- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

277 Elementor courses

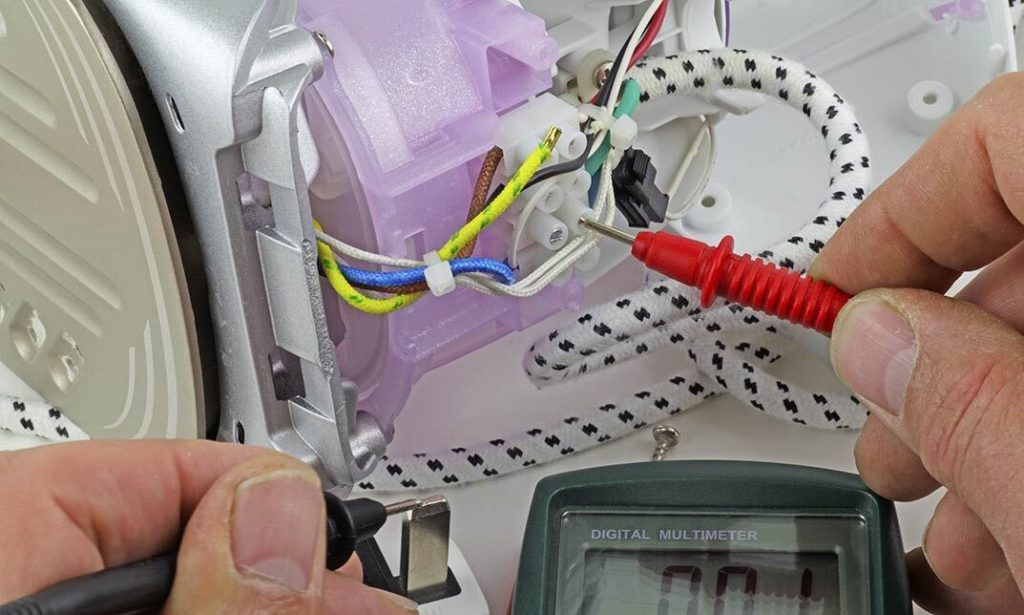

Enhance workplace safety with our comprehensive PAT Testing Training in 2021. Stay up-to-date with the latest industry standards and regulations, ensuring your team is well-equipped to perform Portable Appliance Testing effectively. Gain practical skills, knowledge, and certification for a secure and compliant work environment. Enroll now for the latest PAT Testing Training and empower your team to prioritize electrical safety in the modern workplace.

Xero Accounting and Bookkeeping Training Course

By IOMH - Institute of Mental Health

Overview of Xero Accounting and Bookkeeping Join our Xero Accounting and Bookkeeping Training Course course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Xero Accounting and Bookkeeping Training Course course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Xero Accounting and Bookkeeping Training Course course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! This Xero Accounting and Bookkeeping Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Xero Accounting and Bookkeeping Training Course. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Xero Accounting and Bookkeeping Training Course course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Xero Accounting and Bookkeeping Training Course is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Disclaimer Please be aware that this Xero Accounting and Bookkeeping Training Course is not certified or endorsed by Xero. Completing this course will not grant you any Xero certificate, certification, or badge. However, you will receive a CPD QS certificate upon completion of the course. Requirements You don't need any educational qualification or experience to enrol in the Xero Accounting and Bookkeeping Training Course course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Xero Accounting and Bookkeeping Training Course Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Course Curriculum Introduction Introduction 00:02:00 Getting Started Introduction - Getting Started 00:01:00 Signing up to Xero 00:04:00 Quick Tour of Xero 00:12:00 Initial Xero Settings 00:13:00 Chart of Accounts 00:14:00 Adding a Bank Account 00:08:00 Demo Company 00:04:00 Tracking Categories 00:07:00 Contacts 00:12:00 Invoices and Sales Introduction - Invoices and Sales 00:01:00 Sales Screens 00:04:00 Invoice Settings 00:13:00 Creating an Invoice 00:17:00 Repeating Invoices 00:07:00 Credit Notes 00:10:00 Quotes Settings 00:03:00 Creating Quotes 00:07:00 Other Invoicing Tasks 00:03:00 Sending Statements 00:03:00 Sales Reporting 00:05:00 Bills and Purchases Introduction - Bills and Purchases 00:01:00 Purchases Screens 00:04:00 Bill Settings 00:02:00 Creating a Bill 00:13:00 Repeating Bills 00:05:00 Credit Notes 00:06:00 Purchase Order Settings 00:02:00 Purchase Orders 00:08:00 Batch Payments 00:12:00 Other Billing Tasks 00:02:00 Sending Remittances 00:03:00 Purchases Reporting 00:05:00 Bank Accounts Introduction - Bank Accounts 00:01:00 Bank Accounts Screens 00:07:00 Automatic Matching 00:04:00 Reconciling Invoices 00:06:00 Reconciling Bills 00:03:00 Reconciling Spend Money 00:05:00 Reconciling Receive Money 00:04:00 Find and Match 00:04:00 Bank Rules 00:09:00 Cash Coding 00:03:00 Remove and Redo vs Unreconcile 00:04:00 Uploading Bank Transactions 00:07:00 Automatic Bank Feeds 00:06:00 Products and Services Introduction - Products and Services 00:01:00 Products and Services Screen 00:02:00 Adding Services 00:03:00 Adding Untracked Products 00:03:00 Adding Tracked Products 00:07:00 Fixed Assets Introduction - Fixed Assets 00:01:00 Fixed Assets Settings 00:05:00 Adding Assets from Bank Transactions 00:06:00 Adding Assets from Spend Money 00:05:00 Adding Assets from Bills 00:02:00 Depreciation 00:04:00 Payroll Introduction - Payroll 00:01:00 Payroll Settings 00:15:00 Adding Employees 00:18:00 Paying Employees 00:10:00 Payroll Filing 00:04:00 VAT Returns Introduction - VAT Returns 00:01:00 VAT Settings 00:02:00 VAT Returns - Manual Filing 00:06:00 VAT Returns - Digital Filing 00:02:00

Intermediate Python Coding

By IOMH - Institute of Mental Health

Overview of Intermediate Python Coding Join our Intermediate Python Coding course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Intermediate Python Coding course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Intermediate Python Coding course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! Get a Quick Look at The Course Content: This Intermediate Python Coding Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Intermediate Python Coding. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Intermediate Python Coding course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Intermediate Python Coding is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements You don't need any educational qualification or experience to enrol in the Intermediate Python Coding course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Intermediate Python Coding Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum Section 01: Introduction Course Introduction 00:02:00 Course Curriculum 00:05:00 How to get Pre-requisites 00:02:00 Getting Started on Windows, Linux or Mac 00:01:00 How to ask Great Questions 00:02:00 Section 02: Class Introduction to Class 00:07:00 Create a Class 00:09:00 Calling a Class Object 00:08:00 Class Parameters - Objects 00:05:00 Access Modifiers(theory) 00:10:00 Summary 00:02:00 Section 03: Methods Introduction to methods 00:06:00 Create a method 00:07:00 Method with parameters 00:12:00 Method default parameter 00:06:00 Multiple parameters 00:05:00 Method return keyword 00:04:00 Method Overloading 00:05:00 Summary 00:02:00 Section 04: OOPs Object-Oriented Programming Introduction to OOPs 00:05:00 Classes and Objects 00:08:00 Class Constructors 00:07:00 Assessment Test1 00:01:00 Solution for Assessment Test1 00:03:00 Summary 00:01:00 Section 05: Inheritance and Polymorphism Introduction 00:04:00 Inheritance 00:13:00 Getter and Setter Methods 00:12:00 Polymorphism 00:13:00 Assessment Test2 00:03:00 Solution for Assessment Test2 00:03:00 Summary 00:02:00 Section 06: Encapsulation and Abstraction Introduction 00:03:00 Access Modifiers (public, protected, private) 00:21:00 Encapsulation 00:07:00 Abstraction 00:07:00 Summary 00:02:00 Section 07: Python Games for Intermediate Introduction 00:01:00 Dice Game 00:06:00 Card and Deck Game Playing 00:07:00 Summary 00:01:00 Section 08: Modules and Packages Introduction 00:01:00 PIP command installations 00:12:00 Modules 00:12:00 Naming Module 00:03:00 Built-in Modules 00:03:00 Packages 00:08:00 List Packages 00:03:00 Summary 00:02:00 Section 09: Working Files with Pandas Introduction 00:02:00 Reading CSV files 00:11:00 Writing CSV files 00:04:00 Summary 00:01:00 Section 10: Error and ExceptionHandling Introduction 00:01:00 Errors - Types of Errors 00:08:00 Try - Except Exceptions Handling 00:07:00 Creating User-Defined Message 00:05:00 Try-Except-FinallyBlocks 00:07:00 Summary 00:02:00

Sage 50 Accounting

By IOMH - Institute of Mental Health

Overview of Sage 50 Accounting Sage 50 Accounting helps make business finance simple and clear. In the UK, more than half of small and medium-sized businesses use Sage 50 Accounting for their day-to-day accounts. This has created a steady demand for people who know how to use this software well. This course will guide you through all the important parts of Sage 50 Accounting — from setting up the system to preparing detailed financial reports. You will learn how to manage customers and suppliers, do bank reconciliations, handle fixed assets, and process VAT. The course also includes Sage 50 Payroll, where you will be shown how to handle employee records, run payroll, make online submissions, and complete year-end tasks. These skills are used every day in UK businesses and are important for keeping company finances on track. This course is designed to help you understand each feature step by step. With the UK accounting industry growing by 5% every year, learning Sage 50 Accounting gives you a strong advantage. Many employers look for people who can confidently use Sage 50 Accounting in real work settings. Whether you are just starting or want to build on your current skills, this course will help you manage a full range of accounting tasks. By the end, you’ll feel ready to support businesses with practical and valuable Sage 50 Accounting knowledge. Learning Outcomes By the end of this course, you will be able to: Set up the Sage 50 Accounting system and add customer and supplier details Handle invoices, credit notes, and payments quickly and accurately Reconcile bank accounts, including different account types Complete VAT returns and carry out year-end tasks Run payroll, including adding new employees and sending online submissions Create budgets and prepare management reports for better business decisions Who is this course for? Accountants who want to build confidence using Sage 50 Accounting, widely used in UK businesses Bookkeepers wanting to offer more services with strong Sage 50 skills Business owners who wish to manage their own accounts with trusted software Office staff who deal with company accounts and need to understand both the Accounts and Payroll features of Sage 50 Finance team members who want to be confident with everyday tasks like bank reconciliation, VAT, and payroll Process of Evaluation After studying the Sage 50 Accounting Course, your skills and knowledge will be tested with an MCQ exam or assignment. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Sage 50 Accounting Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. (Each) Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Requirements You don't need any educational qualification or experience to enrol in the Sage 50 Accounting course. Career Path The Sage 50 Accounts course can prepare individuals for a variety of job titles, including: Bookkeeper Accountant Financial Manager Financial Analyst Business Accountant Financial Advisor Tax Specialist Payroll Manager These career opportunities can provide you with a salary ranging from £20,000 to £65,000 in the UK. Course Curriculum Sage 50 Accounts Sage 50 Bookkeeper - Course book 00:00:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:11:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:31:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:14:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:09:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00

Sage 50 Accounting

By IOMH - Institute of Mental Health

Overview of Sage 50 Accounting Sage 50 Accounting is the perfect course for anyone looking to master the art of bookkeeping and accounting. With over 6.1 million users globally, it's no secret that Sage 50 is a market leader. In fact, 96% of Sage 50 Accounts users have reported increased productivity and accuracy in their financial records. This comprehensive course covers everything you need to know about bookkeeping, from creating invoices and managing bank accounts to preparing financial reports and analysing business performance. With step-by-step tutorials and expertly designed Sage 50 Accounting course materials, you'll develop the skills you need to succeed in your financial career. So if you're looking to take your career to the next level, don't wait any longer. Enrol in Sage 50 Accounting course today and start building your financial expertise! With our 100% satisfaction guarantee, you have nothing to lose and everything to gain. Start your journey toward financial success today. Enrol right now! Get a quick look at the course content: This Sage 50 Accounting Course will help you to learn: Master bookkeeping concepts and techniques Gain experience with Sage 50 Accounting software Learn to manage invoices, bank accounts, and financial reports Develop skills in analysing business performance Learn how to prepare accurate financial records Increase productivity and accuracy in financial tasks Enhance career opportunities in the financial industry. This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Sage 50 Accounting. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-to-one support from a dedicated tutor throughout your course. Study online - whenever and wherever you want. Instant Digital/ PDF certificate 100% money back guarantee 12 months access Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Sage 50 Accounting course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Sage 50 Accounting is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. The course is ideal for: Entrepreneurs and small business owners Bookkeepers and accountants Aspiring financial professionals Individuals seeking to improve their financial skills Employees in finance and accounting departments Requirements There is no prerequisite to enrol in this course. You don't need any educational qualification or experience to enrol in the Sage 50 Accounting course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career path The Sage 50 Accounts course can prepare individuals for a variety of job titles, including: Bookkeeper Accountant Financial Manager Financial Analyst Business Accountant Financial Advisor Tax Specialist Payroll Manager These career opportunities can provide you with a salary ranging from £20,000 to £65,000 in the UK. Course Curriculum Sage 50 Accounts Sage 50 Bookkeeper - Coursebook 00:00:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:11:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:31:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:14:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:09:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00

Indulge in ultimate relaxation with our expertly crafted Full Body Massage, Swedish Massage, and LomiLomi Massage services. Unwind as skilled therapists melt away tension, promoting deep relaxation and rejuvenation. Experience the perfect blend of therapeutic techniques for a blissful escape. Book your session now for a journey to total well-being.

Functional Skills Maths

By IOMH - Institute of Mental Health

Overview of Functional Skills Maths Join our Functional Skills Maths course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Functional Skills Maths course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Functional Skills Maths course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! This Functional Skills Maths Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Functional Skills Maths. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Functional Skills Maths course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Functional Skills Maths is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements You don't need any educational qualification or experience to enrol in the Functional Skills Maths course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Functional Skills Maths Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Course Curriculum Integers ( Directed Numbers) Lecture 1 Introduction 00:02:00 Lecture 2 Multiplying any digit number by 11, 22, and 33 00:09:00 Lecture 3 Integers and ordering of integers 00:06:00 Lecture 4 Addition and Subtractions of Integers 00:07:00 Lecture 5 Operations on Integers 00:04:00 Lecture 6 Multiplication and Division of Integers 00:04:00 Lecture 7 Powers of Integers (Exponents) 00:04:00 Factors and Multiples Lecture 8 Complete knowledge about factors and multiples 00:06:00 Lecture 9 Divisibility tests for 2,3,4,5,6 00:07:00 Lecture 10 Divisibility rules 7,8,9,10,11 00:06:00 Lecture 11 Prime Factorization 00:06:00 Lecture 12 Highest Common Factor HCF 00:10:00 Lecture 13 Least Common Multiple LCM 00:16:00 Lecture 14 Relation between LCM and HCF 00:04:00 Fractions Lecture 15 Classification of Fractions 00:04:00 Lecture 16 Convert mixed to improper and improper to mixed fractions 00:03:00 Lecture 17 Equivalent Fractions 00:04:00 Lecture 18 Comparing Fractions after converting to like fractions 00:09:00 Lecture 19 Reducing a fraction to lowest term 00:04:00 Lecture 20 Addition and subtraction OF fractions 00:08:00 Lecture 21 Multiplication and division of fractions 00:11:00 Lecture 22 Word problems on fractions 00:16:00 Simplification Rule : BODMAS Lecture 23 BODMAS and rules to remove brackets 00:03:00 Lecture 24 Simplify expressions using BODMAS rules 00:05:00 Lecture 25 Simplify expressions involving fractions using BODMAS 00:07:00 Decimal numbers Lecture 26 Decimal numbers in relation to fractions 00:08:00 Lecture 27 Like and unlike Decimals 00:05:00 Lecture 28 Ordering of Decimal numbers 00:10:00 Lecture 29 Addition and subtraction of Decimal 00:07:00 Lecture 30 Multiplication of Decimal 00:03:00 Lecture 31 Division of Decimal 00:05:00 Rational Numbers Lecture 32 Rational number 00:02:00 Lecture 33 Representation of Rational Numbers on Number line 00:04:00 Lecture 34 Determining which fraction is terminating or non terminating 00:05:00 Lecture 35 shortcut method of writing decimal expansion of fraction to decimal 00:08:00 Approximation Lecture 36 Rounding to whole number 00:06:00 Lecture 37 Rounding to required number of decimals (1 d.p. ) 00:05:00 Lecture 38 rounding to significant digits 00:07:00 Lecture 39 Practice question on three methods of approximation 00:05:00 Estimation and Scientific Notation or Standard form Lecture 40 Estimation 00:05:00 Lecture 41 Scientific Notation 00:07:00 Lecture 42 Operation on numbers when they are in scientific notation 00:06:00 Percentage Lecture 43 Percentage to fraction and fraction to percentage 00:06:00 Lecture 44 Percentage of a quantity and conversation to decimal 00:06:00 Lecture 45 Expressing one quantity as percentage of another quantity 00:06:00 Lecture 46 Finding increase decrease percent 00:05:00 Lecture 47 Uses of percentages-Word Problems 00:09:00 Ratio and Proportion Lecture 48 Ratio- How to express as simple ratio 00:09:00 Lecture 49 How to compare Ratios 00:04:00 Lecture 50 Word problems on finding ratios 00:07:00 Lecture 51 To divide a given quantity into a given Ratio 00:11:00 Lecture 52 Proportion 00:04:00 Lecture 53 Practice problems on Proportion 00:06:00 Lecture 54 Continued proportion 00:06:00 Unitary Method and its Applications Lecture 55 Direct Variation ( or proportion) 00:04:00 Lecture 56 Problems based on Direct proportion 00:10:00 Lecture 57 Inverse Variation ( or proportion) 00:10:00 Lecture 58 Multiple Ratios 00:10:00 Profit , Loss, discount and Tax Lecture 59 Basics - Profit and Loss 00:04:00 Lecture 60 More practice problems on Profit & Loss 00:06:00 Lecture 61 Selling price formula and Problems 00:04:00 Lecture 62 Cost price formula and Problems 00:03:00 Lecture 63 Higher problems on Profit and Loss 00:08:00 Lecture 64 Basics - Discount.mp4 00:05:00 Lecture 65 Practice problems on Discount 00:04:00 Lecture 66 Tax 00:06:00

Xero Accounting and Bookkeeping Online

By IOMH - Institute of Mental Health

Overview of Xero Accounting and Bookkeeping Online The Xero Accounting and Bookkeeping Online course is perfect for anyone who wants to learn how to manage business finances using one of the most popular accounting tools in the UK. Xero is trusted by over 3.5 million users around the world, and more UK businesses are choosing it every day. With many companies moving away from paper-based accounting, learning how to use Xero gives you a real advantage in today’s job market. This Xero Accounting and Bookkeeping Online course teaches you how to use the software from start to finish. You will learn how to set up your account, send sales invoices, match bank transactions, track inventory, handle payroll, and submit VAT returns. The course is designed to be easy to follow, even if you’re new to accounting. By the end, you’ll know how to manage a company’s books in a smart and simple way. With over £3.7 billion spent on accounting services every year in the UK, there is a growing demand for people who can work with cloud accounting tools. The Xero Accounting and Bookkeeping Online course helps you build the skills that many employers are looking for. Whether you want to work in an office or start your own bookkeeping service, this course can help you move forward. This Xero Accounting and Bookkeeping Online Course will help you to learn: Set up and use Xero Accounting and Bookkeeping Online the right way Create and manage invoices and bills with ease Match bank transactions automatically or by hand Track inventory for products, services, and fixed assets Handle payroll tasks and send VAT returns digitally Create useful financial reports to support smart business choices Who Is This Course for? Small business owners and entrepreneurs who want better control over their finances Finance and accounting staff who want to learn Xero Accounting and Bookkeeping Online Bookkeepers who want to update their knowledge with the latest Xero tools Office staff who work with accounts, invoices, or bank records Anyone who wants to build a career in accounting or finance using practical Xero skills Process of Evaluation After studying the Xero Accounting and Bookkeeping Online, your skills and knowledge will be tested with an MCQ exam or assignment. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Xero Accounting and Bookkeeping Online, you can order your CPD Accredited Digital / PDF Certificate for £5.99. (Each) Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Requirements You don't need any educational qualification or experience to enrol in the Xero Accounting and Bookkeeping Online course. Career Path Completing the Xero Accounting and Bookkeeping Online course can lead to roles such as: Bookkeeper – £22,000 to £35,000 per year Accounts Assistant – £20,000 to £28,000 per year Financial Administrator – £24,000 to £32,000 per year Accounts Payable/Receivable Clerk – £21,000 to £30,000 per year Xero Certified Advisor – £30,000 to £45,000 per year Course Curriculum Introduction Introduction 00:02:00 Getting Started Introduction - Getting Started 00:01:00 Signing up to Xero 00:04:00 Quick Tour of Xero 00:12:00 Initial Xero Settings 00:13:00 Chart of Accounts 00:14:00 Adding a Bank Account 00:08:00 Demo Company 00:04:00 Tracking Categories 00:07:00 Contacts 00:12:00 Invoices and Sales Introduction - Invoices and Sales 00:01:00 Sales Screens 00:04:00 Invoice Settings 00:13:00 Creating an Invoice 00:18:00 Repeating Invoices 00:07:00 Credit Notes 00:06:00 Quotes Settings 00:03:00 Creating Quotes 00:07:00 Other Invoicing Tasks 00:03:00 Sending Statements 00:03:00 Sales Reporting 00:05:00 Bills and Purchases Introduction - Bills and Purchases 00:01:00 Purchases Screens 00:04:00 Bill Settings 00:02:00 Creating a Bill 00:13:00 Repeating Bills 00:05:00 Credit Notes 00:06:00 Purchase Order Settings 00:02:00 Purchase Orders 00:08:00 Batch Payments 00:12:00 Other Billing Tasks 00:02:00 Sending Remittances 00:03:00 Sending Remittances 00:03:00 Purchases Reporting 00:05:00 Bank Accounts Introduction - Bank Accounts 00:01:00 Bank Accounts Screens 00:07:00 Automatic Matching 00:04:00 Reconciling Invoices 00:06:00 Reconciling Bills 00:03:00 Reconciling Spend Money 00:05:00 Reconciling Receive Money 00:04:00 Find and Match 00:04:00 Bank Rules 00:09:00 Cash Coding 00:03:00 Remove and Redo vs Unreconcile 00:04:00 Uploading Bank Transactions 00:07:00 Automatic Bank Feeds 00:06:00 Products and Services Introduction - Products and Services 00:01:00 Products and Services Screen 00:02:00 Adding Services 00:03:00 Adding Untracked Products 00:03:00 Adding Tracked Products 00:07:00 Fixed Assets Introduction - Fixed Assets 00:01:00 Fixed Assets Settings 00:06:00 Adding Assets from Bank Transactions 00:06:00 Adding Assets from Spend Money 00:05:00 Adding Assets from Bills 00:02:00 Depreciation 00:04:00 Payroll Introduction - Payroll 00:01:00 Payroll Settings 00:15:00 Adding Employees 00:18:00 Paying Employees 00:10:00 Payroll Filing 00:04:00 VAT Returns Introduction - VAT Returns 00:01:00 VAT Settings 00:02:00 VAT Returns - Manual Filing 00:06:00 VAT Returns - Digital Filing 00:06:00 Assignment Assignment - Xero Accounting and Bookkeeping Online 00:00:00 Recommended Materials Workbook - Xero Accounting and Bookkeeping Online 00:00:00

Recruitment Consultant Training

By IOMH - Institute of Mental Health

Overview of Recruitment Consultant Training In today’s competitive job market, Recruitment Consultants play an important role in connecting skilled candidates with businesses looking to grow. The UK recruitment industry is strong, with over £38.9 billion in yearly revenue and more than 115,000 people working in around 31,000 recruitment companies. This Recruitment Consultant Training course is designed to help you build a successful career in this fast-moving field by teaching you both the practical and strategic parts of recruitment. The course covers everything you need to know, from UK recruitment laws to building strong relationships with clients. You’ll learn useful methods for attracting the right candidates, running successful interviews, and managing clients in a way that brings results. Whether you are just starting in recruitment or already have some experience, this Recruitment Consultant Training gives you a clear structure to follow and helps you improve your skills. With many UK industries facing skill shortages, there’s a growing need for trained Recruitment Consultants who understand how to meet the needs of both job seekers and employers. This Recruitment Consultant Training will help you become more than just a recruiter—it will help you become a trusted advisor who brings real value. By the end of the course, you’ll be ready to succeed and make a positive impact in the world of recruitment. By completing this Recruitment Consultant Training, you will be able to: Understand the main rules and standards of the recruitment industry. Use UK recruitment laws correctly in real work situations. Find the best ways to attract, manage, and support candidates. Build strong methods for getting and keeping clients. Study key numbers that show how well your recruitment work is doing. Design clear and fair interview steps to help choose the right candidates. Who is this course for? This Recruitment Consultant Training course is perfect for: Anyone who wants to start a career in recruitment and needs a full understanding of how it works, including the laws and best practices. People already working in recruitment who want to improve in areas like getting clients, managing candidates, or checking performance. Business owners or HR staff who want to learn better ways to hire the right people. Staff at job agencies who want deeper knowledge of recruitment in the UK. Anyone planning to start their own recruitment agency and needs to learn the full process and how to grow the business. Process of Evaluation After studying the Recruitment Consultant Training Course, your skills and knowledge will be tested with an MCQ exam or assignment. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Recruitment Consultant Training Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. (Each) Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Requirements There is no prerequisite to enrol in this Recruitment Consultant Training course. Career Path This Recruitment Consultant Training Course will lead you to many different career opportunities. Here are a few prospects: Recruitment Consultant - £25K to £35K/year Senior Recruitment Consultant - £35K to £50K/year Recruitment Team Leader - £40K to £55K/year Recruitment Manager - £50K to £65K/year Recruitment Agency Director - £65K to £100K+/year Frequently Asked Questions (FAQ's) Q. How do I purchase a course? 1. You need to find the right course on our IOMH website at first. You can search for any course or find the course from the Courses section of our website. 2. Click on Take This Course button, and you will be directed to the Cart page. 3. You can update the course quantity and also remove any unwanted items in the CART and after that click on the Checkout option and enter your billing details. 4. Once the payment is made, you will receive an email with the login credentials, and you can start learning after logging into the portal. Q. I have purchased the course when will I be able to access the materials? After purchasing the course, you should receive an email with the login credentials within 24 hours. Please check your spam or junk folder if you didn't receive it in your inbox. You can access your courses by logging into your account. If you still need any assistance, please get in touch with our Customer Support team by providing the details of your purchase. Q. I haven't received my certificate yet. What should I do? You should receive your Digital Certificate within 24 hours after placing the order, and it will take 3-9 days to deliver the hard copies to your address if you are in the UK. For International Delivery, it will take 20-25 days. If you require any assistance, get in touch with our dedicated Customer Support team, and your queries/issues will be dealt with accordingly. Q. I don't have a credit/debit card, what other methods of payment do you accept? You can make the payment using PayPal or you can Bank Transfer the amount. For Bank transfer you will require an invoice from us and you need to contact our Customer Support team and provide details of your purchase to get the invoice. After that, you will receive an email with the invoice and bank details and you can make the payment accordingly. Q. Can I do the courses from outside UK? We are an online course provider, and learners from anywhere in the world can enrol on our courses using an internet-connected device. Q. When I log into the account it says 'Contact Administrator'. To resolve this issue, please log out of your account and then log back in. Course Curriculum Recruitment Consultant Training - Updated Version Module 1 - Introduction to Recruitment: Importance and Implications 00:17:00 Module 2 - An Overview of the Recruitment Industry 00:26:00 Module 3 - The UK Recruitment Legislation 00:19:00 Module 4 - Sales and Selling in the Recruitment Industry 00:11:00 Module 5 - The Recruitment Process 00:47:00 Module 6 - Key Performance Indicators for the Recruitment Industry 00:25:00 Module 7 - Candidate Attraction for Recruitment 00:35:00 Module 8 - Candidate Management 00:22:00 Module 9 - Candidate Interview Processes 00:24:00 Module 10 - Client Acquisition 00:36:00 Module 11 - Client Strategy in the Recruitment Sector 00:25:00 Module 12: Client Management 00:27:00 Module 13 - Steps to Starting and Running a Successful Recruiting Service 00:23:00 Recruitment Consultant Training - Old Version Recruitment Basics Introduction to Recruitment 00:15:00 Recruitment 01:00:00 Shortlisting 00:15:00 Selection 01:00:00 Definitions of Training and Development 00:15:00 Considerations in the Design of Training Programmes 00:15:00 Implementing Training 00:15:00 Learning Methods 00:30:00 Recruitment Module One - Getting Started 00:15:00 Module Two - Introduction to Recruitment 00:30:00 Module Three - The Selection Process 00:30:00 Module Four - Goal Setting 00:30:00 Module Five - The Interview 00:30:00 Module Six - Types of Interview Questions 00:30:00 Module Seven - Avoiding Bias in Your Selection 00:30:00 Module Eight - The Background Check 00:30:00 Module Nine - Making Your Offer 00:30:00 Module Ten - Orientation and Retention 00:30:00 Module Eleven - Measuring the Results 00:30:00 Module Twelve - Wrapping Up 00:15:00 Managing Recruitment Module One - Getting Started 00:30:00 Module Two - Defining and Knowing the Position 01:00:00 Module Three - Hiring Strategy 01:00:00 Module Four - Lure in Great Candidates 01:30:00 Module Five - Filtering Applicants to Interview 01:00:00 Module Six - The Interview (I) 01:00:00 Module Seven - The Interview (II) 01:00:00 Module Eight - Selection Process (I) 01:00:00 Module Nine - Selection Process (II) 01:00:00 Module Ten - Making an Offer 01:00:00 Module Eleven - Onboarding 01:00:00 Module Twelve - Wrapping Up 00:30:00 Recruitment - Interview Process History of the Interviewing Process 00:30:00 The Recruitment and Selection Process 00:15:00 Factors in the Hiring Process 00:15:00 Cost Analysis 00:15:00 Job Analysis and Position Profiles 00:30:00 Determining the Skills You Need 00:15:00 Finding Candidates 00:30:00 Advertising Guidelines 00:00:00 Screening Resumes 00:30:00 Performance Assessments 00:30:00 Problems Recruiters Face 00:15:00 Interviewing Barriers 00:15:00 Non-Verbal Communication 00:15:00 Types of Questions 00:30:00 Case Study 00:15:00 Traditional vs. Behavioral Interviews 00:30:00 Other Types of Questions 00:15:00 The Critical Incident Technique 00:15:00 Listening for Answers 00:30:00 Difficult Applicants 01:00:00 Interview Preparation and Format 00:00:00 Other Interview Techniques 00:30:00 Scoring Responses 00:15:00 Checking References 00:30:00 Human Rights 00:15:00 Assignment Assignment - Recruitment Consultant Training 00:00:00

Xero Accounting and Bookkeeping Online

By IOMH - Institute of Mental Health

Overview of Xero Accounting and Bookkeeping Online Join our Xero Accounting and Bookkeeping Online course and discover your hidden skills, setting you on a path to success in this area. Get ready to improve your skills and achieve your biggest goals. The Xero Accounting and Bookkeeping Online course has everything you need to get a great start in this sector. Improving and moving forward is key to getting ahead personally. The Xero Accounting and Bookkeeping Online course is designed to teach you the important stuff quickly and well, helping you to get off to a great start in the field. So, what are you looking for? Enrol now! Get a quick look at the course content: This Xero Accounting and Bookkeeping Online Course will help you to learn: Learn strategies to boost your workplace efficiency. Hone your skills to help you advance your career. Acquire a comprehensive understanding of various topics and tips. Learn in-demand skills that are in high demand among UK employers This course covers the topic you must know to stand against the tough competition. The future is truly yours to seize with this Xero Accounting and Bookkeeping Online. Enrol today and complete the course to achieve a certificate that can change your career forever. Details Perks of Learning with IOMH One-To-One Support from a Dedicated Tutor Throughout Your Course. Study Online - Whenever and Wherever You Want. Instant Digital/ PDF Certificate. 100% Money Back Guarantee. 12 Months Access. Process of Evaluation After studying the course, an MCQ exam or assignment will test your skills and knowledge. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Xero Accounting and Bookkeeping Online course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. Shipping Charges: Inside the UK: £3.99 International: £10.99 Who Is This Course for? This Xero Accounting and Bookkeeping Online is suitable for anyone aspiring to start a career in relevant field; even if you are new to this and have no prior knowledge, this course is going to be very easy for you to understand. On the other hand, if you are already working in this sector, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Disclaimer Please be aware that this Xero Accounting and Bookkeeping Online is not certified or endorsed by Xero. Completing this course will not grant you any Xero certificate, certification, or badge. However, you will receive a CPD QS certificate upon completion of the course. Requirements You don't need any educational qualification or experience to enrol in the Xero Accounting and Bookkeeping Online course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online course. Career Path The certification and skills you get from this Xero Accounting and Bookkeeping Online Course can help you advance your career and gain expertise in several fields, allowing you to apply for high-paying jobs in related sectors. Course Curriculum Introduction Introduction 00:02:00 Getting Started Introduction - Getting Started 00:01:00 Signing up to Xero 00:04:00 Quick Tour of Xero 00:12:00 Initial Xero Settings 00:13:00 Chart of Accounts 00:14:00 Adding a Bank Account 00:08:00 Demo Company 00:04:00 Tracking Categories 00:07:00 Contacts 00:12:00 Invoices and Sales Introduction - Invoices and Sales 00:01:00 Sales Screens 00:04:00 Invoice Settings 00:13:00 Creating an Invoice 00:18:00 Repeating Invoices 00:07:00 Credit Notes 00:06:00 Quotes Settings 00:03:00 Creating Quotes 00:07:00 Other Invoicing Tasks 00:03:00 Sending Statements 00:03:00 Sales Reporting 00:05:00 Bills and Purchases Introduction - Bills and Purchases 00:01:00 Purchases Screens 00:04:00 Bill Settings 00:02:00 Creating a Bill 00:13:00 Repeating Bills 00:05:00 Credit Notes 00:06:00 Purchase Order Settings 00:02:00 Purchase Orders 00:08:00 Batch Payments 00:12:00 Other Billing Tasks 00:02:00 Sending Remittances 00:03:00 Sending Remittances 00:03:00 Purchases Reporting 00:05:00 Bank Accounts Introduction - Bank Accounts 00:01:00 Bank Accounts Screens 00:07:00 Automatic Matching 00:04:00 Reconciling Invoices 00:06:00 Reconciling Bills 00:03:00 Reconciling Spend Money 00:05:00 Reconciling Receive Money 00:04:00 Find and Match 00:04:00 Bank Rules 00:09:00 Cash Coding 00:03:00 Remove and Redo vs Unreconcile 00:04:00 Uploading Bank Transactions 00:07:00 Automatic Bank Feeds 00:06:00 Products and Services Introduction - Products and Services 00:01:00 Products and Services Screen 00:02:00 Adding Services 00:03:00 Adding Untracked Products 00:03:00 Adding Tracked Products 00:07:00 Fixed Assets Introduction - Fixed Assets 00:01:00 Fixed Assets Settings 00:06:00 Adding Assets from Bank Transactions 00:06:00 Adding Assets from Spend Money 00:05:00 Adding Assets from Bills 00:02:00 Depreciation 00:04:00 Payroll Introduction - Payroll 00:01:00 Payroll Settings 00:15:00 Adding Employees 00:18:00 Paying Employees 00:10:00 Payroll Filing 00:04:00 VAT Returns Introduction - VAT Returns 00:01:00 VAT Settings 00:02:00 VAT Returns - Manual Filing 00:06:00 VAT Returns - Digital Filing 00:06:00 Assignment Assignment - Xero Accounting and Bookkeeping Online 00:00:00 Recommended Materials Workbook - Xero Accounting and Bookkeeping Online 00:00:00

Search By Location

- Elementor Courses in London

- Elementor Courses in Birmingham

- Elementor Courses in Glasgow

- Elementor Courses in Liverpool

- Elementor Courses in Bristol

- Elementor Courses in Manchester

- Elementor Courses in Sheffield

- Elementor Courses in Leeds

- Elementor Courses in Edinburgh

- Elementor Courses in Leicester

- Elementor Courses in Coventry

- Elementor Courses in Bradford

- Elementor Courses in Cardiff

- Elementor Courses in Belfast

- Elementor Courses in Nottingham