- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Certified Artificial Intelligence Practitioner

By Mpi Learning - Professional Learning And Development Provider

This course shows you how to apply various approaches and algorithms to solve business problems through AI and ML, follow a methodical workflow to develop sound solutions, use open-source, off-the-shelf tools to develop, test, and deploy those solutions, and ensure that they protect the privacy of users. This course includes hands-on activities for each topic area.

CAIA Level 1 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. For Level I, the curriculum takes a bottom-up approach to the alternative investments industry. The readings offer detailed insights into the variety of institutional-quality strategies spanning the alternatives universe. Upon completing Level I, Candidates should have working knowledge of the relevant strategies available for investment, along with the basic tools to evaluate them. The CAIA Charter is granted upon completion of two levels of qualifying exams, combined with relevant professional experience. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Professional Standards and Ethics • Professionalism • Integrity of Capital Markets • Duties to Clients • Duties to Employers • Investment Analysis, Recommendations, and Actions • Conflicts of Interest Topic 2: Introduction to Alternative Investments • What is an Alternative Investment? • The Environment of Alternative Investment • Quantitative Foundations • Statistical Foundations • Foundations of Financial Economics • Derivatives and Risk-Neutral Valuation • Measures of Risk and Performance • Alpha, Beta, and Hypothesis Testing Topic 3: Real Assets • Natural Resources and Land • Commodities • Other Real Assets • Real Estate and Debt • Real Estate Equity Topic 4: Private Securities • Private Equity Assets • Private Equity Funds • Private Equity Funds of Funds • Evolution of Investing in Private Equity • Private Credit and Distressed Debt Topic 5: Hedge Funds • Structure of Hedge Funds • Macro and Managed Future Funds • Event-Driven and Relative Value Hedge Funds • Equity Hedge Funds • Funds of Hedge Funds Topic 6: Structured Products • Introduction to Structuring • Credit Risk and Credit Derivatives • CDO Structuring of Credit Risk • Equity-Linked Structured Products DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

CAIA Level 2 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. The Level II curriculum takes a top-down approach and provides Candidates with the skills and tools to conduct due diligence, monitor investments, and appropriately construct an investment portfolio. In addition, the Level II curriculum contains Emerging Topic readings; articles written by academics and practitioners designed to further inform and provoke the Candidate’s investment management process. After passing the Level II exam you are eligible, with relevant professional experience, to join the CAIA Association as a Member and receive the CAIA Charter. You will be part of an elite group of more than 13,000 professionals worldwide. Only after joining the Association, you are eligible to add the CAIA designation to your professional profiles. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Emerging Topics • Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets • Technical Guide for Limited Partners: Responsible Investing in Private Equity • Channels for Exposure to Bitcoin • Assessing Long-Term Investor Performance: Principles, Policies and Metrics • Demystifying Illiquid Assets: Expected Returns for Private Equity • An Introduction to Portfolio Rebalancing Strategies • Longevity and Liabilities: Bridging the Gap • A Short Introduction to the World of Cryptocurrencies Topic 2: Ethics, Regulation and ESG • Asset Manager Code • Recommendations and Guidance • Global Regulation • ESG and Alternative Investments • ESG Analysis and Application Topic 3: Models • Modeling Overview and Interest Rate Models • Credit Risk Models • Multi-Factor Equity Pricing Models • Asset Allocation Processes and the Mean-Variance Model • Other Asset Allocation Approaches Topic 4: Institutional Asset Owners and Investment Policies • Types of Asset Owners and the Investment Policy Statement • Foundations and the Endowment Model • Pension Fund Portfolio Management • Sovereign Wealth Funds • Family Offices and the family office Model Topic 5: Risk and Risk Management • Cases in Tail Risk • Benchmarking and Performance Attribution • Liquidity and Funding Risks • Hedging, Rebalancing, and Monitoring • Risk Measurement, Risk Management, and Risk Systems Topic 6: Methods for Alternative Investing • Valuation and Hedging Using Binomial Trees • Directional Strategies and Methods • Multivariate Empirical Methods and Performance Persistence • Relative Value Methods • Valuation Methods for Private Assets: The Case of Real Estate Topic 7: Accessing Alternative Investments • Hedge Fund Replication • Diversified Access to Hedge Funds • Access to Real Estate and Commodities • Access through Private Structures • The Risk and Performance of Private and Listed Assets Topic 8: Due Diligence and Selecting Managers • Active Management and New Investments • Selection of a Fund Manager • Investment Process Due Diligence • Operational Due Diligence • Due Diligence of Terms and Business Activities Topic 9: Volatility and Complex Strategies • Volatility as a Factor Exposure • Volatility, Correlation, and Dispersion Products and Strategies • Complexity and Structured Products • Insurance-Linked and Hybrid Securities • Complexity and the Case of Cross-Border Real Estate Investing DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Good Clinical Practice Auditing - Principles and Practice

By Research Quality Association

Course Information Our comprehensive course is used as a gateway to those stepping into the world of auditing clinical studies. Tailored for those already acquainted with Good Clinical Practice (GCP) and those transitioning from other audit disciplines, this programme stands as a pivotal guide. Pre-existing knowledge of GCP will significantly enhance your learning experience in auditing against these guidelines. How is this course run? Engage in immersive workshops providing hands-on practice with auditing techniques in a GCP context. Our seasoned tutors, boasting extensive audit experience, intertwine theory with practical insights drawn from their own professional journeys. What will I learn? A comprehensive understanding of the historical backdrop and objectives driving Good Clinical Practice, incorporating the latest industry developments Solid grounding in quality assurance activities aligned with regulatory standards Insight into potential pitfalls within clinical trials and the pivotal role of auditors in addressing these issues Clarity on the roles and responsibilities inherent to clinical trials auditing Exposure to a diverse range of audit techniques complemented by illustrative examples and supportive documents A nuanced understanding of regulatory inspectors' activities Expanded professional networks to propel your auditing career forward. Benefits include: A clear understanding of the role of the auditor under Good Clinical Practice improved audits Improved Good Clinical Practice compliance for your clinical trials. This course is structured to encourage delegates to: Discuss and develop ideas Solve specific problems Examine particular aspects of Good Clinical Practice. Tutors Tutors will be comprised of (click the photos for biographies): Rosemarie Corrigan EVP Global Quality, Worldwide Clinical Trials Cathy Dove Director and Owner, Dove Quality Solutions Julie Kelly Associate Director, Clinical Quality Assurance, Corcept Therapeutics Susana Tavares Director of Research Quality Assurance, - Programme Please note timings may be subject to alteration. Day 1 12:30 Registration 13:00 Welcome and Objectives for the first day of the course 13:30 Laying the Foundations Introduction to the clinical development process, the concepts of quality assurance, quality control and audit. 14:30 Break 15:00 Patient Protection Requirements for informed consent and ethics committee. Access to source documentation. Including a patient protection exercise. 16:05 Workshop 1 - Case Study on Informed Consent 16:45 End of Day Questions and Answers 17:00 Close of Day Day 2 08:50 Questions and Answers from Day 1 09:00 Effective Site Audits The procedures involved in selecting and setting up audits at investigator sites. 09:40 Workshop 1 - Planning the Effective Audit 10:30 Break 10:45 Source Data Verification The need for and purpose of verifying data. 11:25 Workshop 2 - Source Data Verification 12:30 Lunch 13:30 IMP Management The requirements surrounding the distribution of investigational medicinal products. Accountability from release to destruction. 14:15 Critical Document Audits The conduct of other study specific audits including protocols, databases and reports. 15:00 Break 15:15 Non-compliance Determining the acceptability of data. 16:00 Fraud - Fact or Fiction? How to identify fraud and its consequences 16:45 End of Day Questions and Answers 17:00 Close of Day Day 3 08:50 Questions and Answers from Days 1 and 2 09:00 Auditing Third Parties A review of audits of contract research organisations. 10:00 System Audits The concept of auditing processes across many clinical trials, including a practical exercise in process mapping. 10:45 Break 11:00 Workshop 3 - Process Mapping 11:45 Effective Audits Where theory meets reality. 12:30 Lunch 13:20 Audit Reports - Closing the Loop An examination of the processes which follow the evidence gathering phase of the audit. 14:20 Workshop 4 - Audit Reports Audit reports, corrective and preventive action. 15:00 Break 15:10 Regulatory Inspection Auditors and regulatory inspections -how the QA team can help the organisation to perform during a regulatory inspection. 15:55 Final Questions and Answers 16:10 Close of Course Extra Information Face-to-face course Course Material Course material will be available in PDF format for delegates attending this course. The advantages of this include: Ability for delegates to keep material on a mobile device Ability to review material at any time pre and post course Environmental benefits – less paper being used per course. The material will be emailed in advance of the course and RQA will not be providing any printed copies of the course notes during the training itself. Delegates wishing to have a hard copy of the notes should print these in advance to bring with them. Alternatively delegates are welcome to bring along their own portable devices to view the material during the training sessions. Remote course Course Material This course will be run completely online. You will receive an email with a link to our online system, which will house your licensed course materials and access to the remote event. Please note this course will run in UK timezone. The advantages of this include: Ability for delegates to keep material on a mobile device Ability to review material at any time pre and post course Environmental benefits – less paper being used per course Access to an online course group to enhance networking. You will need a stable internet connection, a microphone and a webcam. CPD Points 17 Points Development Level Develop

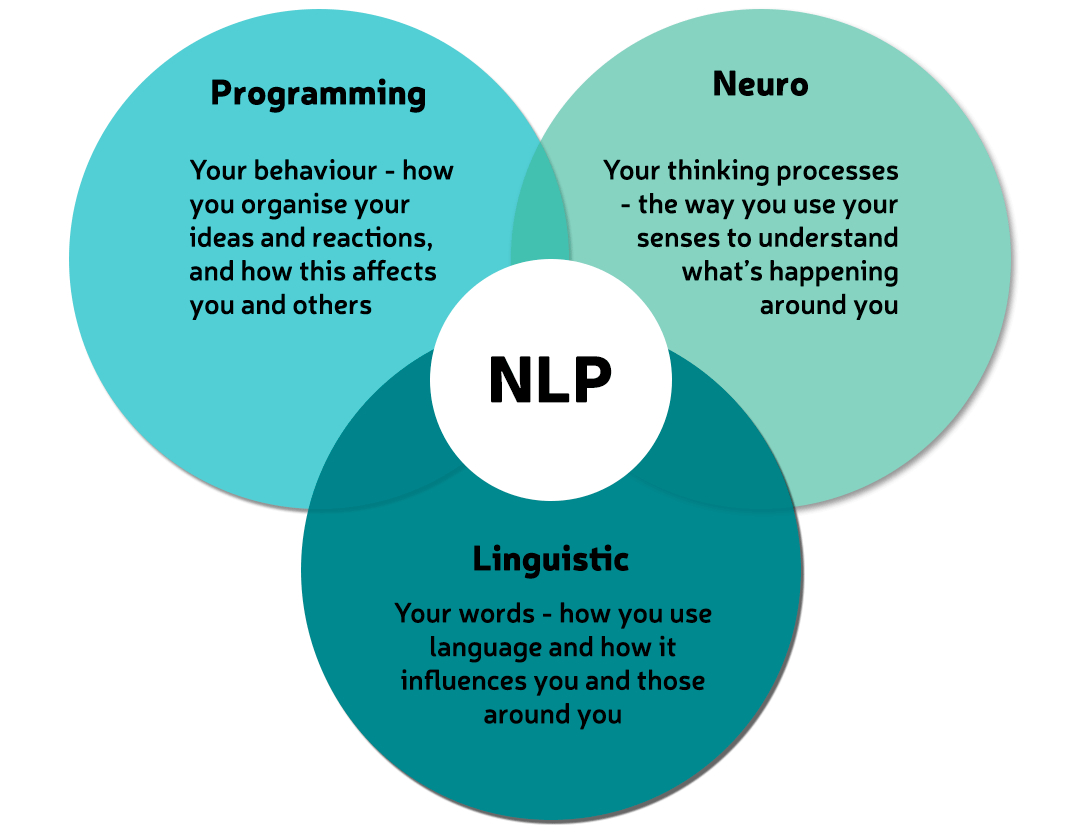

NLP Business Diploma (Fundamentals of Collaborative Working)

By Proactive NLP Ltd

NLP Business Diploma - The Fundamentals of Collaborative Relationships training & certification with Proactive NLP Ltd is your first step towards developing collaborative leadership and collaborative cultures. Start transforming your projects now!

ESG Fundamentals for Organisational Leaders (£1450 total for this 2-day course for a group of 4-10 participants)

By Buon Consultancy

Explore the key concepts of Environmental, Social, and Governance (ESG) with our expert-led course designed for professionals. Learn how to seamlessly incorporate sustainable practices into your business strategy and enhance your corporate responsibility. Gain the tools and insights necessary to effectively implement ESG initiatives within your organisation. Join now and lead the change towards a more sustainable future!

Foundation level Anti Wrinkle and Dermal Fillers Course -Choose your own dates .

By Sassthetics Training Academy

One-2 one training in Aesthetics -Anti Wrinkle and Dermal fillers . Choose your own dates

Body Piercing Training Course 1 or 2 Days-choose your own dates .

By Sassthetics Training Academy

One -2- One Body Piercing Training Course . 1 or 2 days depending on the level of mentorship you require. Blackpool based

Search By Location

- Ethics Courses in London

- Ethics Courses in Birmingham

- Ethics Courses in Glasgow

- Ethics Courses in Liverpool

- Ethics Courses in Bristol

- Ethics Courses in Manchester

- Ethics Courses in Sheffield

- Ethics Courses in Leeds

- Ethics Courses in Edinburgh

- Ethics Courses in Leicester

- Ethics Courses in Coventry

- Ethics Courses in Bradford

- Ethics Courses in Cardiff

- Ethics Courses in Belfast

- Ethics Courses in Nottingham