- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

70 CV courses delivered Live Online

Value Stream Management Foundation (DevOps Institute)

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for People working in an organization aiming to improve performance, especially in response to digital transformation or disruption. Any roles involved in the creation and delivery of products or services: Leadership and CXO, especially CIO, CTO, CPO, and CVO Transformation and evolution leads and change agents Value stream architects, managers, engineers Scrum Masters, agile and DevOps coaches and facilitators Portfolio, product and project managers, and owners Business analysts Architects, developers, and engineers Release and environment managers IT Ops, service and support desk workers Customer experience and success professionals Overview After completing this course, students will be able to: Describe the origins of value stream management and key concepts such as flow, value, and delivery Describe what value stream management is, why it's needed and the business benefits of its practice Describe how lean, agile, DevOps, and ITSM principles contribute to value stream management Identify and describe value streams, where they start and end, and how they interconnect Identify value stream roles and responsibilities Express value streams visually using mapping techniques, define current and target states and hypothesis backlog Write value stream flow and realization optimization hypotheses and experiments Apply metrics such as touch/processing time, wait/idle time, and cycle time to value streams Understand flow metrics and how to access the data to support data-driven conversations and decisions Examine value realization metrics and aligning to business outcomes, and how to sense and respond to them (outcomes versus outputs) Architect a DevOps toolchain alongside a value stream and data connection points Design a continuous inspection and adaptation approach for organizational evolution The Value Stream Management Foundation course from Value Stream Management Consortium, and offered in partnership with DevOps Institute, is an introductory course taking learners through a value stream management implementation journey. It considers the human, process, and technology aspects of this way of working and explores how optimizing value streams for flow and realization positively impacts organizational performance. History and Evolution of Value Stream Management and its Application Value stream management?s origins Definitions of value stream management Flow Lean and systems thinking and practices Agile, DevOps and other frameworks Research and analysis Identifying Value Streams What is a value stream? Identifying value streams Choosing a value stream Digital value streams Value stream thinking Mapping Value Streams Types of maps Value stream mapping The fuzzy front end Artifacts 10 steps to value stream mapping Mapping and management VSM investment case Limitations of value stream mapping Connecting DevOps Toolchains CICD and the DevOps toolchain Value stream management processes Value stream management platforms DevOps tool categories Building an end-to-end DevOps toolchain Common data model and tools integrations Value Stream Metrics The duality of VSM Downtime in technology Lean, DORA and Flow metrics Definition of Done Value metrics Benefits hypotheses Value streams as profit centers KPIs and OKRs Inspecting the Value Stream 3 Pillars of Empiricism Organizational performance Visibility When to inspect Data and discovery Insights and trends Organizing as Value Streams Value stream alignment Team types and topologies Project to product Hierarchy to autonomy Target Operating Model Value stream people Value stream roles Value stream funding Evolving Value Streams Why now? Transitions VSM capability matrix VSM culture iceberg Learning Making local discoveries global improvements Managing value stream interdependencies

VMware vRealize Automation SaltStack SecOps: Deploy and Manage [V8.6]

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Security administrators who are responsible for using SaltStack SecOps to manage the security operations in their enterprise Overview By the end of the course, you should be able to meet the following objectives: Describe the architecture of SaltStack Config and SaltStack SecOps Integrate SaltStack Config with directory services. Configure roles and permissions for users and groups to manage and use SaltStack SecOps Use targeting to ensure that the jobs run on the correct minion systems Use remote execution modules to install the packages, transfer files, manage services, and manage users on minion systems Manage configuration control on the minion systems with states, pillars, requisites, and declarations Use Jinja and YAML code to manage the minion systems with the state files Enforce the desired state across minion systems automatically Use SaltStack SecOps to update the compliance and vulnerability content libraries Use SaltStack SecOps to enforce compliance and remediation on the infrastructure with industry standards Use SaltStack SecOps to provide automated vulnerability scanning and remediation on your infrastructure This two-day, hands-on training course provides you with the advanced knowledge, skills, and tools to achieve competency in using VMware vRealize© Automation SaltStack© SecOps. SaltStack SecOps allows you to scan your system for compliance against security benchmarks, detect system vulnerabilities, and remediate your results. This course enables you to create the SaltStack SecOps custom compliance libraries and use SaltStack SecOps. In addition, this course provides you with the fundamentals of how to use VMware vRealize© Automation SaltStack© Config to install software and manage system configurations. Course Introduction Introductions and course logistics Course objectives SaltStack Config Architecture Identify the SaltStack Config deployment types Identify the components of SaltStack Config Describe the role of each SaltStack Config component SaltStack Config Security Describe local user authentication Describe LDAP and Active Directory authentication Describe the roles and permissions in vRealize Automation for SaltStack Config Describe the roles and permissions in SaltStack Config Describe the SecOps permissions in SaltStack Config Describe the advanced permissions available in SaltStack Config Targeting Minions Describe targeting and its importance Target minions by minion ID Target minions by glob Target minions by regular expressions Target minions by lists Target minions by compound matching Target minions by complex logical matching Remote Execution and Job Management Describe remote execution and its importance Describe functions and arguments Create and manage jobs Use the Activities dashboard Configuration Control Through States, Pillars, Requisites, and Declarations Define the SaltStack states Describe file management in SaltStack Config Create the SaltStack state files Identify the components of a SaltStack state Describe pillar data and the uses of pillar data Configure pillar data on the SaltStack Config master server Use pillar data in variables in the state files Describe the difference between IDs and names in the state files Use the correct execution order Use requisites in the state files Using Jinja and YAML Describe the SaltStack Config renderer system Use YAML in the state files Use Jinja in the state files Use Jinja conditionals, lists, and loops Using SaltStack SecOps Comply Describe the SaltStack SecOps Comply architecture Describe CIS and DISA STIG benchmarks Describe the SaltStack SecOps Comply security library Describe the remediation differences between SaltStack SecOps and VMware Carbon Black© Create and manage the policies Create and manage the custom checks Run assessments on the minion systems Use SaltStack SecOps to remediate the noncompliant systems Manage the SaltStack SecOps Comply configuration options Manage the benchmark content ingestion Using SaltStack SecOps Protect Describe Common Vulnerabilities and Exposures (CVEs) Use the Protect dashboard Create and manage the policies Update the vulnerability library Run the vulnerability scans Remediate the vulnerabilities Manage the vulnerability exemptions

![VMware vRealize Automation SaltStack SecOps: Deploy and Manage [V8.6]](https://cademy-images-io.b-cdn.net/9dd9d42b-e7b9-4598-8d01-a30d0144ae51/4c81f130-71bf-4635-b7c6-375aff235529/original.png?width=3840)

Administering Cisco UCS X-Series Solutions with Intersight (INTUCSX)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for The primary audience for this course is as follows: Server Administrators Systems Engineers Storage Administrators Technical Solutions Architects Integrators and Partners Consulting Systems Engineers Network Administrators Network Engineers Network Managers Architects Overview Upon completion of this course, the student will be able to meet these overall objectives: Understand, describe, and configure Cisco Intersight (on prem and SaaS models) Understand, describe, and configure Intersight Advanced features (IST, ICO, IWOM) Understand, describe, and configure IMM and UMM mode for UCS Understand, describe, and configure Cisco X-Series (FI, IFM, X210c Server, Adv Fabric Module) Create Intersight Pools, Policies, and Management for X-Series Design and operate Cisco UCS with Intersight Managed Mode Solutions This deep-dive training covers Cisco UCS X-Series server family and how Intersight can be the enablement platform for all UCS servers. We will cover Intersight features such as IWOM, IST, ICO, and programmability either On-Prem or in the Cloud. Attendees will learn the breadth of the physical X-Series (pools, policies, firmware, so much more) platform as well as maintaining existing infrastructure with Intersight Infrastructures Services. Also covered is how to manage physical, virtual, cloud platforms and deploy to any or all. Section 1: Intersight Foundations Intersight Architecture Flexible Deployment Models Cisco Intersight Infrastructure Service Licensing Intersight Essentials License Tier Intersight Advantage License Tier Intersight Premier License Tier Section 2: Monitoring and Maintaining UCS Infrastructure with Intersight Device Health and Monitoring Standalone Management for UCS C-Series Servers Server Compatibility (HCL), Advisories (CVEs), and Contract Status Firmware Upgrades Section 3: Designing & Operationalizing Cisco UCS Solutions with Intersight Implementing Cisco Hyperflex with Intersight Managing Cisco HyperFlex in vSphere Environment Section 4: Cisco UCS M5, M6, X Overview and Configuration Cisco UCS X-Series with Intersight Deployment Architecture X-Series Fabric Interconnects Compute X-Series Power/Cooling Efficiency Cooling Capacity Airflow Thermal Policies Future-Proof Cooling Power Policies Compute Series Architecture ? C220 M6 Architecture ? C240 M6 Cisco VIC Offerings for M6 GPU Offerings for X-Series Management Options for C220 / C240 M6 Rack Servers UCS 7th Generation Intel Rack Servers Architecture ? C220 M7 Architecture ? C240 M7 Intel 4th Gen Intel© Xeon© SP Sapphire Rapids High Level Features M7 Memory DIMMs Architecture ? C225 M6 Architecture ? C245 M6 Section 5: Designing Cisco UCS LAN and SAN Connectivity LAN Connectivity Overview Gen 4 End Host Mode Requirements for Configuring VLANs in Cisco UCS Manager Role of the vNIC in Abstracting MAC Addresses Configuring Compute Node SAN Connectivity Fibre Channel Switching Fibre Channel Operating Modes EHM and N-Port Virtualization Configuring VSANs in Cisco UCS Manager Creating VSANs and FCoE VLANs in Cisco UCS Role of vHBAs when Abstracting WWNNs and WWPNs into a Service Profile Configuring Manual Uplink Pinning and Recovery from Failure Section 6: Configuring Cisco UCS-X in IMM Mode IMM and Domain Profiles Domain Policy Concepts and Usage Cisco Intersight Server Profiles Creating and Deploying a UCS C-Series Server Profile ? Process Overview Importing a Server Profile ? Process Overview Upgrading Firmware Cisco IMM Transition Tool Thermal Policies Power Policies Section 7: Implementing Cisco UCS-X Firmware Updates Intersight Platform Firmware Operations Overview Intersight Firmware Bundles Cisco Stand-Alone Firmware Management Cisco HX Firmware Management UCS Managed Infrastructure Firmware Management UCS Intersight Managed Mode Firmware Management Hardware Compatibility List Section 8: Intersight Workload Optimizer (IWO) Intersight Workload Optimizer Overview IWO Delivery and Tiers Workload Optimizer ? What?s New? IWO Value Proposition Application Resource Management IWO Market Section 9: Intersight Cloud Orchestrator (ICO) Sample Scenario Workflow Designer Validate and Execute a Workflow ICO ? Intersight Cloud Orchestrator Infrastructure Orchestration Infrastructure as Code with ICO Immutability with Intersight Cloud Orchestrator Workflow Versions Rollback Tasks (Task Designer) Section 10: Intersight API Overview Intersight API Resources SDKs / Ansible Modules Use Case Additional course details: Nexus Humans Administering Cisco UCS X-Series Solutions with Intersight (INTUCSX) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Administering Cisco UCS X-Series Solutions with Intersight (INTUCSX) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Cisco Implementing and Operating Cisco Security Core Technologies v1.0 (SCOR)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for Security engineer Network engineer Network designer Network administrator Systems engineer Consulting systems engineer Technical solutions architect Network manager Cisco integrators and partners Overview After taking this course, you should be able to: Describe information security concepts and strategies within the network Describe common TCP/IP, network application, and endpoint attacks Describe how various network security technologies work together to guard against attacks Implement access control on Cisco ASA appliance and Cisco Firepower Next-Generation Firewall Describe and implement basic email content security features and functions provided by Cisco Email Security Appliance Describe and implement web content security features and functions provided by Cisco Web Security Appliance Describe Cisco Umbrella security capabilities, deployment models, policy management, and Investigate console Introduce VPNs and describe cryptography solutions and algorithms Describe Cisco secure site-to-site connectivity solutions and explain how to deploy Cisco Internetwork Operating System (Cisco IOS) Virtual Tunnel Interface (VTI)-based point-to-point IPsec VPNs, and point-to-point IPsec VPN on the Cisco ASA and Cisco Firepower Next-Generation Firewall (NGFW) Describe and deploy Cisco secure remote access connectivity solutions and describe how to configure 802.1X and Extensible Authentication Protocol (EAP) authentication Provide basic understanding of endpoint security and describe Advanced Malware Protection (AMP) for Endpoints architecture and basic features Examine various defenses on Cisco devices that protect the control and management plane Configure and verify Cisco IOS software Layer 2 and Layer 3 data plane controls Describe Cisco Stealthwatch Enterprise and Stealthwatch Cloud solutions Describe basics of cloud computing and common cloud attacks and how to secure cloud environment The Implementing and Operating Cisco Security Core Technologies (SCOR) v1.0 course helps you prepare for the Cisco© CCNP© Security and CCIE© Security certifications and for senior-level security roles. In this course, you will master the skills and technologies you need to implement core Cisco security solutions to provide advanced threat protection against cybersecurity attacks. You will learn security for networks, cloud and content, endpoint protection, secure network access, visibility, and enforcements. You will get extensive hands-on experience deploying Cisco Firepower© Next-Generation Firewall and Cisco Adaptive Security Appliance (ASA) Firewall; configuring access control policies, mail policies, and 802.1X Authentication; and more. You will get introductory practice on Cisco Stealthwatch© Enterprise and Cisco Stealthwatch Cloud threat detection features. This course, including the self-paced material, helps prepare you to take the exam, Implementing and Operating Cisco Security Core Technologies (350-701 SCOR), which leads to the new CCNP Security, CCIE Security, and the Cisco Certified Specialist - Security Core certifications. Describing Information Security Concepts* Information Security Overview Assets, Vulnerabilities, and Countermeasures Managing Risk Vulnerability Assessment Understanding Common Vulnerability Scoring System (CVSS) Describing Common TCP/IP Attacks* Legacy TCP/IP Vulnerabilities IP Vulnerabilities Internet Control Message Protocol (ICMP) Vulnerabilities TCP Vulnerabilities User Datagram Protocol (UDP) Vulnerabilities Attack Surface and Attack Vectors Reconnaissance Attacks Access Attacks Man-in-the-Middle Attacks Denial of Service and Distributed Denial of Service Attacks Reflection and Amplification Attacks Spoofing Attacks Dynamic Host Configuration Protocol (DHCP) Attacks Describing Common Network Application Attacks* Password Attacks Domain Name System (DNS)-Based Attacks DNS Tunneling Web-Based Attacks HTTP 302 Cushioning Command Injections SQL Injections Cross-Site Scripting and Request Forgery Email-Based Attacks Describing Common Endpoint Attacks* Buffer Overflow Malware Reconnaissance Attack Gaining Access and Control Gaining Access via Social Engineering Gaining Access via Web-Based Attacks Exploit Kits and Rootkits Privilege Escalation Post-Exploitation Phase Angler Exploit Kit Describing Network Security Technologies Defense-in-Depth Strategy Defending Across the Attack Continuum Network Segmentation and Virtualization Overview Stateful Firewall Overview Security Intelligence Overview Threat Information Standardization Network-Based Malware Protection Overview Intrusion Prevention System (IPS) Overview Next Generation Firewall Overview Email Content Security Overview Web Content Security Overview Threat Analytic Systems Overview DNS Security Overview Authentication, Authorization, and Accounting Overview Identity and Access Management Overview Virtual Private Network Technology Overview Network Security Device Form Factors Overview Deploying Cisco ASA Firewall Cisco ASA Deployment Types Cisco ASA Interface Security Levels Cisco ASA Objects and Object Groups Network Address Translation Cisco ASA Interface Access Control Lists (ACLs) Cisco ASA Global ACLs Cisco ASA Advanced Access Policies Cisco ASA High Availability Overview Deploying Cisco Firepower Next-Generation Firewall Cisco Firepower NGFW Deployments Cisco Firepower NGFW Packet Processing and Policies Cisco Firepower NGFW Objects Cisco Firepower NGFW Network Address Translation (NAT) Cisco Firepower NGFW Prefilter Policies Cisco Firepower NGFW Access Control Policies Cisco Firepower NGFW Security Intelligence Cisco Firepower NGFW Discovery Policies Cisco Firepower NGFW IPS Policies Cisco Firepower NGFW Malware and File Policies Deploying Email Content Security Cisco Email Content Security Overview Simple Mail Transfer Protocol (SMTP) Overview Email Pipeline Overview Public and Private Listeners Host Access Table Overview Recipient Access Table Overview Mail Policies Overview Protection Against Spam and Graymail Anti-virus and Anti-malware Protection Outbreak Filters Content Filters Data Loss Prevention Email Encryption Deploying Web Content Security Cisco Web Security Appliance (WSA) Overview Deployment Options Network Users Authentication Secure HTTP (HTTPS) Traffic Decryption Access Policies and Identification Profiles Acceptable Use Controls Settings Anti-Malware Protection Deploying Cisco Umbrella* Cisco Umbrella Architecture Deploying Cisco Umbrella Cisco Umbrella Roaming Client Managing Cisco Umbrella Cisco Umbrella Investigate Overview and Concepts Explaining VPN Technologies and Cryptography VPN Definition VPN Types Secure Communication and Cryptographic Services Keys in Cryptography Public Key Infrastructure Introducing Cisco Secure Site-to-Site VPN Solutions Site-to-Site VPN Topologies IPsec VPN Overview IPsec Static Crypto Maps IPsec Static Virtual Tunnel Interface Dynamic Multipoint VPN Cisco IOS FlexVPN Deploying Cisco IOS VTI-Based Point-to-Point IPsec VPNs Cisco IOS VTIs Static VTI Point-to-Point IPsec Internet Key Exchange (IKE) v2 VPN Configuration Deploying Point-to-Point IPsec VPNs on the Cisco ASA and Cisco Firepower NGFW Point-to-Point VPNs on the Cisco ASA and Cisco Firepower NGFW Cisco ASA Point-to-Point VPN Configuration Cisco Firepower NGFW Point-to-Point VPN Configuration Introducing Cisco Secure Remote Access VPN Solutions Remote Access VPN Components Remote Access VPN Technologies Secure Sockets Layer (SSL) Overview Deploying Remote Access SSL VPNs on the Cisco ASA and Cisco Firepower NGFW Remote Access Configuration Concepts Connection Profiles Group Policies Cisco ASA Remote Access VPN Configuration Cisco Firepower NGFW Remote Access VPN Configuration Explaining Cisco Secure Network Access Solutions Cisco Secure Network Access Cisco Secure Network Access Components AAA Role in Cisco Secure Network Access Solution Cisco Identity Services Engine Cisco TrustSec Describing 802.1X Authentication 802.1X and Extensible Authentication Protocol (EAP) EAP Methods Role of Remote Authentication Dial-in User Service (RADIUS) in 802.1X Communications RADIUS Change of Authorization Configuring 802.1X Authentication Cisco Catalyst© Switch 802.1X Configuration Cisco Wireless LAN Controller (WLC) 802.1X Configuration Cisco Identity Services Engine (ISE) 802.1X Configuration Supplicant 802.1x Configuration Cisco Central Web Authentication Describing Endpoint Security Technologies* Host-Based Personal Firewall Host-Based Anti-Virus Host-Based Intrusion Prevention System Application Whitelists and Blacklists Host-Based Malware Protection Sandboxing Overview File Integrity Checking Deploying Cisco Advanced Malware Protection (AMP) for Endpoints* Cisco AMP for Endpoints Architecture Cisco AMP for Endpoints Engines Retrospective Security with Cisco AMP Cisco AMP Device and File Trajectory Managing Cisco AMP for Endpoints Introducing Network Infrastructure Protection* Identifying Network Device Planes Control Plane Security Controls Management Plane Security Controls Network Telemetry Layer 2 Data Plane Security Controls Layer 3 Data Plane Security Controls Deploying Control Plane Security Controls* Infrastructure ACLs Control Plane Policing Control Plane Protection Routing Protocol Security Deploying Layer 2 Data Plane Security Controls* Overview of Layer 2 Data Plane Security Controls Virtual LAN (VLAN)-Based Attacks Mitigation Sp

Introduction to Diabetes (NORFOLK ICS ONLY)

By BBO Training

Introduction to Diabetes (2-Day Course) - Norfolk ICB OnlyThis course is for those from the Norfolk ICB only using the unique booking code. Applicants not using this code nor Identifying themselves as Norfolk ICB employees will not be able to attend.Course Description:These two days of comprehensive training are designed for nurses, nurse associates, pharmacists, paramedics, and other Allied Healthcare Professionals (AHPs), and experienced healthcare assistants (HCAs) who are new to or fairly new to the field of diabetes care. If you've recently started seeing patients with diabetes, or are planning to; this course is tailored to provide you with the fundamental knowledge and skills required to confidently care for individuals with diabetes. The primary focus is on adults with Type 2 diabetes, although key recommendations and signposting for patients with Type 1 diabetes will also be covered.Diabetes presents a significant healthcare challenge, costing the NHS £10 billion each year and impacting patients and their families. Primary care professionals play a pivotal role in managing the ever-increasing numbers of people diagnosed with Type 2 diabetes. Good diabetes care is crucial and aligns with national and local policies supported by robust NICE guidance.These interactive days of learning will incorporate various methods, including case studies, to help you progress from basic knowledge to a more confident and positive approach in reviewing and managing patients with diabetes. 2 Day Introduction to diabetes management in primary care (This is intended to provide an overview the programme may change slightly) DAY ONE 09.15 Coffee and registration 09.30 Introduction and course objectives 09.45 Setting the scene - screening, diagnosis, prediabetes, patho-physiology and symptoms, remission in Type 2 diabetes 10.45 Coffee 11.00 Type 1 Vs Type 2 Diabetes 11.20 Metabolic Syndrome and Diagnostic Criteria 11.45 Diabetes Prevention Programme 12.15 Managing Diabetes in Primary Care and Supporting Lifestyle 12.30 Lunch 13.30 Pharmacological Management of Type 2 Diabetes 14.30 Methods for Monitoring Glucose 14.45 Diabetic Emergencies (hypos, HHS and DKA) 15.15 Sick Day Rules 15.30 Action plan, evaluation, and resources 15.45 Close DAY TWO 09.15 Coffee and registration 09.30 Review progress since Day 1 09.45 Macrovascular Complications 10.15 Modifiable Risk Factors leading to CVD 11.00 Coffee 11.20 Cholesterol & Hypertension Management 12.00 Microvascular Complications 12.30 Lunch 13.30 Diabetes and Emotional Wellbeing 14.30 Case Studies 15.30 Q&A, Evaluations 15.45 CloseKey Learning Outcomes for Both Days:Upon completing this course, participants will be able to:1. Explain the physiology of diabetes and differentiate between Type 1 and Type 2 diabetes.2. Discuss methods for diagnosing diabetes and provide information to individuals newly diagnosed with Type 2 diabetes.3. Describe approaches that support achieving remission in Type 2 diabetes.4. Explain basic advice related to a healthy diet, various dietary approaches, and carbohydrate awareness.5. Discuss the modes of action of commonly used non-insulin medications.6. Identify major complications that may arise in individuals with long-standing diabetes and measures to limit or prevent them.7. Describe key advice for patients regarding the recognition and appropriate treatment of hypoglycaemia.8. Discuss DVLA guidance concerning driving and diabetes.9. Explain the risks of acute hyperglycaemia and provide advice to patients on self-managing illness periods.10. Provide examples of referral pathways to other services such as weight management, secondary care, podiatry, structured education, activity, and psychological services.11. Describe the process of routine foot review and factors influencing diabetic foot risk status.12. Discuss local recommendations for the appropriate use of blood glucose and ketone monitoring.13. Explain the key components and processes of an annual diabetes review and a self-management plan.Join us for this comprehensive 2-day course via Zoom and enhance your ability to provide effective diabetes care within primary care settings.

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Report writing (In-House)

By The In House Training Company

This very practical session is designed to enable participants to improve the impact, clarity and accuracy of their reports. It focuses equally on the two key areas - structure and writing technique. This course will help participants: Scope reports based on objective and intended readership Write a structured report Use the Fog Index to ensure readability Write grammatically correct and well-punctuated text Review and edit their work. 1 Introduction Objectives and overview Introductions and personal aims 2 What makes a good report? Practical activity and feedback 3 Before you start The planning process and scoping a report Organising information Key report headings What goes where? Writing practice and review 4 Writing tips and techniques Clear English and use of language Grammar and sentence structure Refresher in punctuation Writing in the third person The Fog Index - and how to measure readability 5 Pulling it all together Reviewing and proofing 6 Review Summary of key learning points Action planning

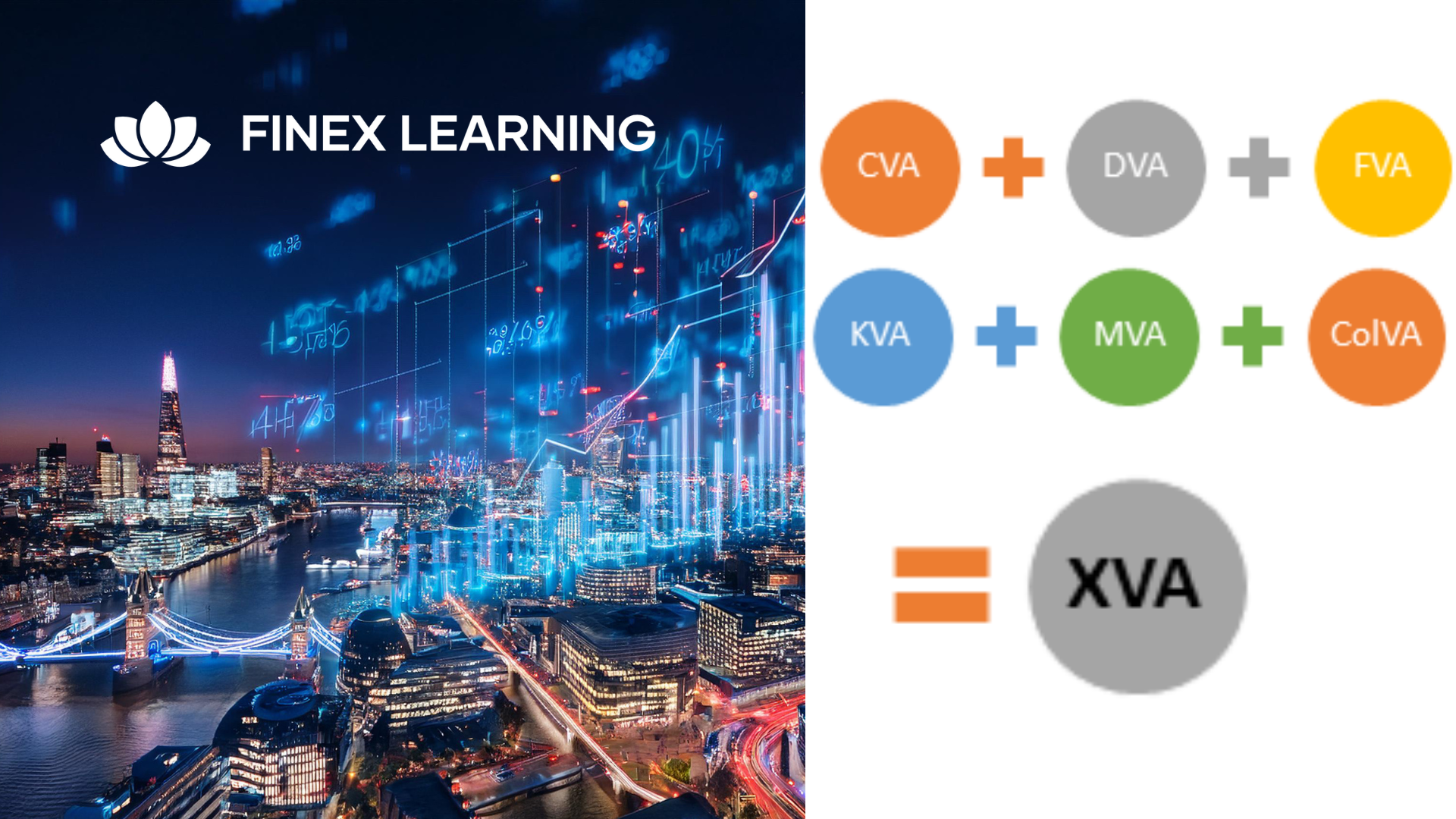

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Stress Awareness: Life Changes and Transitions. What’s Going On?

By believe-IN. Make It Happen!®

believe-IN Webinar Series: Plan the Way Out Life Changes Webinar 1: Stress awareness: life changes and transitions. What’s going on?