- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4631 Technology courses

Design of Circulating Fluidized Bed Boilers

By EnergyEdge - Training for a Sustainable Energy Future

Enhance your knowledge of circulating fluidized bed boilers with EnergyEdge's classroom training. Join us to gain valuable insights and skills.

The Innovative Portfolio Management Capability

By IIL Europe Ltd

The Innovative Portfolio Management Capability The nature of work has changed; a new structure must be adapted to help propel the Agile PMO across the enterprise. Factoring in innovation and strategic alignment as part of every project is the formula for achieving success. The PMO is uniquely positioned to operationalize and serve as a center of innovation excellence for the entire organization. Learn how to elevate PPM offices to digitally transform the enterprise through ecosystem enablement and emerging technology empowerment. How the PMO can lead innovation outcomes and accelerate business results How innovation systems can improve project quality and business strategy alignment How PMOs must become the center of excellence for innovation to help lead the agile and digital efforts across organizations

Disability Assessor

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Disability Assessor Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Disability Assessor Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Disability Assessor Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Disability Assessor Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Disability Assessor? Unlimited access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Disability Assessor there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Disability Assessor course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Disability Assessor does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Disability Assessor was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Disability Assessor is a great way for you to gain multiple skills from the comfort of your home. Module 01: Disability Assessment and Disability Assessor Disability Assessment and Disability Assessor 00:20:00 Module 02: Legal Frameworks, Policy and Guidelines Legal Frameworks, Policy and Guidelines 00:25:00 Module 03: Disability Models and Disability Assessment Methods Disability Models and Disability Assessment Methods 00:22:00 Module 04: Preparation for the Assessment Preparation for the Assessment 00:20:00 Module 05: The Assessment Process The Assessment Process 00:22:00 Module 06: ICF and Disability Assessment ICF and Disability Assessment 00:25:00 Module 07: Assistive Technology and Ergonomics Assistive Technology and Ergonomics 00:25:00 Module 08: Disability Assessment Report Writing Disability Assessment Report Writing 00:23:00 Assignment Assignment - Disability Assessor 06:04:00 Order Your Certificate Order Your Certificate QLS

Basics Blockchain

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Basics Blockchain Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Basics Blockchain Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Basics Blockchain Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Basics Blockchain Course, like every one of Study Hub's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Basics Blockchain? Lifetime access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD QS-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Basics Blockchain there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Basics Blockchain course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Basics Blockchain does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Basics Blockchain was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Basics Blockchain is a great way for you to gain multiple skills from the comfort of your home. Section 01: Introduction What and Why of Blockchain 00:08:00 Section 02: Underlying technologies of Blockchain Underlying technologies of Blockchain 00:07:00 Section 03: Advantages of Blockchain Advantages of Blockchain 00:07:00 Section 04: How Blockchain works How Blockchain works 00:11:00 Section 05: Types of blockchain and bitcoin Types of blockchain and bitcoin 00:06:00 Section 06: Libra [Facebook's cryptocurrency] Libra [Facebook's cryptocurrency] 00:03:00 Section 07: Ethereum [The revolution in Blockchain technology] Ethereum [The revolution in Blockchain technology] 00:07:00 EVM [Unbelievable 256 bit machines] and Dapps 00:05:00 Section 08: Forming Blockchain Solutions Forming Blockchain Solution Part 1 00:06:00 Forming Blockchain Solution Part 2 00:08:00 Assignment Assignment -Basics Blockchain 00:39:00 Order Your Certificate Order Your Certificate QLS

Project Quantity Surveyor - QLS Endorsed Bundle

By Imperial Academy

10 QLS Endorsed Courses for Project Quantity Surveyor | 10 QLS Endorsed Certificates Included | Lifetime Access

Overview Successful complaint management means satisfied customers, which results in increased sales. Thus, proper complaint management can turn the situation in favour of the business. Master the strategies of complaints management with our exclusive Customer Care Complaints Management course. In this course you will understand the process of building rapport and trust with the customers. The modules will show you how you can establish effective communication with the customers. In addition, you will learn about different types of customers and be able to handle their complaints with expertise. The course will also focus on compliant prevention and service recovery. So, if you desire to take your customer service skills to the next level and increase your employability, join today! Course Preview Learning Outcomes Understand how to build trust with your customer Develop the skills required for effective communication Learn how to deal with different types of customers Know the strategies to resolve customer-centric complaints Grasp the techniques of customer-compliant prevention and service recovery Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Engaging tutorial videos, materials from the industry-leading experts Opportunity to study in a user-friendly, advanced online learning platform Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email. What Skills Will You Learn from This Course? Communication Complaint Management Complaint Prevention Who Should Take This Customer Care Complaints Management Course? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Customer Care Complaints Management course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Certificate of Achievement After completing this course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates & Transcripts can be obtained either in Hardcopy at £14.99 or in PDF format at £11.99. Career Pathâ This exclusive Customer Care Complaints Management course will equip you with effective skills and abilities and help you explore career paths such as Customer Care Executive Customer Service Manager Call Center Executive Module 01: Complaints & Customer Value Complaints & Customer Value 00:14:00 Module 02: Building Rapport & Trust Building Rapport & Trust 00:11:00 Module 03: Effective Communication Effective Communication 00:13:00 Module 04: Handling Various Customer Types Handling Various Customer Types 00:13:00 Module 05: Customer-Centric Complaint Resolution Customer-Centric Complaint Resolution 00:14:00 Module 06: Proactive Complaint Prevention and Service Recovery Proactive Complaint Prevention and Service Recovery 00:14:00 Module 07: Advanced Technology and Tools in Customer Care Advanced Technology and Tools in Customer Care 00:22:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

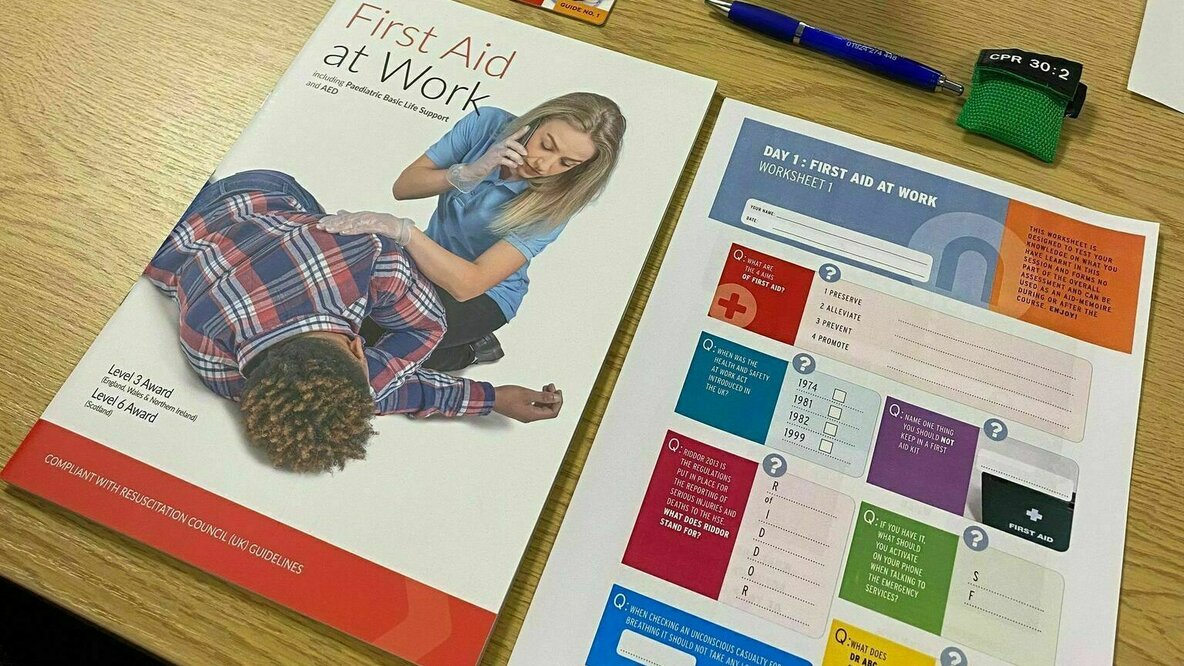

Emergency First Aid at Work (NUCO Accredited) 1 Day Course

By Complete Training

The Emergency Fist Aid at Work is an accredited 1 day, instructor led course in a fully equipped training room. We use a mixture of training methods such as hands on activities, role play, group discussion, games and the use of equipment / technology to cover the different learning styles of the individual. All learners will have the skills and knowledge to provide the organisation with Emergency First Aider’s that can provide treatment to their casualties in a prompt, safe and effective manner. A range of subjects are covered including:- • Responsibilities and reporting • Resuscitation and AED awareness • Burns • Assessment of the situation • Anatomy • Choking • Dealing with an unresponsive casualty • Minor injuries • Epilepsy • Basic hygiene in First Aid • Bleeding control • Shock Certification Practical assessment is ongoing by the instructor, and a three year qualification will be issued to those who satisfy the criteria. In addition, the HSE strongly recommend that all students undergo an annual refresher programme of three hours. Instructions Please can learners ensure they wear trousers and a full shoe. Learners need to be physically fit and well to undertake the activities for First Aid Training, which requires learners to carryout CPR on the floor. Directions Complete Training Somerset House, Sandal Castle Centre Asdale Road Wakefield WF2 7JE All training is carried out at our office (Somerset House, map is attached). Please note that we do not provide lunch so you will have to bring your own. Please do not park in the office car park as not all spaces belong to us. There is available parking in Asda and Aldi next door, or the public car park at either side of Square Pizza Amenities Rest Room Fridge on site Parking Toilets

Earn your"Medical Secretary Diploma and master the skills needed for a successful career in medical administration. Learn scheduling, medical records management, confidentiality, and more. Ideal for aspiring medical secretaries and healthcare professionals looking to enhance their administrative expertise. Enrol today!

Crime Analysis

By The Teachers Training

Crime Analysis is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Crime Analysis and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 10 hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Module 01: Introduction to Crime Analysis Introduction to Crime Analysis 00:33:00 Module 02: The Criminal Justice System in England and Wales The Criminal Justice System in England and Wales 00:20:00 Module 03: Classification of Crime Classification of Crime 00:39:00 Module 04: Crime Scene Crime Scene 00:28:00 Module 05: Crime Mapping Crime Mapping 00:30:00 Module 06: Tactical Crime Analysis Tactical Crime Analysis 00:46:00 Module 07: Strategic and Administrative Crime Analysis Strategic and Administrative Crime Analysis 00:34:00 Module 08: Criminal Behaviour and Psychology Criminal Behaviour and Psychology 00:42:00 Module 09: Financial and Environmental Criminology Financial and Environmental Criminology 00:44:00 Module 10: Criminal Justice Criminal Justice 00:38:00 Module 11: Criminal Profiling: Science, Logic and Metacognition Criminal Profiling: Science, Logic and Metacognition 00:27:00 Module 12: Phases of Profiling Phases of Profiling 00:32:00 Module 14: Technology in Criminal Intelligence Analysis Technology in Criminal Intelligence Analysis 00:22:00 Module 13: Criminal Intelligence Analysis Criminal Intelligence Analysis 00:23:00 Module 15: Research Method and Statistics in Crime Analysis Research Method and Statistics in Crime Analysis 00:30:00 Module 16: Policing and Cyber Security Policing and Cyber Security 00:47:00 Module 17: Forecasting Future Occurrences and Prediction Forecasting Future Occurrences and Prediction 00:37:00

Search By Location

- Technology Courses in London

- Technology Courses in Birmingham

- Technology Courses in Glasgow

- Technology Courses in Liverpool

- Technology Courses in Bristol

- Technology Courses in Manchester

- Technology Courses in Sheffield

- Technology Courses in Leeds

- Technology Courses in Edinburgh

- Technology Courses in Leicester

- Technology Courses in Coventry

- Technology Courses in Bradford

- Technology Courses in Cardiff

- Technology Courses in Belfast

- Technology Courses in Nottingham