- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1546 Courses

The Level 3 Contract Management Course provides a comprehensive understanding of the intricacies of contract management in the modern world. With modules covering everything from the principles of English Contract Law to negotiation techniques and risk assessment, this course equips individuals with essential skills for navigating the complex landscape of contractual agreements. In an era where businesses thrive on partnerships and agreements, proficiency in contract management is invaluable. Learning this skill opens doors to a plethora of job opportunities in the UK, with positions such as Contract Manager, Procurement Officer, or Legal Advisor being in high demand. According to recent data, professionals with expertise in contract management earn competitive salaries, with average annual earnings ranging from £35,000 to £60,000 depending on experience and industry. Moreover, the advantages of acquiring this qualification extend beyond job prospects, as it enhances one's ability to mitigate risks, resolve disputes, and optimize supplier relationships. With the demand for contract management professionals steadily increasing by 10-15% annually, investing in this course promises a rewarding career path in a flourishing sector. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access Course Curriculum: Module 01: Introduction to Contract Management Module 02: Contract Manager's Roles, Responsibilities & Career Opportunitiesv Module 03: Principles of English Contract Law Module 04: Classification of Contracts Module 05: Case Study on Contract Management Module 06: Contract Management Plan & Efficiency Module 07: Risks, Disputes & Supplier Relation In Contract Management Module 08: Negotiation, Variation & Changes in Contract Management Module 09: Contract Management Process Evaluation & KPI Module 10: Contract Review, Challenges and Future Learning Outcomes: Understand principles of English Contract Law and its application. Identify and classify various types of contracts effectively and efficiently. Analyze real-life case studies to apply contract management principles. Develop robust contract management plans to enhance organizational efficiency. Effectively manage risks, disputes, and supplier relations in contract management. Evaluate contract management processes using Key Performance Indicators (KPIs). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Level 3 Contract Management Course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Level 3 Contract Management . Moreover, this course is ideal for: Professionals seeking to advance in contract management roles. Individuals aspiring to enhance their understanding of contract law. Those looking to improve contract negotiation and management skills. Graduates aiming to pursue careers in procurement and supply chain. Managers responsible for overseeing contract management processes. Requirements There are no requirements needed to enrol into this Level 3 Contract Management Course. We welcome individuals from all backgrounds and levels of experience to enrol into this Level 3 Contract Management Course. Career path After finishing this Level 3 Contract Management Course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Contract Management are: Contract Manager - £35K to 60K/year Procurement Specialist - £30K to 50K/year. Legal Advisor (Contracts) - £40K to 70K/year. Supplier Relations Manager - £35K to 55K/year. Compliance Officer (Contracts) - £30K to 50K/year. Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Arts Management: Leadership, Entrepreneurship, and Global Dynamics Course is an indispensable pursuit in today's creative economy. With modules ranging from financial management to global dynamics, this course equips individuals with the skills necessary to navigate the complexities of the arts industry. In an era where creativity and business acumen intertwine, mastering Arts Management, Leadership, and Entrepreneurship becomes paramount. Understanding the nuances of cultural policy and internationalization fosters adept leadership and entrepreneurial spirit within the arts sphere. The course not only enhances employability but also opens doors to a plethora of job opportunities, especially in the UK, where the arts sector thrives. Graduates of this course can expect lucrative job prospects, with salaries ranging from £25,000 to £45,000 annually. Furthermore, the advantages of this Arts Management: Leadership, Entrepreneurship, and Global Dynamics course are palpable, with the arts sector witnessing a steady increase in demand for skilled professionals, boasting a growth rate of 10-15% annually. Therefore, investing in Arts Management, Leadership, and Entrepreneurship education ensures not only personal growth but also contributes to the vitality of the arts industry. Key Features: CPD Certified Arts Management Course Free Certificate Developed by Specialist Lifetime Access Course Curriculum Module 01: Introduction to Arts Management Module 02: Planning in Arts Management Module 03: Financial Management in Arts Module 04: Fundraising in Arts Management Module 05: Marketing in Arts Module 06: Organisational Perspectives Module 07: Leadership and Entrepreneurship Module 08: Cultural Policy Module 09: Globalisation and Internationalisation in Arts Management Module 10: Career in Arts Management Learning Outcomes: Master strategic planning and financial management for artistic endeavours. Develop expertise in fundraising techniques to support artistic initiatives. Acquire essential marketing skills tailored to the arts industry. Understand diverse organisational perspectives within arts management contexts. Cultivate leadership qualities essential for driving artistic ventures. Navigate the complexities of cultural policies and global dynamics in arts. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Arts Management: Leadership, Entrepreneurship, and Global Dynamics course is accessible to anyone eager to learn more about this topic. Through this Arts Management: Leadership, Entrepreneurship, and Global Dynamics course, you'll gain a solid understanding of Arts Management: Leadership, Entrepreneurship, and Global Dynamics. Moreover, this course is ideal for: Aspiring arts administrators seeking comprehensive industry insights. Creatives eager to understand the business side of the arts. Entrepreneurs interested in ventures within the cultural sector. Professionals transitioning to roles in arts management. Students passionate about merging creativity with managerial acumen. Requirements There are no requirements needed to enrol into this Arts Management: Leadership, Entrepreneurship, and Global Dynamics course. We welcome individuals from all backgrounds and levels of experience to enrol into this Arts Management: Leadership, Entrepreneurship, and Global Dynamics course. Career path After finishing this Arts Management: Leadership, Entrepreneurship, and Global Dynamics course you will have multiple job opportunities waiting for you. Arts Administrator - £20K to 30K/year. Cultural Events Manager - £25K to 35K/year. Marketing Coordinator (Arts Sector) - £22K to 32K/year. Fundraising Officer (Arts Organisation) - £22K to 35K/year. Arts Development Officer - £24K to 35K/year. Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

In today's rapidly evolving regulatory landscape, navigating compliance intricacies is imperative for businesses. This online Compliance Management Training Course provides a comprehensive understanding of compliance frameworks and equips individuals with essential skills to ensure organizational adherence to legal and ethical standards. Covering modules ranging from the fundamentals of compliance to risk assessment and management, this course instills expertise crucial for mitigating potential legal liabilities and safeguarding corporate integrity. In the UK, where stringent regulatory requirements prevail, proficiency in Compliance Management is highly sought after by employers across diverse sectors. Acquiring this skill not only enhances job prospects but also commands competitive salaries, with median salaries ranging from £30,000 to £60,000 annually depending on experience and industry. The significance of this course is further underscored by the escalating demand for compliance professionals, with job opportunities projected to increase by 6% annually, outpacing the average job growth rate. In essence, investing in Compliance Management education not only opens doors to lucrative career prospects but also fortifies organizational resilience in an increasingly regulated environment. Key Features: CPD Certified Developed by Specialist Lifetime Access Course Curriculum: Module 01: Introduction to Compliance Module 02: Compliance Management System Module 03: Basic Elements of Effective Compliance Module 04: Compliance Audit Module 05: Compliance and Ethics Module 06: Introduction to Risk and Basic Risk Types Module 07: Further Risk Types Module 08: Introduction to Risk Management Module 09: Risk Management Process Module 10: Risk Assessment and Risk Treatment Module 11: Types of Risk Management Learning Outcomes: Identify key compliance principles for organisational adherence and governance. Implement a robust compliance management system to ensure regulatory compliance. Analyse basic elements crucial for an effective compliance framework. Conduct compliance audits to assess adherence to regulatory requirements. Understand the correlation between compliance and ethical business practices. Differentiate between various types of risks and their management strategies. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Compliance Management Online Training course is accessible to anyone eager to learn more about this topic. Through this course, you'll gain a solid understanding of Compliance Management. Moreover, this course is ideal for: Compliance officers seeking advanced knowledge in compliance management. Legal professionals aiming to enhance their understanding of compliance frameworks. Business professionals responsible for ensuring regulatory adherence within their organisations. Risk management professionals interested in integrating compliance into their strategies. Corporate executives striving to foster a culture of ethical and compliant conduct. Requirements There are no requirements needed to enrol into this Compliance Management Online Training course. We welcome individuals from all backgrounds and levels of experience to enrol into this Compliance Management Online Training course. Career path After finishing this Compliance Management Online Training course you will have multiple job opportunities waiting for you. Some of the following Job sectors of Compliance Management are: Compliance Officer - £40K to 70K/year. Risk Analyst - £35K to 55K/year. Compliance Manager - £50K to 80K/year. Regulatory Affairs Specialist - £45K to 65K/year. Corporate Governance Advisor - £45K to 70K/year. Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting - 20 Courses Bundle

By NextGen Learning

Get ready for an exceptional online learning experience with the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle! This carefully curated collection of 20 premium courses is designed to cater to a variety of interests and disciplines. Dive into a sea of knowledge and skills, tailoring your learning journey to suit your unique aspirations. This Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting is a dynamic package, blending the expertise of industry professionals with the flexibility of digital learning. It offers the perfect balance of foundational understanding and advanced insights. Whether you're looking to break into a new field or deepen your existing knowledge, the Financial Advisor package has something for everyone. As part of the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting package, you will receive complimentary PDF certificates for all courses in Financial Advisor bundle at no extra cost. Equip yourself with the Financial Advisor bundle to confidently navigate your career path or personal development journey. Enrol our Financial Advisor bundletoday and start your career growth! This Financial Advisor Bundle Comprises the Following CPD Accredited Courses: Finance: Financial Advisor Finance and Budgeting Diploma Corporate Finance: Profitability in a Financial Downturn Finance: Financial Risk Management Financial Wellness: Managing Personal Cash Flow Financial Statement Analysis Masterclass Pension Capital Budgeting & Investment Decision Rules Corporate Finance: Working Capital Management Financial Statements Fraud Detection Training Presenting Financial Information Financial Reporting Financial Modeling Using Excel Banking and Finance Accounting Statements Financial Analysis Tax Accounting Diploma Career Development Plan Fundamentals CV Writing and Job Searching Learn to Level Up Your Leadership Networking Skills for Personal Success Ace Your Presentations: Public Speaking Masterclass Learning Outcome: By completing the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting course, you will: Gain comprehensive insights into multiple fields. Foster critical thinking and problem-solving skills across various disciplines. Understand industry trends and best practices through the Financial Advisor Bundle. Develop practical skills applicable to real-world situations. Enhance personal and professional growth with the Financial Advisor Bundle. Build a strong knowledge base in your chosen course via the Financial Advisor Bundle. Benefit from the flexibility and convenience of online learning. With the Financial Advisor package, validate your learning with a CPD certificate. Each course in Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Embrace the future of learning with the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting , a rich anthology of 15 diverse courses. Each course in the Financial Advisor bundle is handpicked by our experts to ensure a wide spectrum of learning opportunities. ThisFinancial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle will take you on a unique and enriching educational journey. The bundle encapsulates our mission to provide quality, accessible education for all. Whether you are just starting your career, looking to switch industries, or hoping to enhance your professional skill set, the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle offers you the flexibility and convenience to learn at your own pace. Make the Financial Advisor package your trusted companion in your lifelong learning journey. CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle is perfect for: Lifelong learners looking to expand their knowledge and skills. Professionals seeking to enhance their career with CPD certification. Individuals wanting to explore new fields and disciplines. Anyone who values flexible, self-paced learning from the comfort of home. Requirements Without any formal requirements, you can delightfully enrol this Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting course. Career path Unleash your potential with the Financial Advisor, Budgeting, Investment, Corporate Finance & Accounting bundle. Acquire versatile skills across multiple fields, foster problem-solving abilities, and stay ahead of industry trends. Ideal for those seeking career advancement, a new professional path, or personal growth. Embrace the journey with the Financial Advisor bundle package. Certificates Certificate Of Completion Digital certificate - Included Certificate Of Completion Hard copy certificate - Included You will get a complimentary Hard Copy Certificate.

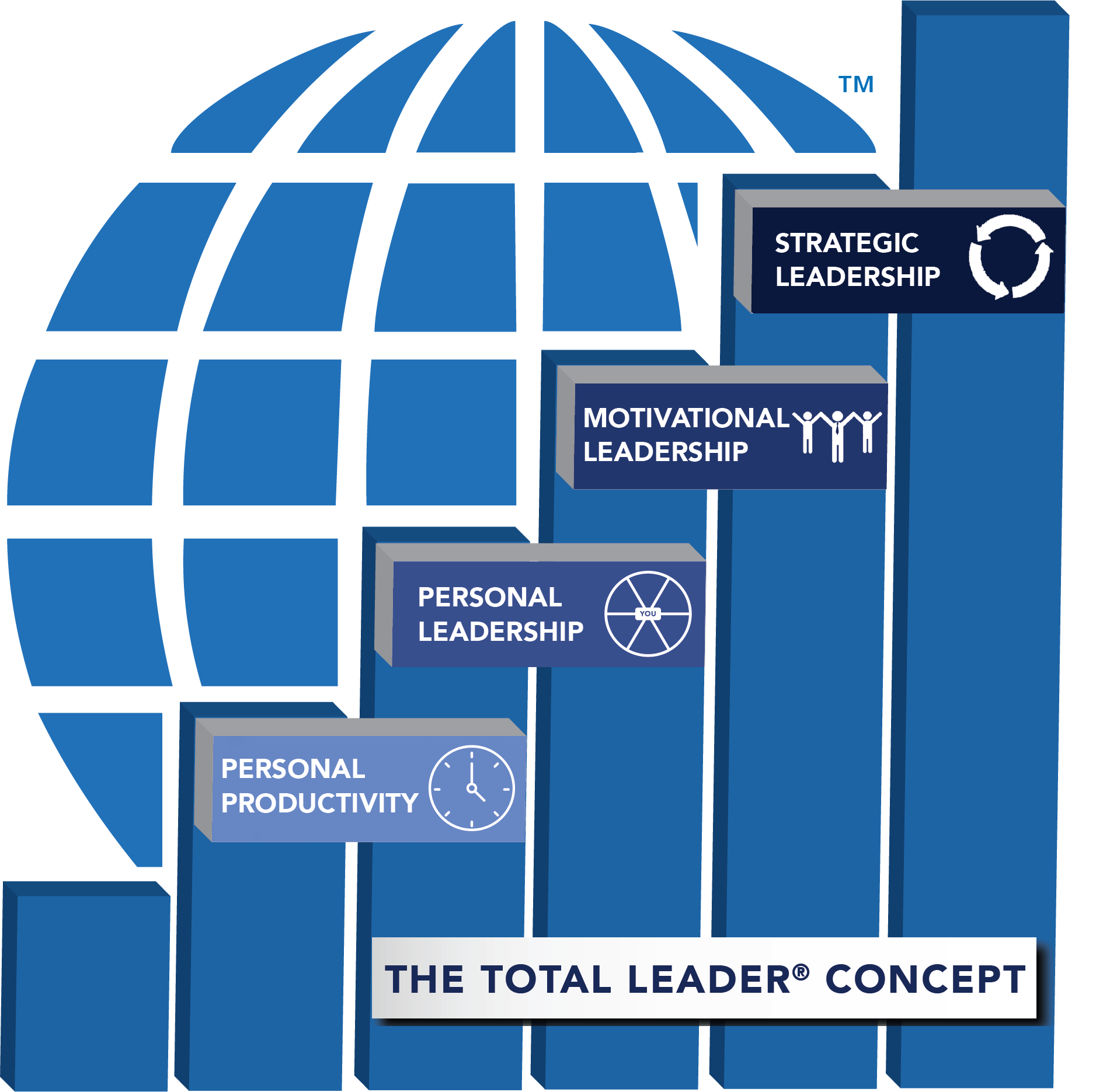

Foundations of Success

By Leadership Management International (LMI) UK

The LMI Foundations of Success workshop introduces the concepts and practical tools used to help countless individuals within thousands of organisations, of all sizes and complexity in both the public and private sector, realise more of their true potential.

Active Shooter: Surviving An Attack

By Compete High

ð¨ Prepare, Protect, Survive: Active Shooter - Surviving An Attack Course! ð¡ï¸ In today's unpredictable world, being equipped with the knowledge and skills to respond effectively to an active shooter situation is paramount. Introducing our comprehensive Active Shooter - Surviving An Attack course, designed to empower individuals with the tools they need to survive and protect themselves and others during a crisis. ð ð¦ What You'll Learn: Our course covers essential strategies and tactics for surviving an active shooter situation, including: Recognizing the warning signs of potential threats Implementing effective lockdown and evacuation procedures Utilizing improvised weapons for self-defense Communicating with law enforcement during an active shooter incident Providing first aid and medical assistance to victims ð Why Take This Course? By enrolling in our Active Shooter - Surviving An Attack course, you'll gain invaluable knowledge and skills that could save lives in a crisis. Here are some benefits of taking this course: Empowerment: Feel confident and empowered knowing that you have the skills to respond effectively during an active shooter situation. Safety Preparedness: Equip yourself with the knowledge and strategies to protect yourself and others in the event of an emergency. Peace of Mind: Gain peace of mind knowing that you have taken proactive steps to enhance your safety and preparedness. Community Protection: By learning how to respond to an active shooter incident, you can contribute to creating a safer environment for your community. ð¯ Who is this for? Individuals: Anyone concerned about their safety in public spaces, workplaces, or educational institutions. Professionals: Security personnel, law enforcement officers, and first responders seeking specialized training in active shooter response. Parents and Educators: Individuals responsible for the safety and well-being of children and students. Business Owners: Employers and business owners interested in implementing active shooter preparedness programs for their employees. ð Career Path: Completion of our Active Shooter - Surviving An Attack course can open up opportunities for individuals in various fields, including: Security Industry: Enhance your qualifications and job prospects in the security industry by demonstrating expertise in active shooter response. Emergency Management: Pursue a career in emergency management or disaster preparedness, where knowledge of active shooter response is highly valued. Law Enforcement: Supplement your training and expertise as a law enforcement officer with specialized knowledge in active shooter response tactics. Healthcare: Healthcare professionals can benefit from understanding active shooter response protocols to ensure the safety of patients and staff in medical facilities. ð FAQ: Frequently Asked Questions Q: Is this course suitable for beginners? A: Yes, our Active Shooter - Surviving An Attack course is designed to accommodate individuals of all experience levels, providing foundational knowledge and practical skills for surviving an active shooter incident. Q: How long does it take to complete the course? A: The duration of the course varies depending on individual learning pace and the specific curriculum. However, most learners can complete the course within a few hours of study. Q: Are there any prerequisites for enrolling in the course? A: No, there are no specific prerequisites for enrolling in our Active Shooter - Surviving An Attack course. However, a basic understanding of emergency procedures and crisis response may be beneficial. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course, learners will receive a certificate of achievement, verifying their participation and mastery of the course material. Q: Is the course content updated regularly to reflect the latest best practices and guidelines? A: Yes, our course content is regularly reviewed and updated to ensure that it reflects the most current best practices, guidelines, and industry standards in active shooter response. Q: Can I access the course materials on my mobile device or tablet? A: Yes, our course materials are accessible on a variety of devices, including desktop computers, laptops, tablets, and smartphones, allowing for flexible and convenient learning options. Don't wait until it's too late. Enroll in our Active Shooter - Surviving An Attack course today and take proactive steps to protect yourself and others in the face of adversity. Your safety and preparedness are worth investing in! ðð¡ï¸ Course Curriculum Module 1 Introduction to Active Shooter Situations Introduction to Active Shooter Situations 00:00 Module 2 Run, Hide, Fight.docx Run, Hide, Fight.docx 00:00 Module 3 First Aid and Trauma Care First Aid and Trauma Care 00:00 Module 4 Communication and Coordination Communication and Coordination 00:00 Module 5 Mental Preparedness Mental Preparedness 00:00 Module 6 Workplace Violence Prevention Workplace Violence Prevention 00:00

Infectious Diseases in the Workplace

By Compete High

Title: ð¡ï¸ Mastering Workplace Health: Infectious Diseases in the Workplace ð¡ï¸ Are you ready to safeguard your workplace against the invisible threats of infectious diseases? Introducing our comprehensive text course, 'Infectious Diseases in the Workplace,' your ultimate guide to understanding, preventing, and managing contagious illnesses within your professional environment. ð¨âð¼ Why Choose 'Infectious Diseases in the Workplace'? In today's fast-paced and interconnected world, infectious diseases pose a significant risk to businesses and employees alike. From seasonal flu outbreaks to global pandemics, being prepared to tackle these challenges head-on is essential for maintaining productivity, morale, and most importantly, safety in the workplace. Our expertly crafted text course offers invaluable insights into the world of infectious diseases, equipping you with the knowledge and strategies necessary to protect yourself, your colleagues, and your organization. Delve into topics such as: Understanding the fundamentals of infectious diseases Identifying common workplace pathogens Implementing effective prevention and control measures Navigating legal and ethical considerations Responding to outbreaks and emergencies with confidence With a blend of theory, practical tips, and real-world case studies, this course empowers you to become a proactive advocate for workplace health and safety. ð©âð¼ Who is this for? Whether you're an HR professional, a healthcare worker, a manager, or simply someone who wants to promote a healthier work environment, this course is tailor-made for you. No prior medical or scientific knowledge is required - just a desire to learn and a commitment to fostering a safer workplace for all. ð¼ Career Path Investing in your understanding of infectious diseases in the workplace opens up a world of opportunities across various industries and roles. Here are just a few career paths that can benefit from this course: Occupational Health Specialist: Become an indispensable asset to your organization by developing expertise in preventing and managing workplace-related health issues. Human Resources Manager: Safeguard employee well-being and organizational productivity by integrating infectious disease management strategies into HR policies and procedures. Healthcare Administrator: Lead your healthcare facility to excellence by staying ahead of infectious disease trends and implementing best practices for infection control. Emergency Preparedness Coordinator: Prepare your organization to respond effectively to infectious disease outbreaks and other health-related emergencies. Public Health Advocate: Champion community health initiatives and advocate for policies that promote disease prevention and workplace safety. ð FAQs Q: Can I take this course if I don't have a background in healthcare or science? A: Absolutely! Our course is designed to be accessible to individuals from all backgrounds. We provide clear explanations and practical examples to ensure that everyone can grasp the concepts and apply them effectively in the workplace. Q: How long does it take to complete the course? A: The duration of the course depends on your pace of learning. On average, students complete the course within [insert estimated timeframe], but you can progress through the material at your own convenience. Q: Will I receive a certificate upon completion? A: Yes, upon successfully completing the course and passing the final assessment, you will receive a certificate of completion to showcase your newfound expertise in infectious disease management. Q: Is the course updated to reflect current events and emerging infectious diseases? A: Absolutely. We continuously monitor developments in the field of infectious diseases to ensure that our course content remains relevant and up-to-date. You can rest assured that you'll be equipped with the latest knowledge and strategies to address evolving challenges in the workplace. Q: Can I access the course materials on mobile devices? A: Yes, our platform is mobile-friendly, allowing you to access course materials anytime, anywhere, from your smartphone or tablet. Don't let infectious diseases catch you off guard. Enroll in 'Infectious Diseases in the Workplace' today and take the first step towards creating a safer, healthier, and more resilient workplace environment. Your colleagues - and your bottom line - will thank you. ð Course Curriculum Module 1 Introduction to Infectious Diseases in the Workplace Introduction to Infectious Diseases in the Workplace 00:00 Module 2 Common Infectious Diseases in the Workplace Common Infectious Diseases in the Workplace 00:00 Module 3 Personal Protective Equipment (PPE) Personal Protective Equipment (PPE) 00:00 Module 4 Hygiene Practices to Prevent the Spread of Infectious Diseases Hygiene Practices to Prevent the Spread of Infectious Diseases 00:00 Module 5 Vaccinations and Immunizations Vaccinations and Immunizations 00:00 Module 6 Health and Safety Policies and Procedures Health and Safety Policies and Procedures 00:00

Advanced financial analysis (In-House)

By The In House Training Company

In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions: all require some degree of financial knowledge. The key financial skills are not as difficult to learn as many people believe and in the hands of an experienced senior executive they can provide a formidable competitive advantage. After completing this course delegates will be able to: Understand fundamental business finance concepts; understand, analyse and interpret financial statements: Profit Statement, Balance Sheet and Cashflow Statement Understand the vital difference between profit and cashflow; identify the key components of working capital and how they can be managed to generate strong cashflow Evaluate pricing decisions based on an understanding of the nature of business costs and their impact on gross margin and break-even sales; managing pricing, discounts and costs to generate strong business profits; understand how lean manufacturing methods improve profit Use powerful analytical tools to measure and improve the performance of their own company and assess the effectiveness of their competitors Apply and interpret techniques for assessing and comparing investment opportunities in capital projects, business acquisitions and other ventures; understand and apply common methods of business valuation Understand the role of business finance in formulating and implementing competitive business strategy; the role of budgeting as part of the planning process and the various approaches to budgeting and performance measurement 1 Basic principles Delivering value to key stakeholders Accounting concepts, GAAP, IFRS and common terms Understanding and using the balance sheet Understanding and using the profit statement Recognising the vital difference between profit and cashflow Understanding and using the cashflow statement What financial statements can and cannot tell us 2 Managing and improving cashflow Sources of finance and their advantages and disadvantages What is working capital and why is it so important? Managing stocks, debtors and creditors Understanding how working capital drives business growth Understanding and avoiding the over-trading trap Unlocking the funds tied up in fixed assets: asset backed loans and leasing 3 Managing and improving profit Understanding how profits generate cashflow The fundamental nature of costs: fixed and variable business costs Understanding gross margin and break-even How common pricing methods affect gross margin and profit Effective strategies to improve gross margin Using value chain analysis to reduce costs Lean manufacturing methodsUnderstanding Just-in-time, 6 Sigma and Kaizen methods Improving profitEffective and defective strategies 4 Measuring and managing business performance Measures of financial performance and strength Investor behaviour: the risk and reward relationship Return on investment (ROI): the ultimate measure of business performance How profit margin and net asset turnover drive return on net assets Why some companies are more profitable that others Understanding competitive advantage: cost and differentiation advantage Why great companies failWhat happened to Kodak? Using a 'Pyramid of Ratios' to improve business performance Using Critical Success Factors to develop Key Performance Indicators 5 Budgeting and forecasting methods Using budgets to support strategy Objectives and methods for effective budgets Using budgets to monitor and manage business performance Alternative approaches to budgeting Developing and implementing Balanced Scorecards Beyond Budgeting Forecasting methods and techniques Identifying key business drivers Using rolling forecasts and 'what-if' models to aid decision-making

Search By Location

- Investing Courses in London

- Investing Courses in Birmingham

- Investing Courses in Glasgow

- Investing Courses in Liverpool

- Investing Courses in Bristol

- Investing Courses in Manchester

- Investing Courses in Sheffield

- Investing Courses in Leeds

- Investing Courses in Edinburgh

- Investing Courses in Leicester

- Investing Courses in Coventry

- Investing Courses in Bradford

- Investing Courses in Cardiff

- Investing Courses in Belfast

- Investing Courses in Nottingham