- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

CHILD PROTECTION ADVANCED ONE DAY COURSE

By Child Protection Training Uk

Everyone shares responsibility for safeguarding and promoting the welfare of children and young people, irrespective of individual roles. This course is for those who have already completed a Level 1 course and need to gain an advanced knowledge of Child Protection, including working towards becoming a Designated Safeguarding Lead (DSL), manager or policy writer. This course is designed for individuals who work with children in either a paid or voluntary capacity. It relates to the issues surrounding safeguarding children by exploring the concepts of "child vulnerability", "child protection" and "significant harm"; coupled with the individual and organisational responsibilities of protecting children from abuse.

Safe Recruitment for Employers & Managers

By Prima Cura Training

Safer recruitment is designed to help those who are responsible for employing anyone who works with vulnerable groups, to identify and deter or reject individuals who are deemed to be at risk of abusing. It is crucial that all employers have a recruitment policy in place that takes into account safer recruitment best practices and considerations. This course covers key topics including: advertising, application forms, selecting candidates for interview based on the information they have presented, and post-interview checks - including DBS checks - before making an offer of employment. Recruitment of staff is now a complex process and there are many issues that need to be considered to ensure safe and successful recruitment, to reduce in turn the risk of harm, abuse and neglect of adults and children.

Credit control and debt recovery - legal issues (In-House)

By The In House Training Company

It is essential that those charged with responsibility for credit control and debt recovery have a full appreciation of the relevant law: no-one can negotiate effectively to recover a debt if they don't understand the ultimate sanctions they can apply. This programme is designed to give them a practical, up-to-date understanding of the law as it applies to your particular organisation. This course will help ensure that participants: Understand the relevant laws Know how and when to invoke legal processes Avoid legal pitfalls in debt collection negotiations Specific, practical learning points include: Definition of 'harassment' How to set up an in-house collection identity Whether cheques in 'full and final settlement' are binding The best steps to trace a 'gone away'... and many, many more. 1 Data protection and debt recovery There are a whole range of things which can be checked on members of the public and which are not affected by the restraints of the Data Protection Act. These will be explained in simple, clear terms so that staff can use this information immediately. 2 County Court suing The expert trainer will show how to sue for money owed, obtain judgment and commence enforcement action without leaving your desk. This module is aimed at showing how to make the Courts work for you instead of the other way around! 3 Enforcement of judgments There are many people who have a County Court Judgment (CCJ) against their debtor but who still remain unpaid. This session explains each of the enforcement methods and how to use them to best effect. Enforcement methods covered include: Warrant of Execution Using the sheriff (now known as High Court Enforcement Officers) Attachment of earnings Third Party Debt Orders Charging Orders (over property and goods) Winding-up companies and making individuals bankrupt 4 Office of Fair Trading rules on debt recovery Surprisingly few people are aware of the Office of Fair Trading rules on debt recovery and many of those that do know think they don't apply to them - but they do. Make sure you know what you need to! 5 New methods to trace elusive, absentee and 'gone away' debtors Why write the money off when you can trace the debtor and collect the money you are owed? 6 Credit checking of new and existing customers It makes sense to credit check would-be, new and existing customers to evaluate the likelihood of payment delays or perhaps not being paid at all. This session shows a range of credit checking steps, many of which can be done completely free of charge, including a sample credit application/ account opening form. 7 Late Payment of Commercial Debts Regulations Do your staff understand this legislation and how to use it to make people pay quicker than ever before? The trainer shows how. 8 The Enterprise Act The Enterprise Act made some startling changes to corporate and personal insolvency. What are the implications for credit control and debt recovery within your organisation?

MIDAS TRAINING

By Lloyds School Of Motoring

MiDAS is the Minibus Driver Awareness Scheme, organised by the Community Transport Association UK (CTA) which promotes a nationally recognised standard for the assessment and training of minibus drivers. The course is designed to enhance minibus driving standards and promote the safer operation of minibuses.

ADVANCED DRIVING COURSE

By Lloyds School Of Motoring

The Advanced Driving Course is designed to promote the principles of road safety and of enhanced driving methods. Training is delivered in cars or vans and encourages drivers to achieve high driving standards. This course is relevant to any driver wishing to hone their driving skills. There are many benefits; being a safer driver is just one aspect.

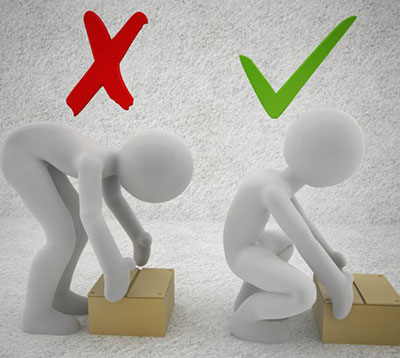

MANUAL HANDLING

By Lloyds School Of Motoring

Manual Handling covers more than simply lifting or carrying something. The term is used to describe activities such as lifting, lowering, pushing, pulling, carrying, moving, holding or restraining an object or person. It also covers activities that require the use of force or effort such as pulling a lever or operating power tools. The aim of the course is to provide a theoretical knowledge and the practical skills to recognise the risk of unsafe practices.

DRIVER CPC PERIODIC TRAINING

By Lloyds School Of Motoring

Driver CPC is short for “Driver Certificate of Professional Competence”. This was introduced by an EU Directive in 2003. LGV and PCV drivers require to complete a total of 35 hours of CPC Periodic training every 5 years. This is classroom based and modules are delivered in 7 hour sessions.

CPC MODULE 4 – LORRY

By Lloyds School Of Motoring

We understand how much confusion there is around Driver CPC and we are here to help and assist with the process. If you are a lorry driver of either Category C1 or C and passed the driving test after 10th September 2009 you will need to complete Initial Driver CPC to be able to drive commercially (for hire or reward). There are two elements involved in Initial Driver CPC to be completed sequentially: Module 2 – Case Study Module 4 – Show & Tell Demonstration Module 2 is known as the “Case Study” and is a computer based test which you take at a Pearson Vue test centre. Module 4 is also known as the “Show & Tell Demonstration”. Lloyds School of Motoring conducts training for this and will book your test at the DVA test centre in Belfast.

CPC MODULE 4 - BUS

By Lloyds School Of Motoring

We understand how much confusion there is around Driver CPC and we are here to help and assist with the process. You will need to complete Initial Driver CPC to be able to drive commercially (for hire or reward). There are two elements involved in Initial Driver CPC to be completed sequentially: Module 2 – Case Study Module 4 – Show & Tell Demonstration Module 2 is known as the “Case Study” and is a computer based test which you take at a Pearson Vue test centre. Module 4 is also known as the “Show & Tell Demonstration”. Lloyds School of Motoring conducts training for this and will book your test at the DVA test centre in Belfast.

BUS TRAINING

By Lloyds School Of Motoring

Lloyds School of Motoring specialise in both minibus driver training and bus training courses. To maximise employment opportunities, we recommend that consideration is given to opting for the full bus licence when completing bus training courses.

Search By Location

- issue Courses in London

- issue Courses in Birmingham

- issue Courses in Glasgow

- issue Courses in Liverpool

- issue Courses in Bristol

- issue Courses in Manchester

- issue Courses in Sheffield

- issue Courses in Leeds

- issue Courses in Edinburgh

- issue Courses in Leicester

- issue Courses in Coventry

- issue Courses in Bradford

- issue Courses in Cardiff

- issue Courses in Belfast

- issue Courses in Nottingham