- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

10 Secrets to Writing a Business Administration Thesis That Stands Out

5.0(22)By The Academic Papers UK

There are multiple steps and proven strategies that will help you write your Business Administration thesis impressively.

FREC 3

By NR Medical Training

NR Medical Training offers the Qualsafe First Response Emergency Care (FREC 3) Level 3 RQF, a nationally accredited qualification ideal for anyone aspiring to be a first responder. This course is tailored for a wide range of professionals, including police officers, firefighters, and event medical staff, as well as roles like Emergency/Community First Responders, Door Supervisors, and Security Guards.

Legionella/Water Quality Risk Management – General Awareness

By HYDROP E.C.S.

Our Legionella/Water Quality Risk Management – General Awareness course offers a basic introduction to Legionnaires' disease Management and Control.

Tableau Desktop Training - Analyst

By Tableau Training Uk

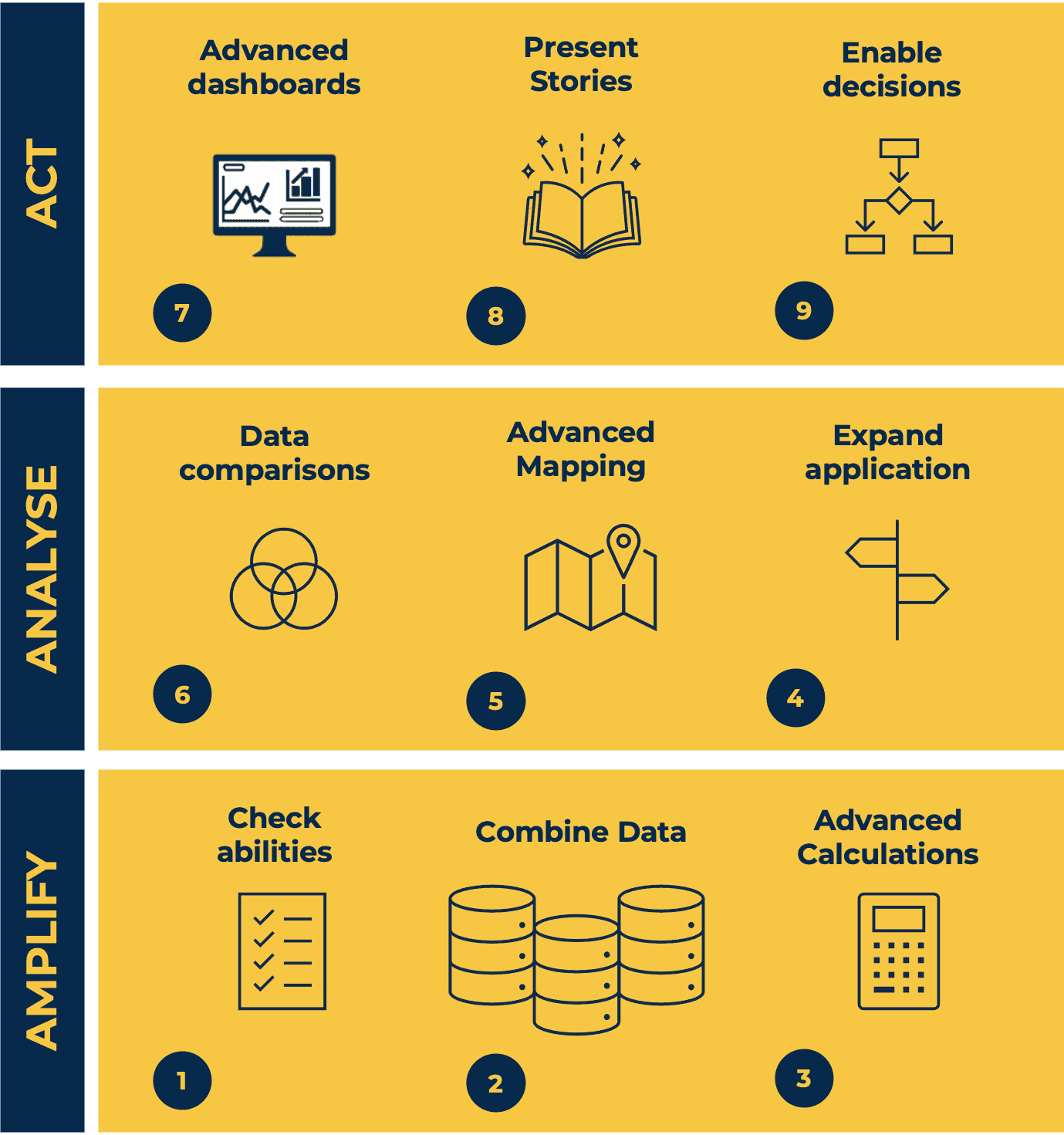

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Professional Customer Care

By Dickson Training Ltd

Any team member with Customer interaction (including internal) are the 'Ambassadors' of the company/organisation. If they project positive professionalism - they win others' confidence. If they appear or sound like they are in any way indifferent or unprofessional - they will cost sales and lose clients/customers. With this 2 day Training course, that will be tailored to your company/organisation, each person attending will upgrade their professional standards in people skills, telephone manner and email etiquette. No training in this area may well be a false economy as there is a much greater risk of disenfranchised customers and team members - and probably increases your competitors to win business at your expense. Professional customer care is all too frequently regarded as a token issue in most induction sessions for employees. Surprisingly it is very rarely considered as a key priority, despite being essential for ensuring customer commitment is secure and supplier/partnerships are robust. Excellent customer care is paramount in our ever increasingly competitive market and making customers feel valued and looked after is often a differentiator. This 2-day course will help you understand your customers and the vital importance of customer care in any organisation. You will gain the tools and techniques to apply your learning directly back into the workplace and deliver excellent customer care. Course Syllabus The syllabus of the Professional Customer Care course is comprised of four modules, covering the following: Module One What is Excellent Customer Care? Internal versus external customers Why customer care is important Meeting customer expectations Module Two Making a Personal Difference How do you measure customer care? Making a difference Taking ownership Positive mental attitude Displaying professionalism both face-to-face and over the telephone Using positive language Module Three Gathering Information and Offering Solutions Asking the right questions Active listening skills Summarising and clarifying skills Module Four Dealing with Difficult Situations How to give a 'service' no Demonstrating empathy Assertiveness techniques Handling a complaint Problem solving Saying 'sorry' Making realistic promises and keeping them Real Play Scenarios with a Professional Actor (Optional Extra) This programme benefits significantly from our innovative training feature: Real Play. Using a professional actor who performs role plays as different customer characters in carefully devised situations, the delegates have the opportunity to 'pause' the role play to coach and control their character to improve their skill sets and practice the theory delivered. These scenarios can deal with difficult situations and enacting options to ensure good customer relations are intact. The outcome of the scenario is the responsibility of the delegates, not the trainer and actor. The actor will remain in character throughout the de-brief in order to bring to life the impact and possible next steps. Objectives By the end of the course participants will be able to Adopt a professional telephone manner Communicate assertively by taking control and directing the conversation Deliver information positively by offering options and alternatives Develop a range of versatile behaviours to use when dealing with difficult situations by: Listening actively Using empathy Gathering relevant information through effective questioning Finding solutions to concerns/problems quickly and efficiently Speaking positively and assertively What Is The Benefit? For individuals this course will increase confidence and ability to deal with customers in all situations, which will in turn create customer loyalty and raise their profile. For an employer, ensuring that all customer facing employees are demonstrating excellent customer care instils confidence in the customers and promotes a positive image of the company. In-House Courses Every single team member or employee that has a role which involves engaging with a customer, client and/or a key partner/supplier has a responsibility for projecting a positive image of the organisation which they represent. That may sound obvious, but how many hundreds of experiences have you had as a customer where you were treated with indifference and a distinct lack of professionalism by the receptionist, the retail assistant, the tele-agent, the delivery person, the credit controller or the departmental manager of the operation that you were dealing with? Far too many to count? This is because professional customer care is regarded as a token issue in most induction sessions for employees - and it is very rarely considered as a key priority to ensure customer commitment is secure and supplier/partnerships are robust. Yet the hugely expensive churn in customer/client commitments and staff is enormously expensive and immensely disruptive to any organisation. The Importance of Customers and Clients Every client/customer engaging person needs to recognise that it is ultimately the client or customer that pays their wages. If they gain a basic understanding of the clients' motivations and behaviours, coupled with some core skills in how to care for them, they will attain the status of 'professional'. This will very quickly translate into increased revenues, retained loyalty, high commitment and far greater security for all parties. The foundation has to be based on the authentic commitment to both the customer and also to the organisation they work for. Disenfranchisement readily curdles into sloppy behaviours cloaked in unprofessional attitudes and demeanours; plenty there to repel the most loyal of customers. If your company or organisation relies on repeat business and retaining the confidence and commitment of your clients, then all of your team members - perhaps including managers who set the example and have the biggest influence on the where the needle points to in relation to professionalism - need to be trained on the core basics of professional customer care. Customer Care Programmes from Dickson Training Ltd We are delighted to boast about the many successes we have had in providing effective and long lasting improvements for many clients, where awards have been won and, more importantly, talent has been retained because their clients and customers keep on coming back. Professional customer care extends to suppliers and partners that you value and need to get the best service and rates from, as well as any 'internal clients' such as other departments where you need to rely on their support and collaboration in order to achieve your goals. It is amazing what effective professional customer care training can do for any organisation. Without it your organisation may be vulnerable, with it you are much more likely to see increased performances and much greater security and growth. Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

Tableau Desktop Training - Foundation

By Tableau Training Uk

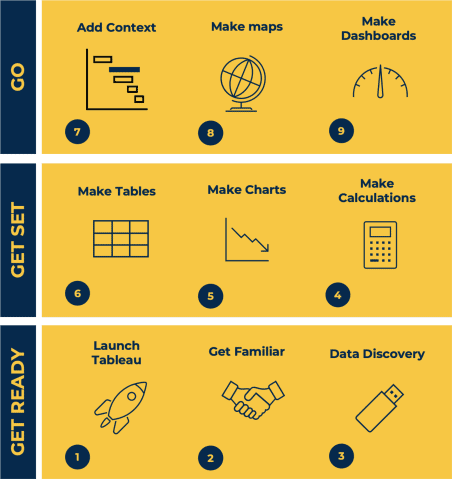

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Visual Analytics Best Practice

By Tableau Training Uk

This course is very much a discussion, so be prepared to present and critically analyse your own and class mates work. You will also need to bring a few examples of work you have done in the past. Learning and applying best practice visualisation principles will improve effective discussions amongst decision makers throughout your organisation. As a result more end-users of your dashboards will be able to make better decisions, more quickly. This 2 Day training course is aimed at analysts with good working knowledge of BI tools (we use Tableau to present, but attendees can use their own software such as Power BI or Qlik Sense). It is a great preparation for taking advanced certifications, such as Tableau Certified Professional. Contact us to discuss the Visual Analytics Best Practice course Email us if you are interested in an on-site course, or would be interested in different dates and locations This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course includes the following topics: WHAT IS VISUAL ANALYSIS? Visual Analytics Visual Analytics Process Advantages of Visual Analysis Exercise: Interpreting Visualisations HOW DO WE PROCESS VISUAL INFORMATION? Memory and Processing Types Exercise: Identifying Types of Processing Cognitive Load Exercise: Analysing Cognitive Load Focus and Guide the Viewer Remove Visual Distractions Organise Information into Chunks Design for Proximity Exercise: Reducing Cognitive Load SENSORY MEMORY Pre-attentive Attributes Quantitatively-Perceived Attributes Categorically-Perceived Attributes Exercise: Analysing Pre-attentive Attributes Form & Attributes Exercise: Using Form Effectively Colour & Attributes Exercise: Using Colour Effectively Position & Attributes Exercise: Using Position Effectively ENSURING VISUAL INTEGRITY Informing without Misleading Gestalt Principles Visual Area Axis & Scale Colour Detail Exercise: Informing without Misleading CHOOSING THE RIGHT VISUALISATION Comparing and Ranking Categories Comparing Measures Comparing Parts to Whole Viewing Data Over Time Charts Types for Mapping Viewing Correlation Viewing Distributions Viewing Specific Values DASHBOARDS AND STORIES Exercise: Picking the Chart Type Exercise: Brainstorming Visual Best Practice Development Process for Dashboards and Stories Plan the Visualisation Create the Visualisation Test the Visualisation Exercise: Designing Dashboards and Stories This training course includes over 20 hands-on exercises to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives an extensive training manual which covers the theory, practical applications and use cases, exercises and solutions together with a USB with all the materials required for the training. The course starts at 09:30 on the first day and ends at 17:00. On the second day the course starts at 09:00 and ends at 17:00. Students must bring their own laptop with an active version of Tableau Desktop 10.5 (or later) pre-installed. What People Are Saying About This Course "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G. "The course tutor Steve was incredibly helpful and taught the information very well while making the two days very enjoyable."Bradd P. "The host and his courses will give you the tools and confidence that you need to be comfortable with Tableau."Jack S. "Steve was fantastic with his knowledge and knowhow about the product. Where possible he made sure you could put demonstrations in to working practice, to give the audience a clear understanding."Tim H. "This was a very interesting and helpful course, which will definitely help me produce smarter, cleaner visualisations that will deliver more data-driven insights within our business."Richard A. "Steve is very open to questions and will go out of his way to answer any query. Thank you"Wasif N. "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G.

Team Building & Team Development

By Dickson Training Ltd

Our Team Building Programmes are 'simply excellent' (quote from Unilever). They always deliver much greater energy' motivation and efficiently accelerates to a galvanised, integrated team for their Manager/Team Leader. They're great fun and very commercially orientated - the best of both key elements to a successful and long-lasting high performance team. A successful company is always made up of successful teams. Teams that can work autonomously with a clearly defined set of goals, roles, vision, responsibility and culture will always reach for and achieve far greater success than a team that works just as a group of individuals. Our team building solutions are individually built and geared towards teams at any level within an organisation, providing an independent and objective perspective to promote a common purpose such as the creation of a 'high performance team'. Out With The Old Traditionally, team building events have been restricted to certain levels of management where they head off site for a bit of archery, quad biking and paintballing or something along those lines. Then over some coffee and cocktails, business plans and more efficient ways to work are casually discussed. Whilst being out having fun instead of being at work may improve an individual person's mood, the effect will only be short-term, and will not go far in creating permanent and cohesive teams who are able to overcome challenges together and drive the business forward when back in the workplace. In With The New Today's business thinking is more strategic and certainly has to look for returns on the investment. That is why Dickson Training Ltd's team building programmes are bespoke and built to your requirements through research, understanding your business and, most importantly, what results and achievements you are looking to get out of the programme. Once "what success looks like" has been established, we create tasks and activities that will test your leadership, problem solving, communication and team work skills. When the tasks have been completed, the learning - both practical and theory - is debriefed to the group as well as how it will translate back in your business. Not only are our events great fun, but they provide participants with learning points they can act upon to improve or enhance the working practices/environment. Team Building That Gets Results We have a highly innovative team who design team builds to suit all budgets and time or space restrictions. Large or small, we will develop the perfect event to meet your commercial objectives, keeping in line with your values and company culture. More recently we have combined team galvanising events with ways to engage the participants with and support their local communities. This solution has proved extremely popular with our clients and we are continuing to develop more and more programmes doing exactly this. " Phil did everything in a very professional and focused manner, without losing sight of the overall aims or having 'fun'. When I moved to Airbus UK and subsequently European Aeronautic Defense and Space Company (EADS), I had no hesitation in recommending Phil and the team to deliver the required training and team events. Without doubt Phil and his team are excellent providers of training, to suit even bespoke requirements, and I would not hesitate in recommending the team to any business in the future. " Glenn Brown, Systems & Expertise Manager, Airbus Personnel Service Augmented Skills – an Essay by Phil Dickson All of you, who are reading this, and all the people you meet and work with will have – ‘Augmented Skills’. So – if you are an IT Engineer or a Pharmacist; perhaps you are, or know, a Departmental Leader and you work with a Logistics Project Manager; these roles will demand core skills, whether they be technical know-how or qualifications in the discipline. But to be that bit better; more reliable; more effective & productive and therefore more valuable and, frankly, marketable – capitalizing on ‘Augment Skills’ comes into play. The I T Engineer who was a Chess Champion at Uni, which would indicate that they possess some key ‘Augmented skills’ including how they plan 3 steps ahead and are always prepared for the unexpected. The Pharmacist, who is a keen sportsperson in their private life, will likely be tenacious, team-orientated and disciplined – again these are superb qualities to have in this – or any – role. Your colleagues, as well as yourself, will have ‘Augmented Skills’ that will be an asset if only they are explored and applied to their role and indeed, career. Everyone has their own 'Super-power' If they love gardening, they are probably strategic, patient and inclined to research; if they cook or bake, they are usually well organized and comfortable with multi-tasking. A big reader will tend to be considered and possess good critical thinking faculties, and an amateur mechanic or keen DIY person will often be practical, resourceful and very determined. I have observed that many new Parents discover they have ‘Augmented Skills’ they didn’t know they had... such as getting order out of chaos and displaying industrial amounts of patience and good grace when they really do not feel like it. They very often become far more compassionate and empathetic. Most people have their very own ‘Superpower’. Invite your team members to offer their ‘Augmented Skills’ to your work-place – and just watch as it elevates the motivation levels and improves results. It’ll be very rewarding for all concerned – and for meeting the Team’s objectives, to encourage the person who is a talented artist to be a sounding board on some of the marketing imagery and layouts; for the team member who is great at Maths or resolving crosswords to be asked for their input to solving a problem that is causing logistical or operational headaches. Never exploit a Team member’s unique special skills at their expense I would like to stress, however, that it must never be an area where a team member gets exploited by harvesting their unique special skills to coerce them into taking on greater responsibilities and tasks without providing them with the commensurate salary and status. To do so would be immoral and, ultimately, counter-productive as it would lead to resentment and disenfranchisement. This is about encouraging people’s capability and inviting their input to boost confidence and enhance the team’s capability. Often, we need to be more than what our Job Description says It is also important to highlight that whatever a person’s role or function is – they will definitely need to have additional capabilities to be effective. The best example of this is when we designed and delivered a range of ‘Advanced Customer Care skills’ training sessions for the Met Office a few years ago…we met so many remarkably super-bright Meteorologists, many of whom were having to make significant adjustments to answering questions from Customers that seemed to be illogical and often, obtuse. It wasn’t enough for these Meteorologists to be highly skilled at interpreting data and identifying patterns – they needed ‘Augmented skills’ to make that information accessible to members of the public (and Council workers and Air Traffic controllers and Shipping agents) and many other people, as to what that particular weather system was going to be like in their area and at what time. They have to know how to ‘de-jargonise’ the material and provide succinct, clear, and yet temperate, descriptions without ever appearing exasperated, impatient or judgmental in response to sometimes quite silly questions. For a highly trained scientist – that can be counter-intuitive. Being Philosophical... and a wee bit pretentious At the risk of being a little Philosophical (and probably a wee bit pretentious) – in my own role of Trainer – my core skills have to include – being a very good communicator, an active listener and have innovative and engaging ways to convert an idea, or a model, into practical application that my Delegates and Clients gain tangible benefits from. This is how it applies to me... I really enjoy composing short, light classical-style piano pieces. Now, to do this well, you need to be able to find a transition from one chord or melody to a different theme or key. It has to be worked out very carefully to have incremental transitions and pleasant-sounding developments as the piece unfolds. I think I have become better at this as I have honed my skills as a composer. But I have realized that these very same skills have ‘Augmented’ my ability to help a Manager, or a Team, move from a state of conflict; tension; disfunction; disenfranchisement; lack of confidence to a place that is more harmonious with far greater productivity. The very same process of careful listening, considering options, taking well-considered steps, having a creative, sometimes brave, move towards a resolution are at play in both Training and Piano Compositions! Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

ILM Level 2 Award in Leadership and Team Skills

By Dickson Training Ltd

An accredited qualification to prepare supervisors and team leaders for a future management role. This programme gives Team Leaders & Managers the skills, disciplines and confidence to manage their team effectively and add a great deal more value to the organisation - where they have to apply their learning in order to achieve the highly coveted ILM qualification. In order for a business to obtain maximum results, it is important that employees are motivated and supported in their job roles. It is the responsibility of the team leader or supervisor to lead their team effectively and present feedback to management. This 3-day programme will guarantee to boost your performance as a team leader and help you make the transition from working in a team to leading a team. We use a combination of theory and practical to help you develop yourself, and a toolkit of resources to use in the workplace. This is an internationally accredited course which not only carries kudos but it ensures you apply the learning back into the workplace for an immediate impact. All of our ILM Programmes are provided in partnership with BCF Group Limited, which is the ILM Approved Centre we deliver under. Course Syllabus The syllabus of the ILM Level 2 Award in Leadership and Team Skills course is split into three main modules, covering the following: Module One Developing Yourself as a Team Leader Learning the various roles, functions and responsibilities of a team leader - depending on workplace Recognising limits of authority and accountability, and how these are defined Developing personal skills and abilities for effective team leading Using reflective learning skills to improve performance Identifying areas of strength and possible improvement Finding ways of obtaining feedback from others Receiving and responding positively to feedback Module Two Workplace Communications Learning stages in the communication process Consideration of the recipient's needs Spotting barriers to communication and how to overcome them Establishing a range of direct communication methods relevant to the team Collating a range of direct communication methods relevant to people outside own area of responsibility. This includes written, telephone, e-mail and face-to-face Recognising the aspects of face-to-face communication, including appearance, impact, body language Realising the importance of succinct and accurate records of one-to-one oral communication Reasons for maintaining records of one-to-one communication (e.g. potential disciplinary or legal issues) Module Three Managing Yourself Setting SMART objectives and using them to prioritise own actions Learning simple time management techniques Developing an awareness of own skills and abilities Giving yourself personal objectives in relation to team objectives Developing flexibility and responding to daily changing circumstances Diagnosing the causes and impacts of stress at work Identifying symptoms of stress in yourself Knowing the implications of stress for workplace and non-work activities/relationships Developing simple stress management techniques Available sources of support Action planning and review techniques Accreditation As with all ILM accredited programmes, participants will need to complete the post-programme activity in order to achieve their full ILM Level 2 Award in Team Leading. This element is designed to show to ILM that you are able to apply what you have learned in the workplace. Who Is It For? This programme is ideal for practising or aspiring team leaders, in any industry sector, who is looking to gain a solid foundation or develop their existing skills as a team leader. This internationally recognised course will give you a solid understanding of what is needed to be a successful team leader, how to delegate, motivate and how to implement these skills in to your work place. What Will I Learn? At the end of the course, successful candidates will: Have a good understanding of the team leader role Apply a range of effective communication skills to overcome barriers Know how to motivate, build confidence and gain the best from their teams Identify, build and encourage effective team behaviours Apply practical skills and knowledge to be transferred to the workplace Gain an internationally recognised qualification What Is Required? There are no formal entry requirements, but participants will normally be either practising or aspiring team leaders, with the opportunity to meet the assessment demands and have a background that will enable them to benefit from the programme. Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. For more information about running this course in-house at your premises, please contact us for more information.

Search By Location

- FA Courses in London

- FA Courses in Birmingham

- FA Courses in Glasgow

- FA Courses in Liverpool

- FA Courses in Bristol

- FA Courses in Manchester

- FA Courses in Sheffield

- FA Courses in Leeds

- FA Courses in Edinburgh

- FA Courses in Leicester

- FA Courses in Coventry

- FA Courses in Bradford

- FA Courses in Cardiff

- FA Courses in Belfast

- FA Courses in Nottingham