- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1531 Development courses in London

Being a Mentor using the SSSC National Induction resource

By The Leadership Wizard

Being a Mentor in the Early Years

Chairing meetings skills for Elected Members Masterclass (In-House)

By The In House Training Company

Meetings are a traditional and essential component of local government. For both elected members and officers, meetings serve as a forum for discussion and agreement, planning and monitoring, communication and leadership, and decision-making. Used appropriately, meetings can challenge, inspire, illuminate and inform. And while they are not the only meetings that elected members will be asked to attend, committee meetings, in particular, are a mainstay of the political management process. Effective chairing is important because it can provide clear leadership and direction, ensure that debates are focused and balanced, enable decisions to be reached and ensure that resources are used to best effect. This two-hour 'masterclass'-style workshop will help elected members to understand their role, offer some approaches and ideas that will help to tackle typical challenges, and help to generally improve their effectiveness as a chair. To understand the skills and qualities of a good chair To learn ideas and approaches for chairing a successful meeting that is on time and achieves its outcomes To understand the protocols and boundaries for appropriate meeting etiquette and the chair's role in managing this effectively To appreciate how to manage yourself and others appropriately To take away personal actions to apply to your role 1 Welcome and introductions Objectives What's the challenge for you? 2 We can't go on meeting like this Common meeting challenges for chairs and why they succeed or fail Consequences and impact for the Council What's the context? 3 Roles and responsibilities of an effective chair Activities and input that explore the role, skills and qualities needed Role of the chair: what is it and how to do it well 4 Chairing for success - ideas and approaches to meet the challenges Managing time and boundaries Preparation and planning Creating the right environment Self-management Challenging personalities and good meeting behaviour 5 Final plenary session What's your plan? Take away actions

Creating effective specifications (In-House)

By The In House Training Company

High quality specifications are of paramount importance in achieving the right technical performance and value for money. This long-established training programme has been developed to help those involved in producing specifications to create high quality documents in an organised and effective way. It provides a sound foundation for those new to the topic whilst at the same time offering new insights to those with more experience. The programme emphasises the need for a clear definition of requirements combined with the ability to communicate those requirements effectively to third parties. A structured method of preparing specifications is provided, and a range of practical techniques is presented, to enable participants to put the principles into practice. The commercial and contractual role of specifications is also addressed. The objectives of the workshop are to: Provide a clear understanding of the role and purpose of specifications Present a framework for organising and producing specifications Define the key steps involved in creating effective specifications Demonstrate methods for assisting in defining requirements Provide tools and techniques for scoping and structuring specifications Show the role of specifications in managing variations and changes to scope Present methods to assist the writing and editing of specifications Review how specifications should be issued and controlled DAY ONE 1 Introduction Review of course objectives Review of participants' needs and objectives 2 Creating effective specifications The role of specifications in communicating requirements The costs, benefits and qualities of effective specifications Understanding the differences between verbal and written communication The five key steps of 'POWER' writing: prepare-organise-write-edit-release Exercise: qualities of an effective specification 3 Step 1: Preparing to write - defining readership and purpose; the specification and the contract Designing the specifications required; applying BS 7373 Defining the purpose, readership and title of each document Effective procedures for writing, issuing and controlling specifications The roles and responsibilities of the key players Understanding contracts; the contractual role of the specification Integrating and balancing the technical and commercial requirements Writing specifications to achieve the appropriate contract risk strategy Deciding how to specify: when to use functional and technical specifications The role of specifications in managing variations and changes to scope 4 Case study 1 Teams review a typical project scenario and identify the implications for the specification Feedback and discussion 5 Step 2: Organising the specification content Defining the need and establishing user requirements Deciding what issues the specification should cover Scoping techniques: scope maps, check lists, structured brainstorming Clarifying priorities: separating needs and desires Dealing with requirements that are difficult to quantify Useful techniques: cost benefit analysis, QFD, Pareto analysis 6 Case study 2 Teams apply the scoping techniques to develop the outline contents for a specification Feedback and discussion DAY TWO 7 Step 2: Organising the specification content (cont) Deciding what goes where; typical contents and layout for a specification The three main segments: introductory, key and supporting Creating and using model forms: the sections and sub-sections Detailed contents of each sub-section Tools and techniques for outlining and structuring specifications 8 Case study 3 Teams develop the detailed specification contents using a model form Feedback and discussion 9 Step 3: Writing the specification The challenges of written communication Identifying and understanding the readers needs Choosing and using the right words; dealing with jargon Problem words; will, shall, must, etc; building a glossary Using sentence structure and punctuation to best effect Understanding the impact of style, format and appearance Avoiding common causes of ambiguity Being concise and ensuring clarity Choosing and using graphics to best effect Exercises and examples 10 Step 4: Editing the specification Why editing is difficult; how to develop a personal editing strategy Key areas to review: structure, content, accuracy, clarity, style and grammar Editing tools and techniques 11 Step 5: Releasing and controlling the specification Key requirements for document issue and control Final formatting and publication issues; document approval Requirements management: managing revisions and changes 12 Course review and action planning What actions should be implemented to improve specifications? Conclusion

Java Evenings Course. Basic Java syntax and principles of object-oriented programming. Our Style: Hands-on, Practical Course, Instructor-led Course. Level: From basics to fully functional. Who would benefit from the course: basics to Java, attend after work. Duration: one lesson of 2 hours per week for 6 weeks, from 6pm to 8pm.

Duration: 1 Day Who would find this course useful? C++ coders. This course covers C++ programming principals and the syntax of all generally used C++ statements. Level: From beginners. For classroom courses: Bring your own device.

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Creating a culture of teamwork in an Early Years Team.

By The Leadership Wizard

Belonging & Connection

Our organisations are increasingly diverse and a cultural mix in training brings a fantastic variety of learning styles and sometimes barriers, too. Help managers and trainers understand the impact of different cultures and nationalities in the training room and make simple adjustments to ensure training is effective for all. Who are you training? Culture and its impact on learning Breaking down cultural learning barriers Intercultural communication Cultural competency and its importance in the training room Training techniques for the diverse classroom Effective questioning and concept checking Having a global mindset

Refresh and revitalise your sales teams with a bespoke sales training programme that’s designed to lift their skills and motivation. Our sales experts use learner-centred and coaching methodologies to provide top tips to make a difference to success rates and relationships straight away. Stripped-back sales skills with sensational results, a bespoke course may include: Applying the steps of any sales cycle to your market Communication and relationship building Qualifying and questioning skills Prospecting and pre-call planning Making a pitch Emotional intelligence in sales Objection handling Closing the deal

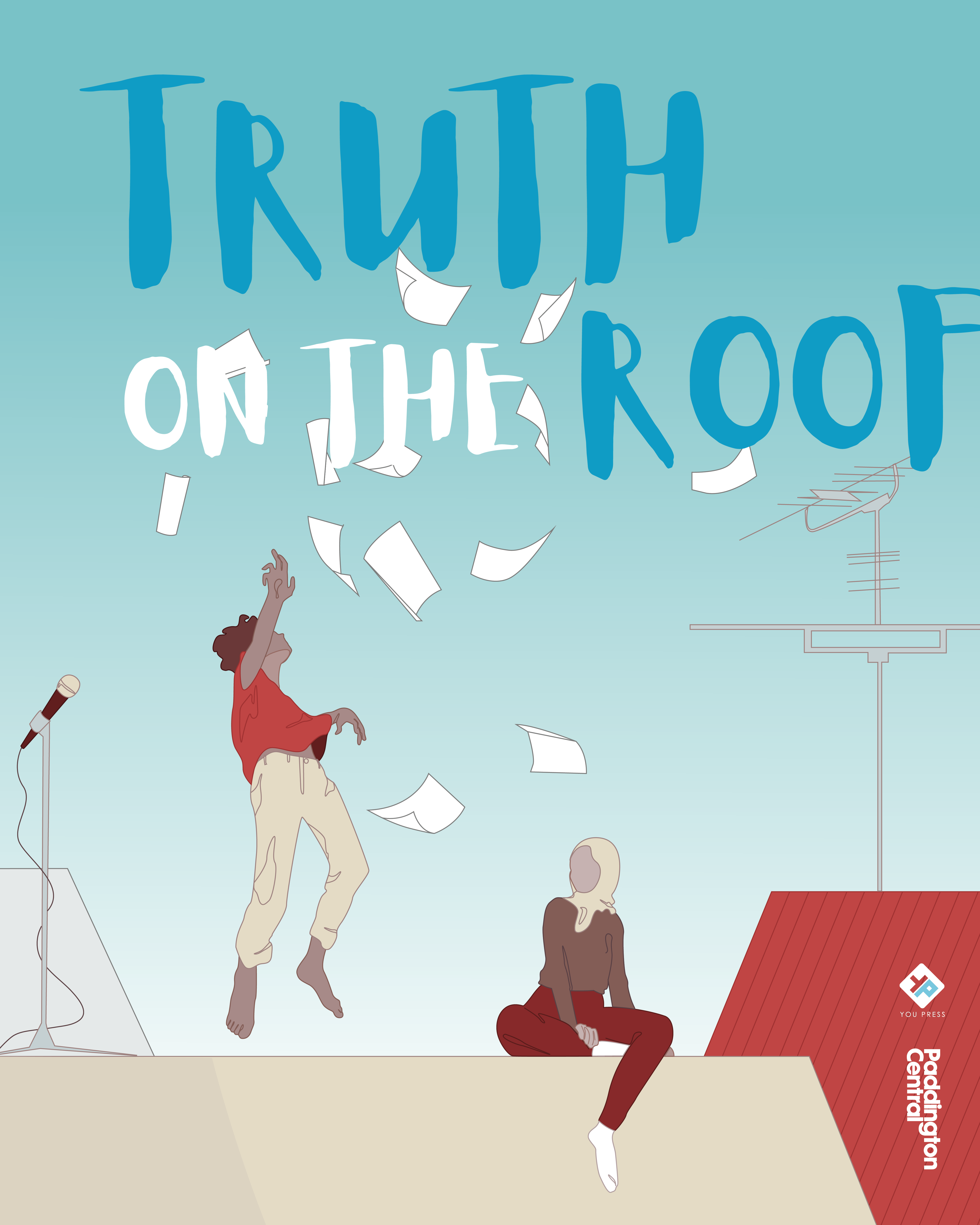

Truth On The Roof: Poetry & Public speaking programme

By You Press

Truth on the Roof is a special project dedicated to conscious storytelling, offering young individuals the opportunity to express themselves and engage in discussions about various social issues through art forms like poetry, music, and spoken word.

Search By Location

- Development Courses in London

- Development Courses in Birmingham

- Development Courses in Glasgow

- Development Courses in Liverpool

- Development Courses in Bristol

- Development Courses in Manchester

- Development Courses in Sheffield

- Development Courses in Leeds

- Development Courses in Edinburgh

- Development Courses in Leicester

- Development Courses in Coventry

- Development Courses in Bradford

- Development Courses in Cardiff

- Development Courses in Belfast

- Development Courses in Nottingham