- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

5575 Compliance courses in Formby delivered On Demand

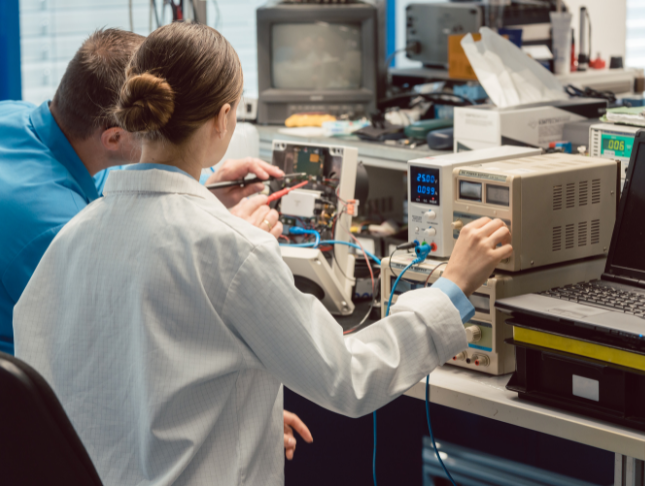

In the ever-evolving world of production, ensuring impeccable quality is paramount. 'Product Testing Protocols for Quality Assurance' offers a comprehensive dive into the methodologies and strategies vital for ensuring stellar product quality. Starting with the rudiments of product testing, the course delves deep into varied test types, utilising tools effectively, deciphering results, and the significance of adhering to global standards. With a robust curriculum encompassing everything from failure prevention to continuous improvement, this course is a passport to mastering the nuances of quality assurance in product testing. Learning Outcomes Understand the foundational principles of product testing. Identify and differentiate between various types of product tests. Master the art of designing and conducting product tests efficiently. Analyse and interpret testing outcomes to drive product quality. Recognise the importance of compliance, and adopt strategies for ongoing enhancement in product testing. Why buy this Product Testing Protocols for Quality Assurance? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Product Testing Protocols for Quality Assurance for? Quality assurance analysts and enthusiasts. Manufacturers keen on refining their product quality. Product developers aiming for benchmark quality standards. Team leaders responsible for product validation. Start-up founders launching new products and wishing to ensure top-notch quality. Career path Quality Assurance Analyst: £25,000 - £40,000 Product Testing Engineer: £30,000 - £50,000 Compliance Officer: £28,000 - £45,000 Quality Control Manager: £35,000 - £60,000 Product Development Specialist: £32,000 - £55,000 Continuous Improvement Manager: £40,000 - £70,000 Prerequisites This Product Testing Protocols for Quality Assurance does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 1: Introduction to Product Testing Introduction to Product Testing 00:11:00 Module 2: Types of Product Tests Types of Product Tests 00:16:00 Module 3: Planning and Executing Product Tests Planning and Executing Product Tests 00:15:00 Module 4: Testing Tools and Equipment Testing Tools and Equipment 00:10:00 Module 5: Interpreting Test Results Interpreting Test Results 00:11:00 Module 6: Compliance and Standards Compliance and Standards 00:09:00 Module 7: Preventing Failure and Surprises Preventing Failure and Surprises 00:14:00 Module 8: Communicating Test Results Communicating Test Results 00:18:00 Module 9: Continuous Improvement Through Testing Continuous Improvement Through Testing 00:10:00

In a world where longevity and retirement planning have become paramount, the role of Pension Consultants is undeniable. Dive into the universe of pension consultancy with the course - 'Pension Consultant Certification: Expertise in Retirement Planning.' This course doesn't merely present theories, but guides you through the intricate processes of pension schemes, their selection, and their management. As you traverse through its meticulously crafted modules, you'll gain insights into retirement planning, pension transfers, and the ever-crucial client relationship management. This is not just another certification; it's your ticket to becoming a sought-after expert in the realm of retirement planning. Learning Outcomes Understand the foundational principles of pension consulting and retirement planning. Gain the knowledge to assess, select, and implement suitable pension schemes. Acquire the capability to manage pension transfers and consolidations efficiently. Learn to develop effective pension investment strategies to maximise benefits. Familiarise with the compliance and regulatory framework governing pensions. Why buy this Pension Consultant Certification: Expertise in Retirement Planning? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Pension Consultant Certification: Expertise in Retirement Planning for? Individuals aiming to carve a niche in retirement planning. Financial planners keen to expand their service offering. Advisors wishing to enhance their pension-related knowledge. Recent graduates in finance looking to specialise in a lucrative domain. Any professional keen on understanding the nuances of pension schemes and their management. Career path Pension Consultant: £30,000 - £60,000 Retirement Planning Advisor: £35,000 - £65,000 Pension Scheme Manager: £40,000 - £70,000 Pension Investment Strategist: £45,000 - £75,000 Client Relationship Manager (Pensions): £32,000 - £67,000 Regulatory Compliance Officer (Pensions): £38,000 - £73,000. Prerequisites This Pension Consultant Certification: Expertise in Retirement Planning does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Pension Consultant Certification: Expertise in Retirement Planning was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 01: Introduction to Pension Consulting Introduction to Pension Consulting 00:24:00 Module 02: Retirement Planning and Pension Scheme Assessment Retirement Planning and Pension Scheme Assessment 00:16:00 Module 03: Pension Scheme Selection and Implementation Pension Scheme Selection and Implementation 00:18:00 Module 04: Pension Transfers and Consolidation Pension Transfers and Consolidation 00:17:00 Module 05: Pension Investment Strategies Pension Investment Strategies 00:17:00 Module 06: Maximising Pension Benefits Maximising Pension Benefits 00:16:00 Module 07: Compliance And Regulatory Framework Compliance And Regulatory Framework 00:17:00 Module 08: Communication and Client Relationship Management Communication and Client Relationship Management 00:15:00

Embarking on the labyrinthine journey of UK's corporate tax return procedures? Dive deep with our course, 'Navigating Corporate Tax Return Procedures in the UK.' This comprehensive guide sheds light on the intricacies from the very basics to emerging trends. Delve into modules that meticulously cover areas like income, expenses, tax reliefs, international considerations, and more. By the course's end, be poised to decode, manage, and even strategise for optimal taxation paths for businesses operating within the UK. Learning Outcomes Understand the fundamentals of corporate tax return procedures in the UK. Identify and manage income and expenses relevant to corporate tax returns. Analyse various tax reliefs, credits, and special schemes available to corporations. Ensure compliance with reporting obligations and handle tax investigations and disputes adeptly. Recognise emerging trends and updates in the corporate taxation landscape. Why buy this Navigating Corporate Tax Return Procedures in the UK? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success Who is this Navigating Corporate Tax Return Procedures in the UK for? Finance and accounting professionals keen on refining their tax knowledge. Business owners aiming to optimise their company's tax obligations. Academics and students aspiring for a deeper comprehension of the UK tax environment. Legal professionals looking to integrate tax considerations in their advisories. International businesses eyeing the UK market and needing to familiarise with its tax nuances. Career path Tax Consultant: £30,000 - £60,000 Corporate Tax Advisor: £40,000 - £80,000 Tax Compliance Officer: £35,000 - £65,000 Tax Strategist: £45,000 - £90,000 International Tax Manager: £50,000 - £95,000 Tax Dispute Resolution Specialist: £40,000 - £85,000 Prerequisites This Navigating Corporate Tax Return Procedures in the UK does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Module 1: Introduction to Corporate Tax Return in the UK Introduction to Corporate Tax Return in the UK 00:17:00 Module 2: Income and Expenses in Corporate Tax Returns Income and Expenses in Corporate Tax Returns 00:15:00 Module 3: Tax Reliefs, Credits, and Special Schemes Tax Reliefs, Credits, and Special Schemes 00:13:00 Module 4: Compliance and Reporting Obligations Compliance and Reporting Obligations 00:14:00 Module 5: International Tax Considerations International Tax Considerations 00:13:00 Module 6: Tax Investigation and Dispute Resolution Tax Investigation and Dispute Resolution 00:14:00 Module 7: Emerging Trends and Updates in Corporate Taxation Emerging Trends and Updates in Corporate Taxation 00:17:00 Module 8: Corporate Tax Calculation Corporate Tax Calculation 00:09:00

Professional Certificate Course in The Human Element in Loss Prevention in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course delves into system safety principles and techniques, equipping participants with the knowledge and skills to manage safety functions in various industries effectively. After the successful completion of the course, you will be able to learn about the following; Explore Rationale, Nature and Role of Motivation Theories. Learn and Apply Motivation Theories. Understand Organisational Environment and the Safety Culture. Implement Processes Focusing on Improving Safety Behaviour. Explore Workplace Safety Behavior and Conflict Management. Participants will learn about the nature and role of system safety, management strategies, elements of a system safety program plan, and tools and techniques for implementing system safety measures. The course covers job safety analysis techniques and explores effective methods for managing the safety function within organizations. Through practical examples and case studies, participants will develop the expertise needed to create and maintain a safe working environment. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Psychology and Safety; the Human Element in Loss Prevention Self-paced pre-recorded learning content on this topic. The Human Element in Loss Prevention Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be an added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone who is eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. System Safety Engineer Safety Program Manager Occupational Health and Safety Specialist Safety Compliance Officer Risk Management Analyst Safety Consultant Safety Coordinator Environmental Health Officer Safety Training Instructor Safety Program Coordinator Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Advanced Professional Certificate in International Financial Crimes

4.9(261)By Metropolitan School of Business & Management UK

Advanced Professional Certificate Courses These are short online certificate courses of a more advanced nature designed to help you develop professionally and achieve your career goals, while you earn a professional certificate which qualifies you for the appropriate continuous professional development (CPD). Advanced Professional Certificate in International Financial Crimes This Advanced professional certificate course explores the concept and evolution of financial crimes, including fraud, corruption, and money laundering principal and secondary offences. The course provides insight into relevant cases involving financial crimes, focusing on the regulatory landscape of insider dealing and market abuse. The course presents an in-depth and detailed analysis of white-collar crimes' concepts, characteristics, and effects and reflects on various white-collar crimes' civil remedies. In addition, the course explains the concept and evolution of money laundering and Identifies the three stages of money laundering, all while explaining the aim and techniques of each stage. The course provides insight into different methods used in money laundering, including trade schemes, insurance policies, and cryptocurrencies. Also, the course presents an analysis of the impact of money laundering on economic growth and financial stability. Finally, the course is designed to cover the framework of international cooperation in the fight against financial crimes. The course provides insight into various international platforms involved in this global effort, including the European Union, the United Nations, and the FATF. From this perspective, the course covers multiple topics, including market abuse and market manipulation, corruption, and money laundering. Also, the course presents an analysis of various global financial crime risk management challenges. Course Details After the successful completion of this lecture, you will be able to; Understand the concept of financial crimes. Understand the concept and the regulatory landscape of corporate fraud. Understand the concept and the regulatory landscape of bribery and corruption. Reflect on various cases involving financial crimes. Understand the concept and the regulatory landscape of insider dealing and market abuse. Reflect on money Laundering Principal offences. Understand the concept, characteristics, and effects of white-collar crimes. Reflect on various white-collar crimes civil remedies. Understand the concept and evolution of money laundering. Identify the three stages of money laundering. Understand different methods used in money laundering. Measure the impact of money laundering on economic growth. Understand the framework of international cooperation in the fight against financial crimes. Understand the European Union anti-money laundering regulatory landscape. Understand the United Nations anti-money laundering regulatory landscape. Reflect on the EU market abuse regulation. Understand the intergovernmental anti-money laundering regulatory landscape. Reflect on various global financial crime risk management challenges. Accreditation The content of this course has been independently certified as conforming to universally accepted Continuous Professional Development (CPD) guidelines. Entry Requirements There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and gets updated on current ideas in their respective field. We recommend this certificate for the following audience. Legal advisors. Compliance specialists Compliance officers Financial advisors and managers Banking professionals Accountants Real estate agents Insurance professionals Legal advisors. Law practitioners. Contract specialists. Legal officers. Contract managers. Business developers. Law lecturers. Business lecturers. Legal and business researchers.

Unlock the intricacies of the UK's Value Added Tax system with our 'Essentials of UK VAT at QLS Level 3' course. Delve into the nuances of VAT calculations, registration, and how it applies to goods, services, and even vehicles. With a curriculum that's meticulously designed, ensure you're equipped with the knowledge to manage VAT effectively, from understanding its core terminology to ensuring full compliance. Learning Outcomes Comprehend the fundamental principles and terminologies of VAT in the UK. Learn the procedures for VAT registration and the various VAT rates. Understand invoicing, record-keeping, and the meticulous process of VAT return. Gain insights into VAT exemptions, zero-rated VAT, and their applications. Stay abreast of contemporary issues, including digital tax mandates and potential penalties. Why choose this Essentials of UK VAT at QLS Level 3 course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Essentials of UK VAT at QLS Level 3 course for? Individuals aiming to enhance their knowledge of UK's taxation system. Business owners looking to grasp the VAT requirements for goods and services. Finance professionals seeking clarity on VAT compliance and exemptions. Start-ups or entrepreneurs preparing for VAT registration. Digital businesses adapting to the 'Making Tax Digital' initiative. Career path VAT Consultant: £30,000 - £55,000 Tax Compliance Officer: £28,000 - £46,000 Financial Advisor: £35,000 - £60,000 VAT Specialist: £40,000 - £65,000 Bookkeeper with VAT Specialisation: £25,000 - £38,000 Digital Tax Analyst: £32,000 - £50,000 Prerequisites This Essentials of UK VAT at QLS Level 3 does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for only £85 to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Course Curriculum Essentials of UK VAT - Updated Version Understanding VAT 00:33:00 VAT Terminology and Calculation 00:33:00 VAT Taxable Persons 00:41:00 VAT Registration 00:35:00 VAT Rates 00:28:00 Invoicing and Records 00:26:00 VAT Application in Goods, Services and Vehicles 00:27:00 Supply 00:37:00 The VAT Return 00:23:00 Tips on VAT Compliance 00:20:00 VAT Exemptions and Zero-Rated VAT 00:34:00 Miscellaneous VAT Issues and Penalties 00:38:00 Making Tax Digital 00:24:00 Essentials of UK VAT - Old Version Basics of UK VAT 00:10:00 Overview of VAT 00:10:00 Businesses and Charging VAT 00:10:00 Private Limited Company & Corporation Tax 00:15:00 Carried Forward Losses on Company Tax Return 00:05:00 The VAT Registration Threshold 00:05:00 VAT Administration Including Guidance, Rulings, Penalties and Appeals 00:35:00 Assignment Assignment - Essentials of UK VAT at QLS Level 3 00:00:00 Order your QLS Endorsed Certificate Order your QLS Endorsed Certificate 00:00:00

Messy records? Missing files? Welcome to the side of admin where everything finally makes sense. This Data Documentation and Record Keeping Course is your guide to getting things sorted—properly. You’ll learn the art of tidy records, digital documentation, smart filing systems, and how to avoid the chaos that often comes with paper trails and forgotten file names. From managing sensitive data to keeping consistent logs, the course takes you through exactly what’s needed to stay organised, stay secure, and stay one step ahead. Whether you’re in healthcare, finance, education, or any sector that still loves a good spreadsheet (and let’s be honest, that’s most of them), good record keeping isn't just useful—it’s essential. This course helps you avoid those costly errors, keep your audits painless, and make sure that everything is easy to find when needed. No fluff, just the solid know-how to keep your records neat, clear and reliable. Because when the paperwork’s right, everything else runs smoother. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 1: Introduction to Data Documentation and Record Keeping Module 2: Data Collection and Organisation Module 3: Data Storage and Retrieval Module 4: Data Documentation Strategies Module 5: Record-Keeping and Compliance Module 6: Data Security and Access Control Learning Outcomes: Master data collection techniques for comprehensive information acquisition. Implement effective strategies for organised and retrievable data storage. Develop robust documentation practices to enhance data comprehension. Ensure compliance with industry standards through meticulous record-keeping. Establish advanced data security measures and access control protocols. Navigate the complexities of the evolving data landscape with confidence. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Data analysts and entry-level professionals. IT professionals seeking to enhance data management skills. Business professionals involved in data-driven decision-making. Compliance officers and regulatory affairs specialists. Information security enthusiasts. Professionals aiming to advance their career in data management. Individuals transitioning to roles requiring data expertise. Anyone keen on mastering the intricacies of data documentation and record keeping. Career path Data Analyst Compliance Officer Information Security Analyst Records Manager Database Administrator Regulatory Affairs Specialist Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

GDPR, Data Protection, and Cyber Security Training

By Compliance Central

The General Data Protection Regulation (GDPR) has significantly increased the demand for Data Protection Officers (DPO) in the UK, leading to attractive earning opportunities for skilful GDPR professionals. Recent statistics reveal that DPOs in the UK earn an average salary of £55,000 to £75,000 per year, depending on their experience and GDPR expertise. This high earning potential further emphasises the value placed on GDPR, data protection and compliance in the digital age. Navigate the complex world of data protection regulations with our GDPR, Data Protection, and Cyber Security course. Gain the essential GDPR, Data Protection, and Cyber Security knowledge and skills to excel in this rapidly evolving field. Designed for GDPR professionals, cyber security officers, and data management individuals, equip yourself to thrive in this data-driven era. Two Free Courses are: Course 01: GDPR Training Course 02: Cyber Security So, enrol in our GDPR, Data Protection, and Cyber Security bundle now! Why would you choose the GDPR, Data Protection, and Cyber Security: Lifetime access to GDPR course materials Full tutor support is available from Monday to Friday with the GDPR course Learn GDPR skills at your own pace from the comfort of your home Gain a complete understanding of GDPR course Accessible, informative GDPR learning modules designed by expert instructors Get 24/7 help or advice from our email and live chat teams with the GDPR course Study GDPR in your own time through your computer, tablet or mobile device A 100% learning satisfaction guarantee with your GDPR course GDPR, Data Protection, and Cyber Security Training Course Curriculum Course 01: UK - GDPR Training Basics Of GDPR Principles of GDPR Legal Foundation for Processing Rights of Individuals Accountability and Governance Data Protection Officer Security Of Data Personal Data Breaches International Data Transfers After the Brexit Exemptions - Part One Exemptions - Part Two National Security and Defence Understanding Data Protection Act 2018 Course 02: Cyber Security Cyber Security and Fraud Prevention Security Investigations and Threat Awareness Laws and Regulations CPD 20 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this GDPR, Data Protection, and Cyber Security bundle. Data management or data protection professionals. Professionals seeking enhanced understanding of GDPR compliance. Compliance officers ensuring adherence to data protection regulations. HR personnel handling employee data. Requirements To enrol in this GDPR, Data Protection, and Cyber Security, all you need is a basic understanding of the English Language and an internet connection. Career path Our GDPR, Data Protection, and Cyber Security course will prepare you for a range of careers, including: Data Protection Officer - £45K-£75K per year. GDPR Compliance Manager - £40K-£60K per year. Data Privacy Consultant - £35K-£55K per year. Data Governance Analyst - £30K-£45K Per year. Privacy Officer - £30K-£50K per year. Information Security Manager - £50K-£80K per year. Certificates CPD Accredited PDF Certificate Digital certificate - Included Get a CPD accredited PDF certificate for Free. CPD Accredited Hardcopy Certificate Hard copy certificate - £10.79 Get a CPD accredited Hardcopy certificate for Free. After successfully completing this GDPR : GDPR course, you get a PDF and a hardcopy certificate for free. The delivery charge of the hardcopy certificate inside the UK is Free and international students need to pay £9.99 to get their hardcopy certificate.

Basics of Employment Law

By Online Training Academy

Unlock the essential knowledge needed to navigate the complexities of workplace regulations with our comprehensive "Basics of Employment Law" course. Designed for professionals aiming to understand and apply fundamental legal principles in employment contexts, this course covers essential modules to equip you with practical insights and compliance strategies. Key Features: CPD Certified Free Certificate from Reed CIQ Approved Developed by Specialist Lifetime Access In the Basics of Employment Law course, learners will gain a comprehensive understanding of the laws that govern workplaces. They will learn about the legalities involved in recruiting employees, including the rights and responsibilities of both employers and job applicants. Understanding employment contracts will equip learners with the knowledge to navigate the terms and conditions of employment agreements effectively. The course covers important aspects such as workplace discrimination and the rights related to parental leave, sick pay, and pension schemes. Learners will also delve into health and safety regulations to ensure a safe working environment. They will learn about employee monitoring and data protection laws, crucial for maintaining privacy and security at work. The course further explores the creation and significance of employee handbooks. Learners will grasp the concepts of minimum wage laws and disciplinary procedures, including the processes involved in dismissal, handling grievances, and participating in employment tribunals. Course Curriculum Module 01: Basics of Employment Law Module 02: Legal Recruitment Process Module 03: Employment Contracts Module 04: Discrimination in the Workplace Module 05: Parental Rights, Sick Pay and Pension Scheme Module 06: Health & Safety at Work Module 07: Workplace Monitoring and Data Protection Module 08: Employee Handbook Module 09: National Minimum Wage & National Living Wage Module 10: Disciplinary Procedure Module 11: Dismissal, Grievances and Employment Tribunals Learning Outcomes: Understand key principles of employment law and its application. Demonstrate knowledge of legal requirements in recruitment processes. Explain the components and implications of employment contracts. Identify types of workplace discrimination and legal protections. Describe rights related to parental leave, sick pay, and pensions. Outline health and safety obligations and employee responsibilities at work. CPD 10 CPD hours / points Accredited by CPD Quality Standards Basics of Employment Law 3:16:29 1: Module 01: Basics of Employment Law 16:17 2: Module 02: Legal Recruitment Process 23:35 3: Module 03: Employment Contracts 14:06 4: Module 04: Discrimination in the Workplace 27:43 5: Module 05: Parental Rights, Sick Pay and Pension Scheme 27:28 6: Module 06: Health & Safety at Work 09:35 7: Module 07: Workplace Monitoring and Data Protection 06:59 8: Module 08: Employee Handbook 13:03 9: Module 09: National Minimum Wage & National Living Wage 21:57 10: Module 10: Disciplinary Procedure 13:55 11: Module 11: Dismissal, Grievances and Employment Tribunals 20:51 12: CPD Certificate - Free 01:00 Who is this course for? HR professionals seeking legal compliance knowledge. Small business owners managing employee contracts and disputes. Individuals entering HR or administrative roles in organizations. Legal professionals expanding expertise into employment law. Managers aiming to improve workplace compliance and employee relations. Career path HR Officer Legal Advisor Compliance Manager Employee Relations Specialist Recruitment Consultant Business Owner Certificates Digital certificate Digital certificate - Included Reed Courses Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! Picture this: You're working in the financial services industry and you come across a transaction that seems suspicious. You suspect that it could be related to money laundering, but you're not quite sure. What do you do? If you're not equipped with the knowledge and skills needed to prevent financial crimes, you could end up inadvertently facilitating the very crimes you're trying to prevent. That's where KYC and AML for Preventing Financial Crime comes in. Our online course on KYC and AML is designed to provide you with the essential knowledge and skills needed to prevent financial crimes such as money laundering, terrorist financing, and fraud. Through a series of engaging and interactive modules, you will learn about the legal and regulatory frameworks surrounding KYC and AML, the types of financial crimes, and the methods used to prevent them. Enrol now and become a specialist in KYC and AML, helping to prevent financial crimes in your organisation and the wider community. With our online course, you will gain the knowledge and skills needed to make a difference in the fight against financial crimes & AML. Learning Outcomes of this KYC and AML course: Understand the concepts of KYC and AML Learn about the legal and regulatory frameworks surrounding KYC and AML Gain knowledge of the types of financial crimes Understand the methods used to prevent financial crimes Why Prefer this KYC and AML for Preventing Financial Crime Course? Opportunity to earn a certificate accredited by CPD QS after completing this KYC and AML for Preventing Financial Crime course Get a free student ID card! (£10 postal charge will be applicable for international delivery). Innovative and engaging content. Free assessments. 24/7 tutor support Curicullum Breakdown of KYC and AML for Preventing Financial Crime Course: Module 01: Introduction to KYC Module 02: Customer Due Diligence Module 03: AML (Anti-Money Laundering) Module 04: KYC, AML, and Data Privacy Regulations for Businesses Operations in the United Kingdom Module 05: Regulations to be Complied by Industries Module 06: Methods for Carrying out KYC and AML and the Future of KYC Compliance KYC and AML for Preventing Financial Crime is a comprehensive online course that provides you with the knowledge and skills needed to prevent financial crimes such as money laundering, terrorist financing, and fraud. Our course covers the essential concepts of KYC (Know Your Customer) and AML (Anti-Money Laundering) and provides you with the knowledge needed to identify and prevent financial crimes. Through a series of interactive modules, you will learn about the legal and regulatory frameworks surrounding KYC and AML, the types of financial crimes, and the methods used to prevent them. Our course is designed to be engaging and interactive, allowing you to learn at your own pace and complete the course in your own time. You will learn about the legal and regulatory frameworks surrounding KYC and AML, the types of financial crimes, and the methods used to prevent them. Our course is suitable for anyone who wants to learn about KYC and AML, including professionals in the financial services industry, compliance officers, risk managers, and anyone interested in preventing financial crimes. Assessment Process of Diploma in Know Your Customer (KYC) at QLS Level 3: You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. After passing the Advanced Diploma in Know Your Customer (KYC) at QLS Level 3 exam, you will be able to request a certificate at an additional cost that has been endorsed by the Quality Licence Scheme. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Professionals in the financial services industry Compliance officers Risk managers Anyone interested in preventing financial crimes Requirements You will not need any prior background or expertise to take this KYC and AML for Preventing Financial Crime course Career path The knowledge and skills gained from our course can be used in a range of careers in the financial services industry. Here are some job roles and their average salary range in the UK: Compliance Officer: £30,000 - £70,000 per year Risk Manager: £35,000 - £85,000 per year Anti-Money Laundering Specialist: £30,000 - £60,000 per year Fraud Investigator: £25,000 - £55,000 per year