- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

397 Courses

The NEBOSH National Diploma is designed to provide the underpinning knowledge for a professional career in health and safety. The course is suitable for both newly appointed safety practitioners and those with substantial experience who wish to obtain Chartered Membership of IOSH. It equips holders to advise on effective management of risk across the range of employment sectors.

Transport Manager - CPC Passenger Transport Course, Notes & Exams May 2025

By Total Compliance

#cpc #cpcexam #driver_training #drivertraining #grantham #hgv #lincolnshire #training_course #transport #transportmanager

Transport Manager CPC Road Haulage Course, Notes & Exams May 2025

By Total Compliance

#cpc #cpcexam #driver_training #drivertraining #grantham #hgv #lincolnshire #training_course #transport #transportmanager

Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

Develop your technical report writing and presentation skills with EnergyEdge's course designed for oil & gas professionals. Sign up now!

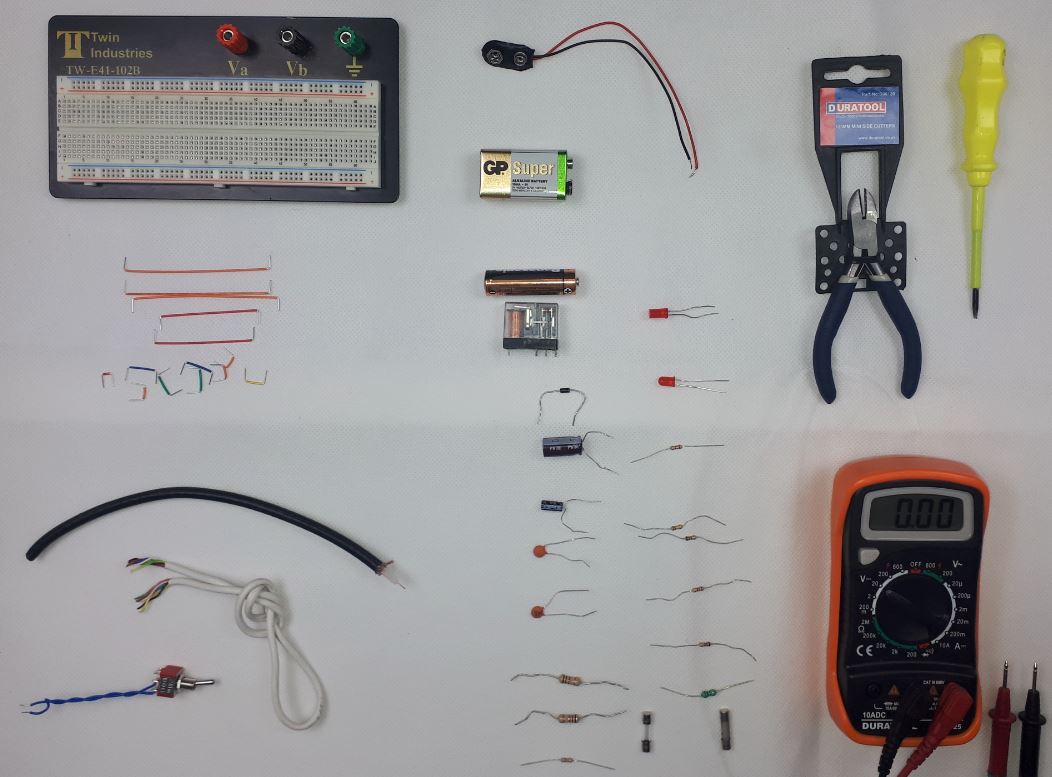

Preliminary Electronic Security Course

By Hi-Tech Training

The Preliminary Electronic Security Course is an introductory (or revision) course designed to provide participants who have no previous Electrical or Electronics experience with the background skills required to attend the CCTV Installation Course, Access Control Course or Fire Alarm Foundation Course. The course gives both an introduction to electronics and electronic security and shows how the two fields merge together. Ideal for a beginner wishing to learn more about this fascinating area. A large practical content is guaranteed. The day will be an excellent learning experience with a skilled instructor. It is a great introduction to the other courses we provide.

Course Details Please note there is an additional charge for both OP & Sup units needing to be completed via re-assessment, please call the YCDI team if you are unsure - 01782 438813. If your streetworks card is about to or has already expired, you will need to take a NRSWA reassessment course. You are not able to work on a streetworks site with expired certificates. You can take reassessments at anytime before your certificates expire and the remaining time left before expiry is now added to your new card. For example, if you take your reassessment with 6 months still remaining, it will be added to your new card when you receive it, resulting in 5 years and 6 months on your card expiry. If you completed your NRSWA Operative or Supervisor course with us, we will advise you that you will need to complete the reassessment course within 3 months of the expiry date. If you are unsure what course is best for you, contact a member of our team who will be happy to help you. Prepare for your reassessment with our practice quiz. Although this quiz is aimed at people taking the full 5-day course, the questions will still be helpful revision before taking your reassessments.

PRINCIPLES OF INTERNATIONAL TAXATION

By Mojitax

MojiTax Principles of International Taxation is a comprehensive self-paced program designed to provide students with an in-depth understanding of international taxation. The training covers all essential concepts, principles, and skills needed to succeed in the Advanced Diploma in International Taxation (ADIT) professional exam. It includes engaging presentations, funny stories to illustrate key topics, multiple-choice questions, and additional study resources such as an E-textbook and interactive quizzes. It is divided into five parts, each covering a section of the ADIT syllabus on Principles of International Taxation. Students can choose to take the ADIT professional exam or MojiTax exam upon completing the course, and our team is always available to assist with any questions or concerns. . Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award : MOJITAX certificate of knowledge, and ADIT Module 1 (exam preparation). Author: MojiTax Start date : NA Duration: Self Paced ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 1. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have a solid understanding of international taxation principles and confidently pass the ADIT Module 1, Principles of International Taxation exam in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our Banking training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam: 01 Introduction Introduction to MojiTax PITIntroduction to MojiTax PITADIT/CIOT websiteADIT Syllabus: Principles of International Taxation 02 Part 1: Basic principles of international taxation - 20% Presentation: Basic Principles of International TaxationChapter 1: Basic Principles of International TaxationQuiz 1: Test your knowledgeADIT Revision Questions, Chapter 1 03 Part 2: Double taxation conventions (DTCs), focusing on the current version of the OECD Model Tax Convention (MTC) - 30% Presentation: Double Tax ConventionsChapter 2: Double taxation conventions (DTCs), focusing on the current version of the OECD Model Tax Convention (MTC)Quiz 2: Test your knowledgeADIT Revision Questions, Chapter 2OECD Model Tax Convention and commentariesUN Model Tax Convention 04 Part 3: Transfer pricing and restrictions on interest deductibility - 20% Presentation: Transfer Pricing & Restrictions on interest deductibilityChapter 3: Transfer pricing and restrictions on interest deductibilityQuiz 3: Test your knowledgeADIT Revision Questions, Chapter 3 05 Part 4: International tax avoidance - 25% Presentation: International Tax AvoidanceChapter 4: International tax avoidanceQuiz 4: Test your knowledgeADIT Revision Questions, Chapter 4BEPS Report - Summary 06 Part 5: Miscellaneous topics - 5% Presentation: Miscellaneous topicsChapter 5: Miscellaneous topicsQuiz 5: Test your knowledgeADIT Revision Questions, Chapter 5 07 Examination & Certificate Assessment GuidanceAssessment & Certificate PortalModule Feedback

Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

Develop your technical report writing and presentation skills with EnergyEdge's course designed for oil & gas professionals. Sign up now!

Search By Location

- Revision Courses in London

- Revision Courses in Birmingham

- Revision Courses in Glasgow

- Revision Courses in Liverpool

- Revision Courses in Bristol

- Revision Courses in Manchester

- Revision Courses in Sheffield

- Revision Courses in Leeds

- Revision Courses in Edinburgh

- Revision Courses in Leicester

- Revision Courses in Coventry

- Revision Courses in Bradford

- Revision Courses in Cardiff

- Revision Courses in Belfast

- Revision Courses in Nottingham