- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

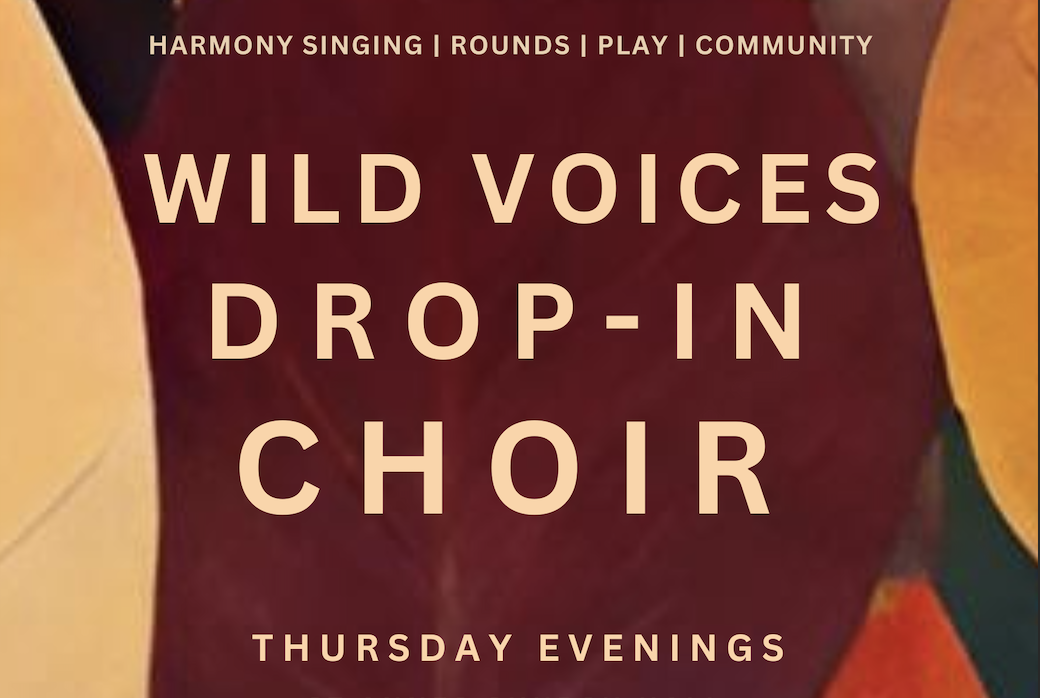

Learn simple breathing and vocal techniques to reduce stress and anxiety in the body, boost the immune system, and build connections for general wellbeing. We play with sound, rhythm and improvisation, learn close vocal harmony arrangements of different genres, and have loads of fun! Come and enjoy the incredible benefits singing in a group has on mental and physical health, and be part of this wonderful growing community. Everyone is welcome!

Managing a Virtual Team 1 Day Training in Bristol

By Mangates

Managing a Virtual Team Skills 1 Day Training in Bristol

Essential Management Skills 1 Day Workshop in Bromley

By Mangates

Essential Management Skills 1 Day Workshop in Bristol

Essential Management Skills 1 Day Workshop in Bristol

By Mangates

Essential Management Skills 1 Day Workshop in Bristol

Employee Engagement 1 Day Training in Bristol

By Mangates

Employee Engagement 1 Day Training in Bristol

TWO SPACES LEFT! 15th September Lil Chase #Agent121. Looking for: PICTURE BOOKS, CHAPTER BOOKS, MG, YA

5.0(3)By I Am In Print

LOOKING FOR: PICTURE BOOKS, CHAPTER BOOKS, MG, YA Lil is a Senior Editor at Hachette Children's. She has well over 15 years experience in the publishing industry, working for major publishers and literary agents too. For twelve years, Lil was a Senior Commissioning Editor at Working Partners Ltd – the creatives behind massive commercial hits such as Beast Quest, Warriors and the Daisy Meadows series. There she created globally successful concepts for every age group and developed storylines so the books were unputdownable. Lil is also an author in her own right: she has written 6 books under her own name, and ghost written many others under various pseudonyms. In every age level, Lil would like to see originality - particularly in voice. A strong character with depth, venturing on a quest that's never been undertaken before will get her excited. The 'quest' doesn't have to be epic in scale, it could be as small as petting the next-door neighbour's dog, or getting the good looking new kid to notice you, it just has to be something a reader will want to invest in. She also loves humour and is happy to see anything quirky (perhaps even downright silly!). For picture books, Lil would like you to submit a covering letter, and 1 complete manuscript, double-spaced, with spreads marked out, in a single word or PDF doc. For chapter books, MG and YA, please send a covering letter, the first three chapters and a synopsis, double spaced, in a single Word or PDF doc. Please send EITHER picture books OR another genre, not both in one submission. By booking this session you agree to email your material to reach I Am In Print by the stated submission deadline to agent121@iaminprint.co.uk. Please note that I Am In Print take no responsibility for the advice given in your Agent121. The submission deadline is: Monday 8th September 2025

17th September Laura Williams #Agent121. Looking for: YA, ADULT FICTION, NON-FICTION

5.0(3)By I Am In Print

LOOKING FOR: YA, ADULT FICTION, NON-FICTION Laura Williams is literary agent at the Greene and Heaton Literary Agency. She is seeking literary fiction, commercial fiction, psychological thrillers and high concept Young Adult. Laura is actively building a fiction list and a small non-fiction list. She is currently looking for literary fiction, edgy commercial fiction, psychological thrillers and high-concept contemporary young adult, as well as narrative non-fiction of all types. Her taste is quite dark, and she loves gothic, ghost stories, horror and anything sinister. She also loves books that make her cry, from big love stories to intense family dramas. She is open to historical or horror YA, but not magical or fantasy. Meditative or moving novels about modern life, appeal to Laura, sad stories with love and the importance of caring for each other shining through. She also loves stories about female friendships or conversely groups of women who don't get on, such as the hugely fun BAD SUMMER PEOPLE by Emma Rosenblum. She is always on the lookout for a big tragic love story to make her cry happy or sad tears. At the more commercial end of fiction, think funny novels with warmth and romantic comedies with a bit of depth – think Marian Keyes. Most of all Laura is looking for novels she hasn’t read before – something unusual structurally or thematically, something that shines a light on a subject the author is passionate about, something that’ll break her heart or raise her blood in an entirely new way. Laura is always looking to promote diverse voices from across the globe, and is particularly keen on LGBTQI+ stories. Laura would like you to submit a covering letter, a 1-2 page synopsis and the first 5,000 words of your completed manuscript in a single word document. (In addition to the paid sessions, Laura is kindly offering one free session for low income/under-represented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Wednesday 10th September 2025

SOLD OUT! 19th September Alice Williams #Agent121. Looking for: PICTURE BOOKS, YOUNG FICTION, CHAPTER BOOKS, MG, YA

5.0(3)By I Am In Print

LOOKING FOR: PICTURE BOOKS, YOUNG FICTION, CHAPTER BOOKS, MG, YA Alice set up Alice Williams Literary in 2018 after representing children's books for over ten years at David Higham Associates. She is especially keen to consider playful, funny books for all ages, and is on the lookout for heartwarming, empowering stories, whether in a realistic, contemporary setting, or a wildly imaginative fantasy world - or somewhere in-between. Alice is offering 121 sessions for young fiction, middle grade, YA and picture book writers. For chapter books, MG and YA fiction, please submit a covering letter, synopsis and the first three chapters of your manuscript in a single word document. For picture books, please submit a covering letter and two texts, or for illustrators one dummy and examples from your portfolio or a link to your website. Alice is only seeking to discuss texts/novels with writers living in the UK and Ireland. English does not need to be your first language, but you must be living within the UK or Ireland. (In addition to the paid sessions, Alice is kindly offering one free session for low income/under-represented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Thursday 11th September 2025

Confined Space Risk Management and Permits

By Vp ESS Training

Confined Space Risk Management and Permits - This course includes a basic level of confined space knowledge with the opportunity to use confined space equipment in a simulated environment and a team exercise of creating and reviewing a safe system of work. Note: A pre-requisite qualification is required to complete this course. Day 1 is a CS1 course and the Confined Space Risk Management (CSRM) can be completed as a 1 Day add-on. Any of following courses can be completed as a pre-requisite within 12 weeks of the CSRM; CS1, CS2, 6160-09. Book via our website @ https://www.vp-ess.com/training/confined-spaces/confined-space-risk-management-and-permits/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Search By Location

- BA Courses in London

- BA Courses in Birmingham

- BA Courses in Glasgow

- BA Courses in Liverpool

- BA Courses in Bristol

- BA Courses in Manchester

- BA Courses in Sheffield

- BA Courses in Leeds

- BA Courses in Edinburgh

- BA Courses in Leicester

- BA Courses in Coventry

- BA Courses in Bradford

- BA Courses in Cardiff

- BA Courses in Belfast

- BA Courses in Nottingham