- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

23176 Improv courses

ICA Certificate in Managing Sanctions Risk

By International Compliance Association

ICA Certificate in Managing Sanctions Risk Sanctions can be complex, and dealing with sanctioned parties can be risky. National or international sanctions may be issued against individuals, entities, groups or nations; or even trading activities/particular sectors. Those bodies charged with enforcing sanctions compliance are particularly active at the moment, with multiple fines for firms in recent years stretching into billions of dollars. Suitable for those working in financial crime and regulatory compliance, this could help you: understand sanctions and the international context discover the screening systems and controls define a sanctions governance framework manage alert investigations learn the challenges of change and the cost of getting it wrong This course is awarded in association with Alliance Manchester Business School, the University of Manchester. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Students who successfully complete the course will be awarded the ICA Certificate in Managing Sanctions Risk and will be entitled to use the designation- Spec.Cert(Sanctions) This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. This course provides Participants with a detailed understanding of the following topics: Understanding sanctions The international context Defining a sanctions governance framework Sanctions lists and screening Managing alert investigations The cost of getting it wrong The challenges of change

ICA Certificate in Financial Crime Prevention

By International Compliance Association

ICA Certificate in Financial Crime Prevention A practical, introductory course that will give you a solid understanding of core financial crime, fraud, bribery, and corruption risks. This qualification explores: Financial crime - the risks Fraud controls - different strategies, systems, and controls in practice Fraud typologies in banking Bribery & corruption - the risks and international initiatives to combat these risks Fraud response policy - explore the objectives of a plan, the reporting channels and contingencies This course is awarded in association with Alliance Manchester Business School, the University of Manchester. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Students can expect the following outcomes Understanding of the key risks and controls essential for financial crime prevention. Knowledge to help protect a firm against the continuous threat of financial crime Verifiable evidence of learning ICA Certificate in Financial Crime Following successful completion of the ICA Certificate in Financial Crime Prevention training course, students will be able to use the designation 'Cert. (FCA).' This course is awarded in association with Alliance Manchester Business School, the University of Manchester. This ICA Certificate in Financial Crime Prevention training course develops knowledge and practical skills in the following areas: What is Financial Crime? What Are the Financial Crime Risks? Fraud Controls Banking - Fraud Typologies Identity Theft and Electronic Crime Bribery & Corruption Fraud Response Policy Criminal Offences - exploring the UK system At the end of the course there is a one hour multiple choice examination that is taken online.

ICA Certificate in Anti Money Laundering

By International Compliance Association

ICA Certificate in Anti Money Laundering A practical, introductory-level course that will give you a solid understanding of core money laundering and terrorist financing risks. Through this qualification, you will: discover what money laundering and terrorist financing are and why sanctions are important appreciate the vulnerabilities of financial institutions to money laundering and terrorist financing explore what anti money laundering and combating terrorist financing is in practice and what the legal and regulatory structures look like understand management obligations and the risk-based approach to money laundering and terrorist financing Suitable for operational or front-line staff and those considering embarking on a new career in AML as a stepping-stone for study at a higher level. This course is awarded in association with Alliance Manchester Business School, the University of Manchester. What are the benefits of undertaking this qualification?: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate This ICA Certificate in Anti Money Laundering is awarded in association with Alliance Manchester Business School, the University of Manchester. Upon successful completion of this course, students will be awarded the ICA Certificate in Anti Money Laundering - Cert (AML) What will you learn? Understanding Money Laundering, Terrorist Financing and Sanctions Vulnerabilities of financial institutions to money laundering and terrorist financing Anti money laundering and combating terrorist financing in practice Anti money laundering and combating terrorist financing - legal and regulatory structures Management obligations and the risk-based approach to money laundering and terrorist financing How will you be assessed? Assessed by online multiple-choice exam

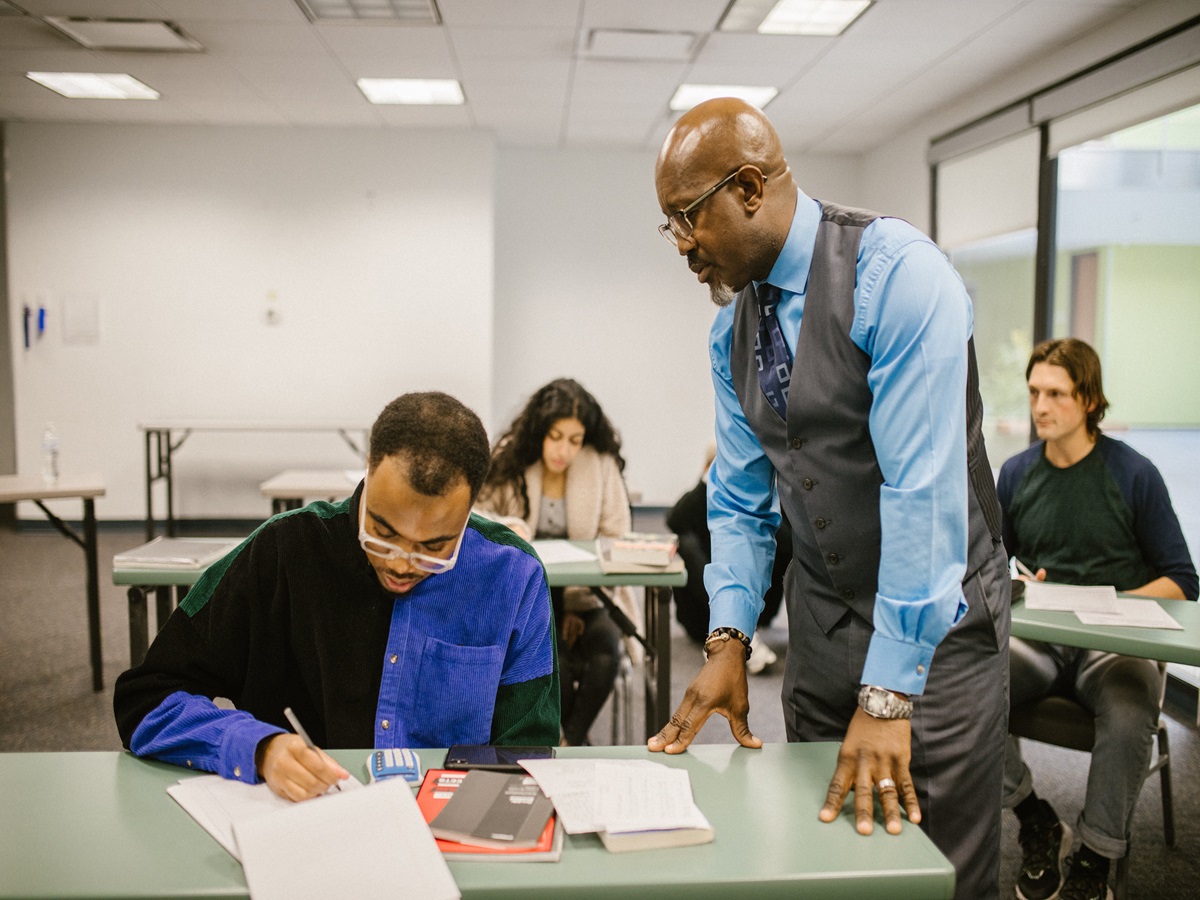

Level 3 Award in Education and Training

By Karen Blake Coaching

Level 3 Award in Education and Training: Elevate your career as a certified educator! Gain essential teaching skills, curriculum expertise, and effective classroom management. Flexible study options with ongoing support. Enrol now to advance your teaching journey

Everything DiSC Facilitator Training

By DISCGB

This programme has been specifically designed to help experienced trainers, facilitators and coaches use Everything DiSC and the Five Behaviours assessments, and deliver workshops, with their own clients and in-house teams.

Commercial Awareness - Tools and Analysis

By Mpi Learning - Professional Learning And Development Provider

In today's fast-changing competitive environment, people in all roles need to have more commercial awareness and responsibility.

Writing Clear Business Communication: Virtual In-House Training

By IIL Europe Ltd

Writing Clear Business Communication: Virtual In-House Training This program is about learning about the writing process and covers the full spectrum of documents used when corresponding in the workplace. The ability to write effectively comes naturally to some people, but for the vast majority, it is a task often approached with a mixture of trepidation and dread. Effective writing seldom, if ever, 'magically materializes' on the spot. In reality, it is most often the product of planning, writing, and rewriting. This is why writing is called a process; it must go through a series of steps before it is clear and complete. This program is about learning about the writing process and covers the full spectrum of documents used when corresponding in the workplace. The ability to write effectively comes naturally to some people, but for the vast majority, it is a task often approached with a mixture of trepidation and dread. However, the ability to communicate in the written word, for whatever purpose, is an important part of our working and personal lives and can have a direct impact on our ability to persuade, gain commitment or agreement and enhance understanding. Good writing sounds like talking on paper, which is why this program is focused on getting the message across and achieving the desired results using the 'keep it simple and direct' approach. What you Will Learn At the end of this program, you will be able to: Write effective e-mails, letters, memos, and reports Clearly articulate the message Achieve desired results from correspondence Organize content for maximum impact Format for enhanced understanding Choose the appropriate communication medium for each document Revise documents to increase clarity and impact Foundations Concepts Business writing as a form of professional communication How business writing compares to other forms of writing Characteristics of good business writing Challenges with business writing The Project Environment Business writing in the project environment The concept of art, science, and optics of business writing Art Economy Precision Action Music Personality Science Purpose, simple, compound, and complex sentence structures Techniques to engage the reader Point of view: tone, attitude, and humor Organization: opening, body, and closing Support and coherence Optics Visual optics Sound optics Feel optics Effective optics Efficient optics Email Formal vs. informal emails Suggestions for improving email communication Instant and text messaging Reports Common types of reports created Formatting of reports Guidelines for meeting minutes Contracts Types of contracts Common agreements Procurement documents Templates, Forms, and Checklists Templates Forms Checklists Other Formatting Good Documentation Practices Good documentation practices Data integrity in business communication

Managing Smaller Projects

By Underscore Group

Learn how to better apply project management techniques to manage small projects as part of your normal role.

Architecture Tutor One to One

By Real Animation Works

Face to Face customised and bespoke.

Stress is part of life. Now managing it can be, too. Mindful Stress Management is a self-paced course designed to help you handle everyday stress in a healthier, more sustainable way. Developed by NASM wellness experts, this course provides simple, science-backed tools you can put to use immediately – including guided audio sessions, gentle movement flows, printable worksheets, and everyday techniques that fit into your real routine. Whether you need quick relief or you're ready to build long-term habits, this course gives you the support to respond instead of react. So you can start feeling more like yourself again. One moment at a time.

Search By Location

- Improv Courses in London

- Improv Courses in Birmingham

- Improv Courses in Glasgow

- Improv Courses in Liverpool

- Improv Courses in Bristol

- Improv Courses in Manchester

- Improv Courses in Sheffield

- Improv Courses in Leeds

- Improv Courses in Edinburgh

- Improv Courses in Leicester

- Improv Courses in Coventry

- Improv Courses in Bradford

- Improv Courses in Cardiff

- Improv Courses in Belfast

- Improv Courses in Nottingham