- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6574 Finance courses

Description Business Accounting Diploma In today's fast-paced business environment, mastering the intricacies of accounting is paramount. For those looking to enhance their knowledge and skills in this domain, the Business Accounting Diploma offers a comprehensive online course tailored to meet the demands of the modern-day financial landscape. The Business Accounting Diploma provides learners with a comprehensive understanding of the basics of business accounting. This foundational module ensures that students start with a strong grasp of the core concepts, paving the way for a deeper exploration of more advanced topics. As the course progresses, students encounter the ins and outs of Financial Reporting Standards. This essential section ensures that learners become well-versed in the globally recognised standards, ensuring their preparedness for the international business world. But what's business accounting without mastering the art of bookkeeping? The Bookkeeping Essentials module takes participants through the crucial components of systematic financial record-keeping. From ledgers to journals, this segment promises to instil the necessary skills for meticulous financial documentation. Ensuring a company's financial health isn't just about tracking money; it's also about adeptly managing revenues and expenses. The Revenue and Expense Management segment teaches students how to oversee income streams and control outgoing funds efficiently, ensuring profitability. A critical aspect of business accounting revolves around the complex world of taxation. The Understanding Business Taxation module ensures that participants are well-equipped to navigate tax regulations, compliance, and efficient tax planning. No business can thrive without its workforce, and managing their financial compensation is pivotal. The Payroll Management section offers insights into efficient wage and salary administration, ensuring that businesses operate smoothly and employees are compensated fairly. Cash is undoubtedly king in the business realm. The Cash Flow and Budgeting segment delves into the essential strategies to maintain healthy cash flows and set realistic budgets. This knowledge ensures businesses remain solvent and can invest in growth opportunities. Diving deeper into the financial strategies of a company, the Management Accounting module introduces learners to the nuances of using accounting information for strategic decision-making, ensuring that businesses not only survive but thrive. Every business, be it a budding startup or an established conglomerate, requires financing and investment. The corresponding module in the Business Accounting Diploma imparts knowledge on how businesses can secure funds, manage investments, and ensure returns are maximised. Lastly, the Future of Business Accounting offers a glimpse into what lies ahead. With the financial world constantly evolving, this module ensures that learners are prepared for upcoming trends and shifts in the accounting domain. In summary, the Business Accounting Diploma is not just an online course; it's a journey. A journey that transforms participants from novices to experts in the realm of business accounting. With its comprehensive modules and practical approach, this course promises to equip learners with the skills and knowledge required to excel in the dynamic world of business finance. Whether you're a business owner, an aspiring accountant, or someone looking to upscale their financial knowledge, this diploma serves as your stepping stone to success. What you will learn 1:Understanding the Basics of Business Accounting 2:Financial Reporting Standards 3:Bookkeeping Essentials 4:Revenue and Expense Management 5:Understanding Business Taxation 6:Payroll Management 7:Cash Flow and Budgeting 8:Management Accounting 9:Financing and Investment 10:The Future of Business Accounting Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Description Commercial And Corporate Law Diploma Discover the intricate world of commercial and corporate law with the comprehensive online Commercial And Corporate Law Diploma. This course, specifically tailored for the digital age, provides an in-depth understanding of the foundations and complexities surrounding corporate transactions and practices in the UK and globally. The course starts with an insightful introduction to commercial and corporate law, laying the groundwork for learners. You'll then journey through the different types of business entities, getting to grips with the various structures and their implications. This knowledge is pivotal for anyone keen on understanding the distinction between sole traders, partnerships, and limited companies, to name a few. Corporate governance, often a misunderstood area, takes centre stage as students explore directors' duties. Unravelling the responsibilities and obligations of those at the helm of companies, this section ensures that learners are well-equipped to understand the accountability mechanisms inherent in corporate structures. Next, the course delves into the crucial area of contract law and business transactions. In this segment, learners will grasp how contracts are formed, interpreted, and executed, as well as the potential pitfalls that can arise in business dealings. But what about the human element? The Commercial And Corporate Law Diploma doesn't forget this, offering a comprehensive section on employment and labour relations. From hiring practices to redundancy protocols, it ensures a holistic understanding of workplace legalities. Finance remains the lifeblood of any corporate entity. As such, the course covers financing and securities extensively. Whether it's share issuance, bonds, or other financial instruments, learners will gain a robust understanding of how businesses secure the resources they need. Of course, not all businesses thrive. The inevitable yet delicate topics of insolvency and bankruptcy are addressed with clarity. By engaging with this module, students will comprehend the procedures and repercussions of businesses facing financial distress. In the modern world, intellectual property rights are paramount. Be it patents, trademarks, copyrights, or design rights, the Commercial And Corporate Law Diploma provides a clear overview of how businesses can protect their most valuable intangible assets. Trade is no longer just a local affair. With globalisation, international trade, particularly concerning the UK, is pivotal. The course ensures learners are well-versed in this, exploring trade agreements, tariffs, and the broader implications of Brexit. Lastly, looking to the horizon, the course addresses future trends and challenges in corporate law. In an ever-evolving landscape, staying ahead and being informed of potential shifts can make all the difference. To sum it up, the online Commercial And Corporate Law Diploma offers a comprehensive, accessible, and up-to-date overview of the legal landscape affecting businesses today. Whether you're a budding entrepreneur, a legal professional looking to refresh your knowledge, or simply someone with a keen interest in the corporate world, this course is your ticket to understanding the nuances of commercial and corporate law in today's digital age. Join now and embark on a journey of legal discovery and empowerment. What you will learn 1:Introduction to Commercial and Corporate Law 2:Types of Business Entities 3:Corporate Governance and Directors' Duties 4:Contract Law and Business Transactions 5:Employment and Labour Relations 6:Financing and Securities 7:Insolvency and Bankruptcy 8:Intellectual Property Rights 9:International Trade and the UK 10:Future Trends and Challenges in Corporate Law Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

Sage 50 Level 1-3

By OnlineCoursesLearning.com

Sage 50 Certification Level 1-3 Is it accurate to say that you are hoping to overhaul your finance staff or possibly your bookkeeping framework? The Sage 50 programming is utilized all through the UK and can make bookkeeping rehearses inside your business simpler and more proficient. This program offers the total preparing program, from fledgling level to cutting edge level, creating this an extraordinary open door to propel staff in the records office. Each level offers 10 modules that become really testing and expand on past information, as the course advances. There could be no greater chance to select or give this preparation to an individual from your staff. What's Covered in the Course? This confirmation program is separated into three levels: fledgling, middle of the road and progressed. Each level offers such a lot of substance, which you can see beneath: Level 1: Beginner Bookkeeping essentials and monetary administration utilizing the Sage 50 programming; Foundation data to and the historical backdrop of Sage 50, including the benefits of embracing this product; The arrangements and highlights of Sage 50, for example, how you can improve your bookkeeping and monetary administration; The establishment and set-up of the product, just as how to reestablish back-up records, so you'll never lose critical information again; Step by step instructions to explore through the Sage 50 programming, including how to print reports; An outline of the graph of records, which will permit representatives to get a handle on significant wording and make as well as alter these reports; Bank records and compromise, so you'll generally have precise records of your records; The creation and upkeep of negligible money, provider and client records; Making and overseeing deals solicitations and receipts and the contrasts between them. Level 2: Intermediate: Get familiar with the fundamentals of accumulations and prepayments, including month end reports and setting up prepayments; The most effective method to set up fixed resources and ascertain devaluation esteems, including how to utilize an Asset Disposal Wizard, fixing mistakes and the administration of client and provider data; Preparing buy orders, stock control and checking, including how to make, revise and erase requests and what to look like up past orders, while keeping up stock levels; The most effective method to set item evaluating, construct a value list and ascertain client limits and credits; The total deals request measure, for example, despatching a request, distributing stock and making a review trail. Level 3: Advanced The significance of credit control and how to carry out control methodology, including seeing client history and matured equilibriums and hailing exchange debates; Instructions to oversee VAT, including returns, changing installment frameworks and clearing accounts; An outline of utilizing unfamiliar monetary standards, like exchanging, change, managing unfamiliar providers or potentially clients, bank moves and getting to exchanges and solicitations; Venture the board, including appointing costs and the administration of assets, recording costs, dispensing and accommodating stocks and charging clients; Producing project reports and making preliminary adjusts and benefit/misfortune proclamations. What are the Benefits of the Course? Here are the advantages of taking the course: You get every one of the 6 Sage 50 courses in one simple to-follow bundle - extraordinary for novices and those with a current central information; Staff can gain from the solace of their home or while at the workplace, and the course can oblige their individual learning pace; The substance can be applied as they learn, so they don't need to stand by until each of the three levels have been finished, prior to incorporating their learning; No essentials are needed for you or your staff, to begin.

Family Law at QLS Level 5 Diploma

By Imperial Academy

Level 5 | FREE 2 CPD Courses | Free QLS Hard Copy + PDF Certificates | Advanced Learning Materials | Lifetime Access

OTHM Level 3 Foundation Diploma in Accountancy

By School of Business and Technology London

Getting Started The OTHM Level 3 Foundation Diploma in Accountancy provides learners with a solid basis for pursuing a career in various organisations involving financial management and accountancy. This program is structured to guarantee that each learner not only acquires knowledge in accountancy but also develops the capabilities to swiftly adapt to changing circumstances and advance in their educational journey. Key Benefits Learners get a basic understanding of how to record financial transactions. Learners learn what is needed to record financial transactions accurately and completely. Exploring how income and expenditure are classified and managed. Accounting approaches utilised for items of capital and revenue expenditure and income. Preparing principal source documents and Books of Prime (Original) Entry for business transactions. Key Highlights Are you aspiring to have a career in various organisations with financial management and accountancy? Then, the OTHM Level 3 Foundation Diploma in Accountancy is the ideal starting point for your career journey. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace, choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our OTHM approved tutors, who would be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The OTHM Level 3 Foundation Diploma in Accountancy can open many career pathways including, but not limited to: Budget analyst with an estimated average salary of £42,100 per annum Public accountant with an estimated average salary of £20,265 per annum Accounting assistant with an estimated average salary of £23,250 per annum Accounting clerk with an estimated average salary of £30,566 per annum Bookkeeping assistant; with an estimated average salary of £20,967 per annum About Awarding Body OTHM is an established and recognised Awarding Organisation (Certification Body) launched in 2003. OTHM has already made a mark in the UK and global online education scenario by creating and maintaining a user-friendly and skill based learning environment. OTHM has both local and international recognition which aids OTHM graduates to enhance their employability skills as well as allowing them to join degree and/or Master top-up programmes. OTHM qualifications has assembled a reputation for maintaining significant skills in a wide range of job roles and industries which comprises Business Studies, Leadership, Tourism and Hospitality Management, Health and Social Care, Information Technology, Accounting and Finance, Logistics and Supply Chain Management. Assessment Time-constrained scenario-based assignments No examinations Entry Requirements Learners must be 18 years of age and Demonstrate the ability to undertake the learning and Assessment A learner not from a majority English-speaking country must provide evidence of English language competency. Progression Learners completing the OTHM Level 3 Foundation Diploma in Accountancy will allow progress to : Wide range of undergraduate programmes, including OTHM Level 4 Diploma in Accounting and Business. Why gain a OTHM Qualification? Quality, Standards and Recognitions- OTHM qualifications are approved and regulated by Ofqual (Office of the Qualifications and Examinations Regulation); hence, the learners can be very confident about the quality of the qualifications as well. Career Development to increase credibility with employers- All OTHM qualifications are developed to equip learners with the skills and knowledge every employer seeks. The learners pursuing an OTHM qualification will obtain an opportunity to enhance learning and grow key competencies to tackle situations and work on projects more effectively, which will, in turn, give learners the potential to get promotions within the workplace. Alternatively, it allows them to progress onto an MBA top-up/Bachelor's degree / Master's degree programme around the World. Flexible study options- All OTHM qualifications have a credit value, which tells you how many credits are awarded when a unit is completed. The credit value will indicate how long it will normally take you to prepare for a unit or qualification. Three different types of qualification are The award is achieved with 1 - 12 credits The certificate is completed with 13 - 36 credits The diploma is completed with at least 37 credits The OTHM Level 3 Foundation Diploma in Accountancy consists of 3 mandatory units for a combined total of 60 credits, 600 hours Total Qualification Time (TQT) and 240 Guided Learning Hours (GLH) for the completed qualification. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Recording Financial Transactions Reference No : R/617/3339 Credit : 20 || TQT : 200 This unit aims to provide learners with a foundational grasp of the process of documenting financial transactions. This unit encompasses the essentials for accurately and comprehensively recording financial transactions, including using source documents. Lastly, it delves into the categorisation and handling of income and expenditures. UNIT2- Management Information Reference No : L/617/3338 Credit : 20 || TQT : 200 This unit aims to enhance learners' understanding of cost and management accounting, as well as the significance of management information. This unit also introduces the application of Information and Communication Technology (ICT) in the management information recording process and examines its benefits and drawbacks. UNIT3- Maintaining Financial Records Reference No : J/617/3337 Credit : 20 || TQT : 200 This unit aims to impart to learners the rationale behind the necessity for maintaining financial records. It also focuses on equipping learners with the skills to employ the double-entry bookkeeping system and to create both a three-column cash book and a bank reconciliation statement. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

CMI Level 5 Certificate in Management and Leadership

By School of Business and Technology London

Getting Started The CMI Level 5 Certificate in Management and Leadership course is designed for practising or aspiring middle managers and leaders at operations, division, departmental or specialist level, who are typically accountable to a senior manager or business owner. Leading and managing individuals and teams to deliver in line with the organisational strategy is the primary role of a practising manager. You'll develop the key strategic skills and competencies required to manage teams and individuals effectively, enabling you to deliver long-lasting results. The CMI Level 5 Certificate in Management and Leadership is a shorter course focusing on improving your capabilities and core management skills to the next level. Achieving the CMI Level 5 Certificate in Management and Leadership qualification will enhance your credibility and enable you to outperform in demanding roles and situations. You'll have a wide range of modules to choose from, and depending on your career goals, you can select the modules that will be most effective for your progression. Key Benefits For Learners: Improve your capabilities and core management skills Develop the knowledge and skills required for managing and leading individuals and teams Provide an extensive knowledge of skills to excel in specific management areas For Organisations: Deliver aims and objectives in line with wider organisational strategy Provide you with a fully wider range of skills and knowledge required to be a manager as part of an organisation Focus on the areas that are most appropriate to your role and organisation Key Highlights Are you an aspiring Manager or Leader looking for career development? Then, the CMI Level 5 in Management and Leadership qualification offered by School of Business and Technology London is the right solution for you. Remember! The assessment for the qualification is done based on assignments only, and you do not need to worry about writing any exam. With the School of Business and Technology London, you can complete the qualification at your own pace choosing online or blended learning from the comfort of your home. Learning and pathway materials and study guides developed by our CMI-approved tutors will be available around the clock in our cutting-edge learning management system. Most importantly, at the School of Business and Technology London, we will provide you with comprehensive tutor support through our dedicated support desk. If you choose your course with blended learning, you will also enjoy live sessions with an assigned tutor, which you can book at your convenience. Career Pathways The CMI Level 5 Management & Leadership can open many career pathways including, but not limited to: Operations Manager, with an estimated salary of £51,577 per annum Divisional Manager, with an estimated salary of £48,613 per annum Departmental Manager, with an estimated salary of £34,997 per annum Regional Manager, with an estimated salary of £51,372 per annum About Awarding Body Chartered Management Institute established over 60 years ago as the British Institute of Management back then; it has developed the UK's very first diploma in management studies. In the years that followed CMI has consistently been at the forefront of all aspects of management and leadership. Today CMI is the only chartered professional awarding body committed to offering the highest standards in management and leadership excellence. Presently over 100,000 managers use its unique services daily. CMI qualifications aim for managers and leaders at any level, and it remains the only Awarding Body which can award Chartered Manager status - the ultimate management accolade. Employers highly value the qualifications awarded by CMI, and boost your career prospects. What is included? Learn 100% online at your own pace Dedicated support from expert tutors Dedicated Support Desk Portal: You can raise queries, request tutor support and ask for a call back whenever you need guidance and assistance. Elevate Knowledge: Your tutors will provide formative assessment feedback for each module, helping you improve your achievements throughout the program Schedule online personal tutor meetings whenever you want, which will help you get the most out of your studies and provide guidance, support and encouragement 10 months support period 24-hour access to the online learning platform 'MyLearnDirect' Schedule live online classes for each module at your convenience. (Blended learning only) Quality learning resources and study guides developed by CMI-approved tutors. All assessment materials are conveniently accessible through the online learning platform 'MyLearnDirect' Induction: We offer online and flexible learning induction to help you settle in and prepare for your online studies Get Foundation Chartered Manager status upon course completion Access to CMI Management Direct. It has 100,000s of reliable and validated management and leadership resources, including company and industry reports, videos, checklists, E-books, and journals. You have access to CMI Membership and Support for the duration of your study. Assessment For each module you study, you will complete a written assignment of 3000 to 4,000 words and submit it online at your MyLearnDirect learning portal. The submitted assignments will be assessed by your CMI-approved tutor. Entry Requirements This course is designed for current or aspiring mid-level managers. You don't need any formal qualifications to study this course. However, to be eligible for this course, you must: Be 19 years of age and over Have some team leading or supervisory experience or managerial experience in the junior or middle management level Possess the ability to complete the Level 5 course Our friendly admissions advisors will provide the best advice, considering your needs and goals. Progression A possible progression route on successful completion of a CMI Level 5 in Management and Leadership would be to, Progress to other qualifications at the next level (e.g. from Level 5 Certificate to level 6 or 7 Certificate) Why gain a CMI Qualification? This online CMI Level 5 Certificate in Management and Leadership course is perfect if you are a current or aspiring mid-level manager looking to advance in your career. The globally recognised CMI Level 5 Certificate is perfect for you if you want to increase your opportunities for obtaining a middle management position. The key leadership skills and knowledge you'll develop with this course will be remarkably effective. Upon completing this course, you can progress to further learning within the suite of Level 5 courses in Management and Leadership - i.e. achieving a certificate and topping up to a Diploma. You may also wish to further your ongoing personal and professional development by accessing other CMI courses, such as the CMI Level 6 or Level 7 courses in Management and Leadership, with the goal of becoming a Chartered Manager. Studying for a CMI qualification offers you more than just academic standing. When you enrol with us for the CMI Level 5 Certificate in Management and Leadership, you will have access to CMI Membership and Support for the duration of your study alongside your qualification. CMI graduates achieve remarkable things: 72% agree that their CMI qualification gave them a competitive edge in the job application process. 89% agree they use the skills learnt on their accredited qualification in their current role. 88% agree that the accredited qualification gave them good career prospects. Recent CMI graduates earn a median of 28k compared to just 21k for a typical business studies graduate. Employers highly value the qualifications awarded by CMI, and over 80% of managers agree that a CMI qualification is essential to becoming a professional manager. Learners must complete any combination of units to a minimum of 130 TUT hours, 13 credits to achieve this qualification. There is a barred combination of units - learners taking 502 cannot select 503, 505 or 511, and learners taking 526 cannot select 501 or 502. Learners cannot select unit 608 as part of this qualification. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. UNIT1- Principles of Management and Leadership in an Organisational Context Reference No : CMI 501 Credit : 7 || TQT : 70 LEARNING OUTCOME 1. Understand factors which impact on an organisation's internal environment. 2. Understand the application of management and leadership theories. 3. Understand the knowledge, skills and behaviours to be effective in a management and leadership role UNIT2- Principles of Developing, Managing and Leading Individuals and Teams to Achieve Success Reference No : CMI 502 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand approaches to developing, managing and leading teams 2. Understand approaches to achieving a balance of skills and experience in teams. 3. Know techniques for leading individuals and teams to achieve success. UNIT3- Managing Performance Reference No : CMI 504 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the rationale for managing performance within organisations. 2. Know how to manage performance. 3. Understand frameworks, diagnostic and evaluation tools used for performance management. UNIT4- Principles of Developing a Skilled and Talented Workforce Reference No : CMI 508 Credit : 4 || TQT : 40 LEARNING OUTCOME 1. Understand the benefits of developing a skilled and talented workforce. 2. Understand the factors which influence workforce development. 3. Understand the scope of learning and development as part of a workforce development strategy. UNIT5- Managing Stakeholder Relationships Reference No : CMI 509 Credit : 4 || TQT : 40 LEARNING OUTCOME 1. Understand the different types and value of stakeholder relationships. 2. Understand the frameworks for stakeholder management. 3. Know how to manage stakeholder relationships. UNIT6- Managing Conflict Reference No : CMI 510 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the types, causes, stages and impact of conflict within organisations. 2. Understand how to investigate conflict situations in the workplace. 3. Understand approaches, techniques, knowledge, skills and behaviours for managing conflict. UNIT7- Planning, Procuring and Managing Resources Reference No : CMI 516 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the importance of effective and efficient resource use in organisations. 2. Know how to plan resources to meet organisational objectives. 3. Know how to procure resources. UNIT8- Principles of Innovation Reference No : CMI 517 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the role of innovation within organisations. 2. Understand the process of managing innovation in an organisation. UNIT9- Principles of Marketing Products and Services Reference No : CMI 523 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the role of marketing to support the achievement of organisational objectives. 2. Understand the factors in the organisation's marketing environment which impact on the marketing of a product or service. 3. Know how to market a product or service. UNIT10- Managing Finance Reference No : CMI 520 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand finance within organisations. 2. Know how to set and manage budgets. UNIT11- Using Data and Information for Decision Making Reference No : CMI 521 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the use of data and information in decision making. 2. Be able to interpret data and information to support decision making. 3. Know how to present data and information used for decision making. UNIT12- Managing Change Reference No : CMI 514 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the reasons for change in organisations. 2. Understand approaches to change management. 3. Understand how to initiate, plan and manage change in an organisation. UNIT13- Creating and Delivering Operational Plans Reference No : CMI 515 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the principles of operational planning in an organisation. 2. Know how to create an operational plan in line with organisational objectives. 3. Know how to manage and lead the delivery of an operational plan. UNIT14- Principles of Managing and Leading Individuals and Teams to Achieve Reference No : CMI 503 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand approaches to managing and leading teams. 2. Know how to achieve a balance of skills and experience in teams. 3. Know techniques for managing and leading individuals and teams to achieve success. UNIT15- Forming Successful Teams Reference No : CMI 505 Credit : 4 || TQT : 40 LEARNING OUTCOME 1. Understand the purpose and characteristics of successful teams. 2. Understand approaches to team formation. 3. Know how to analyse and respond to the challenges of team formation. UNIT16- Managing Equality, Diversity and Inclusion Reference No : CMI 506 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand legal and organisational approaches to equality, diversity and inclusion. 2. Understand the role and responsibilities of a manager in relation to equality, diversity and inclusion. 3. Know how to develop and implement plans which support equality, diversity and inclusion within an organisation. UNIT17- Principles of Delivering Coaching and Mentoring Reference No : CMI 507 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the role and purpose of coaching and mentoring within an organisation. 2. Understand the use of models and processes used in workplace coaching and mentoring. 3. Know how to manage the delivery of effective coaching and mentoring. UNIT18- Principles of Recruiting, Selecting and Retaining Talent Reference No : CMI 511 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the factors that impact on recruitment and selection. 2. Know how to plan for recruitment and selection. 3. Understand approaches to the recruitment and selection of a diverse and talented workforce. UNIT19- Workforce Planning Reference No : CMI 512 Credit : 4 || TQT : 40 LEARNING OUTCOME 1. Understand the rationale for workforce planning. 2. Understand the principles and practices of workforce planning. UNIT20- Managing Projects to Achieve Results Reference No : CMI 513 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the role of projects in delivering organisational strategy. 2. Understand processes for initiating, planning and managing projects. 3. Understand the factors which contribute to effective project management. UNIT21- Managing Risk Reference No : CMI 518 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the scope of business risk management. 2. Understand the process for managing business risk. UNIT22- Managing Quality and Continuous Improvement Reference No : CMI 519 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand the scope and purpose of quality management within organisations. 2. Understand approaches for managing quality. 3. Understand the application of continuous improvement within organisations. UNIT23- Managing the Customer Experience Reference No : CMI 522 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the principles of managing the customer experience. 2. Understand the customer journey in the context of an organisation. 3. Know how to manage the customer experience. UNIT24- Conducting a Management Project Reference No : CMI 524 Credit : 10 || TQT : 100 LEARNING OUTCOME 1. Know how to plan a management project. 2. Be able to conduct a management project. UNIT25- Using Reflective Practice to Inform Personal and Professional Development Reference No : CMI 525 Credit : 5 || TQT : 50 LEARNING OUTCOME 1. Understand the value of reflective practice to inform personal and professional development. 2. Know how to apply reflective practice to inform personal and professional development. UNIT26- Principles of Leadership Practice Reference No : CMI 526 Credit : 8 || TQT : 80 LEARNING OUTCOME 1. Understand leadership practice in an organisation. 2. Understand leadership styles 3. Understand the impact of leadership within organisations. UNIT27- Strategic Corporate Social Responsibility and Sustainability Reference No : CMI 608 Credit : 6 || TQT : 60 LEARNING OUTCOME 1. Understand corporate social responsibility and sustainability in organisational contexts. 2. Know how corporate social responsibility and sustainability is applied in an organisational setting. Delivery Methods School of Business & Technology London provides various flexible delivery methods to its learners, including online learning and blended learning. Thus, learners can choose the mode of study as per their choice and convenience. The program is self-paced and accomplished through our cutting-edge Learning Management System. Learners can interact with tutors by messaging through the SBTL Support Desk Portal System to discuss the course materials, get guidance and assistance and request assessment feedbacks on assignments. We at SBTL offer outstanding support and infrastructure for both online and blended learning. We indeed pursue an innovative learning approach where traditional regular classroom-based learning is replaced by web-based learning and incredibly high support level. Learners enrolled at SBTL are allocated a dedicated tutor, whether online or blended learning, who provide learners with comprehensive guidance and support from start to finish. The significant difference between blended learning and online learning methods at SBTL is the Block Delivery of Online Live Sessions. Learners enrolled at SBTL on blended learning are offered a block delivery of online live sessions, which can be booked in advance on their convenience at additional cost. These live sessions are relevant to the learners' program of study and aim to enhance the student's comprehension of research, methodology and other essential study skills. We try to make these live sessions as communicating as possible by providing interactive activities and presentations. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. Management Direct As part of the program, you will get access to CMI Management Direct, which provides a rich foundation of management and resource for students. The Management Direct is packed with content, including: E-Books Articles Leader videos Idea for leaders Models and so much more... How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

Professional Certificate Course in Contemporary Audit Processes and Procedures in London 2024

4.9(261)By Metropolitan School of Business & Management UK

Gain a deeper understanding of the modern audit landscape and master the latest techniques and technologies for ensuring accuracy and compliance with "Contemporary Audit Processes and Procedures," the ultimate guide to contemporary auditing.After the successful completion of the course, you will be able to learn about the following; Explain the concept of a strategic audit and its importance in evaluating an organization's overall performance and effectiveness. Trace the evolution of strategic audit techniques and describe how they have adapted to changing business environments and industry trends. Identify key laws and regulations governing the auditing profession, including the Sarbanes-Oxley Act, and explain their impact on audit processes and procedures. Analyze the reporting requirements for suspected or unidentified noncompliance with laws and regulations, and describe the role of auditors in identifying and addressing such issues. Define the Generally Accepted Auditing Standards (GAAS) concept and explain how they provide a framework for audit procedures and practices. Discuss the importance of avoiding conflicts of interest in auditing, including strategies for identifying and managing potential conflicts, and describe the legal and ethical implications of such conflicts. This course provides an in-depth analysis of strategic auditing and compliance principles and practices. Students will thoroughly understand the evolution of strategic audit techniques, including their adaptation to changing business environments and industry trends. The course also explores the auditing profession's legal and regulatory framework, including the Sarbanes-Oxley Act and other key legislation. Topics covered in this course include the reporting requirements for noncompliance with laws and regulations, the concept of Generally Accepted Auditing Standards (GAAS), and the importance of avoiding conflicts of interest in auditing. Students will also learn about the concept of professional scepticism and the legal requirements for completing an audit. Gain a deeper understanding of the modern audit landscape and master the latest techniques and technologies for ensuring accuracy and compliance with "Contemporary Audit Processes and Procedures," the ultimate guide to contemporary auditing. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Contemporary Audit Processes and Procedures Self-paced pre-recorded learning content on this topic. Contemporary Audit Processes and Procedures Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor Internal Auditor External Auditor Compliance Officer Risk Manager Chief Financial Officer Accounting Manager Finance Manager Business Owner Operations Manager Risk and Compliance Consultant Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

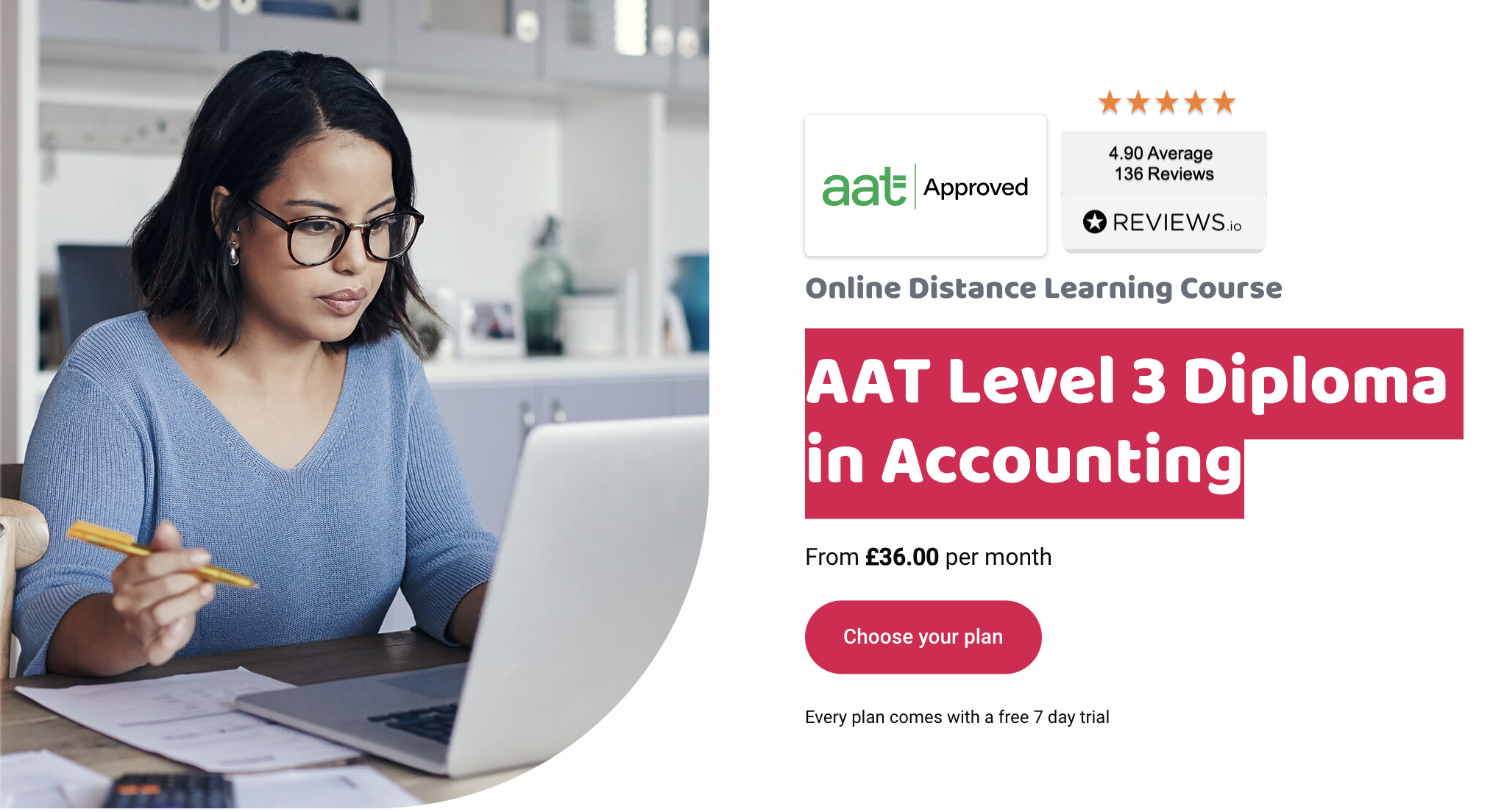

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Overview This comprehensive course on Accountancy will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Accountancy comes with accredited certification which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Accountancy. It is available to all students, of all academic backgrounds. Requirements Our Accountancy is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 12 sections • 12 lectures • 03:42:00 total length •Introduction to Accounting: 00:15:00 •The Role of an Accountant: 00:16:00 •Accounting Concepts and Standards: 00:22:00 •Double-Entry Bookkeeping: 00:23:00 •Balance Sheet: 00:21:00 •Income statement: 00:19:00 •Financial statements: 00:27:00 •Cash Flow Statements: 00:17:00 •Understanding Profit and Loss Statement: 00:17:00 •Financial Budgeting and Planning: 00:28:00 •Auditing: 00:17:00 •Assignment - Accountancy: 00:00:00

Description: The art of managing multiple financial accounts is called accounting. It is required for businesses in order to manage and predict financial encounters for the company. Whatever the case, accounting is a crucial part of running a business and with the help of this Advanced Accounting Diploma you could be just as important. This course is divided into four parts, and you start with learning the basics of accounting career. You will learn how to be successful, different careers in accounting, business softwares and much more. You will also discover more about accounting career training, how to find jobs in accounting, forensic accounting and free softwares. In the next section you indulge in bookkeeping and payroll management as part of this course and will be able to find out about terminologies, understand balance sheet, financial planning, budgeting and control. Finally you look into the American taxing system including focusing on specific states. This is the ultimate guide to accounting as you get to look into additional subjects such as tax, bookkeeping and payroll as well. So take this course now otherwise your balance sheet will only be weighed down. Who is the course for? Professionals who are seeking work in finance department, particularly in accounting activities People who want to get into banking and understand the financial sector Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Advanced Accounting Diploma is a useful qualification to possess and would be beneficial for any professions or career from any industry you are in such as: Accounting Mangers Accountants Bankers Finance Officer Payroll Officer Bookkeeper Finance Administrator Accounting Course Overview (Accounting) 00:05:00 Getting the Facts Straight 00:30:00 The Accounting Cycle 00:30:00 The Key Reports 00:30:00 A Review of Financial Terms 00:30:00 Understanding Debits and Credits 00:15:00 Your Financial Analysis Toolbox 00:30:00 Identifying High and Low Risk Companies 00:30:00 The Basics of Budgeting 00:30:00 Working Smarter 00:10:00 Bookkeeping Module One - Introduction 00:30:00 Module Two - Basic Terminology 01:00:00 Module Three - Basic Terminology (II) 01:00:00 Module Four - Accounting Methods 01:00:00 Module Five - Keeping Track of Your Business 01:00:00 Module Six - Understanding the Balance Sheet 01:00:00 Module Seven - Other Financial Statements 01:00:00 Module Eight - Payroll Accounting Terminology 01:00:00 Module Nine - End of Period Procedures 01:00:00 Module Ten - Financial Planning, Budgeting and Control 01:00:00 Module Eleven - Auditing 01:00:00 Module Twelve - Wrapping Up 00:30:00 Payroll Management What Is Payroll? 00:30:00 Principles Of Payroll Systems 01:00:00 Confidentiality And Security Of Information 00:30:00 Effective Payroll Processing 01:00:00 Increasing Payroll Efficiency 01:00:00 Risk Management in Payroll 00:30:00 Time Management 00:30:00 Personnel Filing 00:30:00 When Workers Leave Employment 01:00:00 Hiring Employees 00:30:00 Paye and Payroll for Employers 01:00:00 Tell HMRC about a New Employee 01:00:00 Net And Gross Pay 00:30:00 Statutory Sick Pay 00:30:00 Minimum Wage for Different types of Work 01:00:00 Tax System in the UK Tax System in the UK 01:00:00 Tax Management USA Individual Tax Saving Ideas 01:00:00 Tax Saving Measures For Business 01:00:00 The Tax Audit 01:00:00 The Ins And Outs Of Federal Payroll Taxes 02:00:00 Why People File Taxes Online 00:30:00 What Are Your County Property Taxes Used For? 00:30:00 Offering Personal Financial Advice -Ameriprise Financial Services 01:00:00 Using Free Tax Preparation Software 00:30:00 Consulting Tax Attorneys - Tax Law Specialists 00:30:00 Delinquent Property Taxes- Three Steps To Deal With Your Delinquent Property Taxes 01:00:00 Federal Income Taxes - How To Deal With Federal Income Taxes? 01:00:00 File State Taxes- E-File System Is The Best Way To File Your State Taxes 00:30:00 Filing Income Taxes- How To File Income Taxes? 01:00:00 Financial Planning Software- Nine Benefits Of Financial Planning Software 01:00:00 Free Taxes- Benefits Of Filing Free Taxes Online 00:30:00 Income Tax Forms- Three Must To Follow If You Desire To Fill Your Income Tax Forms Yourself 00:30:00 LLC Tax Savings- How To Avail LLC Tax Savings 00:30:00 Benefits Of Online Tax Forms Over Traditional Methods 00:30:00 Save On Taxes By Refinancing Your Mortgage 00:30:00 Save On Taxes By Spending Less On Credit 00:30:00 Save On Taxes By Investing In Life Insurance 00:30:00 Save On Taxes: Hot Tips 01:00:00 Save On Taxes With Tax Deductions 01:00:00 Federal Tax Law 2005 For Nonprofit Organizations 00:30:00 Understanding California State Taxes 00:30:00 Make Your Personal Finances Work for You 01:00:00 The Importance of Acquiring a Financial Planning Certificate 00:30:00 Social Development and Financial Planning 01:00:00 An Overview Of Hennepin County Property Taxes 00:30:00 Kentucky State Taxes 01:00:00 Maryland State Taxes 01:00:00 Ohio State Taxes 00:30:00 UBS Financial Services For Small And Large Business 00:30:00 What Is A VP Financial Planner? 00:15:00 Accounting Career Basics A Career in Accounting: Tips on How You Can be Successful 00:30:00 Accountancy Auditing Careers 00:30:00 Accountancy Career Change 00:30:00 Accountancy Career: The Reasons Why You Should Choose Accounting 01:00:00 Accounting/Accountancy Career: Steps to Success 00:30:00 Accounting Auditing Careers 00:30:00 Accounting Careers in Pontypridd 00:30:00 Accounting Careers: Promising Opportunities and Tips 00:30:00 Accounting Dictionary 00:30:00 Accounting Principles and Tulsa 00:30:00 Accounting Software for Small Businesses 00:30:00 Accounting Terms - Profit, Loss and Other Terms 00:30:00 Accounting Career Fundamentals Accounting 00:30:00 Advanced Accounting Career Training 00:30:00 Careers in Accountancy 01:00:00 Church Accounting Software 00:30:00 Finding an Accounting Job 00:30:00 Forensic Accounting 00:30:00 Free Accounting Software 00:30:00 List of Accounting Careers 00:30:00 Services in Financial Accounting 00:30:00 Successful Career in Accounting Even if You're Hit Forty! 00:30:00 The Benefits of an Accountancy Career 00:30:00 Types of Accountancy Career 00:30:00 Accounting Calculation 00:15:00 Reference Books Accounting Principles 00:00:00 Financial Accounting & Reporting 00:00:00 Mock Exam Mock Exam- Advanced Accounting Diploma 00:30:00 Final Exam Final Exam- Advanced Accounting Diploma 00:30:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Search By Location

- Finance Courses in London

- Finance Courses in Birmingham

- Finance Courses in Glasgow

- Finance Courses in Liverpool

- Finance Courses in Bristol

- Finance Courses in Manchester

- Finance Courses in Sheffield

- Finance Courses in Leeds

- Finance Courses in Edinburgh

- Finance Courses in Leicester

- Finance Courses in Coventry

- Finance Courses in Bradford

- Finance Courses in Cardiff

- Finance Courses in Belfast

- Finance Courses in Nottingham