- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

56 Courses

INTERNATIONAL TRADE RESEARCH

By Export Unlocked Limited

This module aims to develop knowledge from research activities to gain an understanding of international trade theory, global economic development and growth, currency and exchange rates, trade policies and their impact on an organisation, free trade agreements, direct investment from financial sources outside the UK, tariffs and no trade barriers, supply chain and logistics, intercultural management and international law and treaties.

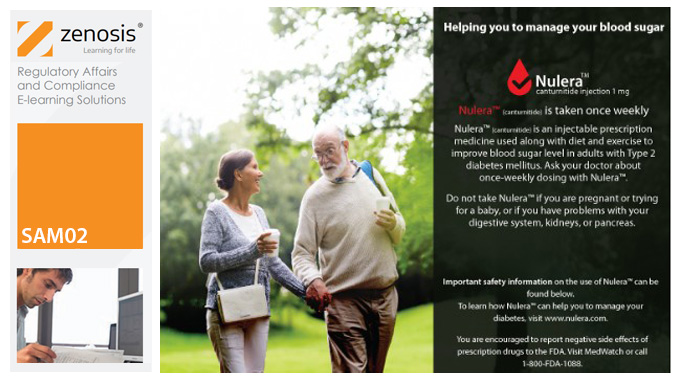

SAM02: Regulatory Requirements and Guidance on Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we explain how to advertise and promote prescription drugs in various media, whether to healthcare professionals or consumers, in compliance with legal requirements and guidance from the FDA.

SAM01: Legal and Regulatory Framework for Advertising and Promotion of Prescription Drugs in the USA

By Zenosis

In this course we set out the legal framework for the regulation of advertising and promotion of prescription drugs in the USA. We identify the regulatory authorities and sources of guidance. We summarize basic requirements that advertisements and promotional labeling must meet, and we identify consequences that may follow failure to comply.

SAM03: Consumer-directed Advertising and Online Promotion of Prescription Drugs in the USA

By Zenosis

Unlike the great majority of other countries, the advertising of prescription drugs directly to consumers is permitted in the USA. Spending by drug companies on direct-to-consumer (DTC) advertising of prescription drugs has increased more than four-fold over two decades, with a dramatic increase in the number of TV ads. In addition, the Internet and social media platforms have increasingly enabled companies to engage more actively with the public.

ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC)

By International Compliance Association

ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC) Course This leadership programme has been designed to sharpen the strategic skills of senior practitioners and those aspiring to hold the highest anti-money laundering/financial crime position within a firm. This expert qualification offers: Specialist knowledge - the highest level in the field Strategic thinking - helps your leadership ambitions Innovation - explores new ideas, best practice, and future developments from a global perspective Fellowship of ICA - become automatically eligible for the highest grade of membership Networking - grow with other like-minded, senior professionals. With a focus on anti-money laundering, managing fraud and anti-bribery, and corruption, this qualification has helped hundreds of senior financial crime compliance professionals from all over the world unlock career growth opportunities. This course is awarded in association with Alliance Manchester Business School, the University of Manchester. How will the course be delivered This course is delivered online with materials delivered for you to study in your own time and at your own pace. There will be eight 3-hour virtual masterclasses over four weekends and seven live virtual classrooms spread over the duration of the course. Upon successful completion of the course, course materials and assessment, you will be awarded the ICA Professional Postgraduate Diploma in Financial Crime Compliance (FCC). This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. Assessment This course will be assessed via: The production of 8 x 1000-1500 word masterclass commentaries: these are summaries of the key learning points outlined in the masterclasses and its impact on your own practice, which forms the reflective journal. A three hour competency-based interview, using information describing your career to date and other evidence you wish to submit to map your knowledge, skills and experience against the National Occupational Standards The syllabus covers a variety of key issues relevant at a senior level and is designed to provide an insight into risks and potential hurdles faced by your organisation. The syllabus is delivered by an exclusive series of high-profile masterclasses covering relevant topics. Standards, research and assessment Financial crime risks: science or art? Ethics, corporate governance & responsibility Managing the internal AML enemy Cyber security: threats to the organisation FinTech and financial crime compliance Fraud and internal threat Risk based approach: too busy or too afraid Sanctions: a changing landscape.

ICA International Diploma in Anti Money Laundering

By International Compliance Association

ICA International Diploma in Anti Money Laundering -Flagship qualification This ICA Diploma in Anti Money Laundering training course is an in-depth, graduate level programme which will provide Participants with a professional qualification in anti-money laundering upon completion and helps individuals develop best practice initiatives and prepares them to face present and future challenges, reducing risk. This qualification is increasingly important for professionals as money laundering prevention remains high on the agenda for financial services professionals. This Diploma will help Participants find an integrated approach to fighting the risk is needed and knowledgeable. There are many benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate Course format 9-month course assessed by 3 written assignments (3,000 - 3,500 words) A mixture of guided online study and participation in live sessions: 2 x virtual classrooms* 1 x immersive learning scenario (putting you at the centre of a story) 3 x tutorials (a chance to discuss elements of the course in more depth) 3 x assessment preparation sessions Videos covering the latest industry developments and case studies Access to the ICA members' portal containing additional reading and resources Proactive support throughout the course to help you stay on track Students of this course will achieve the following outcomes: Increased potential for career progression Extensive knowledge and highly developed AML skills Enhanced workplace performance Professional membership of the ICA Ability to reduce reputational and financial risk for the organisation On successful completion of this ICA Diploma in Anti Money Laundering training course students will be awarded an ICA Diploma in Anti Money Laundering and will be able to use the designation 'Dip.(AML)'. This course is awarded in association with Alliance Manchester Business School, the University of Manchester. The ICA Diploma in Anti Money Laundering training course instructs students in the following areas: Anti money laundering (AML) and countering the financing of terrorism CFT in context Terrorist financing proliferation financing and sanctions Designing a comprehensive AML/CTF risk-based approach for a financial services business Risk-based customer due diligence (CDD), customer risk profiling and monitoring Governance and leadership Suspicious activity reports/ suspicious transaction reports and dealing with the authorities

ICA International Advanced Certificate in Anti Money Laundering

By International Compliance Association

ICA International Advanced Certificate in Anti Money Laundering This ICA International Advanced Certificate in Anti Money Laundering training course is an intermediate level programme designed to develop Participants existing skills and knowledge base in anti-money laundering. You can study at home through online learning and also attend two highly interactive workshops if these are offered in your jurisdiction. All material for this training course is now delivered online, making it more accessible and environmentally sound. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate The expected outcomes of this ICA International Advanced Certificate in Anti Money Laundering training course are as follows: Reduced exposure to reputational and financial risk for your organisation Enhanced workplace performance Full preparation to advance to the diploma programmes Increased potential for career progression Students successfully completing this training course will receive the ICA International Advanced Certificate in Anti Money Laundering and will also be able to use the designation 'Adv. Cert. (AML)'. This qualification is awarded in association with Alliance Manchester Business School, the University of Manchester. During this ICA International Advanced Certificate in Anti Money Laundering training course, students will cover the following subjects: What are the Money Laundering, Terrorist Financing and Sanctions Risks that must be Managed? The International Bodies and Standard Setters National Legal and Regulatory Frameworks Taking an AML/CFT Risk-based Approach and Managing the Risks Initial and 'Ongoing' Customer Due Diligence (CDD) Monitoring Activity and Transactions Recognising and Reporting Suspicions The Vulnerabilities of Specific Services and Products How will you be assessed? Assessed by a one-hour, question-based exam and one research-based assignment

Certificate in Anti Money Laundering

By EduXpress

Embark on a journey into the intricate world of financial safeguarding with the 'Certificate in Anti Money Laundering'. This course unveils the veiled intricacies of illicit financial activities, offering a comprehensive exploration of the tools and techniques used to combat money laundering. Delve into the depths of the Proceeds of Crime Act 2002, understanding its pivotal role in shaping current practices. The curriculum further navigates through the evolution of anti-money laundering regulations, emphasising the critical responsibilities of Money Laundering Reporting Officers. Engaging modules like Sanctions and Embargoes, Risk-based Approach, and Customer Due Diligence, equip learners with the acumen to identify and report suspicious activities effectively. Moreover, the course addresses modern challenges like Cybercrime in AML, integrating anti-bribery measures, and the importance of continual awareness and anti money laundering training in this ever-evolving field. Learning Outcomes: Acquire a solid understanding of the foundational aspects and legal framework of anti-money laundering. Develop the ability to implement and manage effective KYC and customer due diligence processes. Gain proficiency in identifying and reporting suspicious conduct and transactions. Understand the role and responsibilities of a Money Laundering Reporting Officer in various organisational contexts. Enhance awareness of the interconnectedness of cybercrime with anti-money laundering strategies and the importance of ongoing training. Why Choose Us? Lifetime access to course materials Full tutor support is available Monday through Friday for all courses Learn essentials skills at your own pace from the comfort of your home Gain a thorough understanding of the course Access informative video modules taught by expert instructors 24/7 assistance and advice available through email and live chat Study the course on your computer, tablet, or mobile device Improve your chances of gaining professional skills and earning potential by completing the course. Who is this course for? Individuals aspiring to specialise in financial compliance and anti-money laundering. Banking and financial services professionals seeking to enhance their regulatory knowledge. Law enforcement officials and legal practitioners requiring in-depth understanding of money laundering mechanisms. Compliance officers and regulatory consultants aiming to update their expertise in AML strategies. Recent graduates and career changers interested in pursuing roles in anti money laundering jobs particularly within financial regulation and compliance. Assessment The course includes a series of quizzes that will test your understanding and retention of the material covered in the course. The quizzes will help you to identify areas where you may need further practice, and you will have the opportunity to review the course materials as needed. Upon successfully passing the final quiz, you will be able to order your certificate of achievement. Career Path Anti-Money Laundering Analyst: £35,000 - £50,000 per annum Compliance Officer: £28,000 - £45,000 per annum Financial Crime Investigator: £30,000 - £55,000 per annum Regulatory Affairs Manager: £40,000 - £70,000 per annum Forensic Accountant: £45,000 - £65,000 per annum AML Consultant: £50,000 - £80,000 per annum Course Content Certificate in Anti Money Laundering Introduction to Money Laundering Proceeds of Crime Act 2002 Development of Anti-Money Laundering Regulation Responsibility of the Money Laundering Reporting Officer Sanctions and Embargoes Risk-based Approach Know Your Customer (KYC) Customer Due Diligence Record Keeping Suspicious Conduct and Transactions Assessment Order Your Certificate Order Your Certificate

MENTAL HEALTH – UNDERSTANDING AND MEETING NEEDS

By Inclusive Solutions

In this course we explore Mental Health and address how such needs can be met in mainstream classrooms. Course Category Behaviour and Relationships Meeting Emotional Needs Description This is our lead workshop/training day on understanding mental health, behaviour and relationship work in schools other settings and is both a values primer and a practical guide to successful innovative strategies for improving behaviour and strengthening relationships for challenging children and young people of all ages. Not just another day on ‘Behaviour Management’ – Our Mental Health Day goes well beyond a rewards and sanctions approach to ‘behaviour’. We will be focused on those young people for whom rewards and punishments do not always work and who confuse the adults who work with them. We aim to take a relationships-based approach and to give those attending an opportunity to think more deeply about why young people do the things they do and what our part as adults is in creating, sustaining and changing these behaviours. The day gives those present opportunities to reflect on their attitudes and practice in relation to children’s behaviour and relationship building. If your usual approaches to managing tackling mental health needs aren’t working with particular individuals then take a tour through this range of cutting edge strategies for bringing about positive behaviour change, and for meeting challenging emotional needs Learning Objectives reinforce and affirm good practice re-energise, stimulate and challenge thinking about inclusion of challenging pupils and children increased understanding of mental health increased confidence in managing challenging pupils in mainstream schools access to a wider range of practical strategies to impact on behaviour problems opportunity to reflect on professional attitudes and behaviour towards mental health in families and pupils Who Is It For ? Anyone concerned with understanding and meeting emotional and mental health needs Course Content Circle of Courage – belonging-achievement-generosity – independence – model for understanding mental health Compass of Anxiety – understanding and going deeper Active listening – Listening to the person underneath the behaviour Involving other children and young people in solutions and interventions - Circles of friends: peer support, counselling and mediation Team Problem Solving – Solution Circles: a 30 minute group problem solving process to get Teams ‘unstuck’ and to generate positive first action steps Restorative justice and restitution: principles and practice of this approach to repairing harm and restoring relationships without reliance on punishment Understanding the effects of Separation, Loss, Trauma and Neglect on children’s learning and relationships in school and what adults can do to reach and support these children

Organisation Programme - Bribery and corruption risk assessment

By Global Risk Alliance Ltd

Our training programme will provide those involved at any stage of the process for procuring goods and/or services within their organisations with the knowledge and skillset to identify and mitigate the threat posed by the breadth and multi-layered complexity of procurement fraud, corruption and associated financial crime and money laundering.

Search By Location

- Sanctions Courses in London

- Sanctions Courses in Birmingham

- Sanctions Courses in Glasgow

- Sanctions Courses in Liverpool

- Sanctions Courses in Bristol

- Sanctions Courses in Manchester

- Sanctions Courses in Sheffield

- Sanctions Courses in Leeds

- Sanctions Courses in Edinburgh

- Sanctions Courses in Leicester

- Sanctions Courses in Coventry

- Sanctions Courses in Bradford

- Sanctions Courses in Cardiff

- Sanctions Courses in Belfast

- Sanctions Courses in Nottingham