- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

48549 Courses delivered On Demand

The 'Creative Card Making / Handmade Greeting Card' course is a delightful journey into the art of crafting personalized and unique greeting cards. Participants will explore the fundamentals of creative card design, learn essential design principles, and master various card-making techniques, including pop-up cards, hand lettering, and calligraphy. Additionally, the course offers insights into turning this creative passion into a card-making business. Learning Outcomes: Acquire the knowledge and skills to craft beautiful and personalized greeting cards. Understand design elements and principles for creating visually appealing cards. Master diverse card-making techniques, from stamping to embossing. Create unique card folds and engaging pop-up cards. Develop proficiency in hand lettering and calligraphy for card personalization. Explore innovative card-making materials and tools. Learn strategies for marketing and selling handmade cards. Gain insights into establishing and managing a card-making business. Why buy this Creative Card Making / Handmade Greeting Card? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Creative Card Making / Handmade Greeting Card there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Creative Card Making / Handmade Greeting Card does not require you to have any prior qualifications or experience. You can just enrol and start learning. Arts and crafts enthusiasts seeking a creative outlet. Individuals interested in personalized and handmade gifts. Aspiring card designers and artists. Entrepreneurs looking to start a handmade card business. Prerequisites This Creative Card Making / Handmade Greeting Card was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Freelance Greeting Card Designer - £15,000 to £40,000 annually. Handmade Card Business Owner - £20,000 to £60,000+ annually. Arts and Crafts Instructor - £20 - £40 per hour. Etsy Seller - Earnings vary widely based on sales. Stationery Shop Owner - £20,000 to £50,000+ annually. Course Curriculum Module 01: Introduction to Creative Card Making Introduction to Creative Card Making 00:06:00 Module 02: Design Elements and Principles for Handmade Greeting Cards Design Elements and Principles for Handmade Greeting Cards 00:05:00 Module 03: Card-Making Techniques Card-Making Techniques 00:06:00 Module 04: Creating Unique Folds and Pop-up Cards Creating Unique Folds and Pop-up Cards 00:04:00 Module 05: Hand Lettering and Calligraphy Hand Lettering and Calligraphy 00:05:00 Module 06: Card-Making Business Card-Making Business 00:07:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Legal Office Administration Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Legal Office Administration Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Legal Office Administration Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Legal Office Administration Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Legal Office Administration? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Legal Office Administration there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Legal Office Administration course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Legal Office Administration does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Legal Office Administration was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Legal Office Administration is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Certification for Paralegals Certifications 00:07:00 The Law Office Ethical Considerations 00:10:00 The Basics 00:04:00 Client Relations 00:05:00 Dealing With Mail 00:05:00 File Management 00:03:00 Use Of Technology 00:06:00 Skills that Every Legal Secretary Should Have 00:06:00 Billing How Attorneys Charge 00:09:00 Time and Cost Entries 00:05:00 Trust Accounts 00:04:00 Docket Administration 00:05:00 Preparing Legal Documents Basic Preparation 00:13:00 Legal Citations 00:05:00 The Law Library 00:05:00 Litigation What is Litigation 00:04:00 Delivery of Documents 00:04:00 Motions Prior to and During Trial 00:07:00 Contracts The Basics 00:04:00 The Essential Elements 00:03:00 Remedies for Breach of Contract 00:04:00 Torts The Goal of Tort Law 00:10:00 Negligence 00:11:00 Strict Liability 00:07:00 Criminal Law and Procedure Criminal Law Basics 00:20:00 Criminal Procedure 00:15:00 Family Law Marriage 00:08:00 Annulment and Divorce 00:05:00 Child Custody 00:09:00 Business Law Types of Organizations 00:07:00 Corporations 00:09:00 Real Estate The Basics 00:10:00 Documenting Transactions 00:12:00 Estate Planning and Guardianship The Basics 00:07:00 Characteristics of a Will 00:08:00 Types of Trusts and Funding 00:04:00 Elder Law 00:06:00 Bankruptcy The Basics 00:14:00 Mock Exam Mock Exam- Legal Office Administration 00:20:00 Final Exam Final Exam- Legal Office Administration 00:20:00

Overview Delving into education, especially when targeting mature audiences, requires finesse, insight, and an unique set of skills. Our course, 'Adult Education Mastery Training', promises to guide you through this intricate path, starting from captivating your audience to transforming yourself into an educator they'll never forget. This comprehensive curriculum, tailored to cater to the specifics of adult learners, ensures that your teaching methods will not just be effective but truly enchanting. Amidst a sea of educational programmes, what sets ours apart is a keen focus on adult learners, a segment often overlooked in traditional training. Through modules like 'Engage and Teach All Learners' and 'Create Amazing Training Materials', we empower educators to make a mark, ensuring every lesson leaves an imprint. Navigating the waters of adult education can sometimes present turbulent waves, but with our guidance on 'Handle Challenging Trainees', you're equipped to stay the course with grace and tenacity. Enrolling in the 'Adult Education Mastery Training' is a pledge to excellence. Teaching mature audiences will no longer be the mysterious territory it once seemed. With our comprehensive guidance, educators can confidently enter this domain, leaving an indelible mark on every learner they encounter. Learning Outcomes Acquire the art of captivating mature audiences effectively. Understand the nuances and needs of adult learners, catering to them adeptly. Develop top-tier training materials that resonate and leave a lasting impression. Implement strategies to engage every type of learner, ensuring inclusivity. Tackle and navigate challenging situations and individuals with poise. Why buy this Adult Education Mastery Training course? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Adult Education Mastery Training there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Adult Education Mastery Training course for? Educators aiming to specialise in adult learning modules. Trainers keen on enhancing their methodologies for mature audiences. HR professionals aspiring to conduct in-house training sessions. Course designers wishing to target the adult learner demographic. Individuals aspiring to make a career switch into adult education. Prerequisites This Adult Education Mastery Training does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Adult Education Mastery Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Adult Education Specialist: Average salary range £32,000 - £42,000 Per Annum. Training Coordinator: Average salary range £25,000 - £35,000 Per Annum. Course Developer for Adults: Average salary range £30,000 - £40,000 Per Annum. Corporate Trainer: Average salary range £35,000 - £50,000 Per Annum. Learning and Development Manager: Average salary range £40,000 - £55,000 Per Annum. Adult Literacy Teacher: Average salary range £28,000 - £38,000 Per Annum. Course Curriculum Hook Your Class Introduction and Welcome to Training Essentials of Adult Education 00:29:00 Hook Your Class - Part 1 00:17:00 Hook Your Class - Part 2 00:23:00 Become Their Favorite Become Their Favorite - Part 1 00:31:00 Become Their Favorite - Part 2 00:32:00 Create Your Presence 00:20:00 Engage and Teach All Learners Understand Your Learners 00:33:00 Reach Every Learner - Part 1 00:35:00 Reach Every Learner - Part 2 00:30:00 Create Amazing Training Materials Create Amazing Training Materials - Part 1 00:32:00 Create Amazing Training Materials - Part 2 00:20:00 Handle Challenging Trainees Handle Resenters, Talk Hogs, Hecklers and Gripers 00:24:00 Handle Experts, Know-It-Alls and Quiet Types 00:20:00 Workbook Workbook - Adult Education Mastery Training 00:00:00 Assignment Assignment - Adult Education Mastery Training 00:00:00

Overview In the heart of London, the allure of freshly baked pastries wafts through the air, beckoning culinary enthusiasts to embark on a journey of sweet discovery. Our Pastry Chef Training course, nestled amidst the city's historic streets, offers a comprehensive curriculum that delves deep into the world of pastries, baking, cupcakes, and even the intricacies of running a cake business. Whether you're searching for 'pastry chef training near me' or keen on understanding the pastry chef training requirements in the UK, our programme stands as a beacon for all budding bakers and entrepreneurs. The art of baking is a delicate dance between precision and creativity. This course, designed meticulously, ensures that learners grasp the foundational techniques of baking while also exploring the delightful realm of cupcake creation. But it doesn't stop there. For those with an entrepreneurial spirit, the cake business module provides insights into turning passion into profit, making it a holistic learning experience. London, with its rich culinary history, serves as the perfect backdrop for this training. Aspiring pastry chefs from all over the UK flock to our course, eager to hone their skills and carve a niche for themselves in the competitive world of patisserie. With our training, you're not just learning to bake; you're mastering the art and business of it. Learning Outcomes: Understand the foundational techniques and principles of pastry creation. Master the art of baking, ranging from basic breads to intricate desserts. Develop expertise in crafting a variety of cupcakes, focusing on both taste and presentation. Gain insights into the operational and marketing aspects of running a successful cake business. Acquire the knowledge and confidence to establish oneself in the UK's dynamic pastry industry. Why buy this Pastry Chef Training? Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Pastry Chef Training you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Pastry Chef Training course for? Aspiring bakers keen on mastering the art of pastries and baking. Individuals looking to start or expand their own cake business. Culinary enthusiasts wanting to delve deeper into the world of cupcakes. Those curious about the pastry chef training requirements in the UK. Anyone in the UK searching for a comprehensive pastry chef training programme. Prerequisites This Pastry Chef Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. Career path Pastry Chef: Average salary range £20,000 - £28,000 Annually Baker: Average salary range £18,000 - £25,000 Annually Cupcake Specialist: Average salary range £19,000 - £26,000 Annually Cake Business Owner: Average salary range £25,000 - £50,000 (depending on business size and location) Annually Cake Decorator: Average salary range £20,000 - £27,000 Annually Pastry Product Developer: Average salary range £23,000 - £30,000 Annually Course Curriculum Pastry Chef Introduction to Baking 01:00:00 The Ingredients 00:45:00 Basic Doughs 00:40:00 Danish Pastries 00:45:00 Puff Pastry Breakfast Items 00:40:00 Cookies 00:25:00 Sauces 00:30:00 Baking Birthday Cakes 01:00:00 Wedding Cake Decorating 00:15:00 Christmas Cakes 00:30:00 Cup Cake Baking Introduction 00:30:00 Cupcakes & Muffins 00:30:00 Baking 01:00:00 Icing & Working with Chocolate 01:00:00 Cake Decorating 01:00:00 Creating Stands and Displays 00:15:00 Cake Business Meeting Clients/Establishing Requirements for Jobs 00:30:00 Pricing, Ingredients & Budgeting 00:30:00 Supplies and Equipment Needed 00:30:00 Cake Transportation 00:15:00 Photographing your Cakes 01:30:00 Running Your Own Business 01:00:00 Marketing and Social Media 00:30:00 The Do's and Don'ts & What to Do When Things Don't Go to Plan 00:15:00 Accounting, VAT, Tax, Insurance and Record Keeping 01:00:00 Hiring Staff and Providing Sufficient Training 01:30:00

Stepping into the realm of B2B sales? Prepare to delve deep into the intricate world of 'B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales'. This course unravels the mysteries behind understanding B2B buyers and lays a foundation to construct impactful marketing strategies. Delve into the art of aligning sales with marketing, building robust sales teams, and mastering lead generation. The latter modules accentuate essential sales techniques, proficient management strategies, and the importance of customer relationships. Ready to conquer global B2B sales? We've got you covered. Join us and get ahead in the competitive B2B sales sphere! Learning Outcomes Comprehend the fundamentals of B2B sales and marketing. Identify and understand the unique needs and behaviours of B2B buyers. Design and implement a robust B2B marketing plan. Acquire knowledge on aligning sales teams and marketing efforts for optimal results. Master the tools and techniques for efficient customer relationship management. Why buy this B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales course for? Aspiring B2B sales and marketing enthusiasts keen to deepen their understanding. Business owners wanting to refine their sales strategies. Marketing professionals aiming to specialise in the B2B sector. Sales managers seeking insights into team building and lead generation. B2B consultants striving to enhance their market reach and efficacy. Prerequisites This B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales does not require you to have any prior qualifications or experience. You can just enrol and start learning.This B2B Sales & Marketing Strategies: Winning in Business-to-Business Sales was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path B2B Sales Manager: £40,000 - £60,000 B2B Marketing Specialist: £35,000 - £50,000 Sales Team Lead: £45,000 - £65,000 Lead Generation Expert: £30,000 - £45,000 Customer Relationship Manager: £35,000 - £55,000 Global B2B Sales Executive: £50,000 - £70,000 Course Curriculum Module 01: Introduction to B2B Sales and Marketing Introduction to B2B Sales and Marketing 00:14:00 Module 02: Understanding the B2B Buyer Understanding the B2B Buyer 00:12:00 Module 03: Creating A B2b Marketing Strategy Creating A B2b Marketing Strategy 00:13:00 Module 04: Sales And Marketing Alignment Sales And Marketing Alignment 00:14:00 Module 05: Building A B2b Sales Team Building A B2b Sales Team 00:14:00 Module 06: B2b Lead Generation B2b Lead Generation 00:14:00 Module 07: B2B Sales Techniques B2B Sales Techniques 00:15:00 Module 08: B2b Sales Management B2b Sales Management 00:13:00 Module 09: Customer Relationship Management Customer Relationship Management 00:11:00 Module 10: Global B2b Sales And Marketing Global B2b Sales And Marketing 00:11:00

This Tailoring and Alterations course equips individuals with essential skills in garment modification and customization. Through a comprehensive curriculum, participants will learn the art of tailoring, from basic sewing techniques to advanced alterations, enabling them to transform clothing to fit their preferences. Learning Outcomes: Introduction to Tailoring: Understand the fundamentals of tailoring and its importance in garment modification. Sewing Machine Essentials: Master the operation of sewing machines and their use in alterations. Basic Sewing Techniques: Learn essential stitches and sewing skills for garment repair and customization. Altering Tops and Shirts: Gain proficiency in altering tops and shirts to achieve a perfect fit. Altering Pants and Skirts: Develop the skills to alter pants and skirts to suit individual preferences. Advanced Alterations: Explore complex alterations, including resizing and restyling garments. Special Projects: Apply acquired skills to create unique and customized clothing pieces. Why buy this Tailoring and Alterations? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Tailoring and Alterations you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Tailoring and Alterations course is ideal for Individuals interested in clothing customization and personal style enhancement. Aspiring fashion designers seeking foundational tailoring skills. Seamstresses and hobbyists looking to expand their alteration capabilities. Wardrobe stylists aiming to offer tailored fitting services. Prerequisites This Tailoring and Alterations was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Tailor: Average earnings range from £18,000 to £30,000 per year. Fashion Designer: Salaries vary widely, with established designers earning substantially more. Seamstress: Average earnings range from £15,000 to £25,000 per year. Wardrobe Stylist: Earnings vary based on experience and clientele, with potential for substantial income. Course Curriculum Module 01: Introduction to Tailoring Introduction to Tailoring 00:12:00 Module 02: Sewing Machine Essentials Sewing Machine Essentials 00:10:00 Module 03: Basic Sewing Techniques Basic Sewing Techniques 00:10:00 Module 04: Altering Tops and Shirts Altering Tops and Shirts 00:09:00 Module 05: Altering Pants and Skirts Altering Pants and Skirts 00:10:00 Module 06: Advanced Alterations Advanced Alterations 00:11:00 Module 07: Special Projects Special Projects 00:11:00

Embark on a transformative journey with 'Learn to be Happy Through Life Lessons'. Dive deep into introspection with sections like 'It's Probably Your Fault' and understand the signals sent by your emotions. Relationships can be a maze, but with guidance on how they influence our happiness, it becomes easier to navigate. Grasp the essence of real-world challenges and wrap up with a holistic understanding of happiness and life's purpose. Every module is crafted to ensure that by the end, contentment isn't just a word, but a tangible experience. Learning Outcomes Comprehend the root causes of unhappiness and the role of self-accountability. Interpret the messages relayed by different emotions and their significance. Analyse the impact of relationships on well-being, both positive and negative. Navigate real-world challenges with a clear perspective on achieving happiness. Synthesise all the lessons to form a comprehensive understanding of life and contentment. Why buy this Learn to be Happy Through Life Lessons course? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Learn to be Happy Through Life Lessons there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Learn to be Happy Through Life Lessons course for? Individuals seeking clarity on personal happiness determinants. Those keen on strengthening or reassessing their relationships. People facing real-world challenges and seeking guidance. Curious minds eager to decode the messages behind emotions. Anyone looking to enrich their life with profound lessons and insights. Prerequisites This Learn to be Happy Through Life Lessons does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Learn to be Happy Through Life Lessons was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Happiness Consultant: £35,000 - £50,000 Life Coach: £30,000 - £60,000 Relationship Therapist: £40,000 - £70,000 Emotion Analyst: £38,000 - £55,000 Well-being Strategist: £45,000 - £65,000 Life Lesson Educator: £32,000 - £48,000 Course Curriculum Section 01: Introduction Promotional video 00:03:00 The basic concept of this course - plus your 1st lesson! 00:05:00 A word of warning Don't make yourself UNHAPPY! 00:03:00 Section 02: It's Probably Your Fault Taking Responsibility 00:06:00 NOBS and WIMPS - know the difference!! 00:06:00 Section 03: EMOTIONS... WHAT ARE THEY TELLING US? Negative emotions? Bring them on! 00:06:00 Explanatory style - what's YOUR story? 00:06:00 If you fail - fail like a baby 00:05:00 Section 06: AND FINALLY. IT ALL COMES DOWN TO A healthy person wants many things a sick person only one 00:07:00 The roles we play 00:07:00 Wealth and material possessions! 00:05:00 What you do for a living - and its effects on happiness 00:07:00 Section 05: RELATIONSHIPS. DO OTHERS HELP OR HINDER? A feeling of 'Belonging' 00:06:00 Family. You can't choose them! 00:07:00 Significant 'other'. 00:08:00 Section 04: REAL LIFE STUFF Sovereignty. What, when - and with whom. 00:06:00 Your legacy what will they say? 00:07:00 Section 07: BEFORE I GO... Final Thoughts 00:02:00 Downloadable Resources Resource - Learn to be Happy Through Life Lessons 00:00:00

Venture into the dynamic world of youth work with our 'Youth Work Diploma' course. This comprehensive curriculum delves into the many facets of youth support, from the foundational principles to the vital nuances of social care and mental well-being. Furthermore, it elucidates the significance of safeguarding, the nuances of internet safety, the essence of effective communication, and the legal parameters in youth work. Learning Outcomes Comprehend the foundational principles and ethos of youth work. Understand the interplay between youth work and social care. Gain insights into the significance of mental health in youth support. Grasp the importance of safeguarding and internet safety measures. Learn the legal frameworks and guidelines in youth support. Why buy this Youth Work Diploma course? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Youth Work Diploma there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Youth Work Diploma for? Aspiring youth support workers wanting a comprehensive introduction. Educators aiming to enhance their understanding of youth-related concerns. Parents seeking a better understanding of internet safety and mental well-being for young ones. Social workers wishing to integrate youth-centric approaches. Counsellors and therapists aiming to work with young individuals. Prerequisites This Youth Work Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Youth Work Diploma was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Youth Support Worker: £20,000 - £26,000 School Counsellor: £23,000 - £30,000 Youth Safeguarding Officer: £22,000 - £28,000 Youth Community Organiser: £19,000 - £25,000 Youth Internet Safety Advisor: £21,000 - £27,000 Youth Legal Advocate: £24,000 - £31,000 Course Curriculum Section 01: Introduction to Youth Work Module 01: Introduction to Youth Work 00:13:00 Module 02: Who are the Youth Workers? 00:11:00 Module 03: Youth Worker Role and Methods 00:20:00 Section 02: Youth Work and Responsibilities Module 04: Social Worker Guidelines 00:21:00 Module 05: Role as a Caregiver 00:23:00 Module 06: Health and Safety Responsibilities 00:50:00 Section 03: Youth Work and Social Care Module 07: Introduction to Health and Social Care 00:15:00 Module 08: Rights and Responsibilities as a Health and Social Care Worker 00:39:00 Module 09: Social Influences 00:21:00 Section 04: Youth Work and Mental Health Module 10: Introduction to Mental Health 00:18:00 Module 11: Youth Work in Mental Health 00:25:00 Module 12: Social Attitudes to Mental Illness 00:15:00 Section 05: Youth Work and Safeguarding Module 13: Child Safeguarding 00:12:00 Module 14: Safeguarding Vulnerable Adults 00:25:00 Module 15: Understanding Abuse and Neglect 00:14:00 Section 06: Youth Work and Internet Safety Module 16: The Concept of Privacy and Appropriate Online Content 00:15:00 Module 17: Safe Use of Social Media 00:17:00 Module 18: Mobile Device Safety 00:18:00 Section 07: Youth Work and Importance of Communication Module 19: Communication and its Relevance 00:47:00 Module 20: Understanding the Importance of Communication in Care 00:17:00 Module 21: Teamwork and Casework Process 00:36:00 Section 08: Youth Work and Legalities Module 22: Legal Responsibilities 00:17:00 Module 23: Principles and Policies in Social Care Work 00:20:00 Module 24: Mental Health Legislation and Services 00:28:00 Module 25: Safeguarding Legislations 00:17:00 Module 26: Understanding Legal, Professional Standards of Practice and Ethical Aspects of Health Care Part - 1 00:48:00 Module 27: Understanding Legal, Professional Standards of Practice and Ethical Aspects of Health Care Part - 2 00:48:00

Unlock a brighter, worry-free future with our transformative course, 'Overcome Overthinking and Worrying.' Dive into a journey of self-discovery and empowerment as you learn to break free from the chains of anxiety and excessive thinking. With eight comprehensive sections and expert guidance, this course equips you with the tools to conquer your mind and regain control over your life. Say goodbye to relentless worry and embrace a path to a more peaceful and fulfilling existence. Learning Outcomes Develop a deep understanding of thought patterns and their impact on your well-being. Master the art of thought journaling to gain insight into your inner world. Identify and challenge limited thinking patterns that hold you back. Learn effective relaxation exercises to manage stress and anxiety. Cultivate mindfulness and diffusion techniques for a calmer, more present mindset. Why buy this Overcome Overthinking and Worrying course? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Overcome Overthinking and Worrying there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Overcome Overthinking and Worrying course for? Individuals seeking relief from chronic overthinking and anxiety. Professionals looking to enhance their mental resilience and productivity. Students aiming to improve their focus and concentration. Anyone interested in personal growth and inner transformation. Those committed to living a more balanced, worry-free life. Prerequisites This Overcome Overthinking and Worrying does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Overcome Overthinking and Worrying was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Life Coach: £25,000 - £60,000 per annum Counsellor: £22,000 - £50,000 per annum Mental Health Support Worker: £18,000 - £30,000 per annum HR Specialist: £25,000 - £55,000 per annum Meditation Instructor: £20,000 - £45,000 per annum Wellness Consultant: £22,000 - £50,000 per annum Course Curriculum Section 01: Introduction to the Course Introduction to the Course 00:03:00 Section 02: Introduction to Thought Journaling Uncovering Automatic Thoughts 00:04:00 Understanding Feedback Loops 00:04:00 The Nature of Automatic Thoughts 00:01:00 Characteristics of Automatic Thoughts Part 01 00:08:00 Characteristics of Automatic Thoughts Part 02 00:08:00 Thought Journal 00:02:00 Section 03: Introduction to Limited Thinking Patterns Filtering 00:02:00 Polarised Thinking 00:02:00 Overgeneralise Thinking 00:02:00 Mind Reading 00:02:00 Catastrophising 00:01:00 Magnifying 00:02:00 Personalisation 00:01:00 Shoulds 00:02:00 Composing Balanced Alternative Thoughts 00:08:00 Using Thought Journal for Limited Thinking Patterns 00:02:00 Section 04: Introduction to Hot Thoughts Eight Steps for Changing Hot Thoughts 00:07:00 Section 05: Introduction to Relaxation Exercises Abdominal Breathing 00:15:00 Progressive Muscle Relaxation 00:11:00 Relaxation without Tension 00:01:00 Cue Controlled Relaxation 00:07:00 Visualisation 00:04:00 Section 06: Introduction to Controlling Worry Worry System 00:02:00 Relaxation 00:02:00 Risk Assessment 00:07:00 Worry Exposure 00:03:00 Worry Behaviour Prevention 00:02:00 Section 07: Introduction to Mindfulness and Diffusion The Thought Mechanism 00:02:00 Labelling Effect 00:01:00 The Meaning of Thoughts 00:02:00 Waterfall Metaphor 00:01:00 Mindfulness 00:03:00 Dealing with Anxiety 00:03:00 Section 08: Knowing What Really Matters Knowing What Really Matters 00:10:00 Section 09: Conclusion Conclusion 00:02:00

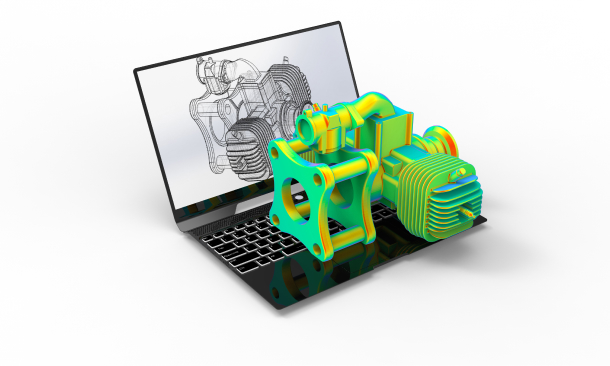

Venturing into the dynamic world of design? Dive deep into the 'Solidworks Foundation Training' course and uncover the nuances of cutting-edge 3D design software. From understanding the basics in the introductory unit to mastering the art of animation, this course ensures a comprehensive grasp on design essentials. By the time you complete the final project, you'll be adept at rendering, adding decals and text, and showcasing your work in the best light and scene, ready to revolutionise the design landscape. Learning Outcomes Understand the foundational concepts of Solidworks and its application in design. Gain proficiency in enhancing designs with appropriate material, appearance, and scenes. Develop skills to effectively utilise lights, cameras, and animations in design projects. Master the techniques of adding decals, text, and rendering to designs. Successfully complete a project demonstrating holistic knowledge and application of the course content. Why buy this Solidworks Foundation Training? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Solidworks Foundation Training there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Solidworks Foundation Training for? Beginners eager to embark on a design journey using Solidworks. Design enthusiasts keen to upgrade their digital design toolkit. Individuals transitioning from traditional design platforms to advanced 3D software. Professionals in the design sector aiming to upskill. Students pursuing design and looking for an industry-relevant course. Prerequisites This Solidworks Foundation Training does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Solidworks Foundation Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Solidworks Designer: £30,000 - £40,000 Product Designer: £35,000 - £45,000 CAD Engineer: £33,000 - £43,000 3D Visualiser: £28,000 - £38,000 Design Engineer: £34,000 - £44,000 Animator: £25,000 - £35,000 Course Curriculum Unit 01: Introduction 1.1 About the Course 00:01:00 Unit 02: Material, Appearance and Scene 2.1.Overview 00:03:00 2.2. Applying Material 00:08:00 2.3. Appearance 00:05:00 2.4. Working with Woods 00:05:00 2.5. Working with Glass 00:04:00 2.6. Scene 00:04:00 Unit 03: Lights and Camera 3.1. Lights 00:07:00 3.2. Camera 00:04:00 Unit 04: Decals and Text 4.1. Decals 00:07:00 4.2. Text 00:05:00 Unit 05: Rendering 5.1. Options 00:04:00 5.2. Rendering Panel 00:03:00 5.3. Schedule Rendering 00:02:00 Unit 06: Animation 6.1. Creating Motion Study 00:02:00 6.2. Animation Wizard 00:08:00 6.3. Applying Motors 00:04:00 6.4. Changing Appearance and Camera Position 00:07:00 6.5. Walkthrough 1 00:09:00 6.6. Walkthrough 2 00:06:00 Unit 07: Project 7.1. Task 1 00:00:00 7.2. Task 2 00:00:00 7.3. Task 3 00:00:00 Supporting Materials 00:00:00 Assignment Assignment - Solidworks Foundation Training 00:00:00