- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

39 Business Analytics & Intelligence courses in Edinburgh

Tableau Desktop Training - Foundation

By Tableau Training Uk

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Visual Analytics Best Practice

By Tableau Training Uk

This course is very much a discussion, so be prepared to present and critically analyse your own and class mates work. You will also need to bring a few examples of work you have done in the past. Learning and applying best practice visualisation principles will improve effective discussions amongst decision makers throughout your organisation. As a result more end-users of your dashboards will be able to make better decisions, more quickly. This 2 Day training course is aimed at analysts with good working knowledge of BI tools (we use Tableau to present, but attendees can use their own software such as Power BI or Qlik Sense). It is a great preparation for taking advanced certifications, such as Tableau Certified Professional. Contact us to discuss the Visual Analytics Best Practice course Email us if you are interested in an on-site course, or would be interested in different dates and locations This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course includes the following topics: WHAT IS VISUAL ANALYSIS? Visual Analytics Visual Analytics Process Advantages of Visual Analysis Exercise: Interpreting Visualisations HOW DO WE PROCESS VISUAL INFORMATION? Memory and Processing Types Exercise: Identifying Types of Processing Cognitive Load Exercise: Analysing Cognitive Load Focus and Guide the Viewer Remove Visual Distractions Organise Information into Chunks Design for Proximity Exercise: Reducing Cognitive Load SENSORY MEMORY Pre-attentive Attributes Quantitatively-Perceived Attributes Categorically-Perceived Attributes Exercise: Analysing Pre-attentive Attributes Form & Attributes Exercise: Using Form Effectively Colour & Attributes Exercise: Using Colour Effectively Position & Attributes Exercise: Using Position Effectively ENSURING VISUAL INTEGRITY Informing without Misleading Gestalt Principles Visual Area Axis & Scale Colour Detail Exercise: Informing without Misleading CHOOSING THE RIGHT VISUALISATION Comparing and Ranking Categories Comparing Measures Comparing Parts to Whole Viewing Data Over Time Charts Types for Mapping Viewing Correlation Viewing Distributions Viewing Specific Values DASHBOARDS AND STORIES Exercise: Picking the Chart Type Exercise: Brainstorming Visual Best Practice Development Process for Dashboards and Stories Plan the Visualisation Create the Visualisation Test the Visualisation Exercise: Designing Dashboards and Stories This training course includes over 20 hands-on exercises to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives an extensive training manual which covers the theory, practical applications and use cases, exercises and solutions together with a USB with all the materials required for the training. The course starts at 09:30 on the first day and ends at 17:00. On the second day the course starts at 09:00 and ends at 17:00. Students must bring their own laptop with an active version of Tableau Desktop 10.5 (or later) pre-installed. What People Are Saying About This Course "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G. "The course tutor Steve was incredibly helpful and taught the information very well while making the two days very enjoyable."Bradd P. "The host and his courses will give you the tools and confidence that you need to be comfortable with Tableau."Jack S. "Steve was fantastic with his knowledge and knowhow about the product. Where possible he made sure you could put demonstrations in to working practice, to give the audience a clear understanding."Tim H. "This was a very interesting and helpful course, which will definitely help me produce smarter, cleaner visualisations that will deliver more data-driven insights within our business."Richard A. "Steve is very open to questions and will go out of his way to answer any query. Thank you"Wasif N. "Steve was willing to address questions arising from his content in a full and understandable way"Lisa L. "Really enjoyed the course and feel the subject and the way it was taught was very close to my needs"James G.

Tableau Desktop Training - Analyst

By Tableau Training Uk

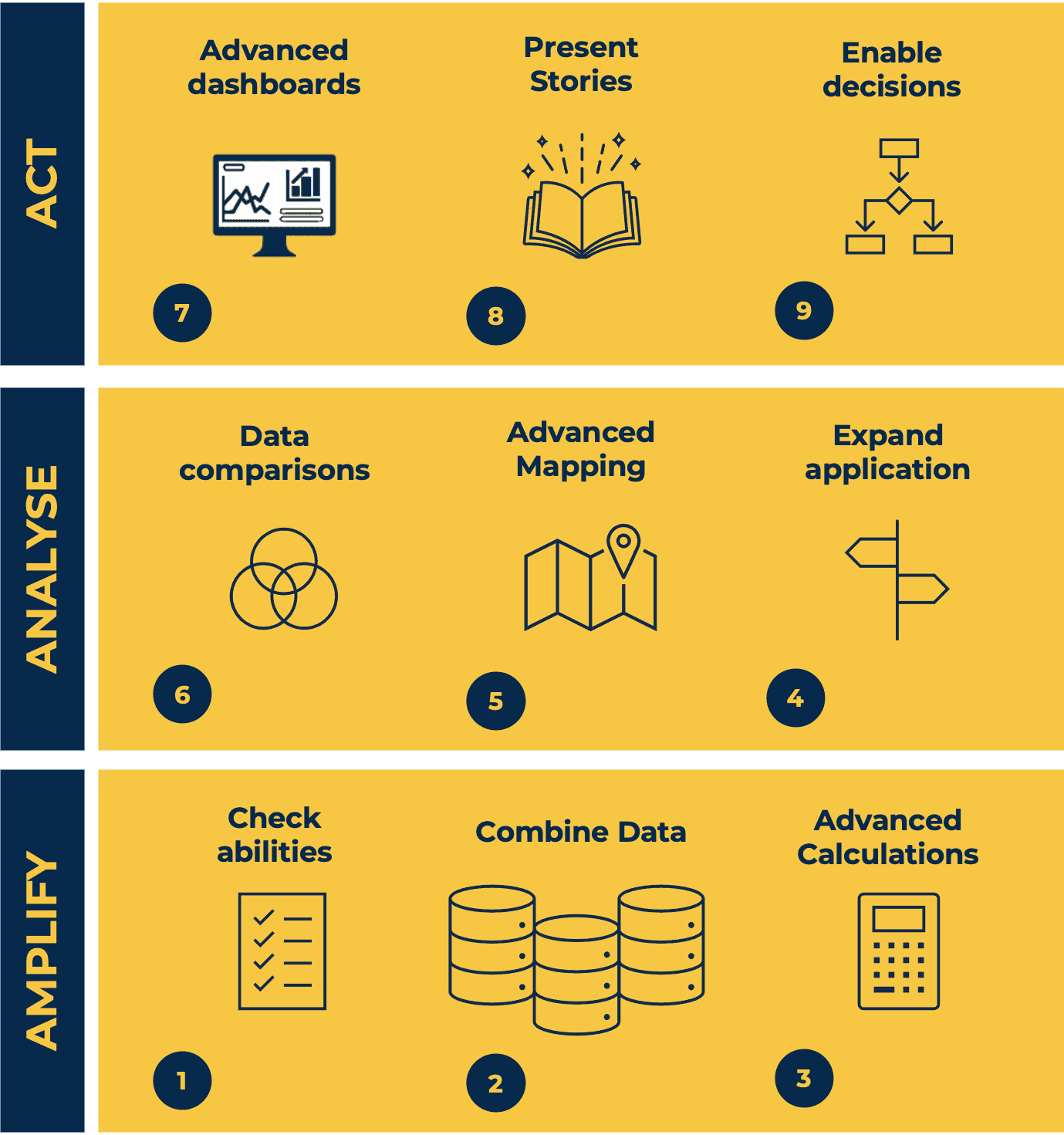

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Power BI - dashboards (1 day) (In-House)

By The In House Training Company

Power BI is a powerful data visualisation program that allows businesses to monitor data, analyse trends, and make decisions. This course is designed to provide a solid understanding of the reporting side of Power BI, the dashboards, where administrators, and end users can interact with dynamic visuals that communicates information. This course focuses entirely on the creation and design of visualisations in dashboards, including a range of chart types, engaging maps, and different types of tables. Designing dashboards with KPI's (key performance indicators), heatmaps, flowcharts, sparklines, and compare multiple variables with trendlines. This one-day programme focuses entirely on creating dashboards, by using the many visualisation tools available in Power BI. You will learn to build dynamic, user-friendly interfaces in both Power BI Desktop and Power BI Service. 1 Introduction Power BI ecosystem Things to keep in mind Selecting dashboard colours Importing visuals into Power BI Data sources for your analysis Joining tables in Power BI 2 Working with data Utilising a report theme Table visuals Matrix visuals Drilling into hierarchies Applying static filters Group numbers with lists Group numbers with bins 3 Creating visuals Heatmaps in Power BI Visualising time-intelligence trends Ranking categorical totals Comparing proportions View trends with sparklines 4 Comparing variables Insert key performance indicators (KPI) Visualising trendlines as KPI Forecasting with trendlines Visualising flows with Sankey diagrams Creating a scatter plot 5 Mapping options Map visuals Using a filled map Mapping with latitude and longitude Mapping with ArcGIS or ESRI 6 Creating dashboards High-level dashboard Migration analysis dashboard Adding slicers for filtering Promote interaction with nudge prompts Searching the dashboard with a slicer Creating dynamic labels Highlighting key points on the dashboard Customised visualisation tooltips Syncing slicers across pages 7 Sharing dashboards Setting up and formatting phone views Exporting data Creating PDF files Uploading to the cloud Share dashboards in SharePoint online

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Commercial instinct (In-House)

By The In House Training Company

An insightful, enjoyable and experiential programme to help you analyse data and information and make a balanced decision based upon sound commercial reasoning. It will enable you to identify options, make decisions and take actions based on a thorough analysis combined with instinct and intuition to make a positive effect on profitability. This programme will help you: Identify ways to analyse data and sort relevant from irrelevant information Develop analytical and numerate thinking, and consider the financial implications of a decision Make decisions based on sound commercial reasoning - a mix of intuition and analysis Select from a range of tools to analyse a situation and apply these effectively Understand how costs and profits are calculated Use tried-and-tested techniques to manage and control your budgets Appreciate the fundamentals of financial analysis Focus on the bottom line Identify the basics of capital investment appraisal for your business Evaluate results and seek opportunities for improvement to your business 1 The commercial environment What do shareholders and investors want? What do managers want? Profit v non-profit organisations Investor expectations 2 Financial and non-financial information Risk and reward considerations Drivers of commercial decisions 3 Running a business A practical exercise to bring financial statements to life Different stakeholder interests in a business The impact and consequences of decisions on financial statements 4 Where do I make a difference to the organisation? How can I contribute to an improved business performance? Key performance indicators - measuring the right things A 'balanced scorecard' approach - it's not all about money! 5 A 'balanced scorecard' approach Analysing and reviewing my contribution to the business direction What is the current focus of my commercial decisions? Developing the business in the right way - getting the balance right! Where should/could it be in the future? Do my decisions support the overall vision and strategy? 6 Making commercial decisions Left-brain and right-brain thinking Convergent and divergent thinking Analysis and instinct Interactive case study exercise - emotional and rational decisions Reflection - what is my style of making decisions 7 Let's consider the customer! Identifying target markets Differentiating propositions and products Customer service considerations Marketing considerations and initiatives Pricing strategies and considerations 8 Strategic analysis The external environment The internal environment LEPEST analysis SWOT analysis Forecasting Group activity - analysing markets and the competition How do these improve your decisions? 9 Comparing performance Analysing key financial ratios Ways to compare performance and results Break-even analysis 10 Profit and loss accounts and budgeting Managing income and expenditure The budgeting process How does this link to the profit and loss account? Managing and controlling a cost centre/budget The role of the finance department Different ways of budgeting Incremental budgeting Zero-based budgeting 11 Understanding the balance sheet Purpose of balance sheets Understanding and navigating the content What does a balance sheet tell you? How do you affect your balance sheet? Links to the profit and loss account A practical team exercise that brings financial statements to life 12 Business decisions exercise How does this improve your decisions? A practical exercise to apply new knowledge and bring commercial thinking to to life The impact and consequences of decisions on financial statements 13 Working capital Why is this important? The importance of keeping cash flowing Business decisions that affect cash Calculating profit 14 Capital investment appraisal Capex v Opex Payback Return on investment The future value of money The concept of hurdle rate 15 Lessons learned and action planning So what? Recap and consolidation of learning The decisions that I need to consider Actions to achieve my plan

Cost reduction (In-House)

By The In House Training Company

Businesses that don't control their costs don't stay in business. How well are you doing? Is everyone in your organisation sufficiently aware of costs, managing them effectively and maximising opportunities to reduce them? If there is scope for improvement, this course will help get you back on track. It will demonstrate that cost reduction is so much more than cost control and cost cutting. True cost management is about being aware of costs, seeking to reduce them through good design and efficient operating practices whilst taking continuing action on overspending. This course will develop the participants' skills in: Being aware of costs at all times Seeking cost reduction from the start (including life-cycle costing) Appraising projects / production to identify and take out risk Understanding real budgeting Using techniques such as ZBB and ABC where appropriate Ensuring cost reports lead to action Managing a cost reduction process that delivers Benefits to the organisation will include: Identification of cost reduction and business improvement opportunities Better reporting and ownership of costs Greater awareness and control of everyday costs 1 Introduction - the cost management process The risks of poor cost control Capital and revenue costs The importance of cost awareness The importance of cost reduction Cost management - the key aspects How to build a cost management and control process checklist for your areas of responsibility 2 Cost removal - taking out costs Cost awareness Costs of poor design / poor processes Value engineering Removing redundant costs 3 The need for commercial, technical and financial appraisals Understand the problems before cash is committed and costs incurred Making the effort to identify commercial and technical risk The time value of money - DCF techniques for long term projects Cost models for production processes and projects Costing models - project appraisals The use of spreadsheets to identify sensitivity and risk How to focus on risk management 4 Budgeting - proper budgeting challenges costs The philosophy of the business - are costs an issue? The importance of having the right culture The need for detailed business objectives Budgetary control measures Designing budget reports - for action 5 Zero-based budgeting (ZBB) - the principles Much more than starting with a clean sheet of paper What ZBB can achieve The concept of decision packages - to challenge business methods and costs Only necessary costs should be incurred A review of an operating budget - demonstrating what ZBB challenges and the costs it may lead to being taken out 6 Awareness of overheads and other costs Definitions of cost - direct and indirect Dealing with overheads - what is meant by allocation, absorption or apportionment? The apparent and real problems with overheads Different ways of dealing with overheads Review of overhead allocation methods and accounting and reporting issues 7 Overheads and product costing Activity-based costing (ABC) - the principles Where and how the ABC approach may be helpful Know the 'true' cost of a product or a project Should you be in business? Will you stay in business? Identifying weaknesses in a traditional overhead allocation How ABC will help improve product or service costing Identifying which products and activities should be developed and which abandoned 8 Cost reduction culture The need for cost reports What measures can be used to identify over-spends as early as possible Cost control performance measures and ratios 9 Design of cost control reports Reports should lead to action and deliver Selecting cost control measures which can be acted upon Practice in designing action reports 10 Course summary - developing your own cost action plan Group and individual action plans will be prepared with a view to participants identifying their cost risks areas and the techniques which can be immediately applied to improve costing and reduce costs

AI For Leaders

By Mpi Learning - Professional Learning And Development Provider

In the past, popular thought treated artificial intelligence (AI) as if it were the domain of science fiction or some far-flung future. In the last few years, however, AI has been given new life. The business world has especially given it renewed interest. However, AI is not just another technology or process for the business to consider - it is a truly disruptive force.

Educators matching "Business Analytics & Intelligence"

Show all 3Search By Location

- Business Analytics & Intelligence Courses in London

- Business Analytics & Intelligence Courses in Birmingham

- Business Analytics & Intelligence Courses in Glasgow

- Business Analytics & Intelligence Courses in Liverpool

- Business Analytics & Intelligence Courses in Bristol

- Business Analytics & Intelligence Courses in Manchester

- Business Analytics & Intelligence Courses in Sheffield

- Business Analytics & Intelligence Courses in Leeds

- Business Analytics & Intelligence Courses in Edinburgh

- Business Analytics & Intelligence Courses in Leicester

- Business Analytics & Intelligence Courses in Coventry

- Business Analytics & Intelligence Courses in Bradford

- Business Analytics & Intelligence Courses in Cardiff

- Business Analytics & Intelligence Courses in Belfast

- Business Analytics & Intelligence Courses in Nottingham