- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

230 Courses

After Effects for Graphic Design

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special After Effects for Graphic Design Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The After Effects for Graphic Design Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This After Effects for Graphic Design Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This After Effects for Graphic Design Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this After Effects for Graphic Design ? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing. Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the After Effects for Graphic Design there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the PDF certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This After Effects for Graphic Design course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already work in relevant fields and want to polish their knowledge and skills. Prerequisites This After Effects for Graphic Design does not require you to have any prior qualifications or experience. You can just enrol and start learning. This After Effects for Graphic Design was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This After Effects for Graphic Design is a great way for you to gain multiple skills from the comfort of your home. Section 01: Introduction Using After Effects for Design Projects 00:02:00 About the Exercise Files 00:01:00 A Brief Intro to After Effects 00:02:00 Getting Comfortable with the After Effects Interface 00:06:00 Importing Photoshop Files 00:05:00 Exporting Photoshop, JPG, and PNG Files 00:05:00 Section 02: Creating Special Effects Creating an Editorial Graphic 00:09:00 Add a Dramatic Lighting Effect 00:07:00 Adding a Page Curl 00:07:00 Creating a Burst of Light 00:08:00 Color Keying for Transparent Imagery 00:07:00 Color Keying for Advanced Transparency - Part 1 00:06:00 Color Keying for Advanced Transparency - Part 2 00:05:00 Section 03: Creating Patterns and Textures Creating a Kaleidoscope Pattern 00:05:00 Generating a Unique Texture 00:06:00 Create Line Art from a Photo 00:04:00 Shapes with Radio Waves 00:07:00 Interlocking Zig Zag Pattern 00:08:00 Section 04: Generating Artwork from (Almost) Nothing Enhancing an Illustration with Lightning 00:07:00 Enhancing an Illustration with Rain 00:06:00 Creating a Water Surface Part 1 00:05:00 Creating a Water Surface Part 2 00:07:00 Creating a Water Surface Part 3 00:04:00 Making Realistic Melted Chocolate Part 1 00:06:00 Making Realistic Melted Chocolate Part 2 00:05:00 Creating Bubbles for Champagne Part 1 00:07:00 Creating Bubbles for Champagne Part 2 00:09:00 Section 05: Where to Go from Here Where to Go from Here 00:01:00 Assignment Assignment - After Effects for Graphic Design 02:27:00 Order Your Certificate Order Your Certificate QLS

M.D.D PRE-MARITAL COUNSELLING LONDON PACKAGE (COUPLES)

4.9(27)By Miss Date Doctor Dating Coach London, Couples Therapy

Introducing Pre-Marital Counselling London Package: Building a Strong Foundation for a Lifelong Partnership Are you planning to tie the knot and seeking guidance to ensure a strong and healthy foundation for your marriage? Miss Date Doctor’s Pre-Marital Counselling London Package offers you expert support and valuable insights to prepare for a fulfilling and lasting partnership. Pre-marital counselling is a proactive approach that helps couples explore their expectations, communication styles, and potential areas of growth before entering into marriage. Our experienced counsellors in London are dedicated to helping you lay the groundwork for a successful and harmonious marriage. Here’s how the Pre-Marital Counselling London Package can support you: Effective Communication: Our counsellors will guide you in developing open and effective communication skills to express your feelings and needs clearly, fostering understanding and connection. Conflict Resolution: Pre-marital counselling addresses conflict resolution strategies, ensuring that you are equipped with healthy ways to navigate disagreements and challenges in your marriage. Exploring Expectations: We’ll help you and your partner explore and align your expectations about various aspects of marriage, such as roles, finances, family, and lifestyle. Strengthening Intimacy: Pre-marital counselling provides a safe space to discuss emotional and physical intimacy, fostering a deeper connection and understanding between you and your partner. Financial Planning: Our counsellors will assist you in creating a financial plan, emphasizing financial transparency and teamwork to manage shared resources. Building Trust: Trust is a fundamental aspect of a successful marriage. Pre-marital counselling helps you and your partner build and strengthen trust through open and honest discussions. Shared Values and Goals: We’ll explore your shared values and long-term goals, ensuring that you are aligned in your vision for the future. Handling Life Transitions: Pre-marital counselling can prepare you for various life transitions, such as starting a family, changing careers, or dealing with unexpected challenges. The Pre-Marital Counselling London Package at Miss Date Doctor offers you an opportunity to invest in the foundation of your marriage. Our skilled counsellors provide a safe and supportive space to discuss important topics, discover each other’s strengths, and build a solid framework for a successful partnership. Take the first step towards a joyful and harmonious marriage with the Pre-Marital Counselling London Package. Embrace the opportunity to grow together, nurture your relationship, and create a lasting bond that will withstand the tests of time. Let our experienced counsellors guide you towards a fulfilling and loving marriage that stands the test of time. 3 x 1 hour https://relationshipsmdd.com/product/pre-marital-counselling-london-package/

AAT Level 1 Award in Business Skills

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview At the start of any career, gaining a solid understanding of key business skills is extremely valuable. These qualifications and courses are designed to blend core skills with key finance knowledge, to give you essential business skills. This Level 1 qualification covers a range of skills and relevant supporting knowledge to help prepare students for applying numbers in business and working in a business environment. It will give students an understanding of: • How different organisations operate • How to contribute effectively in the workplace • How businesses process sales and purchases, and the documents and procedures associated with this. Students will also be equipped with the basic numerical skills needed in the workplace, such as decimals, percentages and fractions, and applying proportions and ratios. The jobs it can lead to: • Data entry clerk • Accounts administrator • Administrative assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Working in the business environment: This unit introduces students to the skills needed in the workplace, including the importance of teamwork, communication, effective time management and professional behaviour. They’ll also learn about some of the core finance processes linked to sales and purchase orders. Learning outcomes: • Develop skills for the workplace. • Understand how organisations operate. • Understand how sales and purchases support businesses. • Apply business procedures to sales and purchases. Using numbers in business: Numeracy is an essential business skill. This unit will introduce students to the basic skills needed when working with numbers in a business environment, developing confidence and skills to use and apply numbers to a wide range of situations. Learning outcomes: • Perform simple business calculations. • Calculate decimals, fractions, percentage, proportions and ratios. • Use tools and techniques to present numerical data.

Dive into the world of healthcare, where the 'Duty of Candour in Healthcare: Ethical Practices and Legal Obligations' course offers a comprehensive journey into one of the sector's most pivotal facets. The course meticulously elucidates the critical duty of candour, providing learners with a blend of legal, ethical, and communicative nuances. From understanding the foundational concepts to navigating the intricacies of adverse events and accountability, this course is an invaluable roadmap for anyone aiming to uphold the highest standards in healthcare. Discover the steps that transform a simple legal requirement into a force for positive change. With modules that focus on cultural shifts, future challenges, and the paramount importance of clear communication, participants are equipped to foster an environment where transparency and accountability reign supreme. More than just theory, the curriculum guides learners through the very processes that ensure patient safety, trust, and overall excellence in the healthcare realm. In today's fast-paced medical world, errors and oversights can occur. However, it's how these are addressed, learnt from, and prevented in the future that distinguishes exceptional healthcare providers. This course not only highlights the importance of acknowledging mistakes but offers strategies to implement effective change, ensuring the ongoing improvement and trustworthiness of healthcare services. Learning Outcomes Upon completion of this course, participants will be able to: Understand the core concepts and significance of the duty of candour within healthcare settings. Recognise and navigate the legal frameworks surrounding the duty of candour. Develop robust communication techniques tailored for duty of candour procedures. Gain insight into the management and rectification of adverse events. Grasp the essentials of apology, compensation, and strategies for learning from incidents. Why buy this Duty of Candour in Healthcare: Ethical Practices and Legal Obligations? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Duty of Candour in Healthcare: Ethical Practices and Legal Obligations there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this Duty of Candour in Healthcare: Ethical Practices and Legal Obligations course for? This Duty of Candour in Healthcare: Ethical Practices and Legal Obligations does not require you to have any prior qualifications or experience. You can just enrol and start learning. Healthcare administrators keen on enhancing transparency and trustworthiness in their services. Medical practitioners aiming to further their knowledge in ethical and legal domains. Legal professionals specialising in healthcare regulations and frameworks. Medical students or interns seeking a comprehensive understanding of patient rights and provider obligations. Change agents within the healthcare sector focused on driving cultural evolution and improvement. Prerequisites This Duty of Candour in Healthcare: Ethical Practices and Legal Obligations does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Duty of Candour in Healthcare: Ethical Practices and Legal Obligations was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Healthcare Administrator: £30,000 - £45,000 per annum Medical Practitioner (GP): £58,000 - £88,000 per annum Healthcare Lawyer: £40,000 - £100,000 per annum Medical Ethics Consultant: £35,000 - £60,000 per annum Hospital Risk Manager: £40,000 - £55,000 per annum Patient Advocacy Director: £50,000 - £70,000 per annum Course Curriculum Module 01: Introduction to Duty of Candour Introduction to Duty of Candour 00:05:00 Module 02: Duty of the Candour Process Duty of the Candour Proces 00:05:00 Module 03: Legal Framework Legal Framework 00:05:00 Module 04: Communication Skills for Duty of Candour Communication Skills for Duty of Candour 00:12:00 Module 05: Understanding and Managing Adverse Events Understanding and Managing Adverse Events 00:14:00 Module 06: Apology and Compensation Apology and Compensation 00:11:00 Module 07: Learning from Incidents Learning from Incidents 00:13:00 Module 08: Accountability and Oversight Accountability and Oversight 00:11:00 Module 09: Cultural Change Cultural Change 00:09:00 Module 10: Future Directions and Challenges Future Directions and Challenges 00:13:00

Description Of the many vulnerabilities and threats to the financial services sector, financial crime risk has emerged as a pervasive, yet widely misunderstood category of risk. As consumers, governments, and the financial industry have gained familiarity with various forms of financial crime, financial services organizations have seen that the underlying risk of financial crimes not only includes the direct action taken by criminals, but also includes the impact of deterrence, detection, and resolution on the organization and its customers. Financial services organizations have the difficult task of effectively identifying the greatest risks to themselves and to their customers, protecting both parties against unnecessary risks and satisfying regulatory requirements for greater transparency, awareness, and consolidation of information across the organization. This interactive and engaging programme aims to help participants understand the financial crime regulatory framework; and develop a comprehension on the management of financial crime risks. Training Duration This course may take up to 2 hours to be completed. However, actual study time differs as each learner uses their own training pace. Participants This course is ideal for anyone wishing to know more about Financial Crime Risk Management, and the regulatory requirements for investment firms, insurance and banking institutions. It is also suitable to professionals pursuing regulatory CPD in Financial Regulation (such as the FCA etc). It will be particularly suitable to: • Compliance professionals • Consultants • Corporate executives (including CEOs and CFOs) • Senior managers • Risk executives • Directors • MLROs Training Method The course is offered fully online using a self-paced approach. The learning units consist of reading material. Learners may start, stop and resume their training at any time. At the end of each session, participants take a Quiz to complete their learning unit and earn a Certificate of Completion upon completion of all units. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution. The syllabus is verified by external subject matter experts and can be accredited by regulators and other bodies for 2 CPD Units that approve education in financial regulation, such as the FCA and other financial regulators. The course may be also approved for up to 2 CPD Units by institutions that approve general financial training, such as the CISI. Eligibility criteria and CPD Units are verified directly by your association or other bodies in which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk. Access to the course is valid for 365 days.

Professional Scrum Master I

By Fractal Training

Join the Scrum.org accredited Live Virtual Class - Professional Scrum Master I™ (PSM I) to master the fundamentals of Scrum. Learn the framework, mechanics, and roles to ensure successful implementation by your team. Course Description Our Scrum.org certified online professional scrum master courses set industry standards with a remarkable 98% first-time pass rate. Say goodbye to PowerPoint and embrace 100% interactivity. Gain hands-on practical skills, learning how to implement immediately and achieve tangible results. Learn to empower Scrum Teams for organisational value delivery. Gain insight into Scrum theory, empiricism, and its framework-to-principal connection. Understand how to apply Agile principles to real-world contexts. Grasp uncertainty and complexity in product delivery, Scrum values' significance, and the essence of "Done" for transparency. Master agile planning with the Product Backlog. Acquire self-management, interpersonal skills, and the crucial role of a Scrum Master as a leader. Develop the necessary skills, traits, and behaviour for effective Scrum Mastery. Why Train With Us? Explore Agile and Scrum principles with our immersive two-day online course where we prioritise your growth and success. Led by experienced industry professionals and supportive Professional Scrum Trainers, we go beyond PowerPoint to offer engaging, hands-on learning experiences. Gain a profound understanding of Scrum theory and discover practical applications relevant to your workplace challenges enabling immediate and impactful change. From debunking myths to empowering your Scrum Teams with the right practices, we'll be with you every step of the way - from learning to passing the test and implementing it seamlessly into your job context. Who Should Attend This Course? Suitable for all industries tackling complex problems, the Professional Scrum Master training course is designed for: Those aspiring to become Scrum Masters Practitioners and consultants seeking to enhance their Scrum expertise Anyone involved in product delivery through Scrum methodologies Agile managers aiming to understand the Scrum Master's role Your Professional Scrum Trainer Meet Jay, founder of Fractal Systems and a dedicated Professional Scrum Trainer. With over 20 years of experience in team and leadership roles, Jay is well-versed in delivering continuous value. His unique teaching approach involves zero PowerPoint and instead relies on engaging, experience-based sessions using techniques from Liberating Structures and Neuro Linguistic Programming. Jay's expertise lies in business transformations, offering training, mentoring, coaching, and consulting to foster success through collaborative efforts. Rapid learning and practical application are the hallmarks of his approach. Jay & the entire Fractal team are invested in your learning journey and are here to support you from start to end, including offering additional valuable support: Free PSM1 practice assessment for certification success Free PSM1 resource bundle to master Scrum Free PSM1 exam revision sheets Free exam coaching sessions for first-time success in your PSM1 exam Free 1:1 coaching to excel at work as a Professional Scrum Master Our Clients Our Testimonials

The vital role of CFOs in business exit preparation

By FD Capital

he role of a CFO extends beyond day-to-day financial management and plays a pivotal role in preparing a business for an exit. The role of a CFO extends beyond day-to-day financial management and plays a pivotal role in preparing a business for an exit, whether it be through a merger, acquisition, or other strategic transaction. Here are some key points to consider: Financial Due Diligence: CFOs play a crucial role in conducting financial due diligence to assess the company’s financial health and identify any potential risks or issues. This involves reviewing financial statements, accounting practices, contracts, and other financial data to ensure accuracy and transparency. Valuation and Financial Modeling: CFOs work closely with the executive team, external advisors, and investment bankers to determine the company’s valuation. They develop financial models, assess growth projections, and analyze market comparables to arrive at a fair and realistic valuation range. Financial Documentation and Reporting: CFOs ensure that financial documentation and reporting are in order, accurate, and compliant with regulatory requirements. This includes preparing financial statements, management reports, and other financial disclosures necessary for the exit process. Negotiation and Deal Structuring: CFOs collaborate with legal and executive teams to negotiate the terms of the exit transaction. They provide financial insights and expertise to structure the deal in a way that maximizes value for the company and its stakeholders. Tax Planning and Optimisation: CFOs work closely with tax advisors to develop tax-efficient strategies for the exit transaction. They assess potential tax implications, explore tax-saving opportunities, and ensure compliance with applicable tax laws and regulations. Financial Communication and Investor Relations: CFOs play a critical role in communicating the financial aspects of the exit to internal and external stakeholders. They work with investor relations teams to ensure that key messages are effectively conveyed, providing transparency and clarity throughout the exit process. https://www.fdcapital.co.uk/podcast/the-vital-role-of-cfos-in-business-exit-preparation/ Tags Online Events Things To Do Online Online Seminars Online Business Seminars #business #cfo #preparation #exit #vital

***24 Hour Limited Time Flash Sale*** QLS Endorsed AML and KYC Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Discover a world of opportunity with our AML and KYC - QLS Certificate bundle. This all-inclusive learning package features 7 powerful courses, including 2 QLS-endorsed courses - Certificate in Anti Money Laundering (AML) and KYC. Enhance your theoretical understanding of these fields, as our courses are backed by the Quality License Scheme. Once completed, you'll receive a hardcopy certificate for these two courses, a valuable addition to your professional portfolio. But the learning doesn't stop there. Delve into 5 more relevant CPD QS accredited courses, designed to complement your AML and KYC knowledge. As you journey through Financial Investigator: Financial Crimes, Certificate in Compliance, Internal Audit Skills, GDPR, and Financial Management, you'll acquire a comprehensive grasp of finance's pivotal aspects, nurturing a profound theoretical understanding. Equip yourself with an AML and KYC bundle, your pathway to an accomplished future. This bundle comprises the following courses: QLS Endorsed Courses: Course 01: Diploma in Anti-Money Laundering (AML) Training at QLS Level 4 Course 02: Certificate in KYC at QLS Level 3 CPD QS Accredited Courses: Course 03: Financial Investigator : Financial Crimes Course 04: Certificate in Compliance Course 05: Internal audit skills Course 06: GDPR Course 07: Financial Management Learning Outcomes By the end of this AML and KYC - QLS Certificate bundle course,learners will be able to: Gain a comprehensive understanding of Anti Money Laundering (AML) principles and procedures. Develop a strong foundational knowledge of KYC regulations. Master the techniques used in financial investigations pertaining to financial crimes. Gain a solid understanding of compliance in the financial sector. Build your internal audit skills to enhance organisational efficiency. Understand the intricacies of GDPR and how it impacts financial institutions. Grasp essential financial management principles to improve decision making. Attain a hardcopy certificate for the 2 QLS-endorsed courses. This course bundle uniquely weaves together crucial aspects of AML and KYC, financial investigation, compliance, internal audit skills, GDPR, and financial management. By diving into the theoretical underpinnings of these fields, you will cultivate a well-rounded understanding of financial regulation. The QLS-endorsed courses offer an in-depth study of AML and KYC, crucial elements in maintaining financial transparency and integrity. The CPD QS accredited courses round off your learning with a broader look at relevant aspects of the financial sector. The end result? A robust, in-depth understanding of finance's core aspects. Knowledge from these courses can enable you to navigate the financial landscape efficiently, leading to more informed decisions and better risk management. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This AML and KYC - QLS Certificate course is ideal for: Individuals aspiring to enter finance and looking to understand its core concepts. Professionals in the financial sector aiming to enhance their knowledge base. Compliance officers seeking to improve their understanding of AML and KYC. Auditors aiming to expand their skillset and knowledge in finance. Career path Anti-Money Laundering (AML) Specialist - £35,000 to £50,000 annually KYC Analyst - £30,000 to £45,000 annually Financial Investigator - £40,000 to £60,000 annually Compliance Officer - £30,000 to £50,000 annually Internal Auditor - £30,000 to £55,000 annually Financial Manager - £45,000 to £65,000 annually Certificates Digital certificate Digital certificate - Included Hard copy certificate Hard copy certificate - Included

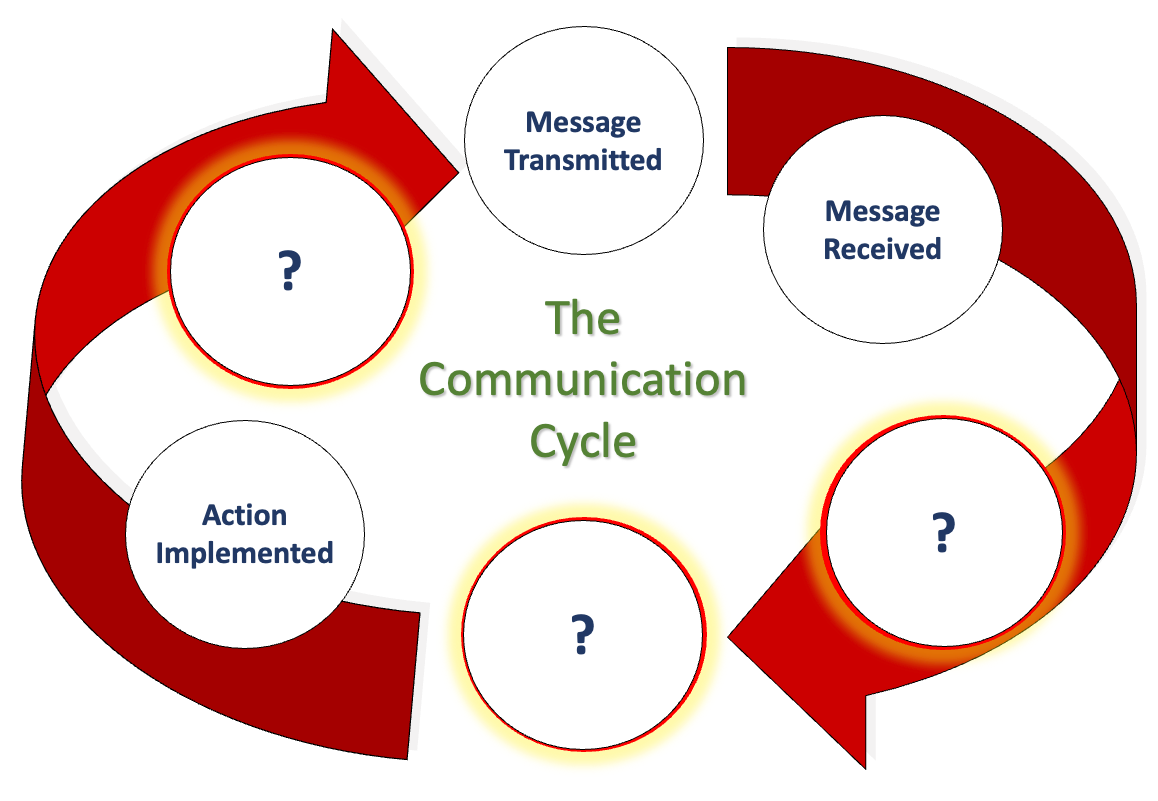

We communicate daily in many ways, including email, phone, text, Zoom, Teams, Google Meets, Slack, and even that old-fashioned thing, what was it now... oh yes, talking face-to-face. But, when we look at communication closely and really drill down into what we are doing in conjunction with how our brain works (neuroscience), how internal, organisational, and social politics control what we believe we can say, how hierarchical positioning impacts our honesty and how the lack of psychological safety means we say what we know others want to hear rather than what they need to hear…. It is oh so complicated! This workshop not only explores the concept of excellent communication, but we also want to hear what you believe it is too. We also delve into how organisational culture influences our perception of speaking up. Factors that hinder open and honest communication, and we work collaboratively towards removing these barriers to achieve a communication style that fosters trust and transparency, creating psychological safety. This workshop is particularly relevant to our Emotional Intelligence workshop (EI and Me). We firmly believe that developing emotional intelligence is the key to unlocking Clean Communication, a skill that is crucial for all of us, regardless of our roles and responsibilities, so that we thrive in our professional environment. If you want to see if we are correct, why not have us facilitate a workshop for you and see what you get by the end of it? LENGTH - Normally, one day. But please contact us to discuss your specific needs, or we can offer advice. NEXT WORKSHOP START - Please ask for more information as we deliver bespoke closed events for your people at your location or a mutually suitable location. WORKSHOP DELIVERY - The best environment for this workshop is face-to-face, but we can facilitate this workshop online. Suitability - Who should attend? Who Should Attend and Why? Who? - Perhaps think of this another way… who shouldn’t attend to ensure we can attain Clean Communication? There’s your answer. Why? - Every person needs to understand what we are saying above about how we get trapped in this organisational formatting which changes how we communicate and how it prevents us from communicating cleanly. EVERY organisation has this, despite what our values profess. And 'Values', that’s a whole other story. Workshop Content Using the 'Moccasin Approach'® to clean our personal and organisational communication LaPD’s Communication Cycle and what we must consider. (Can you work out what the ? represent above? Accountability and Responsibility raises its head in Communication. It has to. Bias, unconscious bias and its impacts on our communication. The conundrum of communicating with others and their styles (The TRAP). How would my perfect Manager/Leader communicate with me? Nonverbal communication (body language), rapport, Clean Communication. Negative communication can go viral (Self-Fulfilling Prophecy). Reflections, findings and goals (individual and team). Meeting our workshop objectives by listing five areas for development. Workshop delivery and venue This workshop is usually one day in duration, and it focuses solely on how we communicate with each other. It can also be a two-day event incorporating aspects of Emotional Intelligence (EI) with group, and individual activities to allow discussions about the various communication we need in your organisation. When you consider the content we deliver, we are sure you will understand why we always prefer to deliver our workshops, courses and programmes face-to-face. Face-to-face workshops and courses can be held at a location of your choice or, if you wish, a central UK location, such as the Macdonald Burlington Hotel in Birmingham, located directly across from the Birmingham New Street train station. We can deliver our workshops, courses and programmes online, although this will mean splitting elements into manageable learning events to suit the online environment.

Search By Location

- Transparency Courses in London

- Transparency Courses in Birmingham

- Transparency Courses in Glasgow

- Transparency Courses in Liverpool

- Transparency Courses in Bristol

- Transparency Courses in Manchester

- Transparency Courses in Sheffield

- Transparency Courses in Leeds

- Transparency Courses in Edinburgh

- Transparency Courses in Leicester

- Transparency Courses in Coventry

- Transparency Courses in Bradford

- Transparency Courses in Cardiff

- Transparency Courses in Belfast

- Transparency Courses in Nottingham