- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Finance for Non-Financial Managers

By Capital City Training & Consulting Ltd

Enroll today and gain the financial acumen needed to evaluate performance, assess opportunities, and make smart investments. Unlock your career growth potential and contribute to your organization's bottom line. 6+ Hours of Video 15+ Hours to Complete30+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Finance for Non-Finance Managers course cuts through financial jargon to provide business leaders the concepts and tools to evaluate performance and drive better decisions. Financial literacy is no longer just for finance teams - it's an essential skill for managers. This practical course focuses on translating financial statements and analysis into actionable insights. Through real-world cases and hands-on exercises, the self-paced online format allows busy professionals to boost their finance skills on their own time. Whether you're making investment choices or reviewing budget variances, this program will equip you to understand the numbers and take confident action. With over 6 hours of content and 30+ exercises, the program covers financial accounts, ratios, cash flows, capital budgeting, valuation, and more. A completed case study ties together the key concepts. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to Key Financial Statements and Reports Profitability, Efficiency, and Credit Health Metrics Return on Capital and Cash Flow Analysis Time Value of Money and Investment Appraisal Budgeting, Cost Behaviour, and Decision Making Business Valuation Methods and Value Creation Certificate Upon Successful Course Completion

Python GUI Programming - Building a Desktop Application with Tkinter and SQLite

By Packt

Implement a hands-on Python GUI project: Build a Cryptocurrency portfolio app with Python, Tkinter, SQLite3, and the CoinMarketCap API

Copywriting & Proofreading - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

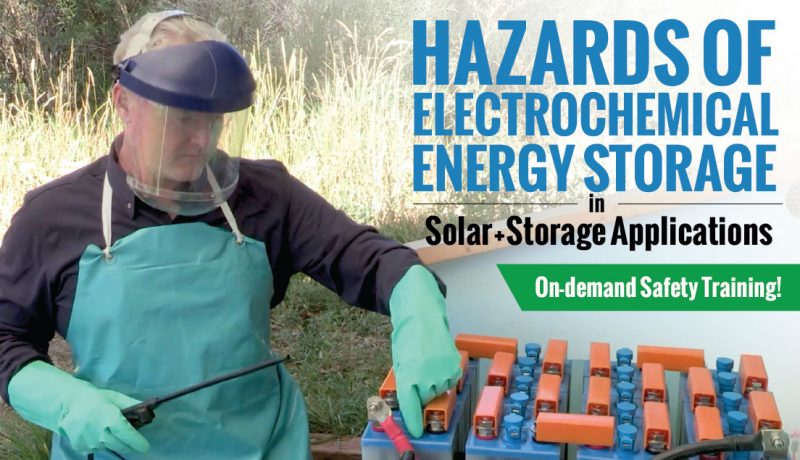

CE529: Hazards of Electrochemical Energy Storage in Solar + Storage Applications

By Solar Energy International (SEI)

Common chemistries, including lead acid, lithium ion, and nickel iron, each have different installation, maintenance, storage, and transportation requirements that can lead to fatal consequences if not conducted properly. This 8-hr online course, produced under an OSHA Susan Harwood Training Grant, provides training on the hazards associated with each energy storage technology and the control measures to eliminate or mitigate those hazards. This training includes five lessons for a total of 4 contact training hours. Lessons includes presentations, field videos, interactive exercises, and quizzes. Lesson content includes Lesson 1: Introduction to the Course and OSHA requirements Lesson 2: Energy Storage Technologies- Energy storage basics, lead-acid energy storage systems, lithium-ion energy storage, other types of electrochemical energy storage systems Lesson 3: Energy Storage Safety Regulations- OSHA safety regulations, NFPA 70 (the National Electrical Code) and NFPA 70E (Standard for Electrical Safety in the Workplace) NFPA 855 (Installation of Stationary Energy Storage Systems), the International Residential Code (IRC) and the International Fire Code (IFC) Lesson 4: Electrical Hazards- Electrical shock hazards, electrical arc flash hazards, electrical PPE, electrical connection hazards Lesson 5: Other Hazards- Chemical hazards, fire hazards, gas hazards, physical hazards, storage and transportation hazards, temperature effects on batteries, working space and clean installations

Learning Azure Process Automation Using PowerShell

By Packt

This course uses Azure PowerShell to automate tasks and manage Azure Cloud services with ease. The course is intended to help people learn Azure concepts quickly and give enough practice exercises to get them started with their cloud journey with a specific focus on Microsoft Azure and task automation.

Happiness Club for Unlimited Self-Esteem Because you deserve it! • Improve your self-esteem • Understand the reasons behind your self-esteem issues • Boost your confidence • Improve your relationships - romantic and otherwise • Invoke your Freaking Goddess! Overcome fear and Imposter Syndrome

Wellbeing Ambassador Programme

By Clare Martin

The Wellbeing Ambassador Programme is our comprehensive wellbeing training for leaders. It is based on evidence-based positive psychology research to help those who lead others to confidently support wellbeing.

Financial Accounting & Analysis

By Capital City Training & Consulting Ltd

Our comprehensive Financial Accounting & Analysis certification program teaches the essential accounting concepts and skills for practical financial statement analysis, looking at real-world data and applications. This course will prepare you for careers in investment banking, private equity, business valuation, and corporate finance. 7+ Hours of Video 15+ Hours to Complete30+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Best Practice Financial Modelling certification program teaches the essential skills needed to build robust forecast models for companies, and prepare you for careers in investment banking, private equity, corporate finance, and business valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to Accounting Flow and Financial Statement Analysis Coverage of Income Statements, Cash Flow, Balance Sheets Profit Margin, EPS, Revenue, Inventory, COGS, and More Depreciation Methods, Impairments, Intangibles, and Leases Consolidated Income Statements and Non Controlling Interests Identifying and Correcting Errors in Income Statements Certificate Upon Successful Course Completion

Financial Modelling Best Practices

By Capital City Training & Consulting Ltd

Enroll today to learn methods and techniques used to build financial models at the world's leading banks and financial institutions. Create rigorous models, gain strategic insight and advance your finance career. 8+ Hours of Video 17+ Hours to Complete50+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive Best Practice Financial Modelling certification program teaches the essential skills needed to build robust forecast models for companies, and prepare you for careers in investment banking, private equity, corporate finance, and business valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Essentials of financial model construction and design principles Flexible time frameworks, forecasting operations, and linking historical data Working capital modelling from an analyst perspective Depreciation, debt structuring, interest expenses, and tax modelling Key analysis techniques like DuPont Analysis and Discounted Cash Flow Sensitivity analysis, scenario modelling, credit, and liquidity analysis Certificate Upon Successful Completion