- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1197 Accountant courses in Bonhill delivered On Demand

Advanced Diploma in Xero Accounting and Bookkeeping Level 7

By Compliance Central

Xero is a cloud-based accounting software used by over 3 million users in over 180 countries. It is expected to grow by 10% in the next five years, making it a lucrative and rewarding career choice for accountants and bookkeepers. With Xero Accounting & Bookkeeping skills, you can have a career that is both financially rewarding and versatile. The average salary for a Xero accountant or bookkeeper in the UK is £35,000, with experienced professionals earning upwards of £50,000. And, because Xero is used by businesses of all sizes in a variety of industries, you have the flexibility to work in the setting that best suits your needs and interests. Whether you want to work full-time or part-time, remotely or in an office, Xero offers a career path that is right for you. And, with the increasing demand for Xero skills, there are more job opportunities than ever before. If you are looking for a career that is both lucrative and rewarding, Xero Accounting & Bookkeeping is a great option to consider. With its high demand for skilled professionals, competitive salaries, and versatility, a career in Xero Accounting & Bookkeeping is a smart choice for your future. Courses in this Xero Accounting & Bookkeeping Exclusive Package: Course 01: Advanced Diploma in Xero Accounting & Bookkeeping at QLS Level 7 Course 02: Quickbooks Online Course 03: Tax Accounting Course 04: Sage 50 Accounts Course 05: Diploma in Payroll: UK Payroll Course 06: Pension What will make you stand out? On completion of this online Xero Accounting & Bookkeeping course, you will gain: CPD QS Accredited Proficiency After successfully completing the Xero Accounting & Bookkeeping course, you will receive a FREE PDF Certificate from REED as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials. The online test with immediate results You can study and complete the Xero Accounting & Bookkeeping course at your own pace. Achieve mastery in Xero Accounting & Bookkeeping with our QLS Level 7 Diploma. From invoices and sales to VAT returns, our comprehensive course covers everything you need to excel in modern financial management. The curriculum of the Advanced Diploma in Xero Accounting & Bookkeeping at QLS Level 7: Introduction: Learn the basics of Xero accounting & bookkeeping. Getting Started: Set up your Xero account and start recording transactions. Invoices and Sales: Create and manage invoices and sales. Bills and Purchases: Record and pay bills and expenses. Bank Accounts: Reconcile bank accounts and track cash flow. Products and Services: Set up and manage products and services. Fixed Assets: Record and track fixed assets. Payroll: Calculate and pay payroll. VAT Returns: Prepare and file VAT returns. Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Upon successful completion of the Xero Accounting & Bookkeeping course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £129 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Disclaimer This course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Xero Accounting & Bookkeeping course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Xero Accounting & Bookkeeping. This Xero Accounting course is suitable for: Aspiring accountants looking to specialize in Xero Accounting & Bookkeeping. Small business owners are managing their own finances with Xero. Bookkeepers are seeking advanced knowledge and certification in Xero. Financial professionals are aiming to enhance their skills in Xero Accounting & Bookkeeping Career changers interested in Xero Accounting & Bookkeeping. Entrepreneurs want to streamline their accounting processes with Xero. Requirements To enrol in this Xero Accounting & Bookkeeping course, all you need is a basic understanding of the English Language and an internet connection. Study for the Xero Accounting & Bookkeeping course using any internet-connected device, such as a computer, tablet, or mobile device. Career path After completing this Xero Accounting & Bookkeeping training, you can explore Xero accounting course-related jobs easily, such as - Senior Supervisor Mentor Auditor Account Assistant Bookkeeper Assistant Accountant Finance Manager Payroll Administrator Accounts Assistant Credit Controller Sales Ledger Clerk Management Accountant Sales Ledger Clerk Financial Controller Certificates Certificate of completion Digital certificate - Included After successfully completing this course, you can get a CPD accredited digital PDF certificate for free. QLS Endorsed Hard Copy Certificate Hard copy certificate - £129

Accountancy provides an excellent opportunity to gain the skills and knowledge you'll need to advance in your career. Take this course anywhere and at any time. Don't let your lifestyle limit your learning or your potential. Accountancy will provide you with the right CPD Accredited qualifications that you'll need to succeed. Gain experience online and interact with experts. This can prove to be the perfect way to get noticed by a prospective employer and stand out from the crowd. Accountancy has been rated and reviewed highly by our learners and professionals alike. We have a passion for teaching, and it shows. All of our courses have interactive online modules that allow studying to take place where and when you want it to. The only thing you need to take Accountancy is Wi-Fi and a screen. You'll never be late for class again. Experienced tutors and mentors will be there for you whenever you need them, and solve all your queries through email and chat boxes. Why Choose Accountancy Training? Opportunity to earn a certificate accredited by CPD after completing this Accountancy Training course Student ID card with amazing discounts - completely for FREE! (£10 postal charges will be applicable for international delivery) Globally accepted standard structured lesson planning Innovative and engaging content and activities Assessments that measure higher-level thinking and skills Complete the Accountancy Training program in your own time, at your own pace Each of our students gets full 24/7 tutor support ****Course Curriculum**** Here are the topics you will cover in the Accountancy Training Course: ***Accounting and Finance*** Module 01: Introduction to Accounting What Is Accounting? Accounting and Bookkeeping Who Uses Accounting Information? Financial Statements How Different Business Entities Present Accounting Information Module 02: The Role of an Accountant What Is an Accountant? Roles and Responsibilities Important Skills Transparency and Security Data Analysis Module 03: Accounting Concepts and Standards Introduction to Accounting Concepts Standards International Accounting Standards International Financial Reporting Standards Module 04: Double-Entry Bookkeeping Introduction of Double-Entry Bookkeeping What Does the Account Show? Rules for Double-Entry Transactions Accounting for Inventory Double-Entry Transactions for Inventory Returns of Inventory Drawings Income and Expenses How Many Different Expense Accounts Should Be Opened? Balancing Accounts Module 05: Balance Sheet Introduction of Balance Sheet The Components of a Balance Sheet The Accounting Equation Understanding the Balance Sheet What Does the Date on the Balance Sheet Mean? Module 06: Income statement Understanding the Income Statement The Accrual Concept Revenue Expenses Net Income Interest and Income Taxes Bad Debt Expense Module 07: Financial statements Introduction of Financial Statements Trial Balance Statement of Comprehensive Income Calculation of Profit Difference between Gross and Net Profits Trading Account Profit and Loss Account Statement of Financial Position Module 08: Cash Flow Statements What Is a Statement of Cash Flows? What Is the Purpose of the Cash Flow Statement? Cash and Cash Equivalents Operating Activities Investing Activities Financing Activities Module 09: Understanding Profit and Loss Statement Introduction of Profit and Loss Account Measurement of Income Relation Between Profit and Loss Account and Balance Sheet Preparation of Profit and Loss Account Module 10: Financial Budgeting and Planning What Is a Budget? Planning and Control Advantages of Budgeting Developing the Profit Strategy and Budgeted Profit and Loss Statement Budgeting Cash Flow from Profit for the Coming Year Capital Budgeting Module 11: Auditing What Is an Audit? Types of Audits Why Audits? Who's Who in the World of Audits What's in an Auditor's Report Assessment Process Once you have finished the learning stages in the Accountancy Training course, your abilities will be assessed by an automated multiple-choice question session, after which you will receive the results immediately. Showcase Your Accomplishment of New Skills: Get a Certification of Completion The learners have to successfully complete the assessment of this Accountancy Training course to achieve the CPD accredited certificate. Digital certificates can be ordered for only £10. The learner can purchase printed hard copies inside the UK for £29, and international students can purchase printed hard copies for £39. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this course. This course is open to everybody. Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this course, you are to start your career or begin the next phase of your career.

Embark on a journey to master the intricacies of Canadian tax accounting with our comprehensive 'Canadian Tax Accounting Diploma Course'. This course is a beacon of knowledge for anyone aspiring to navigate the complex tax system of Canada. It begins by laying the foundation of the tax system and administration in Canada, offering a deep dive into the various aspects of tax planning principles. As you progress, the course intricately unfolds the layers of income determination and taxation, guiding you through various income sources such as employment, business, and property. The course doesn't stop there; it further delves into the nuances of capital gains, losses, corporations, partnership businesses, limited partnerships, joint ventures, and the taxation of trusts. With a focus on both domestic and international business expansion, this course also addresses the vital aspects of GST/HST. Whether you are seeking a Canadian tax accountant near you or aiming to become a Canadian American tax accountant, this course is your gateway to excellence. Learning Outcomes: Gain comprehensive understanding of Canada's tax system and administrative procedures. Develop strategic skills in tax planning and principles. Acquire expertise in income determination and taxation across various sources. Learn the intricacies of corporate tax structures and partnership businesses. Expand knowledge on GST/HST and its application in domestic and international contexts. Why buy this Canadian Tax Accounting Diploma Course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Certification After studying the course materials of the Canadian Tax Accounting Diploma Course there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Canadian Tax Accounting Diploma Course course for? Aspiring Canadian tax accountants seeking specialised knowledge. Professionals aiming to excel in Canadian-American tax accounting. Individuals planning to establish a career in tax accounting in London. Entrepreneurs requiring insights into Canadian tax for business expansion. Finance students or graduates pursuing a career in tax accounting. Prerequisites This Canadian Tax Accounting Diploma Course does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Canadian Tax Accounting Diploma Course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Tax Consultant: £30,000 - £60,000 Per Annum Corporate Tax Advisor: £35,000 - £70,000 Per Annum Tax Manager: £40,000 - £80,000 Per Annum Tax Accountant: £32,000 - £65,000 Per Annum Financial Analyst: £35,000 - £70,000 Per Annum Business Development Manager: £40,000 - £85,000 Per Annum Course Curriculum Module 01: Tax System and Administration in Canada Tax System and Administration in Canada 00:27:00 Module 02: Tax Planning Principles Tax Planning Principles 00:25:00 Module 03: Income Determination and Taxation Income Determination and Taxation 00:36:00 Module 04: Income From Employment Income From Employment 00:40:00 Module 05: Income From Business Income From Business 00:27:00 Module 06: Income From Property Income From Property 00:34:00 Module 07: Capital Gains And Capital Losses Capital Gains And Capital Losses 00:43:00 Module 08: Introduction to Corporations Introduction to Corporations 00:39:00 Module 09: Partnership Businesses Partnership Businesses 00:25:00 Module 10: Limited Partnership & Joint Ventures Limited Partnership & Joint Ventures 00:14:00 Module 11: Taxation of Trusts Taxation of Trusts 00:17:00 Module 12: GST/HST GST/HST 00:25:00 Module 13: Domestic and International Business Expansion Domestic and International Business Expansion 00:26:00 Assignment Assignment - Canadian Tax Accounting Diploma Course 00:00:00

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before In the UK, the accounting and bookkeeping industry is booming, with a projected growth rate of 8% by 2026. As businesses become increasingly complex, the demand for skilled professionals in this field is skyrocketing. According to a report by the Association of Chartered Certified Accountants (ACCA), nearly 80% of small businesses in the UK outsource their accounting and bookkeeping tasks. Are you ready to take this chance and pursue a fulfilling career? This Accounting & Bookkeeping bundle offers a combination of introductory and advanced courses, taking you from the fundamentals of accounting principles to specialised areas like financial analysis, tax accounting, and anti-money laundering. You'll master industry-standard software like Xero and Sage 50, gain a deep understanding of payroll management, and develop the critical thinking skills necessary to become a financial investigator. With a single payment, you will gain access to Accounting & Bookkeeping Bundle, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Accounting & Bookkeeping Course Bundle Package includes: Main Course: Advanced Diploma in Xero Accounting And Bookkeeping at QLS Level 7 10 Premium Additional CPD QS Accredited Courses - Course 01: Introduction to Accounting Course 02: Accountancy Course 03: Xero Accounting - Complete Training Course 04: Payroll: Payroll Management Course 05: Sage 50 Diploma Course 06: Managerial Accounting Course 07: Tax Accounting Diploma Course 08: Financial Analysis Course Course 09: Financial Investigator Course 10: Anti Money Laundering and Fraud Management Whether you're looking to launch a new career or enhance your existing qualifications in accounting, this bundle provides a roadmap to success. Enrol today and take control of your financial future! Learning Outcomes of accounting & bookkeeping Learn to navigate popular accounting software like Xero and Sage. Gain expertise in preparing financial statements and analysing financial data. Master the intricacies of payroll management and tax accounting regulations. Develop skills in identifying and preventing financial fraud and money laundering. Understand the principles of managerial accounting for effective decision-making. Acquire knowledge in conducting comprehensive financial investigations and audits. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of accounting & bookkeeping Get a free student ID card with accounting & bookkeeping Training program (£10 postal charge will be applicable for international delivery) The accounting & bookkeeping is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the accounting & bookkeeping course materials The accounting & bookkeeping comes with 24/7 tutor support Take a step toward a brighter future! *** Course Curriculum *** Main Course: Advanced Diploma in Xero Accounting And Bookkeeping at QLS Level 7 Module 01: Introduction Module 02: Getting Started Module 03: Invoices and Sales Module 04: Bills and Purchases Module 05: Bank Accounts Module 06: Products and Services Module 07: Fixed Assets Module 08: Payroll Module 09: Vat Returns Course 01: Introduction to Accounting Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules Lecture-3.Financial Accounting Process and Financial Statements Generates Lecture-4.Basic Accounting Equation and Four Financial Statements Lecture-5.Define Chart of Accounts and Classify the accounts Lecture-6. External and Internal Transactions with companies Lecture-7.Short Exercise to Confirm what we learned in this section Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies Lecture-9.Depreciation Policies Lecture-10.Operational Fixed Asset Controls Lecture-11.Inventory Accounting and Controls Lecture-12.Revenue Accounting and Controls Lecture-13.Expenses Accounting and Working Capital Course 02: Accountancy Module 01: Introduction To Accounting Module 02: The Role Of An Accountant Module 03: Accounting Concepts And Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income Statement Module 07: Financial Statements Module 08: Cash Flow Statements Module 09: Understanding Profit And Loss Statement Module 10: Financial Budgeting And Planning Module 11: Auditing =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £139) CPD 285 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This Accounting & Bookkeeping bundle is open to everybody. Bookkeeping Beginners Accounting Enthusiasts Career Changers Business Owners Finance Professionals Requirements You will not need any prior background or expertise to enrol in this Accounting & Bookkeeping bundle. Career path After completing this Accounting & Bookkeeping bundle, you are to start your career or begin the next phase of your career. Bookkeeper Accountant Tax Advisor Financial Analyst Auditor Fraud Investigator Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free.

Accounting has various sectors. But have you ever thought of yourself as a Tax Accountant? If not, then start thinking about it now. You will be amazed when you hear the salary of a Tax Accountant, they typically get an amount of £55,000 - £75,000 per annum in the UK. However, tax accountants require excellent knowledge about their fields and quality skills. To help you acquire this knowledge, we carefully formulated this Tax Accounting course to demonstrate to you the tax system in the UK. In this course you will learn about the value tax, capital gain tax, corporation tax, inheritance tax and many more. Alongside that, it will discuss double-entry accounting, financial analysis and accounting management. These skills of taxation will help you fulfil your work efficiently. Furthermore, with the progression of studying this course, you will gain expertise in submitting a self-assessment tax return. Thus, if you are keen to learn and advance your career, then sign up for this course right now. After completing the course, you will get a CPD- certificate of achievement, which will boost your employability. Join now! Learning Outcomes Get acquainted with the tax system and administration in the UK Know more about how to submit a self-assessment tax return Deepen your understanding of the fundamentals and advanced level of income tax Acquire detailed knowledge about value tax, capital gain tax, corporation tax, inheritance tax and many more Understand what double-entry accounting is Learn about the career opportunities as a Tax Accountant in the UK Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Upon successful completion of the final assessment, you will be eligible to apply for the Quality Licence Scheme Endorsed Certificate of Achievement. This certificate will be delivered to your doorstep through the post for £99. An extra £10 postage charge will be required for students leaving overseas. CPD Accredited Certificate After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Method of Assessment At the end of the course, there will be a final assessment. A set of questions will be provided, and you can complete these questions according to your convenient time. After you submit the assignment, our expert team will evaluate them and provide constructive feedback. Career path This course both enhances your skills and prepares you for future opportunities. Some of them are given in the down below: Tax Accountant Tax Administrator Tax Assistant Manager Tax Associate Auditor

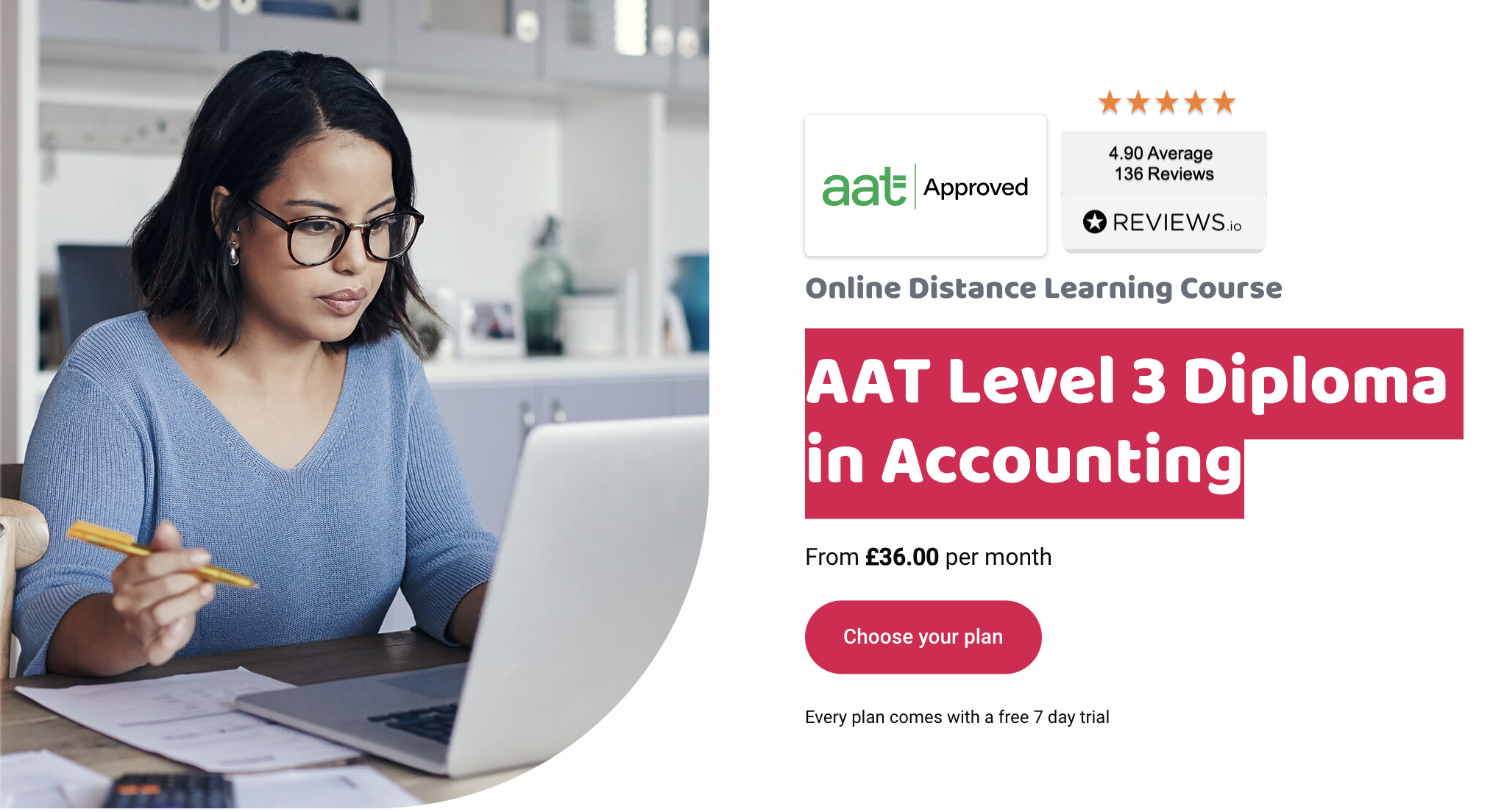

Are you looking to progress your career in accountancy? Have you got a solid understanding of accounting processes? Studying AAT Level 3 Diploma in Accounting could be the next step in your journey to becoming a qualified accountant. This course is suitable if you have previous accountancy experience, through study or work experience, and you’re looking to develop your skills further so you can become qualified and work in a variety of accounting roles. Entry requirements If you work in accounts or have studied accountancy before (such as AAT Level 2 Certificate), you may be able to start at this level. If you don’t have any previous accountancy experience, we recommend starting at Level 2. You’ll also need a good grasp of Maths and English skills to complete the course. We recommend that you register with AAT before starting this course. You’ll be given your AAT student number, which enables you to enter for assessments. AAT Level 3 Diploma syllabus By the end of the AAT Level 3 Diploma course, you will be able to prepare Sole Traders and Partnership Financial Statements, do depreciation calculations, understand management accounting techniques, and know how to apply VAT legislation. You’ll also learn about different business types and how technology impacts business. Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Management Accounting Techniques (MATS) The purpose and use of management accounting within organisations The techniques required for dealing with costs How to attribute costs according to organisational requirements How to investigate deviations from budgets Spreadsheet techniques to provide management accounting information Management accounting techniques to support short-term decision making Principles of cash management Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation Business Awareness (BUAW) Business types, structures and governance, and the legal framework in which they operate The impact of the external and internal environments on businesses, their performance and decisions How businesses and accountants comply with the principles of professional ethics. The impact of new technologies in accounting and the risks associated with data security How to communicate information to stakeholders How is this course assessed? The Level 3 course is assessed by unit assessments. A unit assessment only tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Mostly marked by the computer Getting your results Computer marked assessment results are available in your MyAAT account within 24 hours.* For assessments marked by the AAT, you can expect to receive your results within six weeks. * For a short period, Q2022 results may take up to 15 days. Grading To be awarded the AAT Level 3 Advanced Diploma in Accounting qualification you must achieve at least a 70% competency level in each unit assessment. Resits You can resit an assessment to improve your grade. Results from the assessment with the highest marks will be used to calculate your final grade. There are no resit restrictions or employer engagement requirements for any fee paying student on any of our AAT courses. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe. Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready, or recap previous levels at no extra cost. Instant access to our unique comprehensive Study Buddy learning guide. Access to Consolidation and Progress Tests, and computer and self marked Mock Exams. You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours. You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you. Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials. What could I do next? After completing this level, you could go onto job roles such as a finance officer, assistant accountant and an advanced bookkeeper, earning salaries of up to £25,000. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can continue your studies and move onto the AAT Level 4 Diploma in Professional Accounting at no additional cost. Additional costs You are required to become a member of the Association of Accounting Technicians (AAT) launch to fulfil your qualification. Fees associated with admission and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT One off Level 3 Registration Fee: £225 AAT Assessment Fees: £70 to £80 per unit but this can vary depending on where you sit your assessment. Please be aware that these are subject to change.

Give a compliment to your career and take it to the next level. This Accountancy, AML, Financial Investigator bundle will provide you with the essential knowledge to shine in your professional career. Whether you want to develop skills for your next job or elevate your skills for your next promotion, this Payroll, Employment Law & Business Administration bundle will help you stay ahead of the pack. Throughout the Accountancy, AML, Financial Investigator programme, it stresses how to improve your competency as a person in your chosen field while also outlining essential career insights in the relevant job sector. Along with this Accountancy, AML, Financial Investigator course, you will get 10 premium courses, an originalhardcopy, 11 PDF certificates (Main Course + Additional Courses) Student ID card as gifts. This Accountancy, AML, Financial Investigator Bundle Consists of the following Premium courses: Course 01: Accountancy Course 02: Accounting and Tax Course 03: Diploma in Quickbooks Bookkeeping Course 04: Microsoft Excel Level 3 Course 05: Team Management Course 06: Level 3 Xero Training Course 07: Effective Communication Skills Diploma Course 08: Decision-Making Course 09: Applied Business Analysis Diploma Course 10: Fraud Management & Anti Money Laundering Awareness Complete Diploma Course 11: Financial Investigator Enrol now in Accountancy, AML, Financial Investigator to advance your career, and use the premium study materials from Apex Learning. Certificate: PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) Curriculum of Accountancy, AML, Financial Investigator Bundle Course 01: Accountancy Module 01: Introduction to Accounting Module 02: The Role of an Accountant Module 03: Accounting Concepts and Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income statement Module 07: Financial statements Module 08: Cash Flow Statements Module 09: Understanding Profit and Loss Statement Module 10: Financial Budgeting and Planning Module 11: Auditing Course 02: Accounting and Tax Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 10: Management Accounting and Financial Analysis Module 11: Career as a Tax Accountant in the UK Course 03: Diploma in Quickbooks Bookkeeping Getting prepared - access the software and course materials Getting started Setting up the system Nominal ledger Customers Suppliers Sales ledger Purchases ledger Sundry payments Sundry receipts Petty cash VAT - Value Added Tax Bank reconciliation Payroll / Wages Reports Tasks Course 04: Microsoft Excel Level 3 Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks Using Lookup Functions and Formula Auditing Sharing and Protecting Workbooks Automating Workbook Functionality Creating Sparklines and Mapping Data Forecasting Data Excel Templates Course 06: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 07: Effective Communication Skills Diploma Module 01: Business Communication Module 02: Verbal and Non-verbal Communication Module 03: Written Communication Module 04: Electronic Communication Module 05: Communicating with Graphic Module 06: Effectively Working for Your Boss Course 08: Decision-Making Module 01: What is Decision Making? Module 02: Stress and Its Impact Module 03: Time Stress and Decision Making Module 04: Personal Level Decision making Under Stress Module 05: Organisational Level Decision making Under Stress Module 06: Decision Making for Conflict Management Course 09: Applied Business Analysis Diploma Module 01: Introduction to Business Analysis Module 02: Business Processes Module 03: Business Analysis Planning and Monitoring Module 04: Strategic Analysis and Product Scope Module 05: Solution Evaluation Module 06: Investigation Techniques Module 07: Ratio Analysis Module 08: Documenting and Managing Requirements Module 09: Career Prospect as a Business Analyst in the UK Course 10: Fraud Management & Anti Money Laundering Awareness Complete Diploma Module 01: Introduction to Money Laundering Module 02: Proceeds of Crime Act 2002 Module 03: Development of Anti-Money Laundering Regulation Module 04: Responsibility of the Money Laundering Reporting Office Module 05: Risk-based Approach Module 06: Customer Due Diligence Module 07: Record Keeping Module 08: Suspicious Conduct and Transactions Module 09: Awareness and Training Course 11: Financial Investigator Module 01: Introduction to Financial Investigator Module 02: Introduction to Financial Investigation Module 03: Characteristics of Financial Crimes Module 04: Categories of Financial Crimes Module 05: Financial Crime Response Plan Module 06: Collecting, Preserving and Gathering Evidence Module 07: Laws against Financial Fraud CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Accountancy, AML, Financial Investigator bundle. Requirements This Accountancy, AML, Financial Investigator course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included

Overview Gain the skills and abilities to attain a long and satisfying career in business by studying the principles of Accounting and Bookkeeping.This Diploma in Accounting and Bookkeeping course will quickly and efficiently provide the tutoring you need to excel in organising the financial management of a company.Written with the aid of industry experts, the course will train you to keep a business payroll operating, track supplies and inventory, handle budgets and cash, pay taxes, and report to all of your stakeholders. There is no more complete way to obtain this certificated amount of training and learn how to master a dynamic career path. How will I get my certificate? Upon successful completion of the Diploma in Accounting and Bookkeeping course, obtaining your certificate is a straightforward process. Here's how it works: Course Completion: Once you've successfully finished the course, you'll be eligible to receive your certificate. Order Your Certificate: You can conveniently order your certificate directly through our platform. Who is this course for? Diploma in Accounting and Bookkeeping is specially designed for a variety of learners. Open to all: No prior experience or certifications are required. Inclusive Learning: Welcoming students from various academic backgrounds. Universal Accessibility: Open to everyone interested in studying a Diploma in Accounting and Bookkeeping. Requirements Our Diploma in Accounting and Bookkeeping course is designed for maximum flexibility and accessibility. It is optimised for use on PCs, Macs, laptops, tablets, and smartphones. Study easily on your tablet or smartphone, accessible with any Wi-Fi connection. No time limit for completion; study at your own pace and on your own schedule. Basic English proficiency is required to ensure effective learning. This course structure allows for a convenient and adaptable learning experience. Career path Having these various qualifications will increase the value of your CV and open you up to multiple sectors, such as: Accountant: Steady career, £22k-£35k+. Manage day-to-day finances. Management Accountant: Analyse data, £28k-£40k+. Influence key decisions. Financial Analyst: Assess investments, £25k-£35k+. Fast-paced, dynamic environment. Auditor: Verify records, £28k-£40k+. Ensure financial integrity. Tax Advisor: Minimise tax liabilities, £25k-£35k+. Help clients save money. Remember, ranges vary depending on experience and location. Consider professional certifications for a boost! Course Curriculum 9 sections • 21 lectures • 05:56:00 total length •Introduction: 00:02:00 •Introduction to Bookkeeping: 00:15:00 •Manual System: 00:08:00 •Computerised Systems: 00:11:00 •How it Fits Together: 00:08:00 •Bookkeeping Basics: 00:30:00 •Ledgers: 00:10:00 •Trial Balance and Coding: 00:11:00 •PNL Account and Balance Sheet: 00:05:00 •AILE Personal: 00:06:00 •Course Overview: 00:05:00 •Getting the Facts Straight: 00:30:00 •The Accounting Cycle: 00:30:00 •The Key Reports: 00:30:00 •A Review of Financial Terms: 00:30:00 •Understanding Debits and Credits: 00:15:00 •Your Financial Analysis Toolbox: 00:30:00 •Identifying High and Low Risk Companies: 00:30:00 •The Basics of Budgeting: 00:30:00 •Working Smarter: 00:10:00 •Assignment - Diploma in Accounting and Bookkeeping: 00:10:00

Register on the Diploma in Accountancy today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The Diploma in Accountancy is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The Diploma in Accountancy Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the Diploma in Accountancy, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Introduction to Accounting Introduction to Accounting 00:15:00 Module 02: The Role of an Accountant The Role of an Accountant 00:16:00 Module 03: Accounting Concepts and Standards Accounting Concepts and Standards 00:22:00 Module 04: Double-Entry Bookkeeping Double-Entry Bookkeeping 00:23:00 Module 05: Balance Sheet Balance Sheet 00:21:00 Module 06: Income statement Income statement 00:19:00 Module 07: Financial statements Financial statements 00:27:00 Module 08: Cash Flow Statements Cash Flow Statements 00:17:00 Module 09: Understanding Profit and Loss Statement Understanding Profit and Loss Statement 00:17:00 Module 10: Financial Budgeting and Planning Financial Budgeting and Planning 00:28:00 Module 11: Auditing Auditing 00:17:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.