- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3391 Courses

Certified Internal Auditor

By Compete High

ð Unlock Your Potential with the Certified Internal Auditor Course! ð Are you ready to elevate your career to new heights and become a trusted expert in internal auditing? Look no further than our Certified Internal Auditor course, a comprehensive program designed to equip you with the knowledge and skills needed to excel in the field of internal audit. Join us on a transformative journey where professionalism meets proficiency, and unlock a world of opportunities as a certified internal auditor. ð Benefits of Taking the Certified Internal Auditor Course: Enhanced Expertise: Gain comprehensive knowledge of internal audit principles, practices, and methodologies, empowering you to conduct thorough and effective audits in various organizational settings. Professional Recognition: Earn a prestigious certification that is recognized and respected by employers worldwide, showcasing your commitment to excellence and proficiency in internal auditing. Career Advancement: Open doors to exciting career opportunities and advancement prospects in internal auditing, risk management, compliance, and other related fields, as organizations seek qualified professionals to ensure operational efficiency and compliance. Increased Credibility: Establish yourself as a trusted expert in internal audit, earning the trust and confidence of stakeholders, clients, and employers with your proven skills and expertise. Continuous Learning: Stay updated on the latest trends, best practices, and regulations in internal auditing through ongoing professional development and networking opportunities within the internal audit community. ð©âð¼ Who is this for? Aspiring Internal Auditors: Individuals looking to enter the field of internal audit and build a successful career in financial governance, risk management, and compliance. Experienced Auditors: Seasoned auditors seeking to enhance their skills, expand their knowledge, and earn professional certification to validate their expertise. Finance Professionals: Accountants, financial analysts, and professionals in related fields looking to specialize in internal auditing and advance their careers. ð Career Path: Upon completing the Certified Internal Auditor course and obtaining certification, graduates can pursue various career paths and roles in internal auditing, including: Internal Auditor: Conducting audits of financial, operational, and compliance processes to evaluate organizational effectiveness and ensure regulatory compliance. Risk Manager: Identifying, assessing, and mitigating risks to the organization's assets, operations, and reputation through effective risk management practices. Compliance Officer: Ensuring adherence to laws, regulations, and industry standards by developing and implementing compliance programs, policies, and procedures. Audit Manager: Overseeing audit teams, planning and executing audit engagements, and providing guidance and support to auditors throughout the audit process. ð FAQs (Frequently Asked Questions): Q: Is the Certified Internal Auditor course suitable for beginners? A: Yes, the course is designed to accommodate learners of all levels, from beginners to experienced professionals. The curriculum covers foundational concepts as well as advanced topics to cater to diverse learning needs. Q: How long does it take to complete the course? A: The duration of the course may vary depending on the learning format (e.g., self-paced online course, instructor-led training). Typically, participants can complete the course within a few months, but this may vary based on individual learning pace and schedule. Q: Will I receive a certification upon completing the course? A: Yes, upon successfully completing the Certified Internal Auditor course and meeting all certification requirements, participants will receive a certification that is recognized and respected by employers worldwide. Q: Can I access the course materials after completing the program? A: Yes, participants typically have access to course materials, resources, and updates even after completing the program, allowing for ongoing professional development and reference. Q: Is there a prerequisite for enrolling in the course? A: While there are no specific prerequisites for enrolling in the Certified Internal Auditor course, having a basic understanding of accounting, finance, and business principles may be beneficial for maximizing learning outcomes. Q: How will the course benefit my career prospects? A: The Certified Internal Auditor certification is highly regarded by employers and can significantly enhance your career prospects in internal auditing, risk management, compliance, and related fields. It validates your expertise and demonstrates your commitment to professional excellence. ð Start Your Journey to Success Today! Don't miss out on the opportunity to elevate your career and become a certified internal auditor. Enroll now in the Certified Internal Auditor course and unlock a world of possibilities in internal auditing and beyond. Your path to professional growth and success begins here! ððð Course Curriculum Module 1 Importance of Clear and Impactful Audit Reporting. Importance of Clear and Impactful Audit Reporting. 00:00 Module 2 Components of an Effective Audit Report Components of an Effective Audit Report 00:00 Module 3 Effective Communication of Findings and Recommendations Effective Communication of Findings and Recommendations 00:00 Module 4 Addressing Stakeholder Concerns and Feedback Addressing Stakeholder Concerns and Feedback 00:00 Module 5 Ensuring Follow-Up on Audit Recommendations Ensuring Follow-Up on Audit Recommendations 00:00 Module 6 Ethical Considerations in Reporting Audit Results Ethical Considerations in Reporting Audit Results 00:00

Maximizing Revenue Growth: Mastering Go-To-Market Strategies

By Compete High

ð Unlock Your Business Potential with 'Maximizing Revenue Growth: Mastering Go-To-Market Strategies' Course! ð Ready to propel your business to new heights and maximize your revenue? Look no further! Dive into our comprehensive online course meticulously designed to equip you with the essential strategies for unprecedented success in the market. ð Here's what you'll master in each module: ð¹ Module 01: Create a Unique Competitive Advantage Uncover the secrets to set your business apart from the competition. Learn how to identify and leverage your unique strengths to create an unbeatable competitive edge. ð¹ Module 02: Position Your Product or Service in Action Craft a winning strategy to effectively position your product or service in the market. Gain insights into consumer behavior and learn to tailor your offerings for maximum impact. ð¹ Module 03: Determine Your Target Market Discover the power of pinpoint accuracy! Understand your audience better than ever before and learn how to target and captivate your ideal customers. ð¹ Module 04: Build a Compelling Value Proposition Learn the art of crafting compelling value propositions that resonate with your audience. Master the skills needed to communicate your product or service's unique benefits effectively. ð What's in it for you? â Actionable insights from industry experts â Practical strategies for immediate implementation â Engaging learning materials: videos, quizzes, and real-world case studies â Accessible anytime, anywhere - fit your learning into your schedule ð Elevate your revenue game and outshine your competition! Enroll now and transform your business into a revenue-generating powerhouse. Don't miss this opportunity to revolutionize your approach to market strategies! Join 'Maximizing Revenue Growth: Mastering Go-To-Market Strategies' and take the first step towards exponential success. Enroll today and start your journey to maximizing revenue growth! ððð¡ Course Curriculum Module 01: Create a Unique Competitive Advantage Unique Competitive Advantage Explained 00:00 Unique Competitive Advantage - Company Examples 00:00 How to Determine Your Unique Competitive Advantage 00:00 Step 1 - Evaluate Your Strengths 00:00 Step 2 - Evaluate Your Competitive Landscape 00:00 Step 3 - Identify Your Unique Competitive Advantage 00:00 Step 4 - Test Your Unique Competitive Advantage 00:00 Common Mistakes 00:00 Workshop - Unique Competitive Advantrage In Action 00:00 Module 02: Position Your Product or Service in Action Positioning is about Your Customer's Point of View 00:00 What Investors are Looking For 00:00 Ben and Jerry's Case Study 00:00 Keys to Success 00:00 The Positioning Framework Overview 00:00 Step 1 - Create Meaningful Attributes - Part 1 00:00 Step 1 - Create Meaningful Attributes - Part 2 00:00 Step 1 - Create Meaningful Attributes - Part 3 00:00 Viking Cruises - Case Study 00:00 Step 2 - Custom Attributes 00:00 Step 3- Evaluate Rank Attributes 00:00 Step 4 - Evaluating Positioning Rankings 00:00 2122 - Step 5 - Positioning of Your Attributes 00:00 Step 6 - Your Positioning Statement 00:00 Common Mistakes 00:00 Workshop - Position Your Product or Service in Action 00:00 Module 03: Determine Your Target Market Target Market Essentials 00:00 Why is Your Target Market So Important 00:00 Define Your Target Market 00:00 Step 1 - Define Standard Attributes - Demographics 00:00 Step 1 (con't) - Define Standard Attributes - More Demographics 00:00 Step 1 (con't) - Define Standard Attributes - Psychographics 00:00 Step 2 - Develop Custom Attributes 00:00 Step 3 - Validation 00:00 Step 4 - Adjust Your Strategy 00:00 Workshop - Devleoping Your Target Market 00:00 Module 04: Build a Compelling Value Proposition Characteristics of Unique Value Propositions 00:00 Types of Customer Benefits UVPs Express 00:00 Examples of Unique Value Propositions 00:00 What Investors Are Looking For 00:00 Value Proposition vs Competitive Advantage 00:00 Understand Your Competitor's Unique Value Proposition 00:00 Streaming Services Example 00:00 The Value Proposition Framework 00:00 Step 1 - Brainstorming 00:00 Step 2 - Create a Value Proposition List 00:00 Step 3 - Determine Uniqueness 00:00 Step 4 - Prioritize Top Value Propositions 00:00 Step 5 - Tell a Story 00:00 Common Mistakes 00:00 Workshop - Build Your Unique Value Proposition 00:00

Upgrade Your Excel Skills

By IOMH - Institute of Mental Health

Overview This Upgrade Your Excel Skills course will unlock your full potential and will show you how to excel in a career in Upgrade Your Excel Skills. So upskill now and reach your full potential. Everything you need to get started in Upgrade Your Excel Skills is available in this course. Learning and progressing are the hallmarks of personal development. This Upgrade Your Excel Skills will quickly teach you the must-have skills needed to start in the relevant industry. In This Upgrade Your Excel Skills Course, You Will: Learn strategies to boost your workplace efficiency. Hone your Upgrade Your Excel Skills to help you advance your career. Acquire a comprehensive understanding of various Upgrade Your Excel Skills topics and tips from industry experts. Learn in-demand Upgrade Your Excel Skills that are in high demand among UK employers, which will help you to kickstart your career. This Upgrade Your Excel Skills course covers everything you must know to stand against the tough competition in the Upgrade Your Excel Skills field. The future is truly yours to seize with this Upgrade Your Excel Skills. Enrol today and complete the course to achieve a Upgrade Your Excel Skills certificate that can change your professional career forever. Additional Perks of Buying a Course From Institute of Mental Health Study online - whenever and wherever you want. One-to-one support from a dedicated tutor throughout your course. Certificate immediately upon course completion 100% Money back guarantee Exclusive discounts on your next course purchase from Institute of Mental Health Enrolling in the Upgrade Your Excel Skills course can assist you in getting into your desired career quicker than you ever imagined. So without further ado, start now. Process of Evaluation After studying the Upgrade Your Excel Skills course, your skills and knowledge will be tested with a MCQ exam or assignment. You must get a score of 60% to pass the test and get your certificate. Certificate of Achievement Upon successfully completing the Upgrade Your Excel Skills course, you will get your CPD accredited digital certificate immediately. And you can also claim the hardcopy certificate completely free of charge. All you have to do is pay a shipping charge of just £3.99. Who Is This Course for? This Upgrade Your Excel Skills is suitable for anyone aspiring to start a career in Upgrade Your Excel Skills; even if you are new to this and have no prior knowledge on Upgrade Your Excel Skills, this course is going to be very easy for you to understand. And if you are already working in the Upgrade Your Excel Skills field, this course will be a great source of knowledge for you to improve your existing skills and take them to the next level. Taking this Upgrade Your Excel Skills course is a win-win for you in all aspects. This course has been developed with maximum flexibility and accessibility, making it ideal for people who don't have the time to devote to traditional education. Requirements This Upgrade Your Excel Skills course has no prerequisite. You don't need any educational qualification or experience to enrol in the Upgrade Your Excel Skills course. Do note: you must be at least 16 years old to enrol. Any internet-connected device, such as a computer, tablet, or smartphone, can access this online Upgrade Your Excel Skills course. Moreover, this course allows you to learn at your own pace while developing transferable and marketable skills. Course Curriculum Unit 01: Introduction Welcome 00:02:00 Unit 02: Excel Productivity Tips -Part 1 Camera Tool 00:05:00 Add Line Break in Formula Bar 00:03:00 Advanced Copy-Paste using Office Clipboard 00:03:00 Navigation between Worksheets using Shortcut Keys 00:01:00 Flash Fill 00:02:00 Add Multiple Rows and Columns Quickly 00:02:00 Delete Blank Rows 00:03:00 Multi Level Row and Column Sorting 00:04:00 Add Sparklines 00:03:00 Paste Special - Transpose 00:03:00 Unit 03: Excel Productivity Tips - Part 2 Snap to Grid 00:03:00 Create Custom Auto fill List 00:06:00 Absolute Cell Reference 00:03:00 Import Data from Web page 00:04:00 Move Cell Direction 00:03:00 Delete Data using Mouse 00:02:00 Status Bar Quick Calculations 00:03:00 Link Text Boxes to Cell 00:04:00 Phone Number and ZIP Code Format 00:04:00 Speaking Cell 00:05:00 Unit 04: Excel Productivity Tips - Part 3 Invisible Text 00:03:00 Worksheet Grouping 00:04:00 Advanced Transpose 00:04:00 XLStart Folder 00:03:00 Use Slicers 00:05:00 Convert Text to Numbers 00:03:00 Hiding Workbook Elements 00:02:00 Useful Shortcut Keys 00:03:00 Sort data from Left to Right 00:03:00 Advanced Filter (Complex) 00:11:00 Unit 05: Excel Productivity Tips - Part 4 Email as PDF 00:02:00 Synchronous Scrolling 00:03:00 Quick Analysis of data within Excel 00:02:00 Fill blank cells with Value 00:03:00 Hidden Chart Source Data 00:03:00 Two more Shortcuts 00:03:00 Add Blank Rows 00:03:00 Custom views in Excel 00:06:00 EMBED Feature 00:04:00 Adding Country code in Mobile Numbers 00:04:00 Unit 05: Excel Productivity Tips - Part 5 Plot an Average Line to a Chart 00:04:00 3D Referencing 00:04:00 Extract Unique Values 00:03:00 Excel Array Formula 00:04:00 Forecast Sheet 00:04:00 Add Spin Controls in Excel 00:05:00 Move Data using Mouse 00:01:00 Add new entry in Auto Correct to use across Office Applications 00:05:00 Find Differences between Two Lists 00:02:00 Find formulas Quickly 00:02:00 Unit: 06 Wrap Up Thank You 00:01:00

Corruption and Procurement Fraud Training Programmes

By Global Risk Alliance Ltd

Our In-Person training programmes provide students involved at any stage of operational processes, projects or procuring goods and/or services within their organisations with the knowledge and skillset to identify and mitigate the threat posed by the breadth and multi-layered complexity of procurement fraud and corruption. Course objectives Our courses aims to increase and enhance delegates’ understanding of the various procurement fraud and corruption threats which impact upon them and the organisations, sectors and regions in which they operate and provide them with the tools necessary to risk assess and mitigate those threats.

Overview This comprehensive course on Financial Modeling Using Excel will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Financial Modeling Using Excel comes with accredited certification which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Financial Modeling Using Excel. It is available to all students, of all academic backgrounds. Requirements Our Financial Modeling Using Excel is fully compatible with PC's, Mac's, Laptop,Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 2 sections • 9 lectures • 01:31:00 total length •Welcome to the Course! Get the Overview of What You'll Learn: 00:04:00 •Planning your Financial Model: 00:09:00 •Building a Model Template: 00:12:00 •Projecting the Income Statement: 00:13:00 •Projecting the Balance Sheet: 00:17:00 •Projecting Cash Flows: 00:14:00 •Advanced Financial Modeling: 00:14:00 •BONUS LESSON: Top 5 Excel Features for Financial Modellers: 00:08:00 •Resources - Financial Modeling Using Excel: 00:00:00

Overview This comprehensive course on Excel Pivot Tables will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Excel Pivot Tables comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Excel Pivot Tables. It is available to all students, of all academic backgrounds. Requirements Our Excel Pivot Tables is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 7 sections • 18 lectures • 00:47:00 total length •Excel Pivot Tables: 00:03:00 •Overview about Store Dataset: 00:02:00 •Data Insights: 00:02:00 •Sales Profit Summary: 00:03:00 •Highlight the Data: 00:01:00 •Unprofitable Products: 00:02:00 •Create Crosstabs: 00:02:00 •Select Regions for Unprofitable Products: 00:04:00 •Real Time Analytics and Insights: 00:02:00 •Search Data for States with Slicers: 00:06:00 •Finding Trends: 00:02:00 •Find Data for Specific Date: 00:04:00 •Reporting Made Easy: 00:02:00 •Generate Reports with Pivot Tables: 00:04:00 •Marketing Analytics: 00:02:00 •Target Your Advertisements: 00:05:00 •Become Analyst: 00:01:00 •Assignment - Excel Pivot Tables: 00:00:00

Microsoft Excel 2016

By Course Cloud

Course Overview The comprehensive Microsoft Excel 2016 has been designed by industry experts to provide learners with everything they need to enhance their skills and knowledge in their chosen area of study. Enrol on the Microsoft Excel 2016 today, and learn from the very best the industry has to offer! This best selling Microsoft Excel 2016 has been developed by industry professionals and has already been completed by hundreds of satisfied students. This in-depth Microsoft Excel 2016 is suitable for anyone who wants to build their professional skill set and improve their expert knowledge. The Microsoft Excel 2016 is CPD-accredited, so you can be confident you're completing a quality training course will boost your CV and enhance your career potential. The Microsoft Excel 2016 is made up of several information-packed modules which break down each topic into bite-sized chunks to ensure you understand and retain everything you learn. After successfully completing the Microsoft Excel 2016, you will be awarded a certificate of completion as proof of your new skills. If you are looking to pursue a new career and want to build your professional skills to excel in your chosen field, the certificate of completion from the Microsoft Excel 2016 will help you stand out from the crowd. You can also validate your certification on our website. We know that you are busy and that time is precious, so we have designed the Microsoft Excel 2016 to be completed at your own pace, whether that's part-time or full-time. Get full course access upon registration and access the course materials from anywhere in the world, at any time, from any internet-enabled device. Our experienced tutors are here to support you through the entire learning process and answer any queries you may have via email.

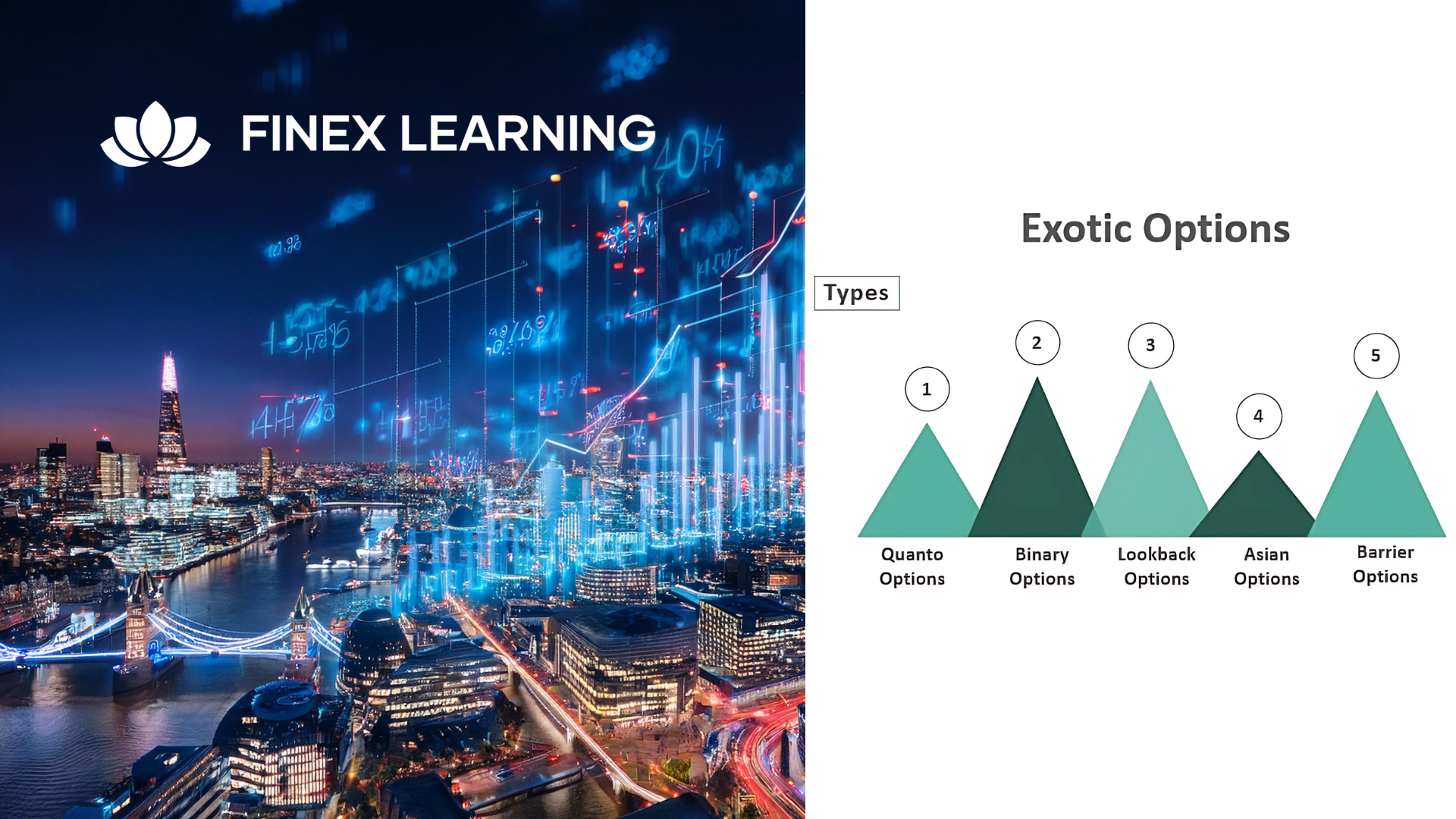

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Accounting and Finance Courses in London

- Accounting and Finance Courses in Birmingham

- Accounting and Finance Courses in Glasgow

- Accounting and Finance Courses in Liverpool

- Accounting and Finance Courses in Bristol

- Accounting and Finance Courses in Manchester

- Accounting and Finance Courses in Sheffield

- Accounting and Finance Courses in Leeds

- Accounting and Finance Courses in Edinburgh

- Accounting and Finance Courses in Leicester

- Accounting and Finance Courses in Coventry

- Accounting and Finance Courses in Bradford

- Accounting and Finance Courses in Cardiff

- Accounting and Finance Courses in Belfast

- Accounting and Finance Courses in Nottingham