- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Business networking skills (In-House)

By The In House Training Company

This workshop will provide participants with the insight and skills to be more effective business networkers, face-to-face and online. The approach taken is to build on the strengths people already have and their successes. It is easier to develop what you already have than to try and develop skills that do not come easily. Being yourself is the most effective tool for business networking and building relationships. This course will help those attending: Appreciate the importance of networking, and different forms of networking Understand the dynamics of communication that are specific to networking Become more confident and assured when 'working' a room Improve their influencing skills, especially with people who are experts and in positions of authority 'Sell' themselves and promote their company Identify and manage their profiles using online social networking sites Use effective follow-up to maintain active contacts and connections Select the correct networking groups, clubs and events Create their own personal network 1 The importance, and different types, of networking Personal objectives and introductions Test networking session Examples of the importance, purpose and format of various types of networking, and benefits you can expect 2 How to work a room - preparation and strategy Three things to know before you attend any event Non-verbal communication and art of rapport Breaking the ice - worked examples with practical demonstration 3 Communication dynamics in networking - the power of the listening networker Why it is better to listen than talk Effective questioning and active listening Creating a natural and engaging conversation, 1-2-1 and in a larger group 4 Assumptions when networking How to use the 'instant judgement' of others to your advantage What assumptions are you making? How to keep an open mind 5 Business networking etiquette Meeting and greeting at a business networking event - approaching complete strangers and introducing yourself Socialising: joining and leaving groups easily Making a good first impression in 30 seconds The use of status when networking 6 Making connections Asking for cards, contact details and referrals Gaining a follow-up commitment Some tips and tricks 7 Business networking rehearsals Practice sessions 8 Personal business networking online Overview of different types of networking sites - there is a lot more out there than just Facebook! Examples of creating an effective profile Using social networking effectively - case studies and application 'Advanced' applications - blogs, articles, twitter, feeds, etc. Online demonstration and examples 9 Building relationships - follow-up and follow-through Maintaining a good database Developing a contact strategy with different types and levels of contact How to analyse your contact base

Tableau Desktop Training - Foundation

By Tableau Training Uk

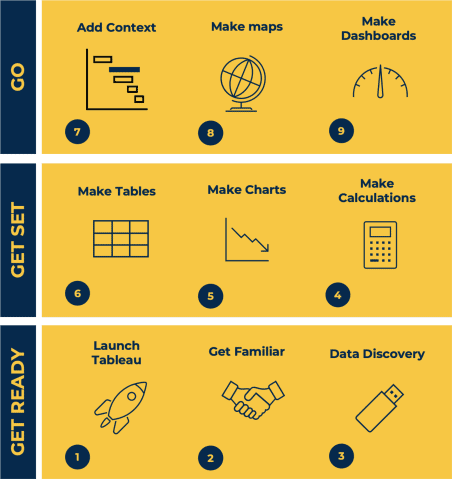

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Building successful working relationships (In-House)

By The In House Training Company

This 2-day workshop is offered with an internal and external focus. Day 1 will focus on building your internal network and relationships by focusing on your personal network, your brand, influencing skills and perceptions. Day 2 focuses on your external relationships with suppliers, patient groups etc. This will focus on assertiveness, outcome rather than relationship focus, and influencing and negotiating skills. DAY ONE 1 Can you succeed by yourself? 2 Relationship awareness theory 3 The Strengths Deployment Inventory / Your FACET5 profile 4 Building rapport 5 Influencing power bases 6 Active listening 7 Building your personal internal network 8 Perceptions 9 Your brand DAY TWO 3 Preparing for conflict 2 The negotiation conversation 1 Your stakeholders and what they want from you 4 Influencing others 5 Your communication approaches for success 6 Emotional Intelligence 7 The trust model 8 Knowing your outcomes

Chairing meetings skills for Elected Members Masterclass (In-House)

By The In House Training Company

Meetings are a traditional and essential component of local government. For both elected members and officers, meetings serve as a forum for discussion and agreement, planning and monitoring, communication and leadership, and decision-making. Used appropriately, meetings can challenge, inspire, illuminate and inform. And while they are not the only meetings that elected members will be asked to attend, committee meetings, in particular, are a mainstay of the political management process. Effective chairing is important because it can provide clear leadership and direction, ensure that debates are focused and balanced, enable decisions to be reached and ensure that resources are used to best effect. This two-hour 'masterclass'-style workshop will help elected members to understand their role, offer some approaches and ideas that will help to tackle typical challenges, and help to generally improve their effectiveness as a chair. To understand the skills and qualities of a good chair To learn ideas and approaches for chairing a successful meeting that is on time and achieves its outcomes To understand the protocols and boundaries for appropriate meeting etiquette and the chair's role in managing this effectively To appreciate how to manage yourself and others appropriately To take away personal actions to apply to your role 1 Welcome and introductions Objectives What's the challenge for you? 2 We can't go on meeting like this Common meeting challenges for chairs and why they succeed or fail Consequences and impact for the Council What's the context? 3 Roles and responsibilities of an effective chair Activities and input that explore the role, skills and qualities needed Role of the chair: what is it and how to do it well 4 Chairing for success - ideas and approaches to meet the challenges Managing time and boundaries Preparation and planning Creating the right environment Self-management Challenging personalities and good meeting behaviour 5 Final plenary session What's your plan? Take away actions

Introduction to health and safety - best-practice (In-House)

By The In House Training Company

Health and safety awareness training is mandatory for staff at all levels of an organisation. This is the ideal course to satisfy that requirement - a stimulating 'entry-level' programme explaining how health and safety should be managed in any working environment. The course outlines the basics of health and safety law and how organisations and individuals can become liable for health and safety offences. Roles and responsibilities for health and safety are discussed by reference to the key legislation and the expert trainer will explore with the delegates how these responsibilities are managed in practice in different types of organisation. The principles of risk assessment will be considered and their practical implementation discussed in relation to the management of the various hazards that are likely to be present in a typical workplace. This course will give staff: An understanding of health and safety law, liability and enforcement An explanation of the principles of health and safety management in the workplace and an understanding of who should be responsible for different aspects of health and safety A practical explanation of risk assessment and what constitutes a suitable and sufficient assessment A broad knowledge of the typical hazards in a workplace and how these should be managed 1 Overview of health and safety law Statute and civil law Liability and enforcement Statutory duties Contract law 2 Legislative framework The workplace - extent of responsibility / shared responsibility Relevant legislation 3 Management of Health and Safety Health and Safety at Work etc Act 1974 Management of Health and Safety at Work Regulations 1999 Workplace (Health, Safety and Welfare) Regulations 1992 Accident Reporting (RIDDOR) Consultation with Employees and Safety Committees 4 Risk management within your organisation Business risk management Health and safety risk management The principles of risk assessment Transferring the risk to contractors and third parties 5 Risk assessment exercise - 'Challenge Anneka' 6 Managing the hazards in the workplace Work equipment Lifting equipment Display screens Manual handling Fire Chemicals (COSHH) Personal protective equipment (PPE) 7 Practical exercise - Workplace inspection 8 Questions, discussion and review

CDM 2015 - in-depth (In-House)

By The In House Training Company

The learning objectives that we believe you require to be covered within the training include: A detailed understanding of the CDM 2015 Regulations and how they should work in practice An understanding of the key roles (Designer, Principal designer, contractor, principal contractor and client) under CDM 2015 What constitutes design and when you may be acting as a designer The requirements for notification Pre construction information, the construction phase plan and the H&S file An opportunity for delegates to ask questions and gain clarification on specific project requirements 1 Introduction Why manage health and safety? The costs of accidents Construction industry statistics Why CDM 2015? 2 Overview of health and safety law and liabilities Criminal and civil law Liability Enforcement and prosecution Compliance - how far do we go? Statutory duties 3 Health and safety law in construction - the current framework Framework of relevant legislationHealth and Safety at Work etc Act 1974Management of Health and Safety at Work Regulations 1999Construction (Design and Management) Regulations 2015Work at Height Regulations 2005 Who is responsible for the risks created by construction work? Shared workplaces/shared responsibilities Control of contractors - importance of contract law 4 CDM 2015 - the principles and current best practice Scope - what is construction? Application - when do the Regulations apply? The CDM management systemDutyholders (client, designer, principal designer, principal contractor, contractor)Documents (pre construction information, Notification, construction phase Plan, H&S File)Management process The 2015 HSE guidance / industry best practice Clarification of roles and responsibilities 5 Competence under CDM 2015 What is 'Competence'? The criteria to be used in construction Achieving continuous improvement 6 Part 4 Construction Health Safety and Welfare Overview of Part 4 Responsibilities Welfare arrangements 7 Risk assessment and the role of the designer Principles of risk assessment Loss prevention / hazard management What is a suitable risk assessment?Design v construction risk assessmentThe client is a designer?Whose risk is it? 8 Risk assessment exercise Understanding the principles of design risk assessment Identifying hazards under the control of clients and designers Quantifying the risk 9 Questions, discussion and review

Project management made easy! (In-House)

By The In House Training Company

Project management can seem scary and rather intimidating. The whole aim of this programme is to give people a simple and straightforward way of dealing with projects without having to use complex and confusing systems. This two-day course is designed to introduce the apparently complex world of project management in a simple and practical manner. The programme is for anybody who has to run a project of any nature. It has been attended by people from as diverse fields as events management, fashion, charities, oil companies and so on. The programme is run without using any IT project management systems although an introduction can be given if required. At the end of the programme participants will leave understanding: What a project is and why projects are so important today The roles of a project manager Some key language and concepts A simple 5-step model for organising projects How to make sure you understand what your 'client' really wants A set of three simple tools to plan the project How to make decisions What to monitor when the project is running How to close the project 1 Introduction What is the aim of this programme? 2 Background thinking What is a project? The project manager's eternal triangle (cost-quality-time) What are the characteristics of successful projects? Who are the key characters in a project? What are the roles of a project manager? 3 The project process Why have one? 4 Project initiation What is the aim? Identifying key information Key skill: mission analysis Initial risk analysis Document and sign-off 5 Decision-making - 'Stop, Think, Act!' The 'Stop, Think, Act!' technique Recognise the opportunity to make a decision The 3 Cs - making sure we understand the decisions we have to make Identifying options Making your decision Taking it to action 6 Creativity 7 The planning stage Identify all discrete tasks Sequence and dependencies Time line - critical path Resources Project base-line 8 Execution stage - delivering the result Monitor Evaluate Adapt Control Review 9 The project close Review Documentation Have we delivered? What have we learned?

Introduction to procurement (In-House)

By The In House Training Company

This very practical one-day programme provides participants with the skills and knowledge required to be an effective member of the procurement team and to enable them to procure a wide range of resources for the organisation, in a compliant and cost-effective manner. It also empowers them to be able to collaborate with all key stakeholders. By the end of the programme participants will be able to: Understand the basic concepts of good procurement practice Apply a range of tools and techniques for developing scopes of work and specifications Apply various methods to select and evaluate suppliers Develop robust contract award strategies Appreciate the commercial importance of effective procurement and opportunities to reduce cost and add value Develop appropriate procurement strategies depending on risk and value Appreciate the legal aspects of procurement 1 Welcome Introductions Aims and objectives Plan for the day 2 The basics of procurement The concept of total cost of ownership v price The procurement cycle The roles of the customer and the contractor Impact upon profit 3 Specification process Importance of effective specifications Specification development process Types of specification Team approach Use of performance specifications Early supplier involvement (ESI) / early contractor involvement (ECI) 4 Quality Concepts and practices Defining 'fit for purpose' Conformance to requirements Compliance to standards Role of the supplier Quality assurance tools and techniques 5 Procurement methods RFP RFQ ITT Negotiated procurement Strategic partnerships Outsourcing 6 Tendering How to undertake a formal tendering process Business case to award Critical stages in the process Risks and benefits 7 Tender evaluation How to undertake a quotation analysis Tools of analysis Use of VFM models Role of the customer Comparisons around cost, quality, and delivery 8 Supplier selection and evaluation Developing critical selection criteria Using the 10Cs model Importance of effective selection process Weighting systems Importance of validity and evidence 9 Capital equipment procurement Life cycle cost issues Payback calculations Compatibility issues Maintenance and training issues After-sales support 10 Supplier relationships Corporate social responsibility issues Communication 360 feed-back Open and ethical Initial understanding Clear and fair terms and conditions 11 Close Review of key learning points Personal action planning

Telephone Sales - outbound (In-House)

By The In House Training Company

Telephone selling can be a challenge. It can be a pressured environment and sales professionals need to be able to maintain peak performance in order to meet - and preferably exceed - their targets. This programme will help make it easier for them. The expert trainer covers the whole process, to help participants see it from their customer's perspective. The focus is on how to use a practical understanding of sales psychology, and of the nature of the telephone sales conversation, to help make it easier for customers to buy. This programme will give your team the skills to: This course will help participants: Understand why people buy - and how that makes it easier to sell Manage the sales process better Steer their sales calls to a more positive outcome Recognise - and respond to - customer buying signals Meet and overcome objections Choose the most appropriate techniques for closing with confidence Enhance their resilience Improve their communication skills on the telephone 1 Introduction Aims and objectives Overview Self-appraisal of current skills and development areas 2 The sales approach What selling means Why selling is like nature 3 The telephone as an instrument of communication Qualities of the telephone How telephone communication differs from face-to-face Advantages and drawbacks of the telephone How to optimise selling over the telephone Communication techniques to help you stand out from the crowd 4 Creating a relationship Professional telephone etiquette Building a rapport Connecting with the customer so that they feel you are on the same wavelength 5 The structure of a sales call Opening the call - creating a positive first impression Effective questioning to gather information and establish need Identifying and presenting the features and benefits of the product or service Matching the benefits to customers' needs Recognising and responding to buying signals Anticipating, meeting and overcoming objections Closing the sale and asking for the order - different closing techniques The importance of testimonials - how to obtain them and when to use them 6 Listening skills The challenges of accurate listening How to enhance listening skills Ensuring the customer feels heard and understood through empathetic listening 7 Shaping and using a script Developing a script to increase levels of confidence Leaving the door open 8 Managing the campaign Organisation and call planning Identifying your target market group Planning who and when to call Logging constructive information 9 Personal management The importance of persistence Is there a time to back off? Stamina - optimising energy levels Bouncing back 10 Practising the new information Pulling the details together Practising in a supportive environment 11 Action planning Personal learning summary and action plan

Finance for the non-accountant (In-House)

By The In House Training Company

No-one in business will succeed if they are not financially literate - and no business will succeed without financially-literate people. This is the ideal programme for managers and others who don't have a financial qualification or background but who nonetheless need a greater understanding of the financial management disciplines essential to your organisation. This course will give the participants a sound understanding of financial reports, measures and techniques to make them even more effective in their roles. It will enable participants to: Overcome the barrier of the accountants' strange language Deal confidently with financial colleagues Improve their understanding of your organisation's finance function Radically improve their planning and budgeting skills Be much more aware of the impact of their decisions on the profitability of your organisation Enhance their role in the organisation Boost their confidence and career development 1 Review of the principal financial statements What each statement containsOutlineDetail Not just what the statements contain but what they mean Balance sheets and P&L accounts (income statements) Cash flow statements Detailed terminology and interpretation Types of fixed asset - tangible, etc. Working capital, equity, gearing 2 The 'rules' - Accounting Standards, concepts and conventions Fundamental or 'bedrock' accounting concepts Detailed accounting concepts and conventions What depreciation means The importance of stock, inventory and work in progress values Accounting policies that most affect reporting and results The importance of accounting standards and IFRS 3 Where the figures come from Accounting records Assets / liabilities, Income / expenditure General / nominal ledgers Need for internal controls 'Sarbox' and related issues 4 Managing the budget process Have clear objectives, remit, responsibilities and time schedule The business plan Links with corporate strategy The budget cycle Links with company culture Budgeting methods'New' budgetingZero-based budgets Reviewing budgets Responding to the figures The need for appropriate accounting and reporting systems 5 What are costs? How to account for them Cost definitions Full / absorption costing Overheads - overhead allocation or absorption Activity based costing Marginal costing / break-even - use in planning 6 Who does what? A review of what different types of accountant do Financial accounting Management accounting Treasury function Activities and terms 7 How the statements can be interpreted What published accounts contain Analytical review (ratio analysis) Return on capital employed, margins and profitability Making assets work - asset turnover Fixed assets, debtor, stock turnover Responding to figures EBIT, EBITEDIA, eps and other analysts' measure 8 Other key issues Creative accounting Accounting for groups Intangible assets - brand names Company valuations Fixed assets / leased assets / off-balance sheet finance

Search By Location

- ET Courses in London

- ET Courses in Birmingham

- ET Courses in Glasgow

- ET Courses in Liverpool

- ET Courses in Bristol

- ET Courses in Manchester

- ET Courses in Sheffield

- ET Courses in Leeds

- ET Courses in Edinburgh

- ET Courses in Leicester

- ET Courses in Coventry

- ET Courses in Bradford

- ET Courses in Cardiff

- ET Courses in Belfast

- ET Courses in Nottingham