- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

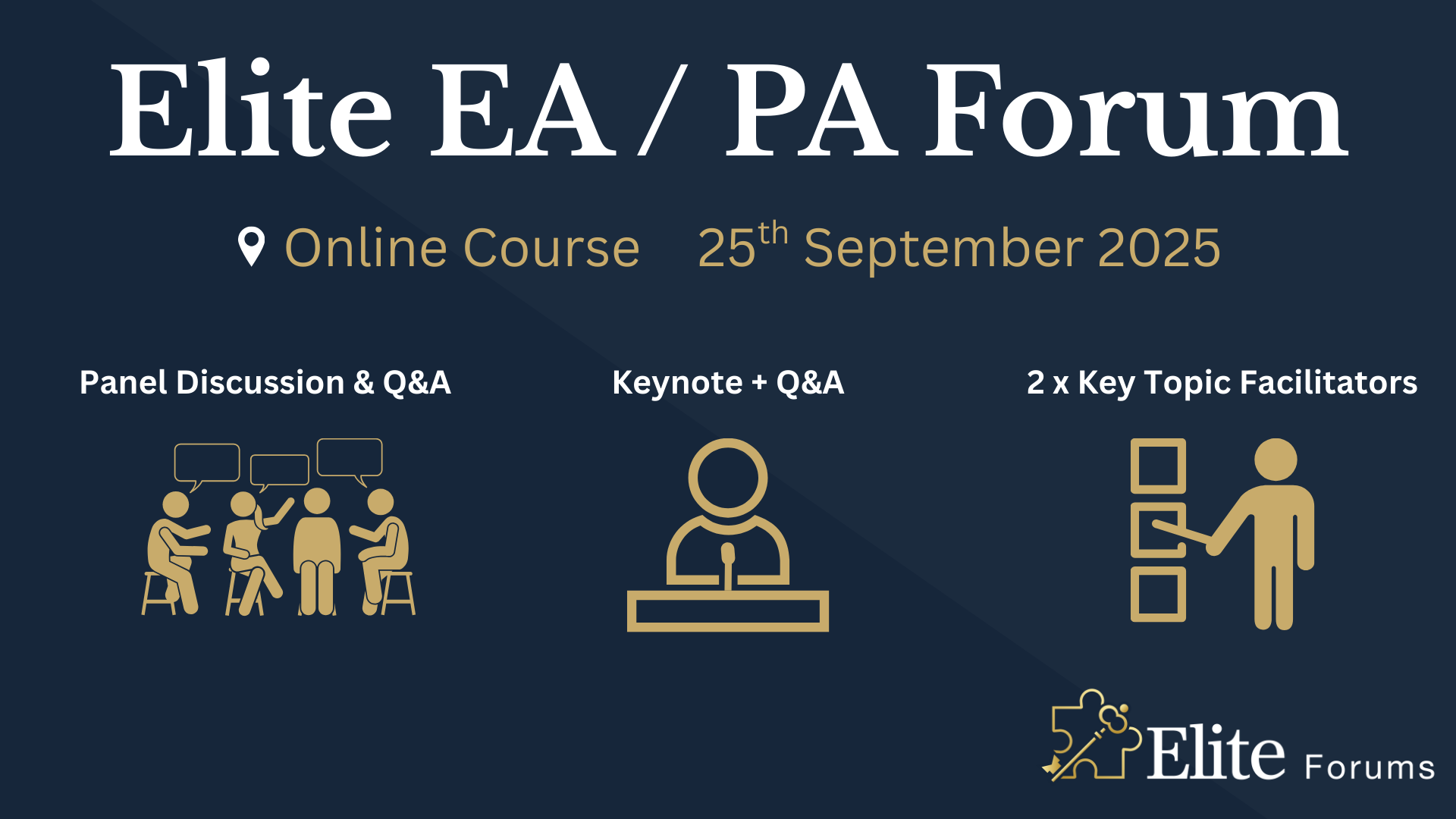

Elite EA PA Forum 🇳🇿

By Elite Forums Events

Elite EA/PA Forum We are delighted to announce that the Elite EA/PA Forum for Australia & New Zealand will be on the 25th of September 2025. Our workshop aims to: Enhance your influence and impact by mastering assertive communication, negotiation, and self-advocacy skills. Stay composed and solution-focused in high-pressure situations with practical tools for crisis management and clear decision-making. Embrace evolving technology by understanding how AI and automation can streamline your role and boost efficiency. Future-proof your career by building strategic value, resilience, and adaptability in an ever-changing professional landscape. Keynote Address with Q&A from the audience: What to expect from Sam's Keynote: With over 30 years supporting leaders at the highest levels, Sam Cohen brings a wealth of insight, experience, and stories (the kind she can share) to the stage. From 18 years serving within The Royal Household - including as Deputy Private Secretary and Press Secretary to Her late Majesty Queen Elizabeth II - to working with The Duke and Duchess of Sussex, running the Prime Minister’s Office at Downing Street, and serving as Chief of Staff to the global CEO of Rio Tinto, Sam’s career is a masterclass in discretion, diplomacy, and delivering at the top. In this exclusive keynote, Beyond the Role, Sam will explore how Executive Assistants don’t just support leaders - they shape leadership, drive strategy, and build legacy from behind the scenes. Join us for this rare opportunity to hear from someone who’s been at the epicentre of power - and bring your questions! The keynote will include a live Q&A, where you can ask Sam about her remarkable career, leadership insights, and how to truly excel in high-performance environments. (Don’t ask her what the Queen kept in her handbag - she’s not telling.) Sam Cohen Career Bio: Sam Cohen has spent the last 30 years working to support leaders in the public and private sectors. Sam spent 18 years serving The Royal Household, as Deputy Private Secretary to Her late Majesty Queen Elizabeth II and Press Secretary to The Queen. Sam also served as Private Secretary to The Duke and Duchess of Sussex. Following this time, Sam worked as Director of the Prime Minister’s Office at Downing Street under Boris Johnson and, most recently, was Chief of Staff to the global CEO at Rio Tinto. Source: ABC News - YouTube Channel. Facilitator - AM: The Future-Proofed Assistant: Speak Up, Stand Out & Shape Your Career Path How to reimagine your Assistant role in 2025 and beyond - How the EA role is evolving (and what Executives now expect) & why Assistants who think like strategists will be indispensable Assertiveness as an Assistant – The key to retaining your role & the difference between being ‘helpful’ and being ‘heard’ Self-Advocacy as a Career Growth Strategy – The importance of advocating for your career development, workload boundaries and recognition Own Your Professional Future - Map your career development. Whether you're an EA for life or looking to a role beyond in the future, this is for you. Ruth Kilah Career Bio: Ruth is an international executive career coach and founder of Hoxton Hyde – Executive Career Coaching & Mentoring, delivering 1:1 and group programs for experienced Executive Assistants. She specialises in helping EAs step into higher-level roles, increase their income, and expand their professional impact. With 14 years’ experience supporting C-suite executives in Australia and the UK, Ruth brings deep industry insight and a strategic approach to career development. She empowers Assistants to gain clarity on their next move, adopt a strategic mindset, communicate their value effectively, and lead their own growth conversations with confidence. A former EA turned Stakeholder Relations and Project Manager, Ruth launched Hoxton Hyde in 2018 after spotting a clear gap in the market for tailored coaching for career-driven EAs. She is a recognised member of the World Administrators Alliance and a respected thought leader in the EA space, regularly sharing insights via LinkedIn and Instagram. Ruth is also a certified fitness and wellness coach, passionate about helping Assistants achieve long-term career fulfilment through intentional development and well-being. Panel: Crisis Mode: What to do when everything goes wrong Master a step-by-step approach to prioritising and problem-solving under pressure. Strengthen emotional resilience and calm decision-making during unexpected disruptions. Learn how to communicate clearly and lead from behind in high-stress situations. Emma-Kate Bos Bio Emma-Kate works alongside the CEO at Squadron Energy, one of Australia’s leading renewable energy companies. With over 28 years of experience in Executive Assistant and Operational roles supporting business leaders in professional services, politics, membership industries, sporting and not-for-profit organisations, Emma-Kate has a deep understanding of business support roles and has managed large teams of assistants and receptionists. She is passionate about developing and mentoring team members Emma-Kate holds an Associate Degree in Law, Mini MBA and Certificate in Public Relations. Sepi Nowlands Sepi has also worked as an EO for Deloitte and spent 18 years previously as an Executive Assistant at the ATO, Law Council of Australia, Grains Research and Development Corporation and Air Services Australia. Holly Clareburt Hollie Clareburt is an experienced Executive Assistant, currently supporting the Managing Director of Microsoft New Zealand and the Chief Partner Officer. Known for her professionalism and discretion, she excels in providing high-level support in fast-paced, executive environments. Prior to Microsoft, Hollie was Executive Assistant to the Chief of Corporate & Enterprise Systems at BECA, and previously supported the CEO at SKY News New Zealand. Her career reflects a strong track record of reliability, organisation, and executive partnership. Liv Wilson With over 20 years of experience across banking, government, creative industries, and global tech, Liv has supported senior leaders at companies including LinkedIn and Slack. She brings a strategic lens to the business support function, with deep expertise in operations, leadership enablement, and organisational effectiveness. As a passionate advocate for elevating the role of Executive Assistants, Liv has led women’s networks, championed DEI and social impact initiatives, and continues to push for recognition of business support as a critical driver of business success. She is currently working on her side hustle business - collaborating with executives, entrepreneurs, and small business owners to amplify their impact by removing operational barriers, optimising systems, and unlocking their capacity to lead and grow. Facilitator - PM: Justin Kabbani AI Is Not Here to Replace You. It's Here to Upgrade You. We'll explore Justin's proven 3P framework: Priming – How to set up AI like a strategic advisor by feeding it context, tone and mindset Prompting – How to craft clear, structured instructions to get consistently great results Producing – How to turn AI outputs into high-leverage work that makes you stand out Your session outcomes: Real examples from admin professionals already using AI to elevate their work Prompts you can copy, adapt, and test live Interactive exercises to build confidence fast A practical challenge to implement right after the session If you’ve been overwhelmed by AI, or underwhelmed by its impact, this session will change that. You'll leave with tools you can use today, and a mindset you’ll carry forward for the rest of your career. Justin Kabbani Career Bio: Justin Kabbani is one of Australia’s most in-demand AI trainers and keynote speakers, known for making AI feel simple, powerful, and immediately useful. He’s worked with brands like Uber, Treasury Wine Estates, and Udemy, helping their teams embed AI into daily workflows, strategic planning, and executive communication. Over the past two years, Justin has trained more than 2,000 professionals across Australia and beyond, consistently earning feedback like “mind-blowing,” and “game-changing”. His signature Prime, Prompt, Produce framework has transformed how business leaders, executive assistants, marketers, and teams think, work, and communicate with AI, without needing to be “tech people.” Justin believes AI isn’t here to replace people. It’s here to take the robotic work off our plate, so we can focus on what humans do best. LinkedIn: https://www.linkedin.com/in/justinkabbani/ Website: https://justinkabbani.com/ Speed Connections Networking Session Join us for Speed Connections, a lively 30-minute networking session designed to foster meaningful connections in a fun, fast-paced environment. Every 10 minutes, attendees will be placed into new breakout rooms with small groups, giving everyone the chance to meet a diverse range of peers. Each breakout session will feature engaging prompts to spark conversations and make networking enjoyable and memorable! Who will attend this event? Executive Assistant (EA) Personal Assistant (PA) Virtual Assistant (VA) Legal Secretary Legal Executive Assistant Administrative Assistant Office Manager Health Care Office Manager Chief of Staff Additional roles may be relevant depending on role responsibilities, along with development opportunities. This workshop is open to females, male including trans women/males and non-binary professionals. Group Rate Discounts: To discuss our group rates in more detail, please email support@elite-forums.com and provide the following: Group Number (How many would like to attend) Event Date (If numerous dates, please advise if we are splitting attendees across multiple dates) Attendee Contact details (Or request our Group Rate Document. Complete and return - we'll sort the rest.) Group discounts are on request - see below group rate discount brackets: 🧩 You just need one piece to come together - to unlock your Elite Potential. 🔑

***24 Hour Limited Time Flash Sale*** Financial Ratio Analysis for Business Decisions Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Financial Ratio Analysis for Business Decisions Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Financial Ratio Analysis for Business Decisions bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Financial Ratio Analysis for Business Decisions Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Financial Ratio Analysis for Business Decisions Career Bundle: Course 01: Financial Ratio Analysis for Business Decisions Course 02: Financial Analysis Course 03: Financial Analysis: Finance Reports Course 04: Understanding Financial Statements and Analysis Course 05: Financial Modelling for Decision Making and Business plan Course 06: Financial Modeling Using Excel Course 07: Basic Business Finance Course 08: Certificate in Business Studies Course 09: Business Administration Course 10: Diploma in Business Analysis Course 11: Business Strategy Planning Masterclass Course 12: Business Management and Finance Course Course 13: Business Performance Management Course 14: Branding Your Business Course 15: Business Law Course 16: Business Improvement Course 17: Finance Principles Course 18: Financial Advisor Course 19: Financial Investigator Course 20: Banking and Finance Accounting Statements Financial Analysis Course 21: Statistical Analysis Course 22: Finance: Financial Risk Management Course 23: Finance and Accounting Level 1 & 2 Course 24: Fundamentals of Corporate Finance Course 25: Corporate Finance Course 26: Corporate Finance: Profitability in a Financial Downturn Course 27: Corporate Finance: Working Capital Management Course 28: Cost Control Process and Management Course 29: UK Tax Accounting Course 30: Pension UK With Financial Ratio Analysis for Business Decisions, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Financial Ratio Analysis for Business Decisions today and take the first step towards achieving your goals and dreams. Why buy this Financial Ratio Analysis for Business Decisions? Free CPD Accredited Certificate upon completion of Financial Ratio Analysis for Business Decisions Get a free student ID card with Financial Ratio Analysis for Business Decisions Lifetime access to the Financial Ratio Analysis for Business Decisions course materials Get instant access to this Financial Ratio Analysis for Business Decisions course Learn Financial Ratio Analysis for Business Decisions from anywhere in the world 24/7 tutor support with the Financial Ratio Analysis for Business Decisions course. Start your learning journey straightaway with our Financial Ratio Analysis for Business Decisions Training! Financial Ratio Analysis for Business Decisions premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of the Financial Ratio Analysis for Business Decisions is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the Financial Ratio Analysis for Business Decisions course. After passing the Financial Ratio Analysis for Business Decisions exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Financial Ratio Analysis for Business Decisions course is ideal for: Students seeking mastery in Financial Ratio Analysis for Business Decisions Professionals seeking to enhance Financial Ratio Analysis for Business Decisions skills Individuals looking for a Financial Ratio Analysis for Business Decisions-related career. Anyone passionate about Financial Ratio Analysis for Business Decisions Requirements This Financial Ratio Analysis for Business Decisions doesn't require prior experience and is suitable for diverse learners. Career path This Financial Ratio Analysis for Business Decisions bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Hard Copy Certificate Hard copy certificate - Included If you are an international student, you will be required to pay an additional fee of 10 GBP for international delivery, and 4.99 GBP for delivery within the UK, for each certificate CPD Accredited Digital Certificate Digital certificate - Included

24 Hour Flash Deal **33-in-1 Financial Manager Diploma Mega Bundle** Financial Manager Diploma Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Financial Manager Diploma package online with Studyhub through our online learning platform. The Financial Manager Diploma bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Financial Manager Diploma course provides complete 360-degree training on Financial Manager Diploma. You'll get not one, not two, not three, but 33 Financial Manager Diploma courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Financial Manager Diploma courses are yours for as long as you want them once you enrol in this course. This Financial Manager Diploma Bundle consists the following career oriented courses: Financial Management Professional Training Certification Finance for Non-finance Managers Certification Accounting Essentials and UK Taxation Understanding Financial Statements and Analysis Diploma in Accountancy Cashflow Management and Forecasting Financial Planning Corporate Risk And Crisis Management Financial Analysis Methods Finance: Financial Risk Management Corporate Finance: Working Capital Management Capital Budgeting & Investment Decision Rules Fundamentals of Corporate Finance Financial Modelling Comprehensive Mortgage Advice and Financial Guidance Sage 50 Accounts and Projects Creation Training Mastering Partnership Accounting: Financial Strategies and Reporting Sole Trader Financial Statements: A Practical Guide Marginal Costing in Economics: Financial Decision-Making Investment Analyst / Advisor Demystifying Depreciation Accounting: Financial Insights Trading and Financing Debt Management, Assessment, Financing & Counselling Tax Strategy and Financial Planning for Beginners Companies House Filing UK Financial Trading Certification and Risk Management Diploma Stock Trading Diploma Accountant's Guide to Climate Change Navigating Corporate Tax Return Procedures in the UK International Banking: Global Operations and Cross-Border Transactions FinTech The Infinite Banking Concept: Privatising Your Financial Future Economics Diploma In this exclusive Financial Manager Diploma bundle, you really hit the jackpot. Here's what you get: Step by step Financial Manager Diploma lessons One to one assistance from Financial Manager Diplomaprofessionals if you need it Innovative exams to test your knowledge after the Financial Manager Diplomacourse 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all 33 Financial Manager Diploma courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Financial Manager Diploma certificate and transcript on the next working day Easily learn the Financial Manager Diploma skills and knowledge you want from the comfort of your home The Financial Manager Diploma course has been prepared by focusing largely on Financial Manager Diploma career readiness. It has been designed by our Financial Manager Diploma specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Financial Manager Diploma Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Financial Manager Diploma bundle course has been created with 33 premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Financial Manager Diploma Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Financial Manager Diploma Elementary modules, allowing our students to grasp each lesson quickly. The Financial Manager Diploma course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. CPD 330 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Financial Manager Diploma training is suitable for - Students Recent graduates Job Seekers Financial analysis Budgeting and forecasting Risk management Financial reporting Strategic planning Investment management Cash flow management Tax planning and compliance Financial modeling Leadership and team management Communication and interpersonal skills Attention to detail Decision-making and problem-solving Regulatory compliance Knowledge of accounting principles and standards Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Financial Manager Diploma. Please note, To get qualified you need to enrol the below programmes: Bachelor's degree in Finance, Accounting, Economics, Business Administration, or a related field Professional certifications such as Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Chartered Financial Planner (CFP) Master's degree in Finance, Business Administration, or a related field (MBA) Continuing education courses or workshops in financial management, investment analysis, or related areas Requirements To participate in this Financial Manager Diploma course, all you need is - A smart device A secure internet connection And a keen interest in Financial Manager Diploma. Career path You will be able to kickstart your Financial Manager Diploma career because this course includes various courses as a bonus. This Financial Manager Diplomais an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Financial Manager Diploma career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Professional Certificate Course in Renewable Energy Policies and Sustainable Development in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course aims to provide learners with a comprehensive understanding of policymaking on renewable energy, market design and regulations, off-grid policies, decarbonization policies, international initiatives for climate change, energy burden, sustainable energy, and the circular economy. After the successful completion of the course, you will be able to learn about the following, Policymaking on Renewable Energy. Market Design and Regulations. Off-grid Policies. Polices on Decarbonization. International Initiatives for Climate Change. Energy Burden. Sustainable Energy. The circular economy. The aim of this course is to provide an in-depth understanding of renewable energy policymaking, market design, and regulations. This course will also explore off-grid policies and policies on decarbonization. Additionally, students will learn about international initiatives for climate change and the importance of reducing energy burden through sustainable energy solutions. The course will also cover the circular economy and its role in the energy transition. The course aims to provide a comprehensive understanding of renewable energy policy-making, market design, regulations, off-grid policies, decarbonization policies, international initiatives for climate change, energy burden, sustainable energy, and circular economy in order to promote a transition towards a sustainable energy future. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Renewable Energy Policies and Sustainable Development Self-paced pre-recorded learning content on this topic. Renewable Energy Policies and Sustainable Development Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Renewable Energy Policy Analyst Sustainable Development Manager Climate Policy Advisor Renewable Energy Project Developer Environmental Compliance Specialist Energy Policy Researcher Sustainability Consultant Renewable Energy Policy Advocate Sustainable Energy Engineer Green Energy Program Manager. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Admin, Secretarial & PA, Minute Taking, Office Management

By Imperial Academy

Level 3, 5 & 7 QLS Endorsed Diploma | QLS Hard Copy Certificate Included | Plus 10 CPD Courses | Lifetime Access

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Do you own real estate? Do you want to sell it or are looking to buy a house? Or you're curious about how the UK's laws and property development work? In either cases, this real estate course is what you need! The complete procedure of buying commercial real estate will be covered in this course, from beginning to end. You'll gain knowledge on topics like the essential elements of physical and financial due diligence, how investors approach the equity raise process, what lenders are looking for when evaluating your deal, and even how to structure partnerships with equity investors to create a "win-win" situation for all parties involved. Due to the enormous demand for Real Estate Agents at QLS Level 5 in the cutthroat market, you can use our comprehensive course to expand your knowledge and advance your career. Learn Real Estate Agents at QLS Level 5 from pros in the field and quickly give yourself the technical information and abilities you need to succeed in your chosen profession. Learning Outcome Moreover, these courses will give you valuable and necessary skills, and you will, Discover what is necessary to purchase a house off the market Analyse several property types and their features Learn about the overall situation with UK property law regulations Have a greater comprehension of marketing that will aid in the sale of your property Understand how to defend your interests in an empty property successfully Learn about the tools that real estate brokers use to save time and money Why Prefer This Real Estate Agents at QLS Level 5 Course? Opportunity to earn a certificate endorsed by the Quality Licence Scheme & another accredited by CPDQS which is completely free. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Innovative and engaging content. Free assessments 24/7 tutor support. Take a step toward a brighter future! *** Course Curriculum *** Here is the curriculum breakdown of the Real Estate Agents at QLS Level 5 course: Introduction to the Course The History, Job Role and Requirements of Estate Agents The Types and Classification of Estate Agents How to be a Successful Estate Agent How to List Properties Handling the Valuation Process Negotiation Strategies and Skills All About Selling Properties All About Letting Properties Digital Marketing for Estate Agents Key Legislation Final Recap Additional Reading Materials Assessment Process After completing an online module, you will be given immediate access to a specially designed MCQ test. The results will be immediately analysed, and the score will be shown for your review. The passing score for each test will be set at 60%. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you have completed all of the Diploma in Basic Real Estate Agents Training at QLS Level 5exams. CPD 150 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Diploma (QLS) Internal Sales Advisor at QLS Level 4 course is for those who want to improve their professional abilities while preparing for their chosen employment. Anyone with interest is welcome to enrol in this course.The training course is perfect for Highly driven students who wish to improve their personal and professional abilities Those who are interested in this subject in depth New graduates from any discipline Requirements No prior background or expertise is required. Career path This training is designed to help you get the dream job or simply the raise you've been after. Use this comprehensive package course to learn the knowledge and abilities you'll need to succeed at work. The following positions can help you launch your career with this course: Property Manager Property Developer Real Estate Agent Certificates CPDQS Accredited Certificate Digital certificate - Included Diploma in Basic Real Estate Agents Training at QLS Level 5 Hard copy certificate - Included Show off Your New Skills with a Certificate of Completion After successfully completing the Diploma in Basic Real Estate Agents Training at QLS Level 5, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme andalso you can order CPDQSAccredited Certificate that is recognised all over the UK and also internationally. The certificates will be home-delivered, completely free of cost.

Professional Certificate Course in the Nature and Challenges of Renewable Energy in London 2024

4.9(261)By Metropolitan School of Business & Management UK

This course aims to provide students with an understanding of the environmental, health, and economic impacts of energy sources, focusing on the challenges and opportunities associated with the transition to renewable energy, the major players in the energy sector, and the policies and regulations that shape the sector. After the successful completion of the course, you will be able to learn about the following, Fossil Fuels and Climate Change. Environment and Health Impacts of Fossil Fuel. The Environmental Impact of Renewable Energy. Renewable Energy Challenges and Opportunities. Energy Transition. Major Players in the Energy Sector. The aim of this course is to provide a comprehensive understanding of the energy sector with a focus on fossil fuels, renewable energy, and their impacts on climate change, environment, and health. This course will also explore the challenges and opportunities of renewable energy and the transition towards a sustainable energy future. By the end of this course, students will have a clear understanding of the major players in the energy sector and their role in shaping the future of energy. This course aims to provide students with an understanding of the environmental and health impacts of fossil fuels and the environmental impact of renewable energy, as well as exploring renewable energy challenges and opportunities, the energy transition, and the major players in the energy sector. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. The Nature and Challenges of Renewable Energy Self-paced pre-recorded learning content on this topic. The Nature and Challenges of Renewable Energy Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Renewable Energy Engineer Sustainable Energy Analyst Energy Efficiency Consultant Renewable Energy Project Manager Green Energy Investment Analyst Renewable Energy Policy Advisor Renewable Energy Economist Climate Change Mitigation Specialist Renewable Energy Business Developer Energy Storage System Engineer Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

CDM- Construction, Design and Management

By Compliance Central

Keeping your staff safe is crucial for the survival of your business. If you need to figure out what Construction Design and Management (CDM) is, then you're in luck! This course will enlighten you and give you the knowledge necessary to work alongside CDM regulations. Construction sites are full of dangers, so ensuring workplace safety should be a top priority for all businesses. If an accident occurs, it can be costly and can even result in severe injury or death for the workers involved. This course is provided by experts knowledgeable about the laws and legislation about CDM rules and what is necessary for a safe workplace. On construction sites, there are countless occupational accidents every day; thus, maintaining workplace safety should be a significant concern. This CDM Bundle Includes Course 01: CDM Regulations Course 02: CDM Construction Phase Plan Course 03: CDM Health and Safety Enrol now to ensure your workplace safety! What you will discover are the following: Learn about Construction Design and Management (CDM) Regulations. CDM regulations and construction projects CDM regulations are important site plans for construction projects Validation and enhancement of design standards. Review of Regulations and Legislation Course Significant Points: Accredited CPD course Exam retakes are unlimited, and tutoring is available Easy access to course materials; guaranteed learning satisfaction Lifetime access and 24/7 support Self-paced online course modules Learn at your own pace from the comfort of your home, as the rich learning materials of this course are accessible from any place at any time. The curriculums are divided into tiny bite-sized modules by industry specialists. And you will get answers to all your queries from our experts. So, enrol and excel in your career with Compliance Central. CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is intended for those with critical responsibilities, whether they are- Clients in construction. Principal Contractors. Designers in charge. Requirements To enrol in this CDM, all you need is a basic understanding of the English Language and an internet connection. Career path You can explore popular and in-demand careers associated with this course after completing it. Some job fields you can look into are: CDM Co-Ordinator: £20,000- £40,000 per annum Technical Co-ordinator: £15,000- £35,000 per annum Principal Designer: £30,000- £50,000 per annum CDM Advisor: £30,000- £50,000 per annum

HACCP Food Safety, Allergen Awareness & Nutrition at QLS Endorsed Diploma

By Compliance Central

In recent years, the global emphasis on food safety and health has surged significantly, with a notable rise in consumer awareness regarding nutrition and allergen information. This shift has spotlighted the crucial need for comprehensive training in HACCP Food Safety, Allergen Awareness & Nutrition, areas that are pivotal to the food industry's success and consumer health. Our HACCP Food Safety, Allergen Awareness & Nutrition at QLS Endorsed Diploma bundle course is meticulously designed to meet these growing demands, ensuring that professionals are well-equipped to navigate the complexities of food safety, allergen management, and nutrition effectively. The HACCP Food Safety, Allergen Awareness & Nutrition bundle is a comprehensive compilation of courses that spans across various crucial aspects of food safety and nutrition, offering a blend of technical knowledge and personal development skills vital for career advancement. This HACCP Food Safety, Allergen Awareness & Nutrition bundle, comprising QLS endorsed and CPD QS accredited courses, is structured to elevate your expertise and understanding of nutrition, weight loss management, allergen awareness, and the pivotal HACCP food safety standards, alongside enriching courses on career development and critical thinking. QLS Endorsed Courses: Course 01: Certificate in Nutrition & Weight Loss Management at QLS Level 3 Course 02: Certificate in Allergen Awareness at QLS Level 4 Course 03: Diploma in HACCP Food Safety at QLS Level 5 CPD QS Accredited Courses: Course 04: Catering - Catering Management Course 05: Higher Technician in Cooking and Gastronomy Course 06: Superfood Nutrition: 60+ Foods For Health & Fitness Course 07: Sports Nutrition Course Course 08: Foot Health Practitioner Course 09: Food Labelling Regulations Training Course 10: How to Improve Your Food Hygiene Rating Course 11: Immunity Boosting Food Take your career to the next level with our bundle that includes technical courses and five guided courses focused on personal development and career growth. Course 12: Career Development Plan Fundamentals Course 13: CV Writing and Job Searching Course 14: Networking Skills for Personal Success Course 15: Ace Your Presentations: Public Speaking Masterclass Course 16: Decision Making and Critical Thinking Seize this opportunity to elevate your career with our comprehensive bundle, endorsed by the prestigious QLS and accredited by CPD. HACCP Food Safety, Allergen Awareness & Nutrition at QLS Endorsed Diploma. Learning Outcomes: Gain an in-depth understanding of HACCP Food Safety principles and their application in ensuring food quality and safety. Master the essentials of Allergen Awareness to prevent cross-contamination and manage allergens effectively in food preparation. Enhance your knowledge on Nutrition & Weight Loss Management, including the role of superfoods and sports nutrition in health and fitness. Develop skills in Catering Management and Cooking and Gastronomy to elevate food preparation standards. Acquire valuable insights into Food Labelling Regulations and how to improve food hygiene ratings for businesses. Embark on a journey of personal development with skills in CV writing, job searching, public speaking, and critical decision-making. This HACCP Food Safety, Allergen Awareness & Nutrition bundle is a unique offering that bridges the gap between essential food safety standards and the growing interest in nutrition and health, making it an invaluable resource for those in the food industry. The HACCP Food Safety, Allergen Awareness & Nutrition course dives deep into the principles of HACCP Food Safety at a level 5 QLS endorsement, ensuring learners understand the critical aspects of food safety management and hazard analysis. Equally, the Allergen Awareness and Nutrition & Weight Loss Management modules provide learners with the knowledge needed to cater to diverse dietary needs and health-conscious consumers. The HACCP Food Safety, Allergen Awareness & Nutrition bundle not only focuses on the technical aspects of food safety and nutrition but also includes CPD QS accredited courses that broaden a professional's skill set in areas such as Catering Management and Gastronomy, further supported by courses on superfood nutrition and sports nutrition. These modules are complemented by practical courses on food hygiene and labelling regulations, crucial for maintaining standards and consumer trust. Moreover, this HACCP Food Safety, Allergen Awareness & Nutrition bundle course distinguishes itself by including five guided courses aimed at personal development and career growth, covering essential skills like CV writing, job searching, public speaking, and critical thinking. This holistic approach ensures that learners are not only equipped with technical knowledge but are also prepared to advance in their careers through enhanced personal development and networking skills. CPD 160 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This HACCP Food Safety, Allergen Awareness & Nutrition course is ideal for: Professionals in the food industry looking to enhance their knowledge in food safety and nutrition. Individuals interested in starting a career in food safety, catering management, or nutrition consultancy. Health enthusiasts seeking comprehensive knowledge on allergen awareness and nutrition. Career changers aiming to enter the food and health sectors with a strong foundational knowledge. Food industry entrepreneurs and business owners looking to improve their food hygiene ratings and understand food labelling regulations. Students and recent graduates aiming to broaden their skill set in food safety and nutrition for better employment opportunities across HACCP Food Safety, Allergen Awareness & Nutrition course. Requirements You are warmly invited to register for this bundle. Please be aware that there are no formal entry requirements or qualifications necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path Food Safety Manager or Coordinator in the hospitality and food service sectors. Nutrition and Weight Loss Consultant, offering personalised nutrition plans and weight management advice. Public Health Advisor, focusing on nutrition and food safety education. Quality Assurance Manager in food production, ensuring compliance with HACCP and food safety standards. Certificates 13 CPD Quality Standard Certificates Digital certificate - Included 3 QLS Endorsed Certificates Hard copy certificate - Included

Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Now Our business course will help you turn your dreams into reality! This Business course is ideal for advancing your career if you're trying to grow your company or looking for a new business to get into. You can succeed significantly in your business operations if you have the appropriate information and abilities. Our Business course can give you the skills you need to move forward, whether you run a start-up, a small firm, or a major organization. You can acquire the knowledge and abilities that will enable you to boost your earnings and expand your firm from marketing and sales to accounting and finance. The course modules will provide you with the necessary decision-making skills, empowering you to be more confident when selecting the best options for your company. In addition, you will discover the most current strategies and tactics to keep one step ahead of the competition. So don't waste your time anymore. Enrol in our Business course today! This Business Training Bundle Consists of the following Premium courses: Course 01: Business Management Advanced Diploma Course 02: Business Law Course 03: Sales: Psychology of Customers Course 04: Logistic Management Course 05: Level 3 Tax Accounting Course 06: Marketing Fundamentals Course 07: Business Branding Course 08: Ecommerce Management Course 09: Budgeting and Forecasting Course 10: Compliance & Business Risk Management Course 11: Business Writing Diploma Learning Outcomes Gain the capacity to design and carry out successful business plans. Have a basic understanding of accounting and financial analysis in business. Examine the ethical and legal ramifications of conducting business. Recognise the significance of marketing in creating a successful company. Assess how current economic developments are affecting corporate operations. Learn efficient communication techniques that can be used in a professional situation. Make use of technology to make business operations more effective. Identify and put into practice the best methods for controlling resources and people. So enrol now in this Business Training Bundle to advance your career! Curriculum of Business Management 01: Introduction to Business Management 02: Operations Management 03: Introduction to Business Analysis 04: Strategic Analysis and Product Scope 05: Project Management 06: Business Development and Succession Planning 07: Business Process Management 08: Planning & Forecasting Operations 09: Performance Management 10: Management of Cash and Credit 11: Managing Risk and Recovery 12: Quality Management 13: Communication Skills 14: Business Environment 15: Organisational Skills 16: Negotiation Techniques 17: Human Resource Management 18: Motivation and Counselling 19: Customer Service 20: Time Management 21: Conflict Management CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this bundle. Career path Enrolling on this Bundle can lead you to the following career paths: Finance Advisor Finance Analyst Project Manager Analysis Chief Executive Officer (CEO) Director Entrepreneur Finance Assistant Finance Director Finance Associate And many more! Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.