- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

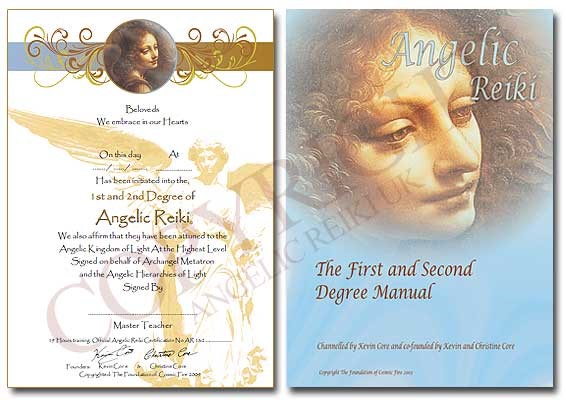

Angelic Reiki 1&2 Workshop

By Academy Of Angelic Healing

Learn Angelic Reiki with multi-award winning Master Teacher, Jayn Lee-Miller, who was one of the first to work professionally with angels and is now approaching her 18th year of teaching Angelic Reiki. Please email info@healingangels.co.uk for full details of this healing module which has been channelled through the Archangel Metatron especially for this time as the consciousness of humanity is collectively ascending to fifth dimension. The Angelic Kingdom of Light is assisting in helping us hold a place of unconditional love to help us remember the divine beings we truly are. In Angelic Reiki you are attuned by Angels to The Angelic Kingdom of Light and during healing exchanges you actually become the Angel you are channelling.

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems. There are two options to complete the NVQ Level 3 in Electrical Installations, these are the C&G 2346 and C&G 2357. Successful completion of the NVQ and AM2 assessment will satisfy the entry criteria for JIB accredited electricians

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems.

If you want to start installing independently or with an electrical contractor look no further as this course will give you the skills and knowledge required. This package which will allow you to become a fully qualified domestic installer and enable you to join a Competent Person Self-Certification Scheme and certify your own domestic work.

Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

Develop your technical report writing and presentation skills with EnergyEdge's course designed for oil & gas professionals. Sign up now!

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

The NVQ Level 3 is designed to provide both new entrants and those seeking progression in their career, with the opportunity to develop the necessary skills to carry out job roles and responsibilities associated with the installation and maintenance of Electrotechnical systems. The EWR is for electricians who have been working in the industry for at least 5 years but have not formally completed an industry apprenticeship or Level 3 NVQ qualification. Successful completion of the NVQ and AM2 assessment will satisfy the entry criteria for JIB accredited Gold Card status. Bear in mind that the C&G 2391-50 and 18th Edition courses are pre-requisites to the Experienced Worker route. In case you don’t hold them, we can help you with a Pre-Experienced Worker Route package.

PRINCE2® Practitioner

By London School of Science and Technology

The PRINCE2® Practitioner course provides delegates with in-depth knowledge of project management methodologies. In this 2-day PRINCE2® Practitioner course enables learners to tailor the PRINCE2® methodology to any given project scenario. At the end of this PRINCE2® Practitioner course, delegates will be able to do delegating tolerances Course Overview The PRINCE2® Practitioner course provides delegates with in-depth knowledge of project management methodologies. In this 2-day PRINCE2® Practitioner course enables learners to tailor the PRINCE2® methodology to any given project scenario. They will learn about various essential topics such as communication management approach, tailoring the SU process, giving Ad Hoc direction, setting up the project controls, risk management procedure, PRINCE2® quality requirements, PRINCE2® approach to plan, tailoring SB, and many more. At the end of this PRINCE2® Practitioner course, delegates will be able to do delegating tolerances and report actual and forecast progress effectively. They will also be able to properly prepare the risk management, change control approach, quality management, and communication management approaches. The PRINCE2® Practitioner enables learners to apply their acquired knowledge and obtain highly reputed jobs with upgraded salaries. Concepts covered: • Balance of justification • Create the project plan • Quality audit trail • Quality review technique • Designing a plan • Gantt chart and tailoring • Change control approach Who should attend this PRINCE2® training course? This PRINCE2® Practitioner training course is for anybody interested in the field of project management. This PRINCE2® course is also intended for anyone looking to build their knowledge of how to tailor the PRINCE2® method to workplace scenarios. Other individuals that would benefit from undertaking PRINCE2® certifications include: • Project Managers • Aspiring Project Managers • Project Board Members • Project Support Staff • Office Support and Line Managers • Product Deliver Managers • Senior Responsible Owners • Change Analysts PRINCE2® Practitioner Prerequisites: It is required that delegates provide sufficient evidence of having satisfied the prerequisites before attending the PRINCE2® Practitioner training course. Delegates must hold the 2009 or 2017 version of the PRINCE2® Foundation certification or another valid qualification such as PMP, CAPM, or an IPMA Level A-D qualification. What’s Included in this PRINCE2® Practitioner Training Course? The following is included in this PRINCE2® Practitioner course: • PRINCE2® Practitioner Examination • Pre-course material • Post-course material • PDUs • Experienced PRINCE2® Instructor • Certificate • Refreshments Course Content: Module 1: Organisation Theme: • Four Levels of Management • PRINCE2® Organisation Requirements • Project Management Team • Project Management Team Roles • Project Board • Project Assurance • Change Authority • Project Support • Communication Management Approach Module 2: Starting Up a Project (SU): • Process Overview • Feasibility Study and Mandate • Appoint the Executive and the Project Manager • Capture Previous Lessons • Design and Appoint the Project Management Team • Prepare the Outline Business Case • Project Product Description • Select the Project Approach and Assemble the Project Brief • Plan the Initiation Stage • Tailoring the SU Process Module 3: Directing a Project (DP): • Authorise Initiation • Authorise the Project • Authorise a Stage or Exception Plan • Authorise Project Closure • Give Ad Hoc Direction • Tailoring the DP Process • Theme Overview • Balance of Justification • Continued Business Justification • PRINCE2® Requirements • Contents of a Business Case • Business Case Development • Benefits Management Approach • Key Responsibilities Module 4: Initiating a Project (IP): • Agree the Tailoring Requirements • Prepare the Risk Management Approach • Prepare the Change Control Approach • Prepare the Quality Management Approach • Prepare the Communication Management Approach • Set Up the Project Controls • Create the Project Plan • Prepare the Benefits Management Approach • Assemble the Project Initiation Documentation • Tailoring the IP process Module 5: Risk Theme: • Risk Definition • Effective Risk Management • PRINCE2® Risk Requirements • Risk Management Approach • Probability/Impact Grid • Risk Register • Risk Management Procedure • Identify Step • Risk Budget • Key Responsibilities Module 6: Quality Theme: • Quality Definitions • Quality Management • Quality Planning and Control • What is Quality Assurance? • PRINCE2® Quality Requirements • PRINCE2® Quality Documentation Requirements • Quality Management Approach • Quality Audit Trail • Project Product Description • Product Description • Quality Review Technique • Quality Review Roles/Responsibilities • Quality Review Meeting • Off-Specifications and Concessions • Review Follow-Up • Quality Review Benefits • Key Responsibilities • Communication Management Approach Module 7: Plans Theme: • Dealing with the Planning Horizon • PRINCE2® Planning Requirements • Documentation Requirements • Project and Stage Plans • Team Plans and Work Packages • Plans Relationship • What is in a Plan? • PRINCE2® Approach to Plans • Designing a Plan • Delivery Approaches • Defining and Analysing the Products • Product Breakdown Structures • Product Description • Product Flow Diagram • Identify the Activities and Dependencies • Preparing Estimates • Preparing a Schedule • Documenting the Plan • Analysing Risks to a Plan • Gantt Chart and Tailoring • Key Responsibilities Module 8: Progress Theme: • Progress Definition • PRINCE2® Requirements • Progress Control • Management by Exception • Delegating Tolerances and Reporting Actual and Forecast Progress • Types of Control • Management Products and Progress Control Module 9: Change Theme: • Issue Definition • PRINCE2® Approach to Change • PRINCE2® Change Documentation • Issue Register • Change Control Approach • Change Budget • Issue and Change Control Procedure • Issue Report • Exception Report Module 10: Controlling a Stage (CS): • Activity Breakdown • Authorise a Work Package • Work Package • Review Work Package Status • Receive Completed Work Packages • Review the Management Stage Status • Report Highlights • Highlight Report • Capture and Assess Issues and Risks • Escalate Issues and Risks • Take Corrective Action • Tailoring CS Module 11: Managing Product Delivery (MP): • Accept a Work Package • Execute a Work Package • Checkpoint Report • Deliver a Work Package • Tailoring MP Module 12: Managing a Stage Boundary (SB) : • Plan the Next Management Stage • What is in a Plan? • Update the Project Plan • Update the Business Case • Report the Management Stage End • End-Stage Report • Produce an Exception Plan • Tailoring SB Module 13: Closing a Project (CP): • Prepare Planned Closure • Hand Over Products • Evaluate the Project • End Project Report • Recommend Project Closure • Tailoring CP DURATION 2 Days WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

If you have at least 5 years working experience and you would like to attain Gold Card status via the Experienced Worker route by joining the City & Guilds 2346 NVQ Level 3, you will also need to hold the below two pre-requisite qualifications: City & Guilds 2391-52 Inspection and Testing Course C&G 2382-22 BS7671 18th Edition

AAT Level 2 Certificate in Accounting

By London School of Science and Technology

This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Course Overview This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Students will also learn about accountancy related business and personal skills and be introduced to the four key themes embedded in the qualification: ethics, technology, communications and sustainability. The jobs it can lead to: • Account administrator • Accounts assistant • Accounts payable clerk • Purchase/sales ledger clerk • Trainee accounting technician • Trainee finance assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They’ll use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. Principles of Costing: This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting tasks. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. Learning outcomes: • Understand the cost recording system within an organisation. • Use cost recording techniques. • Provide information on actual and budgeted cost and income. • Use tools and techniques to support cost calculations. The Business Environment: This unit provides knowledge and understanding of key business concepts and their practical application in the external and internal environment in which students will work. Students will gain an understanding of the legal system and principles of contract law and an appreciation of the legal implications of setting up a business and the consequences this may have. This unit will also give an understanding of how organisations are structured and where the finance function fits. Learning outcomes: • Understand the principles of contract law. • Understand the external business environment. • Understand the key principles of corporate social responsibility (CSR), ethics and sustainability. • Understand the impact of setting up different types of business entity. • Understand the finance function within an organisation. • Produce work in appropriate formats and communicate effectively. • Understand the importance of information to business operations. DURATION 170-190 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Search By Location

- Divi Courses in London

- Divi Courses in Birmingham

- Divi Courses in Glasgow

- Divi Courses in Liverpool

- Divi Courses in Bristol

- Divi Courses in Manchester

- Divi Courses in Sheffield

- Divi Courses in Leeds

- Divi Courses in Edinburgh

- Divi Courses in Leicester

- Divi Courses in Coventry

- Divi Courses in Bradford

- Divi Courses in Cardiff

- Divi Courses in Belfast

- Divi Courses in Nottingham