- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

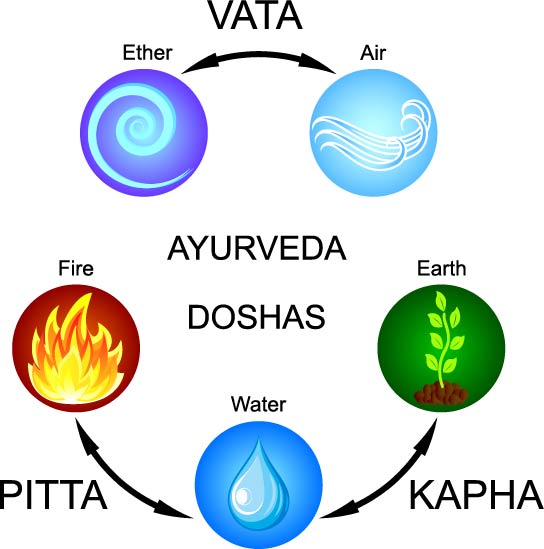

Learn the basics of ayurveda - body types, common ailments, journey of nutrition... Find out how to make a difference to health through diet, lifestyle and herbs. This workshop will empower you through is knowledge and tips but also regard it as a start of a journey to health taken step by step. Breathing practices too.

UNV CCTV Training Course - Welwyn Garden City

By Videcon Training

UNV CCTV Training, covering off the fantastic protfolio of UNV CCTV products, looking at how to configure them, what manufcaturer tools are available and how to connect remotely and via mobile apps to installed systems.

UNV CCTV Training Course - Heckmondwike

By Videcon Training

UNV CCTV Training, covering off the fantastic protfolio of UNV CCTV products, looking at how to configure them, what manufcaturer tools are available and how to connect remotely and via mobile apps to installed systems.

UNV CCTV Training Course - Scotland

By Videcon Training

UNV CCTV Training, covering off the fantastic protfolio of UNV CCTV products, looking at how to configure them, what manufcaturer tools are available and how to connect remotely and via mobile apps to installed systems.

Learn Quilting Basics

By Alan Teather Quilting

Learn how to quilt.

Power BI - introduction (2 day) (In-House)

By The In House Training Company

There is a lot to learn in Power BI, this course takes a comprehensive look at the fundamentals of analysing data and includes a balanced look at the four main components that make up Power BI Desktop: Report view, Data view, Model view, and the Power Query Editor. It also demonstrates how to utilise the online Power BI service. It looks at authoring tools that enable you to connect to and transform data from a variety of sources, allowing you to produce detailed reports through a range of visualisations, in an interactive and dynamic way. It also includes a detailed look at formulas by writing both M functions in Power Query, and DAX functions in Desktop view. This knowledge will allow you to take your reports to the next level. The aim of this course is to provide a complete introduction to understanding the Power BI analysis process, by working hands-on with examples that will equip you with the necessary skills to start applying your learning straight away. 1 Getting Started The Power BI ecosystem Opening Power BI Desktop Power BI's four views Introduction to Dashboards 2 Importing Files Importing data sources Importing an Excel file Importing a CSV file Importing a database Connect to an SQL Server Database Import vs. Direct Query Importing from the web Importing a folder of files Managing file connections 3 Shape Data in the Query Editor The process of shaping data Managing data types Keeping and removing rows Add a custom column Appending tables together Hiding queries in reports Fixing error issues Basic maths operations 4 The Data Model Table relationships Relationship properties 5 Merge Queries Table join kinds Merging tables 6 Inserting Dashboard Visuals Things to keep in mind Inserting maps Formatting Maps Inserting charts Formatting Charts Inserting a tree map Inserting a table, matrix, and card Controlling number formats About report themes Highlighting key points Filter reports with slicers Sync slicers across dashboards Custom web visuals 7 Publish and share Reports Publishing to Power BI service Editing online reports Pinning visuals to a dashboard What is Q&A? Sharing dashboards Exporting reports to PowerPoint Exporting reports as PDF files 8 The Power Query Editor Fill data up and down Split column by delimiter Add a conditional column More custom columns Merging columns 9 The M Functions Inserting text functions Insert an IF function Create a query group 10 Pivoting Tables Pivot a table Pivot and append tables Pivot but don't aggregate Unpivot tables Append mismatched headers 11 Data Modelling Expanded Understanding relationships Mark a date table 12 DAX New Columns New columns and measures New column calculations Insert a SWITCH function 13 Introduction to DAX Measures Common measure functions Insert a SUM function Insert a COUNTROWS function Insert a DISTINCTCOUNT function Insert a DIVIDE function DAX rules 14 The CALCULATE Measure The syntax of CALCULATE Insert a CALCULATE function Control field summarisation Things of note 15 The SUMX measure X iterator functions Anatomy of SUMX Insert a SUMX function When to use X functions 16 Time Intelligence Measures Importance of a calendar table Insert a TOTALYTD function Change financial year end date Comparing historical data Insert a DATEADD function 17 Hierarchies and Groups Mine data using hierarchies Compare data in groups

Contract management for practitioners (In-House)

By The In House Training Company

This two-day programme gives the key insights and understanding of contracting principles and the impact they have on business and operations. The course is designed for individuals involved in or supporting contracting who want to improve their commercial management skills; individuals in functions such as project management, business development, finance, operations who need practical training in commercial management; general audiences wanting to gain a basic understanding of commercial management. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Associate (CCMA) qualification. The programme addresses 31 different subject areas, across the five stages of the contracting process. By the end of the course the participants will be able, among other things, to: Develop robust contract plans, including scope of work and award strategies Conduct effective contracting activities, including ITT, RFP, negotiated outcomes Negotiate effectively with key stakeholders, making use of the key skills of persuading and influencing and to work with stakeholders to improve outcomes Set up and maintain contract management systems Take a proactive approach to managing contracts Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Develop and monitor appropriate and robust Key Performance Indicators to manage the contractor and facilitate improved performance Understand the approvals process and how to develop and present robust propositions Make appropriate use of best practice contract management tools, techniques and templates DAY ONE 1 Introductions Aims Objectives Plan for the day 2 Commercial context Explaining the contracting context Define the key objective The importance of contact management Impact upon the business 3 Stakeholders How to undertake stakeholder mapping and analysis Shared vision concept, How to engage with HSE, Finance, Operations 4 Roles and responsibilities Exploring the key roles and responsibilities of contract administrators, HSE, Finance, Divisional managers, etc 5 Initiating the contract cycle Overview of the contracting cycle Requirement to tender Methods Rationale and exceptions 6 Specifications Developing robust scope of works Use of performance specifications Output based SOW 7 Strategy and award criteria Developing a robust contract strategy Award submissions/criteria 8 Managing the tender process Review the pre-qualification process Vendor registration rules and processes Creation of bidder lists Evaluation, short listing, and how to use of the 10Cs© model template and app 9 Types of contract Classify the different types of contracts Call-offs Framework agreement Price agreements Supply agreements 10 The contract I: price Understanding contract terms Methods of compensation Lump sum, unit price, cost plus, time and materials, alternative methods Cost plus a fee, target cost, gain share contracts Advanced payments Price escalation clauses DAY TWO 11 Risk How to manage risks Risk classification Mitigation of contractual risks 12 Contractor relationship management session Effectively managing relationships with contractors, Types of relationships Driving forces? Link between type of contract and style of relationship 13 Disputes Dealing with disputes Conflict resolution Negotiation Mediation Arbitration 14 Contract management Measuring and improving contract performance Using KPIs and SLAs Benchmarking Cost controls 15 The contract II: terms and conditions Contract terms and conditions Legal aspects Drafting special terms 16 Managing claims and variations How to manage contract and works variations orders Identifying the causes of variations Contractor claims process 17 Completion Contract close-out process Acceptance/completion Capture the learning/HSE Final payments, evaluation of performance 18 Close Review Final assessment

The Expand a Business to Other Countries course gives you the knowledge to grow your business beyond borders. You will learn how to research new markets, understand customers, plan strategies, and use marketing tools the right way. This course breaks down business expansion into easy steps, helping you think clearly and act smartly in global markets. It covers marketing, customer behaviour, branding, pricing, communications, and strategic planning. Course Curriculum ✓ Module 01: Basics of Marketing ✓ Module 02: The Marketing Process ✓ Module 03: Strategic Marketing ✓ Module 04: Marketing Environment ✓ Module 05: Market Segmentations ✓ Module 06: Consumer Buying Behaviour ✓ Module 07: Business Markets and Buying Behaviour ✓ Module 08: Marketing Research ✓ Module 09: Product Strategy ✓ Module 10: Branding Strategy ✓ Module 11: Product Life Cycle ✓ Module 12: Pricing Strategy ✓ Module 13: Marketing Channels ✓ Module 14: Integrated Marketing Communications ✓ Module 15: Advertising and Sales Promotion ✓ Module 16: Personal Selling and Public Relations ✓ Module 17: Direct and Digital Marketing ✓ Module 18: What is Marketing? ✓ Module 19: Common Marketing Types (I) ✓ Module 20: Common Marketing Types (II) ✓ Module 21: The Marketing Mix ✓ Module 22: Communicating the Right Way ✓ Module 23: Customer Communications ✓ Module 24: Marketing Goals ✓ Module 25: The Marketing Funnel ✓ Module 26: Marketing Mistakes (I) ✓ Module 27: Marketing Mistakes (II) ✓ Module 28: An Introduction to Strategic Planning ✓ Module 29: Development of a Strategic Plan ✓ Module 30: Strategic Planning for Marketing ✓ Module 31: Strategic and Marketing Analysis ✓ Module 32: Internal Analysis ✓ Module 33: External Analysis ✓ Module 34: Market Segmentation, Targeting and Positioning ✓ Module 35: Approaches to Customer Analysis ✓ Module 36: Approaches to Competitor Analysis Learning Outcomes Understand the key ideas behind marketing. Learn how the marketing process works. Study customer behaviour in different markets. Discover how to segment and target new markets. Explore product, pricing, and branding strategies. Create effective advertising and promotion plans. Understand how to use digital and direct marketing. Develop a strategic marketing plan for growth. Analyse competitors and customers clearly. Gain skills to enter international markets with confidence. Who is this course for? This course is ideal for business owners, entrepreneurs, and managers who want to grow their company in new countries. It also suits marketing professionals and students eager to learn how global markets work. If you plan to take your product or service to an international level, this course is for you. Eligibility Requirements You don’t need any formal experience to join. A basic interest in business or marketing is enough. This course is simple and clear, and anyone with a desire to grow a business can join. Career Path Once you finish this course, you can pursue roles such as marketing manager, global strategist, brand manager, or business development officer. You can also use these skills to grow your own business or help other companies enter new markets. This course opens doors in international business, trade, and marketing fields. (Learn more about this online course)

Search By Location

- Basic Courses in London

- Basic Courses in Birmingham

- Basic Courses in Glasgow

- Basic Courses in Liverpool

- Basic Courses in Bristol

- Basic Courses in Manchester

- Basic Courses in Sheffield

- Basic Courses in Leeds

- Basic Courses in Edinburgh

- Basic Courses in Leicester

- Basic Courses in Coventry

- Basic Courses in Bradford

- Basic Courses in Cardiff

- Basic Courses in Belfast

- Basic Courses in Nottingham