- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

22064 Courses

Overview 2 day applied course with comprehensive case studies covering both Standardized Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

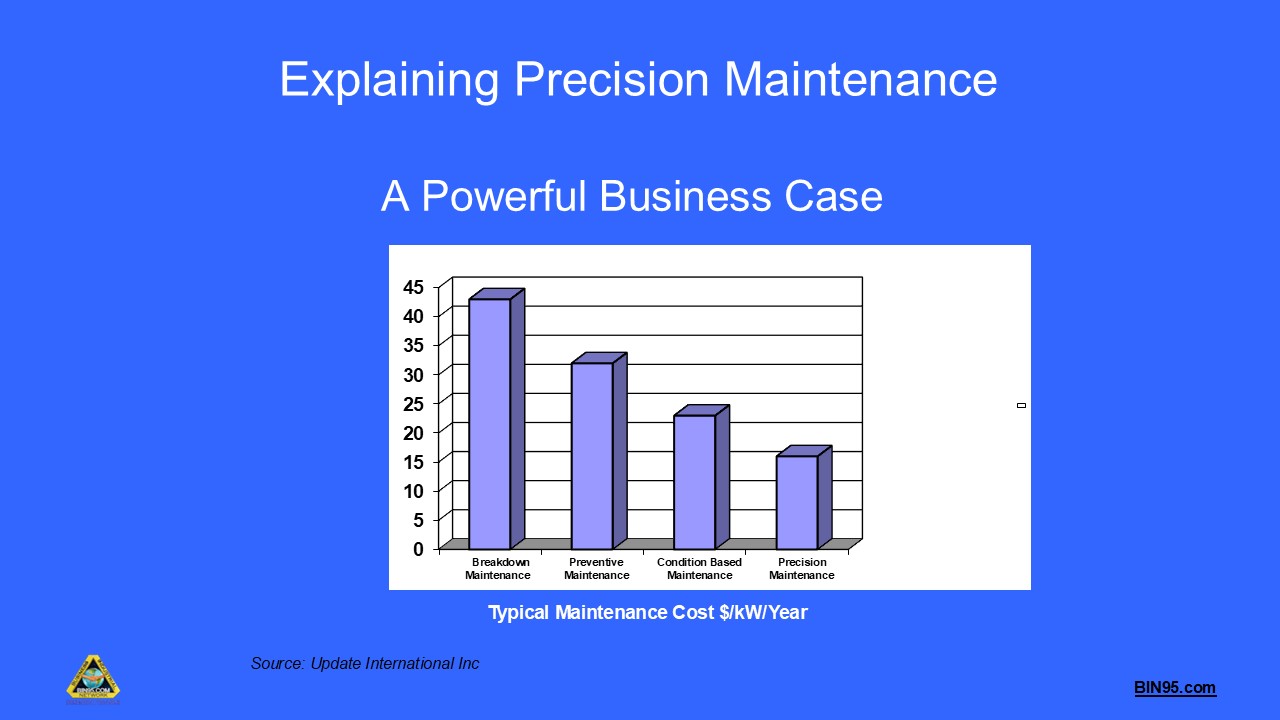

This free course, provided by the BIN95 Manufacturing Training Division, provides a comprehensive understanding of precision maintenance as a critical component of world-class rotating machinery reliability. Participants will learn the business case for precision maintenance, the standards and best practices required, and the practical steps to implement precision maintenance in industrial environments. The course covers key topics, including vibration analysis, alignment, balancing, lubrication, fit and tolerance, torque standards, and the development of a precision maintenance culture. Through real-world examples, standards references (ISO, ANSI), and practical procedures, learners will gain the skills to reduce maintenance costs, increase equipment reliability, and drive continuous improvement in plant operations. Ideal for maintenance professionals, engineers, and reliability managers seeking to elevate their maintenance practices to world-class standards.

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

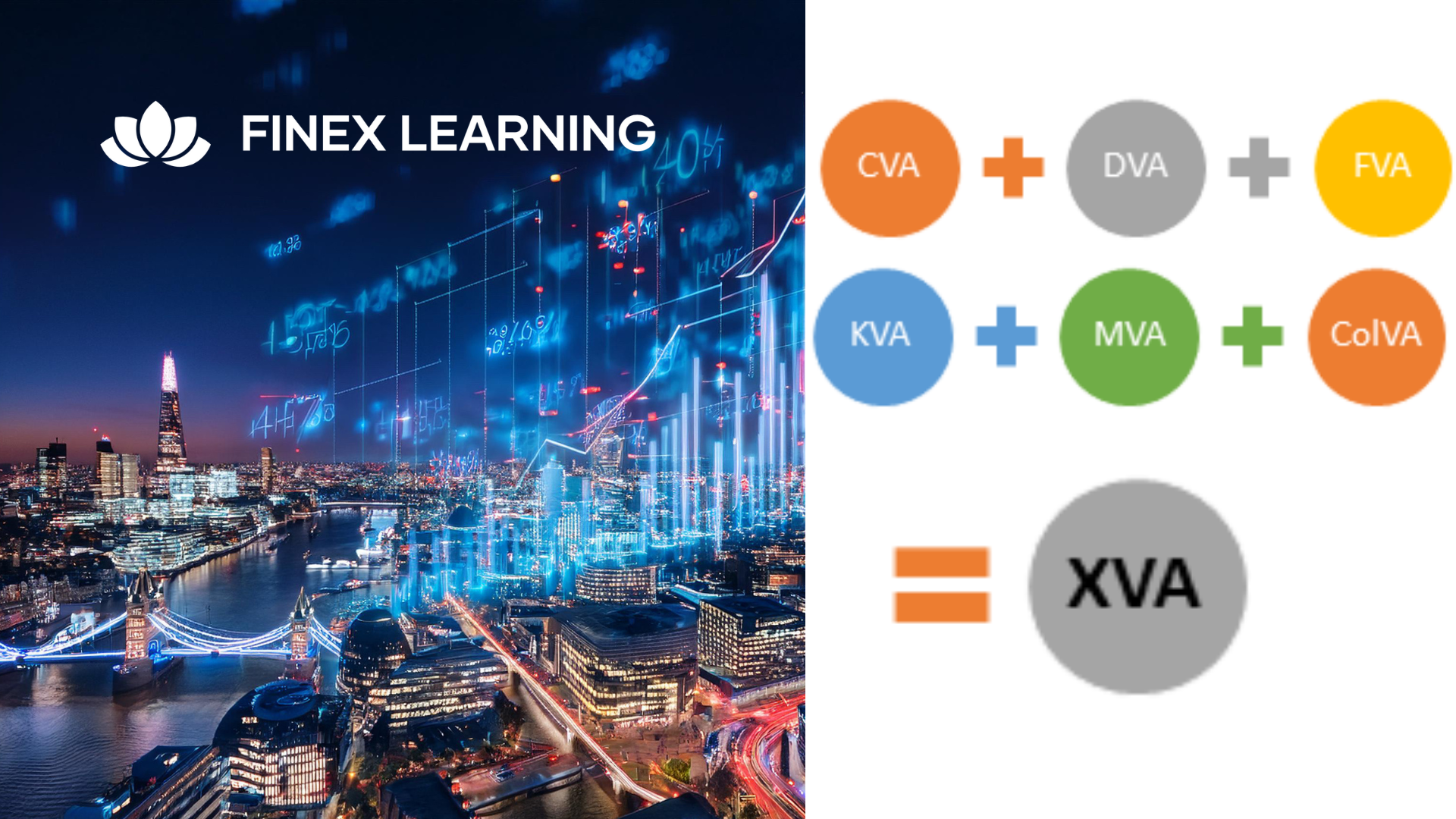

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day applied course on XVA for anyone interested in going beyond merely a conceptual understanding of XVA and wants practical examples of Monte Carlo simulation of market risk factors to create exposure distributions and profiles for derivatives used for XVA pricing Learn how to do Monte Carlo simulation of key market risk factors across major asset classes to create exposure distributions and profiles (with and without collateral) for derivatives used for XVA pricing. Learn how to calculate each XVA. Learn sensitivities of each XVA and how XVA desks manage these. Learn regulatory capital treatment of counterparty credit risk (both for CCR and CVA volatility) and how to stress test this within ICAAP or system-wide external, supervisor-led capital stress test. Who the course is for Anyone involved in OTC derivatives XVA traders XVA quants Derivatives traders and salespeople Risk management Treasury staff Internal audit and finance Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales Product control Research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Finance for Non-Finance Managers (2 Day)

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Those who need to understand the financial implications of their day-to-day decisions to increase the profitability and performance of their business. This course is suitable for managers with little or no financial knowledge. Overview Understanding of financial accounts and reports The ability to use and understanding of financial concepts Analytical skills to interpret financial results using ratios Ability to manage budgets more effectively This course shows how to interpret key financial statements highlighting the questions and areas that matter. It identifies warning signals that managers need to be aware of and shows how to understand key performance indicators to drive profitability. The course will also cover the essentials of budgeting and forecasting as well as addressing key financial terms such as goodwill and accruals & prepayments. Delegates will learn how to appraise capital projects with confidence, allowing them to make the best decisions for their business. Course Outline The basics of finance: How companies are financially structured Accrual v cash accounting The Business Cycle: understand how money flows in a business How businesses are financed: debt and equity Business objectives: using financial data to achieve business targets Key Financial Statements: Income Statement Balance Sheet Cash Flow Statement Key Financial Analysis Ratios Profitability: profit margins, EBIT & EBITDA, operational gearing Return on Investment: ROCE, ROA Leverage: financial gearing & interest cover Liquidity: current & quick ratios Cash Flow: working capital requirement Working capital management Cash flow management Key financial terms ? goodwill, accruals & prepayments, depreciation and amortization Cost analysis, control and reduction Capex v Opex Effective Budgeting and Forecasting to control the business Management Accounts and undertaking variance analysis Improving margins and sales in your business Break even analysis Capital Investment techniques ? NPV, IRR and discounted cash flows Asset Valuation Additional course details: Nexus Humans Finance for Non-Finance Managers (2 Day) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Finance for Non-Finance Managers (2 Day) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Forklift Truck Training The aim of the NPORS Forklift Truck Training is to provide both theoretical and practical training to ensure the safe usage of the FLT Counter Balance Forklifts. As a result of the forklift truck training you will receive the red trained operator card or the Traditional Card. Call to book your forklift course today Experienced operator – NPORS Forklift Truck Test Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Forklift Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Forklift Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Forklift Truck Test is for operators who have received some form of forklift training in the past or alternatively has been operating Forklift trucks for a period of time. If you are unsure if you qualify to go down the forklift truck test route please contact us to discuss this in more detail. There are two parts to the forklift truck course, a theory section comprised of 25 questions and a practical session. Forklift Truck Training Course: Navigating Safety and Efficiency Forklift trucks, also known as lift trucks or forklifts, are indispensable tools in various industries, facilitating the movement and handling of materials with precision and ease. However, operating a forklift requires specialised skills and knowledge to ensure safety, efficiency, and compliance with regulations. In this comprehensive course outline, we will delve into the essential content covered in a forklift truck training course, designed to equip participants with the expertise needed to operate forklifts safely and effectively in the work place. 1. Introduction to Forklift Trucks: Overview of forklift types: counterbalance, reach, pallet trucks, etc. Understanding the components and controls of a forklift Different configurations and attachments for specific tasks All health and safety regulations covered 2. Forklift Safety Procedures: Importance of safety in forklift operation Pre-operational checks and inspections Understanding load capacity and load centre Personal protective equipment (PPE) requirements Emergency procedures: evacuation, fire, and accident response 3. Forklift Operation Basics: Starting, stopping, and manoeuvring the forklift safely around obstacles Steering techniques: forward, reverse, and turning Operating on various surfaces: smooth floors, ramps, and inclines Lifting, lowering, side shifting and tilting loads using hydraulic controls 4. Load Handling Techniques: Proper load assessment: weight, size, and stability Positioning the forklift for efficient loading and unloading Securing loads with proper attachments: forks, clamps, and attachments Stacking and de-stacking loads safely and efficiently 5. Site Safety and Hazard Awareness: Identifying potential hazards in the workplace Working safely around pedestrians, other forklifts, and obstacles Recognising environmental hazards: narrow aisles, confined spaces, and overhead obstructions Understanding site-specific safety rules and regulations 6. Maintenance and Inspections: Importance of regular maintenance for forklift performance and longevity Daily, pre-shift, and post-shift inspection procedures Lubrication points and maintenance schedules Identifying and reporting mechanical issues and defects 7. Practical Hands-On Training: Practical exercises in forklift operation under supervision Manoeuvring through obstacle courses and tight spaces Load handling exercises: stacking, de-stacking, and transporting loads Emergency response drills: simulated scenarios to test response and decision-making skills 8. Assessment and Certification: Written examination to assess theoretical knowledge Practical assessment of forklift operation skills Certification upon successful completion of the course Conclusion: A forklift truck training course equips participants with the essential knowledge, skills, and confidence to operate forklifts safely and efficiently in various work environments. By covering topics such as safety procedures, operation techniques, load handling, site awareness, maintenance practices, and practical hands-on training, participants can enhance their proficiency and contribute to a safer and more productive workplace. Whether you’re a novice operator or an experienced professional, investing in forklift training is essential for ensuring compliance, reducing risks, and promoting excellence in material handling operations. Frequently Asked Questions 1. What types of forklifts are covered in the training? The training covers various forklift types, including counterbalance, reach trucks, and pallet trucks. 2. What are the course components? The course includes theoretical training, practical sessions, safety procedures, load handling techniques, site safety, maintenance, and inspections. 3. Who is the training suitable for? The training is suitable for both novice operators and experienced operators who need certification or recertification. 4. What certification will I receive? Participants will receive an NPORS card, either a red trained operator card or a traditional card, valid for 2-5 years depending on the type. 5. What are the prerequisites for the course? There are no prerequisites for novice operators, but experienced operators should have prior forklift operation experience. Forklift Truck Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of Forklifts and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment. However, this training can only be conducted on your sites Our forklift training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS forklift Tester to your site nationwide, to reduce the amount of time away from work Our more courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today. For those looking for a “NPORS Forklift Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

Search By Location

- exam Courses in London

- exam Courses in Birmingham

- exam Courses in Glasgow

- exam Courses in Liverpool

- exam Courses in Bristol

- exam Courses in Manchester

- exam Courses in Sheffield

- exam Courses in Leeds

- exam Courses in Edinburgh

- exam Courses in Leicester

- exam Courses in Coventry

- exam Courses in Bradford

- exam Courses in Cardiff

- exam Courses in Belfast

- exam Courses in Nottingham