- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

391 Courses in Cardiff delivered Live Online

PECS LEVEL 2

By Pyramid Educational Consultants Uk, Ltd.

Prerequisite: PECS Level 1 Training This two-day training focuses on creating lessons and activities to promote communication throughout the day. Beginning with a review of the Pyramid Approach to Education as it relates to PECS, we guide you in refining your PECS implementation and discuss current challenges you have experienced within the six phases. As you acquire teaching strategies on expanding vocabulary and syntax combined with new ideas for materials, we will discuss how to increase communication opportunities for your learner. Throughout the training, you will be provided with presenter demonstrations, video examples and opportunities to role-play. With innovative ideas, increased confidence and renewed enthusiasm, you will leave the PECS Level 2 Training ready to move PECS users to more sophisticated levels of communication. WATCH VIDEO WHAT YOU WILL LEARN Identify the six phases of the PECS protocol Analyse common difficulties with PECS implementation Generate solutions to common challenges with implementing PECS Provide communication opportunities across the day in all activities Implement specific strategies for teaching advanced language concepts WORKSHOP DETAILS Agenda: 9:00 AM - 4:30 PM Registration Time: 8:30 AM - 9:00 AM CPD Points: Continued Professional Development Points CEUs: 7.5 BACB CEUs / 7.5 IBAO CEUs. Satisfactory completion of this course requires participants to be present for the duration of the course and to participate in all student responding activities (e.g. questions, role play, quizzes, and surveys). Tuition Includes: detailed handout with space for note taking, delegate practise bag and certificate of attendance. *Participants are encouraged to bring the PECS Training Manual (Frost and Bondy, 2002) that they received at their PECS Level 1 Training, as this workshop may reference some pages in the manual. This course is certified by the CPD certification service (the leading independent CPD accreditation institution) as conforming to continuing professional development principles. All delegates will receive a certificate of attendance detailing eligible CPD hours which can be used as verifiable documentary evidence when submitting CPD recording forms. Pyramid Educational Consultants is an approved BACB ACE Provider for Learning (Type 2) Continuing Education Credits. The BACB does not warrant, endorse, sponsor, approve, or partner with the event, organisation, or instructor. Pyramid Educational Consultants is an approved IBAO Provider for Continuing Education Credits.

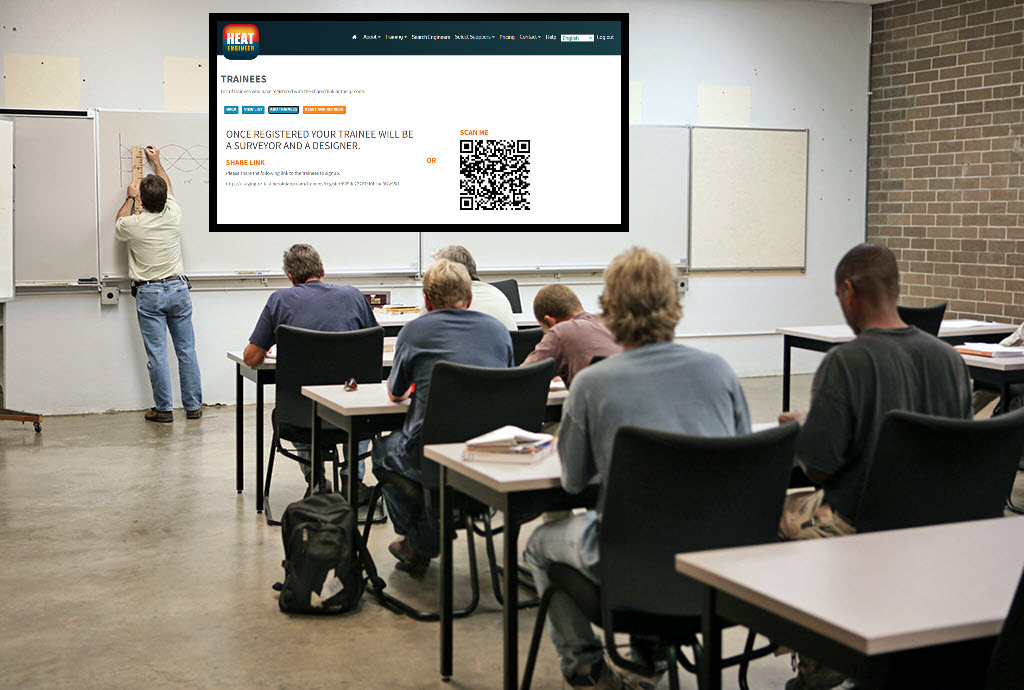

Teachers will become familiar with the software, aiding each learner access to their college dashboard as a designer, so they can complete a heat loss report and other heating design elements. Furthermore each learner will have access to send surveys from the heat engineer app (Apple or Android) which once sent will be received within the college dashboard. Where teachers can assess the survey.

GRAPHIC DESIGN LEVEL 2 DIPLOMA COURSE

By Creative Design School International

A fantastic online one-to-one diploma course for those looking to become a successful graphic designer

GRAPHIC DESIGN FOR BEGINNERS LEVEL 1

By Creative Design School International

This is a beginners level course and will take you through the basics of Graphic Design. This is a great way to start if you have no prior knowledge of graphic design and want to start at the beginning.

Payroll Accounting Training Fast Track

By Osborne Training

Payroll Accounting Training Fast Track (Level 1-3): This course brings you the skills you need to use this popular payroll program to confidently process any businesses payroll. Being able to use Sage 50 Payroll should lead to greater productivity. But it also helps the business conform to employment legislation and data security requirements. Furthermore, broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll. Moreover, it incorporates all the new government requirements for RTI reporting. Finally, Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. In this course, you will be learning from Level 1 to Level 3 of Sage Computerised Payroll which could help you to land your dream job in the Payroll sector. As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) All exams are conducted online through Sage (UK). Level 1: Introduction to payroll Introduction to Real-Time Information (RTI) Preparing employee records Starters - new employees Calculation of Gross Pay The PAYE and National Insurance systems Creating Payslips and analysis Creating Backups and Restoring data Payment analysis Processing National Insurance contributions Voluntary deductions Processing Leavers Completing the Payroll Procedures Level 2: Introduction to Payroll Introduction to Real Time Information (RTI) Preparing employee records Creating Backup and Restoring Data Starters - new employees Calculation of Gross Pay Deductions - Pension schemes and pension contributions Processing the payroll - introduction to the PAYE system Processing the payroll - income tax National Insurance contributions - Processing in the payroll Voluntary deductions Student Loan repayments Attachment of Earnings Orders & Deductions from Earnings Orders Processing Leavers Introduction to statutory additions and deductions Processing Statutory sick pay (SSP) Processing Statutory Paternity Pay (SPP) Statutory paternity pay and paternity leave Completing the processing of the payroll Creating Payslips and analysis Reports and payments due to HMRC Level 3: Advanced processing of the payroll for employees Preparation and use of period end preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Payroll Giving Scheme processing Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

AAT Accounting Training Course Fast Track

By Osborne Training

AAT Accounting Training Course Fast Track: AAT Level 2 & 3 are the Beginner and Intermediate levels of AAT qualification in Accounting. These two levels are a part of three mandatory qualification levels required to be an AAT Certified Accountant. AAT Level 2 course covers the foundational areas and is suited for people with limited or no accounts knowledge. It is the first step for aspirants intending to build a successful career in accounting. The course by taking you through basic accounting principles will enable you to work in an entry-level role in the accounting or finance department. AAT Level 3 is an intermediate or advanced level of AAT accounting qualification. By the end of this course, you'll be competent enough to work in finance, accountancy, or bookkeeping role. Why Take This Course? Build a remarkable reputation: Complete all the three AAT Levels to earn the highly regarded 'MAAT' status. A bright future: With an opportunity to progress to chartered accountancy. Increase your salary: Up-skill yourself and increase your earning potential. Work overseas: AAT qualifications are recognised internationally, giving you the freedom to work abroad. The AAT Level 2 Foundation Certificate in Accounting covers the following areas: Bookkeeping Transactions Bookkeeping Controls Elements of Cost Work Effectively in Finance Using Accounting Software (i.e SAGE) The Level 3 Diploma in Accounting covers the following areas: Advanced Bookkeeping Final Accounts Preparation Indirect Tax Management Accounting: Costing Ethics for Accountants Spreadsheets for Accounting

Level 2 Certificate in Counselling Skills

By Step Into Learning

Do you want a rewarding career working directly with people, making a difference to their everyday lives? If you are warm, open and empathetic and can bring a patient, tolerant, non-judgemental attitude then a career in counselling could be for you.

AAT Courses Online

By Osborne Training

AAT Courses Online Live AAT online courses give you the opportunity to join live online classes. You can interact with your tutor and fellow students and enjoy a shared learning experience. Whilst you are studying, live classes are held regularly to provide you with the support and structure you would get from a traditional classroom environment, wherever you are. The classes are interactive and led by a expert course tutor. Students are able to ask questions in real-time, participate in polls and check their knowledge against their fellow students. You get access to ample study resources online. AAT Level 2 Online Courses When you study aat level 2 online courses, you get coursebooks and workbooks delivered to your home address. You also get access to VLC for additional learning resources such as Practice Assessments, mock tests, crosswords, interactive assessment etc. In addition, you would be given a schedule of live classes. AAT Level 3 Online Courses When you choose to study aat level 3 online courses, you get coursebooks and workbooks delivered to your home address. You also get access to VLC for additional learning resources such as Practice Assessments, mock tests, crosswords, interactive assessment etc. In addition, through your schedule of live classes you can keep yourself up to date with rest of the group. AAT Level 4 Online Courses With aat level 4 online courses, you get coursebooks and workbooks for your chosen subjects delivered to your home address. Through your access to VLC you can join live online classes. In addition, you get ample learning resources such as Practice Assessments, mock tests, crosswords, interactive assessment etc. through your VLC account.

Immigration Law Course - OISC Level 1

By Centre for Human Development

Are you interested in becoming a qualified immigration adviser? Do you want to practice immigration law in the UK? Our 3-month immigration law course will teach you everything you need to know! It’s taught by our skilled team of solicitors and qualified immigration advisers, and it includes CPD accredited training to help you further your career.