- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4215 Accounting courses in Hyde delivered Online

Project Accounting and Finance Skills: In-House Training

By IIL Europe Ltd

Project Accounting and Finance Skills: In-House Training Do you manage both project schedules and budgets, but do not have insight into how actual results relate to the approved budget? Do you desire to have more clarity about the relationship between your project's performance with the accounting and financial systems in your organization? Do you need to understand financial and accounting terminology to bridge the gap between the 'world of finance' and the 'world of project management? Organizations have a need to manage-by-projects, because projects are the means to deliver on strategic goals and objectives. Therefore, the project manager must have an understanding of the financial world of investments to ensure the organization will realize expected business value. This requires a foundation in the principles of accounting and finance to comprehend how the project's contribution provides an organization with a competitive advantage. Learn what you must do to give your organization the assurance it needs that its investment in your project will realize business value. Learn what you must do to give your organization the assurance it needs to know that its investment in your project will realize business value. What You Will Learn At the end of this program, you will be able to: Explain the aspects of classical corporate accounting and finance effects on managing projects Determine how your project fits into the corporate income statement, balance sheet, and cash flow statement Analyze the financial aspects of managing projects Use earned value management as the basis for decision making throughout the project life Recognize the importance of the project manager's financial responsibilities Focus on what PMs do and should be doing, in support of accounting and finance Use financial information within a project environment to meet financial results Track and analyze the project's financial status and forecast with the goal of realizing benefits Generate work performance data to ensure a project's outcome aligns with financial metrics Foundation Concepts Accounting and Finance Terms and Concepts Accounting and Finance Essentials Financial Terms and Concepts Projects as Financial Investments Overview of 'Two Worlds' Project as Investments Accounting and Finance World: Standards, Principles and Practices Accounting and Finance Standards and Principles Accounting and Finance Practices Capital Budgeting Corporate Budgeting Accounting and Finance World: Economic Project Selection Methods Economic Project Selection Methods Economic Project Selection and the Business Case Project Management World Project Management and Financial Controls Project Management and Work Performance Data Project Management and Earned Value Management Project Management and Work Performance Reporting

Overview This five-day workshop provides a detailed review of significant IFRS requirements for the upstream oil and gas sector, including regulatory reporting and the diverse accounting practices that arise from the many commercial and contracting arrangements which are unique to it. It includes coverage of IFRSs, hands-on case studies, examples, exercises, and benefits from the interactive participation of the attendees. The program includes the latest pronouncements, and participants are brought up-to-date on all topics. In addition, participants are provided with information to assist them in researching accounting issues and monitoring future changes.

11 in 1 "Charity Accounting" Bundle only at £53 Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift - Enrol Now Give a compliment to your career and take it to the next level. This Charity Accounting bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Charity Accounting bundle will help you stay ahead of the pack. Throughout the Charity Accounting programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Charity Accounting course, you will get 10 premium courses, an originalhardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Charity Accounting Bundle Consists of the following Premium courses: Course 01: Charity Accounting Course 02: Fundraising Course 03: Double Your Donations & Succeed at Fundraising Course 04: Financial Analysis Course 05: Budgeting and Forecasting Course 06: Introduction to Accounting Course 07: Key Account Management Course Course 08: Professional Bookkeeping Course Course 09: Microsoft Excel Training: Depreciation Accounting Course 10: Certificate in Compliance Course 11: Certificate in Anti Money Laundering (AML) The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your Charity Accounting expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Curriculum of Bundle Course 01: Charity Accounting Module 01: The Concept of Charity Accounting Module 02: Accounting Standards, Policies, Concepts and Principles Module 03: Fund Accounting Module 04: Charity Reporting and Accounts Module 05: Trustees' Annual Report Module 06: Balance Sheet Module 07: Statement of Financial Activities Module 08: Understanding the Income Streams and Expenditure of Charity Module 09: Statement of Cash Flows Module 10: Taxation for Charities and External Scrutiny Module 11: Things to Look Out for in Post Covid Situation How will I get my Certificate? After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) PS The delivery charge inside the UK is £3.99, and the international students have to pay £9.99. CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Charity Accounting bundle. Requirements This course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included P.S. The delivery charge inside the UK is £3.99, and the international students have to pay £9.99.

In today’s world, the accounting and finance industry is more competitive than ever and goes beyond simply having theoretical qualifications. Candidates who desire to make an impression are required to have an understanding of computerised packages such as Sage 50 Accounts & Microsoft Excel. Our 3-month training programme provides everything you need to become fully qualified in Sage 50 Accounts & Microsoft Excel. Once you have completed your training session you will gain accredited certifications and three months of remote experience directly with one of our clients. After completing this programme candidates will be able to showcase that they have the following: Sage 50 Accounts Beginners Sage 50 Accounts Intermediate Sage 50 Accounts Advanced Microsoft Excel for Accountants beginners to advanced 3 months of remote work experience Job reference Career support This comprehensive training programme has been developed to enhance your CV and boost your job prospects. CPD 480 CPD hours / pointsAccredited by The CPD Certification Service Description What’s included 3 months access to the online course Professional qualifications Guaranteed work placement (12 weeks) Accountancy certifications Learn industry-leading software to stand out from the crowd Information-packed practical training starting from basics to advance principles Course content designed considering current software and the job market trends A practical learning experience working with live company data Who is this course for? Part Qualified, Freshly Qualified Accountancy Students Graduates with No or little Job Experience Students Currently Studying or intending to study Accountancy or want to refresh knowledge on tax and accounting People who are already working in the industry but want to gain further knowledge about tax and accounting And Thinking of opening an accountancy/Tax/Payroll Practice Requirements There are no formal entry requirements for this course. We also expect the candidates to have basic knowledge of Accountancy. Career path Candidates who have completed this programme have secured jobs in the following roles; Trainee Accountant – Salary £24,750 Credit Controller – Salary £21,434.43 General Ledger Accountant – Salary £23,850.60 Accountant – Salary £28,985.77 Insurance Accountant – Salary £29,541.25

Description Do you have a background in accounting? Or are you just interested in it and the business sector? If either of these is you, then you should take up accounting career fundamentals course to gain systematic knowledge about various fundamental aspects of accounting career. We are offering you a high-quality comprehensive certificate Course designed to help you learn the accounting career essentials. In any type of businesses, accounting is basically the language in business and having enough knowledge about accountancy is essential for businessmen and women to know how their business is doing. This is why accounting professionals are very much in demand today. And, a lot of certified accountants have become quite successful in their field and some have even started their own business. You will be equipped in this certificate course with the skills and knowledge on accounting career fundamentals. This surely will be helpful to your accounting career. Who is the course for? For anyone who is interested in an accounting career. Entry Requirement: This course is available to all learners, of all academic backgrounds. However, an education and experience in accounting is an advantage. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. PDF certificate's turnaround time is 24 hours and for the hardcopy certificate, it is 3-9 working days Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: This course will be useful and would be beneficial for accounting occupations especially in the field of Accounting Career. Accounting Career Fundamentals Accounting 00:30:00 Advanced Accounting Career Training 00:30:00 Careers in Accountancy 01:00:00 Church Accounting Software 00:30:00 Finding an Accounting Job 00:30:00 Forensic Accounting 00:30:00 Free Accounting Software 00:30:00 List of Accounting Careers 00:30:00 Services in Financial Accounting 00:30:00 Successful Career in Accounting Even if You're Hit Forty! 00:30:00 The Benefits of an Accountancy Career 00:30:00 Types of Accountancy Career 00:30:00 Mock Exam Mock Exam- Accounting Career Fundamentals 00:20:00 Final Exam Final Exam- Accounting Career Fundamentals 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Description Charity Accounting Diploma Navigating the financial landscape of charities requires a unique skill set and a deep understanding of specific regulations. Charities operate under a different set of rules than other businesses, and ensuring their financial management is up to par is critical for their success. This is where the Charity Accounting Diploma comes into play. Tailored exclusively for online learning, this comprehensive course seeks to arm students with the knowledge and tools they need to excel in the world of charity accounting. First and foremost, the course begins with an overview of charity accounting. This foundation ensures that all participants start with a clear understanding of the basics. It's essential to grasp the unique nature of charities and how their financial operations differ from other entities. The course then proceeds to unpack the regulatory landscape for charities. With ever-changing rules and guidelines, it's crucial for charity accountants to remain updated. This section demystifies the regulations governing charities, ensuring that they remain compliant and uphold their reputation. A deep exploration into financial management in charities offers insights into best practices and potential pitfalls. With donations, grants, and various funding methods at play, managing a charity's finances can be intricate. This course ensures that learners can navigate these complexities with ease. One of the significant components of the course is understanding charity funds and reserves. Given that charities function largely on donations and grants, knowing how to manage and report on these funds is imperative. Additionally, the role of trustees in charity accounting is another focal point. Their responsibilities and influence on the financial aspect of charities are crucial for any accountant in this field to understand. No financial course would be complete without discussing auditing and assurance. For charities, these elements offer a layer of credibility and trust. This course provides a comprehensive look into the preparation of charity accounts, offering a step-by-step guide to ensure accuracy and compliance. Transparency and accountability hold a special place in charity accounting. The course delves into the importance of these factors, teaching students how to maintain clarity in their accounts and ensuring stakeholders always have a clear view of the charity's financial health. Gift Aid and VAT have unique implications for charities. With specific rules governing these areas, it's vital for charity accountants to know the ins and outs. This course covers these topics in-depth, providing clarity and guidance on how to manage and report on them accurately. Lastly, given the evolving nature of the sector, the course touches on the future of charity accounting. With technology, regulations, and societal changes always on the horizon, being prepared for what's next is paramount. In conclusion, the Charity Accounting Diploma is not just another online course. It's a journey into the world of charity finance, offering insights, tools, and knowledge that are both comprehensive and relevant. Whether you're a seasoned accountant looking to transition into the charity sector or a newcomer wanting to embark on a meaningful career, this course is the gateway to mastering charity accounting. Register today and elevate your skills in the world of charitable financial management. What you will learn 1:An Overview of Charity Accounting 2:The Regulatory Landscape for Charities 3:Financial Management in Charities 4:Understanding Charity Funds and Reserves 5:The Role of Trustees in Charity Accounting 6:Auditing and Assurance for Charities 7:Preparing Charity Accounts: A Step-by-Step Guide 8:Transparency and Accountability in Charity Accounting 9:Gift Aid and VAT in Charity Accounting 10:The Future of Charity Accounting Course Outcomes After completing the course, you will receive a diploma certificate and an academic transcript from Elearn college. Assessment Each unit concludes with a multiple-choice examination. This exercise will help you recall the major aspects covered in the unit and help you ensure that you have not missed anything important in the unit. The results are readily available, which will help you see your mistakes and look at the topic once again. If the result is satisfactory, it is a green light for you to proceed to the next chapter. Accreditation Elearn College is a registered Ed-tech company under the UK Register of Learning( Ref No:10062668). After completing a course, you will be able to download the certificate and the transcript of the course from the website. For the learners who require a hard copy of the certificate and transcript, we will post it for them for an additional charge.

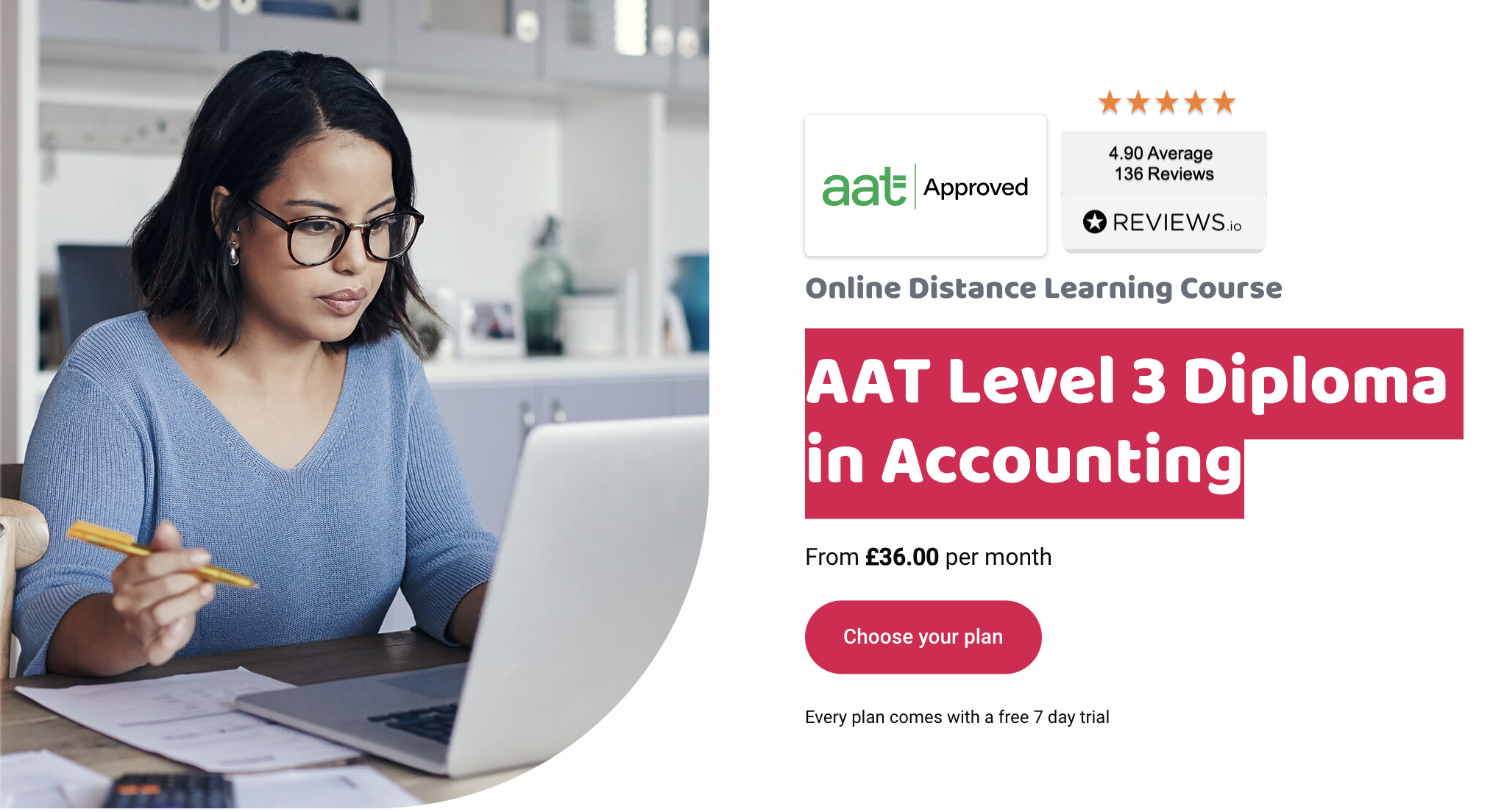

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Course Overview There are some major skillsets that add immense value to your resume, and accounting is on the top list among them. The Fundamental Accounting Concepts course is providing you with a golden opportunity to learn this valuable skill and elevate your resume. This Fundamental Accounting Concepts course is designed to teach you the basic skills required in accounting. From this comprehensive course, you will learn the essential equations used in accounting. You will attain the expertise to conduct all sorts of internal and external transactions. The instructor will also help you grasp a clear understanding of the major accounting policies required for a company. Here, you will also get the opportunity to build adequate skills for inventory accounting, revenue accounting, and expense accounting. This incredible Fundamental Accounting Concepts course will equip you with key skills of accounting within no time. Enroll in the course and build an impressive CV. Learning Outcomes Understand the core principles of financial accounting Learn the basic accounting equations Build the essential skills to conduct external and internal transactions with other companies Enrich your understanding of accounting policies Acquire the skills for inventory accounting Get detailed lessons on revenue and expense accounting Who is this course for? The Fundamental Accounting Concepts course is for those who want to build basic accounting skills Entry Requirement This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Certification After you have successfully completed the course, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path The Fundamental Accounting Concepts course is a useful qualification to possess and would be beneficial for any related profession or industry such as: Accountant Business Owner Banking Executive Introduction to Accounting Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting 00:13:00 Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules 00:10:00 Lecture-3.Financial Accounting Process and Financial Statements Generates 00:14:00 Lecture-4.Basic Accounting Equation and Four Financial Statements 00:21:00 Lecture-5.Define Chart of Accounts and Classify the accounts 00:07:00 Lecture-6. External and Internal Transactions with companies 00:12:00 Lecture-7.Short Exercise to Confirm what we learned in this section 00:06:00 Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies 00:06:00 Lecture-9.Depreciation Policies 00:12:00 Lecture-10.Operational Fixed Asset Controls 00:13:00 Lecture-11.Inventory Accounting and Controls 00:11:00 Lecture-12.Revenue Accounting and Controls 00:08:00 Lecture-13.Expenses Accounting and Working Capital 00:12:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview Learn about Accounting & Bookkeeping from industry experts and boost your professional skill. This Accounting & Bookkeeping course will enhance your skill and make you ready for the job market. You'll get expert opinions about the best practices and problems of Accounting & Bookkeeping. You'll also gain the skills of Accounting & Bookkeeping to excel in your job and tips to master professional skills in no time. You'll be connected with the community of Accounting & Bookkeeping professionals and gain first-hand experience of Accounting & Bookkeeping problem-solving. The Accounting & Bookkeeping is self-paced. You can complete your course and submit the written assignment in your suitable schedule. After completing the Accounting & Bookkeeping, you'll be provided with a CPD accredited certificate which will boost your CV and help you get your dream job. This Accounting & Bookkeeping will provide you with the latest information and updates of Accounting & Bookkeeping. It will keep you one step ahead of others and increase your chances of growth. Why buy this Accounting & Bookkeeping? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Accounting & Bookkeeping there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Accounting & Bookkeeping course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Accounting & Bookkeeping does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Accounting & Bookkeeping was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Accounting & Bookkeeping is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Introduction to the course Introduction 00:02:00 Introduction to Bookkeeping Introduction to Bookkeeping 00:15:00 Bookkeeping systems Manual System 00:08:00 Computerised Systems 00:11:00 How it Fits Together 00:08:00 Basics of Bookkeeping Bookkeeping Basics 00:30:00 The functionality of bookkeeping Ledgers 00:10:00 Trial Balance and Coding 00:11:00 PNL Account and Balance Sheet 00:05:00 On a personal note AILE Personal 00:06:00 Accounting Skills Course Overview 00:05:00 Getting the Facts Straight 00:30:00 The Accounting Cycle 00:30:00 The Key Reports 00:30:00 A Review of Financial Terms 00:30:00 Understanding Debits and Credits 00:15:00 Your Financial Analysis Toolbox 00:30:00 Identifying High and Low Risk Companies 00:30:00 The Basics of Budgeting 00:30:00 Working Smarter 00:10:00