- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4298 Accounting courses

Master the critical domain of Know Your Client (KYC) practices with this in-depth course. Gain a comprehensive understanding of KYC regulations, client due diligence, anti-money laundering, and more. Elevate your compliance acumen and set a new standard in client onboarding and risk assessment.

New Excel Functions

By Ideas Into Action

New Excel Functions Course Description Ross Maynard Description In the second half of 2020 Microsoft released a significant upgrade to the most used spreadsheet programme in the world. Microsoft Excel now offers the ability to handle dynamic arrays – functions that return a range of results that update as the source data changes. In this course, we discuss the power of dynamic arrays and introduce the new functions. The functions I am going to cover are: RANDARRAY- creating a table of random numbers or random dates UNIQUE – identifying the distinct items in a list SEQUENCE – listing numbers with a set interval SORT and SORTBY – new ways of dynamically sorting data FILTER – building the ability to filter data into formulae XLOOKUP – replacing VLOOKUP with greater flexibility IFS and SWITCH making it easier to construct IF statements The new CONCAT, and TEXTJOIN text functions If you have an earlier version of Microsoft Excel then these functions will not be available to you and this course might not be for you. But if you do have a subscription to Office365 – either personally or through your work – I think you will find this course extremely useful. Learning Outcomes Participants in this course will learn: What the new dynamic arrays feature in Microsoft Excel means How the new RANDARRAY function works How the new UNIQUE function works How the new SEQUENCE function works How the new SORT and SORTBY functions work How the new FILTER function works How the new XLOOKUP function can replace VLOOKUP How to build IF statements with the new IFS function How the new SWITCH function works How the new TEXTJOIN function can replace CONCATENATE and CONCAT How the new functions can be used in management reporting Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Level 7 Diploma in Forensic Anthropology: Skeletal Analysis - QLS Endorsed

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

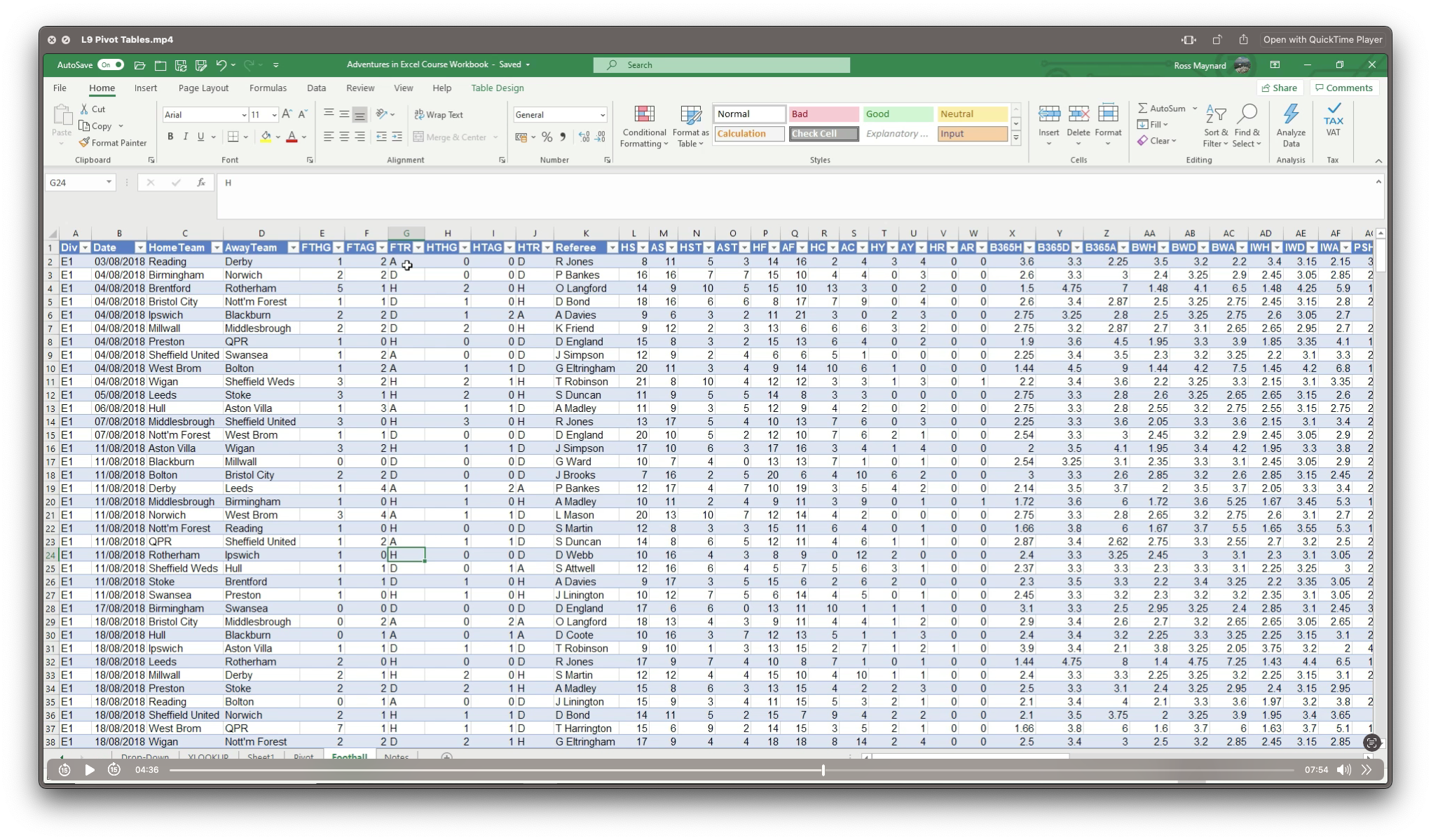

Adventures in Excel

By Ideas Into Action

Description Microsoft Excel has hundreds, if not thousands, of functions and features. This course aims to cover some of the best – that is the ones I find most useful. In “Adventures in Excel”, I cover the simple-to-use but powerful functions that I use most often: Basic features including products and powers Key date functions including the calculation of due dates and days past due Generating random numbers and random dates The new IFS functions (new to Office365) Text functions The most useful logical functions and IS functions How to create a drop-down list The new XLOOKUP function Pivot tables These functions are easy to use, and, unless your role is extremely specialised, they are probably the ones you’ll use 90% of the time. I hope you find the course helpful. Learning Outcomes Participants in this course will learn: Basic Excel functions including SUM, AVERAGE, MIN, MAX, PRODUCT, POWER and SQRT Useful date functions including TODAY, EOMONTH, EDATE, and DAYS Generating random numbers using RAND and RANDBETWEEN; generating random dates; and randomly picking an item from a list or table The new RANDARRAY function in Office365 The new IFS functions in Office365 including AVERAGEIFS, MAXIFS, MINIFS, COUNTIFS, and SUMIFS Text functions including TRIM, LOWER, UPPER, PROPER, LEFT, MID, RIGHT, FIND, TEXTJOIN and CONCATENATE Logical functions AND, OR, and NOT and IS functions ISTEXT, ISNUMBER, ISBLANK and ISERROR How to create a drop-down list The new SORT and FILTER functions in Office365 VLOOKUP and the new XLOOKUP function How to create a Pivot table and analyse data with one Course Requirements There are no pre-course requirements. Additional Resources Course Spreadsheet with the examples covered. About Ross Ross Maynard is a Fellow of the Chartered Institute of Management Accountants in the UK. He is director of Ideas2Action Process Excellence Ltd and has 30 years’ experience as a process improvement consultant and facilitator. Ross is also a professional author of online training courses for accountants. Ross lives in Scotland with his wife, daughter and Cocker Spaniel

Overview Learn how to price equity options and the features that make them different from other asset classes. Explore how to use these products for taking equity risk, yield enhancement and portfolio protection Who the course is for Risk managers Bank treasury professionals Finance Internal Audit Senior management Fixed Income, FX, Credit and Equities traders Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2 day course focuses on best practice bank ALM in today’s environment of a multiplicity of regulatory constraints on the balance sheet Who the course is for Asset Liability Committee (ALCO) members Treasury Risk Finance and internal audit capital management Funding management Liquidity buffer investment team Derivative structurers and salespeople; IT software providers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Credit control and debt recovery - legal issues (In-House)

By The In House Training Company

It is essential that those charged with responsibility for credit control and debt recovery have a full appreciation of the relevant law: no-one can negotiate effectively to recover a debt if they don't understand the ultimate sanctions they can apply. This programme is designed to give them a practical, up-to-date understanding of the law as it applies to your particular organisation. This course will help ensure that participants: Understand the relevant laws Know how and when to invoke legal processes Avoid legal pitfalls in debt collection negotiations Specific, practical learning points include: Definition of 'harassment' How to set up an in-house collection identity Whether cheques in 'full and final settlement' are binding The best steps to trace a 'gone away'... and many, many more. 1 Data protection and debt recovery There are a whole range of things which can be checked on members of the public and which are not affected by the restraints of the Data Protection Act. These will be explained in simple, clear terms so that staff can use this information immediately. 2 County Court suing The expert trainer will show how to sue for money owed, obtain judgment and commence enforcement action without leaving your desk. This module is aimed at showing how to make the Courts work for you instead of the other way around! 3 Enforcement of judgments There are many people who have a County Court Judgment (CCJ) against their debtor but who still remain unpaid. This session explains each of the enforcement methods and how to use them to best effect. Enforcement methods covered include: Warrant of Execution Using the sheriff (now known as High Court Enforcement Officers) Attachment of earnings Third Party Debt Orders Charging Orders (over property and goods) Winding-up companies and making individuals bankrupt 4 Office of Fair Trading rules on debt recovery Surprisingly few people are aware of the Office of Fair Trading rules on debt recovery and many of those that do know think they don't apply to them - but they do. Make sure you know what you need to! 5 New methods to trace elusive, absentee and 'gone away' debtors Why write the money off when you can trace the debtor and collect the money you are owed? 6 Credit checking of new and existing customers It makes sense to credit check would-be, new and existing customers to evaluate the likelihood of payment delays or perhaps not being paid at all. This session shows a range of credit checking steps, many of which can be done completely free of charge, including a sample credit application/ account opening form. 7 Late Payment of Commercial Debts Regulations Do your staff understand this legislation and how to use it to make people pay quicker than ever before? The trainer shows how. 8 The Enterprise Act The Enterprise Act made some startling changes to corporate and personal insolvency. What are the implications for credit control and debt recovery within your organisation?

Search By Location

- Accounting Courses in London

- Accounting Courses in Birmingham

- Accounting Courses in Glasgow

- Accounting Courses in Liverpool

- Accounting Courses in Bristol

- Accounting Courses in Manchester

- Accounting Courses in Sheffield

- Accounting Courses in Leeds

- Accounting Courses in Edinburgh

- Accounting Courses in Leicester

- Accounting Courses in Coventry

- Accounting Courses in Bradford

- Accounting Courses in Cardiff

- Accounting Courses in Belfast

- Accounting Courses in Nottingham