- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Access to Sage 50 Accounts Training in London | Sage Courses Online

By Osborne Training

Course description Sage 50 Accounting / Bookkeeping Training - Fast Track Overview Want to open the door to working in Finance and Accountancy Industry? Starting Sage Line 50 Accounting Fast Track Training course will enhance your career potentials and give you the skills and knowledge you need to get started in Finance and Accountancy Industry. Get a new direction for your career in Accountancy, according to statistics, the average salary for Accountants is £50,000 (Source: Reed), it is the sector where the employability rate is higher than any other sector. With the right skills and practical experience, you would be able to fast track your career in Accountancy and exactly that's where Osborne Training can fill the gap. The intensive programmes include all the skills required to fast track your career in professional Accountancy. Duration 6 Weeks Study Options Classroom Based - Osborne Training offers Daytime or Weekend sessions for Sage 50 Bookkeeping Training Course from London Campus. Online Live - Osborne Training offers online Evening sessions for Sage 50 Bookkeeping Training Classes through the Virtual Learning Campus. Distance Learning - Self Study with Study Material and access to Online study Material through Virtual Learning Campus. Certification You will receive a certificate from Osborne Training once you finish the course. You have an option to get an IAB Certificate subject to passing the exams. What qualification will I gain? You could Gain the following IAB qualifications provided that you book and register for IAB exams and pass the exams successfully: IAB Level 1 Award in Computerised Bookkeeping (QCF) 500/9405/1 IAB Level 2 Award in Computerised Bookkeeping (QCF) 500/9261/3 IAB Level 3 Award in Computerised Bookkeeping (QCF) 500/9407/5 Awarding body International Association of Book-Keepers Sage 50 accounts Course Syllabus Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Stock Valuation, Stock Control, Work in Progress and Finished Goods Prepare and Produce Final Accounts Extended Trial Balance Exporting Data including Linking to Other Systems Management Information Reports Making Decisions with Reports Using Sage Prepare and Process Year End Accounts and Archive Data Final Accounts for Partnerships including Appropriation Accounts The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

The Dance of Earth and Venus with Daniel Docherty

By Sacred Art of Geometry

The Dance of Earth and Venus results in one of the most beautiful and breathtaking rhythms and patterns of the solar system. Every eight Earth years (13 Venus years) they dance a pentagonal form in space akin to the pip-star inside your apple or the petals of a primrose flower! During this course we will learn how to draw this incredible pattern using the traditional tools of compass and straight-edge; we will explore the key aspects of Earth and Venus' cycles that determine such extraordinary heavenly harmony. And time allowing ... with copper leaf and watercolour paint made from malachite and azurite - which in the Hermetic/Alchemical tradition have forever been associated with the planet Venus - we will create stunning mandalas embodying the Earth/Venus dance ... (More info at sacredartofgeometry.com)

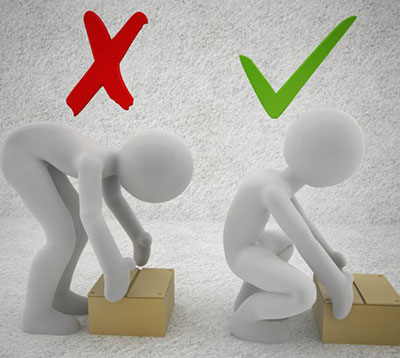

MANUAL HANDLING

By Lloyds School Of Motoring

Manual Handling covers more than simply lifting or carrying something. The term is used to describe activities such as lifting, lowering, pushing, pulling, carrying, moving, holding or restraining an object or person. It also covers activities that require the use of force or effort such as pulling a lever or operating power tools. The aim of the course is to provide a theoretical knowledge and the practical skills to recognise the risk of unsafe practices.

ACCA CPD Courses for Accountants in London | Birmingham | Online CPD Courses

By Osborne Training

Why do you need CPD Courses? CPD stands for Continuous Professional Development. As an accountant, it is vital to gain CPD points to comply with Professional Accounting Bodies (such as ACCA, AAT, CIMA, ICAEW etc.) requirement and to retain your membership. CPD Course Overview You can join various practical accounting cpd courses designed to build the bridge between knowledge and practical aspects of accounting and tax. With this cpd courses many modules of tax and accounting are covered in addition to Computerised Accounting & Payroll. After completing the cpd training you will have the chance to get hands on experience which will open the door for highly paid jobs in Accounting, Tax & Payroll sector. CPD Training Method Classroom Based - Osborne Training offers Daytime or Weekend sessions for accounting CPD Training Courses in London. Online Live - Osborne Training offers Evening or Weekend sessions for online CPD Training Courses through Virtual Learning Campus. A course certificate from Osborne Training, confirming CPD Points and Completion. Total Accounting Training with Job Placement Total Taxation Training Corporation Accounting and Tax Return Income Tax Return Advanced Excel Training

Nutrition & Hydration Awareness

By Prima Cura Training

This course is suited to those who are involved in the planning, provision, and assistance of meals for those in care. It provides a solid insight into the basics of good nutrition as well as providing practical guidance for how to put these into practice within a care setting. Learners will also look briefly at Food Hygiene. This subject forms standard 8 in The Care Certificate.

ADVANCED VALUATION FOR INSTITUTIONAL INVESTORS

By Behind The Balance Sheet

This course was developed for one of the largest investment institutions in the world, a multi-trillion household name. We explain in detail our tips and tricks to build an accurate and rolling enterprise value, and then review different valuation methodologies, from DCF, through the sum of the parts and football field analyses to LTV/CAC based methods. We conclude with a series of case studies examining the valuation of individual stocks.

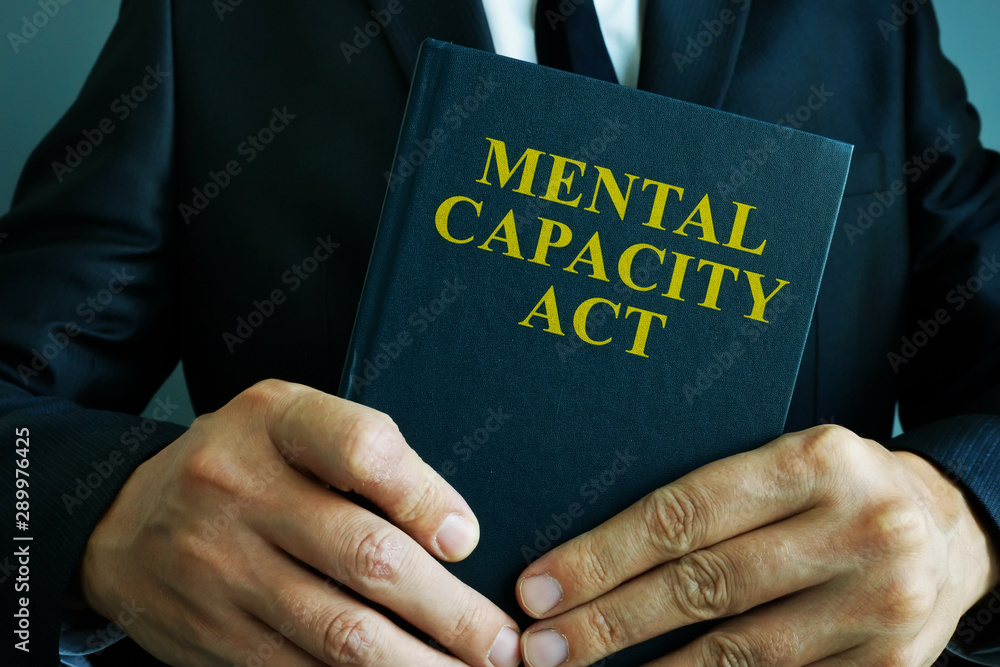

Mental Capacity Act 2005

By Prima Cura Training

This course enables providers and their staff to develop an understanding of the responsibilities and duties around the Mental Capacity Act 2005 (MCA). This essential training is for workers involved in the care, treatment and support of adults who may lack capacity in making life decisions. This training offers vital support for social care providers, so they comply with the Mental Capacity Act and Care Quality Commission requirements and promote human rights.

Course Overview This qualification provides learners with the essential knowledge and skills required by those who wish to pursue a career in the Health and Fitness industry. Level: 2 Duration: 1 year full-time Awarding Awarding Body: ACTIVE IQ Course Fees: Free Example Units and Structure Personal training with clients How the body works Developing self in an active leisure role How to Adopt a Healthy Lifestyle Understanding the active leisure and learning sector Anatomy and Physiology for exercise and health Entry Requirements 4 Grade 3s or above at GCSE, with at least a Grade 2 (at GCSE) or Level 1 functional skills in English and Maths. Demonstrate an understanding of sports at Level 1 standard. Learners must have a level of physical fitness that enables them to meet the physical assessments of the course.

End of Life Awareness

By Prima Cura Training

This course will help you to gain a better knowledge of the policy which underpins end of life care. It will help you to learn about the delivery of great end of life care and improve your communication skills to strengthen working relationships during this period. You will also feel you have a better understanding on how to support the friends and family of the person that you are caring for.

Search By Location

- Course Courses in London

- Course Courses in Birmingham

- Course Courses in Glasgow

- Course Courses in Liverpool

- Course Courses in Bristol

- Course Courses in Manchester

- Course Courses in Sheffield

- Course Courses in Leeds

- Course Courses in Edinburgh

- Course Courses in Leicester

- Course Courses in Coventry

- Course Courses in Bradford

- Course Courses in Cardiff

- Course Courses in Belfast

- Course Courses in Nottingham