- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

19672 Courses

Beginner Celtic Knot Workshop

By Panda Scribes

Introduction to Celtic Knots – Live Zoom Session Join me for a relaxing and creative hour-long Zoom session where you'll learn the basics of how to create beautiful Celtic knots. Perfect for beginners, this introduction will guide you through simple techniques to start drawing your own intricate designs. No prior experience needed—just bring a pencil, paper, and your curiosity!

Much Wenlock Introduction to Foraging Workshops with The Wild Cooke (Longer & Lunch)

By The Wild Cooke

MUCH WENLOCK FORAGING WORKSHOPS Unleash your wild and immerse yourself in the world of foraging with The Wild Cooke. This workshop offers the perfect opportunity to learn, get inspired, and find your inner forager. WORKSHOP HIGHLIGHTS ● Foraging basics: Get an introduction to spring wildfoods, including identification, harvesting, and foraging ethics. ● Cooking and preservation techniques: explore the possibilities of utilising nature's ingredients in your meals and discuss appropriate ways to store them. ● Wild picnic lunch: feeling hungry yet? The workshop ends with a seasonal foragers picnic. Sweets and drinks, too. Yum. DATES Summer ~ 16th August ~ 10.30am - 2.30pm Autumn ~ 4th August ~ 10.30am - 2.30pm

University of Cambridge & Bayfield Training - Real Estate Financial Modelling Certificate (Online Self-Study)

4.3(5)By Bayfield Training

Bayfield Training and the University of Cambridge Department of Land Economy This prestigious eight-week online Real Estate course is suitable for modellers new to Real Estate and experienced Real Estate Analysts looking to formalise their skill set. This course will equip you with skills to start building your own financial models and the certificate will give your employers and colleagues reassurance of your expertise. If you want to enhance your financial modelling skills over an extended period, the Real Estate Financial Modelling Certificate is the course for you. This online real estate course has been put together exclusively for the Real Estate Financial Modelling certificate, using state of the art digital resources such as animations, video-steps, digital whiteboard and video-interactions as well as the spreadsheets, text based resources and tutor contact you would expect from any of Bayfield Training’s classroom based courses. Assessment is in the form of a guided model build exercise and written model appraisal. Participants benefit from an additional months access to the course platform after submission of the assessment. On this course you will: Become a competent model builder, building Real Estate Financial Models from scratch Learn tricks and concepts from financial modelling experts with decades of experience in practice and academia Learn how to use Real Estate Financial Models to make informed investment decisions Learn at a consistent pace over 8 weeks allowing you to take the time to fully grasp this important skill This course is suitable for: Chartered Surveyors Asset Managers Financial Controllers Financial Analysts Investment Managers Property Managers Real Estate Students/Recent Graduates Course Outline: Module 1 - Economic Context Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Introduction to Real Estate Asset Modelling and how it relates to and is distinct from Econometric Models. Why Real Estate Asset Modelling is important Understanding the occupier, asset and development markets and the relevant modelling approaches for each Real Estate Sub-Sector Key Performance Indicators Introduction to conventional valuations and financial mathematics Understanding and minimising errors in Financial Models Module 2 - Cash Flow Fundamentals Constructing a financial model from first principles. Understanding all the components of a basic cash flow model Understand why Corporate Finance Models and Real Estate Models are different Financial Model Design Making the link between valuations, income mathematics and discounted cash flows Internal Rate of Return, Net Present Value,Worth and other metrics Features and techniques to aid fast model building Module 3 - Developing the Cash Flow Adapting financial models for different periodicities and building rent functions for different rent behaviour. Understanding how leases vary with respect to rent over time: Rent Reviews, Break Clauses, Rent Free Periods, Lease Expiries etc. Developing the concept of a Rent Function in Excel Logic mathematics and Logic functions Projecting rent to adapt to different lease contracts and growth patterns Alternative solutions to Logic functions Comparative analysis of lease structures in different jurisdictions and adapting financial models Module 4 - Real Estate Data Understanding the different sources of data, constructing basic time series models and recognising basic patterns. Key Property market indicators Characteristics and application of key input metrics for Real Estate Appraisals Understanding the eight components of Real Estate Price Dynamics Awareness of the different sources of data Reading and using general property market reports Constructing basic time series models and recognising basic patterns Module 5 - Development Appraisals Constructing a development appraisal from first principles and understanding development return metrics. Understanding the key components of a development project Understanding the difference between development and investment appraisals Residual Appraisals and Profit Calculations Cost orientated cash flows and phased sales Cumulative construction cost patterns: incidental, fixed, loaded and S-curve Development return metrics and Modified IRRs Module 6 - Multi-let Cash Flows Constructing an advanced multi-let cash flow model and learn different techniques to build flexible rent functions. Multi-let and portfolio model design principles Building complex date functions and date series The three multi-let rent projection techniques Perpendicular Rent Functions Incorporate advanced rent adjustments into the Rent Function Incorporate sector and period varying rental growth rates Simplifying OPEX and CAPEX projections Discounting techniques on complex and volatile cash flows Module 7 - Project Finance Constructing a flexible Real Estate Debt Finance model. Revision of the Mathematics of amortisation and debt finance Basic senior debt models and geared net cash flow LTV, IRR and Interest Rate Dynamics Flexible term, repayment options and deferred interest Loan covenant tests Understanding different tranches of debt Understanding how complex debt structures impact the returns to different parties Module 8 - Model Interpretation and Risk Analysis Learn how to read, analyse and report on real estate financial models. Understand how to read models and develop an investment narrative Visualise model outputs using graph functions, conditional formatting, dynamic symbols and dashboards Learn how to use built-in Sensitivity, Scenario Analysis tools and third-party add-ins Learn how to construct varied project scenarios in a systematic way Introduction to Monte Carlo Analysis and VBA Optimising sale dates and other parameters Create well written, attractive and persuasive reports Included in the Course Bayfield Training and University of Cambridge Accredited Certificate & LinkedIn Proficiency Badge 64 CPD Hours 1 Month Post-Course Access to the Digital Platform - 12 Months Post-Course Access to the Platform can be purchased for an additional fee Course Files Q&A Webinars and Guest Speaker Webinars Further Learning Resources (Reading, Files and Videos) Post Course Support - Two Months of Questions & Answers 2024 Cohort Dates Include: 3rd June to 29th July 5th August to 25th September 2024 30th September to 25th November For more information, please contact Sam on the Bayfield Training Sales team: E - s.musgrave@bayfieldtraining.com T - 01223 517851 W - www.bayfieldtraining.com

Course Summary Mini Medics - First Aid The Mini Medics courses is a Child friendly introduction to first aid and defibrillation aimed at children between the ages of 8 and 11, but it can suit children of any age from about 5 upwards. The course is kept at a basic level with no use of confusing terminologies. The mini medics course will show complete respect for the child’s ability, make it educational and practical, and instil the importance of helping someone who is poorly or injured. Fully illustrated 24-page ‘First Aid for Children’ book • A unique syringe pen in various colours (or colouring pencils) • A 4-page worksheet There is also the opportunity to purchase t-shirts and hoodies - delivered at a later date Course Contents A range of subjects are covered including: What is First Aid? Safety Communication and contacting the emergency services First Aid kits DR ABC Recovery position Choking Resuscitation (CPR) Defibrillation (AED) Wounds and bleeding Asthma Shock Certification A certificate of attendance is included with the Mini Medic book as a ‘cut-out’ for the child. Duration 3 hours (dependent on the syllabus you want covered including educational, theoretical and practical teaching sessions. A shorter 1 hour version is available for the younger children - enquire by calling 07853393777) Further Information Duration: 3-hours in total (including a 20 min break in the middle) Group size: 10 Candidates per 1 Trainer/Assessor Assessment method: None Pre-requisite: Candidates should be aged 6-11, but suitable for all ages Suggested progression: Mini Medics - Mental Health First Aid *There are chairs in the foyer and a cafe next door (same building) if parents wold like to stay close by.

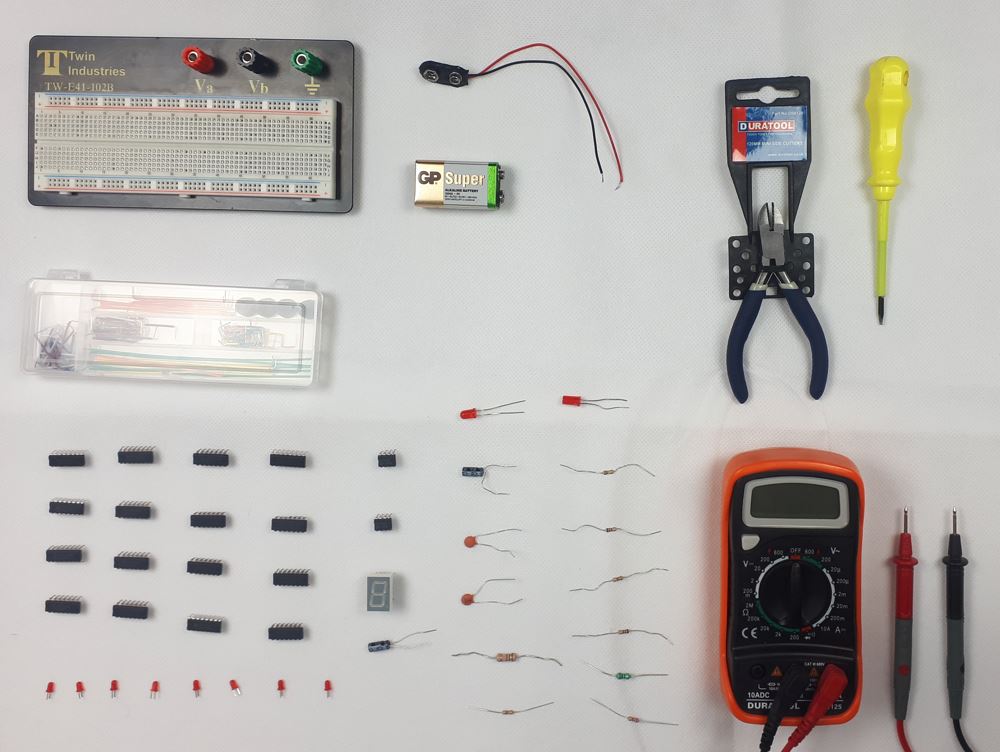

Digital Electronics Course Online

By Hi-Tech Training

This Digital Electronics Course is designed to give practical knowledge of the type of electronic circuitry used in a modern Computer System or in any type of Computer Controlled equipment such as Photocopiers, Cash Registers, Tablets, mobile phones and many other types of IT equipment. Digital Electronics involves the use of Silicon chips (Integrated Circuits). The internal structure of a computer is to a large extent comprised of Digital Electronic Circuits.

EFQM Foundation Training - Online - 2025

By Centre for Competitiveness

The essential course for anyone who wants to find out about the EFQM Model and RADAR and how these tools can benefit their organisation. Whilst this training is effective as a stand-alone course, it is also the starting point for all EFQM qualification routes. Who is it for? This course is suitable for anyone who wants to understand the new EFQM Model and how it can be used to make their organisation more effective. It provides a good overview for consultants who want to add the Model/RADAR to their portfolio of products and services. It is also a pre-requisite for anyone considering one of the EFQM qualification routes as a way of progressing their management development and career. Pre-requisites for this course None Benefits By the end of the course, participants will be able to: explain how the EFQM Model could benefit their organisation and how it could be used to overcome current and future challenges explain how the Model is structured and how the different elements apply to their organisation apply RADAR, the diagnostic and assessment tool, to identify strengths and areas for improvement conduct a high-level health check of their organisation Following the welcome and introduction, this course comprises of 9 modules: Module 1 Why we need a model to face & master complexity? Why the EFQM Model? Module 2 Introduction to the EFQM Model Module 3 The Model (part 1): Direction Module 4 The EFQM Model Module 5 The Model (part 3): Results Module 6 RADAR Module 7 Assessment Module 8 Data & Insights Module 8 Next steps Delivery The course is delivered through a virtual trainer led live class Cost £450 + VAT which includes the training course, the EFQM Model e-book and your EFQM Foundation Certificate. If you are not yet a member but are already thinking about joining CforC, you can find more information on how to become a member and the benefits by clicking here.

Search By Location

- Introduction to French Courses in London

- Introduction to French Courses in Birmingham

- Introduction to French Courses in Glasgow

- Introduction to French Courses in Liverpool

- Introduction to French Courses in Bristol

- Introduction to French Courses in Manchester

- Introduction to French Courses in Sheffield

- Introduction to French Courses in Leeds

- Introduction to French Courses in Edinburgh

- Introduction to French Courses in Leicester

- Introduction to French Courses in Coventry

- Introduction to French Courses in Bradford

- Introduction to French Courses in Cardiff

- Introduction to French Courses in Belfast

- Introduction to French Courses in Nottingham