- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1211 Financial Analysis courses in Cardiff delivered Online

Business and Data Analytics for Beginners Course

By One Education

Data isn’t just for tech wizards anymore — it’s at the heart of smart business decisions. This course takes a light-footed yet sharp approach to show you how data shapes strategies, informs choices, and reveals what’s really going on behind the numbers. Whether you're managing a small team or eyeing growth opportunities, understanding the basics of business and data analytics can help you avoid the guesswork and focus on what truly drives performance. We’ve designed this course to make numbers less intimidating and more insightful. Through clear explanations and well-paced modules, you’ll grasp how data trends, patterns, and reports can support better decision-making across departments. If spreadsheets usually send you running, don’t worry — we keep things clear, logical, and surprisingly engaging. This course is for beginners, but the mindset you’ll develop is fit for any boardroom conversation. Learning Outcomes: Develop an understanding of the principles and practices of business and data analytics Learn effective strategies for problem framing and business process modelling Develop analytical skills for data preparation, evaluation, and deployment Understand how to exploit data to gain a competitive edge Be able to make informed decisions and navigate the complex and dynamic world of business and data analytics The "Business and Data Analytics for Beginners" course is designed to provide a comprehensive understanding of the principles and practices that underpin successful data analysis in a business context. Through engaging modules and real-world case studies, learners will gain insights into the basics of business and data analytics, advanced techniques for data preparation, evaluation, and deployment, and effective strategies for exploiting data to gain a competitive edge. By the end of the course, learners will be equipped with the knowledge and skills to make informed decisions and navigate the complex and dynamic world of business and data analytics. Whether you're a business professional looking to enhance your skills or a beginner looking to enter the world of data analysis, this course is a must-have for anyone interested in the world of business and data analytics. Business and Data Analytics for Beginners Course Curriculum Section 01: Business and Data Analytics Introduction to Business and Data Analytics Where are Insights Business Analytics Being Used Problem Framing Process Section 02: Business Process Model Business Process Modelling Outcome of the First Step Outcome of the Second Step Data Understanding How Do You Exploit Data that no One Else Has? Informational System Usually Section 03: Working on Data Data Preparation Evaluation Deployment Major Health Insurance Company Process How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Business professionals looking to enhance their data analysis skills Beginners interested in the world of business and data analytics Business students interested in the field of data analysis Entrepreneurs looking to incorporate data analysis into their business practices Anyone interested in gaining a comprehensive understanding of data analysis in a business context Career path Data Analyst: £20,000 - £50,000 per year Business Analyst: £25,000 - £60,000 per year Marketing Analyst: £25,000 - £50,000 per year Financial Analyst: £25,000 - £70,000 per year Operations Analyst: £25,000 - £60,000 per year Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Financial Modeling Using Excel Course

By One Education

If spreadsheets make your eyes glaze over, this course will change your perspective. “Financial Modelling Using Excel” is designed for professionals, entrepreneurs, and finance enthusiasts who want to make Excel sing with numbers. With a touch of logic and a bit of flair, you'll learn how to structure financial models that are not only functional but elegantly built. Whether it’s forecasting revenue, building balance sheets, or calculating project viability, this course simplifies the complex into cells and formulas that actually make sense. From budgeting to scenario analysis, this training helps you transform raw data into clear financial insights—all within Excel. It’s ideal for anyone who prefers to work smart with numbers, rather than wrestle them into submission. Tidy sheets, structured models, and the kind of clarity that would make even your accountant raise an eyebrow—this is Excel used at its finest. No fluff, no drama—just formulas, logic, and a satisfying sense of order. Learning Outcomes: Develop a strong understanding of financial modelling and forecasting Build effective financial model templates using Excel Project income statements, balance sheets, and cash flows with ease Gain insight into advanced financial modelling techniques Learn how to apply financial modelling skills in real-world scenarios This comprehensive course is divided into six distinct modules, each focusing on a specific aspect of financial modelling using Excel. The course starts with an introduction to financial modelling and planning your financial model, before moving on to building a model template. You will then learn how to project the income statement, balance sheet, and cash flows. In the advanced financial modelling module, you will gain insight into more complex techniques such as sensitivity analysis, scenario analysis, and Monte Carlo simulation. By the end of this course, you will have the skills and knowledge to build accurate and effective financial models and forecasts, and apply them in real-world scenarios. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completion of this course, you will be equipped with the skills and knowledge to pursue a career in finance. Here are some potential salary ranges for these positions in the UK: Financial Analyst: £26,000 - £70,000 Investment Analyst: £28,000 - £82,000 Risk Analyst: £29,000 - £65,000 Corporate Finance Analyst: £30,000 - £75,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

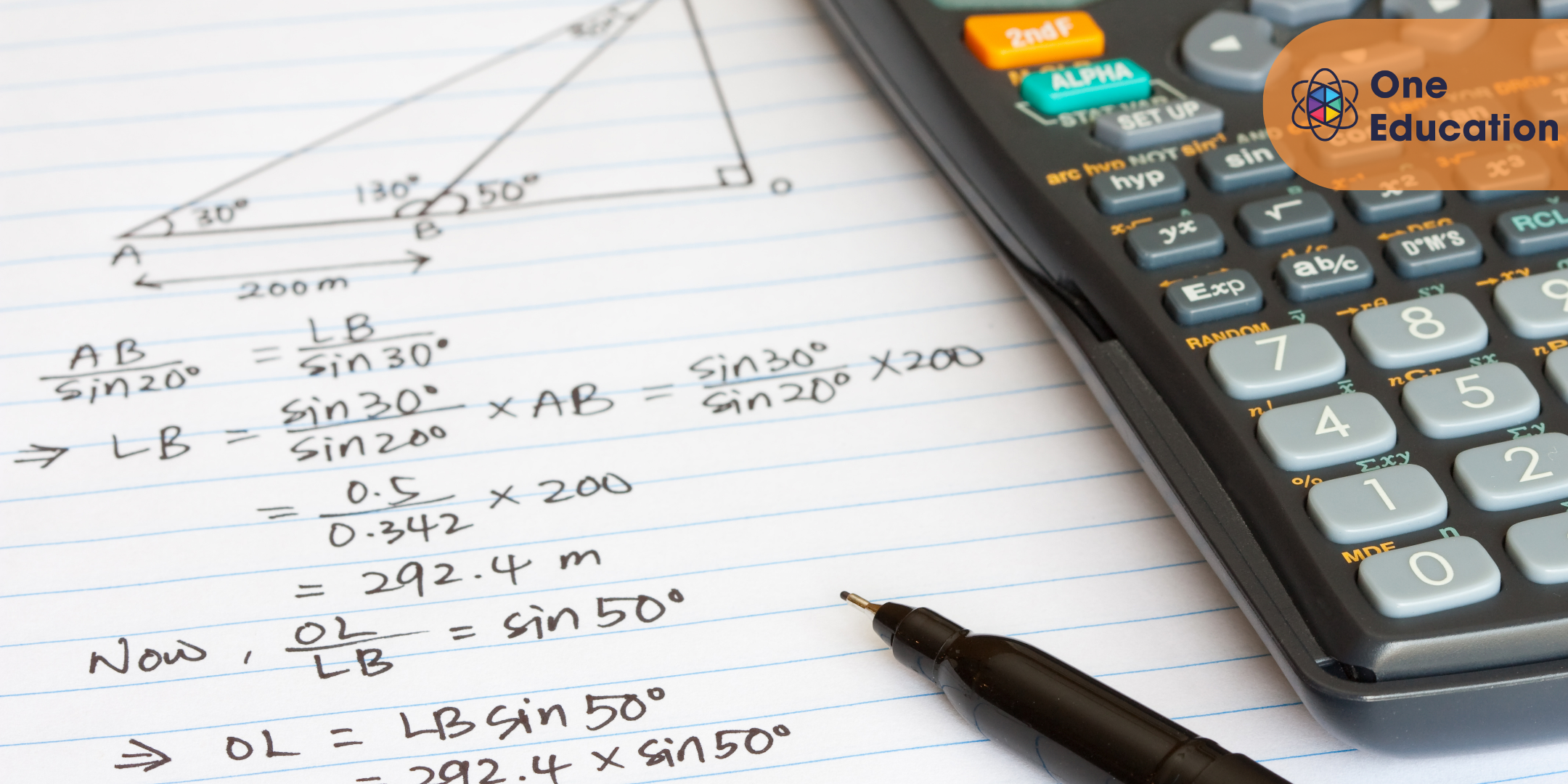

Mathematics Fundamentals - Fraction Course

By One Education

Fractions are the building blocks of many mathematical concepts, and this course is designed to make them approachable and clear. Whether you’re revisiting fractions after some time or encountering them with fresh curiosity, this course offers a straightforward exploration of how fractions work, why they matter, and how to confidently manipulate them. From recognising numerators and denominators to mastering addition, subtraction, multiplication, and division of fractions, you’ll develop a solid grasp that forms the foundation for further mathematical learning. With carefully structured lessons that break down each concept into digestible parts, this course avoids unnecessary jargon and keeps the focus on what really matters—understanding fractions with clarity and confidence. Suitable for learners at various levels, it provides the clarity and support needed to boost both knowledge and self-assurance. If numbers sometimes seem like a puzzle, this course is the friendly guide to making fractions less puzzling and more manageable. Learning Outcomes: Develop a foundational understanding of fractions and their applications in math Learn how to add, subtract, multiply, and divide fractions Gain confidence in solving fraction problems and applying mathematical concepts Expand your understanding of practical applications of fractions in real-world scenarios Prepare for more advanced math courses or exams that involve fractions The Mathematics Fundamentals - Fraction course is designed to provide learners with a comprehensive understanding of fractions and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve fraction problems. Upon completing this course, learners will have a solid foundation in fractions and be prepared for more advanced math courses or exams. With a focus on developing practical skills in adding, subtracting, multiplying, and dividing fractions, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Fraction Course Curriculum Introduction Introduction Fractions Lesson 1 - Finding fractions of whole numbers Lesson 2 - Multiplying fractions Lesson 3 - Simplifying fractions Lesson 4 - Simplifying fractions Lesson 5 - The 3 times table Lesson 6 - Tips for simplifying any fraction Lesson 7 - Multiplying fractions with whole numbers Lesson 8 - Dividing fractions Lesson 9 - Turning improper fractions into mixed fractions Lesson 10 - Turning improper fractions into mixed fractions Lesson 11 - Turning improper fractions into mixed fractions Lesson 12 - Turning improper fractions into mixed fractions Lesson 13 - Turing mixed fractions into improper fractions Lesson 14 - Turning mixed fractions into improper fractions Lesson 15 - Dividing fractions Lesson 16 - Dividing fractions Lesson 17 - Dividing with fractions and whole numbers Lesson 18 - Dividing with fractions and whole numbers Lesson 19 - Adding fractions Lesson 20 - Adding fractions Lesson 21 - Adding fractions Lesson 22 - Adding fractions Lesson 23 - Adding fractions Lesson 24 - Subtracting fractions Lesson 25 - Subtracting fractions Lesson 26 - Subtracting fractions Lesson 27 - Whole numbers subtracting fractions Lesson 28 - Whole numbers subtracting fractions Lesson 29 - Recap Lesson 30 - Practice questions Lesson 31 - Practice questions Lesson 32 - Practice questions Lesson 33 - Practice questions Lesson 34 - Practice questions Lesson 35 - Practice questions Lesson 36 - Practice questions Lesson 37 - Practice questions How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with fractions in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of fractions and their applications in math Students preparing for math exams or courses that involve fractions Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Engineer Architect Mathematician Statistician Financial analyst £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Mathematics Fundamentals - Percentages Course

By One Education

Percentages play a silent yet powerful role in our everyday decisions—whether it’s sorting out discounts, understanding interest rates, or figuring out proportions. The Mathematics Fundamentals - Percentages Course is tailored to help learners grasp the core principles of percentages without any complicated jargon or overwhelming equations. Clear, engaging, and neatly structured, this course takes the mystery out of percentage calculations and turns confusion into confidence. Designed for learners of all levels, this course breaks down the essentials into bite-sized, logical steps—making each concept stick with ease. Whether you're brushing up for exams, sharpening your skills for work, or just trying to finally make sense of supermarket sales, you’ll find this course refreshingly clear. From calculating increase and decrease to working through percentage change and reverse percentages, everything you need is right here—well explained and easy to follow. Learning Outcomes: Develop a foundational understanding of percentages and their applications in math Learn how to calculate percentages of numbers, increase or decrease numbers by percentages, and calculate compound interest Gain confidence in solving percentage problems and applying mathematical concepts Expand your understanding of practical applications of percentages in real-world scenarios Prepare for more advanced math courses or exams that involve percentages The Mathematics Fundamentals - Percentages course is designed to provide learners with a comprehensive understanding of percentages and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve percentage problems. Upon completing this course, learners will have a solid foundation in percentages and be prepared for more advanced math courses or exams. With a focus on developing practical skills in calculating percentages, increasing or decreasing numbers by percentages, and calculating compound interest, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Percentages Course Curriculum Introduction Introduction Percentages Lesson 1 - Finding 10% by dividing by 10 Lesson 2 - Dividing by 10 with numbers that don't end in a zero Lesson 3 - Dividing decimals by 10 Lesson 4 - Dividing by 10 with decimals less than 10 Lesson 5 - Dividing by 10 with whole numbers less than 10 Lesson 6 - Dividing pennies by 10 Lesson 7 - Finding 20% of a number Lesson 8 - Practise finding 20% of a number Lesson 9 - Finding 5% of a number Lesson 10 - Practise finding 5% of a number Lesson 11 - Finding 1% of a number Lesson 12 - Practise finding 1% of a number Lesson 13 - Finding 2% of a number Lesson 14 - Finding 50% of a number Lesson 15 - Practise finding 50% of a number Lesson 16 - Finding 25% of a number Lesson 17 - Finding any percentage of any number Lesson 18 - Ways to find different percentages Lesson 19 - Practise finding any percentage of any number Lesson 20 - Practise finding any percentage of any number Lesson 21 - Using a calculator Lesson 22 - Practise using a calculator to find percentages of numbers Lesson 23 - Let's practise Lesson 24 - Let's practise Lesson 25 - Let's practise Lesson 26 - Let's practise Lesson 27 - Let's practise Lesson 28 - Let's practise Lesson 29 - Let's practise Lesson 30 - Let's practise Lesson 31 - Let's practise Lesson 32 - Let's practise Lesson 33 - Increasing a number by a percentage Lesson 34 - Increasing a number by a percentage Lesson 35 - Increasing a number by a percentage Lesson 36 - Increasing a number by a percentage on a calculator Lesson 37 - Increasing a number by a percentage on a calculator Lesson 38 - Increasing a number by a percentage on a calculator Lesson 39 - Decreasing a number by a percentage Lesson 40 - Decreasing a number by a percentage Lesson 41 - Decreasing a number by a percentage Lesson 42 - Decreasing a number by a percentage on a calculator Lesson 43 - Decreasing a number by a percentage on a calculator Lesson 44 - Simple interest and compound interest Lesson 45 - Simple interest and compound interest Lesson 46 - Compound interest formula Lesson 47 - Interest questions Lesson 48 - Interest questions Lesson 49 - Reverse percentages Lesson 50 - Reverse percentages Lesson 51 - Reverse percentages How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with percentages in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of percentages and their applications in math Students preparing for math exams or courses that involve percentages Career path Accountant Financial analyst Statistician Data analyst Economist £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Financial Wellness: Managing Personal Cash Flow

By IOMH - Institute of Mental Health

This 'Financial Wellness: Managing Personal Cash Flow' course is your roadmap. Take charge of your financial future with this comprehensive course on personal finance and cash flow management. Gain the skills and knowledge needed to budget effectively, manage debt, understand insurance and taxes, and design a financial plan tailored to your unique needs. With sound money management principles and strategies, you can work towards financial stability and unlock opportunities for career development in finance. The UK finance industry is booming, with over 1.1 million people employed and salaries averaging £30-60k for roles like banking, accounting, and analysis. Don't let your finances hold you back. Enrol now and invest in your financial well-being and career potential. With topics spanning budgeting, credit, insurance, and the psychology of money, this Financial Wellness: Managing Personal Cash Flow course provides actionable education for anyone wanting to improve their finances and mental health. Join the thousands in achieving financial freedom and taking control of your money. You will Learn The Following Things: Understand key concepts in personal finance and cash flow management. Develop skills to track income and expenses through budgeting and accounting. Learn strategies to manage debt, credit, and borrowing responsibly. Gain knowledge on insurance policies and tax planning for financial well-being. Design and implement a personalised budget to optimise cash flow. Recognise the relationship between money and mental health. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Financial Wellness: Managing Personal Cash Flow. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement After completing the Financial Wellness: Managing Personal Cash Flow course, you will receive your CPD-accredited Digital/PDF Certificate for £5.99. To get the hardcopy certificate for £12.99, you must also pay the shipping charge of just £3.99 (UK) and £10.99 (International). Who Is This Course for? Individuals looking to take control of their finances and achieve financial stability. Those starting out and wanting to build healthy money habits from the outset. People with limited financial knowledge seek core competencies in personal finance. Anyone facing financial difficulties and wanting to improve their money management. Those seeking to progress their career into finance-related roles. Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Financial Wellness: Managing Personal Cash Flow course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Financial Wellness: Managing Personal Cash Flow Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Financial Advisor - £24K to £40K/year. Accountant - £28K to £45K/year. Financial Analyst - £30K to £60K/year. Banker - £30K to £100K/year. Insurance Agent - £18K to £35K/year. Course Curriculum Module 01: Introduction to Personal Cash Flow Introduction-to-personal-cash-flow 00:22:00 Module 02: Understanding the Importance of Personal Finance Understanding the Importance of Personal Finance 00:22:00 Module 03: Accounting and Personal Finances Accounting and Personal Finances 00:15:00 Module 04: Cash Flow Planning Cash Flow Planning 00:14:00 Module 05: Understanding Personal Money Management Understanding Personal Money Management 00:21:00 Module 06: Borrowing, Credit and Debt Borrowing, Credit and Debt 00:19:00 Module 07: Managing Personal Insurance Managing Personal Insurance 00:19:00 Module 08: Understanding Tax and Financial Strategies Understanding Tax and Financial Strategies 00:40:00 Module 09: Designing a Personal Budget Designing a Personal Budget 00:17:00 Module 10: Money and Mental Health Money and Mental Health 00:15:00 Assignment Assignment - Financial Wellness: Managing Personal Cash Flow 00:00:00

Real Estate Development Mini Bundle

By Compete High

Unlock your potential in the property sector with the Real Estate Development Mini Bundle—designed for those looking to build a strong, hireable skillset in property finance and management. By focusing on essential skills like Finance, MS Excel, Business Analysis, Proofreading, and Business Law, this bundle provides everything you need to stand out in the competitive world of real estate development. Description Success in real estate development depends on a deep understanding of Finance and the ability to analyze business opportunities critically. The Finance skills gained here will make you a valuable asset for companies needing experts who can manage budgets, assess investment viability, and optimize project funding. No modern real estate professional can overlook MS Excel. From financial modeling to data analysis, MS Excel proficiency is a must-have. Employers actively seek candidates skilled in MS Excel to streamline reporting and support data-driven decision-making. Adding depth to your profile, Business Analysis enhances your capability to evaluate market trends, client needs, and project feasibility. Strong Business Analysis skills empower you to identify risks and opportunities, making you indispensable in real estate project teams. The importance of clear communication and error-free documents can’t be overstated, so Proofreading is an invaluable addition. With impeccable Proofreading, you ensure contracts, proposals, and reports reflect professionalism and accuracy, a vital skill for client-facing roles. Finally, understanding Business Law is fundamental in real estate development. Whether it’s contracts, property rights, or regulatory compliance, Business Law knowledge sets you apart as a knowledgeable and reliable professional. Combining Finance, MS Excel, Business Analysis, Proofreading, and Business Law prepares you to confidently enter and thrive in real estate development roles. FAQ Q: Who should consider this bundle? A: Aspiring real estate developers, project managers, financial analysts, and professionals seeking expertise in Finance, MS Excel, Business Analysis, Proofreading, and Business Law. Q: Can this bundle help me in property investment? A: Yes, the combined skills in Finance, MS Excel, Business Analysis, and Business Law give you a significant edge. Q: Do I need prior experience? A: No, this bundle supports beginners and professionals looking to sharpen their real estate development skills.

Sage 50: Sage 50 Course Online Introducing: Sage 50: Sage 50 Course - Master Financial Management with Ease! Are you looking to enhance your financial management skills and take control of your business's accounts? Look no further! The Sage 50: Sage 50 Course is here to empower you with the knowledge and expertise you need to manage your finances effectively. The Sage 50: Sage 50 Course includes multiple instructional videos, instructive images, directions, support, and other resources. You will have access to online help during the course. The Sage 50: Sage 50 Accounts course is conveniently available online, allowing you to study at your own speed and from the comfort of your own home. The Sage 50: Sage 50 Accounts course modules are accessible from any device and location with an internet connection. The Sage 50: Sage 50 Course will provide you with a warm introduction to the world of Sage 50: Sage 50 Accounts. You will discover the key features and benefits of this powerful software, setting the stage for your journey toward financial mastery. The Sage 50: Sage 50 Accounts course will guide you through the process of setting up your Sage 50: Sage 50 Accounts software. From installation to configuration, we will ensure that you are up and running smoothly and ready to harness the full potential of this remarkable tool. With this Sage 50: Sage 50 Course, you will become a pro at managing customer accounts and improving cash flow. Unlock the power of financial reporting with Sage 50: Sage 50 Accounts. The Sage 50: Sage 50 Course will help you learn how to analyse key metrics, identify trends, and make data-driven decisions to drive growth. Main Course: Sage 50 Accounts Course Free Courses included with Sage 50: Sage 50 Course: Along with Sage 50: Sage 50 Course you will get free Level 5 Accounting and Finance Along with Sage 50: Sage 50 Course you will get free Financial Advisor Special Offers of this Sage 50: Sage 50 Course; This Sage 50: Sage 50 Course includes a FREE PDF Certificate. Lifetime access to this Sage 50: Sage 50 Course Instant access to this Sage 50: Sage 50 Course 24/7 Support Available to this Sage 50: Sage 50 Course Sage 50: Sage 50 Course Online You will embark on an exciting adventure into accounting and financial management with our Sage 50: Sage 50 Course. You'll also learn a great deal about inventory management, payroll processing, bookkeeping, and much more from this Sage 50: Sage 50 Course. You'll also discover insider knowledge that will enable you to master Sage 50: Sage 50 accounts. You can advance your career, make better decisions, and be more productive through this Sage 50: Sage 50 accounts course. Who is this course for? Sage 50: Sage 50 Course Online This Sage 50: Sage 50 Course is open to everyone. Requirements Sage 50: Sage 50 Course Online To enrol in this Sage 50: Sage 50 Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Sage 50: Sage 50 Course. Be energetic and self-motivated to complete our Sage 50: Sage 50 Course. Basic computer Skill is required to complete our Sage 50: Sage 50 Course. If you want to enrol in our Sage 50: Sage 50 Course, you must be at least 15 years old. Career path Sage 50: Sage 50 Course Online This Sage 50: Sage 50 Course will offer you with desirable abilities and open the door to a variety of job opportunities., including — Accountant Bookkeeper Financial controller Auditor Budget analyst Financial analyst Payroll specialist Accounts payable clerk Accounts receivable clerk Tax specialist

Stock Trading Analysis with Volume Trading

By NextGen Learning

Course Overview "Stock Trading Analysis with Volume Trading" is designed to provide learners with a comprehensive understanding of how to leverage volume analysis in stock trading. This course covers essential volume indicators, strategies, and techniques, empowering learners to make informed trading decisions. The course aims to enhance trading skills by explaining how volume trends can influence stock price movements, offering learners practical insights into market behaviour. By the end of the course, learners will have the ability to interpret volume data, use it to spot market trends, and apply it within their trading strategies, enhancing their confidence and decision-making capabilities in stock trading. Course Description This course delves into the critical aspect of volume analysis in stock trading, providing a thorough exploration of how trading volume can provide valuable market insights. Learners will study various volume indicators and their applications, uncover trading strategies that incorporate volume as a key factor, and gain the skills necessary to identify profitable market movements. The course also includes practical examples and analysis to demonstrate how volume impacts stock trends, while familiarising learners with the tools used in volume trading. By completing this course, learners will develop the expertise to utilise volume trading strategies to enhance their trading performance and make more informed decisions in real-time market scenarios. Course Modules Module 01: Volume Analysis Module 02: Volume Studies and Indicators Module 03: Volume Trading Strategies and Techniques Module 04: Examples and Analysis Module 05: Trading Platform (See full curriculum) Who is this course for? Individuals seeking to enhance their stock trading skills Professionals aiming to develop expertise in volume trading strategies Beginners with an interest in stock market analysis Anyone looking to understand the role of volume in trading decisions Career Path Stock Trader Financial Analyst Investment Advisor Trading Platform Specialist Portfolio Manager