- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

65642 Courses

Pelvic Floor Confidence Course 1 to 1

By For A Better You - Pilates & Pelvic Floor Health

ARE YOU READY TO IMPROVE YOUR PELVIC FLOOR HEALTH? This course will help you learn more about your pelvic floor health, the importance of your pelvic floor muscles and how to do pelvic floor exercises correctly on a 1 to 1 basis. There will be 4 sessions (1 a week) with me. This personal approach will give you the knowledge needed as well as functional ways to improve how you think and do exercises. The time has come to feel empowered and work towards regaining confidence in your pelvic floor was again!

One Day Owners Maintenance Course

By Snobby Dogs Academy Ltd

Owners Maintenance Courses are ran on the first Tuesday of every month (subject to availability) and are designed for those who want to gain a very basic understanding of grooming and maintaining their own dog between professional grooming appointments. You will need to bring along your own dog to work on for the day. The course will cover: Correct and safe grooming procedures prior to bathing Safe and pain-free matt removal using appropriate products, tools and equipment Correct and safe bathing and drying techniques Nail and ear care How to safely maintain your dog’s coat between their salon visits. Students will receive all course materials and it is recommended that students bring along a camera for before and after photographs as well as pens, high-lighters and notepads.

The Snobby Dogs Academy - One Day Induction

By Snobby Dogs Academy Ltd

Our Induction Days ran on the first Wednesday of every month (subject to availability) and are a pre-requisite to all of our longer courses. The day is designed for those who want to gain a basic understanding of what our longer courses entail and/or are trying to establish if a career in dog grooming is for them. The cost of this day is deducted from one of the longer course of your choice. THE COURSE WILL COVER Health and safety induction and UK Animal Welfare Legislation Handling and correct lifting techniques Preparing and grooming dogs prior to bathing Bathe and clean dogs Drying dogs and preparing their coat for styling Nail and ear care Finishing and styling demonstration by a stylist Students will receive all course materials and it is recommended that students bring along a camera for before and after photographs as well as pens, high-lighters and notepads.

First Aid at Work (RQF) Level 3

By BAB Business Group

Did you know that an estimated 555,000 workers in Britain sustained an injury at work in 2017/18? The Health and Safety (First Aid) Regulations 1981 require all employers to make arrangements to ensure their employees receive immediate attention if they are injured or taken ill at work. This includes carrying out a risk assessment, appointing a suitable amount of first aiders and providing appropriate first aid training. However, having the correct first aid provision in the workplace is not just a legal requirement, it is incredibly important for the safety of all members of staff! The QA Level 3 Award in First Aid at Work (RQF) qualification is specifically designed for individuals who wish to act as a first aider in their workplace. Successful candidates will learn how to manage a range of injuries and illnesses that could occur at work and will be equipped with the essential skills needed to give emergency first aid. What’s more, as a regulated qualification, employers can book this course for their employees and rest assured that they have fulfilled their legal responsibilities for providing quality first aid training, without having to undertake any lengthy due diligence checks.

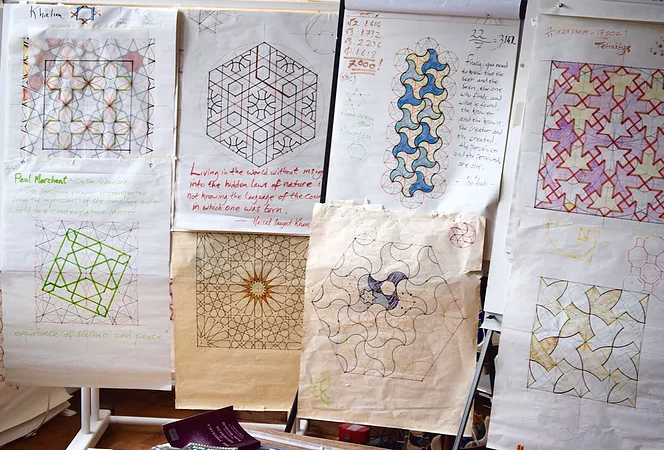

Geometry of the Alhambra with Daniel Docherty

By Sacred Art of Geometry

The Alhambra Palace complex is home to some of the finest examples of Islamic Geometric Pattern in the world. During this three-day course we will learn how to construct a number of these patterns - ranging from the simple to highly sophisticated - using the traditional geometer's tools of compass and straightedge. This course will be led in a gentle, easy to follow, step-by-step manner, suitable for both beginners and experienced alike.

The Art of Projective Geometry Spirals, Buds and Vortex Forms with Sophia Montefiore

By Sacred Art of Geometry

We are eagerly looking forward to welcoming Australian based Artsist/Educator and Projective Geometry expert Sophia Montefiore back to SAOG Studios for a Summer 2021 Projective Geometry course. Participants will be introduced to the fundamental and profound principles of this unique art form through drawing/construction and colour work focussing on Spirals, Buds and Vortex Forms.

Combined First Aid at Work and Paediatric First Aid Course

By BAB Business Group

The Combined First Aid at Work and Paediatric First Aid Course is ideal for those who work in settings that require both first aiders and paediatric first aiders, such as schools, sports clubs or other childcare settings. Combining the QA Level 3 Award in First Aid at Work (RQF) and the QA Level 3 Award in Paediatric First Aid (RQF) into 3 extended days of classroom learning, this specially designed course enables candidates to gain the skills and knowledge needed to provide both adult and paediatric first aid, whilst minimising the number of training days required to achieve both qualification. Candidates will cover a range of topics needed to provide effective first aid for adults, children and infants including CPR and defibrillation, choking, stroke, head injuries, asthma and much more.

Search By Location

- Courses in London

- Courses in Birmingham

- Courses in Glasgow

- Courses in Liverpool

- Courses in Bristol

- Courses in Manchester

- Courses in Sheffield

- Courses in Leeds

- Courses in Edinburgh

- Courses in Leicester

- Courses in Coventry

- Courses in Bradford

- Courses in Cardiff

- Courses in Belfast

- Courses in Nottingham