- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

21546 Courses

EMOTIONAL WELLBEING

By Inclusive Solutions

This workshop gives an opportunity to focus on the emotional needs of children and young people and how to meet these. We lift the lid on an emerging urgent inclusion issue, meeting the emotional well being of all children. In one year 1300 young men committed suicide in the UK. In the UK the commonest cause of death among those aged 16-35 is suicide. Online Course now available via Teachable Platform – Understanding children’s Emotional Needs Learn at your own pace… lots of text and video support Course Category Behaviour and Relationships Meeting emotional needs Early Years Inclusion Description This workshop gives an opportunity to focus on the emotional needs of children and young people and how to meet these. We lift the lid on an emerging urgent inclusion issue, meeting the emotional well being of all children. In one year 1300 young men committed suicide in the UK. In the UK the commonest cause of death among those aged 16-35 is suicide. 1 in 4 women experience domestic violence and 2 women a week are killed by a current or ex partner. We need to find ways to allow children to unclench their hearts and learn to experience, process, communicate and manage their own emotional lives for their own and for the good of the wider community. Testimonials Be the first…. Learning Objectives Increased understanding of emotional needs Access to a wider range of practical strategies to impact on meeting emotional and behaviour problems Deeper understanding of core values surrounding inclusion Opportunity to reflect on professional attitudes and behaviour towards children and their emotional challenges New skills and processes to make emotionally challenged children’s inclusion and achievement more successful Who Is It For ? Early years and school based practitioners Key workers Teaching Assistants with support roles Heads and deputies SENCOs Advanced skills teachers Primary and secondary classroom teachers Parents Local authority support services Course Content Shared experiences of teaching and parenting around emotional well being Circle of Courage as away of understanding emotional needs Fathers, mothers and sons and daughters Drinking and drugs, filling the emotional void Depression and suicide Anger and violence Solution Circle Problem Solving What children really need

BA (HONS) FILMMAKING

By Screen and Film School

Are you really passionate about film? Do you want to get your hands on the kit used to make real films? Do you want to learn your craft from real filmmakers? Screen and Film School is dedicated to one thing: Film. The BA (Hons) Filmmaking is focused on creating the next generation of filmmakers.

Digital CCTV and Remote Access Course

By Hi-Tech Training

The Digital CCTV & Remote Access course is designed to give participants a practical knowledge of integrating Analogue and Digital technologies in addition to access and control from remote locations such as laptops, tablets and mobile phones.

5 Day IAM Certificate Course C23014

By Asset Management Consulting (Asset Management Academy)

Classroom Asset Management course in London. This IAM Certificate course will be hosted in London UK from the 20th November 2023.

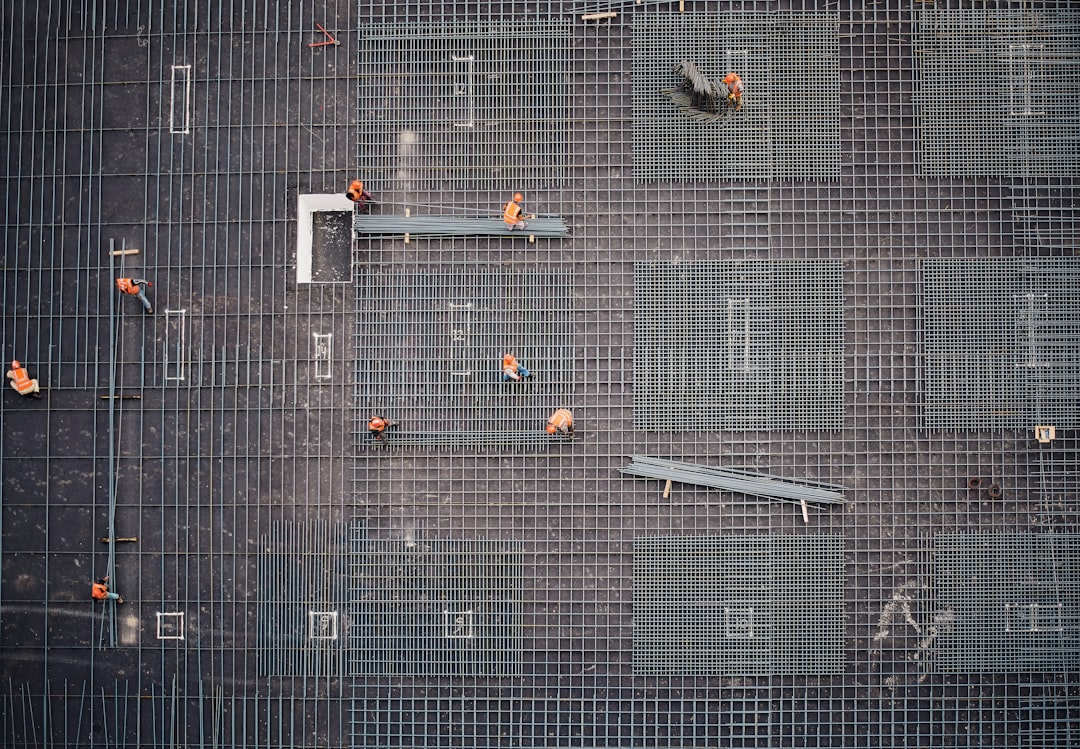

NEBOSH Health and Safety Management for Construction (UK) is guided by legislation but focussed on best practice. With an emphasis on practical application, successful learners will be able to: • Recognise, assess and control a range of common construction hazards • Develop safe systems of work • Take part in incident investigations • Advise on the roles, competencies and duties under construction legislation • Positively influence health and safety culture • Confidently challenge unsafe behaviours • Help manage contractors.

Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3

4.5(3)By Studyhub UK

Imagine a future where you navigate the intricate landscape of the UK insurance sector with confidence and expertise. The 'Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3' offers a comprehensive exploration into the realms of insurance, covering everything from the foundational principles to specific insurance lines including general, commercial, liability, and life insurance. This course is meticulously designed to equip learners with a profound understanding of the industry's operations within the United Kingdom, addressing key topics such as the underwriting process and insurance fraud. By the end of this educational journey, participants will possess a deep comprehension of both theoretical aspects and real-world applications, paving the way for a successful career in insurance. Tailored to demystify the complexities of the insurance domain, the curriculum is structured to foster a robust knowledge base among students. Through ten meticulously crafted modules, learners will unravel the intricacies of the insurance industry, gain insights into the UK-specific regulations and practices, and understand how to effectively manage and mitigate risks through various insurance products. This enlightening voyage through the course not only prepares individuals for the challenges of the insurance world but also empowers them with the skills to make informed decisions and contribute significantly to their professional environments. Learning Outcomes Acquire a thorough understanding of the insurance sector's structure and significance within the UK context. Grasp the fundamental principles governing the insurance industry and how they apply across different types of insurance. Differentiate between personal and commercial insurance lines, understanding the unique characteristics and requirements of each. Recognise the importance of liability and life insurance, including the key factors that influence policy underwriting and claims. Identify and analyze the implications of insurance fraud, along with strategies for its prevention and control. Why choose this Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3 course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3 course for? Individuals seeking a foundational yet comprehensive introduction to the UK insurance industry. Professionals aiming to broaden their knowledge across various insurance lines including general, commercial, and liability. Career changers interested in exploring opportunities within the insurance sector. Students and graduates who wish to enhance their employability by acquiring specialized knowledge in insurance. Anyone with a keen interest in understanding the mechanisms of life insurance and its critical role in financial planning. Career path Insurance Broker with an average salary range of £25,000 - £60,000. Underwriting Manager offering earnings between £40,000 and £70,000. Claims Adjuster, with salaries typically ranging from £23,000 to £45,000. Risk Manager, commanding an average income of £35,000 - £70,000. Insurance Analyst, with potential earnings of £30,000 - £50,000. Compliance Officer in the insurance sector, with salaries ranging from £28,000 to £55,000 Prerequisites This Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3 does not require you to have any prior qualifications or experience. You can just enrol and start learning. This course was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for only £85 to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Course Curriculum Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3 Module 01: Insurance Industry 00:30:00 Module 02: The UK Insurance Industry 00:51:00 Module 03: Principles of Insurance 01:05:00 Module 04: General Insurance 00:39:00 Module 05: Personal Lines Insurance 01:24:00 Module 06: Commercial Lines Insurance 01:01:00 Module 07: Liability Insurance 00:47:00 Module 08: Life Insurance 00:39:00 Module 09: Insurance Fraud 00:23:00 Module 10: Underwriting Process 00:13:00 Assignment Assignment - Certificate in Understanding UK Insurance (General, Commercial, Liability, Life) at QLS Level 3 04:00:00 Order your QLS Endorsed Certificate Order your QLS Endorsed Certificate 00:00:00

If you ever wanted to join a rewarding career as a nurse, paramedic, healthcare assistant or social worker then our Level 3 Diploma in Health and Social Care will help you reach heights that you never dreamt of. In the UK, job opportunities for individuals with a Level 3 Diploma in Health and Social Care are abundant, with a variety of positions available across the healthcare sector. The Office for National Statistics highlights a current vacancy rate of around 152,000 in the social care sector alone. And according to Reed a Social Care Practitioner can earn from £35,000 to £40,000 in a year depending on qualification, experience, location and other factors. This Health and Social Care course will teach the fundamentals, key principles and policies, the rights and responsibilities of a health and social care worker. Not only that you will also learn the Legal, Professional Standards, and Ethical Aspects of it as well. Your journey to a meaningful and impactful career in health and social care starts here. Enrol today in our Level 3 Diploma in Health and Social Care and take the first step towards a future where your work truly matters. Key Features This Health and Social Care (UK) Course is CPD QS Certified Level 3 Diploma Free Certificate Developed by Specialist Lifetime Access Why Choose Our Course? By choosing our Health and Social Care course is a smart investment in your professional future. Our Health and Social Care course is designed by industry professionals to stay ahead of trends, offering the most current and relevant content. This Health and Social Care course provides you with the tools and knowledge needed to excel in today's competitive landscape. With flexible learning options and a commitment to your success, our Health and Social Care course is the key to unlocking your potential and advancing your professional journey. Course Curriculum Module 01: Fundamentals of Health and Social Care Module 02: Relevance of Communication in Health and Social Care Module 03: Rights and Responsibilities in Health and Social Care Roles Module 04: Caregiver and Healthcare Professional Roles Module 05: Promoting Equality, Diversity, and Rights in Health and Social Care Module 06: Key Principles and Policies in Health and Social Care Work Module 07: Legal, Professional Standards, and Ethical Aspects of Health Care - Part 1 Module 08: Legal, Professional Standards, and Ethical Aspects of Health Care - Part 2 Module 09: Safeguarding Vulnerable Individuals in Health and Social Care Module 10: Health and Safety Responsibilities in the Care Setting Module 11: Risk Management Practices in Health and Social Care Learning Outcomes After completing this Level 3 Diploma in Health and Social Care (UK) Course, you will be able to: Apply fundamental health and social care principles in diverse professional settings. Demonstrate effective communication strategies within health and social care contexts. Understand and uphold rights and responsibilities in health and social care roles. Differentiate roles of caregivers and healthcare professionals in care environments. Advocate for equality, diversity, and rights within health and social care. Implement key policies, legal standards, and ethical aspects in healthcare practices. Certification After completing this Level 3 Diploma in Health and Social Care (UK) course, you will get a free Certificate. CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? This Health and Social Care course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Health and Social Care. Moreover, this course is ideal for: Aspiring Health and Social Care Professionals Support Workers in Health and Social Care Settings Individuals Pursuing a Career in Care Services Healthcare Assistants and Caregivers Those Aiming for a Role in Health and Social Care Administration Requirements There are no requirements needed to enrol into this Health and Social Care course. We welcome individuals from all backgrounds and levels of experience to enrol into this Health and Social Care course. Career path After finishing this Health and Social Care course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Health and Social Care are: Mental Health Support Worker - £20K to 26K/year. Social Worker - £27K to 35K/year. Care Home Manager - £30K to 40K/year. Health and Safety Officer - £25K to 35K/year. Community Outreach Coordinator - £22K to 30K/year. Certificates Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

If you ever wanted to join a rewarding career as a nurse, paramedic, healthcare assistant or social worker then our Level 3 Diploma in Health and Social Care will help you reach heights that you never dreamt of. In the UK, job opportunities for individuals with a Level 3 Diploma in Health and Social Care are abundant, with a variety of positions available across the healthcare sector. The Office for National Statistics highlights a current vacancy rate of around 152,000 in the social care sector alone. And according to Reed a Social Care Practitioner can earn from £35,000 to £40,000 in a year depending on qualification, experience, location and other factors. This Health and Social Care course will teach the fundamentals, key principles and policies, the rights and responsibilities of a health and social care worker. Not only that you will also learn the Legal, Professional Standards, and Ethical Aspects of it as well. Your journey to a meaningful and impactful career in health and social care starts here. Enrol today in our Level 3 Diploma in Health and Social Care and take the first step towards a future where your work truly matters. Key Features This Health and Social Care (UK) Course is CPD Certified Level 3 Diploma Free Certificate Developed by Specialist Lifetime Access Why Choose Our Course? By choosing our Health and Social Care course is a smart investment in your professional future. Our Health and Social Care course is designed by industry professionals to stay ahead of trends, offering the most current and relevant content. This Health and Social Care course provides you with the tools and knowledge needed to excel in today's competitive landscape. With flexible learning options and a commitment to your success, our Health and Social Care course is the key to unlocking your potential and advancing your professional journey. Course Curriculum Module 01: Fundamentals of Health and Social Care Module 02: Relevance of Communication in Health and Social Care Module 03: Rights and Responsibilities in Health and Social Care Roles Module 04: Caregiver and Healthcare Professional Roles Module 05: Promoting Equality, Diversity, and Rights in Health and Social Care Module 06: Key Principles and Policies in Health and Social Care Work Module 07: Legal, Professional Standards, and Ethical Aspects of Health Care - Part 1 Module 08: Legal, Professional Standards, and Ethical Aspects of Health Care - Part 2 Module 09: Safeguarding Vulnerable Individuals in Health and Social Care Module 10: Health and Safety Responsibilities in the Care Setting Module 11: Risk Management Practices in Health and Social Care Learning Outcomes After completing this Level 3 Diploma in Health and Social Care (UK) Course, you will be able to: Apply fundamental health and social care principles in diverse professional settings. Demonstrate effective communication strategies within health and social care contexts. Understand and uphold rights and responsibilities in health and social care roles. Differentiate roles of caregivers and healthcare professionals in care environments. Advocate for equality, diversity, and rights within health and social care. Implement key policies, legal standards, and ethical aspects in healthcare practices. Certification After completing this Level 3 Diploma in Health and Social Care (UK) course, you will get a free Certificate. CPD 10 CPD hours / points Accredited by The CPD Quality Standards (CPD QS) Who is this course for? This Health and Social Care course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Health and Social Care. Moreover, this course is ideal for: Aspiring Health and Social Care Professionals Support Workers in Health and Social Care Settings Individuals Pursuing a Career in Care Services Healthcare Assistants and Caregivers Those Aiming for a Role in Health and Social Care Administration Requirements There are no requirements needed to enrol into this Health and Social Care course. We welcome individuals from all backgrounds and levels of experience to enrol into this Health and Social Care course. Career path After finishing this Health and Social Care course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Health and Social Care are: Mental Health Support Worker - £20K to 26K/year. Social Worker - £27K to 35K/year. Care Home Manager - £30K to 40K/year. Health and Safety Officer - £25K to 35K/year. Community Outreach Coordinator - £22K to 30K/year. Certificates Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

We are delighted to announce our next series of in-person training events. Across 30th September to 3rd October 2025, we are joining forces with ASA to bring our ‘Laser Therapy Update’ workshops to anyone interested in adding laser therapy to their clinic AND laser therapists who want to update and refresh their knowledge of MLS® Laser Therapy science and application techniques. These workshops are perfect for anyone wanting to learn more about what laser is, how it works and how to use it to treat a range of commonly seen MSK pathologies and wounds. Discover how to treat patients effectively and integrate laser seamlessly into your practice. Learn the latest science behind MLS® laser therapy Discover how to achieve the best results for your patients Get hands on with MLS® Laser - learn the latest application techniques Opportunity to ask questions and get answers directly from a team of experts. Clarify any confusion! *Please note these workshops are limited to 2 spaces per clinic. Led by experts from ASA Laser, Salvatore Germano and Roberto Terruzzi and supported by UK MLS® laser trainer, this workshop will cover everything you need to know to start and/or continue your laser journey in the best possible way. Got any questions about this workshop? Email sales@celticsmr.co.uk for help.

RACISM – HOW TO IDENTIFY IT AND INTERVENE RESPECTFULLY

By Inclusive Solutions

This course is an exploration of our understanding of structural racism in the UK and provides a good foundation for anyone wanting to be a responsible ally. Are you working with young people, but struggling with conversations about race? Are you worried that you have been getting it wrong when it comes to race? Do you have questions about race that you are afraid to ask? This course is for you. Description Racism is a real problem in the UK, but it is much more hidden and covert than it has been in the past. People know its not ok to say the ’N-word’, but sadly, racism has permeated British society much more deeply than this. On this course we will help redefine the idea of racism and explain the complex nature of its modern day manifestation. We will explore how to talk with young people about race and particularly how to challenge when racism occurs. To achieve this, we need to start with ourselves. We will cover the idea of Unconscious Bias making us react differently to people based on our socialisation. We will cover the concept of White Privilege making it difficult for white people to get into the shoes of someone of another race. We will cover the concept of micro-aggressions that are difficult to report to a superior because they may be misconstrued as a mere “interpretation” of the situation and not an incident of racism. We will introduce the idea of the “racism binary”, and how we need to become more accountable for our own actions, and instead of getting offended, take responsibility when someone says something we did or said was racist. This can lead to a much more useful conversation than trying to defend yourself by saying “I’m not racist”. When we live in a world where racism doesn’t exist, only then can we say “I don’t see colour”, because it does exist, and it does have an impact on peoples lives. When racist incidents happen, people get hurt. Unfortunately, it is an all too familiar feeling for a lot of people in the UK who have been forced to accept it as part of life. Most of these situations will never be resolved, because they will never be reported. Poor handling of racist incidents teach young people not to say anything, thinking it will only make the situation worse. A lot of people believe that racism is never going away, because their experiences have confirmed this belief. There is a lot of work to be done, and the time is now. This course is an exploration of our own socialisation and personal expressions of race, which will leave you feeling positive and hopeful about the future. Be bold, and join us on this journey into the ever growing multicultural melting pot. Enquire for more information about this thought provoking training day. Learning objectives Develop understanding of modern racism in the UK Strengthen knowledge of key terminology Understanding how to think like an “Ally” Explore strategies for dealing with racism when we encounter it Developing our confidence and ability to hold conversations with young people about race Who is it for? Leadership teams seeking guidance and reflection Multi Agency Teams Social workers CAMHS teams Year Managers Primary and secondary staff teams College staff Early Years and School based Practitioners Heads and Deputies SENCOs Advanced Skills Teachers Primary and secondary teachers Local Authority Support Services Voluntary Organisations People who want to “get it right” Content AM What makes a good welcome? Why don’t we talk about race? History of racism in the UK Definition of modern racism – how racism manifests in a post-racist world Unconscious bias The ‘racism binary’ – taking accountability for our words/actions Examining our privilege What does your race mean to you? PM Trust and difference exercises – how can we become more trustworthy? What is good Allyship? What to do and what not to do Strategies for dealing with racism incidents Restorative Justice How can we create dialogue with young people about race? Affinity groups What does the ideal workplace/school look like? What actions will we take away?

Search By Location

- uk Courses in London

- uk Courses in Birmingham

- uk Courses in Glasgow

- uk Courses in Liverpool

- uk Courses in Bristol

- uk Courses in Manchester

- uk Courses in Sheffield

- uk Courses in Leeds

- uk Courses in Edinburgh

- uk Courses in Leicester

- uk Courses in Coventry

- uk Courses in Bradford

- uk Courses in Cardiff

- uk Courses in Belfast

- uk Courses in Nottingham