- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

486 Courses

PRINCE2 7th Edition Foundation

By Advised Skills

The 3-day course is designed to deliver a complete knowledge of the PRINCE2® 7th Edition methodology to the participants. The course prepares you for the exam to obtain the international PRINCE2® 7th Edition Foundation certificate issued by the accrediting organization. PRINCE2® 7th Edition Foundation course offered by Advised Skills Ltd is accredited by PeopleCert, on behalf of AXELOS, based upon Partner's Agreement and complies with the accreditation requirements.

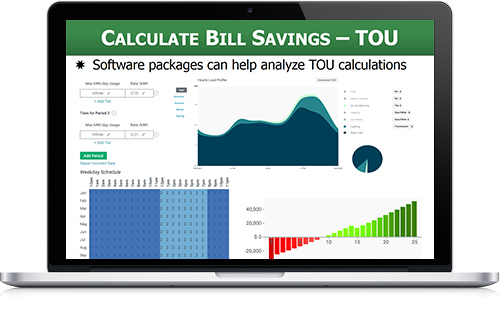

PVOL206: Solar Training - Solar Business and Technical Sales - Online

By Solar Energy International (SEI)

Students who complete PVOL206 will be able to: Discuss the basics of policy and its effect on the solar industry Identify resources to learn more about policy and keep up to date with new developments Describe general sales tips Discuss common objections Identify techniques to close a sale Identify customer motivations and needs Discuss project timeline with customer Manage customer expectations and advise about PV system limitations Discuss manufactures, installation, and roof warranties Explain expected system performance Identify jurisdictional issues (zoning, fire marshal regulations) and city, county, and utility requirements Understand electric bill terminology, key information, and billing procedures Recognize any variations in energy use Determine property type, house orientation, roof tilt/angle, and available area Identify any shading and evaluate obstructions Estimate array size based on customer budget, kWh consumption, and / or available roof area Price array size based on average $/watt Develop price range, savings estimate, and preliminary economic analysis Present (verbal / brief) initial ballpark proposal and benefits, discuss customer's budget limits Identify overall customer considerations and general safety requirements Define the electrical meter and main service panel information required Identify point of interconnection, location for electrical equipment, and location for conduit runs Describe factors to consider with data monitoring Determine maximum PV capacity that can be connected to a specific service and/or electrical panel Create a final array layout Accurately estimate PV system production Define metrics to evaluate labor and material costs Calculate an average residential system cost & identify the major contributing factors Identify the main benefits of reviewing actual build data (job costing) Define property tax exemptions, tax deductions, transfer credits, sales tax exemptions Explain performance based-initiatives Evaluate taxability of credits and other incentives Review net-metering and feed-in tariff laws Identify different utility financial structures and regulated and deregulated markets Describe demand charges & the duck curve Outline financing basics Explore ownership models Calculate annual and cumulative cash flow, determine payback Calculate the environmental benefits of installing solar Identify what to include in a proposal, the proposal process, and what tools are available to generate proposals

Coal Power Plant Life Cycle Management and Flexible Operations in Energy Transition - Decommissioning, Preservation, Repurposing and Recommissioning

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your knowledge in coal power plant life cycle management and flexible operations with EnergyEdge. Learn about decommissioning, preservation, repurposing, and recommissioning.

Integrating UNIX and Microsoft course description This course is designed for the enterprise-level UNIX professional and represents the highest level of professional, distribution-neutral UNIX certification within the industry. It covers administering UNIX enterprise-wide with an emphasis on mixed environments. What will you learn Configure and troubleshoot OpenLDAP. Use OpenLDAP as an authentication backend. Manage software packages. Use Samba - Share configuration - User and group management - Domain integration - Name services - with Linux and Windows clients Integrating UNIX and Microsoft course details Who will benefit: Enterprise-level UNIX professionals. Prerequisites: UNIX network administration. Duration 5 days Integrating UNIX and Microsoft course contents OPENLDAP CONFIGURATION OpenLDAP replication Replication concepts, OpenLDAP replication, replication log files, replica hubs, LDAP referrals, LDAP sync replication. Securing the Directory Securing the directory with SSL and TLS, Firewall considerations, Unauthenticated access methods, User/password authentication methods, Maintanence of SASL user DB, certificates. OpenLDAP Server Performance Tuning Measure OpenLDAP performance, Tune software configuration to increase performance, indexes. OPENLDAP AS AN AUTHENTICATION BACKEND LDAP Integration with PAM and NSS Configure PAM to use LDAP for authentication, NSS to retrieve information from LDAP and PAM modules in UNIX. Integrating LDAP with Active Directory and Kerberos Kerberos integration with LDAP, Cross platform authentication, Single sign-on concepts, Integration and compatibility limitations between OpenLDAP and Active Directory. SAMBA BASICS Samba Concepts and Architecture Samba daemons and components, key issues regarding heterogeneous network, Identify key TCP/UDP ports used with SMB/CIFS, Knowledge of Samba3 and Samba4 differences. Configure Samba Samba server configuration file structure, variables and configuration parameters, Troubleshoot and debug configuration problems. Regular Samba Maintenance Monitor and interact with running Samba daemons, Perform regular backups of Samba configuration and state data. Troubleshooting Samba Samba logging, Backup TDB files, Restore TDB files, Identify TDB file corruption, Edit / list TDB file content. Internationalization Internationalization character codes and code pages, differences in the name space between Windows and Linux/Unix with respect to share, names, user/group/computer naming in a non-English environment. SAMBA SHARE CONFIGURATION Linux File System and Share/Service Permissions File / directory permission control, Samba interaction with Linux file system permissions and ACLs, Use Samba VFS to store Windows ACLs. Print Services Printer sharing, integration between Samba and CUPS, Manage Windows print drivers and configure downloading of print drivers, security concerns with printer sharing. SAMBA USER AND GROUP MANAGEMENT Managing User Accounts and Groups User and group accounts, mappings, user account management tools, smbpasswd, file/directory ownership of objects. Authentication, Authorization and Winbind Local password database, password synchronization, passdb backends, Convert between passdb backends, Integrate Samba with LDAP, Winbind service, PAM and NSS. SAMBA DOMAIN INTEGRATION Samba as a PDC and BDC Domain membership and trust relationships, Create and maintain a PDC and BDC with Samba3/4, Add computers to an existing domain, logon scripts, roaming profiles, system policies. Samba4 as an AD compatible Domain Samba 4 as an AD DC, smbclient, how Samba integrates with AD services: DNS, Kerberos, NTP, LDAP. Configure Samba as a Domain Member Server Joining Samba to NT4 and AD domains, obtain a TGT from a KDC. SAMBA NAME SERVICES NetBIOS and WINS WINS concepts, NetBIOS concepts, local master browser, domain master browser, Samba as a WINS server, name resolution, WINS replication, NetBIOS browsing and browser elections, NETBIOS name types. Active Directory Name Resolution DNS for Samba4 as an AD Domain Controller, DNS forwarding with the internal DNS server of Samba4. WORKING WITH LINUX AND WINDOWS CLIENTS CIFS Integration SMB/CIFS concepts, remote CIFS shares from a Linux client, securely storing CIFS credentials, features and benefits of CIFS, permissions and file ownership of remote CIFS shares. Working with Windows Clients browse lists and SMB clients from Windows, Share file/print resources from Windows, the smbclient program, the Windows net utility.

Integrating Linux and Microsoft course description This course is designed for the enterprise-level Linux professional and represents the highest level of professional, distribution-neutral Linux certification within the industry. LPIC-3 300 covers administering Linux enterprise-wide with an emphasis on mixed environments. What will you learn Configure and troubleshoot OpenLDAP. Use OpenLDAP as an authentication backend. Manage software packages. Use Samba - Share configuration - User and group management - Domain integration - Name services - with Linux and Windows clients Integrating Linux and Microsoft course details Who will benefit: Enterprise-level Linux professionals. Prerequisites: Delegates must have an active LPIC-2 certification to receive LPIC-3 certification, but the LPIC-2 and LPIC-3 exams may be taken in any order. Duration 5 days Integrating UNIX and Microsoft course contents OPENLDAP CONFIGURATION OpenLDAP replication Replication concepts, OpenLDAP replication, replication log files, replica hubs, LDAP referrals, LDAP sync replication. Securing the Directory Securing the directory with SSL and TLS, Firewall considerations, Unauthenticated access methods, User/password authentication methods, Maintanence of SASL user DB, certificates. OpenLDAP Server Performance Tuning Measure OpenLDAP performance, Tune software configuration to increase performance, indexes. OPENLDAP AS AN AUTHENTICATION BACKEND LDAP Integration with PAM and NSS Configure PAM to use LDAP for authentication, NSS to retrieve information from LDAP and PAM modules in UNIX. Integrating LDAP with Active Directory and Kerberos Kerberos integration with LDAP, Cross platform authentication, Single sign-on concepts, Integration and compatibility limitations between OpenLDAP and Active Directory. SAMBA BASICS Samba Concepts and Architecture Samba daemons and components, key issues regarding heterogeneous network, Identify key TCP/UDP ports used with SMB/CIFS, Knowledge of Samba3 and Samba4 differences. Configure Samba Samba server configuration file structure, variables and configuration parameters, Troubleshoot and debug configuration problems. Regular Samba Maintenance Monitor and interact with running Samba daemons, Perform regular backups of Samba configuration and state data. Troubleshooting Samba Samba logging, Backup TDB files, Restore TDB files, Identify TDB file corruption, Edit / list TDB file content. Internationalization Internationalization character codes and code pages, differences in the name space between Windows and Linux/Unix with respect to share, names, user/group/computer naming in a non-English environment. SAMBA SHARE CONFIGURATION Linux File System and Share/Service Permissions File / directory permission control, Samba interaction with Linux file system permissions and ACLs, Use Samba VFS to store Windows ACLs. Print Services Printer sharing, integration between Samba and CUPS, Manage Windows print drivers and configure downloading of print drivers, security concerns with printer sharing. SAMBA USER AND GROUP MANAGEMENT Managing User Accounts and Groups User and group accounts, mappings, user account management tools, smbpasswd, file/directory ownership of objects. Authentication, Authorization and Winbind Local password database, password synchronization, passdb backends, Convert between passdb backends, Integrate Samba with LDAP, Winbind service, PAM and NSS. SAMBA DOMAIN INTEGRATION Samba as a PDC and BDC Domain membership and trust relationships, Create and maintain a PDC and BDC with Samba3/4, Add computers to an existing domain, logon scripts, roaming profiles, system policies. Samba4 as an AD compatible Domain Samba 4 as an AD DC, smbclient, how Samba integrates with AD services: DNS, Kerberos, NTP, LDAP. Configure Samba as a Domain Member Server Joining Samba to NT4 and AD domains, obtain a TGT from a KDC. SAMBA NAME SERVICES NetBIOS and WINS WINS concepts, NetBIOS concepts, local master browser, domain master browser, Samba as a WINS server, name resolution, WINS replication, NetBIOS browsing and browser elections, NETBIOS name types. Active Directory Name Resolution DNS for Samba4 as an AD Domain Controller, DNS forwarding with the internal DNS server of Samba4. WORKING WITH LINUX AND WINDOWS CLIENTS CIFS Integration SMB/CIFS concepts, remote CIFS shares from a Linux client, securely storing CIFS credentials, features and benefits of CIFS, permissions and file ownership of remote CIFS shares. Working with Windows Clients browse lists and SMB clients from Windows, Share file/print resources from Windows, the smbclient program, the Windows net utility.

Entity Framework Core - A Full Tour

By Packt

Dive into the comprehensive world of Entity Framework Core with this detailed course, designed to equip you with the skills to efficiently use EF Core in .NET applications.

Professional Personal Finance Course

By One Education

Managing your money isn’t about luck – it’s about learning the right strategies, staying disciplined, and knowing where every pound is going. The Professional Personal Finance Course is designed to give you a clear, structured understanding of financial planning, debt control, savings, and smarter decision-making. Whether you're looking to improve your budgeting or simply wish to make more informed financial choices, this course will guide you through it all with a sharp, no-fluff approach. No need to decode complicated jargon or sift through outdated advice. This course offers focused and relevant knowledge, written with today’s financial challenges in mind. From managing monthly expenses to getting better at long-term planning, it covers what really matters. It’s ideal for anyone who wants to take charge of their financial wellbeing with confidence and a touch of logic (yes, that old thing). Sensible, structured, and designed for real people, this course doesn’t just teach – it makes you think twice before that next online splurge. Learning Outcomes Understand the key areas of personal finance, including net worth, expenses and income, and savings. Learn how to manage personal expenses and create a budget. Explore ways to increase your income and save for retirement. Understand the importance of having an emergency fund and health insurance. Learn how to use free budgeting software to manage your finances effectively. Develop the skills and knowledge you need to make informed financial decisions and achieve your financial goals. Course Curriculum: Section 01: Introduction Introduction Section 02: Personal Finance Personal Finance Areas of Personal Finance Net Worth Net Worth - Example Section 03: Personal Expenses and Income Housing Expenses Utility Expenses Credit Debts Food Expenses Clothing Expenses Gift Expenses Travel Expenses Extra Income - Part 1 Extra Income - Part 2 Section 04: Savings Emergency Fund Savings on Retirement Health Insurance Section 05: How to Manage Your Personal Finance Using Free Budgeting Software Introduction to the Budgeting Software Setting Up - Part 1 Setting Up - Part 2 Dashboard Budget Analysis How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path You can pursue opportunities such as Financial Advisor - £36,500 per year Financial Analyst - £30,000 per year Accountant - £32,000 per year Budget Analyst - £29,000 per year Credit Analyst - £28,000 per year Investment Banker - £53,000 per year Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Financial Capital Maintenance Course Online

By iStudy UK

Do you want to know the fundamental theory, principles and practices about the conceptual framework for capital maintenance? Do you know that the capital of a company is only maintained when the financial or monetary amount of its net assets at the end of a fiscal period? Do you need to know more about Capital Maintenance? If yes, then this course is designed for you. Course Description: The course focuses the details about the concept Capital Maintenance. Capital Maintenance believes that the profit should not be recognised unless a business has at least maintained a number of its net assets during an accounting period. It can be of two types: a financial concept of capital which is linked to the net assets or equity of a company and a physical concept of the capital where capital is linked to the productive capacity of the entity. In this course, you will learn about the difference between own and borrowed capital, the factors that affect fixed and working capital, etc. In short, the course will give you a detailed idea about the concept capital Maintenance. Course Highlights Financial Capital Maintenance Course Online is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Financial Capital Maintenance Course Online into 7 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 6 hours and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Financial Capital Maintenance Course Online Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Business People or Account Students who are interested in capital Maintenance and People who are planning to start a business. Financial Capital Maintenance Course Online is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Financial Capital Maintenance Course Online is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Capital Finance Basics 01:00:00 Important Factors Affecting The Requirement Of Fixed Capital 01:00:00 Important Factors Affecting The Requirement Of Working Capital 01:00:00 The Differences Between Own And Borrowed Capital 01:00:00 Importance Of Constant Purchasing Power Accounting 00:30:00 Services Provided By Financial Instruments 01:00:00 Financial Institutions And Short Term Loans For Businesses 00:30:00 Mock Exam Final Exam

Unlock The Power of Sustainability In Business -30 January 2024 Seminar

By Sustainability Support Service for Business

Make 2024 your best year ever! Get ready to unlock the POWER of sustainability for your business. The transformational masterclass 'Unlock the Power of Sustainability In Business' returns on 30 January 2024 at 9:30am (GMT). Delivered online, this 90-minute sustainability training course will cover: ✅Fundamentals of sustainability and what it means for businesses ✅Myths about sustainability and 'Net Zero' that will hinder your progress ✅Practical actions to integrate sustainability into your business strategy ✅How to align sustainability with business priorities ✅Getting 'buy in' from employees across the business ✅Mistakes to avoid in transitioning from talk to tangible action Our masterclass goes beyond theory, learning about calculating carbon footprint in your business or even how many trees should be planted each year🌲. Instead, we help employees, Directors and CEOs of limited companies and social enterprises to recognise that embracing sustainability isn't just about compliance! 🚀Learn how you too can take a purposeful and strategic approach to enhance competitiveness and turbo charge growth.🚀 Register now for this transformational seminar that will help you take action for immediate implementation! 🌿Don't miss this opportunity to future-proof your business and gain a competitive edge!🌿

Course Overview How you manage your finances plays a significant role in achieving the success of your life. The Get full Control of Finance course is designed to provide you with a wide range of skills and the ability to establish control over your finances and get a step closer to success. From this Get full Control of Finance course, you will learn how to figure out your current financial situation. This resourceful course will teach you the importance and the process of creating a specific budget. You will understand how to calculate your net worth and pay off the debts. Within a few easy steps, you will acquire the essential skills to keep track of your expenses. From this course, you will be able to get a clear insight into the envelope system. In this step by step learning process, you will pick up the skills to manage your finances with your partner. This Get full Control of Finance course is the ultimate package to help you acquire your financial freedom. Enroll today! Learning Outcomes Learn the strategies to be aware of your current situation Familiarize yourself with the steps of creating an intentional budget Understand the process of calculating your net worth Grasp the skills to track your expanse both digitally and in papers Acquire the strategies of organizing your finance with your partner Know how to create an emergency fund Comprehend the fundamentals of the envelope system Who is this course for? The Get full Control of Finance course is for those interested in enriching their knowledge of finance. Entry Requirement This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Certification After you have successfully completed the course, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path The Get full Control of Finance course is a useful qualification to possess and would be beneficial for any related profession or industry such as: Financial Investigator Finance Advisor Finance Analyst Get full Control of Finance Module 01: Introduction 00:03:00 Module 02: Why Are You Doing This Course? 00:04:00 Module 03: How to Download the Template 00:02:00 Module 04: Becoming Aware of Your Current Situation 00:21:00 Module 05: Creating an Intentional Budget 00:18:00 Module 06: Comparing Your Options 00:07:00 Module 07: Creating Specific Budgets 00:09:00 Module 08: Calculating Your Net Worth 00:04:00 Module 09: Understanding Your Cash Flow 00:08:00 Module 10: How to Pay off Debt Fast 00:12:00 Module 11: Investing and Compound Interest 00:08:00 Module 12: How to Track Your Expenses with Paper Receipts 00:08:00 Module 13: How to Track Your Expenses Digitally 00:05:00 Module 14: The Envelope SystemF 00:06:00 Module 15: Why and How to Create an Emergency Fund 00:05:00 Module 16: How to Organize Your Financial Life 00:05:00 Module 17: How to Organize Finances with Your Partner 00:07:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Search By Location

- .NET Courses in London

- .NET Courses in Birmingham

- .NET Courses in Glasgow

- .NET Courses in Liverpool

- .NET Courses in Bristol

- .NET Courses in Manchester

- .NET Courses in Sheffield

- .NET Courses in Leeds

- .NET Courses in Edinburgh

- .NET Courses in Leicester

- .NET Courses in Coventry

- .NET Courses in Bradford

- .NET Courses in Cardiff

- .NET Courses in Belfast

- .NET Courses in Nottingham