- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

26148 Courses

ONE SPACE LEFT! 15th September Lil Chase #Agent121. Looking for: PICTURE BOOKS, CHAPTER BOOKS, MG, YA

5.0(3)By I Am In Print

LOOKING FOR: PICTURE BOOKS, CHAPTER BOOKS, MG, YA Lil is a Senior Editor at Hachette Children's. She has well over 15 years experience in the publishing industry, working for major publishers and literary agents too. For twelve years, Lil was a Senior Commissioning Editor at Working Partners Ltd – the creatives behind massive commercial hits such as Beast Quest, Warriors and the Daisy Meadows series. There she created globally successful concepts for every age group and developed storylines so the books were unputdownable. Lil is also an author in her own right: she has written 6 books under her own name, and ghost written many others under various pseudonyms. In every age level, Lil would like to see originality - particularly in voice. A strong character with depth, venturing on a quest that's never been undertaken before will get her excited. The 'quest' doesn't have to be epic in scale, it could be as small as petting the next-door neighbour's dog, or getting the good looking new kid to notice you, it just has to be something a reader will want to invest in. She also loves humour and is happy to see anything quirky (perhaps even downright silly!). For picture books, Lil would like you to submit a covering letter, and 1 complete manuscript, double-spaced, with spreads marked out, in a single word or PDF doc. For chapter books, MG and YA, please send a covering letter, the first three chapters and a synopsis, double spaced, in a single Word or PDF doc. Please send EITHER picture books OR another genre, not both in one submission. By booking this session you agree to email your material to reach I Am In Print by the stated submission deadline to agent121@iaminprint.co.uk. Please note that I Am In Print take no responsibility for the advice given in your Agent121. The submission deadline is: Monday 8th September 2025

TWO SPACES LEFT! 24th September Diana Beaumont #Agent121. Looking for: ADULT FICTION, NON-FICTION

5.0(3)By I Am In Print

LOOKING FOR: ADULT FICTION, NON-FICTION Diana joined the prestigious DHH Literary Agency in June 2024. She started agenting with Rupert Heath Literary Agency in 2011 before moving to UTA and Marjacq in 2017. Before that she was senior commissioning editor at Transworld. Diana was chosen as one of The Bookseller’s Rising Stars of 2012, was a nominee for RNA Agent of the Year 2019, and was shortlisted for Literary Agent of the Year 2022 at the British Book Awards. Her list includes a wide range of bestselling and prize-winning authors in the UK and internationally. Diana represents adult fiction and non-fiction. For fiction, she is looking for upmarket women's commercial, with depth and heart, including reading group, historical, saga, uplit and contemporary stories that are irreverent and make her laugh; accessible literary fiction, high-concept crime fiction and thrillers. She has a thing for spy novels and would love to find a great vampire story. On the non-fiction side: memoir, smart, funny feminists, lifestyle, cookery and social justice, and open to anything with a strong, original voice. She also encourages submissions from writers who have been traditionally under-represented. Diana would like you to submit a covering letter, 1 - 2 page synopsis and the first three chapters (a maximum of 5,000 words) of your manuscript in a single word document. (In addition to the paid sessions, Diana is kindly offering one free session for low income/underrepresented writers. Please email agent121@iaminprint.co.uk to apply, outlining your case for this option which is offered at the discretion of I Am In Print). By booking you understand you need to conduct an internet connection test with I Am In Print prior to the event. You also agree to email your material in one document to reach I Am In Print by the stated submission deadline and note that I Am In Print take no responsibility for the advice received during your agent meeting. The submission deadline is: Wednesday 17th September 2025

The Mental Freedom- Break Free from Pain is a wonderful learning opportunity for anyone who has a passion for this topic and is interested in enjoying a long career in the relevant industry. It's also for anyone who is already working in this field and looking to brush up their knowledge and boost their career with a recognised certification. This Mental Freedom- Break Free from Pain consists of several modules that take around 4 hours to complete. The course is accompanied by instructional videos, helpful illustrations, how-to instructions and advice. The course is offered online at a very affordable price. That gives you the ability to study at your own pace in the comfort of your home. You can access the modules from anywhere and from any device. Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification Upon successful completion of the course, you will be able to obtain your course completion PDF Certificate at £9.99. Print copy by post is also available at an additional cost of £15.99 and the same for PDF and printed transcripts. Course Content Introduction PROMO VIDEO 00:05:00 Introduction - Course Goals & Beginning Concepts 00:10:00 WHY You Are in Pain 00:16:00 How to Break Free From Pain 00:08:00 Main Concepts Beating Your FALSE Self-Image 00:25:00 Past & Future -Distractions 00:22:00 The Problem Of Attachments 00:29:00 Losing Your MIND To Gain Your SANITY 00:22:00 The Power Of The Unconscious Mind 00:21:00 Change Your Mind ... Change Your Life Re-writing Your Story 00:16:00 Great Ways To Feel Great - Part 1 00:26:00 Great Ways To Feel Great - Part 2 00:13:00 Additional Strategies 00:19:00 Final Thoughts Gaining Control & Final Thoughts 00:20:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

THIS COURSE PACKAGE INCLUDES: 1: INTRODUCTION TO ECG COURSE - RECORDING & BASIC INTERPRETATION (GPT009) 2: ADVANCED ECG COURSE - INTERPRETATION & ANALYSIS (GPT010) Learn how to set up and record a basic ECG trace, followed by advanced analysis and interpretation FAST-TRACK YOUR ECG TRAINING WITH OUR BEGINNER TO ADVANCED TRAINING PACKAGE 20% off - Multi-Course Discount Cover all stages from Level 1 through to Level 4 (FDSc) Cover your theory training online Practical training in Classroom or Virtual Classroom Comprehensive Practise@Home training kits for VC Awards 2 accredited qualifications Dual Accreditations are awarded for all courses (Open College Network and CPD) Covers all steps required to competently set up and perform an ECG trace. Practical sessions include electrode placement on mannequin, running traces and identifying anomalies. Learn beginner to advanced skills and interpretation. Basic understanding of English language required. OPEN TO ALL APPLICANTS About these courses 1: INTRODUCTION TO ECG COURSE - RECORDING AND BASIC INTERPRETATION (GPT009) PART 1 - Theory Allow approx. 5-6 hours PART 2 - Practical Training Attend a classroom location or join us in our virtual classroom * - 3-4 hours ACCREDITED LEVEL 3 QUALIFICATION * Virtual Classroom option includes a free comprehensive Practise@Home ECG training kit. 2: ADVANCED ECG COURSE - INTERPRETATION AND ANALYSIS (GPT010) E-LEARNING - Theory Allow approx. 6-8 hours ACCREDITED LEVEL 4 QUALIFICATION OPTIONAL: GETTING STARTED IN ECG (GPT002) A free starter ECG Course (unassessed) developed to help you understand the basics of ECG recording: 3 modules in total with no Questions! If you are already familiar with ECGs then you may prefer to save time and opt out of this mini-course at booking stage. This "mini-course" is available at no charge. Learning Outcomes GPT009: Understanding different ECG equipment types ECG equipment - set-up and calibration Includes professionalism, consent, IPC and legal requirement Patient preparation How to correctly apply electrodes to limbs and chest Identify artifacts (equipment and patients Identify and recognise routine traces Identify and recognise non-routine traces Identify traces requiring urgent attention Labelling and reporting GPT010: Understand the acceptable variations within the normal ECG of healthy adults. Recognise the expected patterns of an ECG from a healthy child from birth onwards and identify abnormalities. Interpret abnormal ECG patterns in adults. Diagnose arrhythmias as an underlying cause of palpitations and syncope. Exploring sinus rhythm, extrasystoles, paroxysmal tachycardia and the importance of a physical examination. Identifying syncopal episodes attributable to cardiovascular disease as opposed to arrhythmias. Recognise ECG markers for tachycardias, bradycardias, pre-excitation syndromes, bi-fascicular block, and first-degree block with bundle branch block. Differentiate between supraventricular and ventricular extrasystoles and be able to diagnose broad complex tachycardias, ventricular flutter and fibrillation, sick sinus syndrome, and Stokes-Adams attacks. Recognise and identify symptoms associated with the causes of acute or chronic chest pain in patients who present with myocardial infarction (heart attack), pulmonary embolism, significant central pulmonary embolism, pericarditis, aortic dissection, oesophageal rupture, spinal disorders, vertebral collapse, posterior infarction, and angina. Recognise symptoms indicative of conditions such as pulmonary oedema, chest diseases, and pulmonary congestion. After the course GPT009: Safely and competently set up an ECG machine Introduce patients to the ECG test, adhering to compliancy requirements before and after testing Perform an ECG test to national guidelines Understand basic traces and their correlation to cardiac issues Recognise normal and erroneous recordings Recognise recordings that require urgent medical follow-up Complete the recording and label (or record digital copies) as per guidelines GPT010: Appreciate normal and abnormal ECG variations in the context of varying pathologies. Be able to determine whether an arrhythmia has an underlying cause that requires medical intervention. Interpret ECGs as a function of the patient's ongoing cardiac management. Understand and apply the Burce Protocol exercise test in relevant clinical situations. Know how to clinically respond to a patient with chest pain including further investigations required, pain relief, history and examination and echocardiogram. Understand and apply the fundamental principles of arrhythmia management. Understand the primary causes of heart disease and the diagnostic process. Appreciate the importance of the ECG as a diagnostic tool alongside the patient’s history and clinical presentation and recognising its limitations. Course Package Components: PACKAGE - Beginner to Advanced ECG - Virtual Classroom - INTRO - Part 1 online Part 2 Virtual Classroom (AM) + ADVANCED - E-learning

Expense-Free Tactics Training

By Compete High

ð Unleash Financial Freedom with Expense-Free Tactics Training! ð Are you tired of feeling constrained by financial burdens? Ready to take control of your expenses and pave the way towards a life of financial freedom? Introducing the ultimate solution: Expense-Free Tactics Training! ð Transform Your Financial Reality ð Our comprehensive online course is designed to equip you with powerful strategies and actionable tactics that will revolutionize the way you manage your expenses. Say goodbye to financial stress and hello to a future filled with abundance and prosperity! ð¡ What You'll Learn: Budget Mastery: Discover expert techniques to create and stick to a budget that works for your lifestyle, allowing you to save more and spend wisely. Smart Spending Habits: Learn the art of discerning between needs and wants, and unlock the secrets to making mindful purchasing decisions effortlessly. Debt Demolition: Gain valuable insights on tackling debt effectively, whether it's student loans, credit card debt, or other financial obligations. Generating Additional Income Streams: Explore various avenues for supplementing your income without investing significant capital, enabling you to grow your wealth. Long-Term Financial Planning: Build a solid financial future by understanding investments, retirement planning, and securing your financial legacy. ð Why Choose Expense-Free Tactics Training? Expert Guidance: Led by seasoned financial experts with a proven track record in helping individuals achieve financial success. Flexible Learning: Access our course content at your own pace, anytime and anywhere, fitting seamlessly into your busy schedule. Practical Strategies: Practical, real-world tactics that you can implement immediately for tangible results. Supportive Community: Join a community of like-minded individuals, share experiences, and gain motivation and support along your financial journey. ð Special Limited-Time Offer ð Enroll now and take the first step toward a financially liberated future! As a limited-time offer, we're providing an exclusive discount for early birds! Don't let expenses hold you back from the life you desire. Seize this opportunity to transform your financial landscape with Expense-Free Tactics Training! Course Curriculum

Accredited PRINCE2® Foundation and Practitioner 6th Edition (exams included – with free resit)

By Hudson

PRINCE2® (an acronym for PRojects INaControlled Environment series 2) is a de facto process-based method for effective project management. Used extensively by the UK Government, PRINCE2® is also widely recognised and used in the private sector, both in the UK and internationally. The PRINCE2® method is in the public domain, and offers non-proprietorial best practice guidance on project management.

A Saturday for the wonder of SoulCollage® and your imagination in Hartley Wintney

5.0(2)By The Soul Shed

When we come together to make SoulCollage® in community, amazing things happen. There is a magic in this creative journey that only requires you coming along with your curiosity and imagination. No artistic genius recquired whatsoever. Just your presence! Images have things to say to us. They can call us through our hearts, our instinctual knowing, and our open intuitive minds. Images offer us portals and openings into a deep wisdom stream. All you need to do is be open to the images that are asking for your attention. Then you make a collage, then you listen to what it wants you to know. It is simple, and profound. This is an in place event in a creative studio in the delightful village of Hartley Wintney. You might like to linger after we close and take a look at the local crafts and antique shops, or take a stroll around the village green just outside of where we will be for the day. It is really quite unique. Getting there: Esiliy accessible by the M4 and M3. There is free weekend parking close to the venue. The nearest train station is Winchfield. Here are some things people have said about a SoulCollage® session at The Soul Shed: "Loved this workshop, from start to finish it made my heart sing. It was a feast for the soul with words and images that were crafted into something rich and deep for me" -J.E "What stood out for me was how it just happened ....one thing alchemised into another thing” - L.B "I'd describe it as a good way to reconnect with your creative side, relax and maybe gain insight into what is happening inside you" - D.F.

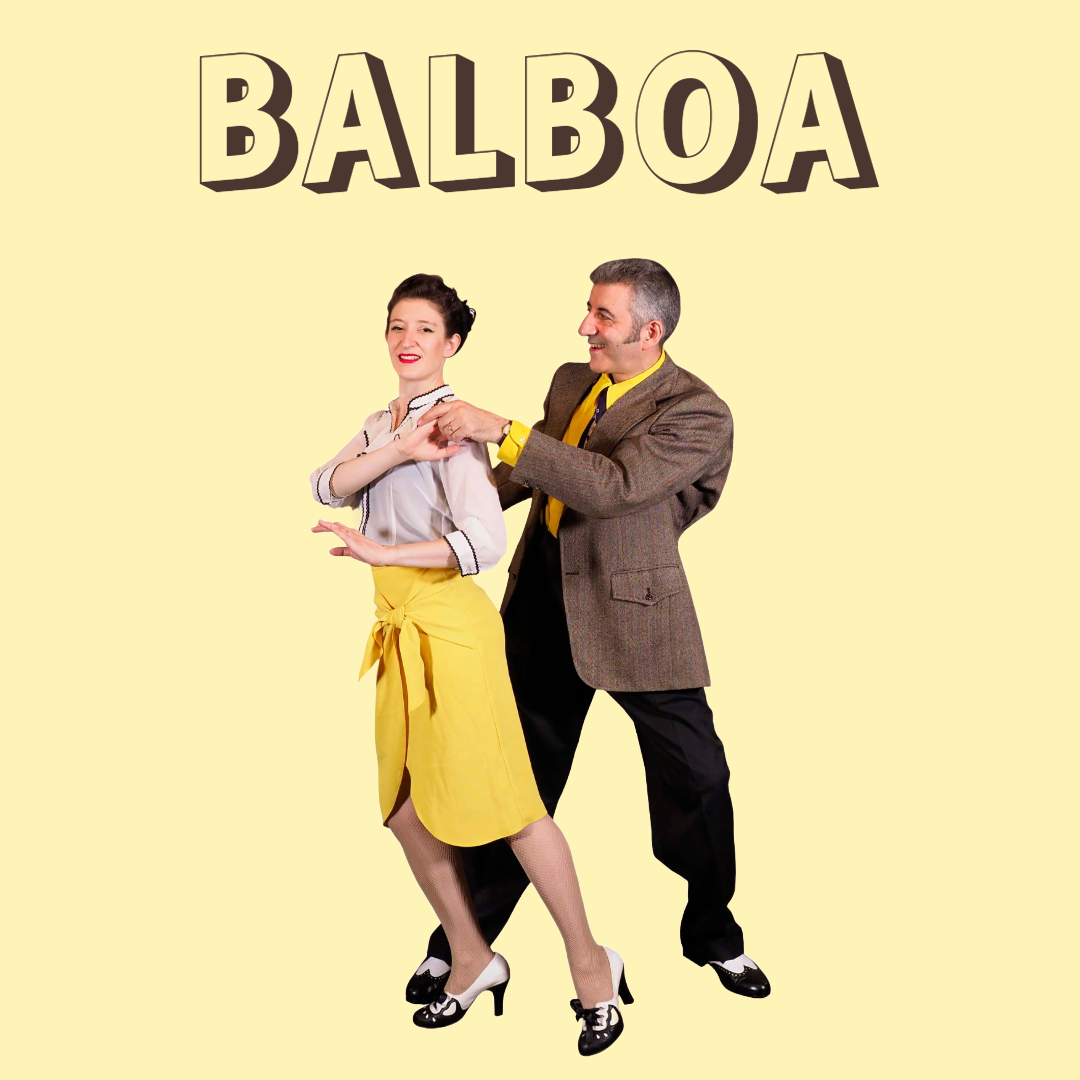

Improver Balboa Workshop with Simon Selmon Join Simon and increase your vocabulary, frame and connection skills. Class will include getting comfortable with the basics, small variations to spice up your footwork, underarm turns, free spins, paddles etc. Suitable for those who have danced Balboa before and want to move up to the next level.

October In-Person 2025 Fundamentals of Organisation & Relationship Systems Coaching Training

By CRR UK

CRRUK equips professionals with the concepts, skills and tools to build conscious, intentional relationships, and to coach relationship systems of any size.

Search By Location

- free Courses in London

- free Courses in Birmingham

- free Courses in Glasgow

- free Courses in Liverpool

- free Courses in Bristol

- free Courses in Manchester

- free Courses in Sheffield

- free Courses in Leeds

- free Courses in Edinburgh

- free Courses in Leicester

- free Courses in Coventry

- free Courses in Bradford

- free Courses in Cardiff

- free Courses in Belfast

- free Courses in Nottingham