objectives By participating in this course, you will be able to: Comprehend the Smart Grid and Smart Meters architecture Review latest trends and challenges within the Smart Grid Technology Perform analysis on smart electronic meters Comply with regulatory and metering standards Recognize the importance of cybersecurity in smart grids Maximize efficiency, reliability, and longevity of your smart meters and equipment Gain valuable insights into power quality and harmonics Target Audience This course will greatly benefit the following groups but not limited to: Smart Grid managers and engineers Smart Meters managers and engineers Power plant managers Outage managers Maintenance and operations engineers Power regulatory personnel Transmission managers and engineers Distribution managers and engineers IT managers Renewable energy managers and engineers Course Level Basic or Foundation Intermediate Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 4 days in total (28 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader is a professional engineer with extensive experience in power system studies, substation design field-testing, and EHS programs settings for Mining and Electrical Utilities sectors. He was formally the Engineering Manager at GE Canada in Ontario. He received his M.Sc. in electrical engineering from the University of New Brunswick and his MBA from Laurier School of Business in Waterloo. He has managed and executed more than 150 engineering projects on substation design EMF audits and power system studies and analyses, EMF audits and grounding audits, for major electrical utilities, mines, oil and gas, data centers, industrial and commercial facilities in Canada and the U.S. He is a certified professional engineer in the provinces of Ontario and Alberta. He has various IEEE publications, has served as a technical reviewer for many IEEE journals in power systems and control systems, and is the chair of the Industry Application Chapter (IAS) for IEEE Toronto Section. He remains a very active member for the IEEE substation committee of IEEE Std. 81 ground testing (WGE6) and IEEE Std. 80 ground design (WGD7). A certified electrical safety trainer by GE Corporate and a Canadian Standard Association (CSA) committee member at the mining advisory panel for electrical safety, he also taught many technical courses all over Canada to industrial customers, electrical consultants as well as to electrical utilities customers. Highlighted Projects: Various Power System Studies for 345/230 kV Stations - Nova Scotia Power (EMERA) RF audits for Telecom tower and antennas - Cogeco/Rogers Mobile Power System analysis - Powell Canada Structural/Geotechnical Design and upgrades - Oakville Hydro Underground Cables testing and sizing - Plan Group Relay programming and design optimization - Cenovus Canada Different Arc Flash Analysis and BESS Design - SNC Lavalin Environmental site assessment (ESA) Phase I/II for multiple stations - Ontario Electromagnetic compatibility (EMC) assessment for Toronto LRT expansion - MOSAIC Battery energy storage system (BESS) installation at City of London - Siemens Canada EMF audits for 500 kV Transmission Lines - Hydro One EMF audits for 500 kV Transmission Lines - Hydro Quebec AC interference for 138 kV line modeling and mitigations - HBMS Mine POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

LNG Markets, Pricing, Trading & Risk Management

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course The LNG market is developing from a fully based market on long-term contracts, to a more flexible market based on a portfolio of contracts of different durations. The increase of LNG demand, fuelled by South Korea, Japan and several other emerging economies, are creating a base for a more flexible market, where the LNG spot market will be playing a key role. Changes in the LNG market can be identified in the following areas: development of terminals and plant sizes, increased integration throughout the supply chain, diversification of supply sources, increased contractual flexibility and increased geographical distance. This is creating the foundation for the development of the LNG spot market right here in Asia today. This 3 full-day intensive intermediate level course will give you cutting-edge knowledge needed in today's complex LNG market. Increase your knowledge and understanding of the LNG market and spot trading aspects by attending this course. Training Objectives By the end of this course, participants will be able to: Leverage on the current and global drivers of the world Natural gas and LNG markets Understand regional LNG pricing effects and who the key buyers and new sellers are Appreciate the trading structures of LNG and how to structure its risk management Understand the workings and future outlook of the Asian LNG Spot market Discover and exploit the arbitrage trading opportunities between the different markets Learn what LNG derivatives are and how it will become available for hedging and proprietary trading purposes Target Audience This course will benefit: LNG market development executives are drawn from both technical and non-technical (commercial, finance and legal) backgrounds. Participants in an LNG market development team, perhaps with expertise in one area of gas development, will benefit from the course by obtaining a good grounding of all other areas. The course is pitched at an intermediate level, although those with a basic knowledge will be able to grasp most of the concepts covered. Course Level Intermediate Trainer Your course leader is a skilled and accomplished professional with over 25 years of extensive C-level experience in the energy markets worldwide. He has strong expertise in all the aspects of (energy) commodity markets, international sales, marketing of services, derivatives trading, staff training and risk management within dynamic and high-pressure environments. He received a Master's degree in Law from the University of Utrecht in 1987. He started his career at the NLKKAS, the Clearing House of the Commodity Futures Exchange in Amsterdam. After working for the NLKKAS for five years, he was appointed as Member of the Management Board of the Agricultural Futures Exchange (ATA) in Amsterdam at the age of 31. While working for the Clearing House and exchange, he became an expert in all the aspects of trading and risk management of commodities. In 1997, he founded his own specialist-consulting firm that provides strategic advice about (energy) commodity markets, trading and risk management. He has advised government agencies such as the European Commission, investment banks, major utilities, and commodity trading companies and various energy exchanges and market places in Europe, CEE countries, North America and Asia. Some of the issues he has advised on are the development and implementation of a Risk Management Framework, investment strategies, trading and hedging strategies, initiation of Power Exchanges (APX) and other trading platforms, the set-up of (OTC) Clearing facilities, and feasibility and market studies like for the Oil, LNG and the Carbon Market. The latest additions are (Corporate) PPAs and Artificial Intelligence for energy firms. He has given numerous seminars, workshops and (in-house) training sessions about both the physical and financial trading and risk management of commodity and carbon products. The courses have been given to companies all over the world, in countries like Japan, Singapore, Thailand, United Kingdom, Germany, Poland, Slovenia, Czech Republic, Malaysia, China, India, Belgium and the Netherlands. He has published several articles in specialist magazines such as Commodities Now and Energy Risk and he is the co-author of a book called A Guide to Emissions Trading: Risk Management and Business Implications published by Risk Books in 2004. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Compressors & Pumps: Selection, Applications, Operation, Troubleshooting and Maintenance

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your expertise in compressor and pump selection, operation, troubleshooting, and maintenance with EnergyEdge's comprehensive classroom training. Elevate your skills today!

Artificial Lift and Real-Time Production Optimization in Digital Oilfield

By EnergyEdge - Training for a Sustainable Energy Future

About this training course Artificial lift systems are an important part of production operations for the entire lifecycle of an asset. Often, oil and gas wells require artificial lift for most of the life cycle. This 5-day training course offers a thorough treatment of artificial lift techniques including design and operation for production optimization. With the increasing need to optimize dynamic production in highly constrained cost environments, opportunities and issues related to real-time measurements and optimization techniques needs to be discussed and understood. Artificial lift selection and life cycle analysis are covered. These concepts are discussed and reinforced using case studies, quizzing tools, and exercises with software. Participants solve examples and class problems throughout the course. Animations and videos reinforce the concepts under discussion. Understanding of these important production concepts is a must have to exploit the existing assets profitably. Unique Features: Hands-on usage of SNAP Software to solve gas-lift exercises Discussion on digital oil field Machine learning applications in gas-lift optimization Training Objectives After the completion of this training course, participants will be able to: Understand the basics and advanced concepts of each form of artificial lift systems including application envelope, relative strengths, and weaknesses Easily recognize the different components from downhole to the surface and their basic structural and operational features Design and analyze different components using appropriate software tools Understand challenges facing artificial lift applications and the mitigation of these challenges during selection, design, and operation Learn about the role of digital oilfield tools and techniques and their applications in artificial lift and production optimization Learn about use cases of Machine learning and artificial intelligence in the artificial lift Target Audience This training course is suitable and will greatly benefit the following specific groups: Production, reservoir, completion, drilling and facilities engineers, analysts, and operators Anyone interested in learning about selection, design, analysis and optimum operation of artificial lift and related production systems will benefit from this course. Course Level Intermediate Advanced Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 5 days in total (35 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 20. This course is also available through our Virtual Instructor Led Training (VILT) format. Prerequisites: Understanding of petroleum production concepts. Each participant needs a laptop/PC for solving class examples using software to be provided during class. Laptop/PC needs to have a current Windows operating system and at least 500 MB free disk space. Participants should have administrator rights to install software. Trainer Your expert course leader has over 35 years' work-experience in multiphase flow, artificial lift, real-time production optimization and software development/management. His current work is focused on a variety of use cases like failure prediction, virtual flow rate determination, wellhead integrity surveillance, corrosion, equipment maintenance, DTS/DAS interpretation. He has worked for national oil companies, majors, independents, and service providers globally. He has multiple patents and has delivered a multitude of industry presentations. Twice selected as an SPE distinguished lecturer, he also volunteers on SPE committees. He holds a Bachelor's and Master's in chemical engineering from the Gujarat University and IIT-Kanpur, India; and a Ph.D. in Petroleum Engineering from the University of Tulsa, USA. Highlighted Work Experience: At Weatherford, consulted with clients as well as directed teams on digital oilfield solutions including LOWIS - a solution that was underneath the production operations of Chevron and Occidental Petroleum across the globe. Worked with and consulted on equipment's like field controllers, VSDs, downhole permanent gauges, multiphase flow meters, fibre optics-based measurements. Shepherded an enterprise-class solution that is being deployed at a major oil and gas producer for production management including artificial lift optimization using real time data and deep-learning data analytics. Developed a workshop on digital oilfield approaches for production engineers. Patents: Principal inventor: 'Smarter Slug Flow Conditioning and Control' Co-inventor: 'Technique for Production Enhancement with Downhole Monitoring of Artificially Lifted Wells' Co-inventor: 'Wellbore real-time monitoring and analysis of fracture contribution' Worldwide Experience in Training / Seminar / Workshop Deliveries: Besides delivering several SPE webinars, ALRDC and SPE trainings globally, he has taught artificial lift at Texas Tech, Missouri S&T, Louisiana State, U of Southern California, and U of Houston. He has conducted seminars, bespoke trainings / workshops globally for practicing professionals: Companies: Basra Oil Company, ConocoPhillips, Chevron, EcoPetrol, Equinor, KOC, ONGC, LukOil, PDO, PDVSA, PEMEX, Petronas, Repsol, , Saudi Aramco, Shell, Sonatrech, QP, Tatneft, YPF, and others. Countries: USA, Algeria, Argentina, Bahrain, Brazil, Canada, China, Croatia, Congo, Ghana, India, Indonesia, Iraq, Kazakhstan, Kenya, Kuwait, Libya, Malaysia, Oman, Mexico, Norway, Qatar, Romania, Russia, Serbia, Saudi Arabia, S Korea, Tanzania, Thailand, Tunisia, Turkmenistan, UAE, Ukraine, Uzbekistan, Venezuela. Virtual training provided for PetroEdge, ALRDC, School of Mines, Repsol, UEP-Pakistan, and others since pandemic. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Search By Location

- IT Courses in London

- IT Courses in Birmingham

- IT Courses in Glasgow

- IT Courses in Liverpool

- IT Courses in Bristol

- IT Courses in Manchester

- IT Courses in Sheffield

- IT Courses in Leeds

- IT Courses in Edinburgh

- IT Courses in Leicester

- IT Courses in Coventry

- IT Courses in Bradford

- IT Courses in Cardiff

- IT Courses in Belfast

- IT Courses in Nottingham