- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

814 Trading courses

Property Investment - It's all about the numbers

By Property SQ2

Property Investment key calculations for profit, mortgage, return on investment. Invest like a pro, know your numbers work on every property deal.

Create a Compelling Company Overview for Investors

By The Teachers Training

Craft a compelling company overview that captivates investors with our specialized course. Learn to highlight your company's strengths, vision, and potential for growth. Gain the skills to create impactful presentations that inspire confidence and attract investment. Elevate your pitch and secure the support your company deserves.

Master the intricacies of Investment with a focus on time management, from understanding the success formula to harnessing productivity tools. This course guides you through managing distractions, enhancing focus, and optimizing energy for investment success.

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Stock Market Investment: Plan for Retirement Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Stock Market Investment: Plan for Retirement Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Stock Market Investment: Plan for Retirement Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Stock Market Investment: Plan for Retirement Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Stock Market Investment: Plan for Retirement? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Stock Market Investment: Plan for Retirement there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Stock Market Investment: Plan for Retirement course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Stock Market Investment: Plan for Retirement does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Stock Market Investment: Plan for Retirement was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Stock Market Investment: Plan for Retirement is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Introduction Introduction 00:02:00 Section 02: The Basics of Retirement Investing The Power of Compound Interest 00:09:00 Small vs. Mid vs. Large-Cap Stocks 00:06:00 Section 03: Retirement Investing Account Types Roth IRA 00:10:00 401(K) & Solo 401(K) 00:08:00 Brokerage Account 00:10:00 Section 04: Investing Strategies for a Wealthy Retirement ETFs (Exchange-Traded Funds) 00:05:00 Mutual Fund vs. Index Fund Investing 00:11:00 Dividend Stock Investing 00:10:00 Value Investing 00:12:00 Investing With Technical Analysis 00:10:00 Diversifying Your Investments 00:09:00 Section 05: How Investment Taxes Work Investing Taxes Simplified 00:05:00

Investment Operations Specialist

By Compliance Central

Investment Operations Specialist Do you want to improve your abilities as an Investment Operations Specialist? If so, you've arrived at the ideal location. By acquiring the Investment Operations Specialist abilities, our in-depth training on the subject will help you provide the finest results possible. For individuals who aspire to achieve success, we offer the Investment Operations Specialist course. You will acquire the fundamental knowledge required to become an expert in Investment Operations Specialist in the Investment Operations Specialist course. The foundational knowledge of investment operations specialist is covered in our course before moving on to more advanced subjects. As a result, this Investment Operations Specialist course's lessons are all clear and simple to understand. Why would you choose the Investment Operations Specialist course from Compliance Central: Lifetime access to Investment Operations Specialist course materials Full tutor support is available from Monday to Friday with the Investment Operations Specialist course Learn Investment Operations Specialist skills at your own pace from the comfort of your home Gain a complete understanding of Investment Operations Specialist course Accessible, informative Investment Operations Specialist learning modules designed by experts Get 24/7 help or advice from our email and live chat teams with the Investment Operations Specialist course Study Investment Operations Specialist in your own time through your computer, tablet or mobile device Curriculum Breakdown of the Investment Operations Specialist Course Course Outline: Module 01: Introduction to Investment Module 02: Types and Techniques of Investment Module 03: Key Concepts in Investment Module 04: Understanding the Finance Module 05: Investing in Bond Market Module 06: Investing in Stock Market Module 07: Risk and Portfolio Management in Investment Operations Specialist CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Investment Operations Specialist The Investment Operations Specialist course helps aspiring professionals who want to obtain the knowledge and familiarise themselves with the skillsets to pursue a career in Investment Operations Specialist. It is also great for professionals who are already working in Investment Operations Specialist and want to get promoted at work. Requirements Investment Operations Specialist To enrol in this Investment Operations Specialist course, all you need is a basic understanding of the English Language and an internet connection. Career path Investment Operations Specialist Operations Analyst: £30,000 to £50,000 per year Operations Manager: £40,000 to £70,000 per year Compliance Specialist: £35,000 to £60,000 per year Risk Analyst: £30,000 to £50,000 per year Fund Accounting Analyst: £25,000 to £45,000 per year Securities Operations Specialist: £30,000 to £55,000 per year Certificates CPD Accredited PDF Certificate Digital certificate - Included CPD Accredited PDF Certificate CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

A WALK THROUGH APPLE'S 10-K

By Behind The Balance Sheet

Discover what drives Apple’s business and stock price. In just one hour. Watch a hedge fund analyst study Apple’s accounts, and learn a process you can use to research any company.

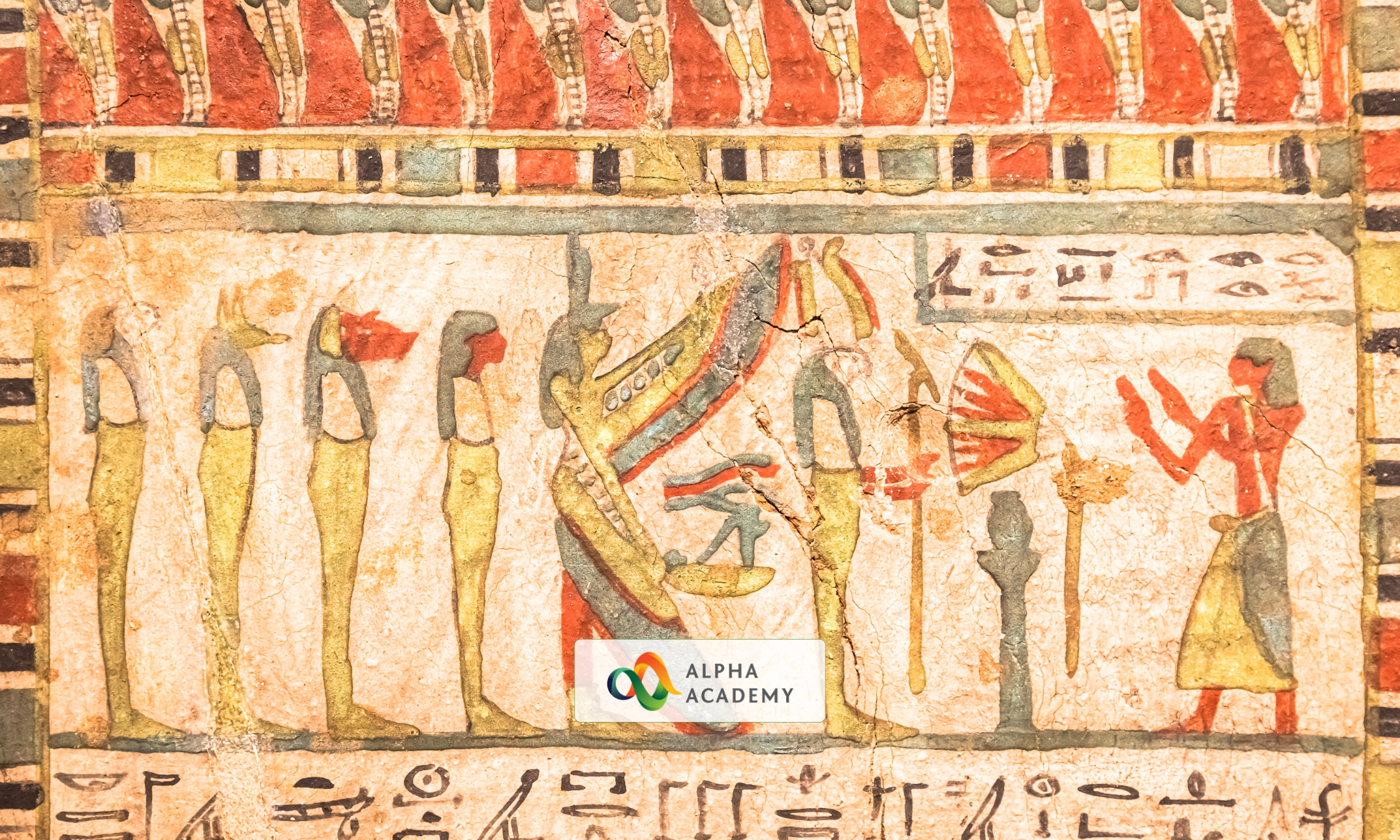

Course Overview Egypt is a country rich with mystery and exciting historical events. Enrich your knowledge about this fascinating country through the Egyptology course. You will get a tour of Egypt without even stepping out of the house. In this Egyptology course, you will receive detailed lessons on different areas of Ancient Egypt. The informative modules will educate you on the Egyptian dynasty, government, society and much more. You will learn about the art and architecture of Ancient Egypt. In addition. You will get introduced to the fundamentals of the trading system, military forces, writings and language used in Ancient Egypt. Through this course, you will not only learn about this historical nation but also receive a certificate of achievement. So enrol now and start learning! Learning Outcomes Learn about the different dynasties of Egypt Enrich your knowledge of Egyptian gods and goddesses Understand the system of Egyptian government and society Explore the fundamentals of Egyptian art and architecture Discover the principles of trade and military force of Ancient Egypt Gain in-depth knowledge of the language, writing and numeral system of Ancient Egypt Assessment and Certification At the end of the Egyptology course, you will be required to sit for an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. After you have successfully passed the final exam, you will be able to order an Accredited Certificate of Achievement at an additional cost of £19 for a PDF copy and £29 for an original print copy sent to you by post or for both £39. Career Path This Egyptology course will provide you with an in-depth understanding of the subject. On successful completion, you will have the skills, confidence and practical knowledge to fast-track a successful career in relevant sectors. Professions in this field include: History Teacher Historian

Embark on a financial journey with our Capital Budgeting & Investment Decision Rules course, where you'll uncover the intricacies of allocating resources wisely in a corporate landscape. Making informed investment decisions is crucial in today's business world, and this course equips you with the knowledge and tools needed to evaluate investment opportunities. From the fundamental principles of Net Present Value (NPV) to the complexities of Internal Rate of Return (IRR), you'll learn to assess and compare projects effectively. Whether you're a finance professional looking to sharpen your skills or a student preparing for a career in financial analysis, this course will be your compass to navigate the world of capital budgeting. Learning Outcomes Master the Net Present Value (NPV) method for project evaluation. Understand the Payback Period Method and its significance in investment decisions. Grasp the intricacies of the Internal Rate of Return (IRR) and its application. Learn how to evaluate projects with different lifespans for effective decision-making. Gain the skills needed to make informed capital budgeting decisions, setting you on the path to success in financial analysis. Why choose this Capital Budgeting & Investment Decision Rules course? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Who is this Capital Budgeting & Investment Decision Rules course for? Finance professionals seeking to enhance their investment evaluation skills. Students preparing for careers in financial analysis and corporate finance. Entrepreneurs and business owners looking to make informed investment choices. Anyone interested in understanding the principles of capital budgeting. Individuals aiming to excel in the field of financial decision-making. Career path Financial Analyst: £25,000 - £50,000 Investment Analyst: £30,000 - £65,000 Corporate Finance Manager: £35,000 - £80,000 Financial Controller: £35,000 - £80,000 Risk Analyst: £25,000 - £60,000 Investment Banker: £40,000 - £100,000 Prerequisites This Capital Budgeting & Investment Decision Rules does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Capital Budgeting & Investment Decision Rules was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Section 01: Introduction Preview 00:01:00 Basics of Time Value of Money 00:10:00 Concepts of Compounding, Discounting, Present Values 00:09:00 Section 02: NPV Method NPV Method Meaning and Decision Rules 00:07:00 Use of NPV with an Example and Practical Life Limitation of NPV Method 00:06:00 NPV Profile of the Project to Understand Sensitivity 00:04:00 Section 03: Payback Period Method Payback Period Meaning and Calculations 00:02:00 Drawback of Payback Period Method 00:03:00 Section 04: Internal Rate of Return (IRR) IRR, Meaning and Method of Calculation with Limitation 00:07:00 Example of Demonstrate NPV and IRR Calculation and Inconsistent Result 00:04:00 Case of Multiple IRR and MRR as an Attempt to Fix the Problem 00:08:00 Section 05: Evaluating Projects in Different Lives How to Choose between Mutually Exclusive Project 00:11:00 Choosing Project with Different Life 00:06:00 Choosing Project in Budget Constraints 00:05:00 Section 06: Conclusion Final Summary 00:04:00 Assignment Assignment - Capital Budgeting & Investment Decision Rules 00:00:00

Investment

By NextGen Learning

Course Overview: This Investment course offers learners a comprehensive understanding of investment strategies and financial markets. The course covers a range of essential topics, including different investment types, portfolio management, and risk assessment. Learners will gain valuable insights into bond and stock markets, enabling them to make informed decisions in diverse investment environments. The course is designed for those looking to enhance their investment knowledge, regardless of their current financial expertise, providing a solid foundation in the principles of investing. Course Description: In this course, learners will explore various investment methods, from bonds to stocks, and gain an understanding of core financial concepts such as portfolio diversification and risk management. The course delves into investment theory, focusing on how markets function, the evaluation of potential returns, and the identification of risk factors. With an emphasis on building a structured investment strategy, learners will also gain an understanding of how to manage and optimise their portfolios. By the end, learners will have the tools and knowledge to evaluate different investment opportunities, supporting their financial growth and decision-making processes. Course Modules: Module 01: Introduction to Investment Overview of investment basics The role of investments in personal finance Understanding risk and return Module 02: Types and Techniques of Investment Stock market, bonds, and real estate investments Active vs passive investing Introduction to alternative investments Module 03: Key Concepts in Investment Compound interest and time value of money Diversification and asset allocation Financial instruments overview Module 04: Understanding the Finance Basics of financial statements Financial ratios and metrics Introduction to valuation techniques Module 05: Investing in Bond Market Types of bonds and their characteristics Bond pricing and yields Understanding interest rates and bond durations Module 06: Investing in Stock Market Stock market indices and trading Analysis of stock performance Fundamentals of stock picking Module 07: Risk and Portfolio Management Measuring and managing investment risk Portfolio construction and diversification strategies Evaluating portfolio performance (See full curriculum) Who is this course for? Individuals seeking to develop investment skills for personal financial growth. Professionals aiming to enhance their understanding of financial markets. Beginners with an interest in investing and financial markets. Anyone interested in building a solid foundation in investment strategies. Career Path: Investment Analyst Financial Planner Portfolio Manager Stock Broker Risk Manager Wealth Manager Financial Consultant

Search By Location

- Trading Courses in London

- Trading Courses in Birmingham

- Trading Courses in Glasgow

- Trading Courses in Liverpool

- Trading Courses in Bristol

- Trading Courses in Manchester

- Trading Courses in Sheffield

- Trading Courses in Leeds

- Trading Courses in Edinburgh

- Trading Courses in Leicester

- Trading Courses in Coventry

- Trading Courses in Bradford

- Trading Courses in Cardiff

- Trading Courses in Belfast

- Trading Courses in Nottingham