- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

967 Courses

The Financial Investigator - CPDQS Accredited Bundle Course is designed to give you the essential tools and knowledge to excel in the field of financial investigation. With a growing demand for experts in this area, this course is your opportunity to enhance your understanding of the financial crime landscape. From forensic analysis to identifying fraudulent activity, this course covers all the bases for those looking to strengthen their career in financial investigations. Delivered entirely online, it’s flexible to suit your schedule, so you can learn at your own pace without the need for physical attendance. This CPDQS-accredited bundle provides you with a thorough understanding of investigative techniques, financial regulations, and the latest tools used to uncover financial misconduct. Whether you’re looking to specialise in financial fraud, anti-money laundering, or asset recovery, this course offers the knowledge and qualifications to help you advance in the industry. With real-world cases and expert-led content, you will be prepared to tackle complex financial challenges. Gain the confidence and skills to analyse financial data and navigate investigations, all from the comfort of your home. Key Features of Financial Investigator Bundle CPD Accredited Financial Investigator Course Instant PDF certificate Fully online, interactive Financial Investigatorcourse Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Enrol now in this Financial Investigator Bundle course to excel! To become successful in your profession, you must have a specific set of Financial Investigator skills to succeed in today's competitive world. In this in-depth Financial Investigatortraining course, you will develop the most in-demand Financial Investigator skills to kickstart your career, as well as upgrade your existing knowledge & skills. Financial Investigator Curriculum Course 01: Financial Investigator Course 02: Accountancy : Accounting Training Course 03: quickbooks Course 04: Charity Accounting Course 05: Tax Accounting Course 06: Financial statement Analysis Course 07: Finance & Investment Course 08: Financial Management Course 09: Corporate Finance Course 10: Islamic Finance Course 11: Investment Course 12: Economics Course 13: Commercial Law 2021 Course 14: Financial Reporting Course 15: Payroll Course 16: Purchase Ledger Course 17: Functional Skills Maths Course 18: AML, KYC & CDD Course 19: Introduction to VAT Course 20: Insurance Accreditation This Financial Investigator bundle courses are CPD accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your Financial Investigator course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course is ideal for all employees or anyone who genuinely wishes to learn more about Financial Investigator basics. Requirements No prior degree or experience is required to enrol in this course. Career path This Financial Investigator Course will help you to explore avariety of career paths in the related industry. Certificates Digital certificate Digital certificate - Included Hardcopy Certificate Hard copy certificate - Included Hardcopy Certificate (UK Delivery): For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99. Hardcopy Certificate (International Delivery): For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

This course is aimed at anyone who undertakes work at height, or who employs people who regularly work at height. It covers what constitutes work at height, the safety issues, and how to assess and reduce some of the risks. Important note: Please note that this is an awareness course only, if your duties include working at height you will also need further practical training, you can get in touch with us to arrange this.

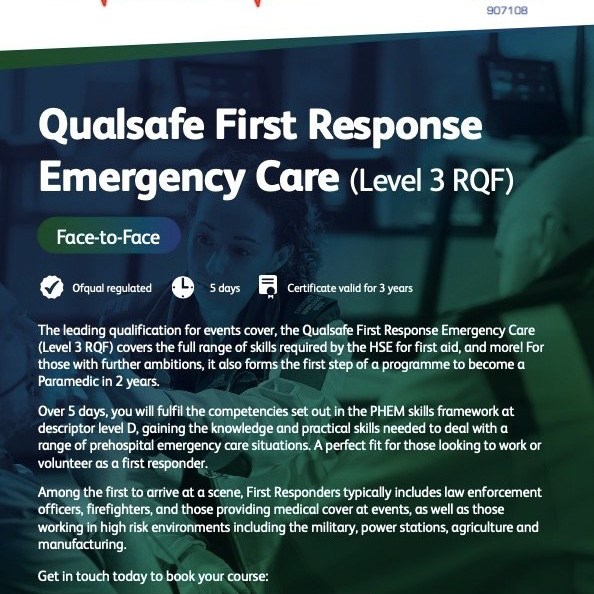

QA Level 3 Award in First Response Emergency Care (RQF)

By Triple L Training & Medical Ltd

🧑⚕️🧑🔬🚑🩺 DO YOU WANT TO LEARN VALUBLE SKILLS, WANT TO WORK EVENTS, FESTIVALS AND IN NIGHTCLUBS, OR HAVE A DESIRE TO WORK IN THE AMBULANCE SERVICE.🚑 This is the first step into the Medical world as a First Responder. The QA Level 3 Award in First Response Emergency Care also known as FREC3 is a PHEM D qualification which is the entry level into being able to provide medical cover at events. The cost is £425 plus VAT per person (£510pp) This is a 5 day course being held at our training centre in Laindon, Essex (SS15 6SS), all days must be attended and sessions will be 9am-5pm each day. Available course dates: July – 8th-12th August - 5th-9th The course will run with a minimum of 4 learners and a maximum of 6 learners. If you would like more information or to book onto either of the above courses please email training@tlmedical.co.uk for a booking form.

Food safety combines a number of practices to reduce health hazards. These include premises hygiene, personal hygiene, risk control, pest control and waste management. This level 2 course is about minimising the level of potential hazards in a food manufacturing setting.

Food safety combines a number of practices to reduce health hazards. These include premises hygiene, personal hygiene, risk control, pest control and waste management. This level 2 course is about minimising the level of potential hazards in a food catering setting.

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £160 as a Gift -Enrol Now From a startup to big-name MNCs, all need Tax Accounting, Payroll & Wage Management for survival! These ultimately influence profitability and impact employees' experience of any organization. Furthermore, Tax Accounting, Payroll & Wage Management sector is continuously growing, and so is the need for experts in this field. Tax Accounting, Payroll & Wage Management play a crucial role, from ensuring statutory compliance to providing quantitative financial information. These ensure an organisation is abiding by law while maintaining a healthy work experience. The ISO rule and the growing importance of Tax Accounting, Payroll & Wage Management make it necessary for all employers and employees to be aware of them. This bundle has everything to make aware you of Tax Accounting, Payroll & Wage Management. Through this bundle, you will acquire knowledge about the tax and insurance system in the UK. Furthermore, you will gain proficiency in payroll management and financial analysis. Moreover, you will familiarise yourself with different laws. Additionally, you will acquire skills for efficient use of Microsoft Office essentials. This bundle is composed of 11 courses: Course 1: Level 3 Tax Accounting Course 2: Payroll Management - Diploma Course 3: Accounting and Bookkeeping Level 2 Course 4: Sage 50 Training Course 5: Wages & Benefits Course 6: Law and Contracts - Level 2 Course 7: Financial Analysis Course 8: Level 3 Xero Training Course 9: Level 2 Microsoft Office Essentials Course 10: GDPR Data Protection Level 5 Course 11: Time Management Throughout this 11-in-1 bundle, you will learn different aspects of Tax Accounting along with different methods for efficient Payroll and Wage Management, including- Level 3 Tax Accounting Familiarise with the tax system and administration in the UK Gain knowledge about management accounting and financial analysis Discover career as a tax accountant in the UK Payroll Management - Diploma Be informed about Payroll basics and pay elements Grasp the concept of pension scheme basics Build up skills in linking payroll to accounts Wages & Benefits Learn the basics of employment law and have knowledge about health & safety at work Have details about national minimum wage & national living wage Understand the concept of parental rights, sick pay, & pension scheme Law and Contracts - Level 2 Get a detailed introduction to UK Laws and privity of contract Know considerations and capacities of contact laws Find out laws and regulations for international trade Financial Analysis Receive an elaborated introduction to financial analysis Grasp a solid understanding of profitability and return ratio Comprehend the concept of liquidity ratio and operational analysis Accounting and Bookkeeping Level 2 Uncover the techniques for effective and efficient bookkeeping systems Learn the rope of the basics of bookkeeping Understand the concept of the functionality of bookkeeping fully Sage 50 Training Be acquainted with payroll basics and pension scheme basics Attain proficiency in quick SSP and editing employee records Discover how to reset payments and have knowledge about the year-end procedure Level 3 Xero Training Get an elaborated introduction to level 3 Xero training Acquire knowledge about invoices and sales along with fixed assets Obtain information about bills and purchases with VAT returns Level 2 Microsoft Office Essentials Be proficient in performing calculations in Microsoft Office Excel Attain expertise in inserting graphic objects in Word 2016 Gain competency in giving presentations using PowerPoint 2016 GDPR Data Protection Level 5 Be aware of the lawful basis for preparation Learn the nuts and bolts of rights and breaches Grasp a strong understanding of the responsibilities and obligations Time Management Learn to identify goals and work accordingly and know how to build your own toolbox Discover your personal working style to be more efficient Gain proficiency in establishing your action plan for better time management Enrol for this Tax Accounting, Payroll & Wage Management now to avoid any workplace hassle and avail yourself of many promising careers! What You Get Out Of Studying With Apex Learning? Lifetime access to this bundle materials Full tutor support available from Monday to Friday Free up your time - don't waste time and money travelling for classes Accessible, informative video modules taught by expert instructors Study the course from your computer, tablet or mobile device Curriculum: Course 1: Level 3 Tax Accounting Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Module 05: Fundamentals of Income Tax Module 06: Payee, Payroll and Wages Module 07: Value Added Tax Module 08: Corporation Tax Module 09: Double Entry Accounting Module 10: Management Accounting and Financial Analysis Module 11: Career as a Tax Accountant in the UK Course 2: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 3: Accounting and Bookkeeping Level 2 Introduction to the course Introduction to Bookkeeping Bookkeeping systems Basics of Bookkeeping The functionality of bookkeeping On a personal note Course 4: Sage 50 Training Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Advanced Diploma Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 5: Wages & Benefits Basics of Employment Law National Minimum Wage & National Living Wage Parental Rights, Sick Pay, & Pension Scheme Health & Safety at Work Course 6: Law and Contracts - Level 2 Module 01: Introduction to UK Laws Module 02: Ministry of Justice Module 03: Agreements and Contractual Intention Module 04: Considerations and Capacities of Contact Laws Module 05: Terms within a Contract Module 06: Misinterpretations and Mistakes Module 07: Consumer Protection Module 08: Privity of Contract Module 09: Insurance Contract Laws Module 10: Contracts for Employees Module 11: Considerations in International Trade Contracts Module 12: Laws and Regulations for International Trade Module 13: Remedies for Any Contract Breach Course 7: Financial Analysis Section-1. Introduction Section-2. Profitability Section-3. Return Ratio Section-4. Liqudity Ratio Section-5.Operational Analysis Section-6. Detecting Manipulation Course 8: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 9: Level 2 Microsoft Office Essentials Getting Started with Microsoft Office Excel 2016 Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Word 2016 Getting Started with Word Formatting Text and Paragraphs Working More Efficiently Managing Lists Adding Tables Inserting Graphic Objects Controlling Page Appearance Preparing to Publish a Document Workbooks - Microsoft Word 2016 (Beginner) PowerPoint 2016 PowerPoint Interface Presentation Basics Formatting Inserting Options Working with Objects Table Charts Review and Presentatin Access 2016 Introduction to Access Modify Data Working with Queries Access Forms Working with Reports Course 10: GDPR Data Protection Level 5 Module 01: GDPR Basics Module 02: GDPR Explained Module 03: Lawful Basis for Preparation Module 04: Rights and Breaches Module 05: Responsibilities and Obligations Course 11: Time Management Identifying Goals Effective Energy Distribution Working with Your Personal Style Building Your Toolbox Establishing Your Action Plan How will I get my Certificate? After successfully completing the course you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £6*11 = £66) Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 115 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Tax Accounting, Payroll & Wage Management bundle is designed for those seeking to gain knowledge and skills about this crucial topic either to start a career in this industry or to get a promotion in their current career. Hence, this bundle is ideal for- Students Graduates Job Seekers Job Holders Entrepreneurs Career path While broadening your knowledge and strengthening your skills, this Tax Accounting, Payroll & Wage Management bundle will pave out many career opportunities, including- Tax Accountant Financial Manager Financial Analyst HR Manager Bookkeeper Account Officer For these career opportunities, the average salary generally varies from £15,000 to £ 50,000 a year. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Level 3 Tax Accounting) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before In the UK, the accounting and bookkeeping industry is booming, with a projected growth rate of 8% by 2026. As businesses become increasingly complex, the demand for skilled professionals in this field is skyrocketing. According to a report by the Association of Chartered Certified Accountants (ACCA), nearly 80% of small businesses in the UK outsource their accounting and bookkeeping tasks. Are you ready to take this chance and pursue a fulfilling career? This Accounting & Bookkeeping bundle offers a combination of introductory and advanced courses, taking you from the fundamentals of accounting principles to specialised areas like financial analysis, tax accounting, and anti-money laundering. You'll master industry-standard software like Xero and Sage 50, gain a deep understanding of payroll management, and develop the critical thinking skills necessary to become a financial investigator. With a single payment, you will gain access to Accounting & Bookkeeping Bundle, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Accounting & Bookkeeping Course Bundle Package includes: Main Course: Advanced Diploma in Xero Accounting And Bookkeeping at QLS Level 7 10 Premium Additional CPD QS Accredited Courses - Course 01: Introduction to Accounting Course 02: Accountancy Course 03: Xero Accounting - Complete Training Course 04: Payroll: Payroll Management Course 05: Sage 50 Diploma Course 06: Managerial Accounting Course 07: Tax Accounting Diploma Course 08: Financial Analysis Course Course 09: Financial Investigator Course 10: Anti Money Laundering and Fraud Management Whether you're looking to launch a new career or enhance your existing qualifications in accounting, this bundle provides a roadmap to success. Enrol today and take control of your financial future! Learning Outcomes of accounting & bookkeeping Learn to navigate popular accounting software like Xero and Sage. Gain expertise in preparing financial statements and analysing financial data. Master the intricacies of payroll management and tax accounting regulations. Develop skills in identifying and preventing financial fraud and money laundering. Understand the principles of managerial accounting for effective decision-making. Acquire knowledge in conducting comprehensive financial investigations and audits. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of accounting & bookkeeping Get a free student ID card with accounting & bookkeeping Training program (£10 postal charge will be applicable for international delivery) The accounting & bookkeeping is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the accounting & bookkeeping course materials The accounting & bookkeeping comes with 24/7 tutor support Take a step toward a brighter future! *** Course Curriculum *** Main Course: Advanced Diploma in Xero Accounting And Bookkeeping at QLS Level 7 Module 01: Introduction Module 02: Getting Started Module 03: Invoices and Sales Module 04: Bills and Purchases Module 05: Bank Accounts Module 06: Products and Services Module 07: Fixed Assets Module 08: Payroll Module 09: Vat Returns Course 01: Introduction to Accounting Section 01: Accounting Fundamental Lecture-1.What is Financial Accounting Lecture-2. Accounting Double Entry System and Fundamental Accounting Rules Lecture-3.Financial Accounting Process and Financial Statements Generates Lecture-4.Basic Accounting Equation and Four Financial Statements Lecture-5.Define Chart of Accounts and Classify the accounts Lecture-6. External and Internal Transactions with companies Lecture-7.Short Exercise to Confirm what we learned in this section Section 02: Accounting Policies Lecture-8.What are Major Accounting Policies need to be decided by companies Lecture-9.Depreciation Policies Lecture-10.Operational Fixed Asset Controls Lecture-11.Inventory Accounting and Controls Lecture-12.Revenue Accounting and Controls Lecture-13.Expenses Accounting and Working Capital Course 02: Accountancy Module 01: Introduction To Accounting Module 02: The Role Of An Accountant Module 03: Accounting Concepts And Standards Module 04: Double-Entry Bookkeeping Module 05: Balance Sheet Module 06: Income Statement Module 07: Financial Statements Module 08: Cash Flow Statements Module 09: Understanding Profit And Loss Statement Module 10: Financial Budgeting And Planning Module 11: Auditing =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £139) CPD 285 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This Accounting & Bookkeeping bundle is open to everybody. Bookkeeping Beginners Accounting Enthusiasts Career Changers Business Owners Finance Professionals Requirements You will not need any prior background or expertise to enrol in this Accounting & Bookkeeping bundle. Career path After completing this Accounting & Bookkeeping bundle, you are to start your career or begin the next phase of your career. Bookkeeper Accountant Tax Advisor Financial Analyst Auditor Fraud Investigator Certificates Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee. CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free.

Level 4 Diploma in Import/Export & Supply Chain Management - QLS Endorsed

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Did you know that the UK exported over £668 billion worth of goods and services in 2022? The import and export industry is a thriving part of the UK economy, and with the rise of e-commerce, it's only going to get bigger. Are you interested in a career in this exciting field? This Import/Export bundle offers a vibrant spectrum of courses, integrating the nuances of Supply Chain Management, Business Law, Tax Accounting, and Transport and Logistics Management, amongst others, to create a thoroughfare for ambitious learners. In a world where 49% of UK businesses are engaged in international trade, being armed with robust, comprehensive knowledge encompassing Purchasing & Procurement, Intermediate Economics and Business Analysis is no less than a strategic investment in your future. This Import/Export at QLS Level 4 course is endorsed by The Quality Licence Scheme and accredited by CPD QS (with 120 CPD points) to make your skill development & career progression more accessible than ever! With a single payment, you will gain access to Diploma in Import/Export course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for absolutely free! This Import/Export Bundle Package includes: Main Course: Diploma in Import/Export at QLS Level 4 10 Additional CPD Accredited Premium Courses related to Import/Export: Course 01: Diploma in Supply Chain Management at QLS Level 5 Course 02: Business Law Course 03: Lean Process and Six Sigma Course 04: Purchasing & Procurement Course 05: Tax Accounting Diploma Course 06: Essentials of UK VAT Course 07: Intermediate Economics Course 08: Transport and Logistics Management Course 09: Business Analysis Course 10: Compliance Risk and Management Learning Outcomes of Import/Export Apply import and export regulations and procedures. Identify and mitigate risks associated with international trade. Utilize Incoterms to manage responsibilities and costs in transactions. Implement effective logistics and supply chain management practices. Analyze international trade finance options for import and export. Develop strategies to ensure compliance with customs regulations. Why Choose Us? Get a Free QLS Endorsed Certificate upon completion of Import/Export Get a free student ID card with Import/Export Training program (£10 postal charge will be applicable for international delivery) The Import/Export is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Import/Export course materials The Import/Export comes with 24/7 tutor support Take a step toward a brighter future! Course Curriculum Course 01: Diploma in Import/Export Processing Level 4 Module 01: Introduction to Import/Export Module 02: Organising the Import/Export Operation Module 03: Products for Your Import/Export Business Module 04: Target the Marketing & Find Your Customers Module 05: Searching, Marketing & Distribution Module 06: Documentation & Supply Chain Management Module 07: Pricing, Payment & Shipping Procedure Module 08: Necessary Tools for Trading Course 02: Business Law Module 01: Understanding Business Law Module 02: European Community Law Module 03: The Court System Module 04: Civil and Alternative Dispute Resolution Module 05: Contract & Business Law Module 06: Employment Law Module 07: Agency Law Module 08: Consumer Law and Protection Module 09: Law of Tort Module 10: Business Organisations Module 11: Company Law Module 12: Business Property Module 13: Competition Law Course 03: International Law Module 01: Basics of International Law Module 02: Sources of International Law Module 03: International Law and Municipal Law Module 04: International Organisations Module 05: International Law of Human Rights Module 06: Private International Law Module 07: International Criminal Law Module 08: Law of Treaties Module 09: Territory and Jurisdiction Module 10: Law of the Sea Module 11: International Commercial Law Module 12: International Environmental Law How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) CPD Hard Copy Certificate: Free (For The First Course: Previously it was £29.99) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £99) CPD 220 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Business owners Trade professionals Supply chain managers Logistics coordinators Finance officers Career changers Requirements You will not need any prior background or expertise to enrol in this course. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Import/Export Manager - £30,000 to £45,000 Supply Chain Manager - £35,000 to £55,000 Logistics Coordinator - £25,000 to £35,000 Procurement Officer - £25,000 to £40,000 Compliance Officer - £28,000 to £45,000 Business Analyst - £30,000 to £50,000 Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Bundle, you need to order to receive a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD. Diploma in Import/Export Processing at QLS Level 4 Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

Level 7 Advanced Diploma in Sage 50 Accounting & Payroll - QLS Endorsed

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

Learn how to identify the different types of fire extinguishers that might be installed within your workplace and what situations they might be used in. At the end of the final module you will be presented with a simulation that will test what you’ve learnt.

Search By Location

- VAT Courses in London

- VAT Courses in Birmingham

- VAT Courses in Glasgow

- VAT Courses in Liverpool

- VAT Courses in Bristol

- VAT Courses in Manchester

- VAT Courses in Sheffield

- VAT Courses in Leeds

- VAT Courses in Edinburgh

- VAT Courses in Leicester

- VAT Courses in Coventry

- VAT Courses in Bradford

- VAT Courses in Cardiff

- VAT Courses in Belfast

- VAT Courses in Nottingham