- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

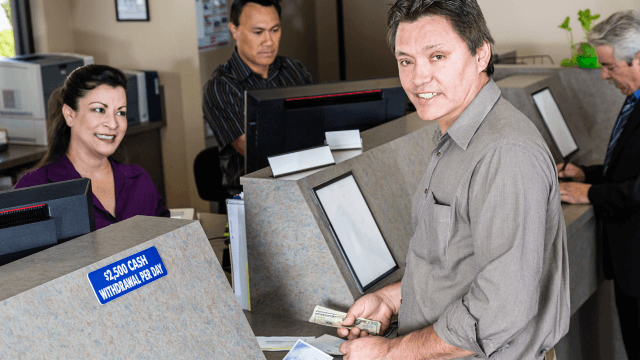

Bank Teller

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Bank Teller Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training employers seek in today's workplaces. The Bank Teller Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Bank Teller Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Bank Teller Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Bank Teller? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standards accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Bank Teller there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Bank Teller course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Bank Teller does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Bank Teller was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Bank Teller is a great way for you to gain multiple skills from the comfort of your home. Module 01: Introduction to a Bank Teller Introduction to a Bank Teller 00:30:00 Module 02: Skills and Abilities of a Bank Teller Skills and Abilities of a Bank Teller 00:30:00 Module 03: Types of Bank Accounts and Opening Them Types of Bank Accounts and Opening Them 00:30:00 Module 04: Mathematics Calculation for Bank Tellers Mathematics Calculation for Bank Tellers 00:30:00 Module 05: Bookkeeping Guideline and Payment Methods Bookkeeping Guideline and Payment Methods 00:30:00 Module 06: Cash Sorting in an Efficient Way Cash Sorting in an Efficient Way 00:30:00 Module 07: How to Identify Counterfeit How to Identify Counterfeit 00:30:00 Module 08: Function and Benefits of Currency Recyclers Function and Benefits of Currency Recyclers 00:30:00 Module 09: Dealing with Frauds Dealing with Frauds 00:30:00 Module 10: Safety Precautions for ATM (Automated Teller Machine) Safety Precautions for ATM (Automated Teller Machine) 00:30:00 Module 11: Customer Services a Bank Teller Can Offer Customer Services a Bank Teller Can Offer 00:30:00 Module 12: Rights and Obligations According to the UK Law Rights and Obligations According to the UK Law 00:30:00 Module 13: Ethical Issues for a Bank Teller Ethical Issues for a Bank Teller 00:30:00

Bank Teller

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Bank Teller Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Bank Teller Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Bank Teller Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Bank Teller Course, like every one of Study Hub's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Bank Teller? Unlimited access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Bank Teller there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Bank Teller course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Bank Teller does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Bank Teller was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Bank Teller is a great way for you to gain multiple skills from the comfort of your home. Module 1 Introduction to a Bank Teller Introduction to a Bank Teller 00:09:00 Module 2 Skills and Abilities of a Bank Teller Skills and Abilities of a Bank Teller 00:10:00 Module 3 Types of Bank Accounts and Opening Them Types of Bank Accounts and Opening Them 00:16:00 Module 4 Mathematics Calculation for Bank Tellers Mathematics Calculation for Bank Tellers 00:12:00 Module 5 Bookkeeping Guideline and Payment Methods Bookkeeping Guideline and Payment Methods 00:17:00 Module 6 Cash Sorting in an Efficient Way Cash Sorting in an Efficient Way 00:08:00 Module 7 How to Identify Counterfeit How to Identify Counterfeit 00:08:00 Module 8 Function and Benefits of Currency Recyclers Function and Benefits of Currency Recyclers 00:10:00 Module 9 Dealing with Frauds Dealing with Frauds 00:15:00 Module 10 Safety Precautions for ATM (Automated Teller Machine) Safety Precautions for ATM (Automated Teller Machine) 00:16:00 Module 11 Customer Services a Bank Teller Can Offer Customer Services a Bank Teller Can Offer 00:14:00 Module 12 Rights and Obligations According to the UK Law Rights and Obligations According to the UK Law 00:07:00 Module 13 Ethical Issues for a Bank Teller Ethical Issues for a Bank Teller 00:07:00

Overview Fund accounting, trustee reports, charity income do all these seem a little confusing to you? Well, not anymore, because you have developed the Charity Accounting Course to help you out. This course is designed to clear out all your confessions and help you establish a solid foundation in charity accounting. The course will introduce you to the vital aspects of charity accounting. Here, you will learn the accounting standards, principles, policies and more. The course will include lessons on fund accounting, balance sheet statements of cash flow and statements of financial activities. Along with that, you will receive a clear understanding of income sheets and expenditures of charity. Through the course you will grasp the vitals of taxation and external scrutiny as well. After the completion of the course, you will receive a CPD-accredited certificate of achievement. This will open new doors of opportunity for you. Course Preview Learning Outcomes Understand the policies and principles of charity accounting Enhance your knowledge of fund accounting, balance sheet statements of cash flow etc Enhance your knowledge about the statement of financial activities Learn about the income sheets and expenditures of charity Grasp the essentials of taxation and external scrutiny Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Fund Accounting Balance sheet management Taxation for charity Who Should Take This Charity Accounting Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Charity Accounting Course Certification After completing and passing the Charity Accounting Course successfully, you will be able to obtain a Recognised Certificate of Achievement. Learners can obtain the certificate in hard copy at £14.99 or PDF format at £11.99. Career Pathâ This exclusive Charity Accounting Course will equip you with effective skills and abilities and help you explore career paths such as Accountant Finance manager Strategic finance business partner Module 01: The Concept Of Charity Accounting The Concept of Charity Accounting 00:21:00 Module 02: Accounting Standards, Policies, Concepts And Principles Accounting Standards, Policies, Concepts and Principles 00:23:00 Module 03: Fund Accounting Fund Accounting 00:21:00 Module 04: Charity Reporting And Accounts Charity Reporting and Accounts 00:23:00 Module 05: Trustees' Annual Report Trustees' Annual Report 00:24:00 Module 06: Balance Sheet Balance Sheet 00:23:00 Module 07: Statement Of Financial Activities Statement of Financial Activities 00:22:00 Module 08: Understanding The Income Streams And Expenditure Of Charity Understanding the Income Streams and Expenditure of Charity 00:19:00 Module 09: Statement Of Cash Flows Statement of Cash Flows 00:19:00 Module 10: Taxation For Charities And External Scrutiny Taxation for Charities and External Scrutiny 00:18:00 Module 11: Things To Look Out For In Post Covid Situation Things to Look Out for in Post Covid Situation 00:17:00 Assignment Assignment - Charity Accounting 00:00:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

20742 Identity with Windows Server 2016

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for This course is primarily intended for existing IT professionals who have some AD DS knowledge and experience and who aim to develop knowledge about identity and access technologies in Windows Server 2016. The secondary audience for this course includes IT professionals who are looking to consolidate their knowledge about AD DS and related technologies, in addition to IT professionals who want to prepare for the 70-742 exam. Overview After completing this course, students will be able to:Install and configure domain controllers.Manage objects in AD DS by using graphical tools and Windows PowerShell.Implement AD DS in complex environments.Implement AD DS sites, and configure and manage replication.Implement and manage Group Policy Objects (GPOs).Manage user settings by using GPOs.Secure AD DS and user accounts.Implement and manage a certificate authority (CA) hierarchy with AD CS.Deploy and manage certificates.Implement and administer AD FS.Implement and administer Active Directory Rights Management Services (AD RMS).Implement synchronization between AD DS and Azure AD.Monitor, troubleshoot, and establish business continuity for AD DS services. This course teaches IT Pros how to deploy and configure Active Directory Domain Services in a distributed environment, how to implement Group Policy, how to perform backup & restore, & how to troubleshoot Active Directory?related issues. Installing & Configuring DCs Overview of AD DS Overview of AD DS DCs Deploying DCs Lab: Deploying and administering AD DS Managing Objects in AD DS Managing user accounts Managing groups in AD DS Managing computer accounts Using Windows PowerShell for AD DS administration Implementing and managing organizational units Lab: Deploying and administering AD DS Lab: Administering AD DS Advanced AD DS Infrastructure Management Overview of advanced AD DS deployments Deploying a distributed AD DS environment Configuring AD DS trusts Lab: Domain and trust management in AD DS Implementing & Administering AD DS Sites & Replication Overview of AD DS replication Configuring AD DS sites Configuring and monitoring AD DS replication Lab: Managing and implementing AD DS sites and replication Implementing Group Policy Introducing Group Policy Implementing and administering GPOs Group Policy scope and Group Policy processing Troubleshooting the application of GPOs Lab: Implementing a Group Policy infrastructure Lab: Troubleshooting a Group Policy Infrastructure Managing User Settings with GPOs Implementing administrative templates Configuring Folder Redirection and scripts Configuring Group Policy preferences Lab: Managing user settings with GPOs Securing AD DS Securing domain controllers Implementing account security Audit authentication Configuring managed service accounts (MSAs) Lab: Securing AD DS Deploying & Managing AD CS Deploying CAs Administering CAs Troubleshooting and maintaining CAs Lab: Deploying and configuring a two-tier CA hierarchy Deploying & Managing Certificates Deploying and managing certificate templates Managing certificate deployment, revocation, and recovery Using certificates in a business environment Implementing and managing smart cards Lab: Deploying certificates Implementing & Administering AD FS Overview of AD FS AD FS requirements and planning Deploying and configuring AD FS Overview of Web Application Proxy Lab: Implementing AD FS Implementing & Administering AD RMS Overview of AD RMS Deploying and managing an AD RMS infrastructure Configuring AD RMS content protection Lab: Implementing an AD RMS infrastructure Implementing AD DS Synchronization with Azure AD Planning and preparing for directory synchronization Implementing directory synchronization by using Azure AD Connect Managing identities with directory synchronization Lab: Configuring directory synchronization Monitoring, Managing, & Recovering AD DS Monitoring AD DS Managing the AD DS database Recovering AD DS objects Lab: Recovering objects in AD DS

Keep Going With QuickBooks 2021 for Windows

By Nexus Human

Duration 2 Days 12 CPD hours Overview What's New in This Guide? The behind-the-scenes journal entry for transactions is now included. This course is a continuation of topics following ?Get Started with QuickBooks 2021 for Windows?. First-time QuickBooks users will learn the basic features of the software. Experienced QuickBooks users will quickly learn the new features and functionality of QuickBooks 2021. This course covers features that are in QuickBooks Pro and Premier 2021. Memorizing Transactions Entering a New Memorized Transaction Editing a Memorized Transaction Deleting a Memorized Transaction Grouping Memorized Transactions Using a Memorized Transaction Printing the Memorized Transaction List Customizing Forms Creating a Custom Template Modifying a Template Printing Forms Using Other QuickBooks Accounts Other QuickBooks Account Types Working with Credit Card Transactions Working with Fixed Assets Working with Long-Term Liability Accounts Using the Loan Manager Creating Reports Working with Quick Reports Working with Preset Reports Sharing Reports Exporting Reports to Microsoft Excel Printing Reports Creating Graphs Creating QuickInsight Graphs Using QuickZoom with Graphs Working with the Sales Graph Customizing Graphs Printing Graphs Tracking and Paying Sales Tax Using Sales Tax in QuickBooks Setting Up Tax Rates and Agencies Indicating Who and What Gets Taxed Applying Tax to Each Sale Determining What You Owe Paying Your Tax Agencies Preparing Payroll with QuickBooks Using Payroll Tracking Setting Up for Payroll Setting Up Employee Payroll Information Setting Up a Payroll Schedule Writing a Payroll Check Printing Paycheck Stubs Tracking Your Tax Liabilities Paying Payroll Taxes Preparing Payroll Tax Forms Using Online Banking Setting Up an Internet Connection Setting Up Bank Feeds for Accounts Viewing, Downloading, and Adding Online Transactions Creating Online Payments Transferring Funds Online Canceling Online Payments Managing Company Files Using QuickBooks in Multi-user Mode Setting Up Users and Passwords Setting a Closing Date Sharing Files with an Accountant Updating QuickBooks Backing Up and Restoring a Company File Condensing a Company File Estimating, Time Tracking, and Job Costing Creating Job Estimates Creating an Invoice from an Estimate Displaying Reports for Estimates Updating the Job Status Tracking Time Displaying Reports for Time Tracking Tracking Vehicle Mileage Displaying Vehicle Mileage Reports Displaying Other Job Reports Writing Letters Using the Letters and Envelopes Wizard Customizing Letter Templates Additional course details: Nexus Humans Keep Going With QuickBooks 2021 for Windows training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Keep Going With QuickBooks 2021 for Windows course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Description This Certified Virtualization Security Expert (Advanced VMware Security) Training covers everything you need to know becoming a Certified Virtualization Security Expert. In this course you will learn about routing and the security design of VMware, Remote DataStore security, Penetration Testing 101, information gathering, scanning and enumeration, penetration testing and the tools of the trade, DMZ virtualization and common attack vectors, hardening your ESX server, hardening your ESXi server, hardening your vCenter server, and 3rd party mitigation tools. This Advanced course provides a solid understanding of the various components that make up the VMware vSphere environment. You will have the opportunity to study and understand all aspects of the CIA triad as it pertains to the VMware vSphere infrastructure from the virtual CPU to the storage devices attached to your host and everything in and around that network, including the interconnectivity and design of all those components. So, get this course to learn more. Assessment & Certification To achieve a formal qualification, you are required to book an official exam separately with the relevant awarding bodies. However, you will be able to order a course completion CPD Certificate by paying an additional fee. Hardcopy Certificate by post - £19 Soft copy PDF via email - £10 Requirements Our Certified Virtualization Security Expert (Advanced VMware Security) Training is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Primer and Reaffirming Our Knowledge Primer and Reaffirming Our Knowledge FREE 00:25:00 Virtual Ports 00:21:00 Symmetric vs. Asymmetric Encryption 01:07:00 File System Structure 00:13:00 Accounts and Groups 00:35:00 Routing and the Security Design of VMware Routing and the Security Design of Vmware 00:11:00 Virtualization Layer 00:28:00 Memory Virtualization 00:28:00 Major Benefits of Using VLANs 00:13:00 Remote Data Store Security Remote DataStore Security 00:15:00 Fiber Channel Attacks - The Basics 00:22:00 Penetration Testing 101 Penetration Testing 101 00:33:00 The Evolving Threat 00:40:00 Information Gathering, Scanning and Enumeration Information Gathering, Scanning and Enumeration9 00:30:00 FireFox Fully Loaded 00:14:00 Introduction to Port Scanning 00:30:00 UDP Port Scan 00:42:00 Penetration Testing and the Tools of the Trade Penetration Testing and the Tools of the Trade 00:43:00 Windows Password Cracking 00:24:00 VASTO 00:22:00 DMZ Virtualization and Common Attack Vectors DMZ Virtualization and Common Attack Vectors9 00:21:00 Clearly Label Networks for Each Zone within the DMZ 00:22:00 Schmoo Con 2010 Virtualization Vulnerabilities Found! 00:08:00 Hardening Your ESX Server Hardening Your ESX Server 01:03:00 Configuring the ESX ESXi Host 02:19:00 Establish a Password Policy for Local User Accounts 00:21:00 Secure the SNMP Configuration 00:19:00 Hardening Your ESXi Server Hardening Your ESXi Server 00:20:00 Hardening Your vCenter Server Hardening Your vCenter Server 00:17:00 VMware Converter Enterprise 01:10:00 3rd Party Mitigation Tools 3rd Party Mitigation Tools 00:24:00 Mock Exam Mock Exam- Certified Virtualization Security Expert (Advanced VMware Security) Training 00:20:00 Final Exam Final Exam- Certified Virtualization Security Expert (Advanced VMware Security) Training 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Google Analytics for Everyone Course

By One Education

Whether you're managing a small blog or running a growing online business, understanding how visitors interact with your website isn’t optional — it’s essential. The Google Analytics for Everyone Course is your pathway to reading your website’s data like a well-written novel. No technical background? No problem. We speak fluent Analytics without sounding like a maths textbook. You'll learn how to navigate reports, interpret traffic sources, and make informed decisions — all while avoiding the confusing jargon that turns data into gibberish. This course doesn't just throw charts and numbers at you — it walks you through what matters and why it matters. From setting up Google Analytics to making sense of the audience behaviour and traffic channels, everything is designed to make you feel like you're wearing a data detective’s hat (minus the trench coat). Whether you're a marketer, content creator, or just someone who wants fewer website guesses and more clarity, this course gives you the confidence to make smarter moves online. Let your decisions be driven by insight — not assumptions. Learning Outcomes: Understand the basics of web analytics and the structure of Google Analytics Set up and manage user accounts in Google Analytics Set goals and track conversions using Google Analytics Analyze website traffic using the audience and acquisition tabs Create custom reports and dashboards using Google Analytics Our Google Analytics for Everyone course is designed to help you become a data-driven marketer using Google Analytics. With 8 comprehensive modules, you will learn how to set up and manage user accounts, set goals, track conversions, analyse website traffic, and create custom reports and dashboards using Google Analytics. This course is perfect for anyone looking to gain a deeper understanding of web analytics and become a data-driven marketer. Whether you are a business owner, marketer, or digital strategist, this course will help you master the skills you need to make informed marketing decisions and drive results. Google Analytics for Everyone Course Curriculum Section 01: Overview of Web Analytics Section 02: Structure of Google Analytics Section 03: Goal Setting Section 04: User Management Section 05: Audience Tab & Acquisition Tab Section 06: Conversion Tab & Dashboard Tab Section 07: Intelligence Tab Section 08: Email & Export Options How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Business owners who want to track the performance of their website Marketers who want to optimise their marketing campaigns Digital strategists who want to gain a deeper understanding of web analytics Students who want to explore the field of web analytics Professionals who want to enhance their data analysis skills Career path Digital Marketing Analyst: £20,000 - £40,000 Web Analyst: £25,000 - £50,000 Marketing Manager: £30,000 - £60,000 Senior Digital Strategist: £40,000 - £80,000 Head of Digital Marketing: £60,000 - £120,000 Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Salesforce Experience (Community) Cloud Consultant Training

By Packt

Immerse into the intricacies of Salesforce Experience Cloud with our training course and explore building sites, Salesforce CMS, content moderation, gamification, and partner portal setups. Learn about sharing rules, dashboards, and Salesforce CMS integration with a focus on user management, social login, and Lightning Bolts.

SC-300: Microsoft Identity and Access Administrator

By Packt

Learn all about Microsoft identity and Azure security the right way with tons of lab exercises. A course that aims to prepare students for the prestigious SC-300: Microsoft Identity and Access administrator exam. The course adheres to the new curriculum and objectives.

Geothermal Project Finance Analysis and Modelling

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) This 4 half-day Virtual Instructor Led Training (VILT) course will address a variety of contract and loan structuring issues associated with geothermal energy projects as well as comparison with solar, wind and battery storage. The course is designed to investigate how various project finance techniques and contract structures can be used to achieve a competitive power prices while maintaining a satisfactory equity return. Distinctive project finance features of power facilities that depend on geothermal, wind, hydro or solar resources will be evaluated with financial models. The course will cover economic analysis of exploration and development of geothermal facilities and how to incorporate probability of failure and success into an IRR framework. Subsequent sessions will address the theory underlying liquidated damages for delay, and performance as well as design of other incentives that is inherent in different contract structures. Nuanced project finance issues associated with structuring debt for renewable projects will be discussed including under what conditions the DSCR drives debt capacity and when the debt to capital ratio is instrumental. The course will be taught with a combination of theoretical discussions, term sheet review and focused financial models. Training Objectives Evaluation of the economic risks that arise from uncertainty associated with drilling exploration wells and development wells for geothermal projects. Analyse the theoretical issues with computing LCOE for geothermal projects compared to other renewable and non-renewable resources and the importance of cost of capital for renewable projects; Understand differences in contract structures for renewable projects and dispatchable projects and how a single price structure can distort incentives for efficient construction and operation; Understand components of financing that influence the bid price required to meet a required rate of return on equity and can result in relatively low prices with reasonable returns. Understand the importance of debt sizing constraints and what strategies are relevant when the debt to capital constraint applies relative to when the debt service coverage ratio drives the debt size; Understand how to compute P50, P90 and P99 for different projects driven by resource risk; Understand the difference between mean reverting resource variation and estimation mistakes that do not correct as the basis for 1-year P90 and 10-year P90. Understand under what conditions debt sculpting can affect returns and how synthetic sculpting can be used to increase returns when the DSCR constraint applies. Understand the theory of credit spreads, variable rate debt and interest rates in different currencies and compute the implied probability of default that in inherent in credit spreads. Understand how to evaluate the costs to equity investors and the benefits to lenders for various credit enhancements including DSRA accounts, cash flow sweeps and covenants. Course Level Basic or Foundation Training Methods The VILT will be delivered online in 4 sessions comprising 4 hours per day, with 2 breaks of 10 minutes per day, including time for lectures, discussion, quizzes and short classroom exercises. Trainer Your expert course leader provides financial and economic consulting services to a variety of clients, he teaches professional development courses in an assortment of modelling topics (project finance, M&A, and energy). He is passionate about teaching in Africa, South America, Asia and Europe. Many of the unique analytical concepts and modelling techniques he has developed have arisen from discussion with participants in his courses. He has taught customized courses for MIT's Sloan Business School, Bank Paribas, Shell Oil, Society General, General Electric, HSBC, GDF Suez, Citibank, CIMB, Lind Lakers, Saudi Aramco and many other energy and industrial clients. His consulting activities include developing complex project finance, corporate and simulation models, providing expert testimony on financial and economic issues before energy regulatory agencies, and advisory services to support merger and acquisition projects. Our key course expert has written a textbook titled Corporate and Project Finance Modelling, Theory and Practice published by Wiley Finance. The book introduces unique modelling techniques that address many complex issues that are not typically used by even the most experienced financial analysts. For example, it describes how to build user-defined functions to solve circular logic without cumbersome copy and paste macros; how to write function that derives the ratio of EV/EBITDA accounting for asset life, historical growth, taxes, return on investment, and cost of capital; and how to efficiently solve many project finance issues related to debt structuring. He is in the process of writing a second book that describes a series of valuation and analytical mistakes made in finance. This book uses many case studies from Harvard Business School that were thought to represent effective business strategies and later turned into valuation nightmares. Over the course of his career our key course expert has been involved in formulating significant government policy related to electricity deregulation; he has prepared models and analyses for many clients around the world; he has evaluated energy purchasing decisions for many corporations; and, he has provided advice on corporate strategy. His projects include development of a biomass plant, analysis and advisory work for purchase of electricity generation, distribution and transmission assets by the City of Chicago, formulation of rate policy for major metro systems and street lighting networks, advocacy testimony on behalf of low income consumers, risk analysis for toll roads, and evaluation of solar and wind projects. He has constructed many advisory analyses for project finance and merger and acquisition transactions. Lastly, our key course expert was formerly Vice President at the First National Bank of Chicago where he directed analysis of energy loans and also created financial modelling techniques used in advisory projects. He received an MBA specializing in econometrics (with honours) from the University of Chicago and a BSc in Finance from the University of Illinois (with highest university honours). POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations