- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1449 C++ courses

CNC (Computer Numerical Control) Programming - 8 Courses Bundle

By NextGen Learning

Are you ready to embark on an enlightening journey of wisdom with the CNC (Computer Numerical Control) Programming bundle, and pave your way to an enriched personal and professional future? If so, then Step into a world of knowledge with our course bundle - CNC (Computer Numerical Control) Programming. Delve into eight immersive CPD Accredited courses, each a standalone course: Course 01: An Introduction to CNC Programming Course 02: C++ Programming Certificate Course Course 03: JavaScript Basics Course 04: Computer Science With Python Course 05: Machine Learning with Python Course Course 06: Computer Simulation of Realistic Mathematical Models Course 07: Building Your Own Computer Course Course 08: 3D Modeling for 3D Printing Traverse the vast landscapes of theory, unlocking new dimensions of understanding at every turn. Let the CNC (Computer Numerical Control) Programming bundle illuminate your path to wisdom. The CNC (Computer Numerical Control) Programming bundle offers a comprehensive exploration into a rich tapestry of vast knowledge across eight carefully curated courses. The journey is designed to enhance your understanding and critical thinking skills. Each course within the bundle provides a deep-dive into complex theories, principles, and frameworks, allowing you to delve into the nuances of the subject matter at your own pace. In the framework of the CNC (Computer Numerical Control) Programming package, you are bestowed with complimentary PDF certificates for all the courses included in this bundle, all without any additional charge. Adorn yourself with the CNC (Computer Numerical Control) Programming bundle, empowering you to traverse your career trajectory or personal growth journey with self-assurance. Register today and ignite the spark of your professional advancement! So, don't wait further and join the CNC (Computer Numerical Control) Programming community today and let your voyage of discovery begin! Learning Outcomes: Attain a holistic understanding in the designated areas of study with the CNC (Computer Numerical Control) Programming bundle. Establish robust bases across each course nestled within the CNC (Computer Numerical Control) Programming bundle. Decipher intricate concepts through the articulate content of the CNC (Computer Numerical Control) Programming bundle. Amplify your prowess in interpreting, scrutinising, and implementing theories. Procure the capacity to engage with the course material on an intellectual and profound level. Become proficient in the art of problem-solving across various disciplines. Stepping into the CNC (Computer Numerical Control) Programming bundle is akin to entering a world overflowing with deep theoretical wisdom. Each course within this distinctive bundle is an individual journey, meticulously crafted to untangle the complex web of theories, principles, and frameworks. Learners are inspired to explore, question, and absorb, thus enhancing their understanding and honing their critical thinking skills. Each course invites a personal and profoundly enlightening interaction with knowledge. The CNC (Computer Numerical Control) Programming bundle shines in its capacity to cater to a wide range of learning needs and lifestyles. It gives learners the freedom to learn at their own pace, forging a unique path of discovery. More than just an educational journey, the CNC (Computer Numerical Control) Programming bundle fosters personal growth, enabling learners to skillfully navigate the complexities of the world. The CNC (Computer Numerical Control) Programming bundle also illuminates the route to a rewarding career. The theoretical insight acquired through this bundle forms a strong foundation for various career opportunities, from academia and research to consultancy and programme management. The profound understanding fostered by the CNC (Computer Numerical Control) Programming bundle allows learners to make meaningful contributions to their chosen fields. Embark on the CNC (Computer Numerical Control) Programming journey and let knowledge guide you towards a brighter future. CPD 80 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals keen on deepening their firm understanding in the respective fields. Students pursuing higher education looking for comprehensive theory modules. Professionals seeking to refresh or enhance their knowledge. Anyone with a thirst for knowledge and a passion for continuous learning. Career path Armed with the CNC (Computer Numerical Control) Programming bundle, your professional journey can reach new heights. The comprehensive theoretical knowledge from this bundle can unlock diverse career opportunities across several fields. Whether it's academic research, consultancy, or programme management, the CNC (Computer Numerical Control) Programming bundle lays a solid groundwork. Certificates CPD Accredited Certificate Digital certificate - Included CPD Quality Standard Hardcopy Certificate (FREE UK Delivery) Hard copy certificate - £9.99 Hardcopy Transcript: £9.99

Introduction to Programming with Python (v1.01)

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for This course is designed for people who want to learn the Python programming language in preparation for using Python to develop software for a wide range of applications, such as data science, machine learning, artificial intelligence, and web development. Overview In this course, you will develop simple command-line programs in Python. You will: Set up Python and develop a simple application. Declare and perform operations on simple data types, including strings, numbers, and dates. Declare and perform operations on data structures, including lists, ranges, tuples, dictionaries, and sets. Write conditional statements and loops. Define and use functions, classes, and modules. Manage files and directories through code. Deal with exceptions. Though Python has been in use for nearly thirty years, it has become one of the most popular languages for software development, particularly within the fields of data science, machine learning, artificial intelligence, and web development?all areas in which Python is widely used. Whether you're relatively new to programming, or have experience in other programming languages, this course will provide you with a comprehensive first exposure to the Python programming language that can provide you with a quick start in Python, or as the foundation for further learning. You will learn elements of the Python 3 language and development strategies by creating a complete program that performs a wide range of operations on a variety of data types, structures, and objects, implements program logic through conditional statements and loops, structures code for reusability through functions, classes, and modules, reads and writes files, and handles error conditions. Lesson 1: Setting Up Python and Developing a Simple Application Topic A: Set Up the Development Environment Topic B: Write Python Statements Topic C: Create a Python Application Topic D: Prevent Errors Lesson 2: Processing Simple Data Types Topic A: Process Strings and Integers Topic B: Process Decimals, Floats, and Mixed Number Types Lesson 3: Processing Data Structures Topic A: Process Ordered Data Structures Topic B: Process Unordered Data Structures Lesson 4: Writing Conditional Statements and Loops in Python Topic A: Write a Conditional Statement Topic B: Write a Loop Lesson 5: Structuring Code for Reuse Topic A: Define and Call a Function Topic B: Define and Instantiate a Class Topic C: Import and Use a Module Lesson 6: Writing Code to Process Files and Directories Topic A: Write to a Text File Topic B: Read from a Text File Topic C: Get the Contents of a Directory Topic D: Manage Files and Directories Lesson 7: Dealing with Exceptions Topic A: Handle Exceptions Topic B: Raise Exceptions

This level two course is aimed at beginners with no previous electrical knowledge or experience who want to enter the electrical industry. Once this course is completed, candidates will be able to get a job as an electrician’s mate, gaining further skills and real-life experience. Once you have passed this level two course, you can move on to the next step of becoming a fully qualified electrician and take the 2365 level three course. You must be over 18 to take this course. Please note this course incorporates weeks 1 to 4 of the Total Electrical 20 course.

LORRY TRAINING

By Lloyds School Of Motoring

Lloyds School of Motoring provides lorry training in our privately owned fleet of vehicles across all categories.

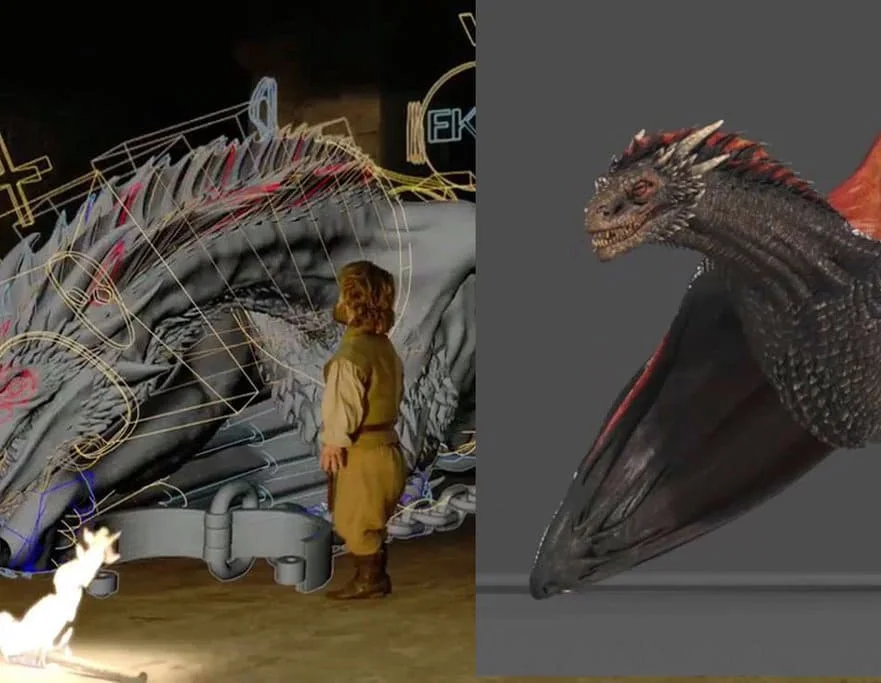

Diploma in Visual Effects for Film and Television Animation

By ATL Autocad Training London

Who is this course for? The Diploma in Visual Effects for Film and Television Animation is tailored for individuals aspiring to work in the Visual Effects, TV, Film, and 3D animation industry. Gain essential skills necessary for a successful career in these fields. Click here for more info: Website Duration: 120 hours of 1-on-1 Training. When can I book: 9 am - 4 pm (Choose your preferred day and time once a week). Monday to Saturday: 9 am - 7 pm (Flexible timing with advance booking). Course Overview for a 120-Hour Diploma Program in Game Design and Development Term 1: Introduction to Game Design and 3D Modeling (40 hours) Module 1: Introduction to Game Design (1 hour) Understanding the game development industry and current trends Exploring game mechanics and fundamental design principles Introduction to the game engines and tools utilized in the program Module 2: 3D Modeling with 3ds Max (25 hours) Familiarization with 3ds Max and its user interface Mastering basic modeling techniques like box modeling and extrusion Advanced modeling skills including subdivision and topology Texturing and shading techniques tailored for game development Module 3: Character Design and Animation (10 hours) Introduction to character design and its developmental process Creating and rigging characters specifically for games Keyframe animation techniques for character movement Term 2: Game Development and Unity 3D (40 hours) Module 4: Unity 3D Basics (20 hours) Navigating Unity 3D and understanding its interface Grasping fundamental game development concepts within Unity Creating game objects, writing scripts, and designing scenes Introduction to scripting using C# Module 5: Advanced Game Development with Unity 3D (10 hours) Constructing game mechanics including UI, scoring, and game states Working with physics and collision systems in Unity Crafting intricate game environments and level designs Module 6: Game Assets with Photoshop (10 hours) Exploring Photoshop tools and features for game asset creation Crafting game elements such as textures, sprites, and icons Optimizing assets for seamless integration into game development Term 3: Advanced Game Design and Portfolio Development (40 hours) Module 7: Advanced Game Design (20 hours) Delving into advanced game design concepts like balancing and difficulty curves Understanding player psychology and methods for engaging audiences Implementing game analytics and user testing for refinement Module 8: Portfolio Development (24 hours) Building a comprehensive portfolio showcasing acquired skills Effective presentation techniques for showcasing work Establishing a professional online presence and networking strategies Final Project: Creating and presenting a collection of best works in collaboration with tutors and fellow students Please note: Any missed sessions or absence without a 48-hour notice will result in session loss and a full class fee charge due to the personalized one-to-one nature of the sessions. Students can request pauses or extended breaks by providing written notice via email. What can you do after this course: Software Proficiency: Master industry-standard design tools for architectural and interior projects. Design Expertise: Develop a deep understanding of design principles and spatial concepts. Visualization Skills: Acquire advanced 2D/3D rendering and virtual reality skills for realistic design representation. Communication and Collaboration: Enhance communication skills and learn to collaborate effectively in design teams. Problem-Solving: Develop creative problem-solving abilities for real-world design challenges. Jobs and Career Opportunities: Architectural Visualizer Interior Designer CAD Technician Virtual Reality Developer 3D Modeler Project Coordinator Freelance Designer Visualization Consultant Students can pursue these roles, applying their expertise in architectural and interior design across various professional opportunities. Course Expectations: Maintain a dedicated notebook to compile your study notes. Schedule makeup sessions for any missed coursework, subject to available time slots. Keep meticulous notes and maintain a design folder to track your progress and nurture creative ideas. Allocate specific time for independent practice and project work. Attain certification from the esteemed professional design team. Post-Course Proficiencies: Upon successful course completion, you will achieve the following: Develop confidence in your software proficiency and a solid grasp of underlying principles. Demonstrate the ability to produce top-tier visuals for architectural and interior design projects. Feel well-prepared to pursue positions, armed with the assurance of your software expertise. Continued Support: We are pleased to offer lifetime, complimentary email and phone support to promptly assist you with any inquiries or challenges that may arise. Software Accessibility: Access to the required software is available through either downloading it from the developer's website or acquiring it at favorable student rates. It is important to note that student software should be exclusively utilized for non-commercial projects. Payment Options: To accommodate your preferences, we provide a range of payment options, including internet bank transfers, credit cards, debit cards, and PayPal. Moreover, we offer installment plans tailored to the needs of our students. Course Type: Certification. Course Level: Basic to Advanced. Time: 09:00 or 4 pm (You can choose your own day and time once a week) (Monday to Friday, 09 am to 7 pm, you can choose anytime by advance booking. Weekends can only be 3 to 4 hrs due to heavy demand on those days). Tutor: Industry Experts. Total Hours: 120 Price for Companies: £3500.00 (With VAT = £4200) For Companies. Price for Students: £3000.00 (With VAT = £3600) For Students.

Improve Your Business Agility with Flawless Execution

By IIL Europe Ltd

Improve Your Business Agility with Flawless Execution Business Agility in conjunction with a commitment to Innovation is a game-changing reality in our world. Individuals who can create ideas and act on them to build new technologies and products are emerging as the new leaders in 21st Century society. Many technology companies in areas like Silicon Valley, university innovation labs, and institutes are cultivating countless innovative ideas and processes. With all this attention, innovation in the corporate business world at C-level execution is somewhat of a mystery and quite hard to define and even harder to master. As with any journey, it begins with a first step. What simple step can you take today to understand how innovation takes place and the factors that empower it, so you can optimize the conditions for future innovation in your organization? Intentional planning that has buy-in from all stakeholders provides a bridge from ideas to executable plans. This accelerates a company's ability to both create and respond to change in order to profit in a turbulent business environment.

SALSA LESSON (BEGINNERS) FOR COUPLES & SINGLES IN HAMMERSMITH - CHISWICK EVERY WEDNESDAY @ 7 PM

5.0(62)By Club Azucar - Latin Dance

Salsa lesson for couples & singles in Hammersmith, Chiswick & Barnes with Club Azucar – Latin Dance taught by native instructor Ginu Nunez from Colombia every Monday @ 7 (Beginners) & 8:00 PM (Intermediate & Adv) @ Rivercourt Methodist church, king st, W6 9JT nearest tube station Ravenscourt Park (1-minute walk)

Overview This comprehensive course on IT For Recruiters will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This IT For Recruiters comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this IT For Recruiters. It is available to all students, of all academic backgrounds. Requirements Our IT For Recruiters is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 8 sections • 60 lectures • 05:10:00 total length •Introduction: 00:02:00 •What is hardware and software: 00:04:00 •Server: 00:08:00 •Project Life cycle: 00:06:00 •Software Development Life Cycle: 00:08:00 •Methodologies: 00:09:00 •CMS: 00:04:00 •API: 00:04:00 •CI/CD: 00:04:00 •Stacks: 00:03:00 •Native and Hybrid Native Apps: 00:02:00 •CTO: 00:13:00 •IT Architect: 00:08:00 •Product Owner: 00:12:00 •Project Manager: 00:13:00 •Product Manager: 00:06:00 •PO vs PM vs Product Manager: 00:07:00 •PO vs Product Manager: 00:04:00 •Business Analyst: 00:09:00 •Business Intelligence Specialist: 00:06:00 •Data Engineer: 00:05:00 •Data Scientist: 00:07:00 •Data Engineer vs Data Scientist: 00:07:00 •Agile Coach: 00:14:00 •Scrum Master: 00:08:00 •Agile Coach vs Scrum Master: 00:01:00 •Frontend Developer: 00:06:00 •Backend Developer: 00:06:00 •Fullstack Developer: 00:04:00 •Frontend vs Backend vs Fullstack Developer: 00:02:00 •iOS Developer: 00:03:00 •Android Developer: 00:04:00 •UX Designer: 00:10:00 •UI Designer: 00:08:00 •UX vs UI Designer: 00:04:00 •QA Engineer_Tester: 00:09:00 •SysAdmin: 00:07:00 •DevOps: 00:05:00 •SEO: 00:10:00 •Programming languages and frameworks. Intro: 00:01:00 •Programming languages and frameworks: 00:08:00 •Java: 00:03:00 •JavaScript: 00:02:00 •Python: 00:01:00 •C: 00:02:00 •C++: 00:03:00 •C#: 00:02:00 •HTML: 00:02:00 •PHP: 00:02:00 •SWIFT: 00:02:00 •Objective-C: 00:01:00 •Ruby: 00:02:00 •SQL: 00:02:00 •Go (Golang): 00:01:00 •Database: 00:05:00 •Types of Databases: 00:07:00 •The day of an IT Recruiter: 00:05:00 •Key principles: 00:03:00 •Sourcing Tipps: 00:03:00 •Good Bye Video: 00:01:00

Internet of Things - IOT for leaders

By Mpi Learning - Professional Learning And Development Provider

The Internet of Things (IoT) promises a wide range of benefits for industry, energy and utility companies, municipalities, healthcare, and consumers. Data can be collected in extraordinary volume and detail regarding almost anything worth measuring, such as public health and safety, the environment, industrial and agricultural production, energy, and utilities.

Search By Location

- C++ Courses in London

- C++ Courses in Birmingham

- C++ Courses in Glasgow

- C++ Courses in Liverpool

- C++ Courses in Bristol

- C++ Courses in Manchester

- C++ Courses in Sheffield

- C++ Courses in Leeds

- C++ Courses in Edinburgh

- C++ Courses in Leicester

- C++ Courses in Coventry

- C++ Courses in Bradford

- C++ Courses in Cardiff

- C++ Courses in Belfast

- C++ Courses in Nottingham