- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

56545 Courses near Ealing delivered Online

ITIL 4 Specialist: Create, Deliver and Support: Virtual In-House Training

By IIL Europe Ltd

ITIL® 4 Specialist: Create, Deliver and Support: Virtual In-House Training The ITIL® 4 Specialist: Create, Deliver, and Support module is part of the Managing Professional stream for ITIL® 4. Candidates need to pass the related certification exam for working towards the Managing Professional (MP) designation. This course is based on the ITIL® 4 Specialist: Create, Deliver, and Support exam specifications from AXELOS. With the help of ITIL® 4 concepts and terminology, exercises, and examples included in the course, candidates acquire the relevant knowledge required to pass the certification exam. What You Will Learn The learning objectives of the course are based on the following learning outcomes of the ITIL® 4 Specialist: Create, Deliver, and Support exam specification: Understand how to plan and build a service value stream to create, deliver, and support services Know how relevant ITIL® practices contribute to the creation, delivery, and support across the SVS and value streams Know how to create, deliver, and support services Organization and Culture Organizational Structures Team Culture Continuous Improvement Collaborative Culture Customer-Oriented Mindset Positive Communication Effective Teams Capabilities, Roles, and Competencies Workforce Planning Employee Satisfaction Management Results-Based Measuring and Reporting Information Technology to Create, Deliver, and Support Service Integration and Data Sharing Reporting and Advanced Analytics Collaboration and Workflow Robotic Process Automation Artificial Intelligence and Machine Learning CI / CD Information Model Value Stream Anatomy of a Value Stream Designing a Value Stream Value Stream Mapping Value Stream to Create, Deliver, and Support Services Value Stream for Creation of a New Service Value Stream for User Support Value Stream Model for Restoration of a Live Service Prioritize and Manage Work Managing Queues and Backlogs Shift-Left Approach Prioritizing Work Commercial and Sourcing Considerations Build or Buy Sourcing Models Service Integration and Management

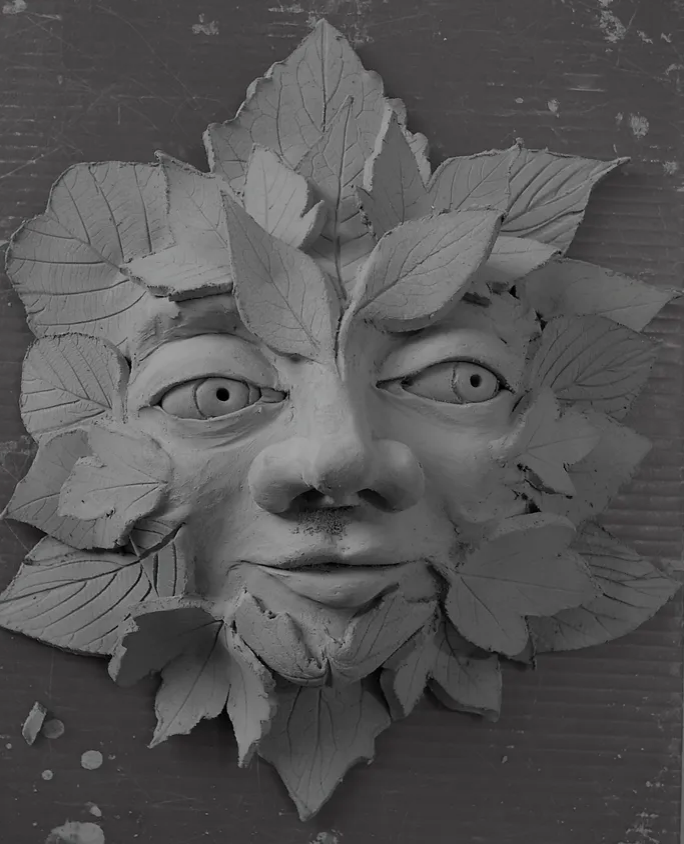

This is a digital download sent directly to your email address so please proved the correct address with payment if different to your paypal. A high quality video with step by step instructions on how to make a green man, suitable for all levels. I will be filming some glazing workshops very soon and adding them to my free youtube channel

PECS LEVEL 2 OVERVIEW (FREE TALK)

By Pyramid Educational Consultants Uk, Ltd.

This 1 hour talk provides information about the content of the NEW PECS L2 workshop. The new PECS Level 2 workshop offers delegates the opportunity to analyse the application of PECS in new real-life examples, while answering questions about their own implementation. Come along to the overview to hear in more detail what the PECS L2 can offer you, how it can improve your implementation skills and confidence. Please note that this is an overview only and is not intended as, nor does it replace the PECS Level 2 training workshop. WORKSHOP DETAILS Agenda: 1 hour Registration Time: N/A Tuition Includes: N/A

HR Roundtable 14 "Dignity at Work"

By Trustees Unlimited

Did you know that people conflict has cost UK organisations £28.5 billion in total, with 10 million people experiencing conflict at work and 5 million suffering from stress, anxiety or depression as a result? Join us for this unmissable HR Roundtable to explore important topics of workplace dignity and respect, how to combine operational excellence with HR excellence, safeguarding reputation and much more. SPEAKER IAN KIRKPATRICK Join us for an exclusive session featuring Ian Kirkpatrick, an esteemed professional with over 25 years of experience operating at the Board level across various industries and sectors. His unique blend of expertise in Operations, Supply Chain Management, and Human Resources Leadership makes him a true industry leader.

Supply Chain Logistics Operative Level 2

By Rachel Hood

Managing the movement of goods across all sectors and distances for a range of customers from private individuals and sole traders through to large global organisations.

The Fintech Frontier: Why FDs Need to Know About Fintech

By FD Capital

The Fintech Frontier: Why FDs Need to Know About Fintech,” the podcast where we delve into the world of financial technology There are numerous areas where fintech can make a significant impact. For example, payment processing and reconciliation can be streamlined through digital payment solutions and automated tools. Data analytics and artificial intelligence can enhance financial forecasting, risk management, and fraud detection. Blockchain technology can revolutionize supply chain finance and streamline processes involving multiple parties. By understanding the capabilities of these fintech solutions, FDs can identify areas for improvement and select the right technologies to optimise their financial operations. Additionally, fintech can greatly enhance financial reporting and analysis. Advanced data analytics tools can extract meaningful insights from vast amounts of financial data, enabling FDs to make data-driven decisions and identify trends and patterns. Automation of repetitive tasks, such as data entry and reconciliation, reduces the risk of errors and frees up valuable time for FDs to focus on strategic initiatives. The adoption of cloud-based financial management systems also provides flexibility, scalability, and real-time access to financial data, empowering FDs to make informed decisions on the go. With the rapid pace of fintech advancements, how can FDs stay up to date and navigate the evolving fintech landscape? Continuous learning and engagement with the fintech community are key. Attend industry conferences, participate in webinars and workshops, and engage with fintech startups and established players. Networking with professionals in the field, joining fintech-focused associations, and following relevant publications and blogs can help FDs stay abreast of the latest fintech developments. Embracing a mindset of curiosity and adaptability is crucial in navigating the ever-changing fintech landscape. I would also encourage FDs to foster partnerships and collaborations with fintech companies. Engage in conversations with fintech providers to understand their solutions and explore potential synergies. By forging strategic partnerships, FDs can gain access to cutting-edge technologies and co-create innovative solutions tailored to their organisation’s unique needs. As we conclude, do you have any final thoughts or advice for our FD audience regarding fintech? Embrace fintech as an opportunity, not a threat. Seek to understand its potential and how it can align with your organisation’s goals and strategies. Be open to experimentation and pilot projects to test the viability of fintech solutions. Remember that fintech is a tool to enhance and optimize financial processes, and as FDs, we have a crucial role in driving its effective implementation. https://www.fdcapital.co.uk/podcast/the-fintech-frontier-why-fds-need-to-know-about-fintech/ Tags Online Events Things To Do Online Online Conferences Online Business Conferences #event #fintech #knowledge #fds #frontier

The International Legal Environment

By Business Works

This module covers the scope of the law, the classification of the law as it relates to international trade, and the influence of international trade over the ages on the development of commercial law. This module will cover legal traditions in different parts of the world, and the sources of a country’s law.

Team Leader/Supervisor Level 3

By Rachel Hood

Managing teams and projects to meet a private, public or voluntary organisation's goals.