- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

20815 Certificate of Business Continuity Programme (CBCI) courses

Chemical Skin Peels (ClinicCare) Training Course

By Cosmetic College

As the field of skin technology and products continues to evolve, skin peels have undergone a remarkable resurgence in popularity. These treatments, also known as "chemical" peels, harness the advancements in specialised products to exfoliate the skin and eliminate dead cells, providing remarkable results while ensuring client comfort. Our course will introduce you to a variety of natural acids, such as glycolic, lactic, and salicylic acid, which are used in modern skin peels. You'll learn the art of mixing peels and working with pre-mixed products, enabling you to customise treatments to address specific skincare concerns and conditions. Our comprehensive training will empower you to confidently combine various skin peels, enhancing the effectiveness of your existing facial treatments. By extending the efficacy of your services, you'll provide your clients with exceptional results and a rejuvenated complexion. Moreover, you'll gain a deep understanding of the science behind skin peels, allowing you to educate your clients on the benefits and guide them towards achieving their skincare goals. Join our Skin Peel Course and unlock the potential of these innovative treatments. With our expert guidance, you'll acquire the expertise and knowledge to become a trusted skincare professional. Course Entry Requirements: Minimum of 18 years Good command of English Previous skin and facial training are desirable; we suggest that learners new to the industry enrol on our facial and skincare course before enrolling on our ClinicCare skin peel course. Course Pre-Study/Practical & Length: This course is a combination of theory study, virtual lectures and onsite practical Course Agenda: All courses are intimate with four learners in class 2-1 ratio. Areas covered within this course are: Anatomy and Physiology of the Skin Infection control Sharps and hazardous waste Pre-study chemical peel theory Practical training 1 model Professional live demonstrations Clinical setup Acids covered in this course: Glycolic acid Kojic acid Lactic acid Enzyme peels Mandelic acid Arbutin Phytic Acid Salicylic acid Equipment / Starter Kits A professional starter kit can be purchased with this course. The kit costs 200 and is an additional cost to the training fees. Key Information A very popular treatment that is growing in popularity. Quick appointments. Minimal downtime which produces quality results. We gear the training around the use of the Clinicare brand which is well-known, reputable and produces effective results. Training in chemical skin peels is the first step for many beauty therapists to become aestheticians. 8 types of chemical peels are covered in this training course, providing you with the knowledge and skills to help clients with a wide range of skin concerns. The course offers hands-on practical training in a small group setting, allowing for personalised instruction and support from the instructor. The course covers a comprehensive curriculum, including the theory behind chemical peels and their various types, as well as practical application techniques. Upon completion, participants will receive a certificate of achievement that demonstrates their newfound knowledge and skills. The use of the Clinicare brand in the training program ensures that participants are learning with products that are highly effective and widely recognised in the beauty industry. The combination of e-learning and practical training provides participants with a well-rounded educational experience, allowing them to build their knowledge and confidence in a convenient and flexible manner. Chemical skin peels are in high demand, making this training program a valuable investment for anyone looking to expand their skills and grow their business. The course is accredited by ABT & CPD, providing participants with the assurance that the training is of high quality and meets industry standards. Course Benefits Benefits for Students Expertise in Skin Rejuvenation: By completing this training course, you will gain in-depth knowledge of chemical skin peels and their application. You will learn various peel types, their effects on the skin, and how to select the appropriate peel for different skin concerns. This expertise will enable you to provide effective treatments and achieve remarkable results for your clients. Versatility in Treating Skin Concerns: Chemical skin peels can address a wide range of skin concerns, including acne, hyperpigmentation, fine lines, and uneven skin texture. By enrolling in this course, you will acquire the skills to tailor treatments to meet individual client needs, helping them achieve healthier, smoother, and more radiant skin. Advanced Techniques and Safety: Our training course focuses on the latest techniques and safety protocols in performing chemical skin peels. You will learn about skin assessment, pre-treatment preparation, peel application methods, post-treatment care, and potential complications. This knowledge will ensure the safety of your clients and enhance your professional credibility. Practical Hands-on Experience: Practical training is an essential component of our course. You will have the opportunity to practice chemical skin peel techniques on models under the guidance of experienced instructors. This hands-on experience will boost your confidence and proficiency in performing the treatments. Benefits for Clients Personalised Treatment Plans: With your comprehensive understanding of chemical skin peels, you will be able to assess clients' skin concerns and develop customised treatment plans. This tailored approach will address their specific needs, leading to more effective and satisfactory results. Improved Skin Texture and Appearance: Chemical skin peels can significantly improve skin texture, reduce hyperpigmentation, diminish acne scars, and minimise the appearance of fine lines and wrinkles. Your expertise in performing these treatments will help clients achieve smoother, clearer, and more youthful-looking skin. Confidence and Trust: Clients will have confidence in your abilities as a trained professional in chemical skin peels. Your knowledge of different peel types and their effects, along with your commitment to safety, will build trust and assurance in your clients, creating a positive treatment experience. Earning Potential Your earning potential can increase after completing the Chemical Skin Peels (ClinicCare) Training Course: Expanded Service Offerings: With expertise in chemical skin peels, you can expand your service menu and offer a popular and in-demand treatment. This diversification can attract new clients and increase your earning potential. Client Retention and Referrals: Satisfied clients who experience positive results from chemical skin peels are more likely to become repeat customers. Additionally, they may refer friends, family, and colleagues to your practice, further growing your client base and increasing your revenue. Professional Advancement: By enhancing your skills and knowledge in chemical skin peels, you position yourself as a knowledgeable and sought-after aesthetics professional. This can lead to opportunities for career advancement, such as working in prestigious clinics, and spas, or establishing your own practice, which can contribute to higher earning potential. Frequently Asked Questions Is this training course suitable for beginners or those with prior experience? Our Chemical Skin Peels (ClinicCare) Training Course is designed for both beginners and experienced professionals in the aesthetics industry. Whether you are just starting your career or looking to enhance your skills, this course will provide you with the necessary knowledge and techniques. What will I learn in this training course? In this course, you will learn about different types of chemical skin peels, their indications, and the process of performing the treatment. You will gain a comprehensive understanding of skin anatomy, product selection, client assessment, treatment planning, application techniques, and post-treatment care. Will I receive hands-on training during the course? Yes, hands-on training is an integral part of our Chemical Skin Peels (ClinicCare) Training Course. You will have the opportunity to practice the techniques on models under the guidance and supervision of our experienced instructors. This practical experience will help you develop confidence and proficiency in performing chemical skin peels. What products or brands will be used in the training course? Our training course focuses on ClinicCare chemical skin peels. ClinicCare is a renowned brand known for its high-quality and effective skincare products. You will learn about their specific range of peels and gain hands-on experience in working with these products. Will I receive a certification upon completion of the course? Yes, upon successfully completing our Chemical Skin Peels (ClinicCare) Training Course, you will receive a certification of completion. This certification validates your training and demonstrates your competence in performing chemical skin peels using ClinicCare products. Are there any post-training support or resources available? Yes, we provide post-training support to our students. Our instructors are available to answer any questions or provide guidance even after you complete the course. Additionally, you will have access to resources and materials that can further enhance your knowledge and skills in chemical skin peels. Can I incorporate chemical skin peels into my existing practice? Absolutely! Chemical skin peels are a popular and effective treatment for various skin concerns. Upon completing the course, you will be equipped with the skills to incorporate chemical skin peels into your existing practice or start offering this service to your clients.

Level 5 Diploma in Education and Training

By Lead Academy

Are you a teacher looking to obtain QTLS - Qualified Teacher Learning and Skills status or enhance your teaching skills? You are at the right place! This comprehensive Level 5 Diploma in Education and Training | DET will equip you with the required skills to work as a teacher in the UK. This nationally recognized education and training diploma will help you advance to higher studies and become a well-trained teacher in the field of lifelong learning. No Previous Experience Needed Available to individuals from all backgrounds, regardless of their previous work experience Unlimited Tutor Support With endless support from an expert tutor, learning has never been simpler Recognised Qualification Ofqual regulation and NCFE accreditation make this course a highly reputable qualification in the industry Interest Free Instalment Plan Pay in 12 interest-free instalments and spread the cost of your purchase over time Fast Track Accelerate your success and start your rewarding career faster with the fast track program Exam Pass Guarantee We are committed to your success and will work closely with you to ensure your success in the exam Diploma in Education and Training (DET) and Post Graduate Certificate in Education (PGCE) are the same qualification. The employers do not discriminate based on the title or where you obtained the qualification. This DET qualification will help to get Qualified Teacher Learning and Skills (QTLS) status. QTLS is a professional status recognised in the Education sector. Course Highlights Course Type: Online Learning Guided Learning Hours (GLH): 360 Hours Teaching Practice Hours: 100 Hours (8 hours of observations of teaching practice) Accreditation: NCFE Qualification: Ofqual Regulated Access: 1 Year Access Certificate: Certificate upon completion (hard copy) Tutor Support- Personalised feedback on all your assignments Customer Support: 24/7 live chat available Level 5 Diploma in Education and Training This Level 5 Diploma in Education and Training | DET will set you up with the appropriate qualifications and adequate credentials that are required for you to have expertise in the field of teaching. NCFE accredits and Ofqual regulates this course, which enhances your resume as a nationally recognised qualification. Upon successful completion of this course, you will gain extensive teaching skills and knowledge to evaluate, create resources, and assist students to reach their full potential. Learning Outcomes By the end of this Level 5 Diploma in Education and Training | DET, you will: Learn to plan and deliver inclusive teaching using various approaches and models. Use behaviour management techniques to create a safe and welcoming environment. Evaluate learning using assessment theories and reflective practices. Understand how to conduct diagnostic assessments and organize inclusive teaching. Recognize the importance of professionalism and accountability in education and training. Support quality assurance and improvement efforts and understand education policies. Who should take this course? This extensive Level 5 Diploma in Education and Training is suitable for: Aspiring teachers Anyone looking to teach young people at school Anyone looking to teach adult people at a higher education level Anyone aiming to achieve Qualified Teacher Learning and Skills Status (QTLS) Entry Requirements This Level 5 Diploma in Education and Training | DET is available to all students of all academic backgrounds. No experience or previous qualifications are required. Applicants must be 19 years of age or over. Before pursuing level 5 education and training, individuals are not required to have completed level 3 or level 4 education and training. Assessment structureAssignment Students must complete a number of brief assignments for each section of the award. The guidelines are designed to assess you according to the following criteria. Each of the ten modules in this qualification has assignments. The assignments can include calls for product evidence such as lesson plans, teaching materials, and other related paperwork. Completing these assignments will allow you to fully engage with and apply the teaching and learning cycle, with feedback provided by your tutor after review. Teaching Assessment In order to properly evaluate your teaching skills, you must submit a teaching assessment that will be based on the following guidelines: You must observe for a minimum of 8 hours. Each observation should last at least 30 minutes. This means you can do 16 observations at 30 minutes or 8 observations at 1 hour each. Either way, you must complete 8 hours of observation. A teacher with appropriate credentials must complete this witness testimony. In exceptional cases, we may also arrange a video link with your tutor to complete these observations. For this training, there is no prerequisite in terms of prior experience. To get your completion certificate, however, you must complete 100 hours of classroom teaching experience throughout the course. You will need to find an expert witness with a level 5 diploma in education and training to observe your practical teaching demonstration. If you prefer, we can help you by providing an expert witness for an additional fee of £250 + VAT for 8 hours. You'll have to keep a record of teaching practise hours and observations in the provided teaching log. Additionally, you'll need to provide a teaching record and documentation of continuous personal development As previously stated, one must observe practice for at least eight hours. These observations must correspond to the following essential units: Teaching, learning and assessment in education and training (level 4) Developing teaching, learning and assessment in education and training (level 5) Progression Opportunities Upon successfully attaining the NCFE Level 5 Diploma in Education and Training, you can: Work towards attaining Qualified Teacher Learning and Skills (QTLS) Improve your chances of getting a promotion Obtain employment in a variety of teaching roles Course Curriculum Course Overview Course Overview - Level 5 Diploma in Education and Training Lesson 1: Roles Responsibilities of Teachers in Education Learning Lesson 1: Roles Responsibilities of Teachers in Education Learning Lesson 2 : Pedagogical Principles Theory and Practice Lesson 2 : Pedagogical Principles Theory and Practice Lesson 3 : Functional Skills and the Minimum Core Lesson 3 : Functional Skills and the Minimum Core Lesson 4 : Planning in Education and Learning Lesson 4 : Planning in Education and Learning Lesson 5 : Selecting, Creating and Using Resources Lesson 5 : Selecting, Creating and Using Resources Lesson 6 : Augmenting Communication through Teaching Strategies Lesson 6 : Augmenting Communication through Teaching Strategies Lesson 7 : The Assessment Process Lesson 7 : The Assessment Process Lesson 8 : Managing Learners Lesson 8 : Managing Learners Lesson 9 : Professionalism and Continued Professional Development Lesson 9 : Professionalism and Continued Professional Development Lesson 10 : Developing Designing Curriculum Lesson 10 : Developing Designing Curriculum Lesson 11 : The Professional Practice Quality Management Lesson 11 : The Professional Practice Quality Management Additional Resource Additional Resource - Level 5 Diploma in Education and Training Assignment 1: Developing Teaching, Learning and Assessment in Education and Training Assignment 1 - Developing Teaching, Learning and Assessment in Education and Training Assignment 2: Teaching, Learning and Assessment in Education and Training Assignment 2 - Teaching, Learning and Assessment in Education and Training Assignment 3: Theories, Principles and Models in Education and Training Assignment 3 - Theories, Principles and Models in Education and Training Assignment 4: Wider Professional Practice and Development in Education and Training Assignment 4 - Wider Professional Practice and Development in Education and Training Assignment 5: Develop Learning and Development Programmes Assignment 5 - Develop Learning and Development Programmes Assignment 6: Identify the Learning Needs of Organisations Assignment 6 - Identify the Learning Needs of Organisations Assignment 7: Internally Assure the Quality of Assessment Assignment 7 - Internally Assure the Quality of Assessment Assignment 8: Understanding and Managing Behaviours in a Learning Environment Assignment 8 - Understanding and Managing Behaviours in a Learning Environment Assignment 9: Understanding the Principles and Practices of Internally Assuring the Quality of Assessment Assignment 9 - Understanding the Principles and Practices of Internally Assuring the Quality of Assessments Assignment 10: Working with Individual Learners Assignment 10 - Working with Individual Learners Recognised Accreditation This Level 5 Diploma in Education and Training | DET is independently accredited by NCFE and regulated by Ofqual. It is a nationally recognised qualification that will help you pave your path to higher education and fulfil the entry requirements of any skilled-oriented job. About NCFE The National Council for Educational Awarding (NCFE) is a national educational awarding organisation that creates, develops, and accredits a range of widely accepted qualifications and awards, including those for online courses. The NCFE Functional Skills certificate is the best option for students who want to gain useful, transferable skills that will enable them to function freely, with self-assurance, and effectively in the real world. Certificate of Achievement Upon successful completion of this Level 5 Diploma in Education and Training | DET and passing the internal assessments, and practical teaching assessments, you will be awarded the qualification: NCFE Level 5 Diploma in Education and Training which is valued by all employers in the UK and globally. FAQs What is a level 5 diploma equivalent to? The Level 5 Diploma in Education and Training qualification is equivalent to the Certificate of Education (CertEd). Additionally, it is equivalent to the second year of a bachelor's degree in the UK. What can I do with a Level 5 diploma in education and training? You can advance to further vocational study, apply for Qualified Teacher Status (QTLS), and earn a Bachelor of Arts in Education or a BA in Education (BEd). Besides these progression opportunities, you can also enhance your resume and increase your chances of getting hired. What is a BTEC equivalent to? BTEC Firsts are Level 2 qualifications, which are the same as GCSE coursework. The level of BTEC Nationals is Level 3, which is the same as A-level study. BTEC Higher Nationals are at the same academic level as the first two years of a degree program (Level 4/5 studies). Do I have to conduct my practical evaluation in a real classroom or workplace? For the Level 5 Diploma in Education and Training qualification, you must be seen teaching in an actual classroom; simulation is not allowed, and your observations must be conducted in an actual classroom. Who should complete the course's observations for the practical evaluation? This witness testimony must be provided by an expert with a Level 5 Diploma in Education and Training. For an additional charge of £250 + VAT for 8 hours, if you'd prefer, we can also assist you by providing an expert witness. How is this course assessed? The course is evaluated through the submission of eight observations of your teaching in a classroom environment and writing assignments based on the course's sections. You will also be required to provide an evidence log showing that you have completed at least 100 hours of teaching. Can I submit my assignment again? Your instructor will provide feedback and the option to resubmit assignments if additional work is required. How can I produce evidence to support my lessons? The teaching session must be recorded using a smartphone, tablet, or other camera device and uploaded to your web portal in order to be graded. In addition to that, you must also provide product evidence such as lesson plans, teaching materials, and other related paperwork How much time will it take to complete this course? For the supervised study, 360 hours are allotted. However, the total amount of time we anticipate you to spend on this award, including all the research and writing tasks is 1200 hours. These hours can be distributed in any way you desire as you have the choice to complete the course whenever it's convenient for you over the course of a year. Should I obtain the level 3 award or the level 4 certificate before taking this course? It is not necessary to have finished the level 3 award in education and training or the level 4 certificate in education and training before enrolling in this course. Will this course qualify me for the Qualified Teacher Learning and Skills Status (QTLS)? The Level 5 Diploma in Education and Training will provide you with the opportunity and skills to apply for QTLS, while it does not automatically grant you this status. For how long can I access this course? You have a year to access this course, so you can complete it at your own pace and convenience. Can I teach infants and children with a level 5 diploma in education and training? Since the majority of the training is geared toward adults, you won't be able to work with young children or teach in primary settings. Do I have to finish the 100 hours of teaching before I sign up for this course? There is no prerequisite in terms of prior knowledge for this training. However, you must complete 100 hours of classroom teaching experience throughout the course to receive your completion certificate. Can I use a smartphone or a tablet to study? With no time limit on completion, our online courses are accessible for life. If there is a safe internet connection, every course is fully accessible from a tablet, phone, or laptop. What will I receive once the course is over? You will be able to order the NCFE-recognised Level 5 Diploma in Education and Training, which is governed by Ofqual, after completing the assignments and the teaching assessment. What is the difference between Level 3, Level 4 and Level 5 Education and training? Education and training levels differ in the depth of knowledge and skills acquired. Level 3 is foundational, Level 4 is subject-specific, and Level 5 is for higher expertise. Completing Level 5 can lead to Qualified Teacher Learning and Skills status. To be able to teach Level 2, one must undertake Level 3; for both Level 2 and 3, Level 4 must be completed; and for all three levels, one must take Level 5. What is the difference between QTS and QTLS? QTS is for teaching up to age 16, while QTLS covers beyond that. QTS is necessary for teaching young students, while QTLS is ideal for teaching at a higher education level. QTS requires an intensive course with work practice, while QTLS requires sector competence and 100 hours of teaching experience.

A course for leisure and professional boaters wanting to undertake more adventurous trips by day and night, this 2 day course, with at least one night navigation exercise, will provide you with an RYA Advanced Powerboat Course Completion certificate. Anyone undertaking this course must have practical skills of the Intermediate level and theory knowledge of at least Coastal Skipper/Yachtmaster level. The course is split between theory and practical, with an emphasis on the application of theory knowledge to practical situations including preperation for sea, passage and pilotage making, skippering (meteorology, rules ofg the road)), navigation at planing speed, night cruising, and emergency situations. The Advanced Powerboat Certificate of Competence can only be issued after an exam, usually taken immediately after the course. If you are looking to take this exam, please let us know and we will arrange an examiner for you. The cost of this exam is payable directly to the RYA. To take this exam your must meet the following pre-requisites: 2 years relevant experience including night pilotage As a guide; 30 days at sea, 2 days as skipper, 800 miles, 12 night hours in the past 10 years Hold a valid First Aid certificate Hold a GMDSS Short Range Certificate (SRC) or higher grade marine radio certificate Age 17 or over Power Courses Our powerboat training is currently delivered on an MCA coded 7.8m Ribcraft with a 200hp Suzuki four stroke outboard engine and an E-series Raymarine chart plotter. We maintain a 3:1 student to instructor ratio which allows our experienced RYA instructors to tailor courses to the various levels and needs on board and deliver at a manageable pace. All course costs include tea and coffee, waterproofs are available on request.

Online In-Service Inspection and Testing (PAT)

By Technique Learning Solutions

Endorsed by City & Guilds for the new 2020 2377 Electrical Equipment Maintenance and testing qualification, the course covers the requirements of the 5th Edition of The Code of Practice for the In‑Service Inspection and Testing of Electrical Equipment. The Code of Practice has been extensively updated and includes the requirements for managing and carrying out the in-service inspection and testing of electrical equipment. As part of the course, learners will have access to three practice examination tests in order to prepare for the City & Guilds In-Service Inspection and Testing of Electrical Equipment 2377. A certificate of completion is issued upon finishing the course which can then be presented to your local assessment centre in order to take the exam.

Course Introduction Covers B12 deficiency, pernicious anaemia, diagnosis, treatment and management. It also covers signs and symptoms Please note: this course is for health care professionals and nurses only. About this event Course Introduction This course concentrates on B12 deficiency, symptoms, treatments and management. The course covers B12 deficiency, pernicious anaemia, diagnosis, treatment and management. It also covers signs and symptoms of pernicious anaemia. This course is interactive and we include case studies and discuss issues regarding diagnostic testing. We review inclusion and exclusion criteria and identification of appropriate clients. Delegates will get the opportunity to review practice with hands on practical demonstrations of how to give injections correctly. We will cover administration techniques, where to give the injections and record keeping / documentation. We will discuss role and responsibilities and contraindications and precautions. The delegates will leave this course with an example of an individual protocol of Patient Specific Direction (PSD) and a competence based framework document to be used in practice. This course is very interactive. AIMS AND OBJECTIVES Understand the need for accountability and responsibility in relation to role development Demonstrate an understanding of safe practice Describe the signs and symptoms of pernicious anaemia Describe pernicious anaemia and its impact on patients Fully understand the principles, and practice B12 deficiency and B12 injections Understand the importance of safety issues related to giving injections Understand the law relating to role and function of the HCA and prescribing. Describe why patients require B12 injectionsBe able to correctly identify anatomical sites for injectionsDemonstrate correct administration techniquesDemonstrate how to correctly dispose of wasteDemonstrate correct infection control procedures and use of PPEDescribe when patients require referral and understand the importance of referral using correct clinical pathwaysDemonstrate an understanding of anaphylaxis and emergency proceduresUnderstand the need for correct prescribing proceduresBe able to document consultations following your organisations procedures COURSE CONTENTS Role and responsibilities Accountability guidelines and requirements Pernicious anaemia Blood- function B12 Deficiency Risk factors/groups Causes of B12 deficiency Diagnosis and reference ranges, testing Protocols and guidelines Factors affecting B12 diagnosis and treatment Factors affecting absorption B12 injections and common side effects Could it be B12 Deficiency Supplements Side effects and management including ADR’s Anaphylaxis Contraindications and Precautions Correct Administration and techniques including practical session Injection sites Legal Issues including consent Prescribing and Patient Specific Directions What to record Storage Disposal of injections/waste Infection control Needle stick injuries Competence and supervised practice Policies and procedures Facts and Figures Setting up and running a clinic Insurance/indemnity Research/evidence base and resources WHO SHOULD ATTEND? HCAs Nurses Doctors Pharmacists Anyone interested in Vitamin B12 deficiency and pernicious anaemia and those working with clients with B12 deficiency AB Health Group awards CPD points / certificate of attendance for each course. If you would prefer an accredited certificate by our accrediting body Aim Qualifications we can organise this. The charge for the certificate including postage is £30.

InDesign Basic to Essential Training Course

By Real Animation Works

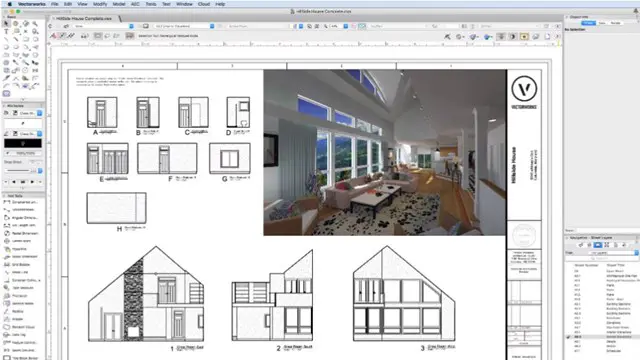

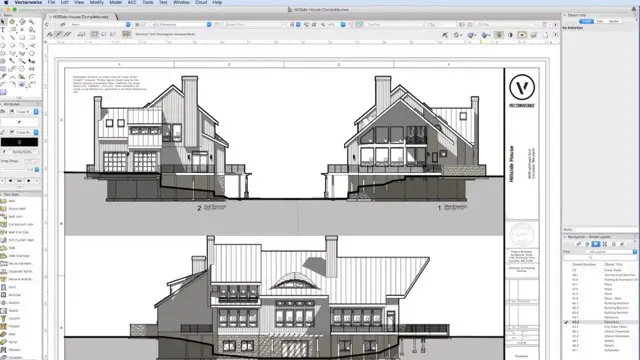

Vectorworks Evening Course face to face One to one

Vectorworks One to One training course for interior designers

By Real Animation Works

Vectorworks Evening Course face to face One to one

3ds max character animation training course 1-2-1

By Real Animation Works

face to face training customised and bespoke. One to One Online or Face to Face

Teenage Fashion Lab (11-17 years)

By Summer Fashion School London

Learn to make on-trend garments, develop your sewing & pattern cutting skills, whilst getting into the mind of a designer. We have a range of compelling and sustainable workshops taught by expert tutors and industry professionals.

AutoCAD One to One Training Course

By Real Animation Works

Autocad face to face training customised and bespoke Online or Face to Face

Search By Location

- Certificate of Business Continuity Programme (CBCI) Courses in London

- Certificate of Business Continuity Programme (CBCI) Courses in Birmingham

- Certificate of Business Continuity Programme (CBCI) Courses in Glasgow

- Certificate of Business Continuity Programme (CBCI) Courses in Liverpool

- Certificate of Business Continuity Programme (CBCI) Courses in Bristol

- Certificate of Business Continuity Programme (CBCI) Courses in Manchester

- Certificate of Business Continuity Programme (CBCI) Courses in Sheffield

- Certificate of Business Continuity Programme (CBCI) Courses in Leeds

- Certificate of Business Continuity Programme (CBCI) Courses in Edinburgh

- Certificate of Business Continuity Programme (CBCI) Courses in Leicester

- Certificate of Business Continuity Programme (CBCI) Courses in Coventry

- Certificate of Business Continuity Programme (CBCI) Courses in Bradford

- Certificate of Business Continuity Programme (CBCI) Courses in Cardiff

- Certificate of Business Continuity Programme (CBCI) Courses in Belfast

- Certificate of Business Continuity Programme (CBCI) Courses in Nottingham