- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

2021 Courses

Tableau Desktop Training - Analyst

By Tableau Training Uk

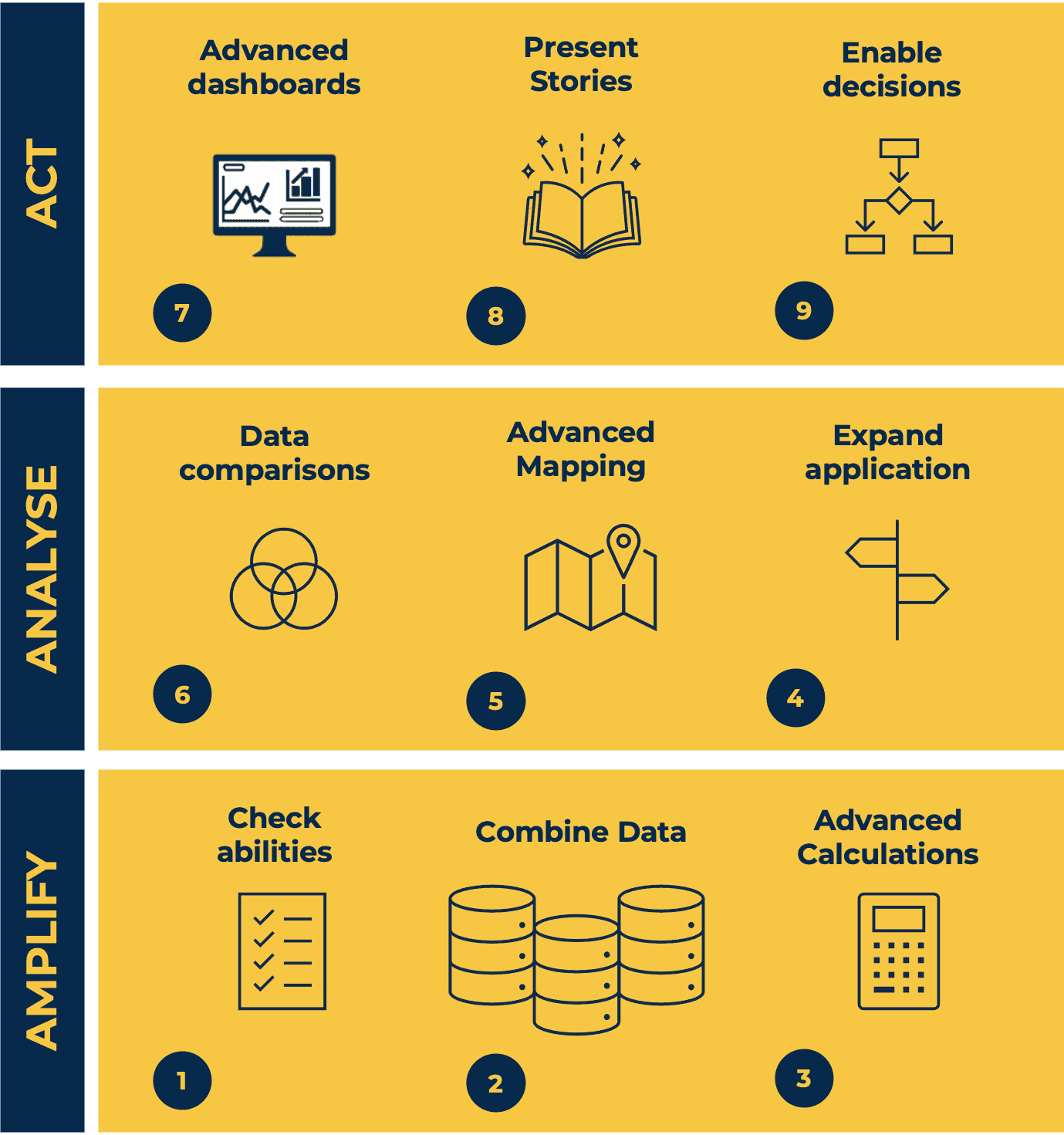

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Java Design Patterns - The Complete Masterclass - Update '18

By iStudy UK

Whether you're an average Java Developer and looking for a course to master Java Design Patterns or want to get the insights into the core of Software Development principles and Design patterns, then taking this Java Design Patterns - The Complete Masterclass - Update '18 course will be perfect for you. With this course, learn the patterns for creating versatile, reusable objects, and discover example use cases, conclude with implementation guidance, tips and techniques for avoiding the challenges posed by an individual pattern Some of the popular creational patterns such as Builder, Singleton, Prototype, Factory Method, and Abstract Factory and other essential concepts like multithreading, hierarchies and mutability also discussed in this course. By the time you complete this course, you'll be able to implement each design pattern in your own Java projects efficiently. What you'll learn Master Java Design Patterns Apply Design Patterns to Real-World Projects Build Software that's Robust and Flexible Using Java Design Patterns Solve common Software architecture problems with Java Design Patterns Requirements Working Java or any OOP Programming Language Knowledge Understand Interfaces, Composition, Inheritance, Polymorphism Willingness to learn and work hard This is NOT a Beginners Course Who this course is for: Programmers with Intermediate to advanced Software development knowledge Developers who want to learn about Programming Design Patterns Introduction Introduction 00:03:00 What You'll Get from this Course 00:05:00 Value: $5000 USD - Download Your FREE Bundle 00:05:00 Download All of the Slides Used in the Course 00:30:00 Download all the Source code for this Course 00:05:00 The gang of Four - The origins of Design Patterns -Strategy Design Pattern The Concepts Behind Design Patterns 00:05:00 The Strategy Design Pattern - Introduction 00:06:00 The Strategy Design Pattern -Score System 00:15:00 The Strategy Design Pattern - Payment System 00:02:00 The Strategy Design Pattern - Payment System - Part 2 00:12:00 The Strategy Design Pattern - Payment System - Final 00:07:00 Resources 00:15:00 Strategy Pattern Exercise and Challenge 00:15:00 The Observer Design Pattern The Observer Design Pattern 00:04:00 The Observer Design Pattern - Classes Creation 00:12:00 The Observer Design Pattern - Final 00:13:00 Resources 2 00:05:00 Strategy Pattern Exercise and Challenge 11 00:15:00 The Java Decorator Design Pattern The Decorator Design Pattern - Introduction 00:04:00 The Decorator Design Pattern - Classes Creation 00:11:00 The Decorator Design Pattern - Final 88 00:09:00 Resources 88 1 00:10:00 The Factory and Simple Factory Design Pattern Introduction to Simple Factory Design Pattern 00:07:00 The Factory Design Pattern - Introduction 00:03:00 The Factory Design Pattern - Part 2 00:12:00 The Factory Design Pattern - Final 00:08:00 Resources 88 2 00:05:00 The Singleton Design Pattern The Singleton Design Pattern - Introduction 00:03:00 The Singleton Design Pattern -Our First Singleton Class 00:06:00 The Singleton Design Pattern - Synchronized Method 00:07:00 The Singleton Design Pattern - Eager Creation 00:04:00 The Singleton Design Pattern - Double-Check Locking Creation 00:06:00 Resources 88 3 00:05:00 The Command Design Pattern in java The Command Design Pattern - Introduction 00:09:00 The Command Design Pattern - Gameboy Example 00:06:00 The Command Design Pattern - Command Interfaces Creation 00:09:00 The Command Design Pattern - Final 00:16:00 Resources 88 4 00:05:00 The Adapter Design Pattern The Adapter Design Pattern - Introduction 00:04:00 The Adapter Design Pattern - Diagram and Class Creation 00:12:00 The Adapter Design Pattern - Object Adapter 00:05:00 The Adapter Design Pattern - Final 00:03:00 Resources 88 5 00:05:00 The Facade Design Pattern The Facade Design Pattern - Introduction 00:04:00 The Facade Design Pattern - Final 00:13:00 Resources 88 6 00:05:00 The Template Design Pattern The Template Method Design Pattern 00:04:00 The Template Method Design Pattern - Part 2 00:07:00 The Template Method Design Pattern - Final 00:12:00 Resources 88 7 00:05:00 The Iterator Design Pattern About Iterator Design Pattern - Introduction 00:06:00 The Problem and Obvious Solution 00:05:00 Iterator Design Pattern Example - Geeky and Dev Stores 888 00:14:00 Rolling our Own Iterator Class 00:08:00 The Java Iterator Class 00:09:00 The State Design Pattern Introduction to Design Patterns - The State Design Pattern 00:08:00 State Design Pattern- The Obvious Solution 00:12:00 State Design Pattern- The Obvious Solution - Part 2 00:06:00 State Design Pattern- The Correct Solution - Part 1 00:13:00 State Design Pattern- The Correct Solution - Part 2 00:12:00 State Design Pattern- The Correct Solution - Test drive - Final 00:09:00 Resources 88 9 00:05:00 The Proxy Design Pattern Introduction to Proxy Design Pattern 00:05:00 Remote Proxy Design Pattern Implementation 00:11:00 Resources 88 10 00:05:00 The MVC - Model View Controller Design Pattern Introduction to MVC Design Pattern 00:07:00 MVC - Class Creation 00:10:00 MVC - Implementation 00:08:00 The Builder Design Pattern Introduction to Builder Design Pattern 00:05:00 Builder Design Pattern Implementation 00:14:00 The Interface Builder Design Pattern - Part 1 00:09:00 The Interface Builder Design Pattern - Final 00:08:00 The Prototype Design Pattern Introduction to Prototype Design Pattern 00:04:00 Cloning Person and Dolphin Objects 00:10:00 Using the Java Cloneable Interface 00:10:00 The Mediator Design Pattern Introduction to Mediator Design Pattern 00:05:00 Meditator Project with Code - Part 1 00:09:00 Meditator Project with Code - Final 00:10:00 Resources 88 11 00:05:00 The Visitor Design Pattern Introduction to Visitor Design Pattern 00:05:00 The Visitor Design Pattern - Cont. 00:07:00 The Visitor Design Pattern - Final 00:10:00 Resources 88 12 00:05:00 The Memento Design Pattern Introduction to Memento Design Pattern 00:05:00 Memento Class Creation 00:06:00 Memento - Final 00:08:00 Resources 88 13 00:05:00 The Interpreter Design Pattern Introduction to the Interpreter Design Pattern 00:03:00 The Interface Interpreter Design Pattern - Final 00:12:00 Resources 88 14 00:05:00 The Chain of Responsibility Design Pattern Introduction to Chain of Responsibility Design Patterns 00:04:00 The Chain of Responsibility Design Pattern - cont 00:09:00 The Chain of Responsibility Design Pattern - Final 00:07:00 Resources 88 15 00:05:00 The Bridge Design Pattern Introduction to Bridge Design Pattern 00:04:00 Bridge Design Pattern - Classes Setup 00:07:00 Bridge Design Pattern - Final 00:03:00 Resources 88 16 00:05:00 The Flyweight Design Pattern Introduction to Flyweight Design Pattern 00:01:00 Flyweight - Final 00:12:00

Follow your dreams by enrolling on the Face Painting and Design course today and develop the experience, skills and knowledge you need to enhance your professional development. Face Painting and Design will help you arm yourself with the qualities you need to work towards your dream job. Study the Face Painting and Design training course online with Janets through our online learning platform and take the first steps towards a successful long-term career. The Face Painting and Design course will allow you to enhance your CV, impress potential employers, and stand out from the crowd. This Face Painting and Design course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Study the Face Painting and Design course through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the Face Painting and Design course, to ensure you are supported every step of the way. Get a digital certificate as proof of your Face Painting and Design course completion. Janets is one of the top online training course providers in the UK, and we want to make education accessible to everyone! Learn the essential skills you need to succeed and build a better future for yourself with the Face Painting and Design course. The Face Painting and Design course is designed by industry experts and is tailored to help you learn new skills with ease. The Face Painting and Design is incredibly great value and allows you to study at your own pace. With full course access for one year, you can complete the Face Painting and Design when it suits you. Access the Face Painting and Design course modules from any internet-enabled device, including computers, tablets, and smartphones. The Face Painting and Design course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the Face Painting and Design now and start learning instantly! What You Get Out Of Studying Face Painting and Design With Janets: Receive a digital Certificate upon successful completion of the Face Painting and Design course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Description The Face Painting and Design training course is delivered through Janets' online learning platform. Access the Face Painting and Design content from any internet-enabled device whenever or wherever you want to. The Face Painting and Design course has no formal teaching deadlines, meaning you are free to complete the course at your own pace. Method of Assessment To successfully complete the Face Painting and Design course, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the Face Painting and Design course. After successfully passing the Face Painting and Design course exam, you will be able to apply for a CPD-accredited certificate as proof of your Face Painting and Design qualification. Certification All students who successfully complete the Face Painting and Design course can instantly download their digital certificate. You can also purchase a hard copy of the Face Painting and Design course certificate, which will be delivered by post for £9.99. Who Is This Course For: The Face Painting and Design is ideal for those who already work in this sector or are an aspiring professional. This Face Painting and Design course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The Face Painting and Design is open to all students and has no formal entry requirements. To study the Face Painting and Design course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Career Path: The Face Painting and Design is ideal for anyone who wants to pursue their dream career in a relevant industry. Learn the skills you need to boost your CV and go after the job you want. Complete the Face Painting and Design and gain an industry-recognised qualification that will help you excel in finding your ideal job. Course Content Face Painting and Design Module: 01 Introduction to Face Painting 00:15:00 Origins of Face Painting 00:30:00 Basic Kit Requirements 01:00:00 Face Painting Code of Practice 00:15:00 Health and Safety in Face Painting 00:30:00 Painting People's Faces 00:15:00 Taking Care of Skin 00:30:00 Face painting Do's and Don'ts 00:30:00 Different Designs : Beginner 00:30:00 Different Designs: Intermediate 00:30:00 Different Designs: Advanced 00:30:00 Module: 02 Pricing and Costs 00:13:00 How to do a Dog Face Paint Design 00:04:00 How to do a Cat Face Paint Design 00:03:00 How to do a Butterfly Face Paint Design 00:06:00 How to do a Dolphin Face Paint Design 00:06:00 How to do a Elephant Face Paint Design 00:10:00 How to do a Monkey Face Paint Design 00:06:00 How to do a Frog Face Paint Design 00:03:00 How to do a Rabbit Face Paint Design 00:03:00 How to do a Swan Face Paint Design 00:04:00 How to do a Tiger Face Paint Design 00:10:00 How to do a Kissing Fish Face Paint Design 00:07:00 How to do a Unicorn Face Paint Design 00:07:00 Module: 03 How to do a Reindeer Face Paint Design 00:04:00 How to do a Dinosaur Face Paint Design 00:03:00 How to do a Pumpkin Face Paint Design 00:09:00 How to do a Spiderman Face Paint Design 00:06:00 How to do a Batman Face Paint Design 00:04:00 How to do a Minnie Mouse Face Paint Design 00:02:00 How to do a Frozen Face Paint Design 00:03:00 How to do a Black Swirl Face Paint Design 00:03:00 How to do a Clown Face Paint Design 00:03:00 How to do a Masquerade Mask Face Paint Design 00:05:00 How to do a Princess Face Paint Design 00:07:00 How to do a Sunset Face Paint Design 00:07:00 How to do a Flower Face Paint Design 00:05:00 How to do a Hibiscus Flower Face Paint Design 00:05:00 Mock Exam Mock Exam- Face Painting and Design 00:20:00 Final Exam Final Exam- Face Painting and Design 00:20:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Mastering Spring Framework Fundamentals

By Packt

From tackling cross-cutting project concerns with Spring to integrating Spring JDBC to work with databases, this course teaches you the essentials you need to know to confidently use the Spring framework container in the workplace.

Level 5 Accounting & Finance Course

By Training Tale

***Level 5 Accounting & Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting & Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting & Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting & Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5 Accounting & Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting & Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting & Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting & Finance There are no specific requirements for because it does not require any advanced knowledge or skills. Students who intend to enrol in this Level 5 Accounting & Finance course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting & Finance This Level 5 Accounting & Finance course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5 Accounting & Finance

By Training Tale

***Level 5 Accounting & Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This Level 5 Accounting & Finance course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5 Accounting & Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5 Accounting & Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting & Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Level 5 Accounting & Finance Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5 Accounting & Finance*** Detailed Course Curriculum of this Level 5 Accounting & Finance Course: Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5 Accounting & Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5 Accounting & Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5 Accounting & Finance This Level 5 Accounting & Finance course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5 Accounting & Finance There are no specific requirements for Level 5 Accounting & Finance course because it does not require any advanced knowledge or skills. Students who intend to enrol in this Level 5 Accounting & Finance course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5 Accounting & Finance This Level 5 Accounting & Finance course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Level 5: Accounting and Finance

By Training Tale

***Level 5: Accounting and Finance*** Accounting and finance assist businesses in measuring, monitoring, and planning their operations. This course has been designed to provide a thorough introduction to business Accounting and Finance as both an idea and a profession. This course will equip you with in-demand accounting and finance skills as well as the ability to complete practicable processes while working in an organisation. This could be tricky, especially if this is your first consignment in the accounting and finance sector. Our Level 5: Accounting and Finance course provides a solid understanding of accounting and financial methods, concepts, and duties to properly prepare you for a career in the accounting and finance sector. Learning Outcomes After completing this Level 5: Accounting and Finance course, learner will be able to: Understand the essentials of accounting and finance Understand the types of cost data and cost analysis Gain a thorough understanding of contribution analysis Understand break-even and cost-volume-profit analysis Understand relevant cost and know to make short-term decisions Know how to manage financial assets Understand forecasting cash needs and budgeting Cost control and variance analysis Know how to manage accounts receivable and credit Know how to manage inventory Understand the time value of money Know how to improve managerial performance Understand capital budgeting decisions Understand improve managerial performance Understand sources of short-term financing Know how to consider term loans and leasing Understand long-term debt and equity financing Understand accounting conventions and recording financial data Why Choose Level 5 Accounting and Finance Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate as soon as completing the course ] ***Level 5: Accounting and Finance*** Detailed Course Curriculum Module 1: Essentials of Accounting and Finance Identify the Non-Financial Manager's Concern with Finance The Importance of Finance Financial and Operating Environment Module 2: Types of Cost Data and Cost Analysis The Importance of Cost Data Types of Costs How Do Your Costs Behave? Segregating Fixed Cost and Variable Cost Cost Allocation Cost Analysis What You Can Learn from the Japanese? Module 3: Contribution Analysis Should You Accept a Special Order? How Do You Determine a Bid Price? Determining Profit from Year to Year Are You Utilising Capacity? Module 4: Break-Even and Cost-Volume-Profit Analysis What is Cost-Volume-Profit Analysis? What and Why of Break-Even Sales? What is the Margin of Safety? Cash Break-Even Point What is Operating Leverage? Sales Mix Analysis Module 5: Relevant Cost and Making Short-Term Decisions What Costs Are Relevant to You? Accepting or Rejecting a Special Order Pricing Standard Products Determining Whether to Sell or Process Further Adding or Dropping a Product Line Utilising Scarce Resources Don't Forget the Qualitative Factors Module 6: Forecasting Cash Needs and Budgeting Forecasts Using Forecasts Preparing Financial Forecasts Budgets The Sales Budget The Production Budget The Direct Material Budget The Direct Labour Budget The Factory Overhead Budget The Ending Inventory The Selling and Administrative Expense Budget The Cash Budget The Budgeted Income Statement The Budgeted Balance Sheet A Shortcut Approach to Formulating the Budget Module 7: Cost Control and Variance Analysis Defining a Standard The Usefulness of Variance Analysis Setting Standards Determining and Evaluating Sales Variances Cost Variances Labour Variances Overhead Variances The Use of Flexible Budgets in Performance Reports Standards and Variances in Marketing Sales Standards Variances in Warehousing Costs Module 8: Managing Financial Assets Working Capital Financing Assets Managing Cash Properly Getting Money Faster Delaying Cash Payments Opportunity Cost of Foregoing a Cash Discount Volume Discounts Module 9: Managing Accounts Receivable and Credit Credit References Credit Policy Analysing Accounts Receivable Module 10: Managing Inventory Inventory Management Considerations Inventory Analysis Determining the Carrying and Ordering Costs The Economic Order Quantity (EOQ) Avoiding Stock Outs Determining the Reorder Point or Economic Order Point (EOP) The ABC Inventory Control Method Supply Chain Management Module 11: The Time Value of Money Future Values - How Money Grows Future Value of an Annuity Present Value - How Much Money is Worth Now? Present Value of Mixed Streams of Cash Flows Present Value of an Annuity Perpetuities Applications of Future Values and Present Values Module 12: Capital Budgeting Decisions Types of Investment Projects What Are the Features of Investment Projects? Selecting the Best Mix of Projects With a Limited Budget Income Taxes and Investment Decisions Types of Depreciation Methods How Does MACRS Affect Investment Decisions? The Cost of Capital Module 13: Improving Managerial Performance What is Return on Investment (ROI)? What Does ROI Consist of? - Du Pont Formula ROI and Profit Objective ROI and Profit Planning ROI and Return on Equity (ROE) Module 14: Sources of Short-Term Financing Trade Credit Cash Discount When are Bank Loans Advisable? Working with a Bank Issuing Commercial Paper Using Receivables for Financing Using Inventories for Financing Module 15: Considering Term Loans and Leasing Intermediate-Term Bank Loans Using Revolving Credit Insurance Company Term Loans Financing with Equipment Leasing Module 16: Long-Term Debt and Equity Financing Types of Long-Term Debt Equity Securities How Should You Finance? Module 17: Accounting Conventions and Recording Financial Data Double Entry and the Accounting Equation Assessment Method After completing each module of the Level 5: Accounting and Finance course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Once you complete all the modules in this manner, you will be qualified to request your certification. Certification After completing the MCQ/Assignment assessment for this Level 5: Accounting and Finance course, you will be entitled to a Certificate of Completion from Training Tale. It will act as proof of your extensive professional development. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? Level 5: Accounting and Finance This course is ideal for: Candidates interested to start a career in accountancy Business owners seeking to look after their own accounts Existing accountancy workers in seeking higher positions or promotion Accountancy workers with no formal qualifications Anyone wishing to boost their career prospects. Requirements Level 5: Accounting and Finance There are no specific requirements for Level 5: Accounting and Finance course because it does not require any advanced knowledge or skills. Students who intend to enrol in this course must meet the following requirements: Good command of the English language Must be vivacious and self-driven Basic computer knowledge A minimum of 16 years of age is required Career path Level 5: Accounting and Finance This course may lead you to a variety of career opportunities. Accounts Assistant Accounts Payable & Expenses Supervisor Accounts Payable Clerk Audit Trainee Payroll Administrator / Supervisor Tax Assistant / Accountant. Accounting Clerk Auditing Clerk Accounts Receivable Clerk Certificates Certificate of completion Digital certificate - Included

Oracle Data Integrator 19c Configuration and Administration (TTOR30319)

By Nexus Human

Duration 3 Days 18 CPD hours This course is intended for This intermediate-level hands-on course is geared for experienced Administrators, Analysts, Architects, Data Scientists, Database Administrators and Implementers Overview This course is approximately 50% hands-on, combining expert lecture, real-world demonstrations and group discussions with machine-based practical labs and exercises. Working in a hands-on learning environment led by our Oracle Certified expert facilitator, students will learn how to: Administer ODI resources and setup security with ODI Apply ODI Topology concepts for data integration Describe ODI Model concepts Describe architecture of Oracle Data Integrator Design ODI Mappings, Procedures, Packages, and Load Plans to perform ELT data transformations Explore, audit data, and enforce data quality with ODI Implement Changed Data Capture with ODI Oracle Data Integrator is a comprehensive data integration platform that covers all data integration requirements from high-volume, high-performance batch loads, to event-driven integration processes and SOA-enabled data services. Oracle Data Integrator's Extract, Load, Transform (E-LT) architecture leverages disparate RDBMS engines to process and transform the data - the approach that optimizes performance, scalability and lowers overall solution costs. Throughout this course participants will explore how to centralize data across databases, performing integration, designing ODI Mappings, and setting up ODI security. In addition, Oracle Data Integrator can interact with the various tools of the Hadoop ecosystem, allowing administrators and data scientists to farm out map-reduce operations from established relational databases to Hadoop. They can also read back into the relational world the results of complex Big Data analysis for further processing. Working in a hands-on learning environment led by our Oracle Certified expert facilitator, students will learn how to: Administer ODI resources and setup security with ODI Apply ODI Topology concepts for data integration Describe ODI Model concepts Describe architecture of Oracle Data Integrator Design ODI Mappings, Procedures, Packages, and Load Plans to perform ELT data transformations Explore, audit data, and enforce data quality with ODI Implement Changed Data Capture with ODI Introduction to Integration and Administration Oracle Data Integrator: Introduction Oracle Data Integrator Repositories Administering ODI Repositories Create and connect to the Master Repository Export and import the Master Repository Create, connect, and set a password to the Work Repository ODI Topology Concepts ODI Topology: Overview Data Servers and Physical Schemas Defining Topology Agents in Topology Planning a Topology Describing the Physical and Logical Architecture Topology Navigator Creating Physical Architecture Creating Logical Architecture Setting Up a New ODI Project ODI Projects Using Folders Understanding Knowledge Modules Exporting and Importing Objects Using Markers Oracle Data Integrator Model Concepts Understanding the Relational Model Understanding Reverse-Engineering Creating Models Organizing ODI Models and Creating ODI Datastores Organizing Models Creating Datastores Constraints in ODI Creating Keys and References Creating Conditions Exploring Your Data Constructing Business Rules ODI Mapping Concepts ODI Mappings Expressions, Join, Filter, Lookup, Sets, and Others Behind the Rules Staging Area and Execution Location Understanding Knowledge Modules Mappings: Overview Designing Mappings Multiple Sources and Joins Filtering Data Overview of the Flow in ODI Mapping Selecting a Staging Area Configuring Expressions Execution Location Selecting a Knowledge Module Mappings: Monitoring and Troubleshooting Monitoring Mappings Working with Errors Designing Mappings: Advanced Topics 1 Working with Business Rules Using Variables Datasets and Sets Using Sequences Designing Mappings: Advanced Topics 2 Partitioning Configuring Reusable Mappings Using User Functions Substitution Methods Modifying Knowledge Modules Using ODI Procedures Procedures: Overview Creating a Blank Procedure Adding Commands Adding Options Running a Procedure Using ODI Packages Packages: Overview Executing a Package Review of Package Steps Model, Submodel, and Datastore Steps Variable Steps Controlling the Execution Path Step-by-Step Debugger Starting a Debug Session New Functions Menu Bar Icons Managing ODI Scenarios Scenarios Managing Scenarios Preparing for Deployment Using Load Plans What are load plans? Load plan editor Load plan step sequence Defining restart behavior Enforcing Data Quality with ODI Data Quality Business Rules for Data Quality Enforcing Data Quality with ODI Working with Changed Data Capture CDC with ODI CDC implementations with ODI CDC implementation techniques Journalizing Results of CDC Advanced ODI Administration Setting Up ODI Security Managing ODI Reports ODI Integration with Java

Sales Training

By KEMP CENTER

Make your life easier, learn how to communicate effectively Do you want to be a good communicator? Professional training for salespeople complete with a certificate Learn how to enter into contracts and how to bookkeep including accounting for travel. Learn from the best in the industry An employment law specialist with extensive experience will be leading the course. Test your knowledge Take the tests and practical tasks in the course to consolidate your knowledge and skills. Take the most effective and comprehensive sales training on the Polish Internet. Join the best salespeople in the business and rocket the sales in your company. In this training discover how the most professional salespeople work every day. Learn how they attract their customers, make business connections, arrange meetings, have key conversations and most importantly how they finalize deals and close contracts. You’ll discover all of this and more with concrete real life examples from a TOP salesperson and manager with 12 years of experience in professional sales. By taking this course you will have instant access to the practices of one of the best salespeople in the business who will also show you their sales process from A to Z as well as interviews with real clients. The sales training is done through the National Education Center’s interactive platform and includes invaluable resources such as a hybrid workshop with practical tasks and training for salespeople complete with expert feedback. Parts of the course will require active participation in order to complete the training. You can take the course at your own pace from the comfort of your own home and will have access to the materials on the interactive platform for two years after completing the course Join the communication course and get the benefits: Learning from a professional instructor24/7 access from any devicePractical exercisesTests, quizzes and recapsCertificate of completionExtra materials and downloadable bonuses100% satisfaction guarantee Your Singing Instructor: Faustine Parsons Communication expert Faustine is a manager, speaker and communication expert. She has over 14 years of experience in coaching and developing people skills for SMEs and international corporations. As a manager, she saw firsthand the importance of an effective team cooperation and got involved in the field. As a consultant, she specialized in smoothing the information exchange, bringing down barriers and creating a positive atmosphere throughout the organization. She developed skills and techniques which solved many of her clients’ problems. She combines the theory of psychology with down to earth practical approach. Let her guide you during the exciting journey through the dynamics of human interactions. Get ready for an interesting and fun ride, as her passion and positivity is contagious from the very beginning. Overview of the course: Detailed video presentations and training videos Fundamentals of effective communication Emotions and problems Daily communication at work and at home Business environment Advanced subjects Repetitions and tests Five repetitions Five tests Final exam Exercises and practial tasks Mapping good and bad practices Recognizing styles, behaviors and personalities Troubleshooting and dispute resolving in practice Giving feedback Overcoming challenges in your position All in one simulation Bonus materials Best practices kaizen map Scenarios and phrases for everyday situations Communication no-nos guide Personalities compendium Experience Beginner-IntermediateLanguage English, German, French, Polish, Portuguese A letter from your expert instructor: Many professionals encounter communication problems both at home and at work. They manifest themselves in misunderstandings, disputes and tension. It does not have to be this way. It all boils down to communication skills. For people and organizations who master them, everything comes easy.In my career, I have seen tremendous transformations on this front. Join me in this unique course and let me show you many of the best practices and techniques to make your life easier. Believe in yourself and make the most of your opportunities. Invest in your communication skills today!Faustine ParsonsCommunication expert

Search By Location

- Intermediate Courses in London

- Intermediate Courses in Birmingham

- Intermediate Courses in Glasgow

- Intermediate Courses in Liverpool

- Intermediate Courses in Bristol

- Intermediate Courses in Manchester

- Intermediate Courses in Sheffield

- Intermediate Courses in Leeds

- Intermediate Courses in Edinburgh

- Intermediate Courses in Leicester

- Intermediate Courses in Coventry

- Intermediate Courses in Bradford

- Intermediate Courses in Cardiff

- Intermediate Courses in Belfast

- Intermediate Courses in Nottingham