- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1223 Financial Analyst courses in Cardiff delivered Online

In the bustling realm of non-profit organisations, securing funds is paramount. Introducing 'Writing Winning Grant Proposals for Non-Profit Organizations', a course meticulously designed to guide you through the labyrinth of grant applications. Delve deep into the art of crafting persuasive proposals, understand the intricacies of budgeting, and master the ethics behind successful grant writing. With a curriculum spanning six comprehensive modules, this course ensures you're well-equipped to navigate the competitive world of grant applications, ensuring your non-profit's mission doesn't just survive, but thrives. Learning Outcomes Understand the foundational principles of grant writing specific to non-profit entities. Develop the ability to create compelling grant proposals that captivate potential funders. Gain insights into effective budgeting and financial management for grant applications. Familiarise oneself with the grant application and review procedures. Recognise the importance of ethics in grant writing and implement strategies for continuous improvement. Why buy this Writing Winning Grant Proposals for Non-Profit Organizations? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success Who is this Writing Winning Grant Proposals for Non-Profit Organizations for? Individuals keen on starting or enhancing a career in non-profit fundraising. Non-profit organisation members aiming to boost their funding success rate. Freelancers looking to expand their portfolio in grant proposal writing. Financial managers in non-profit sectors aiming to understand the grant budgeting process. Aspiring writers keen on specialising in non-profit grant applications. Career path Grant Writer for Non-Profit Organisations: £25,000 - £35,000 Fundraising Manager: £30,000 - £45,000 Non-Profit Financial Analyst: £28,000 - £40,000 Grant Reviewer: £27,000 - £37,000 Non-Profit Development Director: £40,000 - £55,000 Proposal Writing Consultant: £30,000 - £50,000 Prerequisites This Writing Winning Grant Proposals for Non-Profit Organizations does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Grant Writing for Non-Profits Introduction to Grant Writing for Non-Profits 00:20:00 Module 02: Preparing for Grant Writing Success Preparing for Grant Writing Success 00:17:00 Module 03: Crafting Compelling Grant Proposals Crafting Compelling Grant Proposals 00:15:00 Module 04: Budgeting and Financial Management in Grant Proposals Budgeting and Financial Management in Grant Proposals 00:15:00 Module 05: The Grant Application and Review Process The Grant Application and Review Process 00:21:00 Module 06: Grant Writing Ethics and Continuous Improvement Grant Writing Ethics and Continuous Improvement 00:17:00

Stock Market Day Trading Strategies for Beginners Course

By One Education

Navigating the fast-paced world of day trading can feel like chasing shadows—one moment the charts are climbing, the next they’re nosediving. This course is designed to bring clarity to the chaos. Whether you’re curious about candlestick patterns or trying to decipher the rhythm of market movements, this beginner-friendly guide is your shortcut to understanding the essentials. You’ll explore how to interpret price action, manage risks sensibly, and recognise trends that matter—all explained in plain English, without the noise. There’s no secret formula here—just smart strategies, grounded in logic and tested over time. From setting up a basic trading plan to understanding the psychology behind buy-and-sell decisions, this course lays out everything in a structured, no-fluff format. Ideal for aspiring traders who want to cut through the jargon and gain real insight into how day trading ticks. You won’t need a finance degree or a second monitor—just curiosity, consistency, and an internet connection. By the end of this course, you will be able to: Understand the basics of day trading, including terminology and trading tools Perform analysis and read charts to identify profitable trades Manage risk and control emotions while day trading Develop a trading plan and execute trades Use trading simulators to practice and refine your trading skills Stock Market Day Trading Strategies for Beginners is an ideal course for individuals who want to learn how to day trade in the stock market. The course starts with an introduction to day trading and the basics of day trading, including terminology and trading tools. You will learn about chart analysis and technical indicators to identify profitable trades. The course covers trading psychology, including risk management and emotional control, to help you navigate the stressful and volatile world of day trading. Additionally, you will learn how to develop a plan and execute trades, including using stop-loss orders and profit targets. The course includes a section on trading practice, which covers the use of trading simulators to practice and refine your trading skills. You will also learn how to evaluate and improve your trading strategy based on your trading results. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Here are some potential career paths and expected salaries for individuals who have a solid understanding of day trading: Day Trader: £50,000 - £100,000+ per year Proprietary Trader: £100,000 - £500,000+ per year Hedge Fund Trader: £100,000 - £1,000,000+ per year Financial Analyst: £30,000 - £70,000 per year (with day trading skills as an added bonus) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

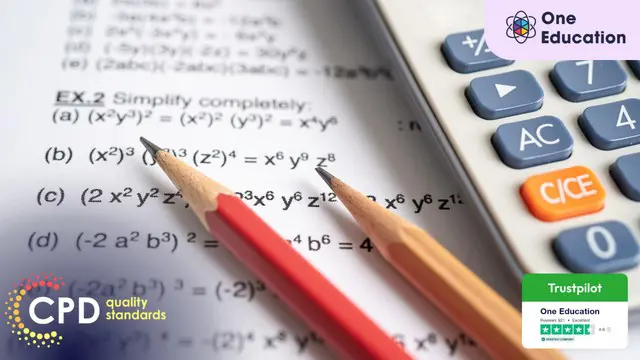

Algebra Fundamentals Course

By One Education

Algebra doesn’t have to be intimidating — in fact, with the right guidance, it can even feel satisfying. Our Algebra Fundamentals Course brings clarity to confusion and simplifies the language of maths in a way that makes sense, whether you're brushing up or learning from scratch. From equations and expressions to inequalities and graphs, this course lays the groundwork with a clear and steady rhythm that keeps numbers from dancing out of reach. Designed for learners of all backgrounds, this course takes a sensible and structured approach. It keeps things moving at a steady pace without jumping ahead or losing focus. Whether you're preparing for further studies or simply looking to sharpen your problem-solving instincts, you'll find each module refreshingly straightforward. There's no jargon parade — just solid algebra with a clear purpose. Let formulas feel less like a foreign language and more like familiar territory. Learning Outcomes: Apply algebraic concepts in real-world scenarios. Perform operations on algebraic expressions and solve linear equations. Work with quadratic polynomials and quadratic equations. Plot points and line graphs on a coordinate axis. Understand and work with algebraic fractions. Solve systems of simultaneous linear equations in two variables The Algebra Fundamentals course is an excellent opportunity for students to develop their algebraic skills and gain a deep understanding of fundamental concepts. By taking this course, you will learn how to perform operations on algebraic expressions and solve linear equations, quadratic polynomials, and systems of simultaneous linear equations in two variables. You will also develop your ability to plot points and line graphs on a coordinate axis and work with algebraic fractions. This course is ideal for students who want to pursue careers in engineering, science, economics, or any other field that requires a strong foundation in algebraic concepts. By taking this course, you will gain the necessary knowledge and skills to succeed in these fields and excel in your future academic and professional pursuits. With engaging lessons and real-world applications, this course is perfect for students of all backgrounds and skill levels. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 15 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path The Algebra Fundamentals course provides you with the ability to explore different job opportunities across various industries with positions and pay scales such as upon completion of the course: Financial Analyst - £35,000-£65,000 Data Analyst - £25,000-£45,000 Market Research Analyst - £20,000-£40,000 Mechanical Engineer - £26,000-£50,000 Economist - £30,000-£70,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Swing Trading Beginners Guide: Part Time Stock Trading Course

By One Education

Swing trading isn’t just a side hustle—it’s a smart strategy for those who want to grow their money without sitting in front of a trading screen all day. This course is crafted for part-time traders who are eager to understand how the stock market really moves over days or weeks, not seconds. Whether you’re analysing a price chart on your lunch break or setting up trades after work, this guide helps you see the bigger picture without overcomplicating the process. With a clear, no-nonsense approach, this beginners’ guide walks you through swing trading fundamentals, chart patterns, risk control, and timing entries with precision. The goal? Help you build the confidence to make calculated decisions, not guesses. It’s an ideal fit for anyone looking to take control of their financial direction with a flexible method suited to busy schedules. Strip away the jargon and the hype—you’ll get solid, focused knowledge that respects your time and delivers what matters. By the end of this course, you will be able to: Understand the difference between day trading and swing trading. Identify trends in the stock market and use them to your advantage. Analyze stocks and determine which ones are suitable for swing trading. Enter and exit stock positions using effective strategies. Set up your trading platform and start swing trading. This Swing Trading Beginners Guide is designed to provide a comprehensive introduction to swing trading. The course starts with an overview of day trading versus swing trading and how swing trading works. It then delves into trading the trend of a stock, finding the best stocks to swing trade, and analyzing stocks using technical and fundamental analysis. The course also covers entering and exiting stock positions, including the use of stop-loss orders and other risk management strategies. Live examples and analysis are provided to help you understand how to apply swing trading principles in real-world scenarios. Finally, the course concludes with a lesson on setting up your trading platform to start swing trading. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path This course can be beneficial for individuals who want to start trading stocks on a part-time basis. Here are some potential career paths and expected salaries for swing traders: Swing Trader: $50,000 - $100,000 per year Stockbroker: $50,000 - $100,000 per year Financial Analyst: $60,000 - $100,000 per year Investment Manager: $80,000 - $150,000 per year Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

New Functions in Microsoft Excel 2021 Course

By One Education

Microsoft Excel 2021 has quietly slipped in a bundle of new functions that can turn even the most mundane spreadsheets into efficient data-processing machines. This course introduces the latest features like XLOOKUP, LET, FILTER, SEQUENCE, and TEXTSPLIT, which not only simplify formulas but make spreadsheets smarter and tidier. Whether you’re an analyst trying to avoid circular references or someone who’s simply tired of tangled VLOOKUPs, this course brings clarity to your cells—no pun intended. Tailored for Excel users who know the ropes but want to keep up with what's new, this course ensures you don’t fall behind the curve. You’ll explore function upgrades that tidy up old formulas, save time, and help you work cleaner and quicker. With a thoughtful structure and a lightly witty tone, the course content walks you through updates that genuinely make a difference—without drowning you in geek speak. Excel’s had a makeover, and it's about time your formulas caught up. Learning Outcomes: Understand the purpose and benefits of new Excel functions. Apply the RANDARRAY function to generate random data. Use the UNIQUE function to extract unique values from a data range. Create custom number sequences with the SEQUENCE function. Sort data effectively with the SORT and SORTBY functions. Filter data easily with the FILTER function. Unlock the full potential of Microsoft Excel with our new course, "The Theory of Constraints and Throughput Accounting." In just a few modules, you'll learn how to utilise the latest functions in Excel to quickly sort, filter, and analyse data. By the end of the course, you'll be equipped with the knowledge to efficiently organise even the most complex datasets. But this course isn't just about learning new functions - it's about applying them to real-world scenarios. With practical examples and exercises throughout the course, you'll learn how to use these functions in meaningful ways. The benefits of this course are clear: increased productivity, better data analysis, and more efficient workflow. Don't miss out on this opportunity to take your Excel skills to the next level - enroll in "The Theory of Constraints and Throughput Accounting" today. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data Analyst - £31,000 per year (average salary) Financial Analyst - £34,000 per year (average salary) Business Intelligence Analyst - £39,000 per year (average salary) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

In the intricate world of finance, making sense of numbers can be both an art and a science. Our 'Financial Analysis Methods' course invites you to embark on a transformative journey, transforming raw financial data into actionable insights. Discover the pathways to determine a business's profitability, liquidity, and potential pitfalls. As you navigate through each section, you'll be equipped with the acumen to make informed financial decisions, discerning the subtleties that lie beneath the surface of financial statements. Learning Outcomes Grasp the foundational concepts and significance of financial analysis. Develop expertise in evaluating business profitability using various metrics. Understand and interpret return and liquidity ratios to assess business health. Gain the ability to perform operational analysis for informed decision-making. Learn techniques to detect financial statement manipulations and inconsistencies. Why choose this Freestyle Swimming: Mastering the Healthiest Swim Technique course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Financial Analysis Methods Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Freestyle Swimming: Mastering the Healthiest Swim Technique course for? Aspiring financial analysts keen on refining their analytical skills. Business owners aiming to better understand their company's financial standing. Students of finance wishing to deepen their understanding of analysis methods. Professionals in the corporate sector seeking insights into financial evaluation. Investment enthusiasts looking to make informed decisions. Career path Financial Analyst: £30,000 - £55,000 Investment Banker: £45,000 - £100,000 Corporate Finance Manager: £40,000 - £80,000 Risk Management Analyst: £35,000 - £65,000 Equity Research Analyst: £40,000 - £75,000 Forensic Accountant: £38,000 - £70,000 Prerequisites This Financial Analysis Methods does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Financial Analysis Methods was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Section-1. Introduction Financial Statement Analysis Objectives 00:02:00 Financial Analysis Methods in Brief 00:10:00 Ratio Analysis 00:05:00 Section-2. Profitability Gross Profit Operating Margin Ratios 00:10:00 Net Profit Expense Control Ratios 00:05:00 ClassRoom Discussion for some other expenses 00:07:00 Use of Profitability Ratio to Understand Competitive advantage and Business Models 00:08:00 Section-3. Return Ratio Return on Assets and FIxed Assets 00:11:00 Return on Capital Employed 00:08:00 Case Study Analysis of three telecom companies 00:15:00 Cautions for using return ratios on face value 00:04:00 Ratios which help to understand how efficiently assets are used 00:17:00 How we measure utlisation of assets not recorded in Balance Sheet 00:09:00 Section-4. Liqudity Ratio Liquidity Ratio to understand Risk inherent in companies 00:05:00 Long Term Liquidity Ratios 00:06:00 Section-5.Operational Analysis Financial Analysis Measure meant to understand efficiency in other operations 00:04:00 Summarise - Ratios use for operational analysis 00:03:00 Dupont Analysis to understand opportunities in optimising return on equity 00:04:00 Section-6. Detecting Manipulation Detecting Manipulation in accounts - Fake Sales 00:11:00 Detecting Manipulation - Wrong Depreciation and others 00:06:00 Pricing Decisions 00:07:00 How to make Capex Decisions 00:05:00 Assignment Assignment - Financial Analysis Methods 00:00:00

Overview Mastering payroll systems across regions has become crucial because of globalisation. The Payroll Management Course offers an expansive curriculum designed meticulously, considering the intricacies and latest trends in payroll systems, especially emphasising the UK model.Module 01 provides an in-depth view of the Payroll System in the UK, laying the foundation for the subsequent modules. The course paves the way for advanced knowledge, from understanding the payroll basics (Module 02) to getting acquainted with company and legislation settings (Modules 03 & 04). Delve into the essentials ofpension schemes (Module 05) and the intricacies of pay elements (Module 06), and get a grip on payroll processing basics (Module 10), among various other critical topics.As we move towards the latter modules,we address standard procedures and contingencies such as employee leaving (Module 21) andyear-end procedures (Module 24), ensuring a holistic grasp of payroll management. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment in this Payroll Management Course. It is available to all students, of all academic backgrounds.The Payroll Management Course is designed for professionals in payroll, HR, accounting, and business owners who want to master payroll systems, with a focus on the UK model. It covers a wide range of topics, from basics to advanced concepts, ensuring a holistic understanding of payroll management in the UK. Requirements Our Payroll Management Course has been designed to be fully compatible with tablets and smartphones. Here are some common requirements you may need: Computer, smartphone, or tablet with internet access. English language proficiency. Required software/tools. (if needed) Commitment to study and participate. There is no time limit for completing this course; it can be studied at your own pace. Career Path Popular and Top Career Paths in a Payroll Management Course: Payroll Specialist - Salary Range: £35,000 - £50,000 annually. Payroll Manager - Salary Range: £45,000 - £80,000 annually. HR Manager - Salary Range: £50,000 - £95,000 annually. Financial Analyst - Salary Range: £40,000 - £80,000 annually. Accounting Manager - Salary Range: £55,000 - £100,000 annually. It's essential to research specific job opportunities and market conditions in your area to get a more accurate understanding of potential salaries. Course Curriculum 1 sections • 24 lectures • 04:37:00 total length •Module 01: Payroll System in the UK: 01:05:00 •Module 02: Payroll Basics: 00:00:00 •Module 03: Company Settings: 00:08:00 •Module 04: Legislation Settings: 00:07:00 •Module 05: Pension Scheme Basics: 00:06:00 •Module 06: Pay Elements: 00:14:00 •Module 07: The Processing Date: 00:07:00 •Module 08: Adding Existing Employees: 00:08:00 •Module 09: Adding New Employees: 00:12:00 •Module 10: Payroll Processing Basics: 00:11:00 •Module 11: Entering Payments: 00:12:00 •Module 12: Pre-Update Reports: 00:09:00 •Module 13: Updating Records: 00:09:00 •Module 14: e-Submissions Basics: 00:09:00 •Module 15: Process Payroll (November): 00:16:00 •Module 16: Employee Records and Reports: 00:13:00 •Module 17: Editing Employee Records: 00:07:00 •Module 18: Process Payroll (December): 00:12:00 •Module 19: Resetting Payments: 00:05:00 •Module 20: Quick SSP: 00:10:00 •Module 21: An Employee Leaves: 00:13:00 •Module 22: Final Payroll Run: 00:07:00 •Module 23: Reports and Historical Data: 00:08:00 •Module 24: Year-End Procedures: 00:09:00

Welcome to the world of finance, where numbers tell compelling stories. Our Financial Reporting course is not just about crunching numbers; it's about deciphering the language of business. Dive into the intricate modules, from understanding the nuances of the Cash Flow Statement to unraveling the complexities of Equity Analysis. This isn't your typical finance class; this is an odyssey into the heart of financial reporting, where each module is a chapter in the epic tale of fiscal comprehension. As you journey through the course, you'll not only master the technical aspects but also develop a financial intuition that sets you apart. Whether you're a budding finance enthusiast or a seasoned professional aiming to refine your skills, this course caters to all. Let the numbers speak, and let your financial acumen soar to new heights. Join us in deciphering the financial realm, one module at a time. Learning Outcomes Master the art of Financial Reporting. Analyze and interpret the Cash Flow Statement. Conduct thorough Credit Analysis. Understand the intricacies of the Balance Sheet. Gain expertise in Equity Analysis and Ratio Analysis. Why choose this Financial Reporting course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Financial Reporting course for? Aspiring finance professionals seeking a comprehensive understanding. Business owners aiming to interpret their financial statements effectively. Students pursuing finance or accounting degrees. Career switchers looking to enter the finance industry. Investors seeking to enhance their financial analysis skills. Career path Financial Analyst: £30,000 - £45,000 Credit Analyst: £35,000 - £50,000 Finance Manager: £40,000 - £60,000 Chartered Accountant: £45,000 - £70,000 Investment Analyst: £50,000 - £80,000 Chief Financial Officer (CFO): £60,000 - £120,000 Prerequisites This Financial Reporting does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Financial Reporting was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Financial Reporting Financial Reporting 00:25:00 Module 02: The Cash Flow Statement The Cash Flow Statement 00:24:00 Module 03: Credit Analysis Credit Analysis 00:30:00 Module 04: The Balance Sheet The Balance Sheet 00:28:00 Module 05: Equity Analysis Equity Analysis 00:16:00 Module 06: Ratio Analysis Ratio Analysis 00:27:00 Module 07: The Applications and Limitations of EBITDA The Applications and Limitations of EBITDA 00:26:00 Module 08: Tax System and Administration in the UK Tax System and Administration in the UK 00:25:00

Business Operation Management and Succession Planning- 8 Courses Bundle

By NextGen Learning

Dive into the comprehensive world of "Business Operation Management and Succession Planning" with this all-inclusive bundle. It's designed to equip you with the knowledge and skills needed to excel in the business landscape. This bundle encompasses eight essential courses .This courses equips you with the tools to optimize operations, make informed decisions, and navigate legal complexities. Additionally, you'll gain insights into business analysis, financial ratios, and succession planning, ensuring you're well-prepared to drive business growth and continuity. Whether you're an entrepreneur, manager, or aspiring leader, this bundle empowers you to excel in the ever-evolving world of business. Enrol today and start your career growth! Courses in Business Operation Management: Course 1: Business Management Course 2: Business Studies Course 3: Business Plan Course 4: Business Law Course 5: Business Analysis Course Level 5 Course 6: Learn Business Development & Sales from A-Z Course 7: Learn to Identify and Solve Business Problems Course 8: Financial Ratio Analysis for Business Decisions Learning Outcomes: Develop a comprehensive understanding of the foundational principles in this field. Gain insights into creating, analysing, and implementing a robust business plan. Understand the nuances of business analysis, including key techniques and methodologies. Develop the ability to identify, analyse, and provide solutions to pressing issues. Enhance decision-making capabilities using financial ratio analysis. The "Business Operation Management and Succession Planning" course is a comprehensive educational package that combines key business management principles with the crucial aspect of succession planning. Business Operation Management entails overseeing the daily operations of an organization, ensuring efficiency and effectiveness in various facets. Succession planning, on the other hand, refers to the strategic process of identifying and developing potential future leaders within the company.This course not only equips individuals with the skills to manage business operations but also imparts knowledge about nurturing talent and planning for the continued success and stability of an organization through seamless leadership transitions. By merging these two vital areas, it prepares learners to excel in the ever-evolving business landscape while ensuring a smooth transition of leadership for long-term prosperity. So, join us today and make your future brighter. CPD 80 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring business professionals keen on enhancing their operation management knowledge. Entrepreneurs looking to strengthen their foundational business acumen. Individuals aiming to pivot into roles that demand business strategy and decision-making skills. Graduates keen on augmenting their academic understanding with business operation management proficiency. Managers and executives responsible for decision-making within their organizations can sharpen their leadership and operational skills. Requirements Without any formal requirements, you can delightfully enrol in this course. Career path Business Analyst - £30K to £50K/year. Business Development Manager - £25K to £55K/year. Operations Manager - £35K to £60K/year. Financial Analyst - £32K to £52K/year. Business Consultant - £40K to £70K/year. Corporate Lawyer - £50K to £90K/year. Sales Manager - £28K to £54K/year. Certificates CPD Certificate Of Completion Digital certificate - Included 8 Digital Certificates Are Included With This Bundle CPD Quality Standard Hardcopy Certificate (FREE UK Delivery) Hard copy certificate - £9.99 Hardcopy Transcript: £9.99

Overview: ***Limited Time Offer*** ★★★ Enrolment Gift: Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £200 - Enrol Now! ★★★ Accounting and Finance is the language of business. It is essential for understanding how businesses operate and make decisions. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course will teach you the fundamentals of accounting and finance, including financial statements, budgeting, financial markets, and risk management. This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course bundle will equip learners with in-depth knowledge and in-demand skills in key areas of accounting and finance. You will master the use of industry-standard software. You will also learn how to use popular accounting software such as Xero, Sage 50, Quickbooks, and Payroll & Vat-Tax. The curriculum also covers critical topics such as financial modelling, fraud detection, and the latest trends in financial management. Along with this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle, you will get 19 premium courses, an original Hardcopy, 20 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This 20-in-1 Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle consists of the following Courses: Course 01: Accounting and Finance Diploma Course 02: Applied Accounting Course 03: Managerial Accounting Masterclass Course 04: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 05: Level 3 Tax Accounting Course 06: Introduction to VAT Course 07: Level 3 Xero Training Course 08: QuickBooks Online Bookkeeping Diploma Course 09: Diploma in Sage 50 Accounts Course 10: Cost Control Process and Management Course 11: Learn to Read, Analyse and Understand Annual Reports Course 12: Financial Statements Fraud Detection Training Course 13: Finance Principles Course 14: Financial Management Course 15: Financial Modelling Course - Learn Online Course 16: Improve your Financial Intelligence Course 17: Financial Analysis Course 18: Banking and Finance Accounting Statements Financial Analysis Course 19: Financial Ratio Analysis for Business Decisions Course 20: Budgeting and Forecasting So, stop scrolling down and procure the skills and aptitude with Apex Learning to outshine all your peers by enrolling in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle. Learning Outcomes of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: Understand the basic concepts of accounting and finance. Apply accounting principles to record and analyze financial transactions. Prepare financial statements, such as balance sheets and income statements. Develop skills in payroll software and systems for accurate processing. Develop budgets and manage financial resources. Understand the financial markets and how to invest money. Understand and manage payroll processes efficiently within any organisational structure. Learn payroll best practices to ensure timely and error-free payments. Key Features of the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax Course: FREE Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax CPD-accredited certificate Get a free student ID card with Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training (£10 applicable for international delivery) Lifetime access to the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course materials The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax program comes with 24/7 tutor support Get instant access to this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course Learn Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training from anywhere in the world The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training is affordable and simple to understand The Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax training is entirely online Enrol today to deepen your understanding of the topic Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax. Description: This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax diploma offers learners the opportunity to acquire the skills that are highly valued in this field. With this Certification, graduates are better positioned to pursue career advancement and higher responsibilities within this setting. The skills and knowledge gained from this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course will enable learners to make meaningful contributions to related fields, impacting their experiences and long-term development. The Course curriculum of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: Course 01: Accounting and Finance Diploma Module: 01 Accounting Introduction First Transactions T Accounts introduction T-Accounts conclusion Trial Balance Income Statement Balance Sheet Module: 02 Balance Sheet Variations Accounts in practise Balance Sheets what are they Balance Sheet Level 2 Income Statement Introduction Are they Expenses, or Assets Accounting Jargon Module: 03 Accruals Accounting is Fundamental Trial Balance 3 days ago More Fixed Assets and how it is shown in the Income Statement Stock movements and how this affects the financials Accounts Receivable How to calculate the Return on Capital Employed Transfer Pricing - International Rules = = = > > > and 19 more courses = = = > > > Certification of Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle: After successfully completing the Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £9.99*20 = £199.7) Hard Copy Certificate: Free (For The Title Course: Previously it was £14.99) Enrol in this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course today and take your career to the next level! Who is this Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax course for? This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course is perfect for anyone who wants to learn about accounting and finance, or who wants to improve their skills in these areas. It is also a great choice for anyone who wants to learn how to use Xero, Sage 50, Quickbooks, Payroll & Vat-Tax. Requirements This Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax bundle course has been designed to be fully compatible with tablets and smartphones. Career path Become a skilled Accountant with our Accounting and Finance: Xero, Sage 50, Quickbooks, Payroll & Vat-Tax Training and explore your opportunities in sectors such as: Accountant: £25,000 - £50,000 Financial analyst: £30,000 - £60,000 Investment banker: £40,000 - £100,000 Chartered accountant: £50,000 - £120,000 Financial controller: £60,000 - £150,000 Chief financial officer: £100,000 - £200,000 Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Accounting and Finance) absolutely Free! Other Hard Copy certificates are available for £14.99 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.