- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

718 Financial Statement courses delivered Online

Creating a Robust Financial Plan - MasterClass

By Entreprenure Now

Making money is the very reason your business exists – but often, entrepreneurs don’t pay enough attention to the financials that drive the bottom line. Whether due to deep-seated money anxiety, lack of skills or knowledge, or an aversion to long-term planning, business owners often use random guesswork to build the sales and expense projections that should be the foundation of their financial plan. Sound financial planning documents can not only win over investors; they’re valuable tools for monitoring the company’s progress toward profitability. In this learning stream, we’ll examine and counteract common misperceptions about financial planning, learn about different models for revenue and cost projections, and discuss concepts such as the maximum negative cash flow that potential investors will scrutinize. Key expense and revenue models and financial statements will be reviewed one-by-one, with accompanying worksheets and formulas to help you build your own realistic, credible models. A workshop session will focus on finding the happy medium between wildly optimistic projections and overly-conservative, ho-hum estimates, so you can present financial statements that are believable, justifiable, and inspire confidence.

QUALIFI Level 3 Extended Diploma in Business, Management and Study Skills

By School of Business and Technology London

Getting Started The QUALIFI Level 3 Extended Diploma in Business, Management and Study Skills qualification develops and rewards learners looking to or already have chosen a career in a business-related sector. It is envisaged that this programme will encourage academic and professional development so that learners move forward to realise their potential and that of organisations across a broad range of sectors. The learners will gain transferable skills and knowledge that will enable individuals to meet business changes. Key Benefits To understand the business environment and business resources. Know how to present business information effectively and to develop English language communication competencies for University Studies. Understand health and safety legislation and regulations affecting a business working environment and workplace welfare. To support learners to develop confidence and skills to communicate academically while gaining awareness and understanding of other cultures and addressing the issues relevant to transitioning to higher education. Understand how successful leaders bring about effective change, impact of organisational culture and thinking entrepreneurially. Key Highlights Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our QUALIFI-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The QUALIFI Level 3 Extended Diploma in Business, Management and Study Skills can open many career pathways including, but not limited to: Operations Manager with an estimated average salary of £28,000 per annum Office Manager with an estimated average salary of £30,000 per annum Financial Planner with an estimated average salary of £22,000 per annum Program Manager with an estimated average salary of £25,000 per annum Junior Manager with an estimated average salary of £22,000 per annum Business Analyst with an estimated average salary of £30,000 per annum Fleet Manager, with an estimated average salary of £25,000 per annum About Awarding Body QUALIFI, recognised by Ofqual awarding organisation has assembled a reputation for maintaining significant skills in a wide range of job roles and industries which comprises Leadership, Hospitality & Catering, Health and Social Care, Enterprise and Management, Process Outsourcing and Public Services. They are liable for awarding organisations and thereby ensuring quality assurance in Wales and Northern Ireland. What is included? Outstanding tutor support that gives you supportive guidance all through the course accomplishment through the SBTL Support Desk Portal. Access our cutting-edge learning management platform to access vital learning resources and communicate with the support desk team. Quality learning materials such as structured lecture notes, study guides, and practical applications, which include real-world examples and case studies, will enable you to apply your knowledge. Learning materials are provided in one of the three formats: PDF, PowerPoint, or Interactive Text Content on the learning portal. The tutors will provide Formative assessment feedback to improve the learners' achievements. Assessment materials are accessible through our online learning platform. Supervision for all modules. Multiplatform accessibility through an online learning platform facilitates SBTL in providing learners with course materials directly through smartphones, laptops, tablets or desktops, allowing students to study at their convenience. Live Classes (for Blended Learning Students only) Entry Requirements The qualification has been designed to be accessible without artificial barriers restricting access and progression. Entry to the qualification will be through a centre interview, and learners will be expected to hold the following: Qualifications at Level 2 or. Work experience in a business environment and demonstrate ambition with clear career goals. Level 3 qualification in another discipline and want to develop their careers in management. Progression Learners completing the QUALIFI Level 3 Extended Diploma in Business, Management and Study Skills can progress to: a QUALIFI Level 4 qualification, or directly into employment in an associated profession or An undergraduate degree. Why gain a QUALIFI Qualification? This suite of qualifications provides enormous opportunities to learners seeking career and professional development. The highlighting factor of this qualification is that: The learners attain career path support who wish to pursue their career in their denominated sectors; It helps provide a deep understanding of the health and social care sector and managing the organisations, which will, in turn, help enhance the learner's insight into their chosen sector. The qualification provides a real combination of disciplines and skills development opportunities. The Learners attain in-depth awareness concerning the organisation's functioning, aims and processes. They can also explore ways to respond positively to this challenging and complex health and social care environment. The learners will be introduced to managing the wide range of health and social care functions using theory, practice sessions and models that provide valuable knowledge. As a part of this suite of qualifications, the learners will be able to explore and attain hands-on training and experience in this field. Learners also acquire the ability to face and solve issues then and there by exposure to all the Units. The qualification will also help to Apply scientific and evaluative methods to develop those skills. Find out threats and opportunities. Develop knowledge in managerial, organisational and environmental issues. Develop and empower critical thinking and innovativeness to handle problems and difficulties. Practice judgement, own and take responsibility for decisions and actions. Develop the capacity to perceive and reflect on individual learning and improve their social and other transferable aptitudes and skills. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- An Introduction to the Business Environment Reference No : A/615/5045 Credit : 10 || TQT : 100 This unit will explain different types of businesses and their ownership in an economy. Learners will understand the owner and stakeholders' role in fulfilling the business's purpose. The unit will help learners to understand how companies are organised to achieve their targets. This unit will also help to know how the economic, political, legal and social environment can impact businesses, giving the learner an understanding of the range of companies. UNIT2- Business Resources Reference No : F/615/5046 Credit : 10 || TQT : 100 The unit will explain how a range of human, physical, technological and financial resources are used and managed within a business. This unit will help the learner understand how human resources are managed and the employability and personal skills required of personnel in an organisation. Learners will understand the purpose of managing resources effectively, not only concerning human resources but also in terms of physical and technological resources. Learners will also understand how an organisation can gain access to sources of finance, both internally and externally and be able to interpret financial statements. UNIT3- An Introduction to Marketing Reference No : J/615/5047 Credit : 10 || TQT : 100 Learners will gain a basic understanding of the role of the marketing function, with particular emphasis on the role of marketing research and how it contributes to marketing planning and the development of a marketing mix for a target group of customers. Learners can develop, analyse and evaluate key marketing techniques to understand them better. UNIT4- Human Resource Management Reference No : L/615/5048 Credit : 10 || TQT : 100 The unit provides an overview of some key areas that fall within the remit of the human resources function. The learners will also learn how organisations gain employee motivation and employee commitment. Finally, learners will know about how employee performance is measured and managed and the benefits of doing so. This knowledge will help learners understand the working environment and the nature of Human Resource Management when seeking or engaging in employment. UNIT5- Business Communication Reference No : R/615/5049 Credit : 10 || TQT : 100 Effective communication is a key area in terms of its contribution to business success. When studying this unit, learners will thoroughly understand the types of business information used internally and externally by organisations and the methods used to communicate information to different audiences. In this unit, learners will be able to develop, analyse and evaluate various techniques used to display multiple types of business information. They will understand the purpose of such communication. They will also produce and consider different types of business communication of their own. UNIT6- Understanding Health and Safety in the Business Workplace Reference No : J/615/5050 Credit : 10 || TQT : 100 This unit will help to prepare learners for the world of work, where health and safety are a vital part of the modern workplace, whatever sector is chosen. There is a level of myth surrounding Health and safety requirements. This unit will help dispel these and promote good health and safety practices as a productive working environment. Learners will understand health and safety legislation, regulations and requirements that form the basis of all workplaces in the UK. UNIT7- Managing Business Operations Reference No : A/617/5537 Credit : 10 || TQT : 100 This unit aims to familiarise learners with the essential aspects of businesses and their operations in both external and internal business environments. The unit emphasises that operational control and sound policies and best practices lead to organisational excellence. UNIT8- An Introduction to Finance Reference No : F/617/5538 Credit : 10 || TQT : 100 This unit introduces learners to practical accounting and financial reporting techniques managers in business organisations use. Learners will gain an understanding of the budgetary control process. UNIT9- English for University Studies Reference No : T/618/7010 Credit : 10 || TQT : 100 This unit aims to develop the language competencies required of an undergraduate-level student. The content is organised around three core skills: listening, reading and writing, using authentic academic and language learning materials. Alongside these skills, learners will have opportunities to develop and expand their range and accuracy of functional, lexical and grammatical structures. The listening component aims to develop comprehension strategies required when attending lectures as well as practice in note-taking. The reading component introduces students to various academic texts, reading purposes and methods. The writing aims to introduce learners to literary conventions and different academic writing text types. Research classes will further expand on students reading and writing skills in their specific subject area. Finally, learners must work on collaborative and independent tasks throughout the course. There will be a strong emphasis on taking responsibility for autonomous learning. UNIT10- Communication and Cultural Skills for University Reference No : A/618/7011 Credit : 10 || TQT : 100 This unit aims to support learners to develop confidence and skills to communicate in an academic environment while gaining awareness and understanding of other cultures and addressing the issues relevant to transitioning to higher education. The communication component aims to improve speaking skills through oral summaries and presentations. Focus also aims to develop critical thinking skills through discussions and debates. The academic culture component focuses on content reflecting important aspects of university life for first-year undergraduates (e.g. email etiquette, finding information, university system) and effective study strategies (e.g. time management, dealing with stress, traits of successful learners). The cultural component enables learners to understand other and local cultures better. When studying abroad, the focus will be on learning about Irish culture, society, and student life. UNIT11- An Introduction to Leadership Skills Reference No : A/617/5540 Credit : 10 || TQT : 100 This unit aims to provide the learner with an introduction to leadership skills, how they can be identified and developed, and to show the importance of motivating others. UNIT12- Organisational Culture Reference No : F/617/5541 Credit : 10 || TQT : 100 To understand aspects of an organisation's culture, its effects on its activities and management, and the significance of an ethical business approach. UNIT13- Workplace Welfare Reference No : J/617/5542 Credit : 10 || TQT : 100 To understand that workforce welfare ensures that everybody employed within the organisation is valued. To comprehend health and safety responsibilities and benefits gained from being part of the organisation. UNIT14- Thinking Entrepreneurially Reference No : R/615/4774 Credit : 10 || TQT : 100 This unit aims to introduce the learner to an evaluation of themselves in an entrepreneurial context by using several techniques, including SWOT. This unit will introduce learners to critical thinking skills and put these into context against a business plan. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Understanding Financial Statements and Analysis

By The Teachers Training

Master the language of business with our Understanding Financial Statements and Analysis Course. Learn to dissect financial data, interpret statements, and make informed decisions. Enroll now to gain vital skills for navigating the financial landscape with confidence.

Financial Investigator Complete Bundle - QLS Endorsed

By Imperial Academy

10 QLS Endorsed Courses for Financial Investigator | 10 Endorsed Certificates Included | Life Time Access

Do you want a fulfilling career in accountancy? Have you passed AAT Level 3 or an equivalent accounting qualification? We can help you reach your goal by studying AAT Level 4. This level builds on the knowledge you gained in the Level 3 Diploma. You will cover higher accounting tasks including drafting financial statements, managing budgets, and evaluating financial performance. There are also optional specialist units including business tax, personal tax, auditing, credit management, and cash and financial management. After qualifying you can work in accounting roles or progress onto studying chartered accountancy. About AAT Level 4 Diploma in Professional Accounting Entry Requirements To progress comfortably on this course, you’ll need to have good accounting knowledge and be able to perform all the financial and management accounting tasks which are tested on the AAT Level 3 course. Plus you’ll need a good standard of English literacy and basic Maths skills. We recommend you register with AAT before starting this course. This will give you your AAT student number, which enables you to enter for assessments. AAT Level 4 Diploma in Professional Accounting syllabus By the end of this course, you’ll be able to apply complex accounting principles, concepts, and rules to prepare the financial statements of a limited company. You’ll also learn management accounting techniques to aid decision making and control, prepare and monitor budgets, and measure performance. This level consists of compulsory and optional units: Compulsory unitsDrafting and Interpreting of Financial Statements (DAIF) The reporting frameworks that underpin financial reporting How to draft statutory financial statements for limited companies How to draft consolidated financial statements How to interpret financial statements using ratio analysis Applied Management Accounting (AMAC) The organisational planning process How to use internal processes to enhance operational control How to use techniques to aid short-term and long-term decision making How to analyse and report on business performance Internal Accounting Systems and Controls (INAC) The role and responsibilities of the accounting function within an organisation How to evaluate internal control systems How to evaluate an organisation’s accounting system and underpinning procedures The impact of technology on accounting systems How to recommend improvements to an organisation’s accounting system Optional units (choose two)Business Tax (BNTA) How to prepare tax computations for sole traders and partnerships How to prepare tax computations for limited companies How to prepare tax computations for the sale of capital assets by limited companies The administrative requirements of the UK’s tax regime The tax implications of business disposals Tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue and Customs Personal Tax (PNTA) The principles and rules that underpin taxation systems How to calculate UK taxpayers’ total income How to calculate income tax and National Insurance Contributions (NICs) payable by UK taxpayers How to calculate capital gains tax payable by UK taxpayers The principles of inheritance tax Audit and Assurance (AUDT) The audit and assurance framework The importance of professional ethics How to evaluate the planning process for audit and assurance How to evaluate procedures for obtaining sufficient and appropriate evidence How to review and report findings Cash and Financial Management (CSFT) How to prepare forecasts for cash receipts and payments How to prepare cash budgets and monitor cash flows The importance of managing finance and liquidity Ways of raising finance and investing funds Regulations and organisational policies that influence decisions in managing cash and finance Credit and Debt Management (CRDM) The relevant legislation and contract law that impacts the credit control environment How information is used to assess credit risk and grant credit in compliance with organisational policies and procedures The organisation’s credit control processes for managing and collecting debts Different techniques available to collect debts How is this course assessed? The Level 4 course is assessed by unit assessments. Unit assessment The Level 4 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 4 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the AAT and the results are released after six weeks Getting your results Assessment results will be available in your MyAAT account when they are released. Grading To be awarded the AAT Level 4 Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 4 content with the use of all other levels, allowing you to recap previous levels at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After you’ve passed this level, you can work in a variety of jobs including forensic accountant, tax manager, accountancy consultant, or finance analyst, earning salaries of up to £37,000 as you advance and gain experience. AAT full members (MAAT) and fellow members (FMAAT) are eligible for exemptions that allow you to take the fast track route to chartered accountant status. You can stay with the same training provider. Eagle offers affordable courses approved by the ACCA (Association of Chartered Certified Accountants) to which you can subscribe. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission, and exam fees, are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 4 Registration Fee: £240 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

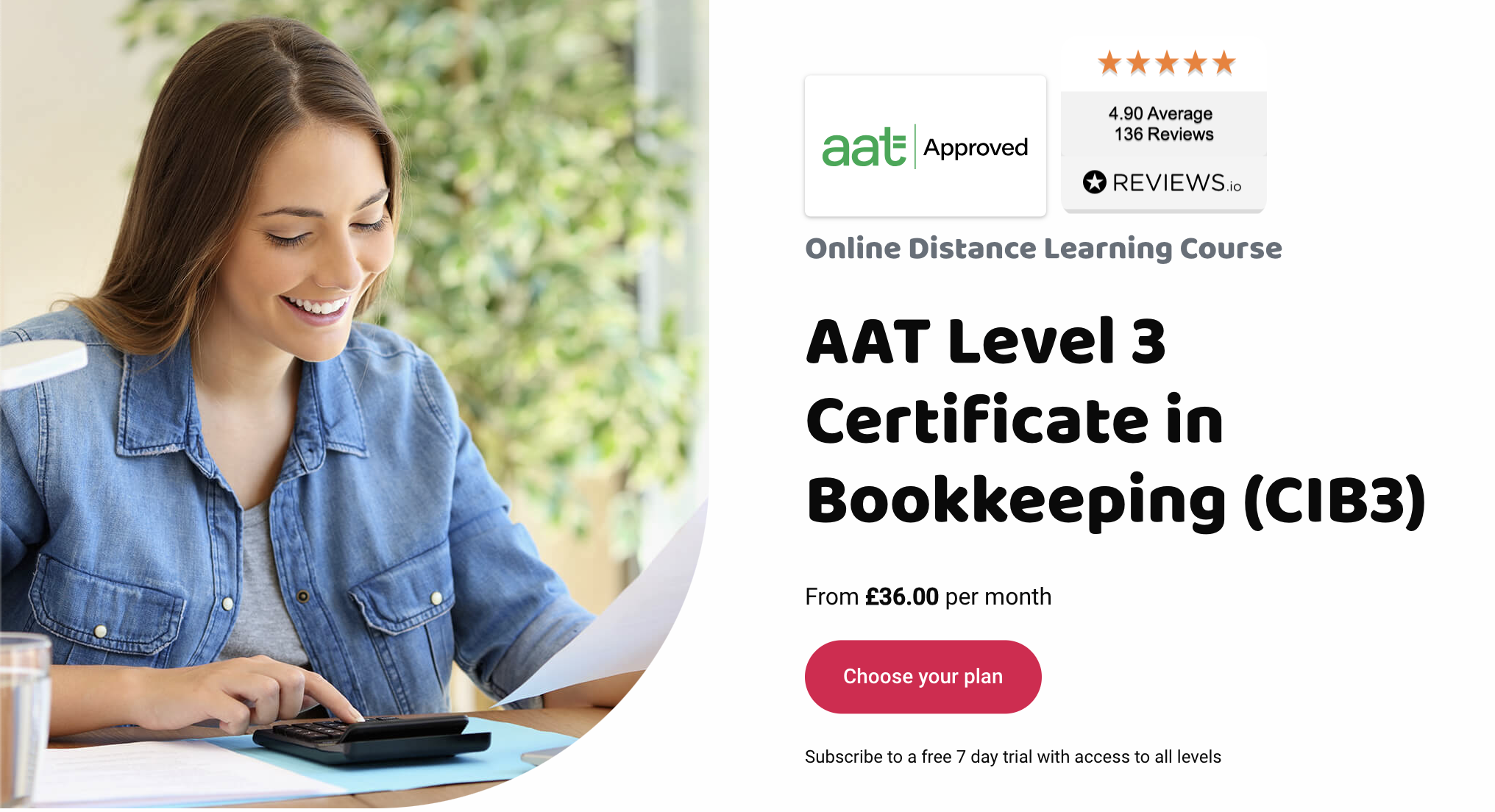

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Corporate and Business Finance Optimisation - Quality License Scheme Endorsed Diploma

4.5(3)By Studyhub UK

Do you want to prepare for your dream job but strive hard to find the right courses? Then, stop worrying, for our strategically modified Corporate and Business Finance Optimisation bundle will keep you up to date with the relevant knowledge and most recent matters of this emerging field. So, invest your money and effort in our 40 course mega bundle that will exceed your expectations within your budget. The Corporate and Business Finance Optimisation related fields are thriving across the UK, and recruiters are hiring the most knowledgeable and proficient candidates. It's a demanding field with magnitudes of lucrative choices. If you need more guidance to specialise in this area and need help knowing where to start, then StudyHub proposes a preparatory bundle. This comprehensive Corporate and Business Finance Optimisation bundle will help you build a solid foundation to become a proficient worker in the sector. This Corporate and Business Finance Optimisation Bundle consists of the following 30 CPD Accredited Premium courses - Course 01 :Financial Consultant Training Course 02 :Making Budget & Forecast Course 03 :Business Model Canvas for Business Plan Course 04 :Dealing With Uncertainity: Make Budgets and Forecasts Course 05 :Financial Modeling Using Excel Course 06 :Debt Management - Online Course Course 07 :Financial Management Course 08 :Financial Statements Fraud Detection Training Course 09 :Anti-Money Laundering (AML) Training Course 10 :Document Control Course 11 :Corporate & Strategic Communication Skills for Managers Course 12 :Excel Vlookup, Xlookup, Match and Index Course 13 :Basic Data Analysis Course 14 :Pension UK Course 15 :GDPR Course 16 :Bookkeeper Training Course Course 17 :Xero Accounting and Bookkeeping Online Course 18 :Quickbooks Online Course 19 :Sage 50 Accounts Course 20 :Commercial Law Course 21 :UK Tax Accounting Course 22 :Cost Control & Project Scheduling Course 23 :Dynamic Excel Gantt Chart and Timelines Course 24 :Understanding Financial Statements and Analysis Course 25: Financial Reporting Course 26: Learn to Read, Analyse and Understand Annual Reports Course 27: Accounting Basics Course 28: Excel Pivot Tables for Data Reporting Course 29: Personal Productivity Course Course 30: Time Management Training - Online Course 10 Extraordinary Career Oriented courses that will assist you in reimagining your thriving techniques- Course 01 :Career Development Plan Fundamentals Course 02 :CV Writing and Job Searching Course 03 :Interview Skills: Ace the Interview Course 04 :Video Job Interview for Job Seekers Course 05 :Create a Professional LinkedIn Profile Course 06 :Business English Perfection Course Course 07 :Networking Skills for Personal Success Course 08 :Boost Your Confidence and Self-Esteem Course 09 :Public Speaking Training Course 10 :Learn to Fight Procrastination Learning Outcome This tailor-made Corporate and Business Finance Optimisation bundle will allow you to- Uncover your skills and aptitudes to break new ground in the related fields Deep dive into the fundamental knowledge Acquire some hard and soft skills in this area Gain some transferable skills to elevate your performance Maintain good report with your clients and staff Gain necessary office skills and be tech savvy utilising relevant software Keep records of your work and make a report Know the regulations around this area Reinforce your career with specific knowledge of this field Know your legal and ethical responsibility as a professional in the related field This Corporate and Business Finance Optimisation Bundle resources were created with the help of industry experts, and all subject-related information is kept updated on a regular basis to avoid learners from falling behind on the latest developments. Certification After studying the complete training you will be able to take the assessment. After successfully passing the assessment you will be able to claim all courses pdf certificates and 1 hardcopy certificate for the Title Course completely free. Other Hard Copy certificates need to be ordered at an additional cost of •8. CPD 400 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Ambitious learners who want to strengthen their CV for their desired job should take advantage of the Corporate and Business Finance Optimisation bundle! This bundle is also ideal for professionals looking for career advancement. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Requirements To participate in this course, all you need is - A smart device A secure internet connection And a keen interest in Corporate and Business Finance Optimisation Career path Upon completing this essential Bundle, you will discover a new world of endless possibilities. These courses will help you to get a cut above the rest and allow you to be more efficient in the relevant fields.