- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6688 Compliance courses in Bootle delivered Online

Anti-Money Laundering (AML) Training For Fee Earners Course

By DG Legal

In January 2024 alone, reports were published about the SRA taking enforcement action against 3 firms and 4 individuals for failure to comply with the Money Laundering Regulations 2017. The fines issued for these non-compliances total over £570,000 plus costs. The absence of staff training, or requirement to complete additional training, was noted in a number of these cases. Many of the breaches resulting in enforcement action involved failures by the fee earners to conduct appropriate due diligence, adequately check the source of funds and/or wealth or recognise and report red flags. As highlighted by enforcement action being taken against individuals as well as firms, fee earners cannot hide behind their firm when AML failures occur and may be held personally accountable by the SRA for non-compliances with the MLR 2017. This course will cover the following to assist fee earners in the application of AML in their casework. How to comply with your obligations and stay compliant Written CRA & MRA Client Booms Risks – what to consider? PCPs – CDD &EDD POCA / TA SOF and SOW On going monitoring Reporting to MLRO/MLCO Tipping off Target Audience The online course is suitable for fee earners or legal practitioners that want to improve their AML knowledge. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Helen Torresi, Consultant, DG Legal Helen is a qualified solicitor with a diverse professional background spanning leadership roles in both the legal and tech/corporate sectors. Throughout her career, she has held key positions such as COLP, HOLP, MLCO, MLRO and DPO for law firms and various regulated businesses and services. Helen’s specialised areas encompass AML, complaint and firm negligence handling, DPA compliance, file review and auditing, law management, and operational effectiveness in law firms, particularly in conveyancing (CQS).

Level 4 Diploma in Import/Export

By Compliance Central

***Navigate the World of Trade: Level 4 Diploma in Import/Export*** Did you know that international trade in goods and services surpassed $28 trillion in 2023? The Import/Export industry is a thriving sector, and with the right knowledge, you can be a part of it. This Level 4 Diploma in Import/Export equips you with the theoretical foundation to navigate the exciting world of international trade. This comprehensive Import/Export course delves into all aspects of Import/Export, from identifying promising products to navigating complex documentation and logistics. You'll gain the theoretical understanding to establish and operate a successful Import/Export business. Learning Outcomes At the end of this Import/Export course, you will: Gain a thorough understanding of the core principles and practices of Import/Export. Develop the ability to identify and source products for international trade. Master the art of marketing and customer acquisition in the global marketplace. Navigate the intricacies of Imp/Exp documentation and supply chain management. Confidently handle pricing, payment methods, and international shipping procedures. Develop a strong foundation for success in the dynamic world of Imp/Export. Key Highlights for Import/Export Course: CPD QS Accredited Proficiency with this Import/Export course After successfully completing the Import/Export course, you will receive a FREE PDF Certificate from REED as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials of this Import/Export course The online test with immediate results You can study and complete the Import/Export course at your own pace. Study for the Import/Export course using any internet-connected device, such as a computer, tablet, or mobile device. Module 01: Introduction to Import/Export This module provides a foundational understanding of the Import/Export industry. You'll explore the global trade landscape, international trade agreements, and the various types of Import/Export transactions. Module 02: Organising the Import/Export Operation Delve into the intricacies of setting up and managing an Imp/Exp business. This module covers essential topics like legal structures, business planning, and regulatory compliance specific to Import/Export. Module 03: Products for Your Import/Export Business Learn how to identify and source profitable products for international trade. This module explores product research, supplier selection, quality control procedures, and international trade regulations. Module 04: Target the Marketing and Find Your Customers Master the art of marketing and customer acquisition in the global marketplace. This module covers international marketing strategies, identifying target markets, and navigating cultural considerations. Module 05: Searching, Marketing, and Distribution Explore various methods for searching for international buyers and suppliers. This module delves into international marketing channels, distribution strategies, and incoterms (international commerce terms). Module 06: Documentation and Supply Chain Management Understand the crucial role of documentation in Import/Export. This module covers essential documents like commercial invoices, certificates of origin, and bills of lading. You'll also explore supply chain management strategies for efficient international trade. Module 07: Pricing, Payment and Shipping Procedure Master the intricacies of pricing your products for international markets. This module covers cost calculations, currency fluctuations, international payment methods, and choosing the right shipping options. Module 08: Necessary Tools for Trading Gain an in-depth understanding of the various theoretical resources and knowledge required for successful Import/Export. This module explores trade finance options, international trade laws, and risk management strategies. Level 4 Diploma in Import/Export Module 01: Introduction to Import/Export Module 02: Organising the Import/Export Operation Module 03: Products for Your Import/Export Business Module 04: Target the Marketing and Find Your Customers Module 05: Searching, Marketing, and Distribution Module 06: Documentation and Supply Chain Management Module 07: Pricing, Payment and Shipping Procedure Module 08: Necessary Tools for Trading Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for Free to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Who is this course for? This Import/Export course is perfect for: Import/Export Entrepreneurs Business Development Managers Marketing Executives Logistics Specialists Economics Graduates Requirements Level 4 Diploma in Import/Export To enrol in this Level 4 Diploma in Import/Export course, all you need is a basic understanding of the English Language and an internet connection. Career path Import/Export Manager International Trade Specialist Customs Broker Freight Forwarder Sourcing Specialist International Sales Manager Logistics Coordinator Compliance Officer (Import/Export) This Level 4 Diploma in Import/Export provides a springboard for a rewarding career in the ever-evolving world of international trade. Certificates CPD Accredited PDF Certificate Digital certificate - Included QLS Endorsed Hard Copy Certificate Hard copy certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Piping Stress Engineering

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) The 5 half-day Piping Stress Engineering Virtual Instructor Led Training (VILT) course will systematically expose participants to: The theory and practice of piping stress engineering, with special reference to ASME B 31.1 and ASME B 31.3 Standards. The basic principles and theories of stress and strain and piping stress engineering, through a series of lessons, case study presentations, in-class examples, multiple-choice questions (MCQs) and mandatory exercises. Principal stresses and shear stresses which form the backbone of stress analysis of a material. Expressions for these quantities will be derived using vector algebra from fundamentals. Thermal stress-range, sustained and occasional stresses, code stress equations, allowable stresses, how to increase flexibility of a piping system, cold spring. The historical development of computational techniques from hand calculations in the 1950s to the present-day software. Training Objectives On completion of this VILT course, participants will be able to: Identify potential loads the piping systems and categorise the loads to primary and secondary. Determine stresses that develop in a pipe due to various types of loads and how to derive stress-load relationships, starting from scratch. Treat the primary and secondary stresses in piping system in line with the intent of ASME Standards B 31.1 and B 31.3 and understand how the two codes deal with flexibility of piping systems, concepts of self-springing and relaxation/shake down, displacement stress range and fatigue, what is meant by code compliance. Understand the principles of flexibility analysis, piping elements and their individual effects, flexibility factor, flexibility characteristic, bending of a curved beam and importance of virtual length of an elbow in the flexibility of a piping system. Learn stress intensification factors of bends, branch connections and flanges. Understand how the stresses in the material should be controlled for the safety of the piping system, the user and the environment. Examine how codes give guidance to determine allowable stresses, stress range reduction due to cyclic loading, and effects sustained loads have on fatigue life of piping. Confidently handle terminal forces and moments on equipment. Understand the supplementary engineering standards required to establish acceptance of the equipment terminal loads and what can be done when there are no engineering standard governing equipment terminal loads is available and learn the techniques of local stress analysis. Get a thorough understanding of the concepts and the rules established by the ASME B 31.1 and ASME B 31.3 Standards. Perform flange load analysis calculations based on Kellogg's Equivalent Pressure method & Nuclear Code method. Perform the same using a piping stress analysis software and check for flange stresses and leakage. Confidently undertake formal training of piping stress analysis using any commercial software, with a clear understanding of what happens within the software rather than a 'blind' software training and start the journey of becoming a specialist piping stress engineer. Target Audience The VILT course is intended for: Recent mechanical engineering graduates who desire to get into the specialist discipline of Piping Stress Engineering. Junior mechanical, chemical, structural and project engineers in the industry who wish to understand the basics of Piping Stress Engineering. Engineers with some process plant experience who desire to progress into the much sought-after specialist disciplines of Piping Stress Engineering. Mechanical, process and structural engineers with some process plant experience who desire to upskill themselves with the knowledge in piping stress engineering and to become a Piping Stress Engineer. Any piping engineer with some pipe stressing experience in the industry who wish to understand the theory and practice of Piping Stress Engineering at a greater depth. A comprehensive set of course notes, practice exercises and multiple-choice questions (MCQs) are included. Participants will be given time to raise questions and participants will be assessed and graded based on responses to MCQs and mandatory exercises. A certificate will be issued to each participant and it will carry one of the three performance levels: Commendable, Merit or Satisfactory, depending on how the participant has performed in MCQs and mandatory exercises. Training Methods The VILT course will be delivered online in 5 half-day sessions comprising 4 hours per day, with 2 breaks of 10 minutes per day. Course Duration: 5 half-day sessions, 4 hours per session (20 hours in total). Trainer Your expert course leader is a fully qualified Chartered Professional Engineer with over 40 years of professional experience in Oil & Gas (onshore and offshore), Petrochemical and Mining industries in engineering, engineering/design management and quality technical management related to plant design and construction. At present, he is assisting a few Perth based oil & gas and mining companies in detail engineering, piping stress analysis, feasibility study and business development work related to plant design. He is a pioneer in piping stress engineering in Western Australia. His recent major accomplishments include the following roles and challenges: Quality Technical Support Manager of USD 54 billion (Gorgon LNG Project). This encompassed management of quality technical services connected with Welding, Welding Related Metallurgy, Non-Destructive Examination, Insulation /Refractory /Coating, AS2885 Pipelines Regulatory Compliance and Pressure Vessel Registration. Regional Piping Practice Lead and Lead Piping Engineer of Hatch Associates. In this role, he was responsible for providing discipline leadership to several mining projects for BHP Billiton (Ravensthorpe), ALCOA-Australia (Alumina), Maáden Saudi Arabia (Alumina), QSLIC China (Magnesium), COOEC China (O&G Gorgon). He was actively involved in the development of piping engineering practice in WA, including training and professional development of graduate, junior and senior engineers. This also includes the formation of the Piping Engineering Specialist Group. Lead Piping/Pipe Stress Engineer on ConocoPhillips' (COP) Bayu Undan Gas Recycle, Condensate production and processing platform. He was able to develop several novel design methodologies for the project and provided training to engineers on how to implement them. These methodologies were commended by COP and the underwriters of the project Lloyds Register of Shipping, UK. Creator of Piping Engineering Professional Course aimed at global engineering community. Professional Affiliations: Fellow, Institution of Mechanical Engineers, UK (IMechE) Fellow, Institution of Engineers, Australia (EA), National Register of Engineers (NER) Member American Society of Mechanical Engineers, USA (ASME) Honorary Life Member, Institution of Engineers, Sri Lanka (IESL) POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

Food Hygiene and Safety, Food Allergen & Food & Nutririon Specialist Training

4.7(47)By Academy for Health and Fitness

Unlock a world of opportunities in the thriving food industry with our comprehensive Food Hygiene and Safety, Food Allergen, and Food & Nutrition Specialist Training bundle. If you're looking to pursue a rewarding career in the culinary field, this bundle is your recipe for success. In the United Kingdom, the food industry is a robust sector with a continuous demand for skilled professionals. With the Food Hygiene and Safety, Food Allergen, and Food & Nutrition Specialist Training bundle, you'll be equipped with the essential knowledge and certifications that employers seek. From kitchen management to nutrition expertise, this bundle covers a wide spectrum of topics to ensure you're well-prepared for a diverse range of roles within the industry. Our bundle includes Food Hygiene Level 3, HACCP Food Safety Levels 1 and 2, Food Allergy Awareness, Food Labelling Regulations Training, and much more. These courses provide you with in-depth insights into food safety, allergen management, and the crucial legal aspects of food labelling. Additionally, you'll gain expertise in nutrition, kitchen management, and even food photography, making you a well-rounded professional in high demand. In the competitive culinary world, a strong foundation in these theoretical aspects sets you apart and opens doors to lucrative positions. Whether you aspire to become a Kitchen Manager, Food and Beverage Manager, or Professional Chef, this bundle lays the groundwork for your culinary journey. Don't miss the opportunity to enhance your knowledge, boost your earning potential, and meet the rising demand for skilled professionals in the UK's food industry. Your culinary future starts here. Learning Outcomes: Food safety expertise for Level 3 certification. Proficiency in HACCP Food Safety Levels 1 and 2. Comprehensive knowledge of food allergen management. Understanding of food labelling regulations and compliance. Enhanced skills in nutrition and dietary guidance. Kitchen management and team leadership capabilities. Expertise in food photography and kitchen hygiene. Dive deep into the culinary world and elevate your career prospects with our Food Hygiene and Safety, Food Allergen, and Food & Nutrition Specialist Training bundle. This comprehensive package of courses equips you with essential knowledge and certifications to excel in the dynamic food industry. Explore the nuances of food safety, earning a Level 3 certification to ensure compliance with industry standards. Master HACCP Food Safety Levels 1 and 2, the foundation of a successful food handling career. Gain insights into food allergen awareness and labelling regulations, setting you on the path to becoming a compliance expert. Delve into the art and science of nutrition, understanding how food impacts health, fitness, and mood. Learn essential kitchen management and team leadership skills to efficiently run culinary operations. Discover the secrets of food photography and ensure impeccable kitchen hygiene standards. By completing this bundle, you'll emerge as a versatile professional ready to tackle diverse roles in the food industry. From nutrition consultants to kitchen managers, food photographers, and even professional chefs, the possibilities are endless. CPD 180 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring Nutrition Consultants Kitchen Managers Food Photographers Culinary Enthusiasts Career path Nutrition Consultant: £25,000 - £50,000 per year. Kitchen Manager: £20,000 - £40,000 per year. Food Photographer: £20,000 - £50,000 per year. Professional Chef: £25,000 - £45,000 per year. Food and Beverage Manager: £25,000 - £50,000 per year. Compliance Specialist: £25,000 - £45,000 per year. Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

SAM02: Regulatory Requirements and Guidance on Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we explain how to advertise and promote prescription drugs in various media, whether to healthcare professionals or consumers, in compliance with legal requirements and guidance from the FDA.

In the ever-evolving landscape of healthcare administration in the UK, the demand for skilled Medical Receptionists and Medical Transcriptionists has surged, presenting challenges in efficient patient care and accurate medical documentation. Recent issues in the Medical Receptionist sector have highlighted the critical need for professionals adept at juggling administrative tasks and ensuring seamless communication within healthcare settings. Our comprehensive course, "Medical Receptionist & Medical Transcription - Complete Training," is meticulously designed to equip you with the diverse skill set required to thrive in these vital roles. This Medical Receptionist & Medical Transcription - Complete Training Bundle Consists of the following Premium courses: Course 01: Medical Transcription Course 02: Medical Receptionist Course 03: Medical & Clinical Administrator Course 04: Mastering Healthcare GDPR Course 05: Transcription and Captioning Course 06: Minute Taking Training Course 07: Clinical Coding Course 08: Clinical Observations Skills Course 09: Medical Coding Inpatient Training: DRG-ICD Course 10: Medical Secretary Certification Course 11: Control and Administration of Medication Course 12: Microsoft Office course Course 13: Customer Service and Communication Skills Course 14: Emergency First Aid at Work Course 15: Goal Setting, Motivation, and Resilience for Life Course 16: Personal Hygiene Course 17: Pharmacy Assistant & Pharmacy Technician Course 18: Midwifery Training Course 19: Paramedicine Study Course 20: Medical Law 10 Extraordinary Career Oriented courses that will assist you in reimagining your thriving techniques- Course 01: Effective Communication Skills Diploma Course 02: Business Networking Skills Course 03: Influencing and Negotiation Skills Course 04: Delegation Skills Training Course 05: Time Management Course 06: Leadership Skills Training Course 07: Decision Making and Critical Thinking Online Course Course 08: Emotional Intelligence and Social Management Diploma Course 09: Assertiveness Skills Course 10: Touch Typing Complete Training Diploma Medical Receptionist & Medical Transcription Learning Outcomes: Upon completion of this Medical Receptionist & Medical Transcription - Complete Training bundle, you should be able to: Efficiently manage medical transcription tasks with precision and accuracy. Navigate the complexities of healthcare GDPR for enhanced compliance. Master the art of clinical coding and observations for meticulous record-keeping. Develop essential skills in minute-taking, ensuring comprehensive meeting documentation. Acquire expertise in Microsoft Office, a fundamental tool in healthcare administration. Demonstrate proficiency in customer service and communication within medical contexts. Unlock the gateway to a fulfilling career by mastering Medical Transcription, Receptionist duties, Clinical Administration, and more. Dive into the intricacies of GDPR compliance in healthcare, sharpen your transcription and captioning skills, and gain expertise in clinical observations and coding. With a focus on practical skills such as minute-taking, medication administration, and proficiency in Microsoft Office, this Medical Receptionist & Medical Transcription course ensures you are well-prepared for the dynamic challenges of the healthcare sector. Elevate your career prospects by gaining knowledge in emergency first aid, goal setting, and resilience, setting the stage for success in the demanding field of Medical Administration. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals aspiring to excel in Medical Administration roles. Those seeking a dynamic career in healthcare support services. Professionals aiming to enhance their administrative skills in medical settings. Aspiring Medical Transcriptionists looking to contribute to accurate record-keeping. Individuals interested in mastering clinical coding and observations. Anyone pursuing a fulfilling career in the healthcare sector without traditional qualifications. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Requirements To participate in this Medical Receptionist & Medical Transcription course, all you need is - A smart device A secure internet connection And a keen interest in Medical Receptionist & Medical Transcription Career path Medical Receptionist: •21,000 - •26,000 per annum Medical Transcriptionist: •22,000 - •28,000 per annum Clinical Administrator: •25,000 - •32,000 per annum Clinical Coder: •27,000 - •34,000 per annum Pharmacy Technician: •20,000 - •26,000 per annum Paramedic: •26,000 - •32,000 per annum Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

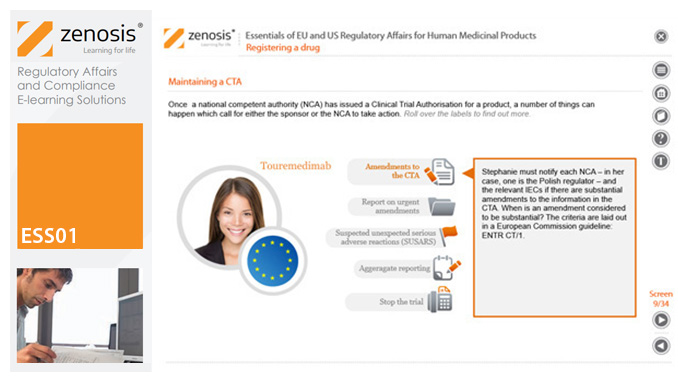

ESS01: Essentials of EU and US Regulatory Affairs for Human Medicinal Products

By Zenosis

This foundation-level module is the ideal introduction for new entrants to the field of pharmaceutical regulatory affairs and compliance. It describes the principal requirements that must be satisfied to gain and maintain approval to market medicinal products in the USA and Europe. The legal framework and the roles of major players in regulation are presented. The life-cycle of a drug is outlined. The various procedures available for assessment and approval of products are described and their requirements outlined. Obligations to be fulfilled after marketing approval are discussed.

***Limited Time Offer*** Give a compliment to your career and take it to the next level. This Business Law will provide you with the essential knowledge and skills required to shine in your professional career. Whether you want to develop skills for your next job or want to elevate skills for your next promotion, this Business Law will help you keep ahead of the pack. The Business Law incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can reinforce your professional skills and knowledge, reaching out to the level of expertise required for your position. Further, this Business Law will add extra value to your resume to stand out to potential employers. Throughout the programme, it stresses how to improve your competency as a person in your profession while at the same time it outlines essential career insights in this job sector. Consequently, you'll strengthen your knowledge and skills; on the other hand, see a clearer picture of your career growth in future. By the end of Business Law, you can equip yourself with the essentials to keep you afloat into the competition. Along with this Business Law course, you will get 10 other premium courses. Also, you will get an original Hardcopy and PDF certificate for the title course and a student ID card absolutely free. Courses are included in this Bundle: Course 01: Business Law Course 02: Commercial Law 2021 Course 03: Compliance & Business Risk Management Course 04: GDPR Data Protection Level 5 Course 05: Level 3 Tax Accounting Course 06: Investment Course 07: Business Analysis Level 3 Course 08: Budgeting and Forecasting Course 09: Fraud Management & Anti Money Laundering Awareness Complete Diploma Course 10: Business Writing Course 11: Workplace Confidentiality So, enrol now to advance your career! How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) P.S. The delivery charge inside the U.K. is £3.99 and the international students have to pay £9.99. Curriculum: Course 1: Business Law Course 2: Commercial Law 2021 01: Introduction of Commercial law 02: Business Organisations 03: International Trade: the Theory, the Institutions, and the Law 04: Sales of Goods Law 05: Consumer Law and Protection 06: E-Commerce Law 07: Competition Law Course 3: Compliance & Business Risk Management 1: Introduction to Compliance 2: Five basic elements of compliance 3: Compliance Management System (CMS) 4: Compliance Audit 5: Compliance and Ethics 6: Risk and Types of Risk 7: Introduction to Risk Management 8: Risk Management Process Course 4: GDPR Data Protection Level 5 01: GDPR Basics 02: GDPR Explained 03: Lawful Basis for Preparation 04: Rights and Breaches 05: Responsibilities and Obligations Course 5: Level 3 Tax Accounting 01: Tax System and Administration in the UK 02: Tax on Individuals 03: National Insurance 04: How to Submit a Self-Assessment Tax Return 05: Fundamentals of Income Tax 06: Payee, Payroll and Wages 07: Value Added Tax 08: Corporation Tax 09: Double Entry Accounting 10: Management Accounting and Financial Analysis 11: Career as a Tax Accountant in the UK Course 6: Investment 01: Introduction to Investment 02: Types and Techniques of Investment 03: Key Concepts in Investment 04: Understanding the Finance 05: Investing in Bond Market Course 7: Business Analysis Level 3 01: Introduction to Business Analysis 02: Business Processes 03: Business Analysis Planning and Monitoring 04: Strategic Analysis and Product Scope 05: Solution Evaluation Course 8: Budgeting and Forecasting Unit-1. Introduction Unit-2. Detail Budget Requirement Unit-3. Process of Making Budget Course 9: Fraud Management & Anti Money Laundering Awareness Complete Diploma 01: Introduction to Money Laundering 02: Proceeds of Crime Act 2002 03: Development of Anti-Money Laundering Regulation 04: Responsibility of the Money Laundering Reporting Office 05: Risk-based Approach Course 10: Business Writing Words to Cut Building Strong Sentences SCQA How to Write Punchy Summaries Words that Work, Feedback that Improves ProofReading Makes Perfect Course 11: Workplace Confidentiality 01: Introduction to workplace confidentiality 02: Business Etiquettes and Types of Confidentiality 03: The Importance of Confidentiality 04: Confidentiality with Co-workers 05: Preventing Confidentiality Breach 06: How Employers Can Protect Confidential Information CPD 120 CPD hours / points Accredited by CPD Quality Standards Certificates Certificate of completion Digital certificate - Included

AML & KYC Compliance: 8-in-1 Premium Online Courses Bundle

By Compete High

Become the compliance expert every financial institution trusts with the AML & KYC Compliance: 8-in-1 Premium Online Courses Bundle. This powerhouse bundle equips you with skills in AML regulations, KYC procedures, Employment Law, Paralegal duties, and advanced Excel and Finance knowledge. Employers highly value professionals adept in Communication Skills, Report Writing, and Administrative Skills to handle compliance workflows efficiently. Your profile will stand out in ATS systems with natural emphasis on keywords like AML, Employment Law, Paralegal, Finance, and Communication Skills. Backed by Compete High’s top reviews (4.8 Reviews.io, 4.3 Trustpilot), you get trusted, practical training that employers want. 📚 Description Compliance is the backbone of modern finance and law. This bundle trains you to handle AML monitoring, KYC verification, and Employment Law compliance seamlessly, supported by strong Administrative Skills and clear Report Writing. You’ll learn how to: Maintain compliance with global regulations Manage legal documentation as a Paralegal Use Excel and finance knowledge to track risk and report Communicate complex compliance info effectively Ideal careers include: AML Compliance Officer KYC Analyst Paralegal Assistant Compliance Administrator Financial Analyst The blend of legal, financial, and administrative training makes you a versatile, hireable candidate. ❓ FAQ Q: Is this bundle for beginners? A: Yes! Step-by-step training ensures you gain skills regardless of prior experience. Q: Will this help me get hired quickly? A: Yes, with strong emphasis on high-demand compliance roles. Q: Does it cover legal and financial skills? A: Absolutely. Includes Employment Law, Finance, and Paralegal knowledge. 🔒 Secure your compliance career now. Enrol today and become indispensable tomorrow! ⚖️📋💼

Safety controls in engineering are the backbone of any successful and efficient system. As industries push the boundaries of innovation, understanding how to integrate safety measures into engineering processes has become more important than ever. This course dives deep into the principles that govern engineering safety controls, offering a clear pathway to understanding their role in preventing accidents and ensuring smooth operations. The course is tailored to those looking to grasp the critical aspects of safety systems that engineers use daily, from hazard identification to risk assessment and the installation of safety protocols. This course is ideal for individuals keen to enhance their understanding of engineering safety without stepping foot in a physical classroom. It focuses on teaching you the skills and knowledge required to navigate the complexities of safety control systems in various engineering fields. With a focus on industry standards and the practical application of safety principles, you will gain an understanding that could support a range of careers in engineering. Whether you're a beginner or someone looking to formalise your knowledge, this course provides a structured way to advance your expertise in engineering safety controls. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 1: Introduction to Engineering and Work Practice Controls Module 2: Identification and Evaluation of Occupational Hazards Module 3: Engineering Controls Module 4: Work Practice Controls Module 5: Implementation and Maintenance of Control Measures Module 6: Environmental Sustainability and Engineering Controls Module 7: Regulatory Framework and Best Practices Learning Outcomes: Analyse occupational hazards for effective mitigation. Develop and implement robust engineering controls. Foster a culture of safety through optimal work practices. Demonstrate proficiency in control measure maintenance. Integrate environmental sustainability into engineering solutions. Navigate regulatory frameworks and apply industry best practices. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Engineers seeking advanced safety knowledge. HSE professionals enhancing their skill set. Graduates aspiring to enter the safety sector. Industry practitioners upgrading their expertise. Project managers with safety responsibilities. Environmental enthusiasts exploring safety dimensions. Regulatory compliance officers aiming for mastery. Individuals committed to fostering workplace safety. Career path Safety Engineer Environmental Health Officer Risk Assessment Specialist Compliance Analyst Health and Safety Consultant Project Safety Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.