- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6294 Courses

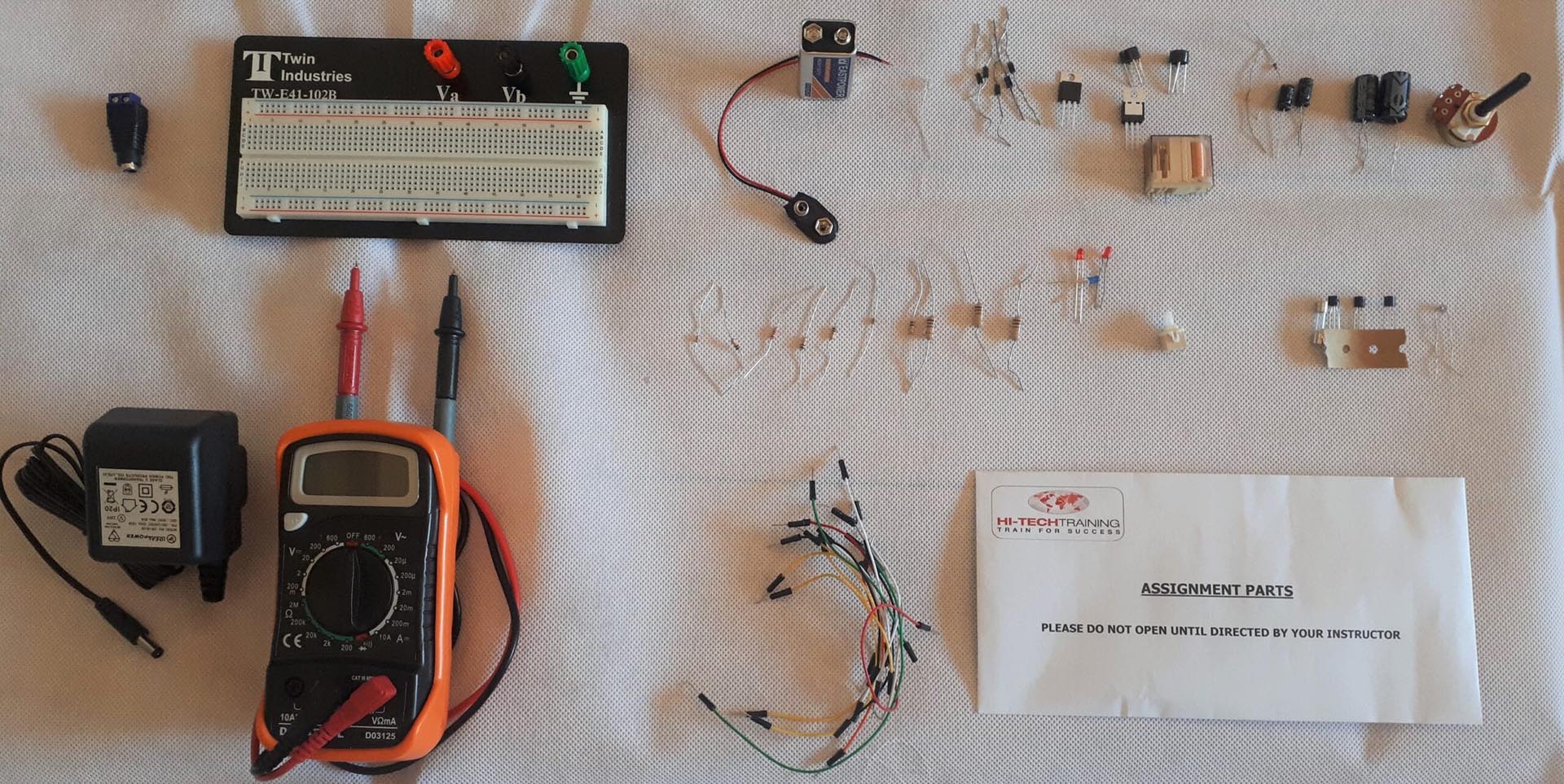

Electronics Repair 1 Course

By Hi-Tech Training

The Electronics Equipment Repair 1 equips participants with practical “Hands-On” skills relevant to the workplace and the theory required for certification. Participants on successful completion of the course will have the skills and knowledge to: Demonstrate the operation of a wide range of electronic components and circuits and their applications in modern electronic-based equipment such as amplifiers, Hi-Fi systems, stereos, and control systems Construct, test and fault-find the following popular basic circuits: Power supplies, amplifiers, timers, etc. Become competent in the correct use of electronic test and measurement equipment such as Analogue and Digital Multimeter and Oscilloscopes.

Git and GitHub Complete Master Class: Beginner to Git Expert

By Packt

This course takes you through the full spectrum of basic to advanced topics, equipping you with the skills you need to get started with Git and GitHub. With the help of exercises and activities, you will be able to grasp all the concepts of Git and GitHub with ease.

M&A Insights for CFOs

By FD Capital

An M&A specialist is a senior CFO with a proven track record of overseeing and implementing mergers and acquisitions. An M&A specialist is a senior CFO with a proven track record of overseeing and implementing mergers and acquisitions. They may be hired on a full-time basis and carry a full CFO workload or can be recruited on a part-time or interim basis to focus on a specific merger or acquisition. This flexibility is ideal for start-ups and SMEs who don’t have the budget to recruit a full external team to oversee an M&A or to hire a full-time CFO. The CFO is a link between both companies engaged in the M&A, acting as the eyes and ears for both the board and CEO. Their financial skills enable them to identify potential M&A opportunities and incorporate risk management into their strategy to get the most value out of their deal. Most companies evolve their approach to mergers and acquisitions organically, especially those who rely on an M&A specialist instead of having a dedicated team that works solely on M&A. The CFO is responsible for considering any potential acquisitions, crunching the numbers involved, and ensuring due diligence. They’ll be responsible for determining the value of a potential M&A and presenting it to the company’s board and leadership team to determine whether to make the purchase. An M&A specialist is responsible for gathering the data – including both positive and negative factors – to present an objective look at the other organisation and the potential value the acquisition could bring. CFOs will spend most of their time getting to grips with the numbers involved, long before presenting the M&A proposal to the board. This exercise also requires them to have real-time insight into their own company’s performance, value, and finances to paint a wider picture. An M&A specialist will take the critical steps of ensuring that the numbers presented to them are correct. CFOs who don’t specialise in M&As will still have the skill set required to oversee the process but may lack the efficiency and unique insight of an M&A specialist. Companies that are exploring the option of a merger or being acquired by another company may also decide to recruit an M&A specialist to prepare their accounting. The organisation will want to ensure they present the correct numbers to get the correct valuation and prevent any delays further in the process if incorrect numbers pop up. Getting on top of the data early can enable CFOs to plan accordingly. Most will want to provide extra time within their strategy for any potential hiccups along the way. Spending more time on the data early on can speed up the process while still ensuring due diligence is met. Visit our website to learn more https://www.fdcapital.co.uk/mergers-and-acquistions-specialist/ Tags Online Events Things To Do Online Online Networking Online Business Networking #finance #insights #cfo #mergers #acquisitions

50 Projects in 50 Days - HTML, CSS, and JavaScript

By Packt

Sharpen your HTML, CSS, and JavaScript by working on a large variety of projects. In this course, we'll be working through a project a day using vanilla JavaScript. Over the next 50 days, you'll have 50 small, unique, DOM-oriented projects under your belt.

Search By Location

- Pop Courses in London

- Pop Courses in Birmingham

- Pop Courses in Glasgow

- Pop Courses in Liverpool

- Pop Courses in Bristol

- Pop Courses in Manchester

- Pop Courses in Sheffield

- Pop Courses in Leeds

- Pop Courses in Edinburgh

- Pop Courses in Leicester

- Pop Courses in Coventry

- Pop Courses in Bradford

- Pop Courses in Cardiff

- Pop Courses in Belfast

- Pop Courses in Nottingham